Global Border Security Drone Market Size, Share, Growth Analysis By Type (Fixed-Wing Drones, Multi-Rotor Drones), By Application (Surveillance, Patrol, Threat Detection, Search and Rescue, Others), By Technology (Thermal Imaging, Radar, LiDAR, AI & Analytics, Others), By End-User (Military, Homeland Security, Coast Guard, Law Enforcement), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165966

- Number of Pages: 296

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

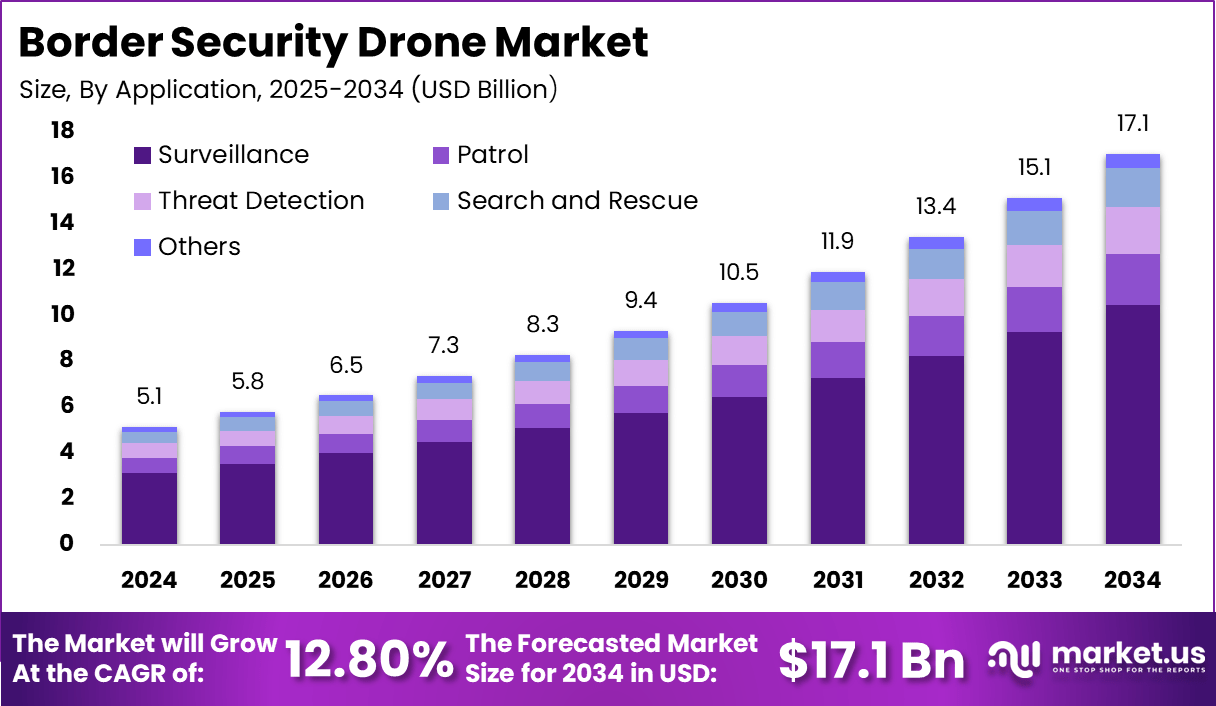

The global Border Security Drone Market is expected to expand rapidly as nations prioritize advanced surveillance, rapid threat detection, and real-time intelligence along critical border zones. With a market value of USD 5.12 billion in 2024 and a projected CAGR of 12.80%, the sector is anticipated to reach USD 17.1 billion by 2034, driven by rising geopolitical tensions, cross-border infiltration risks, and government investments in automated monitoring technologies.

Border agencies are increasingly adopting unmanned aerial systems equipped with thermal imaging, radar, and AI-enabled analytics to strengthen situational awareness, reduce patrol costs, and improve response speed in remote or hostile terrains.

