Global Body Contouring Devices Market by Device Type (Non-invasive and Minimally Invasive Devices, Invasive Devices), By Application, By End-user, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: July 2024

- Report ID: 52819

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

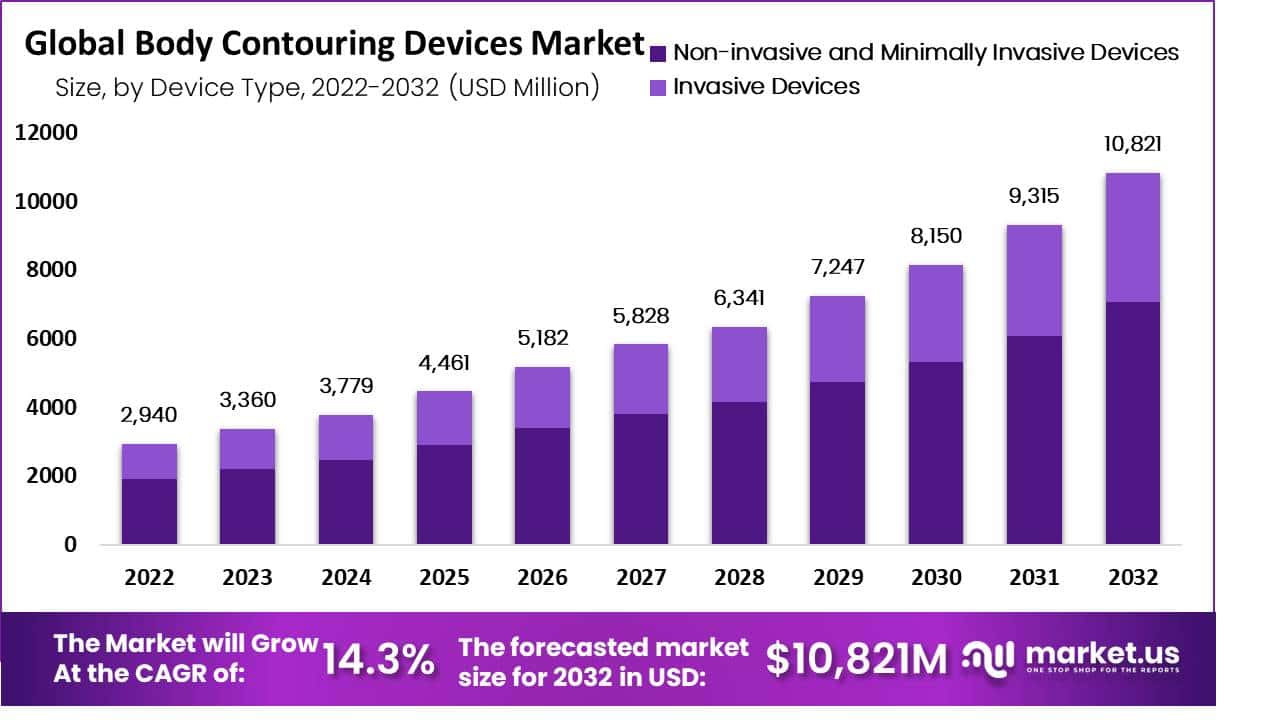

Global Body Contouring Devices Market size is expected to be worth around USD 10,821 Billion by 2033 from USD 3,360 Billion in 2023, growing at a CAGR of 14.3% during the forecast period from 2024 to 2033.

Body contouring aids in skin removal following significant weight loss. This procedure enhances the tone of underlying tissue while also removing extra fat and skin. It consists of several devices that reduce excess skin and fat that persist after people who were obese previously lose weight. Body contouring aids can be used in the reduction of fat in many areas such as the arms, breasts, abdomen, thighs, face, and so on.

Body-contouring surgery has grown in popularity in recent years, owing to an increase in the number of weight loss surgical procedures performed as a final treatment for morbid obesity. The increased awareness of non-invasive and minimally invasive body contouring methods is one of the key factors likely to fuel the growth and demand for body contouring technologies.

Furthermore, the rising prevalence of obesity, increasing accessibility to cosmetic operations, and improved safety due to minimally and non-invasive procedures are likely to boost the worldwide market growth throughout the forecast period.

The launch of improved products, as well as the rise in obesity rates, are also expected to boost market growth. Furthermore, quick improvements in medical aesthetics technology and an increase in body contouring awareness are among the important factors predicted to fuel the growth of the body contouring devices market.

