Global Blood Collection Market Analysis By Collection Site [Venous (Needles and Syringes (Double-Ended Needles, Winged Blood Collection Sets, Standard Hypodermic Needles, Other Blood Collection Needles), Blood Collection Tubes (Serum-separating, EDTA, Heparin, Plasma-separating), Blood Bags, Others), Capillary (Lancets, Micro-Container Tubes, Micro-Hematocrit Tubes, Warming Devices, Others)]; By Application (Diagnostics, Treatment); By Method (Manual Blood Collection, Automated Blood Collection); By End-use (Hospitals, Diagnostics Centers, Blood Banks, Emergency Departments, Others); By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 22535

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

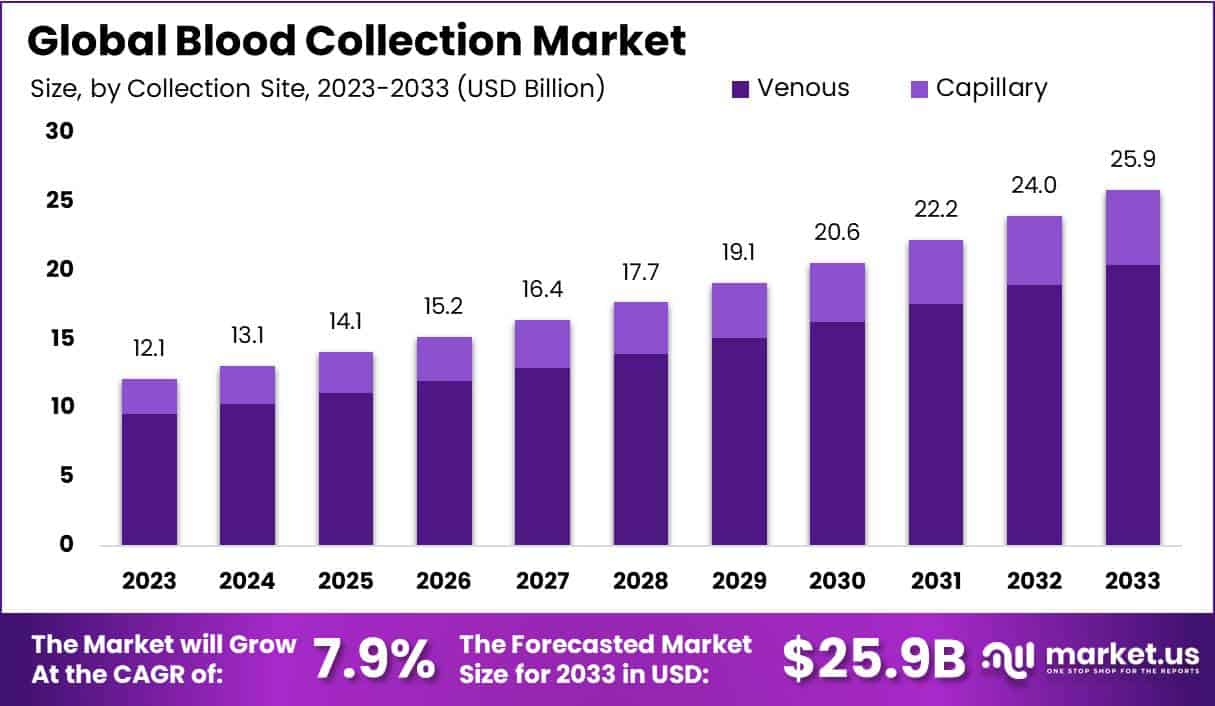

Blood Collection Market size is expected to be worth around USD 25.9 Billion by 2033 from USD 12.1 Billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 7.9% during the forecast period from 2024 to 2033.

Blood collection is when we take a small amount of blood from someone for medical reasons. A trained healthcare person usually uses a needle to get the blood from a vein, often in the arm. This collected blood helps in various tests like checking the number of blood cells, measuring chemicals in the blood, and finding infections or antibodies. Safety is crucial, and strict rules are followed during this process. The blood samples then go to a lab for analysis. The results give important information about the person’s health, like their blood type or if they have any infections. This helps doctors make accurate diagnoses and decide on the best treatments. Overall, blood collection is a routine and safe part of healthcare, providing valuable insights for better patient care.

