Global Bread Emulsifier Market Size, Share, And Industry Analysis Report By Product Type (Lecithin, Mono and di-glycerides, Diacetyl Tartaric Acid Esters of Monoglycerides (DATEM), Sodium Stearoyl Lactylate (SSL), Calcium Stearoyl Lactylate (CSL)), By Form (Powder, Liquid), By End-user (Industrial Bread, Artisanal and Craft Bread, Frozen Bread and Dough, Gluten-Free and Specialty Bread), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 176557

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

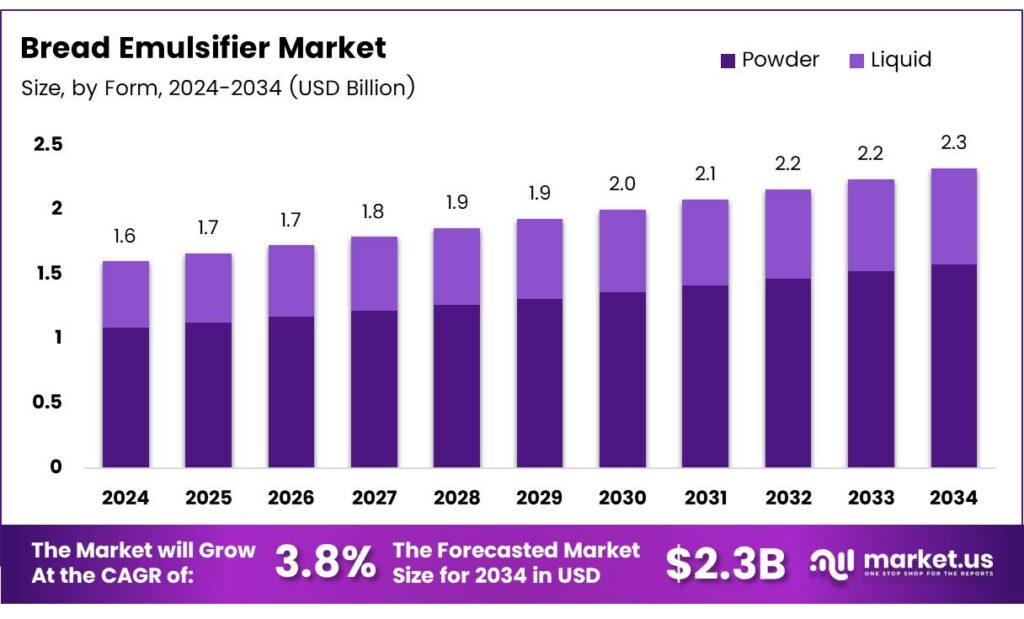

The Global Bread Emulsifier Market size is expected to be worth around USD 2.3 billion by 2034, from USD 1.6 billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

The bread emulsifier market represents a dynamic segment within bakery ingredients, driven by growing demand for consistent texture, extended freshness, and production efficiency. It broadly includes dough strengtheners and dough softeners that support flour performance, enhance dough handling, and improve final bread quality across industrial and artisanal baking segments.

The market continues gaining traction as consumers increasingly prefer soft, voluminous, and long-lasting bakery products. Rising urban consumption and expanding commercial bakeries further accelerate the adoption of functional emulsifiers. Additionally, regulatory focus on clean-label formulations prompts manufacturers to optimize emulsifier blends, ensuring safe usage while meeting evolving bakery ingredient standards globally.

- Emulsifiers play a vital role in improving dough strength, structure, and overall volume. Ingredients like DATEM help reduce added gluten by 30–50% and cut shortening use by 20%, allowing bakeries to enhance texture while lowering formulation costs. These functional benefits support cleaner, healthier product positioning without compromising quality or performance.

Scientific evaluations show that bread made without emulsifiers often turns dry, stale, and lacks volume, while even a 0.5% addition significantly boosts loaf height, softness, and shelf life. Strengtheners such as E472e, E481, and E482, alongside softeners like E471, provide consistent results, helping manufacturers meet growing demand for fresh, uniform, and premium bakery products, ultimately supporting long-term market expansion.

