Global Breast Implants Market Analysis By Product (Silicone Breast Implants, Saline Breast Implants), By Shape (Round, Anatomical), By Application (Reconstructive Surgery, Cosmetic Surgery), By End-use (Hospitals, Cosmetology Clinics, Ambulatory Surgical Centers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 14563

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

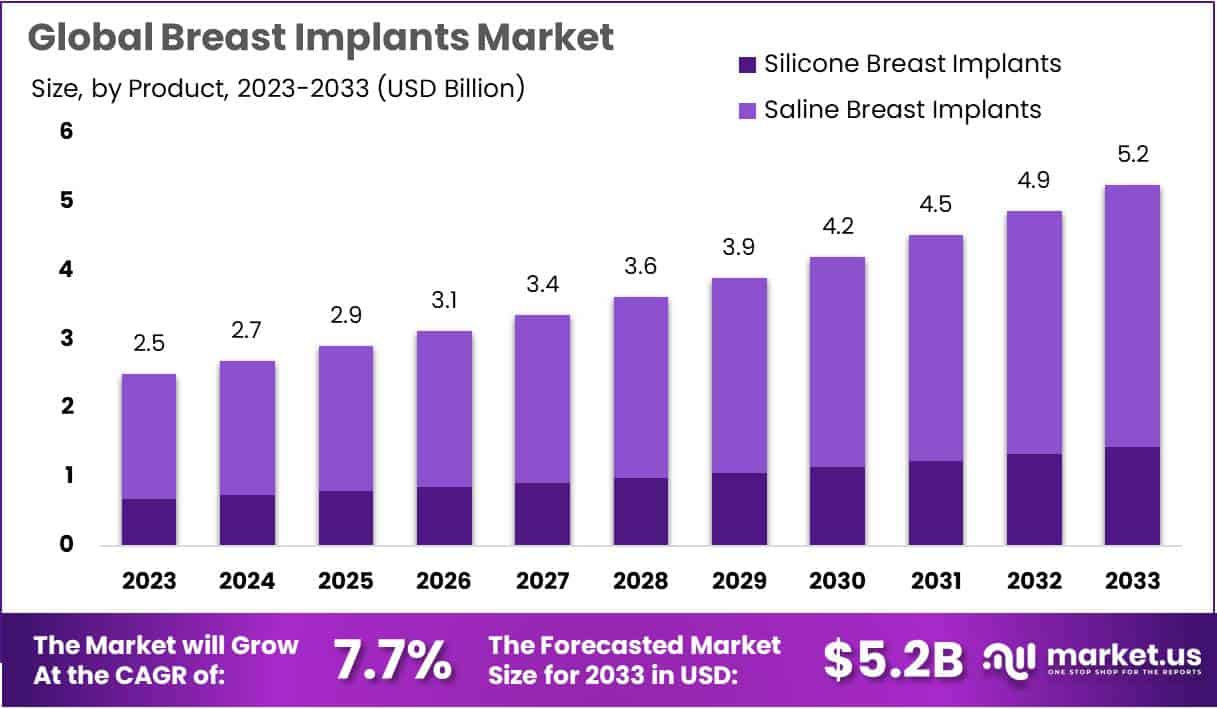

The Breast Implants Market is anticipated to witness substantial growth, with its size projected to reach approximately USD 5.2 Billion by 2033, compared to USD 2.5 Billion in 2023. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 7.7% throughout the forecast period spanning from 2024 to 2033.

Breast implants are specialized medical devices utilized for augmenting or reconstructing the size and shape of women’s breasts. Comprising materials like silicone gel or saline, these implants are surgically placed either for cosmetic enhancement or post-mastectomy reconstruction. They can be positioned beneath chest muscles or directly behind breast tissue, catering to diverse patient needs.

The Breast Implants Market represents the economic landscape surrounding these devices, encompassing manufacturing, distribution, and sales. Market dynamics are shaped by technological advancements, changing consumer preferences, and regulatory trends. Industry stakeholders, including medical device companies and healthcare professionals, contribute to this dynamic market influenced by societal attitudes towards cosmetic surgery and ongoing research into implant safety and efficacy.