The blood collection market encompasses a broad spectrum of products and services vital for healthcare systems and medical facilities. This sector includes devices like needles, tubes, and lancets, designed for the safe and efficient collection of blood samples. Innovations, such as safety needles, have marked advancements in technology. Additionally, specialized tubes cater to diverse testing needs, while blood bags facilitate storage and transportation of blood and its components. Blood collection centers and banks, pivotal in ensuring a secure and ample blood supply, play a crucial role in processing and storing donated blood. Point-of-care testing devices and the integration of automation further contribute to the market’s evolution, enhancing workflow efficiency.

Key elements of the blood collection market include devices like needles, tubes, and lancets, designed for the safe and efficient collection of blood samples. Innovations, such as safety needles, signify advancements in technology. Specialized tubes cater to diverse testing needs, while blood bags facilitate the storage and transportation of blood and its components. Blood collection centers and banks, pivotal in ensuring a secure and ample blood supply, play a crucial role in processing and storing donated blood. The market also witnesses advancements with point-of-care testing devices and the integration of automation, contributing to enhanced workflow efficiency and meeting the evolving demands of healthcare systems.

Key Takeaways

- Market Growth Projection: Blood Collection Market set to reach USD 25.9 Billion by 2033, with a robust CAGR of 7.9% from 2024 to 2033.

- Venous Dominance in Collection Site: Venous segment holds a commanding 79% market share in 2023 due to versatile tools like double-ended needles and winged sets.

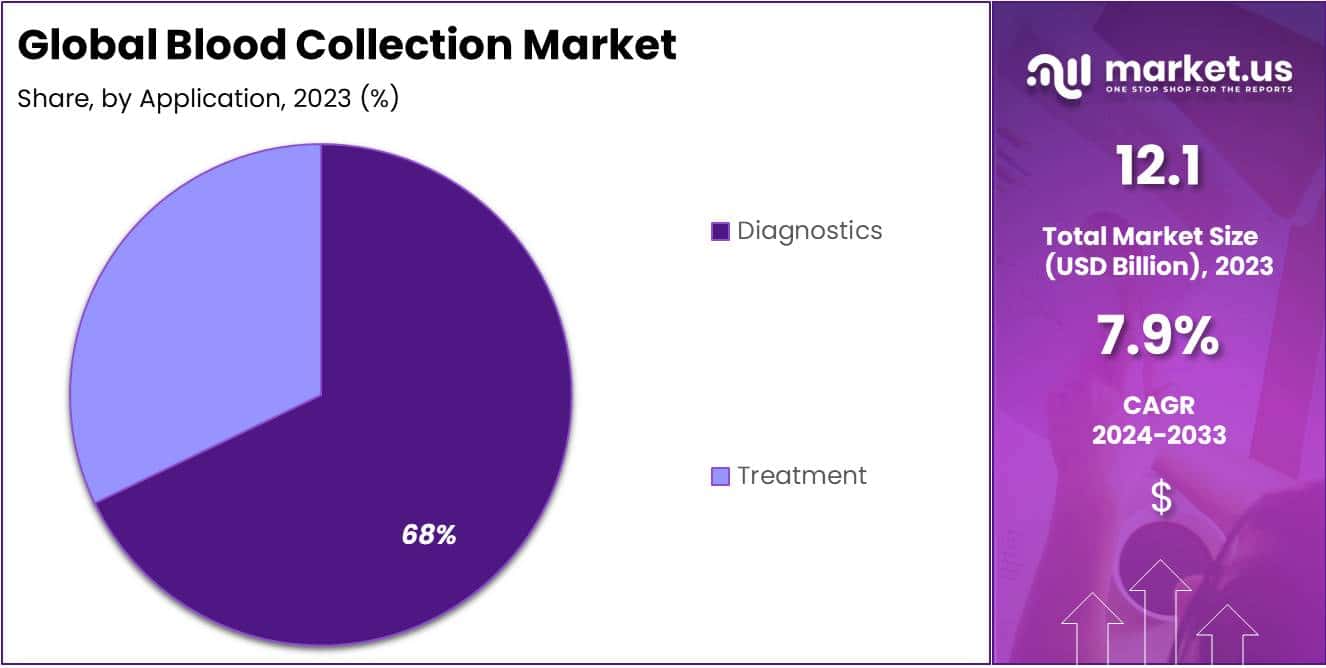

- Diagnostic Segment Leadership: Diagnostics segment claims over 67.6% market share in 2023, highlighting blood collection’s crucial role in healthcare diagnostics.

