Global Bring Your Own Device (BYOD) Market Size, Share, Industry Analysis Report By Deployment (On-Premises, Cloud), By Device Type (Smartphones, Tablets, Laptops, Wearables and Other Endpoints), By Security Solution (Mobile Device Management (MDM), Unified Endpoint Management (UEM), Identity and Access Management (IAM)), By Organization Size (Large Enterprises, Small and Mid-Sized Enterprises (SMEs)), By End-User Vertical (IT and Telecom, Healthcare, Government and Public Sector, Retail, BFSI, Manufacturing and Automotive, Other End-User Verticals), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162828

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Usage and Adoption Statistics

- BYOD Statistics

- Analysts’ Viewpoint

- Regulatory Impact

- By Geography

- By Deployment

- By Device Type

- By Security Solution

- By Organization Size

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

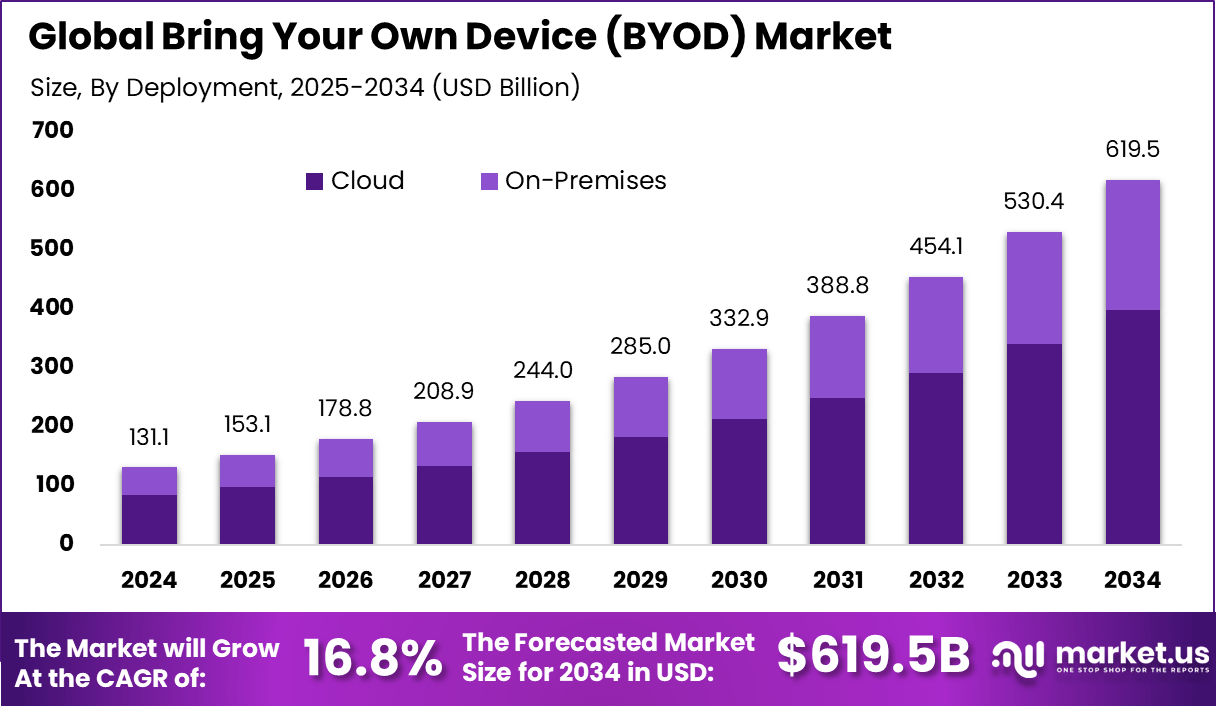

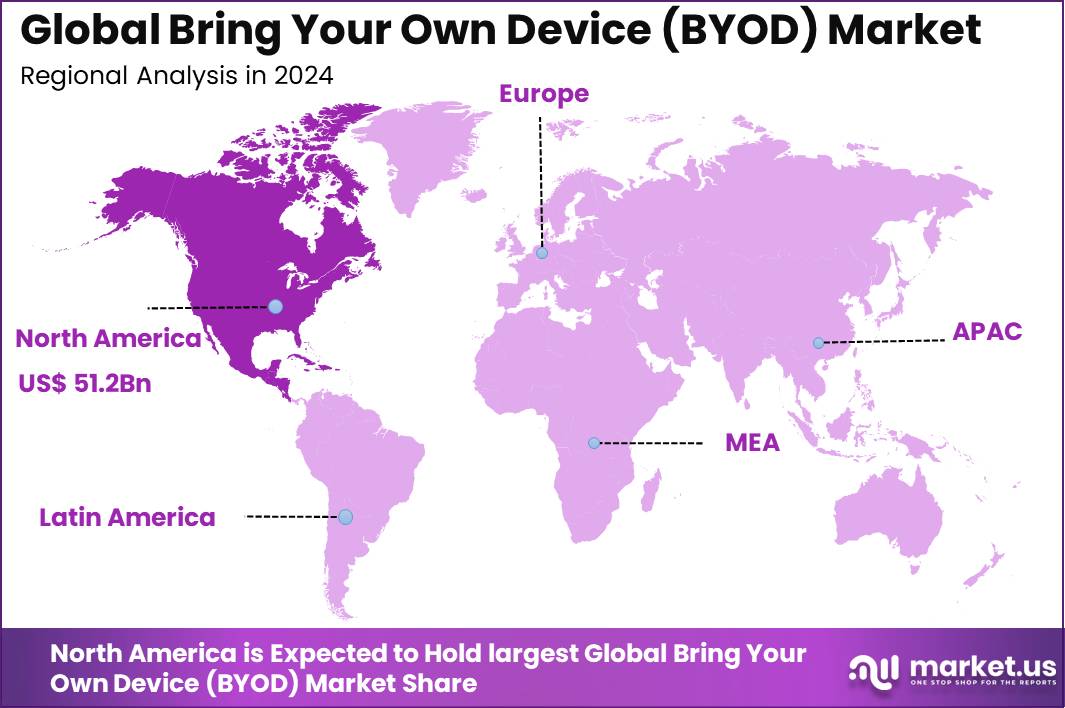

The Global Bring Your Own Device (BYOD) Market generated USD 131.1 billion in 2024 and is predicted to register growth from USD 153.1 billion in 2025 to about USD 619.5 billion by 2034, recording a CAGR of 16.8% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 39.1% share, holding USD 51.2 Billion revenue.

The Bring Your Own Device (BYOD) market reflects the growing trend of employees using personal devices for work purposes. This approach enables companies to allow smartphones, laptops, tablets, and other personal devices onto their corporate networks, promoting flexibility and convenience while maintaining operational efficiency.

The popularity of BYOD has grown rapidly with remote and hybrid work becoming common, driven largely by the widespread availability of high-speed internet like 4G and 5G and the need for more agile work environments. Around 90% of employees now use a mix of personal and company devices for work, and nearly half of organizations expect BYOD adoption to grow significantly in the future.

Top driving factors for the BYOD market include cost savings, increased employee productivity, and flexibility. Organizations save on hardware procurement and maintenance by letting employees use their own devices. Employees tend to work better with familiar technology, evidenced by studies showing a 55% productivity boost and a 56% increase in job happiness when using personal devices.

The widespread adoption across industries such as healthcare, finance, and retail, where secure access to corporate data from anywhere is crucial. The demand for mobile device management and security solutions is strong because companies need to protect sensitive information on various device types while ensuring compliance with regulations.