Bread emulsifiers also open opportunities for cost-efficient product formulation. They allow manufacturers to maintain bread quality while reducing dependency on expensive raw materials. This advantage supports large-scale production and consistent supply, especially across emerging markets experiencing steady growth in packaged bread, buns, and specialty bakery formats.

Key Takeaways

- The Global Bread Emulsifier Market is valued at USD 1.6 billion in 2024 and is projected to reach USD 2.3 billion by 2034, at a 3.8% CAGR from 2025 to 2034.

- Mono and di-glycerides dominate the product type segment with a 34.8% share in 2025.

- Powder emulsifiers lead the form segment with a strong 67.2% market share.

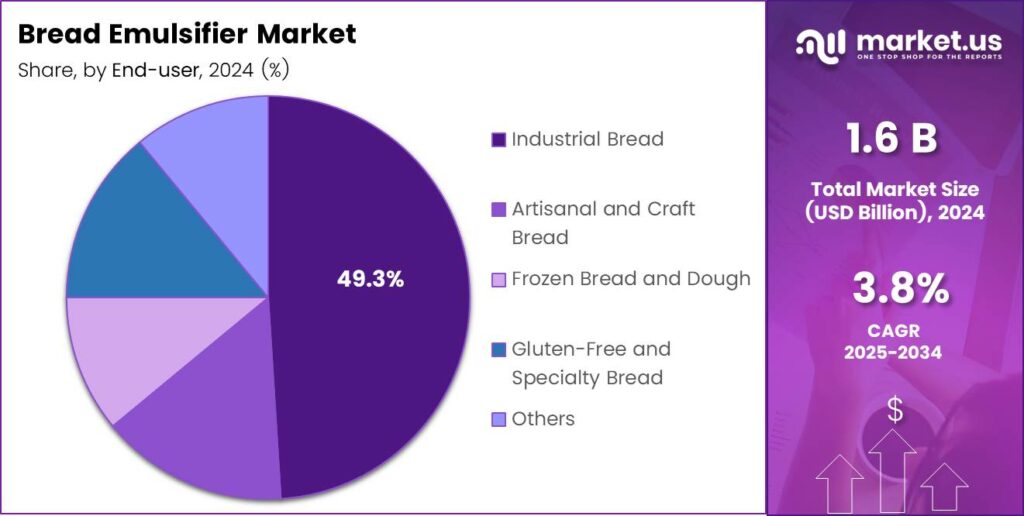

- Industrial Bread is the top end-user category, accounting for 49.3% of total demand.

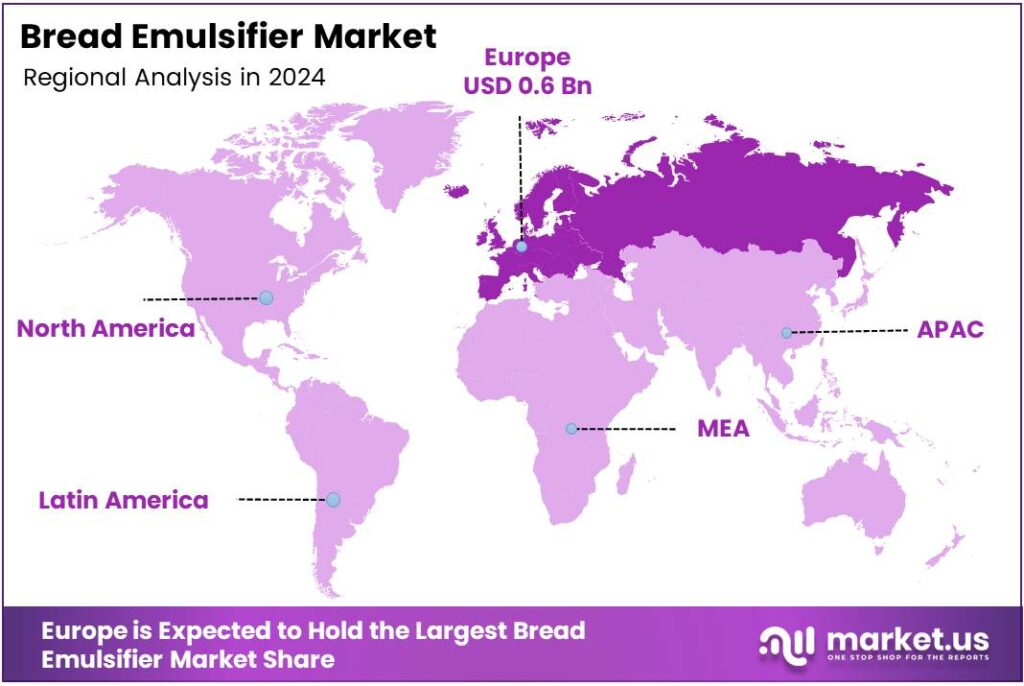

- Europe remains the leading regional market with a 39.9% share, valued at USD 0.6 billion.