- Manual Blood Collection Preference: Manual blood collection method secures a leading position with a substantial 74.5% market share in 2023.

- Hospitals as Primary End-Users: Hospitals dominate the end-use segment with a significant market share of over 35.8% in 2023.

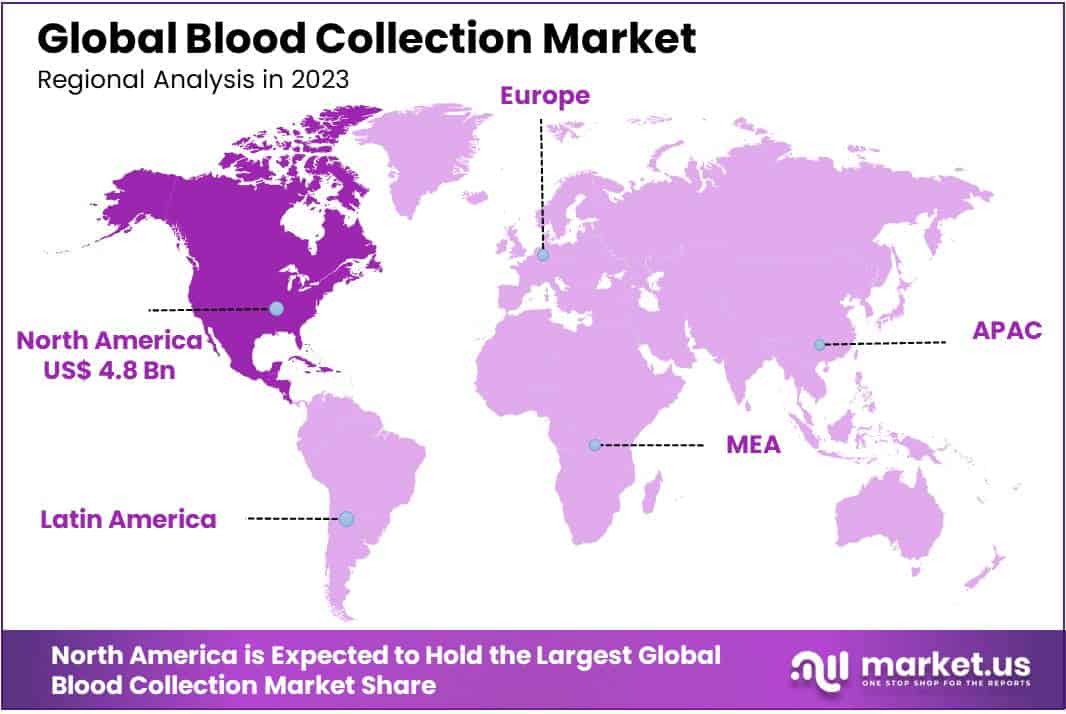

- North America’s Market Dominance: North America leads with a dominant market share of more than 39.7% in 2023, valued at USD 4.8 billion.

Collection Site Analysis

In 2023, the Venous segment held a dominant market position in the Blood Collection Market, securing a substantial 79% share. This dominance can be attributed to the versatility offered by various collection tools within the Venous category.

Needles and Syringes, The use of Double-Ended Needles, Winged Blood Collection Sets, Standard Hypodermic Needles, and other innovative blood collection needles played a pivotal role in the Venous segment’s ascendancy. These tools are crucial in ensuring precise and efficient blood collection procedures.

Blood Collection Tubes, Within this category, Serum-separating, EDTA, Heparin, and Plasma-separating tubes showcased their significance. The diverse range of tubes caters to different requirements, contributing to the overall success of the Venous segment.

Blood Bags, Another substantial contributor to the Venous segment’s dominance is the utilization of blood bags. These bags offer a secure and convenient means of collecting, storing, and transporting blood, contributing significantly to the efficiency of the overall blood collection process.

Various other tools and equipment within the Venous segment also played a crucial role, adding to the comprehensive nature of blood collection processes. These include innovative devices designed to enhance the overall efficacy and safety of blood collection.