Key Takeaways

- The Body Contouring Devices Market was valued at USD 2,940.0 Million in 2023.

- It is projected to reach USD 10,821 Million by 2032.

- The market is growing at a CAGR of 14.3% from 2023 to 2032.

- According to the WHO, around 1.9 billion people over the age of 18 were overweight in 2016.

- Obesity affected almost 650 million of these adults by 2016.

- The Health Survey for England 2021 found that 25.9% of adults in the country are obese.

- Since 1993, the percentage of overweight or obese adults in Britain has risen to 64.3% from 52.9%.

- In 2021, Americans spent more than $14.6 billion on aesthetic procedures.

- Surgical revenues in this domain grew by around 63% in 2021.

- The non-invasive and minimally invasive devices segment held a market share of 65.3% in 2022.

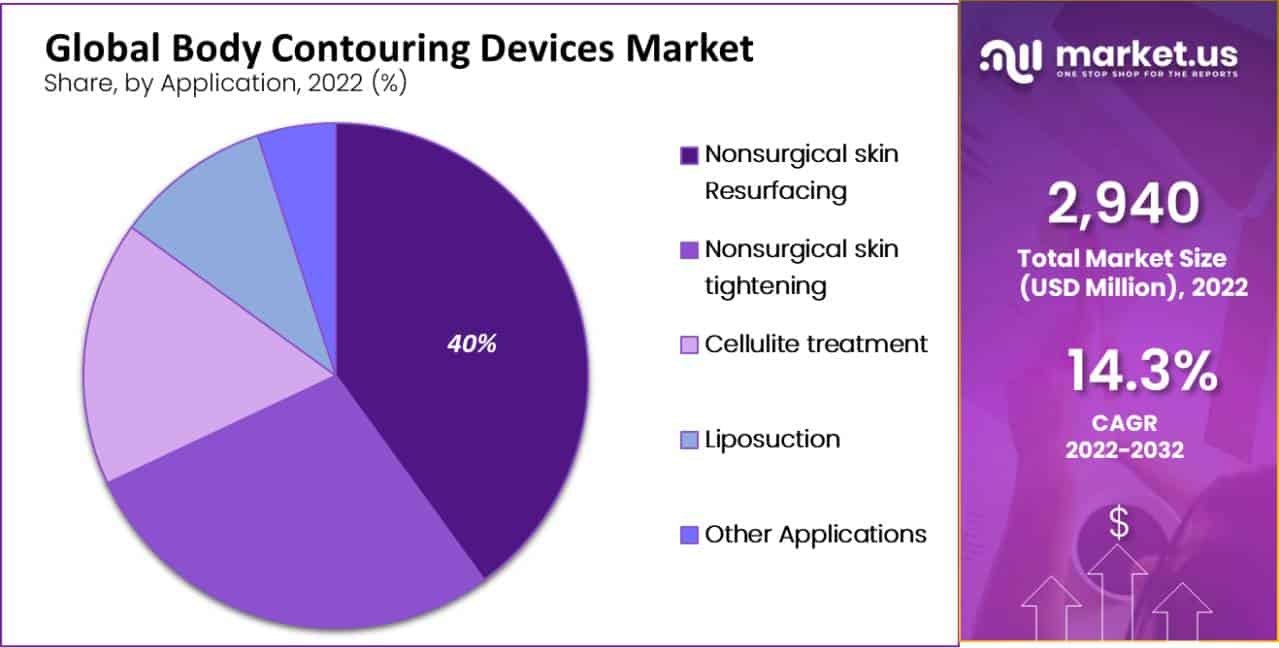

- The nonsurgical skin resurfacing application segment led the market with a revenue share of 24.5% in 2022.

- Hospitals are projected to lead the end-user segment with a revenue share of 59% in 2022.

- According to a survey, 84% of people polled in 19 cities across India stated they are more aware of health and wellness issues after the pandemic.

- In 2020, the United States spent around USD 245.1 billion on medical and health research and development.

Driving Factors

Increase in prevalence of obesity

Worldwide, obesity is becoming a very serious concern. According to the World Health Organization (WHO), globally, around 1.9 billion people over the age of 18 were overweight during the year 2016. Obesity affected almost 650 million of these adults. The rate of obesity increased by almost threefold between 1975 and 2016.