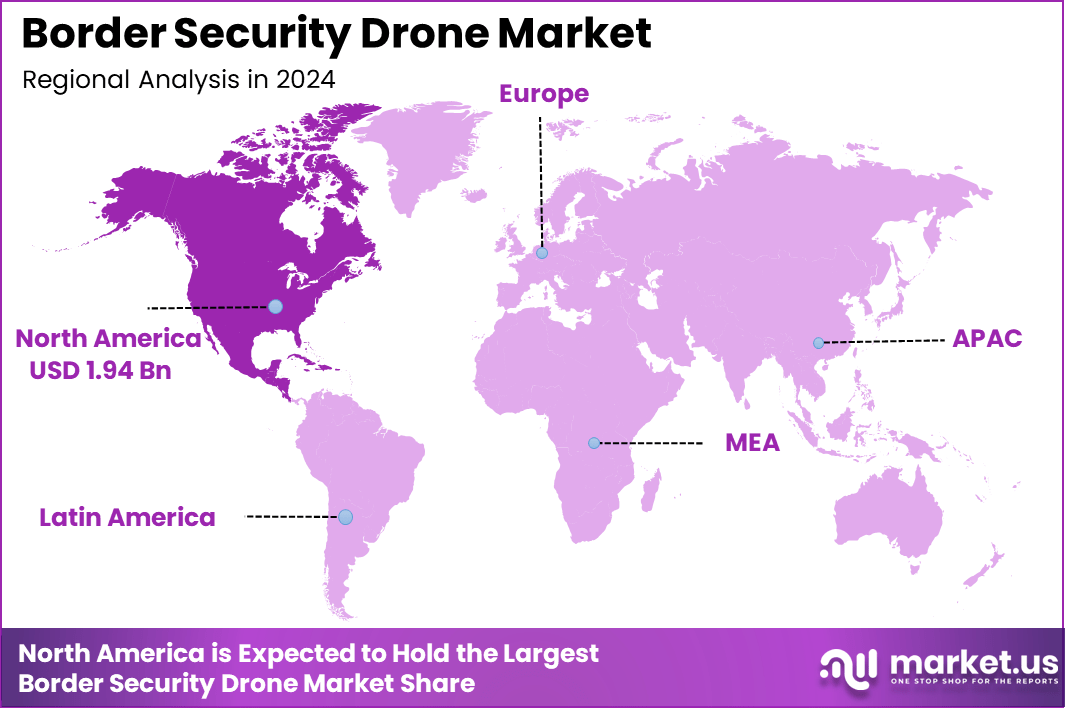

North America accounts for 38% of the global share, reflecting strong adoption by defense and homeland security agencies. The region’s market size of USD 1.94 billion in 2024 is supported by significant procurement programs, advanced drone manufacturing ecosystems, and robust federal funding for border modernization initiatives.