Key Takeaways

- Market Growth: Projected to reach USD 5.2 Billion by 2033, the Breast Implants Market exhibits a 7.7% CAGR from 2024 to 2033, showcasing substantial growth.

- Product Dominance: In 2023, Silicone Breast Implants held an 82.7% market share, driven by their natural feel and appearance, while Saline Implants offered adjustability in a niche market.

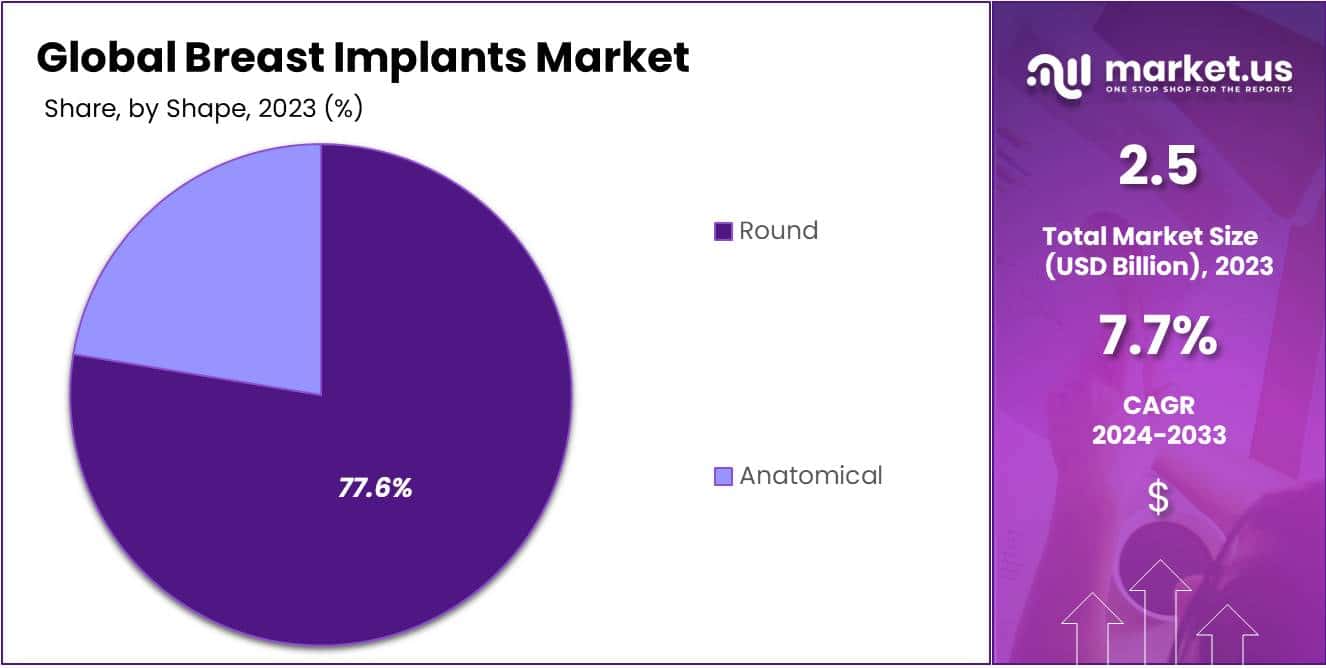

- Shape Trends: Round Shape implants claimed a 77.6% market share in 2023, favored for their versatility, while Anatomical implants, slightly trailing, catered to those seeking a natural outcome.

- End-Use Landscape: Hospitals led with a 66% market share in 2023, emphasizing trust and reliability, while Cosmetology Clinics and Ambulatory Surgical Centers provided personalized approaches and convenient alternatives.

- Market Drivers: Increasing cosmetic surgery demand, technological advancements, rising breast cancer rates, and improving economic conditions contribute to market growth.

- Market Restraints: Safety concerns, regulatory stringency, cultural considerations, and the high cost of procedures pose challenges, impacting market growth potential.

- Market Opportunities: Untapped markets in developing regions, regenerative medicine, R&D for safer implants, and non-surgical alternatives present significant growth prospects.

