Global Boiler Insurance Market Size, Share, Statistics Analysis Report By Boiler Type (Fire-Tube, Water-Tube), By Boiler Fuel (Natural Gas, Coal, Oil , Others), By Coverage Type (Boiler Cover, Boiler and Central Heating Cover, Boiler, Central Heating, Plumbing and Wiring Cover), By End-User (Chemicals, Refineries, Metal and Mining, Food and Beverages, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139055

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Statistics

- Key Takeaways

- Regional Analysis

- By Boiler Type

- By Boiler Fuel

- By Coverage Type

- By End-User

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

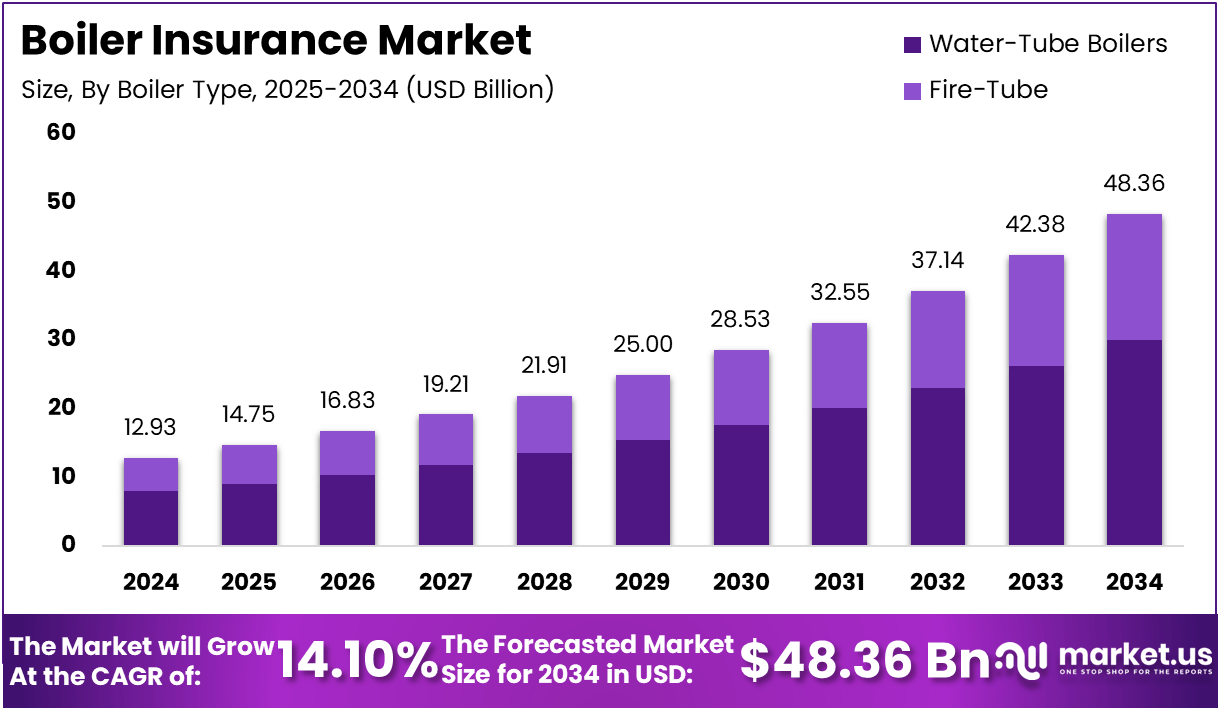

The Global Boiler Insurance Market size is expected to be worth around USD 48.36 Billion By 2034, from USD 12.93 Billion in 2024, growing at a CAGR of 14.10% during the forecast period from 2025 to 2034.