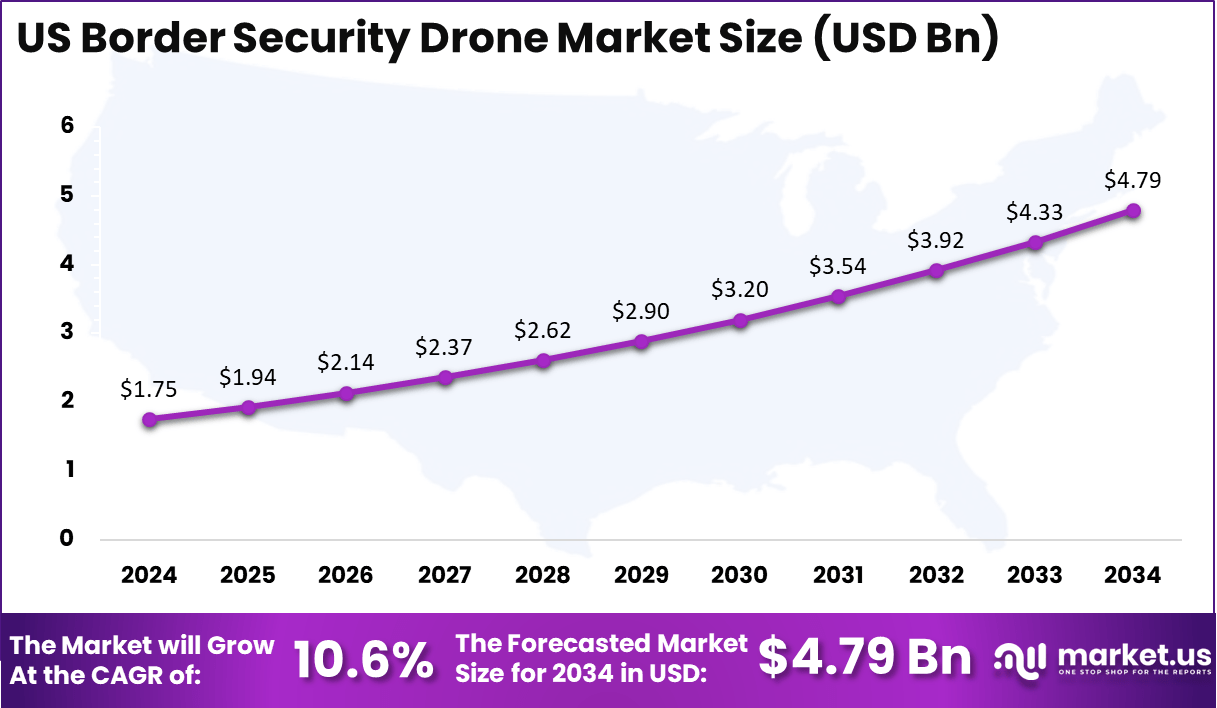

The US dominates regional demand with a valuation of USD 1.75 billion in 2024, expected to grow to USD 4.79 billion by 2034 at a CAGR of 10.6%, as authorities deploy drones for persistent surveillance, drug-smuggling detection, and automated border patrol operations. Strengthening national security remains central to the rising demand for intelligent drone-based border enforcement solutions.

The Border Security Drone Market is emerging as one of the most critical components of modern national security frameworks, as governments worldwide shift toward advanced, technology-driven surveillance solutions to safeguard territorial boundaries. Border regions are increasingly facing challenges such as illegal crossings, smuggling, human trafficking, drug movement, and unauthorized surveillance by hostile groups.

These threats are driving the adoption of unmanned aerial systems capable of providing persistent monitoring, real-time intelligence, and rapid response capabilities across vast and difficult terrains. Drones equipped with high-resolution cameras, thermal imaging, LiDAR, and AI-powered analytics are becoming indispensable tools for defense forces and homeland security agencies, enabling them to detect, track, and assess threats with greater accuracy and lower operational costs compared to manned patrol units.

As global defense spending rises and nations invest heavily in automated border monitoring programs, the market is experiencing strong momentum. Demand is further supported by advancements in battery technology, extended flight endurance, beyond-visual-line-of-sight (BVLOS) capabilities, and the integration of autonomous navigation systems.

With increasing emphasis on strengthening perimeter security and enhancing situational awareness, border security drones are expected to play a transformative role in future defense infrastructure. Their ability to operate continuously and deliver mission-critical intelligence positions them as a cornerstone of next-generation border protection strategies.

In 2025, India’s Border Security Force (BSF), with help from ISRO, developed drone-mounted radar systems to strengthen surveillance along its western and eastern borders. These drones improve the detection of illegal activities such as infiltration and smuggling by providing persistent, accurate monitoring in difficult terrains. The BSF also launched a specialized “School of Drone Warfare” to train personnel in advanced drone operations, reflecting a growing focus on technology-enhanced border security.

Additionally, India fast-tracked a substantial ₹20,000 crore (approximately $2.4 billion) procurement deal for 87 Medium Altitude Long Endurance (MALE) drones equipped with real-time ISR (intelligence, surveillance, reconnaissance) and planned integration of indigenous missile systems to modernize border defense capabilities. Leading Indian firms like Adani Defence, HAL, IdeaForge, and NewSpace Research are expected participants in this initiative.

On the corporate front, mergers such as Unusual Machines’ $14.5 million deal to merge with Aloft Technologies aim to enhance border drone identification capabilities in the U.S. market. Garuda Aerospace showcased eight new drone models in early 2025, focused on defense and emergency response, including rockets, logistical, and firefighting drones. IdeaForge secured orders worth around ₹100 crore (approximately $12 million) for tactical UAVs from the Indian Army in November 2025.

Economically, tariff changes in 2025 have shifted procurement priorities for border security drones, with increasing emphasis on domestic manufacturing and collaborations due to high tariffs (up to 170 percent) on foreign systems, especially from China. This has influenced border agencies to prioritize resilience and supply chain security in acquisitions. The global border security drone market is estimated at $2.5 billion in 2025 and is expected to grow at a 15% CAGR through 2033.

Together, these developments underscore a strategic transition towards integrating advanced sensors, AI, and autonomous capabilities into border drones, investment in indigenous production, and expanding training infrastructure to meet escalating surveillance and security needs worldwide.

Key Takeaways

- The Border Security Drone Market is valued at USD 5.12 billion in 2024, driven by rising global security concerns.

- The market is projected to reach USD 17.1 billion by 2034, reflecting a strong CAGR of 12.80%.