- Market Trends: Growing preference for natural results, personalized implants using 3D printing, social media influence, and increasing male breast procedures reflect evolving consumer preferences.

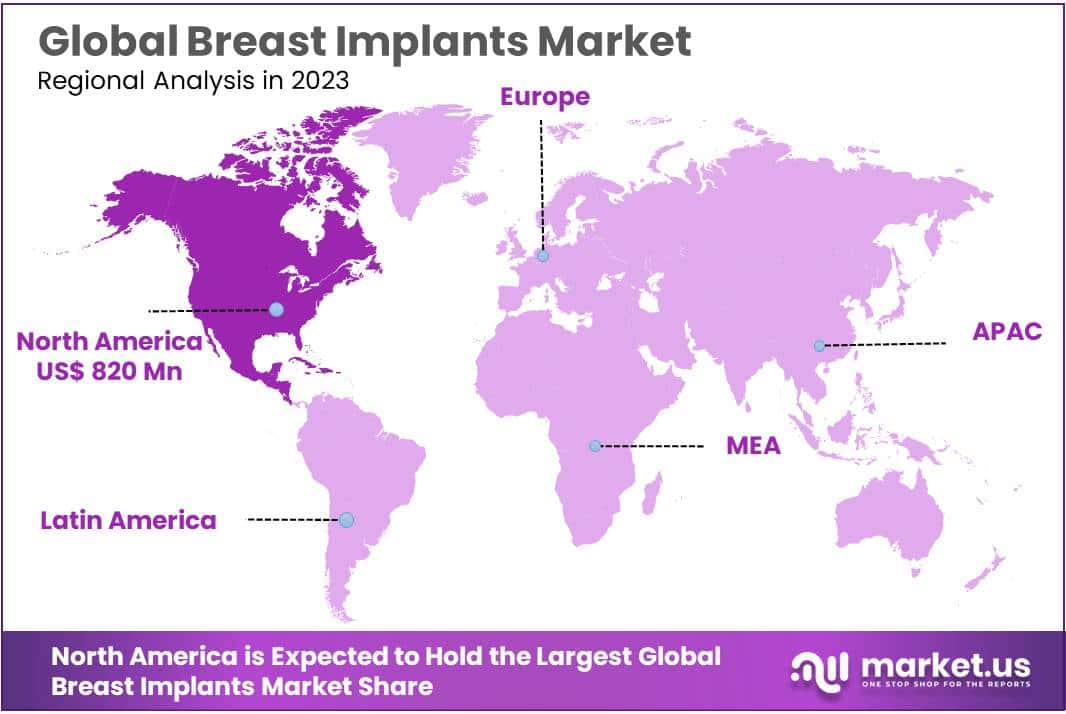

- Regional Analysis: North America leads with a 32.8% market share in 2023, driven by advanced healthcare infrastructure and cultural preferences, while other regions show steady growth influenced by evolving beauty standards.

- Key Players Impact: Allergan, GC Aesthetics, GROUPE SEBBIN SAS, Mentor Worldwide LLC, and Sientra Inc. drive innovation and industry trends, contributing to a dynamic and competitive market landscape.

Product Analysis

In 2023, Silicone Breast Implants held a dominant position in the breast implants market, securing an impressive 82.7% share. These implants, made from silicone gel, have gained widespread popularity due to their natural feel and appearance.

Silicone Breast Implants boast a smooth and soft texture, mimicking the natural suppleness of breast tissue. This characteristic has significantly contributed to their dominance in the market, as they provide a more realistic look and feel compared to alternative options.

On the other hand, Saline Breast Implants, while holding a smaller market share, offer a distinctive advantage. Comprising sterile saltwater, these implants can be adjusted after surgery, allowing for personalized size modifications. Despite holding a comparatively smaller share, Saline Breast Implants attract a niche market seeking flexibility and adjustability.

The Silicone Breast Implants segment is expected to maintain its leading position in the foreseeable future, driven by the enduring preference for a more authentic aesthetic outcome. As advancements in technology continue to enhance the safety and longevity of silicone implants, their dominance is likely to persist, shaping the trajectory of the breast implants market.