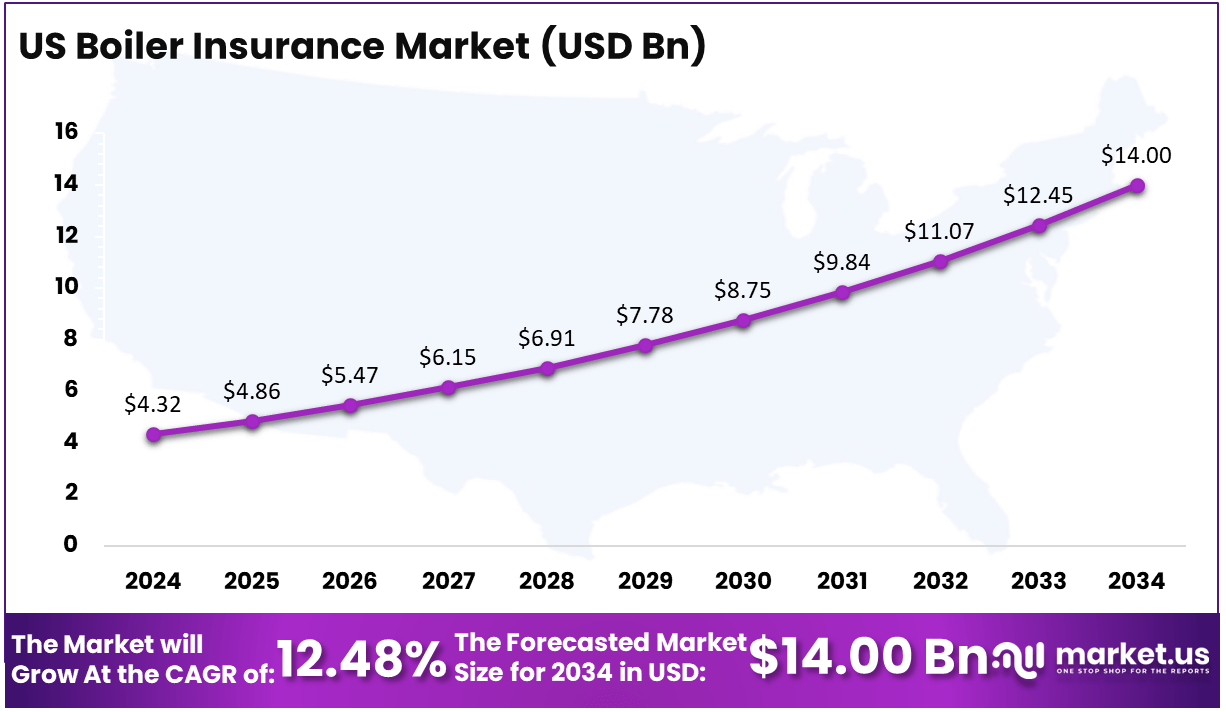

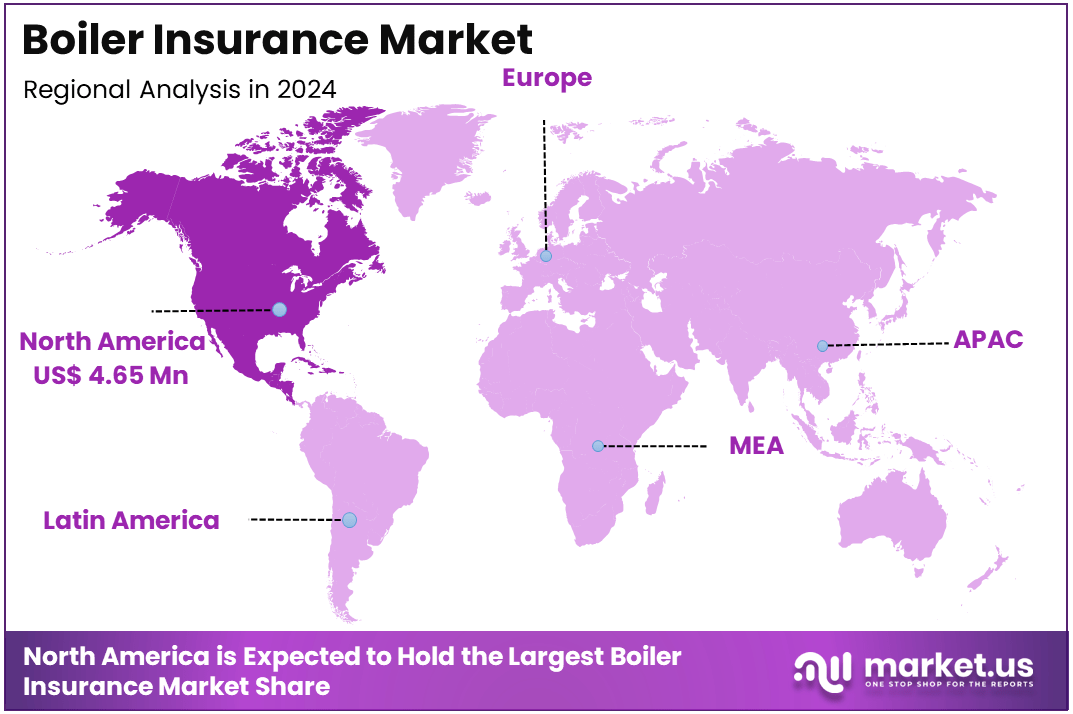

In 2024, North America held a dominant market position, capturing more than a 36% share and earning USD 4.65 billion in revenue. Further, the United States dominated the market by USD 4.32 billion, steadily holding a strong position with a CAGR of 12.48%.

Boiler insurance is a specialized form of coverage designed to protect both residential and commercial boiler systems against potential risks such as damage, breakdowns, and liability. This type of insurance often covers the repair or replacement costs of the boiler, along with other elements like pipes and radiators.

In addition to coverage for breakdowns, some policies also include protection against accidents caused by the malfunctioning of the boiler, which can result in property damage or injury. Given the high cost of boiler systems and the potential risks associated with their operation, boiler insurance provides peace of mind to homeowners and businesses alike.

The global boiler insurance market has seen steady growth in recent years, driven by increased awareness of the risks associated with malfunctioning boilers and the importance of timely maintenance. As both residential and commercial sectors are heavily reliant on boiler systems for heating and hot water, the demand for boiler insurance has surged, particularly in regions with cold climates.

The market is also witnessing expansion due to rising energy prices, which push businesses and homeowners to maintain their equipment to prevent costly disruptions. Key players in the market include insurance companies and specialized firms offering tailored boiler protection plans.

Several factors are driving the growth of the boiler insurance market. First, the increasing number of boiler installations, particularly in emerging markets, is directly contributing to the rising demand for insurance. Additionally, stringent safety regulations around heating systems and a greater focus on preventing accidents or damage have prompted businesses and homeowners to seek comprehensive coverage.