According to JumpCloud, over 80% of organizations now use BYOD, with 68% reporting higher employee productivity and 42% of IT leaders noting that smartphones boost innovation. However, smartphones remain the least provided work devices at only 27%. Security concerns persist, as 30% of IT leaders see it as the biggest barrier, and more than 90% of lost or stolen device incidents result in data breaches.

For example, nearly 80% of organizations have embraced BYOD policies, with many adopting AI-powered mobile security and cloud solutions to better manage risks and foster secure collaboration. Technologies spurring the increasing adoption of BYOD include advanced mobile device management (MDM), AI-driven endpoint security, biometric authentication, and cloud-native enterprise mobility platforms.

Top Market Takeaways

- Cloud deployment led with 64.2%, driven by its scalability, cost efficiency, and ease of integration with enterprise mobility platforms.

- Smartphones accounted for 50.1% of total device usage, underscoring their dominance as the primary tool for workplace connectivity and remote access.

- The Mobile Device Management (MDM) security solution segment held 41.5%, reflecting its importance in safeguarding enterprise data across employee-owned devices.

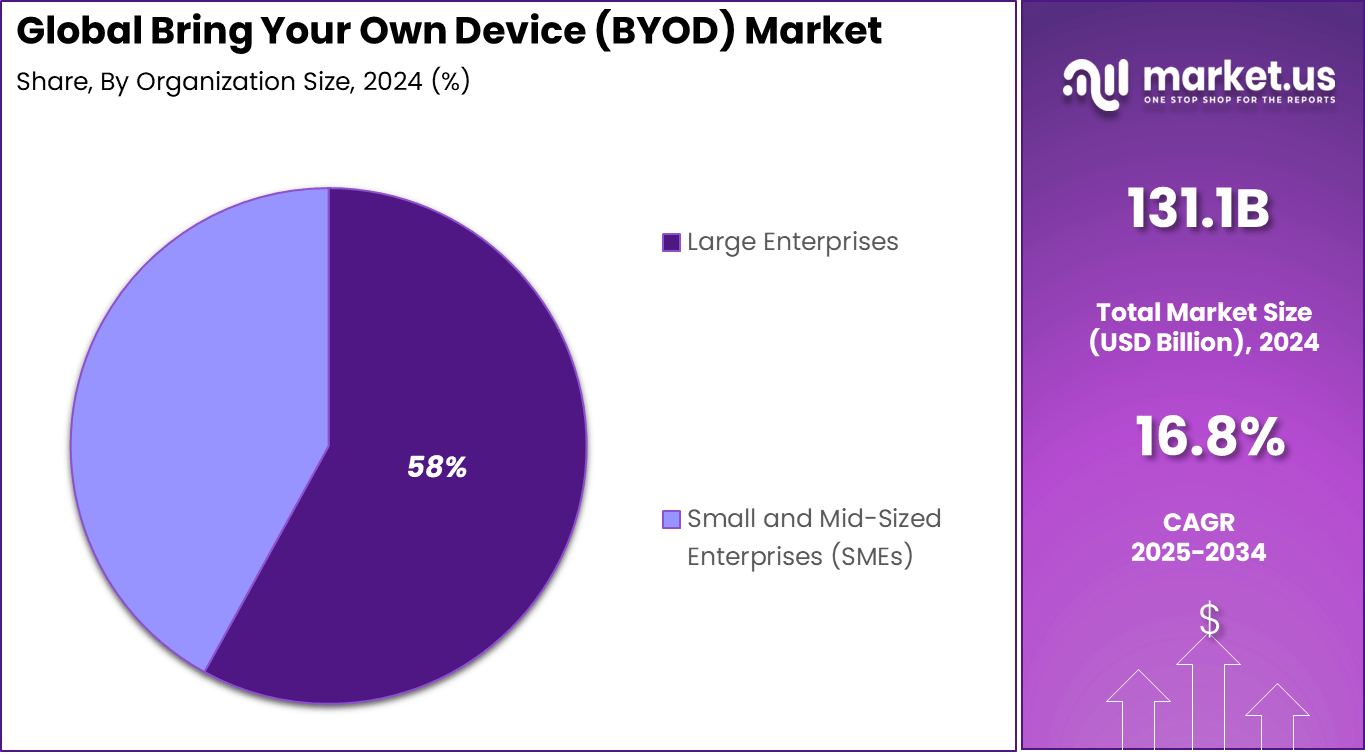

- Large enterprises captured 58%, supported by extensive adoption of BYOD policies to enhance productivity and reduce hardware costs.