Moreover, the Health Survey for England 2021 found that around 25.9% of adults in the country are obese, while the remaining 37.9% being overweight but not obese. The same survey indicates that people in England between the age group of 45 and 74 are most likely to be overweight or obese. Since 1993, the percentage of overweight or obese adults in Britain has risen to 64.3% from 52.9%, with obesity increasing to 28.0% from 14.9%.

Thus, the rise in the prevalence of obesity is a major factor which is anticipated to fuel the demand for body contouring surgeries, thereby, driving market growth during the forecast period.

Rise in cosmetic surgeries

The Aesthetic Plastic Surgery Statistics estimated that several aesthetic plastic surgery procedures will be on the rise in 2021. It shows a large growth in procedures for the breast, face, and body. Since 2020, attractive body operations like liposuction, abdominoplasty, and buttock augmentation have climbed by 63%. Breast augmentation and breast reduction treatments increased by about 48%.

Last year, specialized cosmetic operations such as brow lifts and face lifts surged 54%. These significant increases led to high spending of more than $14.6 billion by Americans on aesthetic procedures in 2021, with surgical revenues growing by around 63%. Surgical procedures increased by around 54%, while non-surgical procedures increased by 44%.

In 2021, the typical plastic surgeon conducted 320 surgical treatment procedures, up from 220 in the year 2020. Approximately 94% of the surgical procedures were performed on women. In 2021, 365,000 breast augmentation surgeries were performed (+44%). Furthermore, around 148,000 women had their implants removed and replaced (+32% from 2020), whereas 71,000 had their implants removed but not replaced (+47%).

Although accounting for only 21% of all treatments, surgical procedures accounted for 69% of total income. In 2021, the average cost of a surgical procedure climbed by 6%, while the non-surgical procedure cost increased by 1%. Thus, rise in cosmetic surgeries is a key factor stimulating the growth of the market.

Demand for non-invasive and minimally invasive body contouring

Major surgical body contouring operations come with a number of unavoidable downsides, including the need for anesthesia, hospitalization, pain, swelling, and a protracted recovery. These factors have made non-invasive and minimally invasive body contouring one of the most enticing fields of aesthetic surgery.

The field is moving towards safer, less intrusive operations with less pain, fewer complications, and a quicker recovery due to patient expectations and needs. It is likely to have a positive impact on the growth of the market during the projected time period.

Restraining Factors

Risks involved in body contouring surgeries

Body contouring surgeries after considerable weight loss is frequently fraught with problems. According to the International Wound Journal, body contouring operations are prone to problems, with complication rates reaching up to 80%.

Complications that are common include delayed wound healing, subsequent wound dehiscence, postoperative haematoma, and seroma. Scarring, fluid accumulation, asymmetry, and permanent shape deformities are the main concerns of body contouring, in addition to general surgery concerns. Therefore, risks and complications associated with body contouring surgeries may restrain the market growth during the estimated time period.

High cost of cosmetic surgeries

Cosmetic surgeries are exceedingly becoming more expensive. According to a 2019 report from the American Society of Plastic Surgeons (ASPS), the national average surgeon cost for breast augmentation surgery has increased by 2.8 percent from 2017. Liposuction prices grew by 4.2 percent, while nose reshaping and stomach tuck prices jumped by 4.4 percent.

The cost of eyelid surgery has risen by 4.3 percent since 2018. The type of surgery chosen, the location of the operation, the surgeon’s experience, and insurance coverage are all cost variables for most cosmetic surgeries. Thus, the high cost involved in cosmetic surgeries may hamper the adoption of body contouring devices over the forecast period.

Device Type Analysis

Non-invasive and minimally invasive devices segment accounts for the largest share of 65.3% in 2022. Due to high safe and cost-effective nature, non-invasive and minimally invasive devices are largely preferred by patients as well as cosmetic surgeons. This is expected to boost the demand for non-invasive and minimally invasive body contouring devices. Furthermore, major investment by market players, and launch of efficient products are key factors driving the growth of the segment.

Invasive body contouring procedures like liposuction is particularly beneficial in eliminating fat from different parts of the body like, the legs, back, abdomen, arms, face, etc. After breast augmentation, liposuction was the second-most performed treatment in the United States in 2020, with 211,067 procedures performed, according to the American Society of Plastic Surgeons (ASPS). Thus, high demand for invasive body contouring procedures like liposuction is driving the growth of the segment.