Moreover, the unpredictable nature of weather patterns, especially in regions with extreme temperatures, has made boiler systems more susceptible to wear and tear, further boosting the need for insurance. Rising energy costs also encourage consumers to ensure their boilers are maintained to avoid costly breakdowns.

The demand for boiler insurance is primarily being driven by the increasing reliance on boiler systems for daily activities, particularly in colder regions where heating is essential. Commercial establishments like hotels, offices, and industrial facilities that depend on boilers for large-scale heating and hot water needs are contributing to a significant portion of market demand.

Residential demand is also growing as homeowners become more aware of the importance of maintaining and insuring their boiler systems. With the shift towards eco-friendly and energy-efficient boilers, insurance providers are responding by offering tailored plans to cater to these newer technologies, ensuring a broad customer base.

Key Statistics

Market Segmentation & Dominance:

- Fuel Type:

- Natural Gas: Accounts for the largest percentage of boiler fuel usage (specific percentage data varies by region, e.g., potentially 35-45% in some regions).

- Coverage Type:

- Boiler and Central Heating Cover: Holds the largest market share, potentially around 40-50% of total coverage policies.

- End User:

- Chemicals: Largest market share, potentially representing 20-30% of the boiler insurance market revenue.

Energy Consumption Thresholds (Regulations/Compliance):

- Energy Management System Requirement: Average annual energy consumption exceeding 85 Terajoules (TJ) over the previous 3 years.