Shape Analysis

In 2023, the breast implants market showcased a clear trend in favor of Round Shape, securing a prominent market position with an impressive 77.6% share. This shape’s popularity can be attributed to its versatility and natural appearance, meeting the diverse aesthetic preferences of consumers.

Round implants, characterized by their symmetrical shape, offer a fuller look to the breasts, contributing to their widespread acceptance among individuals seeking a well-balanced enhancement. The simplicity and predictability of Round Shape implants make them a preferred choice for both surgeons and patients alike.

On the other hand, Anatomical implants, while holding a noteworthy market presence, trailed slightly behind with a 22.4% share in 2023. These implants mimic the natural contours of the breast, aiming to provide a more anatomically realistic appearance. Despite their slightly lower market share, Anatomical implants maintain a dedicated consumer base who prioritize a subtle and natural outcome in their breast augmentation journey.

The market dynamics suggest that the dominance of Round Shape implants may continue, owing to their broad appeal and consistent performance in meeting aesthetic expectations. However, the Anatomical segment, with its unique benefits, remains a compelling choice for those desiring a more personalized and natural enhancement. As the breast implants market evolves, these segmented preferences underscore the importance of offering a diverse range of options to cater to the varied needs and desires of individuals seeking breast augmentation procedures.

End-Use

The Hospital segment emerged as the frontrunner, securing a commanding market position by capturing over 66% of the total share in 2023. This dominance can be attributed to the trust and reliability associated with hospital settings, where patients often seek medical professionals for their breast augmentation procedures. Hospitals, equipped with state-of-the-art facilities and a comprehensive range of medical services, continued to attract a significant portion of the breast implant procedures.

Cosmetology Clinics constituted another vital player in the breast implants market landscape. These clinics, known for their specialized cosmetic services, contributed substantially to the market, offering patients a more personalized and aesthetic-focused approach. Cosmetology Clinics garnered a notable market share, appealing to individuals seeking cosmetic enhancements with a heightened emphasis on appearance and beauty.

Ambulatory Surgical Centers (ASCs) also played a pivotal role in the breast implants market, offering a convenient and efficient alternative for patients undergoing these procedures. These centers, known for their outpatient services and streamlined surgical processes, secured a noteworthy market share. Their popularity can be attributed to factors such as cost-effectiveness, shorter recovery times, and a patient-friendly environment, appealing to those looking for a balance between medical professionalism and convenience.

As the breast implants market continued to evolve, the dynamics among these end-use segments reflected the diverse preferences and priorities of consumers. While hospitals maintained their dominance, cosmetology clinics and ambulatory surgical centers showcased their unique strengths, collectively contributing to the vibrant and dynamic landscape of the breast implants market in 2023.

Key Market Segments

Product

- Silicone Breast Implants

- Saline Breast Implants

Shape

- Round

- Anatomical

Application

- Reconstructive Surgery

- Cosmetic Surgery

End-use

- Hospitals

- Cosmetology Clinics

- Ambulatory Surgical Centers

Drivers

Increasing Cosmetic Surgery Demand

The rising trend of aesthetic enhancement and body image consciousness is a significant driver for the breast implants market. Growing social acceptance of cosmetic procedures has led to a surge in demand for breast augmentation surgeries.

Technological Advancements

Continuous innovations in implant materials and surgical techniques contribute to the market’s growth. Advanced technologies, such as 3D printing for customized implants and cohesive gel implants with improved safety profiles, are driving market expansion.

Rising Breast Cancer Rates

The prevalence of breast cancer is a crucial driver, as breast reconstruction surgeries often involve the use of implants. The increasing incidence of breast cancer worldwide is propelling the demand for breast implants in reconstructive procedures.

Improving Economic Conditions

Economic prosperity and an increase in disposable income in emerging markets are enabling more individuals to afford elective cosmetic surgeries. This financial empowerment is positively influencing the demand for breast implants.

Restraints

Safety Concerns and Complications

Despite advancements, safety concerns and potential complications associated with breast implants, such as rupture, leakage, and capsular contracture, remain significant challenges, impacting market growth.