By Product Type Analysis

Mono and di-glycerides dominate the Bread Emulsifier Market with 34.8% due to their strong functionality in dough stability.

In 2025, Mono and di-glycerides held a dominant market position in the By Product Type Analysis segment of the Bread Emulsifier Market, with a 34.8% share. This segment benefits from scalable usage, consistent dough performance, and compatibility with both industrial and artisanal baking processes, supporting steady global consumption trends.

Lecithin continues to gain traction as a versatile emulsifier, especially across clean-label bread formulations. Bakers prefer it for its natural origin and ability to improve dough handling. Additionally, rising consumer preference for non-synthetic additives encourages manufacturers to adopt lecithin across multiple bread categories.

Diacetyl Tartaric Acid Esters of Monoglycerides (DATEM) expands steadily as bakeries adopt it for strengthening dough networks. It supports better loaf volume and optimizes gluten performance. Moreover, increasing commercial bread production boosts DATEM usage due to its efficiency in improving texture and overall structural integrity.

Sodium Stearoyl Lactylate (SSL) experiences stable demand as manufacturers rely on it for improved dough tolerance during mechanical processing. It helps maintain bread softness and consistency. The segment grows further as industrial bakeries enhance automation levels and require emulsifiers that ensure reliable output quality.

Calcium Stearoyl Lactylate (CSL) supports applications targeting improved crumb structure and enhanced shelf life. Its ability to stabilize baking formulations makes it suitable for varied dough systems. Furthermore, rising packaged bread demand strengthens the relevance of CSL within evolving large-scale production environments.

By Form Analysis

Powder emulsifiers dominate with 67.2% due to longer shelf life and easy blending properties.

In 2025, Powder held a dominant market position in the By Form Analysis segment of the Bread Emulsifier Market, with a 67.2% share. Powder-based emulsifiers are preferred for their stability, transport convenience, and efficient dispersion in dough systems, strengthening adoption in industrial-scale bakery environments worldwide.

Liquid emulsifiers maintain steady usage across applications requiring rapid incorporation and uniform mixing. Their functionality supports continuous-mix operations, enabling bakers to achieve consistent dough textures. In addition, liquid forms are frequently used in high-moisture dough formulations where fast solubility offers valuable processing advantages.

By End-user Analysis

Industrial Bread dominates the Bread Emulsifier Market with 49.3%, supported by high-volume automated production.

In 2025, Industrial Bread held a dominant market position in the by-end-user-analysis segment of the Bread Emulsifier Market, with a 49.3% share. High-capacity production lines rely on emulsifiers to maintain quality consistency, improve loaf texture, and ensure efficiency, boosting demand across commercial and packaged bread categories.

Artisanal and Craft Bread continues expanding as small bakeries adopt emulsifiers to refine texture and prolong freshness without compromising traditional baking methods. Growing urban demand for premium bread supports this segment while ensuring balanced functional enhancement through controlled emulsifier usage.

Frozen Bread and dough rely on emulsifiers to maintain structure during freezing and thawing. These additives help prevent moisture loss, preserve dough elasticity, and enhance post-bake volume. Rising convenience food consumption accelerates the adoption of emulsifiers in frozen bakery supply chains.

Gluten-Free and Specialty Bread shows steady growth as emulsifiers compensate for the absence of gluten. They improve crumb softness and enhance binding properties. Manufacturers expand this segment by developing innovative formulations that align with dietary preferences and nutritional expectations across health-conscious consumers.