- Companies Consuming over 10TJ annually that don’t implement energy management system may face non-compliance penalties.

Lifecycle and Usage (Illustrative Data – Subject to Variation):

- Average Boiler Lifespan: 15-30 years (depending on type, maintenance, and usage intensity).

- Average Annual Boiler Usage (Industrial): 2000-6000 hours.

- Boiler Efficiency Rates: Ranges from 70% to 90+% (depending on technology and maintenance).

Key Takeaways

- Market Size: The boiler insurance market is projected to grow from USD 12.93 billion in 2024 to USD 48.36 billion by 2034, with a CAGR of 14.10%.

- Boiler Type: Water-tube boilers dominate the market, accounting for 62% of the total market share.

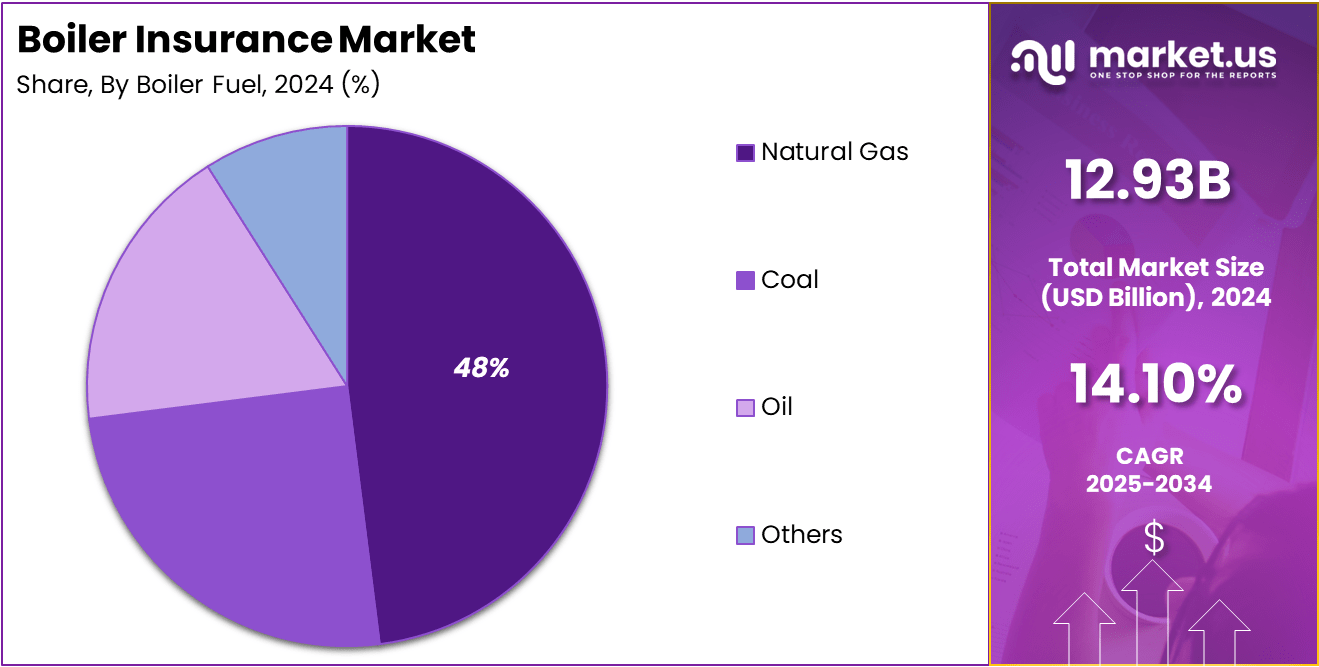

- Boiler Fuel: Natural gas is the leading fuel type, making up 48% of the market.

- Coverage Type: Boiler and central heating cover represents 40% of the market demand.

- End-User Segment: The chemical industry is the largest end-user segment, with a 27% market share.

- Geographical Insights: North America holds a 36% share of the global market.

- US Market Size: The US boiler insurance market is valued at USD 4.32 billion.

- US Market Growth: The US market is growing at a CAGR of 12.48%.