- North America holds a dominant 38% share, supported by high defense spending and advanced drone programs.

- The region’s 2024 market size stands at USD 1.94 billion, led by major border modernization initiatives.

- The US contributes USD 1.75 billion in 2024, showcasing significant adoption across federal border protection agencies.

- The US market is expected to grow to USD 4.79 billion by 2034, registering a CAGR of 10.6%.

- Fixed-wing drones account for the largest share by type at 59.7%, driven by longer endurance and wider coverage.

- Surveillance remains the leading application with a 61.3% share, due to increased demand for persistent monitoring of border zones.

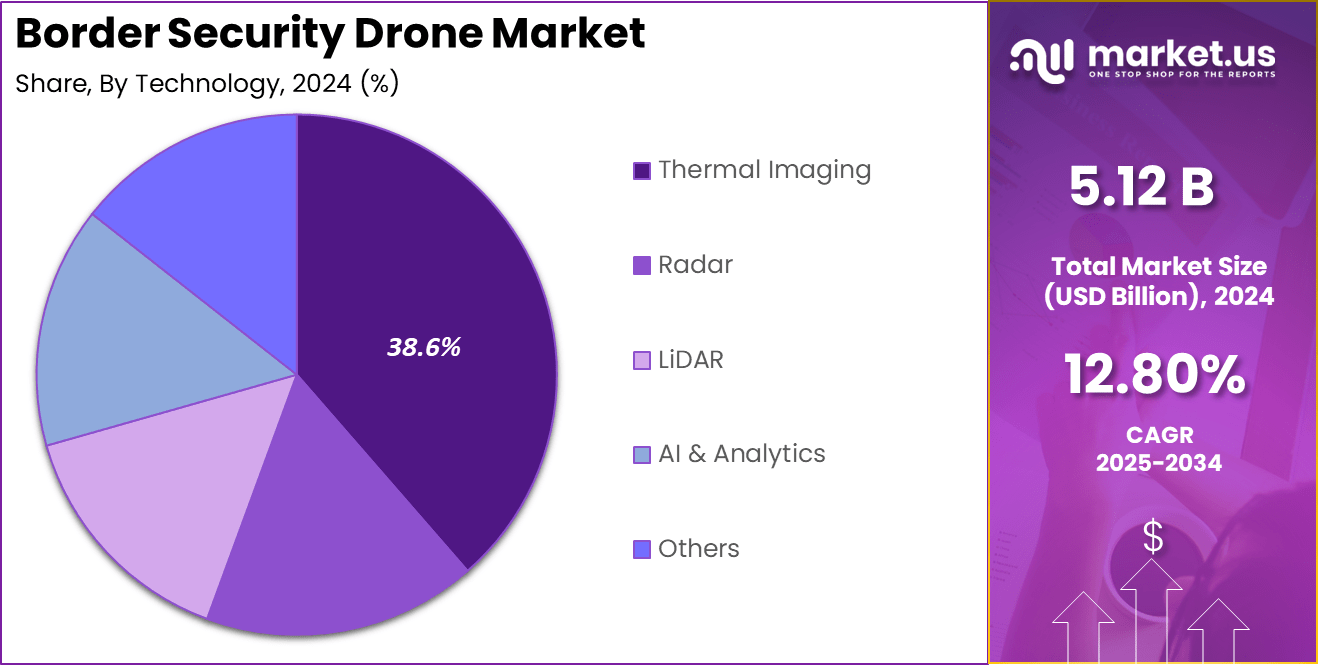

- Thermal imaging technology holds a 38.6% share, reflecting its importance in night operations and low-visibility environments.

- Military end-users dominate the market with a 57.4% share, indicating strong deployment for defense-led border protection missions.

Role Of Aerospace

Aerospace plays a critical role in shaping modern defense, transportation, communication, and scientific advancement, acting as a cornerstone of global technological progress. Its influence extends far beyond aircraft and spacecraft, driving innovation across surveillance, navigation, satellite imaging, autonomous systems, and national security.

In defense, aerospace technologies provide countries with advanced capabilities such as precision strikes, secure communication networks, and rapid mobility for troops and equipment. The integration of unmanned aerial systems, stealth platforms, and next-generation fighter aircraft has significantly strengthened modern military operations.

In the civilian domain, aerospace supports global connectivity through commercial aviation, enabling the efficient movement of people and goods across continents. Satellite-based systems developed through aerospace research power essential services, including GPS navigation, weather forecasting, climate monitoring, and global telecommunications. These technologies are vital for disaster response, scientific research, and sustainable development.