- North America accounted for 39.1% of the global market, driven by mature IT infrastructure, widespread remote work culture, and strong enterprise mobility adoption.

Usage and Adoption Statistics

- 67% of workers use personal devices for work, regardless of company policy.

- 95%+ of organizations allow BYOD in some capacity.

- Smartphones dominate BYOD, generating over 50% of revenue in 2021 due to app availability.

- Employee motivation: Convenience, one-device use for work and personal needs, or dissatisfaction with company-issued devices.

- Business benefits: Cost savings of up to $341 per employee annually, better alignment with hybrid/remote work, and higher productivity.

- Industry adoption: Highest in education (69%), followed by finance, IT, government, and healthcare.

BYOD Statistics

- 95% of organizations allow some form of personal devices in the workplace.

- 82% of companies have formally adopted a BYOD policy.

- 69% of U.S. IT leaders view BYOD as a beneficial move.

- Businesses can reduce costs by up to 11% by shifting from employer-provided devices (EPD) to BYOD.

- Employees use an average of 2.5 devices for work, with 66% relying on smartphones.

- 80%+ of companies actively promote BYOD adoption.

- 67% of employees use personal devices for work, even without formal policies.

- BYOD can improve productivity by 55% and increase employee satisfaction by 56%.

- 39% of organizations cite security concerns as the biggest barrier to adoption.

- A BYOD-enabled employee generates an extra $350 in value per year.

- Employees with BYOD arrangements typically work 2 additional hours per week.

- 87% of businesses depend on employees accessing business apps through smartphones.

- 69% of IT professionals in the U.S. consider BYOD a positive long-term strategy.

Analysts’ Viewpoint

Investment opportunities in BYOD are found in cloud-based mobility solutions, AI-powered security tools, and mobile device management software. As businesses across sectors emphasize remote work readiness and real-time collaboration, these areas attract significant funding. Healthcare and financial sectors in particular seek secure data access for mobile workers aligning with privacy laws, offering consultancy and technology vendors key growth potential.

The rise in mobile workforce size globally underlines the increasing need for scalable and secure BYOD solutions. Business benefits of BYOD include improved workforce productivity, reduced capital expenses for organizations, and stronger employee engagement due to personalized technology usage. Flexible work options supported by BYOD lead to higher retention rates and lower vacancy.

Regulatory Impact

The regulatory environment surrounding BYOD involves compliance with data privacy laws like GDPR, HIPAA, and CCPA, requiring companies to implement strict security controls and policies. Many industries face challenges in balancing employee privacy rights with corporate security mandates. Companies often establish clear BYOD policies delineating usage rules, security protocols, and consequences for data breaches or device loss.

Regulatory scrutiny typically intensifies in sectors handling sensitive information, driving investments in secure access technologies and encryption. Top impacting factors in the BYOD market currently include escalating cybersecurity threats stemming from personal devices with weaker defenses, demands for consistent security policies across diverse operating systems, and privacy concerns from employees wary of invasive monitoring.

According to recent surveys, about 30% of organizations cite information security as the biggest hurdle in BYOD adoption, while 15% worry about employee privacy. The complexity of managing a mix of personal and company data on the same device also challenges IT teams. Successful execution depends on balancing protection with user experience and maintaining continuous compliance.