Regional Analysis

US Boiler Insurance Market Size

Further, in North America, the United States dominates the boiler insurance market with a substantial market size of USD 4.32 billion. This strong position is reinforced by a steady growth trajectory, evidenced by a robust CAGR of 12.48%.

The U.S. market benefits from a large and diverse customer base across both residential and commercial sectors, where boiler systems are integral for heating, hot water, and industrial processes. The demand for boiler insurance in the U.S. is fueled by increasing awareness of the risks associated with boiler malfunctions, coupled with stringent safety regulations that mandate regular maintenance and coverage.

Additionally, the high reliance on natural gas-powered boilers, especially in colder regions, has contributed to the market’s expansion. The presence of key market players in the U.S. further accelerates the availability of tailored boiler insurance plans, catering to the specific needs of consumers and businesses alike.

As energy prices rise and the need for efficient heating systems becomes more critical, the demand for boiler insurance is expected to continue growing, ensuring that the U.S. maintains its dominant market share in North America. This steady growth underscores the resilience of the U.S. boiler insurance sector in the face of evolving market dynamics.

North America Boiler Insurance Market Size

In 2024, North America held a dominant market position in the boiler insurance market, capturing more than a 36% share, equating to approximately USD 4.65 billion in revenue. This strong performance can be attributed to several factors, including the high demand for heating systems, particularly in colder regions like the United States and Canada.

The extensive use of natural gas boilers, which require regular maintenance and insurance, further fuels market growth. In addition, stringent safety regulations in North America are prompting both residential and commercial users to ensure their boiler systems are covered, increasing the demand for insurance services.

The United States remains the largest market in North America, valued at USD 4.32 billion and growing at a CAGR of 12.48%. The nation’s reliance on boilers for industrial processes, heating, and hot water needs, combined with rising energy prices, drives the need for insurance coverage.

Furthermore, the U.S. market benefits from the presence of key insurance providers offering specialized policies that cater to both traditional and energy-efficient boiler systems. These factors collectively help solidify North America’s leading position in the global market.

In contrast, regions like Europe and Asia-Pacific (APAC), while growing, face more fragmented market dynamics. Europe has established boiler usage but has less comprehensive adoption of boiler insurance compared to North America, where regulatory frameworks are more robust. APAC, despite its growing industrial base, sees slower penetration of boiler insurance, mainly due to varying levels of awareness and insurance infrastructure across countries.

Latin America and Africa also represent emerging markets, but their boiler insurance demand is comparatively lower due to economic conditions, less stringent regulations, and slower adoption of modern boiler systems. Similarly, the Middle East has growing industrial boiler usage, but its insurance market is not as mature as that of North America, limiting its share in the global boiler insurance market.

By Boiler Type

In 2024, the Water-Tube Boilers segment held a dominant market position, capturing more than 62% of the global boiler insurance market. This leading position can be attributed to the widespread use of water-tube boilers in large-scale industrial applications, including power plants, manufacturing facilities, and chemical plants.

Water-tube boilers are known for their ability to handle high pressures and generate large volumes of steam efficiently, making them essential for high-demand processes. Their robust performance and longevity also mean that the risk of breakdowns or failures can have significant financial and operational impacts, driving demand for comprehensive insurance coverage.

Additionally, the increasing need for energy efficiency and sustainability has led many industries to adopt water-tube boilers, which offer improved heat exchange capabilities and lower operational costs over time. These boilers’ versatility in both small and large applications adds to their market dominance. As industries continue to grow and expand, the demand for reliable and insured water-tube boilers will remain strong, reinforcing this segment’s leading position in the global market.

By Boiler Fuel

In 2024, the Natural Gas segment held a dominant market position, capturing more than 48% of the global boiler insurance market. Natural gas boilers are widely used across both residential and commercial sectors due to their efficiency, lower emissions, and relatively lower fuel costs compared to other fuel types like coal or oil. This widespread adoption, particularly in regions with cold climates, has made natural gas the preferred fuel for heating systems.