However, as the process requires surgical intervention, which contributes to the cost of surgery, it may affect the growth of the segment in the upcoming years.

Application Analysis

The nonsurgical skin resurfacing application segment leads the market with a revenue share of 24.5% in 2022. Nonsurgical skin resurfacing procedures are minimally invasive and non-invasive in nature. This is a major advantage due to which it is receiving a high demand from cosmetic surgeons as well as patients. Moreover, they are inexpensive cost when compared to some of the other minimally invasive and non-invasive procedures. This is a major factor driving the growth of the segment.

Also, the nonsurgical skin tightening segment is anticipated to witness significant growth during the estimated time period. Non-surgical skin tightening procedures operate by heating deeper layers of skin with targeted energy, stimulating collagen and elastin synthesis and gradually improving skin tone and texture.

Some therapies also have an effect on fibrous tissue, which helps to smoothen the cellulite. The introduction of advanced products is expected to promote segment growth. Eufoton Medical Lasers, for example, will debut the skin-tightening laser treatment Endolift in the United Kingdom in October 2020. To transfer laser energy directly to the subcutaneous layer, the gadget employs an optical fiber that is put beneath the skin without making an incision. In photobiomodulation, the energy induces the remodeling of collagen and connective tissue, resulting in noticeable skin tightening.

End-user Analysis

Hospitals are major end-users

Hospitals and projected to lead the end-user segment with a revenue share of 59% in 2022. The high growth of the segment can be attributed to the increase in the number of hospitals providing body contouring services and the availability of affordable and efficient body contouring treatment options in hospitals. Moreover, high investment in the healthcare sector in developing nations is anticipated to fuel the demand for body contouring treatment in hospital settings during the projected time period.

Moreover, clinics are likely to grow at a significantly high rate during the estimated time period. The rise in a number of multispecialty clinics offering cosmetic surgery procedures is a key driver of the segment. Also, the adoption of advanced surgical options and services in clinics is expected to boost the growth of the segment.

Key Market Segments

Type

- Non-invasive and Minimally Invasive Devices

- Invasive Devices

Applications

- Nonsurgical skin Resurfacing

- Nonsurgical skin tightening

- Cellulite treatment

- Liposuction

- Other Applications

End Users

- Hospitals

- Clinics

- Other End-Users

Opportunity

Rise in health awareness

The Covid-19 pandemic and its subsequent after-effects have altered the healthcare landscape. According to Aditya Birla Health Insurance’s customer behavior survey, people are becoming more aware of and interested in exercise, diet, health products, and services. According to the survey, 84% of people polled in 19 cities across India stated they are more aware of health and wellness issues as a result of the pandemic.

The survey also indicated that adults aged 45 and up were ‘keen to prevent any early signs of aging’ as compared to Gen Z, where 66% thought they did not need to monitor their health data and 21% considered their health was within the norms. Thus, increasing health awareness among individuals is likely to drive the demand for body contouring devices and create promising growth opportunities for key players in the market.

Investment in healthcare

Over the years, several governments and private organizations are investing extensively on research and development (R&D) in the healthcare sector. In 2020, it will account for over two-thirds (66%) of US medical and health R&D investment, equalling $161.8 billion. In 2020, the United States spent around $245.1 billion on medical and health research and development. It spent $161.8 billion on medical and health research and development (66.0%).

Departments and several agencies at the federal level invested $61.5 billion (25.1%). Academic and research organizations contributed $16.8 billion (6.9%). Foundations, voluntary health groups, and professional societies contributed $3 billion (1.2%) to medical and health R&D. State governments invested $2.1 billion (0.9%) on health research and development. Thus, high R&D investments in the healthcare sector by various governments and private organizations is anticipated to positively impact the market growth in the upcoming years.

Trends

Technological advancements

The development of new treatments and novel technologies in body contouring industry has resulted in a paradigm shift. As a result, patients’ expectations and interests are expanding, and they are demanding products and treatments with higher efficacy, low cost, rapid outcomes, and fewer complications. Various surgical and non-surgical methods have been developed over many decades to effectively address patient problems.