By Geography

In 2024, North America accounted for 39.1% of the global BYOD market, supported by high smartphone penetration, flexible workplace culture, and advanced IT infrastructure. Companies in the U.S. and Canada lead in implementing BYOD policies that balance employee autonomy with enterprise-grade data protection. Widespread 5G connectivity and strong digital ecosystems further encourage adoption.

The regional trend is reinforced by investments in mobile security, compliance management, and workforce decentralization. Enterprises in sectors like finance, technology, and education increasingly see BYOD as essential for operational flexibility and talent retention. With regulations encouraging transparency and secure data handling, North America remains at the forefront of strategic BYOD developments worldwide.

By Deployment

In 2024, The cloud segment captured 64.2% of the BYOD market, showing how organizations increasingly rely on cloud-based frameworks to manage, secure, and scale employee device access. Cloud deployment simplifies integration across devices, enabling easier updates, centralized control, and remote access for distributed workforces.

As enterprise operations move toward hybrid and remote models, cloud-based BYOD management tools support seamless connectivity and improved resilience against localized disruptions. This segment continues to benefit from cybersecurity improvements and scalability options that on-premises setups often lack.

Companies appreciate reduced infrastructure costs and faster deployment timelines enabled by cloud solutions. The model also supports automated security updates and consistent compliance management, key advantages for sectors like banking, IT, and healthcare that handle high volumes of sensitive data.

By Device Type

In 2024, Smartphones represented 50.1% of devices used under BYOD frameworks, underscoring their central role in modern workplace mobility. Employees rely on personal smartphones for communication, application access, and workflow continuity, which has transformed them into productivity hubs.

Enterprises have adapted by developing mobile-friendly platforms and security layers to accommodate flexible access while maintaining data protection. The preference for smartphones is further supported by advancements in mobile processors, secure operating systems, and enterprise app integrations.

The convergence of personal and professional usage has encouraged employers to implement stricter policy controls through mobile management solutions. This dominance also reflects a cultural shift toward mobile-first operations, where agility and speed define employee workflows.

By Security Solution

In 2024, Mobile Device Management (MDM) leads with 41.5% of the security solution segment. MDM tools provide centralized control over enrolled devices, allowing IT teams to configure, monitor, and secure hardware remotely. Through encryption and device tracking, organizations mitigate risks related to data theft, malware, and unauthorized access.

This approach keeps employee convenience intact while maintaining regulatory compliance for sensitive information. The continued reliance on MDM also shows a maturing understanding of digital trust among enterprises.

Integration with identity management and endpoint protection systems is making MDM both preventive and adaptive. As companies scale up remote operations, MDM remains the foundation upon which multi-layered security architectures like Unified Endpoint Management (UEM) and Zero Trust frameworks are built.

By Organization Size

Large enterprises held a 58% share of the market, reflecting their early adoption of structured BYOD programs. These organizations benefit from large IT budgets and mature security infrastructures, allowing smooth implementation across diverse departments and geographies. BYOD policies in large enterprises often include integrated analytics and endpoint monitoring to balance productivity with governance.

These enterprises increasingly view BYOD as a cost-saving and productivity-enhancing measure. Scalable management tools reduce the need for company-issued devices while supporting employee satisfaction. The ability to simultaneously manage thousands of connected endpoints demonstrates how large organizations are setting operational benchmarks for BYOD adoption.

Emerging Trends

Emerging trends in BYOD reflect the rapid adoption of 5G and IoT devices, enhancing connectivity for personal gadgets in the workplace. With 5G, data speed and reliability improve, allowing smoother use of multiple devices like smartphones, tablets, and smartwatches.

Over 95% of organizations now allow some form of personal device use, and more than 80% actively encourage BYOD policies. This flexibility supports a mix of remote and office work, driving further adoption. Edge-AI technology on personal devices is also growing, enabling secure workflows without always needing a cloud connection.

The push for stronger security protocols is another major trend. Organizations increasingly implement zero-trust security models and continuous endpoint monitoring to secure BYOD environments, an approach mandated in many regulated sectors like healthcare and finance.