Key Market Segments

By Product Type

- Lecithin

- Mono and di-glycerides

- Diacetyl Tartaric Acid Esters of Monoglycerides (DATEM)

- Sodium Stearoyl Lactylate (SSL)

- Calcium Stearoyl Lactylate (CSL)

- Others

By Form

- Powder

- Liquid

By End-user

- Industrial Bread

- Artisanal and Craft Bread

- Frozen Bread and Dough

- Gluten-Free and Specialty Bread

- Others

Emerging Trends

Shift Toward Natural and Multifunctional Emulsifiers Shapes Market Trends

A major trend in the bread emulsifier market is the move toward natural and label-friendly ingredients. Consumers increasingly check ingredient lists, encouraging manufacturers to use cleaner alternatives. Natural lecithin, enzymes, and plant extracts are gaining popularity as replacements for synthetic emulsifiers.

- India is a good example of how this can open doors for bread emulsifiers. The country projected wheat production at 117.5 million metric tons in 2025, up from 113.3 million in 2024, and total food grain production was estimated at 354 million tons (up from 332.3 million).

The development of multifunctional emulsifiers that offer improved dough tolerance, better volume, and long shelf-life with smaller dosages. These advanced solutions help manufacturers reduce costs while maintaining performance, especially in high-speed industrial baking. Sustainability is also influencing innovation. Companies are exploring emulsifiers sourced from non-GMO crops and responsibly grown raw materials.

Drivers

Rising Demand for High-Quality and Longer-Lasting Bread Products Drives Market Growth

The bread emulsifier market is growing because consumers increasingly prefer soft, fresh, and high-volume bread. Emulsifiers help improve dough strength, texture, and shelf-life, making them essential for modern bakeries. As demand for packaged bakery foods rises, emulsifiers become more important in production.

- Growing urbanization is another strong driver, as busy lifestyles push people toward ready-to-eat bread and bakery items. This shift increases the need for consistent quality, which emulsifiers help maintain during large-scale production. In 2025, global wheat production is forecast at 800.1 million tonnes, which keeps flour supply stable enough for large bakeries to plan high-volume runs and standardize recipes.

Food manufacturers also rely on emulsifiers to reduce production costs. For example, using DATEM or mono- and diglycerides can reduce the need for added gluten and shortenings, helping bakeries remain competitive. This cost efficiency improves adoption across emerging markets as well.

Restraints

Growing Concerns Over Additives in Processed Foods Restrict Market Expansion

The bread emulsifier market faces restraints due to increasing consumer concerns about artificial additives. Many buyers today prefer clean-label and minimally processed food, reducing reliance on synthetic emulsifiers. This shift forces manufacturers to reformulate products, often increasing production complexity.

- Regulatory guidelines in regions like Europe and North America also act as constraints. Strict labeling and safety standards require companies to invest time and resources in compliance. Global cereals trade in 2025/26 is forecast at 500.6 million tonnes. Cleaner-label emulsifiers help here because they can reduce label debates, lower reformulation cycles, and improve consumer trust—especially in packaged bread where buyers notice ingredient lists quickly.

Raw material price volatility is another challenge. Emulsifiers derived from soy, palm oil, or other agricultural sources depend on global supply conditions. Fluctuating prices make it difficult for manufacturers to maintain stable production costs and profit margins over time.

Growth Factors

Rising Demand for Clean-Label and Natural Ingredients Creates New Growth Opportunities

Natural emulsifiers represent one of the biggest opportunities in the bread emulsifier market. As consumers prefer healthier and transparent ingredient lists, companies can grow by developing plant-based options such as sunflower lecithin or enzyme-based solutions.

- The expansion of industrial bakeries in emerging markets also opens new prospects. Countries in the Asia Pacific, Latin America, and the Middle East are witnessing rapid growth in packaged bread consumption. The sector employs nearly 800,000 people and generates over $42 billion in direct wages, with an overall economic impact of more than $186 billion.

Innovation in bakery formulations presents further opportunity. Bread makers increasingly explore gluten-free, high-protein, and specialty breads, all of which depend on emulsifiers for structure and texture. This diversifies usage beyond traditional white bread and boosts market potential.

Regional Analysis

Europe Dominates the Bread Emulsifier Market with a Market Share of 39.9%, Valued at USD 0.6 Billion

Europe leads the Bread Emulsifier Market, supported by mature bakery industries, strong artisan bread culture, and strict quality standards. With a dominant 39.9% share and a valuation of USD 0.6 billion, the region benefits from rising clean-label preferences and steady industrial bread production. Regulatory support for ingredient safety and consistent R&D adoption further strengthen the region’s leadership.