In contrast, the Capillary segment, although holding promise, accounted for a smaller market share in 2023. This category, encompassing Lancets, Micro-Container Tubes, Micro-Hematocrit Tubes, Warming Devices, and other elements, is poised for growth with ongoing advancements in capillary blood collection technologies.

Application Analysis

In 2023, the blood collection market showcased a noteworthy trend, with the Diagnostics segment taking the lead and securing a dominant market position, claiming over a 67.6% share. This segment’s robust performance underscores its pivotal role in the healthcare landscape.

Diagnostics, as a key application, remains at the forefront of blood collection activities, emphasizing the crucial link between effective diagnostic procedures and patient care. The significant market share held by the Diagnostics segment highlights the growing importance of blood samples in diagnosing various medical conditions.

On the treatment front, blood collection plays a vital role in facilitating therapeutic interventions. While holding a substantial share of the market, the Treatment segment showcases the instrumental role of collected blood in medical treatments. This segment, though slightly behind Diagnostics, continues to make significant strides in contributing to advancements in healthcare.

The strong performance of the Diagnostics segment can be attributed to the increasing demand for accurate and timely diagnostic information across various medical disciplines. As healthcare providers emphasize the importance of early detection and precise diagnosis, the Diagnostics segment is expected to maintain its dominant position in the blood collection market.

Looking ahead, the dynamic interplay between Diagnostics and Treatment segments is expected to shape the evolving landscape of the blood collection market. The ongoing advancements in medical technology and the continuous quest for improved patient care are likely to further drive innovation and growth in both these pivotal segments of the market.

Method Analysis

In 2023, the Manual Blood Collection segment emerged as a frontrunner in the market, securing a commanding position with a substantial 74.5% share. This method, involving the skilled hands of healthcare professionals, continues to be a preferred choice for blood collection procedures.

On the flip side, the Automated Blood Collection segment is gaining traction, showcasing a promising rise in adoption. With advancements in technology, automation brings efficiency and precision to the blood collection process. As of 2023, it commands a noteworthy market share, reflecting the growing acceptance of automated methods.

Healthcare practitioners and facilities are increasingly recognizing the advantages of both manual and automated blood collection techniques. While manual collection maintains its stronghold due to the experience and expertise it offers, the automated counterpart is carving its niche by offering streamlined processes and minimizing human errors.

Looking ahead, the dynamics of the blood collection market are poised for further evolution. The market is likely to witness a delicate balance between manual and automated methods, with each continuing to play a pivotal role in meeting diverse healthcare needs. As technology continues to advance, the Automated Blood Collection segment is expected to gradually narrow the gap, presenting a compelling proposition for stakeholders in the healthcare ecosystem.

End-USe Analysis

In 2023, the Hospitals segment has asserted its dominance in the Blood Collection market, securing a significant market share of over 35.8%. This underscores the crucial role hospitals play in the collection of blood, emphasizing their central position in the healthcare ecosystem.

Diagnostics Centers, another pivotal player in the blood collection landscape, contribute substantially to the market, holding a considerable market share. These centers serve as vital hubs for conducting diagnostic tests, further fueling the demand for efficient blood collection processes.

Blood Banks, serving as lifelines in emergencies and planned medical procedures, also play a pivotal role in the market. Their contribution is substantial, with a notable market share that reflects their importance in ensuring a stable and readily available blood supply.

Emergency Departments, known for their immediate response to critical medical situations, have carved out a significant niche in the blood collection market. Their quick and precise blood collection procedures contribute to their notable market share.

Other segments in the blood collection market encompass a diverse range of healthcare facilities and organizations that collectively contribute to the overall market dynamics. These segments, while individually holding smaller market shares, collectively form an integral part of the broader landscape, showcasing the diverse needs and applications of blood collection across various healthcare settings.

As the market continues to evolve, understanding the distinctive roles of each segment is crucial for stakeholders. The dominance of the Hospitals segment highlights its key position, while the contributions of Diagnostics Centers, Blood Banks, Emergency Departments, and other segments collectively shape the dynamic and multifaceted nature of the blood collection market in 2023.