The growing emphasis on environmental sustainability is another key factor contributing to the dominance of natural gas in the boiler insurance market. As governments and industries increasingly prioritize clean energy solutions, natural gas boilers are seen as a more eco-friendly alternative to coal-powered systems, reducing the carbon footprint of heating operations.

Moreover, natural gas boilers offer better operational efficiency and reliability, making them less prone to major failures, which in turn encourages businesses and homeowners to secure insurance coverage for their systems. As energy efficiency remains a key driver in the industry, the natural gas segment is expected to continue its strong market leadership.

By Coverage Type

In 2024, the Boiler and Central Heating Cover segment held a dominant market position, capturing more than 40% of the global boiler insurance market. This segment’s leadership can be attributed to the widespread need for both boiler protection and central heating system coverage, particularly in regions with cold climates where these systems are essential for daily living.

Homeowners and businesses increasingly prefer comprehensive coverage that protects not only the boiler itself but also the entire central heating system, ensuring uninterrupted heating and hot water supply. The combined coverage of both boiler and central heating systems offers significant value by mitigating the risk of unexpected repairs and breakdowns, which can lead to costly expenses.

Furthermore, with the growing trend towards energy-efficient heating systems and smart technology, consumers are looking for policies that cover a range of potential issues related to modern installations. As these systems become more complex, the demand for all-encompassing coverage that guarantees peace of mind continues to drive the Boiler and Central Heating Cover segment’s dominance. This trend is expected to persist as consumers prioritize comprehensive protection for their heating infrastructure.

By End-User

In 2024, the Chemicals segment held a dominant market position, capturing more than 40% of the global boiler insurance market. The chemical industry relies heavily on boiler systems for various critical processes, including steam generation for heating, distillation, and chemical reactions.

This high dependency on boilers for production and safety makes the chemical sector particularly prone to risks associated with boiler breakdowns, which can result in costly operational disruptions. As a result, businesses in this sector prioritize securing comprehensive boiler insurance to mitigate the financial impact of system failures.

Furthermore, the chemical industry operates under strict safety and environmental regulations, which further drives the need for reliable insurance coverage. Boilers in chemical plants are often subjected to high pressures and temperatures, increasing the likelihood of malfunctions and failures.

To minimize downtime and maintain operational efficiency, insurance policies covering both the boilers and related infrastructure are essential. The combination of high risk, stringent regulations, and the need for uninterrupted production gives the Chemicals segment its leading position in the global boiler insurance market.

Key Market Segments

By Boiler Type

- Fire-Tube

- Water-Tube

By Boiler Fuel

- Natural Gas

- Coal

- Oil

- Others

By Coverage Type

- Boiler Cover

- Boiler and Central Heating Cover

- Boiler, Central Heating, Plumbing and Wiring Cover

By End-User

- Chemicals

- Refineries

- Metal and Mining

- Food and Beverages

- Others

Driving Factors

Increasing Industrialization and Demand for Efficient Heating Systems

One of the primary driving factors behind the growth of the boiler insurance market is the rapid pace of industrialization and the growing demand for efficient heating systems across various sectors. As industries expand globally, there is an increasing need for reliable boiler systems, which are integral to a range of manufacturing processes, from chemical production to food processing and power generation.

Boilers are used for steam generation, heating, and powering critical industrial operations. As more companies invest in these systems to boost operational efficiency, the need for insurance coverage to protect these high-value assets has become more pronounced.

In emerging economies, industrial growth is accelerating, particularly in regions like Asia-Pacific and Latin America, where rapid urbanization and infrastructure development are fueling demand for robust energy systems, including boilers. These regions are seeing an increased installation of industrial boilers, which directly translates into higher demand for boiler insurance policies to protect against potential breakdowns and costly disruptions.

Restraining Factors

High Premium Costs for Boiler Insurance

Despite the growing demand for boiler insurance, high premium costs remain a significant restraining factor for the market, particularly for small businesses and homeowners. The premium costs for comprehensive boiler insurance can be substantial, especially for industrial boilers that require specialized coverage for high-risk operations. These high costs can deter some businesses from investing in boiler insurance, particularly in cost-sensitive industries where margins are tight.