Cloud-based unified endpoint management (UEM) solutions are replacing older device management systems, capturing over 60% of the deployment share. These advances aim to balance user convenience with data protection, reflecting the rising demand to manage growing cyber risks tied to diverse device usage.

Growth Factors

Growth factors driving BYOD adoption include the spread of 5G-enabled devices and the permanent shift to hybrid work models. The proliferation of 5G smart devices contributes a 3.2% positive impact on BYOD market growth, making device connectivity faster and more reliable.

Hybrid work policies, now becoming standard, add a 4.1% boost, encouraging more companies to adopt BYOD to support flexible work environments. Cloud-native UEM platforms also play a significant role, facilitating easier management and security with a 3.8% growth influence.

Cost containment remains a crucial factor for small- and medium-sized enterprises adopting BYOD. BYOD reduces upfront capital expenditure on devices by shifting the burden to employees, which is particularly helpful where IT budgets are under pressure.

This shift adds a modest 1.7% to growth but significantly improves operational efficiency and device license management. Technology improvements, such as Edge-AI on personal devices, herald a future with more secure offline workflows, expected to increase as these smart solutions expand beyond North America.

Key Market Segments

By Deployment

- On-Premises

- Cloud

By Device Type

- Smartphones

- Tablets

- Laptops

- Wearables and Other Endpoints

By Security Solution

- Mobile Device Management (MDM)

- Unified Endpoint Management (UEM)

- Identity and Access Management (IAM)

By Organization Size

- Large Enterprises

- Small and Mid-Sized Enterprises (SMEs)

By End-User Vertical

- IT and Telecom

- Healthcare

- Government and Public Sector

- Retail

- BFSI

- Manufacturing and Automotive

- Other End-User Verticals

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Employee Flexibility and Productivity

One major driver of Bring Your Own Device (BYOD) adoption is the flexibility it offers employees. Allowing workers to use their personal devices for professional tasks can lead to greater comfort and familiarity, which often translates into higher productivity. Employees can work more efficiently as they manage work tools they know well and carry devices that suit their preferences and needs.

This flexibility also supports remote and hybrid work arrangements, which have become prevalent. Businesses benefit from increased employee satisfaction and retention because BYOD policies help balance work-life dynamics better. This drive for flexibility and productivity is pushing companies to embrace BYOD despite the challenges it entails.

Restraint Analysis

Security Risks and Data Breaches

A significant restraint hindering BYOD adoption is the heightened security risk posed by personal devices accessing corporate networks. Personal devices may have weaker security controls compared to enterprise-issued hardware, leading to vulnerabilities and potential data breaches. This concern is especially critical as sensitive company data could be exposed through compromised or lost devices.

Cybersecurity threats such as malware infections and unauthorized access are difficult to control in a BYOD environment. Organizations must invest heavily in endpoint security solutions and apply strict mobile device management policies to mitigate these risks. However, the persistent threat of data breaches remains a barrier to wider BYOD implementation.

Opportunity Analysis

Cost Savings on Hardware and Licenses

BYOD presents a valuable opportunity for organizations to reduce costs associated with hardware procurement and software licensing. When employees use their own devices, companies can significantly cut expenses on purchasing, maintaining, and upgrading corporate-owned equipment. Additionally, software licenses can be optimized by allocating them based on actual usage rather than a blanket approach for all devices.

These savings enable businesses, especially small and medium enterprises, to reallocate budgets towards other critical areas like innovation and security improvements. The growing acceptance of BYOD reflects a trend to maximize operational efficiency while maintaining sufficient control over IT resources.

Challenge Analysis

Balancing Security and Privacy

One of the biggest challenges in BYOD programs is striking the right balance between securing business data and respecting employee privacy. Since employees use personal devices for work, companies often require some level of control or monitoring to ensure security protocols are followed. This can lead to concerns over privacy intrusion and distrust between employers and employees.