Key Market Segments

Collection Site

Venous

- Needles and Syringes

- Double-Ended Needles

- Winged Blood Collection Sets

- Standard Hypodermic Needles

- Other Blood Collection Needles

- Blood Collection Tubes

- Serum-separating

- EDTA

- Heparin

- Plasma-separating

- Blood Bags

- Others

Capillary

- Lancets

- Micro-Container Tubes

- Micro-Hematocrit Tubes

- Warming Devices

- Others

Application

- Diagnostics

- Treatment

Method

- Manual Blood Collection

- Automated Blood Collection

End-use

- Hospitals

- Diagnostics Centers

- Blood Banks

- Emergency Departments

- Others

Drivers

Increasing Demand for Diagnostic and Therapeutic Procedures

More people are getting medical tests and procedures that require blood samples. As the population ages and rates of chronic diseases rise, healthcare providers are doing more diagnostic testing and treatments involving blood work. This steady increase in demand drives growth in the blood collection market.

Technological Advancements in Blood Collection Devices

Blood collection methods keep improving through new technologies like automated systems and safety needles. These updates make the process easier and more reliable for both healthcare staff and donors. Adoption of these kinds of tools has accelerated as facilities aim to streamline workflows.

Growing Awareness of Blood Donation

There is also a growing public awareness about the need for blood donations to support medical care. Governments and advocacy groups promote blood drives and educate people on the importance of donating regularly. This helps ensure a robust supply to meet the rising need.

Rising Incidence of Chronic Diseases

The global increase in chronic diseases such as diabetes and cardiovascular disorders is a significant driver for blood collection. Regular blood tests are essential for monitoring and managing these conditions, leading to a higher demand for blood collection services and products.

Restraints

Stringent regulatory requirements

The blood collection market is subject to strict regulatory standards to ensure patient safety and product quality. Compliance with these regulations increases the cost and time required for product development and approval, acting as a restraint for market players.

Risk of infections and contamination

Concerns regarding the risk of infections and contamination associated with blood collection procedures pose a challenge. This is particularly relevant in regions with inadequate healthcare infrastructure and poor sterilization practices, impacting the overall reliability of blood collection processes.

Limited access to healthcare facilities

In certain regions, limited access to healthcare facilities and diagnostic services hinders the growth of the blood collection market. Remote or underserved areas may face challenges in obtaining timely and proper blood collection services, impacting the overall market expansion.

High cost of blood collection devices

The initial investment and ongoing costs associated with implementing advanced blood collection technologies can be a restraining factor, especially for healthcare facilities with budget constraints. This may limit the adoption of innovative blood collection devices in some settings.

Opportunities

Rising popularity of home-based healthcare

The increasing trend towards home-based healthcare services creates a significant growth opportunity for the blood collection market. Innovations in self-collection kits and remote monitoring devices allow patients to collect blood samples in the comfort of their homes, driving market expansion.

Emerging markets and untapped regions

Untapped markets in developing regions present growth opportunities for blood collection market players. The focus on expanding healthcare infrastructure and improving accessibility to diagnostic services in emerging economies creates a conducive environment for market growth.

Collaborations and partnerships

Strategic collaborations and partnerships between blood collection product manufacturers, healthcare providers, and research institutions offer growth opportunities. Such alliances can lead to the development of innovative solutions, increased market penetration, and expanded product portfolios.

Rapid adoption of point-of-care testing

The increasing demand for rapid and on-site diagnostic solutions is propelling the adoption of point-of-care testing. This trend creates opportunities for blood collection device manufacturers to develop products tailored for point-of-care applications, addressing the need for quick and convenient diagnostics.

Trends

Shift towards minimally invasive blood collection techniques

There is a noticeable trend towards minimally invasive blood collection techniques, such as capillary blood sampling and microfluidic devices. These methods offer reduced patient discomfort, quicker recovery, and are gaining popularity in various medical applications.

Integration of information technology in blood collection

The integration of information technology, including electronic health records (EHRs) and mobile health applications, is a growing trend. This integration streamlines the blood collection process, enhances data management, and improves overall efficiency in healthcare settings.

Focus on sustainable and eco-friendly blood collection practices

With an increasing emphasis on sustainability, there is a growing trend towards eco-friendly and reusable blood collection devices. Manufacturers are exploring materials and technologies that minimize environmental impact, aligning with the broader global push towards sustainable healthcare practices.