For small and medium-sized enterprises (SMEs), the cost of insurance premiums can be prohibitive. Additionally, in certain regions, the complexity of the policies and the perceived low risk of boiler malfunctions lead businesses to forgo insurance altogether, relying on basic maintenance to mitigate risks. The steep premiums can also discourage residential customers from purchasing coverage for their boilers, despite the potential for costly repairs or system failures.

Moreover, in markets where awareness of the importance of boiler insurance is still developing, businesses and homeowners may perceive the costs as outweighing the benefits. This lack of awareness, combined with the high upfront cost, can limit the adoption of boiler insurance, slowing overall market growth in certain regions.

Growth Opportunities

Emerging Markets and Green Boiler Technologies

A key growth opportunity in the global boiler insurance market lies in the expanding industrial base in emerging economies, particularly in regions like Asia-Pacific, Africa, and Latin America. As industrialization continues to rise in these areas, the demand for reliable and efficient heating systems will naturally follow.

These regions are increasingly investing in infrastructure development, which includes the installation of boilers in sectors such as chemicals, manufacturing, and energy. This provides significant opportunities for insurance companies to tap into a new and growing customer base.

Additionally, there is a growing trend towards green boiler technologies, including condensing boilers and smart boilers that optimize energy use and reduce emissions. As governments around the world continue to implement stricter environmental regulations, industries are turning to more energy-efficient systems to meet sustainability targets.

Insurance providers can capitalize on this trend by offering specialized coverage for these advanced, eco-friendly technologies. As the adoption of green technologies continues to grow, particularly in industrial sectors and residential markets, there is a clear opportunity for insurers to expand their offerings and cater to the growing demand for energy-efficient boiler solutions.

Challenging Factors

Technological Disruptions in Boiler Systems

The rapid evolution of boiler technology presents a challenge for insurance companies. As boilers become more sophisticated with the integration of smart technology and IoT (Internet of Things), insurers face the challenge of accurately assessing and pricing the risk associated with these newer systems.

The increased complexity of modern boilers, including their enhanced energy efficiency and advanced control systems, means that traditional risk models may no longer apply. This makes it difficult for insurers to create accurate pricing models that reflect the real risk of failure, leading to potential underpricing or overpricing of policies.

Additionally, the shift towards eco-friendly and energy-efficient boilers introduces a layer of uncertainty. While these boilers are designed to reduce operational costs and environmental impact, they also come with different maintenance needs and potential failure points that insurers may not fully understand.

The lack of historical data on these newer systems complicates risk assessment and could lead to higher claims costs or gaps in coverage. This technological disruption also means that insurers must invest in training and upgrading their internal systems to handle the complexities of newer boiler technologies, which can incur significant operational costs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Growth Factors

The global boiler insurance market is experiencing robust growth, driven by several key factors. One of the primary growth drivers is the increasing industrialization across emerging economies. As industries such as chemicals, power generation, and manufacturing expand, the demand for reliable boiler systems continues to rise.

Boilers are crucial for these industries, and their proper functioning is essential for uninterrupted operations. This growth is largely fueled by the heightened awareness of the risks associated with boiler failures, leading businesses to invest in comprehensive coverage.

Another growth factor is the increased regulatory pressure for safety and environmental standards. With stricter safety regulations, particularly in sectors like chemicals and power plants, businesses are increasingly opting for boiler insurance to ensure compliance and avoid fines.

Emerging Trends

Several emerging trends are reshaping the boiler insurance market. Technological integration is one of the most significant trends, as more businesses adopt smart boilers that feature sensors and IoT connectivity.

These innovations allow for real-time monitoring of boiler performance, enabling preventive maintenance and reducing the risk of breakdowns. Insurers are now integrating this data into their pricing models, offering more customized policies based on real-time risk assessment.

Another notable trend is the growing preference for bundled insurance packages. Customers are increasingly looking for comprehensive coverage that includes not only the boiler but also the central heating system, plumbing, and wiring.