North America shows stable demand driven by packaged bakery consumption, large-scale commercial baking operations, and a strong focus on shelf-life optimization. Consumers’ interest in premium baked goods and healthier formulations continues to encourage the use of emulsifiers. Regulatory clarity and rapid innovation adoption support consistent regional expansion.

Asia Pacific reflects fast-paced growth due to rising urbanization, expanding bakery chains, and growing Western-style food consumption. The region’s demand for convenient bakery products, particularly in China, India, and Southeast Asia, fuels uptake. Increasing investments in modern bakery facilities and rising disposable incomes further accelerate market penetration.

The Middle East & Africa market remains developing but shows notable progress in metropolitan areas. Greater reliance on packaged and frozen bakery items enhances emulsifier usage. Growth in retail modernization and expanding quick-service outlets supports regional demand, despite being comparatively smaller than mature global markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Bread Emulsifier Market in 2025 continues to advance steadily as manufacturers emphasize clean-label formulations, improved dough performance, and enhanced shelf-life solutions. Major industry participants are strengthening portfolios through innovation, regional expansion, and strategic partnerships aligned with the rapid growth of industrial and artisanal baking.

IFF remains a significant innovator in functional emulsification systems, leveraging its broad ingredient science capabilities. The company focuses on advanced dough-conditioning technologies that enhance bread volume, texture consistency, and processing efficiency for large-scale bakeries. Its R&D-driven approach positions it well for rising demand in frozen and specialty bakery formats.

ADM continues to expand its bakery ingredient footprint by integrating natural emulsifiers and multifunctional dough enhancers. With strong sourcing capabilities and processing scale, ADM supports global customers seeking reliable formulation stability and reduced dependency on synthetic additives. Its emphasis on sustainability resonates strongly in emerging markets.

Cargill, Incorporated maintains a robust position through its diversified emulsifier technologies and strong presence in both industrial and artisanal bakery supply chains. The company prioritizes label-friendly mono- and diglyceride solutions, enabling customers to balance cost efficiency with performance. Its global distribution strengths allow consistent market reach.

Associated British Foods plc leverages its established bakery ingredient subsidiaries to provide high-performance emulsifiers that optimize dough handling and final bread quality. The company’s strategic integration across bakery supply networks allows it to deliver tailored emulsification solutions, supporting cleaner formulations and market-specific bakery trends.

Top Key Players in the Market

- IFF

- ADM

- Cargill, Incorporated

- Associated British Foods plc

- Palsgaard

- Kerry Group plc.

- AAK Foods

- British Bakels

- Ervesa

- BAKO Group Limited

Recent Developments

- In 2025, IFF highlighted enzyme innovations such as ENOVERA to boost dough strength in industrial baking. This proprietary lipase-based solution serves as a label-friendly alternative to conventional emulsifiers and gluten, improving process tolerance, consistency, and sustainability in products like whole wheat bread.

- In 2025, ADM’s powdered deoiled lecithin, a plant-derived ingredient from soybeans, enhances bakery products by improving dough handling, reducing mixing time, and extending shelf life. It’s promoted for blending, moisture retention, and fat-sparing in baked goods like bread.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.3 Billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lecithin, Mono and di-glycerides, Diacetyl Tartaric Acid Esters of Monoglycerides (DATEM), Sodium Stearoyl Lactylate (SSL), Calcium Stearoyl Lactylate (CSL), Others), By Form (Powder, Liquid), By End-user (Industrial Bread, Artisanal and Craft Bread, Frozen Bread and Dough, Gluten-Free and Specialty Bread, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape IFF, ADM, Cargill, Incorporated, Associated British Foods plc, Palsgaard, Kerry Group plc, AAK Foods, British Bakels, Ervesa, BAKO Group Limited Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Bread Emulsifier MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Bread Emulsifier MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IFF

- ADM

- Cargill, Incorporated

- Associated British Foods plc

- Palsgaard

- Kerry Group plc.

- AAK Foods

- British Bakels

- Ervesa

- BAKO Group Limited