Customization and personalization of blood collection products

The demand for customized and personalized blood collection solutions is on the rise. Manufacturers are focusing on developing products that cater to specific patient needs, ensuring a more tailored and effective approach to blood collection in various healthcare scenarios.

Regional Analysis

In 2023, North America emerged as a pivotal player in the Blood Collection Market, solidifying its dominance with a commanding market share of more than 39.7%. The regional market landscape was characterized by robust growth, underpinned by a market value reaching USD 4.8 billion for the year. Several factors contributed to North America’s prominence in the Blood Collection Market, reflecting a combination of technological advancements, healthcare infrastructure, and a proactive approach to blood-related healthcare services.

North America’s leading position can be attributed, in part, to the region’s commitment to adopting cutting-edge technologies and innovative blood collection methods. The integration of automation, advanced materials, and state-of-the-art devices in blood collection processes has enhanced efficiency, reduced errors, and improved patient outcomes, thereby fostering market growth.

The well-established healthcare infrastructure in North America played a pivotal role in the flourishing Blood Collection Market. Access to sophisticated medical facilities, a high prevalence of diagnostic laboratories, and an extensive network of healthcare professionals contributed to the seamless integration and adoption of advanced blood collection technologies.

The rising incidence of chronic diseases in North America has driven the demand for blood collection products and services. As the region grapples with health challenges such as cardiovascular diseases, diabetes, and cancer, there has been a heightened need for regular blood testing, diagnosis, and therapeutic interventions, further propelling the Blood Collection Market forward.

North America’s commitment to maintaining high standards of healthcare quality and safety has led to stringent regulatory frameworks governing blood collection practices. Compliance with these standards has become a key determinant of market success, with manufacturers and service providers investing in research and development to meet or exceed these regulations.

The Blood Collection Market in North America has witnessed strategic collaborations and partnerships among key stakeholders. Industry players, healthcare institutions, and research organizations have joined forces to drive innovation, share resources, and collectively address challenges in blood collection, thereby fostering a collaborative ecosystem conducive to market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Blood Collection Market thrives on the contributions of key players such as Abbott Laboratories, Sarstedt AG, NIPRO Medical Corp., BD, Terumo Corp., and others. Their collective efforts in advancing technology, ensuring product quality, and addressing healthcare challenges play a crucial role in shaping the present and future of blood collection practices worldwide.

Abbott Laboratories is a major player in the Blood Collection Market, known for its innovative solutions. Their focus on developing advanced blood collection technologies has positioned them as a key contributor to the market. With a reputation for reliability and efficiency, Abbott Laboratories continues to drive advancements in blood collection methods, ensuring accuracy and patient comfort.

Sarstedt AG stands out in the Blood Collection Market for its commitment to quality and precision. Renowned for manufacturing high-quality blood collection tubes and accessories, Sarstedt AG has established itself as a trusted provider in the industry. Their emphasis on research and development reflects in their product range, contributing significantly to the market’s growth.

NIPRO Medical Corp. is a notable player, offering a diverse range of blood collection products. Their focus on user-friendly designs and technological innovation has garnered attention in the market. NIPRO Medical Corp. contributes to the market by providing solutions that prioritize both healthcare professionals’ needs and patient comfort, making a positive impact on overall blood collection practices.

BD is a key influencer in the Blood Collection Market, recognized for its comprehensive portfolio of blood collection devices. Their commitment to addressing evolving healthcare challenges is evident in the development of cutting-edge blood collection technologies. BD’s wide market presence and global reach make them a significant player shaping the future of blood collection practices.

Terumo Corp. plays a pivotal role in the Blood Collection Market with a focus on developing innovative blood collection systems. Known for their dedication to safety and efficiency, Terumo Corp.’s products are integral to modern healthcare practices. Their global impact and continuous efforts in advancing blood collection methodologies position them as a key contributor to the market’s evolution.

Several other key players contribute to the Blood Collection Market, each bringing unique strengths. These players, through their diverse product offerings and regional presence, collectively contribute to the market’s vibrancy and competitiveness. Their role in fostering innovation, ensuring product accessibility, and addressing specific market segments adds depth to the overall landscape of blood collection solutions.

Market Key Players

- Abbott Laboratories

- Sarstedt AG

- NIPRO Medical Corp.