Implementing effective Mobile Device Management (MDM) or Enterprise Mobility Management (EMM) tools can help manage this balance by separating personal data from corporate data. However, policies must be transparent and clearly communicated to avoid resistance and ensure smooth adoption. Navigating this privacy-security tradeoff without disrupting employee morale remains a key challenge for BYOD programs.

Competitive Analysis

The Bring Your Own Device (BYOD) Market is led by major technology and telecom companies such as Cisco Systems Inc., AT&T Intellectual Property, Hewlett Packard Enterprise Development LP, IBM, and Oracle. These organizations offer enterprise mobility management (EMM) and secure connectivity solutions that enable employees to access corporate data through personal devices.

Cybersecurity and device management specialists including Ivanti, Duo, Fixmo, Mobiquity Inc., and Verivo provide mobile application management (MAM) and endpoint protection platforms that ensure secure data exchange between personal and enterprise networks.

Additional contributors such as ALE International, Avaya LLC, Apperian, Gallagher Insurance Brokers Private Limited, Averail, Verizon, LexisNexis Risk Solutions, and Vox Mobile, along with other market participants, support BYOD implementation through unified communication systems, risk management, and secure cloud collaboration tools.

Top Key Players in the Market

- ALE International

- Apperian

- Avaya LLC

- AT&T Intellectual Property

- Hewlett Packard Enterprise Development LP

- Cisco Systems Inc.

- Gallagher Insurance Brokers Private Limited

- Averail

- Duo

- Fixmo

- IBM

- Ivanti

- iPass Inc.

- Mobiquity Inc.

- Oracle

- Verivo

- Verizon

- LexisNexis Risk Solutions

- Vox Mobile

- Others

Recent Developments

- March 2025, Hypori, a secure mobile access platform provider, reported explosive growth in new business with 8x increase in new customers across commercial and federal sectors. The company raised a $12 million Series B extension funding round, enabling expansion of secure mobile services supporting remote and flexible work patterns, a major BYOD adoption driver.

- In November 2024, Microsoft launched Intune Advanced Analytics with Kusto Query Language (KQL) support, enabling admins to run real-time queries and trigger remote actions based on analytics insights, improving endpoint management with AI-driven anomaly detection and device performance monitoring

Report Scope

Report Features Description Market Value (2024) USD 131.1 Bn Forecast Revenue (2034) USD 619.5 Bn CAGR(2025-2034) 16.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment (On-Premises, Cloud), By Device Type (Smartphones, Tablets, Laptops, Wearables and Other Endpoints), By Security Solution (Mobile Device Management (MDM), Unified Endpoint Management (UEM), Identity and Access Management (IAM)), By Organization Size (Large Enterprises, Small and Mid-Sized Enterprises (SMEs)), By End-User Vertical (IT and Telecom, Healthcare, Government and Public Sector, Retail, BFSI, Manufacturing and Automotive, Other End-User Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ALE International, Apperian, Avaya LLC, AT&T Intellectual Property, Hewlett Packard Enterprise Development LP, Cisco Systems Inc., Gallagher Insurance Brokers Private Limited, Averail, Duo, Fixmo, IBM, Ivanti, iPass Inc., Mobiquity Inc., Oracle, Verivo, Verizon, LexisNexis Risk Solutions, Vox Mobile, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bring Your Own Device (BYOD) MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Bring Your Own Device (BYOD) MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALE International

- Apperian

- Avaya LLC

- AT&T Intellectual Property

- Hewlett Packard Enterprise Development LP

- Cisco Systems Inc.

- Gallagher Insurance Brokers Private Limited

- Averail

- Duo

- Fixmo

- IBM

- Ivanti

- iPass Inc.

- Mobiquity Inc.

- Oracle

- Verivo

- Verizon

- LexisNexis Risk Solutions

- Vox Mobile

- Others