Aerospace also plays a foundational role in emerging markets such as urban air mobility, hypersonic travel, and space exploration. Its advancements drive economic growth by creating high-skilled jobs, fostering innovation ecosystems, and enabling cross-sector collaborations. As nations prioritize safety, sustainability, and technological dominance, the role of aerospace continues to expand, shaping future mobility, enhancing global security, and unlocking new possibilities in space and beyond.

Industry Adoption

Industry adoption of advanced technologies has accelerated across nearly every sector as organizations prioritize efficiency, automation, and data-driven decision-making. Businesses are increasingly integrating digital tools to streamline operations, enhance productivity, and remain competitive in fast-changing markets.

Technologies such as artificial intelligence, robotics, IoT, cloud computing, and automation are being rapidly deployed to optimize workflows, reduce operational costs, and improve service delivery. This shift is particularly visible in manufacturing, logistics, automotive, healthcare, and defense, where real-time monitoring, predictive maintenance, and intelligent analytics have become essential components of modern operations.

Enterprises are also adopting industry-specific innovations such as autonomous drones, smart sensors, digital twins, and advanced cybersecurity frameworks to address evolving challenges. The growing focus on sustainability and regulatory compliance is further encouraging industries to invest in solutions that support energy efficiency, carbon monitoring, and environmentally responsible practices. In parallel, workforce transformation is taking place as companies train employees to work alongside intelligent systems and adapt to new digital ecosystems.

The rise of remote work, cloud-based collaboration, and decentralized infrastructure has also fueled faster adoption of flexible and scalable technologies. Overall, industry adoption is moving toward a future where automation, connectivity, and intelligence form the backbone of business operations, enabling organizations to operate with higher accuracy, greater speed, and improved resilience.

Emerging Trends

Emerging trends in the border security drone landscape reflect a rapid shift toward automation, advanced sensing, and integrated intelligence systems that enhance national security operations. One of the most prominent trends is the adoption of AI-driven analytics, enabling drones to autonomously detect suspicious activity, classify objects, and relay actionable insights to command centers in real time.

This reduces human workload and improves decision-making speed, especially in remote or high-risk border areas. Another key trend is the increasing use of beyond-visual-line-of-sight (BVLOS) operations, supported by improved regulatory frameworks and advanced communication networks. BVLOS capabilities allow drones to cover wider territories without constant manual control, significantly boosting operational efficiency.

Thermal imaging and multispectral sensors are also becoming essential, especially for night surveillance and harsh-weather monitoring, providing clearer detection of human and vehicular movement. The integration of 5G and satellite connectivity is further enhancing drone communication reliability, ensuring uninterrupted data transmission even in isolated border regions.

Additionally, hybrid-powered and solar-assisted drones are gaining traction due to longer flight endurance and lower maintenance needs. Militaries and homeland security agencies are also investing in swarm drone systems capable of coordinated real-time surveillance across multiple zones. These emerging trends collectively indicate a future where autonomous, intelligent, and long-range drones become the backbone of border protection worldwide.

US Market Size

The US border security drone market is experiencing strong growth as federal agencies intensify investments in advanced surveillance technologies to secure national boundaries. Valued at USD 1.75 billion in 2024, the market reflects increasing reliance on unmanned aerial systems for persistent monitoring, rapid threat detection, and real-time intelligence gathering.

Rising concerns related to illegal border crossings, drug trafficking, and smuggling activities are driving government programs to deploy drones with improved endurance, advanced imaging, and autonomous navigation capabilities. As part of broader homeland security modernization efforts, agencies such as U.S. Customs and Border Protection (CBP) are expanding their drone fleets and integrating AI-powered analytics to enhance situational awareness across challenging terrains.

By 2034, the US market is expected to reach USD 4.79 billion, growing at a CAGR of 10.6%. This expansion is supported by technological advancements such as BVLOS operations, high-resolution thermal imaging, LiDAR-based mapping, and next-generation communication systems.

The growing collaboration between defense contractors, drone manufacturers, and AI solution providers is strengthening the ecosystem further. Additionally, increased federal funding and strategic initiatives aimed at improving border efficiency and response time are accelerating adoption. The market’s long-term trajectory indicates a sustained shift toward automated, intelligence-driven border management supported by robust drone capabilities.