This trend is gaining traction, particularly in Europe, where harsh winters create a high demand for reliable heating systems. Insurance providers are responding by creating multi-layered policies that provide broader coverage, enhancing customer satisfaction and retention.

Business Benefits

For businesses, boiler insurance offers several key benefits that contribute to long-term operational efficiency and cost savings. By securing comprehensive insurance coverage, companies can protect themselves from the potentially high costs of equipment failure, which can include repair or replacement expenses, as well as revenue losses due to downtime.

This is particularly critical in industrial sectors like chemicals and refineries, where boiler malfunctions can halt entire production lines, leading to significant financial losses. Another benefit is the peace of mind that comes with knowing that the business is covered against unexpected breakdowns.

For industries relying heavily on boilers for operations, such as in the metal and mining sectors, an unexpected failure can be detrimental not only to financial health but also to reputation. Having boiler insurance in place minimizes the impact of such events and allows companies to focus on core operations without worrying about potential risks.

Key Players Analysis

Aviva PLC, one of the leading players in the global insurance market, has been actively strengthening its position in the boiler insurance sector through strategic acquisitions and market expansion. In recent years, the company has focused on enhancing its product offerings by acquiring regional players to increase its market share and broaden its customer base.

Allianz SE, a global insurance giant, has significantly bolstered its presence in the boiler insurance sector with a focus on product innovation and strategic mergers. The company has been actively working on expanding its boiler insurance product range to meet the evolving needs of both commercial and residential customers.

AXA S.A. has been actively strengthening its position in the boiler insurance market through strategic partnerships and a focus on sustainable offerings. In recent years, AXA has been partnering with technology firms to integrate smart monitoring devices into its boiler insurance policies. This allows customers to track the health of their boiler systems in real-time, thereby reducing the likelihood of unexpected breakdowns.

Top Key Players in the Market

- Aviva plc

- Allianz SE

- Axa S.A.

- Bosch Thermotechnology Ltd. (Robert Bosch GmbH)

- British Gas (Centrica PLC)

- CORGI HomePlan Ltd (OVO Group Ltd)

- Domestic & General Group Limited

- Future Generali India Insurance Co. Ltd.

- HomeServe Membership Ltd.

- Tata AIG General Insurance Company Limited (Tata Sons Private Limited)

- Hartford Steam Boiler

- Other Key Players

Recent Developments

- In 2024, the boiler insurance market witnessed a significant shift toward green boiler insurance products, driven by the global push for sustainability and energy efficiency.

- In 2024, a notable development in the boiler insurance market was the integration of smart technology into insurance policies.

Report Scope

Report Features Description Market Value (2024) USD 12.93 Billion Forecast Revenue (2034) USD 48.36 Billion CAGR (2025-2034) 14.10% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Boiler Type (Fire-Tube, Water-Tube), By Boiler Fuel (Natural Gas, Coal, Oil , Others), By Coverage Type (Boiler Cover, Boiler and Central Heating Cover, Boiler, Central Heating, Plumbing and Wiring Cover), By End-User (Chemicals, Refineries, Metal and Mining, Food and Beverages, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape Aviva plc, Allianz SE, Axa S.A., Bosch Thermotechnology Ltd. (Robert Bosch GmbH), British Gas (Centrica PLC), CORGI HomePlan Ltd (OVO Group Ltd), Domestic & General Group Limited, Future Generali India Insurance Co. Ltd., HomeServe Membership Ltd., Tata AIG General Insurance Company Limited (Tata Sons Private Limited), Hartford Steam Boiler, Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aviva plc

- Allianz SE

- Axa S.A.

- Bosch Thermotechnology Ltd. (Robert Bosch GmbH)

- British Gas (Centrica PLC)

- CORGI HomePlan Ltd (OVO Group Ltd)

- Domestic & General Group Limited

- Future Generali India Insurance Co. Ltd.

- HomeServe Membership Ltd.

- Tata AIG General Insurance Company Limited (Tata Sons Private Limited)

- Hartford Steam Boiler

- Other Key Players