- BD

- Terumo Corp.

- Medtronic Plc

- Qiagen NV

- FL Medical s.r.l.

- Greiner Holding AG

- Haemonetics Corp.

Recent Developments

- In October 2023, Terumo Corporation, a prominent Japanese medical device company, successfully acquired Haemonetics Corporation for a significant $1.6 billion. This strategic move is set to enhance Terumo’s range of blood management products and services, consolidating its position in the global blood collection market.

- In September 2023, Becton, Dickinson and Company (BD) made waves with the introduction of their latest innovation, the BD Vacutainer Plus Blood Collection Monitor. This cutting-edge device provides real-time visibility during blood collection procedures, aiming to enhance patient safety and minimize the risk of errors.

- In August 2023, marked a significant development for Greiner Bio-One, a global leader in life science solutions. The company announced the expansion of its blood collection tube production facility in Austria, anticipating a 20% increase in production capacity. This expansion aligns with the growing demand for Greiner Bio-One’s blood collection products.

- In July 2023, Quest Diagnostics and LabCorp, two major players in the U.S. laboratory testing landscape, joined forces in a partnership focused on developing advanced blood collection technology. The collaboration aims to bring about innovative blood collection devices that not only enhance patient outcomes but also contribute to cost reduction in the healthcare sector.

Report Scope

Report Features Description Market Value (2023) USD 12.1 Bn Forecast Revenue (2033) USD 25.9 Bn CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Collection Site [Venous (Needles and Syringes (Double-Ended Needles, Winged Blood Collection Sets, Standard Hypodermic Needles, Other Blood Collection Needles), Blood Collection Tubes (Serum-separating, EDTA, Heparin, Plasma-separating), Blood Bags, Others), Capillary (Lancets, Micro-Container Tubes, Micro-Hematocrit Tubes, Warming Devices, Others)]; By Application (Diagnostics, Treatment); By Method (Manual Blood Collection, Automated Blood Collection); By End-use (Hospitals, Diagnostics Centers, Blood Banks, Emergency Departments, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbott Laboratories, Sarstedt AG, NIPRO Medical Corp., BD, Terumo Corp., Medtronic Plc, Qiagen NV, FL Medical s.r.l., Greiner Holding AG, Haemonetics Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the blood collection market in 2023?The blood collection market size is USD 12.1 billion in 2023.

What is the projected CAGR at which the blood collection market is expected to grow at?The blood collection market is expected to grow at a CAGR of 7.9% (2024-2033).

List the segments encompassed in this report on the blood collection market?Market.US has segmented the blood collection market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Collection Site the market has been segmented into Venous (Needles and Syringes (Double-Ended Needles, Winged Blood Collection Sets, Standard Hypodermic Needles, Other Blood Collection Needles), Blood Collection Tubes (Serum-separating, EDTA, Heparin, Plasma-separating), Blood Bags, Others), Capillary (Lancets, Micro-Container Tubes, Micro-Hematocrit Tubes, Warming Devices, Others). By Application the market has been segmented into Diagnostics, Treatment. By Method the market has been segmented into Manual Blood Collection, and Automated Blood Collection. By End-use the market has been segmented into Hospitals, Diagnostics Centers, Blood Banks, Emergency Departments, and Others.

List the key industry players of the blood collection market?Abbott Laboratories, Sarstedt AG, NIPRO Medical Corp., BD, Terumo Corp., Medtronic Plc, Qiagen NV, FL Medical s.r.l., Greiner Holding AG, Haemonetics Corp, and Others

Which region is more appealing for vendors employed in the blood collection market?North America is expected to account for the highest revenue share of 39.7% and boasting an impressive market value of USD 4.8 billion. Therefore, the blood collection industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for blood collection?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the blood collection Market.

Which segment accounts for the greatest market share in the blood collection industry?With respect to the blood collection industry, vendors can expect to leverage greater prospective business opportunities through the Venous segment, as this area of interest accounts for the largest market share.

-

-

- Abbott Laboratories

- Sarstedt AG

- NIPRO Medical Corp.

- BD

- Terumo Corp.

- Medtronic Plc

- Qiagen NV

- FL Medical s.r.l.

- Greiner Holding AG

- Haemonetics Corp.