By Type

Fixed-wing drones account for 59.7% of the border security drone market, making them the dominant type due to their superior endurance, wider coverage, and higher operational efficiency. These drones are engineered to fly longer distances with minimal energy consumption, allowing border patrol agencies to monitor vast, remote, and hard-to-access areas with fewer interruptions.

Their aerodynamic design supports extended flight times, making them ideal for large-scale surveillance missions, coastal monitoring, anti-smuggling patrols, and rapid-response reconnaissance. Fixed-wing platforms can also carry advanced payloads such as long-range electro-optical sensors, thermal cameras, and communication relays, enabling more accurate detection and tracking of suspicious activities across rugged border zones.

Their ability to operate at higher altitudes enhances visibility and reduces the chances of being detected by hostile groups. In contrast, multi-rotor drones serve as a complementary segment, valued for their agility, vertical takeoff and landing (VTOL) capability, and precision hovering.

While they are widely used for close-range monitoring and quick-deployment missions, their shorter flight time limits their role in long-distance patrol operations. As border security strategies evolve toward long-endurance, high-coverage surveillance systems, fixed-wing drones continue to dominate the market, driven by demand for scalable, reliable, and cost-efficient aerial monitoring solutions.

By Application

Surveillance holds the largest share in the border security drone market at 61.3%, driven by the growing need for continuous, real-time monitoring of national borders. Border regions often span thousands of kilometers across deserts, forests, mountains, and coastlines, making traditional patrol methods costly, slow, and resource-intensive.

Surveillance drones provide a significant advantage by offering persistent aerial coverage, day and night visibility, and rapid area scanning without requiring large manpower. Equipped with high-resolution cameras, thermal imaging, AI-powered object detection, and long-range communication systems, these drones enable agencies to track movement, identify unauthorized crossings, and monitor suspicious activities with exceptional accuracy.

Their ability to automatically transmit live intelligence to command centers has strengthened situational awareness and improved response times across border zones. Other applications, such as patrol, threat detection, search and rescue, and general support, also contribute to market growth, though at smaller shares.

Patrol missions rely heavily on multi-rotor drones for short-range monitoring and quick deployment, while threat detection involves using advanced sensors to identify armed groups, smuggling networks, or illicit activities. Search and rescue operations benefit from drones capable of locating missing individuals in challenging environments. Despite this broad application range, surveillance remains the core operational focus, reflecting increasing demand for high-endurance, intelligence-driven monitoring solutions at borders.

By Technology

Thermal imaging accounts for 38.6% of the border security drone market, making it the leading technology segment due to its unmatched capability to detect activity in low-visibility and nighttime conditions. Border regions frequently experience harsh weather, dense vegetation, and rugged terrains that limit the effectiveness of conventional optical cameras.

Thermal sensors overcome these challenges by detecting heat signatures from humans, vehicles, and animals, enabling precise identification of unauthorized movements even in complete darkness. This makes thermal imaging essential for monitoring remote zones, preventing illegal crossings, and supporting covert surveillance operations.

The technology is widely integrated into fixed-wing and multi-rotor drones used by defense and homeland security agencies, providing real-time intelligence and enhancing border situational awareness. Other technologies such as radar, LiDAR, AI and analytics, and general imaging systems are also gaining momentum. Radar-equipped drones are crucial for long-range detection and tracking in fog, rain, or dust-heavy environments.

LiDAR supports terrain mapping, infrastructure monitoring, and high-accuracy navigation along complex border landscapes. AI and analytics improve mission automation, enabling drones to classify objects, predict movement patterns, and trigger alerts without human intervention. While these technologies contribute to overall operational efficiency, thermal imaging remains the most widely adopted due to its reliability, versatility, and superior performance across varying environmental conditions.

By End-User

Military agencies represent the largest end-user segment in the border security drone market with a 57.4% share, driven by the increasing need for advanced, persistent, and intelligence-rich surveillance capabilities along national borders. Militaries operate in high-risk and strategically sensitive areas where long-endurance drones equipped with thermal imaging, radar, and AI-enabled analytics provide significant tactical advantages.

These systems help monitor infiltration routes, detect armed groups, track smuggling networks, and support rapid reconnaissance during conflicts or heightened geopolitical tensions. Military forces also prefer fixed-wing drones for their extended flight times, wide-area coverage, and ability to carry multiple advanced payloads simultaneously. Their integration into command-and-control frameworks strengthens border situational awareness, reduces manpower load, and enhances decision-making accuracy.