Skin tightening devices such as HIFU and Ulthera first appeared about a decade ago, and the Morpheus8 (radio frequency needling) and Forma by in mode (radio frequency heat) are the most recent non-surgical face and body sculpting choices. These procedures have gained popularity thanks to high profile celebrities such as Kim Kardashian and Eva Longoria, who use the Morpheus8 to cure pregnancy stomach and facial skin laxity. Such key technological developments and product launches is a promising trend, is likely to significantly contribute to the growth of the market in the upcoming years.

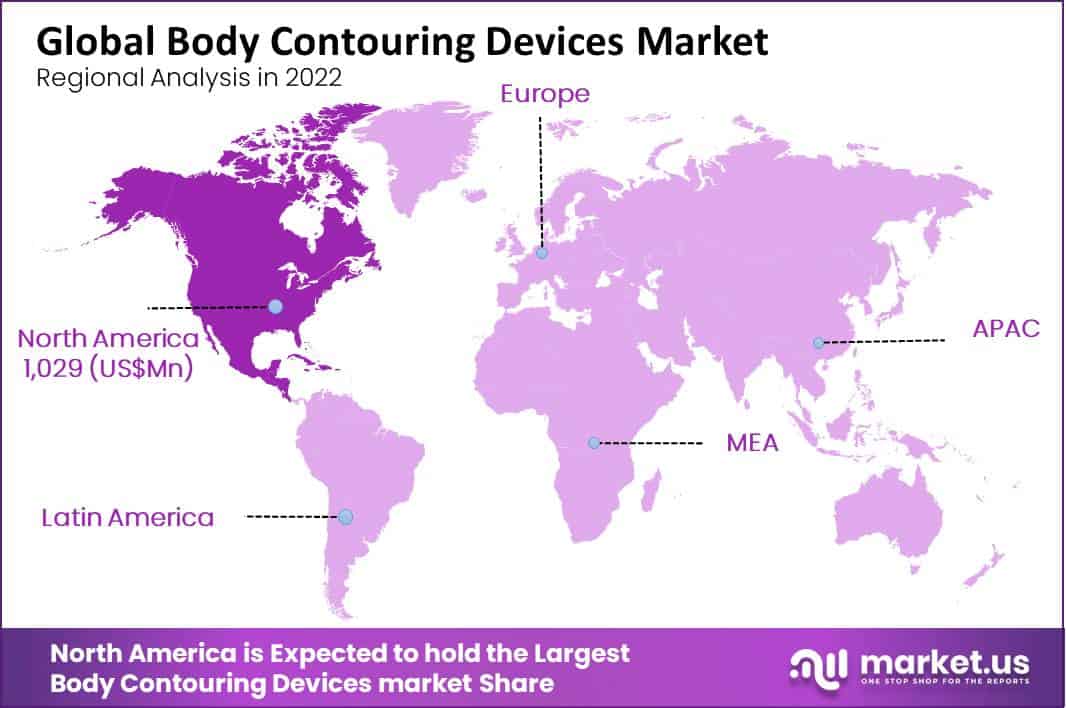

Regional Analysis

The North America region is expected to hold the largest share of the market at 35% and a revenue of US$ 1,029 million during the forecast period. The market’s expansion in North America can be ascribed to high obesity prevalence, a preference for aesthetic operations, and a high consumption of junk food, which contributes to obesity. The high prevalence of obesity in the United States of America is likely to drive market expansion over the forecast period.

According to the United States Centers for Disease Prevention and Control, the obesity prevalence had climbed to 41.9% in 2020 from 30.5% in 2000, according to the National Health Statistics Reports 2021. Thus, a high incidence of obesity is likely to have a favorable impact on the region’s market growth. Furthermore, product debuts by key industry participants are projected to drive market growth.

For example, in July 2022, BTL, the industry leader in non-invasive body sculpting procedures, introduced the new Edge Applicators. The device was created to improve the contour of the body’s curved parts. Furthermore, there has been a significant shift towards minimally invasive procedures in the United States as they provide less discomfort and quick recovery time. As a result of the aforementioned factors, the body contouring devices market is predicted to rise tremendously in the region.

The Asia Pacific market is likely to witness growth at a high rate over the forecast period. Developing economies in Asia, such as China, Japan, and India, have well-developed healthcare infrastructure and facilities and are increasingly more focused on leading through R&D efforts. Asian countries have long been preferred for different aesthetic operations.

Many fat reduction treatments are performed each year in countries such as China and Japan, and the market in the APAC region is being driven by cost-effective and high-quality therapy, rising disposable income, and a growing obese and ageing population.