Regulatory Stringency

Stringent regulatory requirements for approval and post-market surveillance pose challenges for manufacturers. Meeting these regulations adds to the cost and time involved in bringing new products to market, limiting the growth potential.

Cultural and Ethical Considerations

Cultural taboos and ethical concerns regarding cosmetic surgery, particularly in certain regions, act as a restraining factor. Societal perceptions and norms can impact the acceptance of breast implants.

High Cost of Procedures

The cost of breast augmentation surgeries and related procedures can be prohibitive for some individuals. The high upfront expenses, coupled with limited insurance coverage for cosmetic surgeries, may impede market growth.

Opportunities

Emerging Markets

Untapped markets in developing regions present significant growth opportunities. As awareness and acceptance of cosmetic procedures increase in these regions, the demand for breast implants is expected to rise.

Regenerative Medicine and Stem Cell Technology

Research in regenerative medicine and stem cell technology holds potential for developing innovative and natural-looking breast augmentation solutions. This avenue presents a promising growth opportunity for market players.

Focus on R&D for Safer Implants

Investing in research and development to create safer and more durable implant materials can differentiate companies in the market. Products with reduced complications and enhanced safety profiles are likely to gain traction.

Non-Surgical Alternatives

The development of non-surgical alternatives for breast enhancement, such as injectable fillers and fat grafting, represents a growing market segment. Companies investing in these alternatives may capitalize on the demand for less invasive procedures.

Trends

Preference for Natural Results

There is a growing trend toward achieving natural-looking results in breast augmentation. Patients are increasingly opting for implants that mimic the feel and appearance of natural breast tissue, driving the development of cohesive gel implants.

Rise of Personalized Implants

Customization is becoming a key trend, with the demand for personalized implants tailored to individual patient anatomy. 3D printing technology is facilitating the creation of implants that match patient-specific requirements.

Social Media Influence

The influence of social media platforms on beauty standards is impacting the breast implants market. Patients often seek procedures to achieve aesthetics popularized by influencers, driving specific trends in implant sizes and shapes.

Increasing Male Breast Procedures

The market is witnessing a rise in breast augmentation procedures among men. Cultural shifts and changing perceptions of male aesthetics contribute to the growing demand for implants in male patients.

Regional Analysis

North America took the lead in the Breast Implants Market, holding a strong position with over 32.8% market share and holds USD 820 Mn market value for the year 2023. This supremacy is underpinned by a combination of factors, including the region’s advanced healthcare infrastructure and a heightened awareness of cosmetic procedures. A pronounced cultural inclination, societal norms, and individual choices in North America seem to fuel a notable demand for breast implants.

The robust healthcare facilities in North America, particularly in the United States, facilitate access to cutting-edge surgical interventions, including sophisticated breast augmentation procedures involving implants. The economic prosperity of the region likely contributes to a larger population with the means to afford elective cosmetic enhancements such as breast augmentation.

Additionally, North America’s leadership in research and development underscores its commitment to pioneering state-of-the-art technologies and materials in the field of breast implant procedures. The cultural dynamics and prevailing beauty standards in North America significantly contribute to the sustained popularity of cosmetic interventions, with breast implants standing out as a prominent choice.

Europe followed closely, securing a substantial market share due to the growing acceptance of aesthetic enhancements and technological advancements in breast implant procedures. The region accounted for a noteworthy percentage of the market, indicating a steady demand for breast implants.

Asia-Pacific emerged as a promising player in the market, experiencing rapid growth driven by increasing disposable incomes and a rising emphasis on physical appearance. The region’s evolving beauty standards contributed to a significant market share, reflecting a growing demand for breast augmentation procedures.

Latin America showcased a notable presence, with a discernible market share in 2023. The cultural significance of aesthetics and beauty in the region, coupled with improving healthcare facilities, played a role in sustaining the demand for breast implants.