Other end users, such as homeland security departments, coast guards, and law enforcement agencies, also contribute to growing adoption. Homeland security units focus on preventing illegal crossings, drug trafficking, and human smuggling, relying heavily on drones for real-time intelligence along land borders.

Coast guard agencies deploy drones for maritime surveillance, monitoring suspicious vessels, and supporting search-and-rescue missions across coastal borders. Law enforcement bodies use drones for rapid response, emergency assessments, and tracking hostile activities near border towns. While these segments continue to expand, the military remains the dominant user due to higher budgets, large-scale deployment programs, and the need for advanced, mission-critical border monitoring systems.

Key Market Segments

By Type

- Fixed-Wing Drones

- Multi-Rotor Drones

By Application

- Surveillance

- Patrol

- Threat Detection

- Search and Rescue

- Others

By Technology

- Thermal Imaging

- Radar

- LiDAR

- AI & Analytics

- Others

By End-User

- Military

- Homeland Security

- Coast Guard

- Law Enforcement

Regional Analysis

North America accounts for 38% of the global border security drone market, reflecting the region’s advanced technological ecosystem, strong defense spending, and increasing emphasis on modernizing border protection systems. Valued at USD 1.94 billion in 2024, the market benefits from extensive adoption across federal agencies responsible for safeguarding vast land and coastal borders.

The region’s diverse terrain—including deserts, forests, mountainous zones, and long coastlines—drives the need for drones capable of long-endurance surveillance, thermal imaging, radar-based detection, and autonomous navigation. Government programs aimed at strengthening national security, preventing illegal crossings, and combating drug trafficking continue to prioritize the deployment of unmanned aerial systems for real-time monitoring and threat identification.

The United States leads regional demand due to its extensive border infrastructure and large-scale homeland security investments. Agencies such as U.S. Customs and Border Protection (CBP), Department of Homeland Security (DHS), and the Coast Guard increasingly rely on drones to enhance situational awareness and reduce operational costs associated with ground patrols.

Canada is also adopting drones for surveillance in remote border areas and Arctic regions, where manned patrols are difficult and expensive. With ongoing technological advancements, expanding defense budgets, and continuous modernization initiatives, North America is expected to maintain its leadership position as drone-based surveillance becomes integral to border management strategies.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The border security drone market is primarily driven by rising geopolitical tensions, increased illegal border activities, and the growing need for real-time intelligence across large and complex terrains. Governments are investing heavily in advanced surveillance systems to enhance national security, enabling drones to replace or support traditional patrol units with greater efficiency and lower operational costs.

Advancements in thermal imaging, AI-powered analytics, and long-endurance flight technologies further strengthen demand by improving threat detection accuracy and situational awareness. Additionally, the expansion of cross-border smuggling, human trafficking networks, and unauthorized migrations has accelerated the adoption of drones equipped with advanced sensors and autonomous navigation systems. Regulatory support for beyond-visual-line-of-sight (BVLOS) operations and increased defense spending across major economies also contribute significantly to market growth.

Restraint Factors

Despite strong growth potential, the market faces several restraints that impact adoption. High procurement and maintenance costs associated with advanced drones and sensor payloads limit uptake, especially among budget-constrained agencies. Strict regulatory frameworks governing airspace usage and BVLOS operations create operational hurdles and delay large-scale deployments.

Concerns over data privacy, cybersecurity risks, and potential misuse of surveillance technologies also pose challenges for widespread acceptance. Additionally, technological limitations such as battery life constraints, susceptibility to extreme weather conditions, and the need for skilled operators restrict operational efficiency in certain regions.

Terrain complexities in mountainous or densely forested areas may further limit drone performance. Integration with existing border infrastructure requires substantial coordination and investment, slowing adoption for developing nations. These factors collectively hinder market expansion despite strong security-driven demand.

Growth Opportunities

The market presents significant growth opportunities as countries continue modernizing their border security infrastructure. Expansion of autonomous drone fleets capable of long-endurance missions and AI-driven analytics offers strong potential for scaling surveillance and threat detection operations.

Increased adoption of BVLOS capabilities opens opportunities for covering wider geographic areas without requiring extensive manpower. Integrating drones with advanced command-and-control systems, satellite communication, and real-time data-sharing platforms further enhances mission accuracy. Growing interest in hybrid-powered and solar-assisted drones provides opportunities to reduce operational costs and extend flight durations.