Key Regions

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global Body Contouring Devices market may be regarded as moderately competitive. The market is experiencing growth at a significantly high rate due to technological advancements in cosmetic surgery and a rise in demand for minimally invasive and non-invasive cosmetic surgeries. Also, investments in new technology and new product launches by major players is likely to stimulate competition among major industry players.

Top Key Players

- Bausch Health Companies Inc.

- Allergan Plc

- Cynosure, Inc.

- Alma Lasers

- Candela Corporation

- Merz Pharma Gmbh

- Lutronic Corporation

- Sofwave Medical LTD

- Nouvag AG

- Fotona

Recent developments

- Bausch Health Companies Inc. (March 2023): Bausch Health Companies Inc. acquired Solta Medical, a leader in aesthetic and body contouring devices. This acquisition aims to expand Bausch Health’s portfolio in the growing body contouring market, enhancing its product offerings and market reach.

- Allergan Plc (January 2023): Allergan Plc launched CoolSculpting Elite, an advanced body contouring device designed to target and eliminate fat cells more effectively. This new product aims to offer improved results and patient satisfaction in non-invasive fat reduction treatments.

- Cynosure, Inc. (April 2023): Cynosure, Inc. merged with Hologic’s aesthetic division to enhance its body contouring device portfolio. This merger aims to leverage Hologic’s innovative technologies to broaden Cynosure’s market presence and product capabilities.

- Alma Lasers (February 2023): Alma Lasers introduced BeautiFill, a new body contouring and fat transfer device. This launch aims to offer physicians a comprehensive solution for fat reduction and skin tightening, providing enhanced patient outcomes.

- Candela Corporation (June 2023): Candela Corporation acquired Ellipse, a company specializing in advanced laser and IPL technology for body contouring. This acquisition is expected to strengthen Candela’s position in the body contouring market by expanding its technology offerings.

- Merz Pharma Gmbh (May 2023): Merz Pharma Gmbh launched the Cellfina System, an innovative body contouring device aimed at treating cellulite. This new product is designed to provide long-lasting results, enhancing Merz Pharma’s portfolio in aesthetic solutions.

Report Scope

Report Features Description Market Value (2023) USD 3360 Million Forecast Revenue (2032) USD 10,821 Million CAGR (2023-2032) 14.3% Base Year for Estimation 2022 Historic Period 2016-2021 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Device Type – Non-invasive and Minimally Invasive Devices, Invasive Devices, By Application – Nonsurgical Skin Resurfacing, Nonsurgical Skin Tightening, Cellulite Treatment, Liposuction, and Other Applications, and by End-user- Hospitals, Clinics, and Other End-users Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Bausch Health Companies Inc., Allergan Plc, Cynosure, Inc., Alma Lasers, Candela Corporation, Merz Pharma Gmbh, Lutronic Corporation, Sofwave Medical LTD, Nouvag AG, Fotona and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Body Contouring Devices Market?The estimated market value of the Body Contouring Devices Market in 2022 is USD 2,940 Mn. It will reach USD 10,821 Mn by 2032.

Which device types are covered in the Body Contouring Devices Market?The Body Contouring Devices Market covers three device types: non-invasive and minimally invasive devices, invasive devices.

What are the main applications of body contouring devices?Body contouring devices are used for nonsurgical skin resurfacing, nonsurgical skin tightening, cellulite treatment, liposuction, and other applications.

Which end-users are included in the Body Contouring Devices Market?The Body Contouring Devices Market includes hospitals, clinics, and other end-users.

Who are the key players in the Body Contouring Devices Market?The key players in the Body Contouring Devices Market include Bausch Health Companies Inc., Allergan Plc, Cynosure, Inc., Alma Lasers, Candela Corporation, Merz Pharma Gmbh, Lutronic Corporation, Sofwave Medical LTD, Nouvag AG, Fotona, and other key players.

Can the Body Contouring Devices Market analysis be customized?Yes, customization for segments and region/country-level can be provided. Additional customization can also be done based on specific requirements.

Body Contouring Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Body Contouring Devices MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Bausch Health Companies Inc.

- Allergan Plc

- Cynosure, Inc.

- Alma Lasers

- Candela Corporation

- Merz Pharma Gmbh

- Lutronic Corporation

- Sofwave Medical LTD

- Nouvag AG

- Fotona