The Middle East and Africa demonstrated a gradual but steady rise in the breast implants market, reflecting a shift in attitudes towards cosmetic procedures. Factors such as improving economic conditions and a burgeoning medical tourism industry contributed to the region’s emerging market share.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Breast Implants Market, key players like Allergan, GC Aesthetics, GROUPE SEBBIN SAS, Mentor Worldwide LLC, and Sientra Inc. play pivotal roles in shaping industry trends and meeting the diverse needs of consumers. These companies are at the forefront of innovation, contributing to the constant evolution of breast implant technologies.

Allergan, a recognized leader, boasts a robust portfolio of breast implant products, often characterized by advanced features and a commitment to safety. Their continuous research and development efforts underline their dedication to delivering high-quality solutions.

GC Aesthetics is another notable player, emphasizing aesthetic appeal and patient satisfaction. With a global presence, the company focuses on offering a wide range of breast implants to cater to diverse preferences and requirements across different markets.

GROUPE SEBBIN SAS stands out for its commitment to quality and safety standards. The company places a strong emphasis on product reliability, ensuring that their breast implants meet stringent regulatory requirements and provide long-lasting results.

Sientra Inc. brings innovation and customization to the forefront of the market, offering a variety of implant options designed to meet the individualized needs of patients. The company’s focus on patient-centric solutions contributes to its growing influence in the breast implant landscape.

In addition to these key players, there are other notable contributors to the Breast Implants Market. These players, while not as large in scale, play crucial roles in niche markets or specific product segments. Collectively, they contribute to the overall growth and competitiveness of the industry.

The Breast Implants Market continues to be a dynamic and competitive space, with key players driving innovation, ensuring product safety, and meeting the diverse demands of consumers. As technological advancements and consumer preferences evolve, the market is likely to witness further developments and strategic initiatives from these key players.

Market Key Players

- ALLERGAN

- GC Aesthetics

- GROUPE SEBBIN SAS

- Mentor Worldwide LLC

- Sientra Inc.

- Polytech Health & Aesthetics GmbH

- Establishment Labs S.A.

- Shanghai Kangning Medical Supplies Ltd.

- Guangzhou Wanhe Plastic Materials Co. Ltd.

- LABORATOIRES ARION

- HANSBIOMED CO. LTD.

Recent Developments

- In September 2023: Mentor introduced the Motiva Ergonomix Implant, a fresh kind of breast implant aiming for a more natural look and feel. It’s crafted from a special, softer silicone gel compared to regular implants.

- In June 2023: Silimed launches Purethane Implant, made of a polyurethane foam. This material is designed to be friendlier to the body and tougher against ruptures compared to traditional silicone implants.

- In February 2023: Allergan got a boost by acquiring LifeCell Corporation, a company known for breast implants and surgical products. This move broadens Allergan’s range and taps into LifeCell’s expertise in implant technology.

- In January 2023: Motiva Implant made waves by acquiring Sientra, a player in breast implants and surgical products. This strategic move positions Motiva Implant as a global leader and opens doors to Sientra’s innovative product lineup.

Report Scope

Report Features Description Market Value (2023) USD 2.5 Bn Forecast Revenue (2033) USD 5.2 Bn CAGR (2024-2033) 7.7% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Product (Silicone Breast Implants, Saline Breast Implants), Shape (Round, Anatomical), Application (Reconstructive Surgery, Cosmetic Surgery), End-use (Hospitals, Cosmetology Clinics, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico, Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe, Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe, APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC, Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America, Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ALLERGAN, GC Aesthetics, GROUPE SEBBIN SAS, Mentor Worldwide LLC, Sientra Inc., Polytech Health & Aesthetics GmbH, Establishment Labs S.A., Shanghai Kangning Medical Supplies Ltd., Guangzhou Wanhe Plastic Materials Co. Ltd., LABORATOIRES ARION, HANSBIOMED CO. LTD., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ALLERGAN

- GC Aesthetics

- GROUPE SEBBIN SAS

- Mentor Worldwide LLC

- Sientra Inc.

- Polytech Health & Aesthetics GmbH

- Establishment Labs S.A.

- Shanghai Kangning Medical Supplies Ltd.

- Guangzhou Wanhe Plastic Materials Co. Ltd.

- LABORATOIRES ARION

- HANSBIOMED CO. LTD.