The rise of maritime border surveillance, Arctic monitoring, and cross-border infrastructure protection also presents new avenues for drone deployment. Public–private partnerships and collaboration with defense contractors, AI firms, and sensor technology providers are expected to drive innovation, creating opportunities for customized drone solutions tailored to specific border environments.

Trending Factors

Emerging trends indicate a shift toward intelligent, autonomous, and multi-mission drone systems across border security operations. AI and machine learning integration is rapidly expanding, enabling drones to identify threats, classify objects, and trigger automated alerts. Adoption of thermal imaging and multispectral sensors continues to grow for enhanced nighttime and all-weather monitoring.

The trend toward swarm drone technology is gaining traction, allowing coordinated surveillance over wide areas in real time. BVLOS operations are becoming increasingly common as regulatory frameworks evolve. Lightweight composite materials and improved battery technologies are shaping next-generation drone designs, increasing endurance and payload capacity.

Integration of 5G, satellite connectivity, and cloud-based analytics enables seamless communication and faster decision-making. Militaries and homeland security agencies are also adopting drones for multi-role tasks such as search and rescue, coastal patrol, and rapid-response reconnaissance, reflecting a broader trend toward versatile, technology-driven border protection.

Competitive Analysis

The competitive landscape of the border security drone market is shaped by a mix of large defense prime contractors and innovative unmanned systems specialists. Established global players such as Northrop Grumman Corporation, Lockheed Martin Corporation, The Boeing Company, and Elbit Systems Ltd. maintain strong positions due to their broad portfolios, longstanding government relationships, and integrated surveillance-solutions expertise.

These firms benefit from scale, global reach, and the ability to offer turnkey systems combining drones, payloads, command-and-control, and analytics. At the same time, smaller and niche drone manufacturers like Skydio, Inc. are gaining traction by providing autonomous drone solutions tailored for intelligence, surveillance, and reconnaissance missions.

In this context, competitive dynamics are increasingly driven by the following factors: acquisition and partnership strategies to consolidate capabilities; rapid innovation in sensor payloads, AI/analytics, and unmanned endurance; and contract wins with military and homeland security agencies.

Defense primes are leveraging their vast ecosystems to bundle systems; however, challengers focus on agility and specialization. For stakeholders in the border security drone space, maintaining cost-competitiveness, securing long-term contracts, and advancing autonomous capabilities will be critical for sustaining competitive advantage.

Top Key Players in the Market

- Israel Aerospace Industries

- Elbit Systems

- Lockheed Martin

- Northrop Grumman

- Boeing

- Teledyne FLIR

- Skydio

- Autel Robotics

- SenseFly

- PrecisionHawk

- Thales

- BAE Systems

- Others

Recent Developments

- November 13, 2025: Border Security Force (BSF) in India launched its first all-women drone unit, the “Durga Drone Squadron”, at the School of Drone Warfare in Gwalior. This team is being trained in surveillance, reconnaissance, and counter-drone operations, marking a major step in gender inclusion and technology-driven border patrol operations.

- October 16, 2025: The European Commission proposed four flagship defense projects aimed at enhancing drone defense and border monitoring along the Eastern flank of Europe, including the “European Drone Defence Initiative”, which underscores the growing emphasis on unmanned aerial systems in securing external borders.

- November 17, 2025: It was reported that India’s Defence Research and Development Organisation (DRDO) is set to deploy 16 indigenous laser-based anti-drone systems capable of engaging unmanned aerial vehicles up to 2 km away. This highlights an intensified focus on counter-UAV technology as part of border and airspace security.

Report Scope

Report Features Description Market Value (2024) USD 5.12 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR(2025-2034) 12.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Fixed-Wing Drones, Multi-Rotor Drones), By Application (Surveillance, Patrol, Threat Detection, Search and Rescue, Others), By Technology (Thermal Imaging, Radar, LiDAR, AI & Analytics, Others), By End-User (Military, Homeland Security, Coast Guard, Law Enforcement) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Israel Aerospace Industries, Elbit Systems, Lockheed Martin, Northrop Grumman, Boeing, Teledyne FLIR, Skydio, Autel Robotics, senseFly, PrecisionHawk, Thales, BAE Systems, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Border Security Drone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Border Security Drone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Israel Aerospace Industries

- Elbit Systems

- Lockheed Martin

- Northrop Grumman

- Boeing

- Teledyne FLIR

- Skydio

- Autel Robotics

- senseFly

- PrecisionHawk

- Thales

- BAE Systems

- Others