Global Blood Collection Devices Market Analysis By Product (Blood collection tubes, Needles & syringes, Blood bags, Blood collection systems / monitors / devices, Lancets, Accessories), By Method (Manual, Automated), By Application (Diagnostics, Therapeutics), By End‑User (Hospitals & clinics, Diagnostic & pathology laboratories, Blood banks, Research & academic institutes , Home care) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162759

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

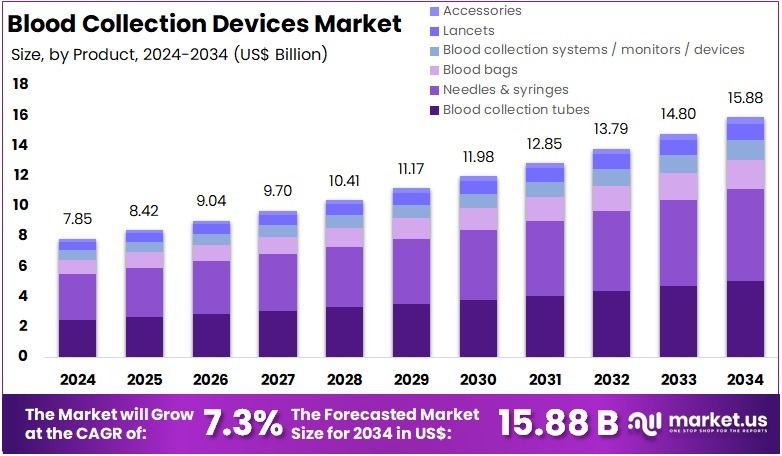

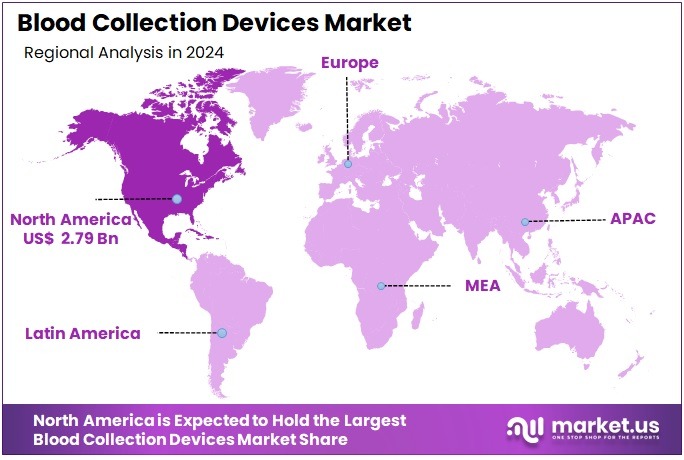

The Global Blood Collection Devices Market Size is expected to be worth around US$ 15.88 Billion by 2034, from US$ 7.85 Billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.6% share and holds US$ 2.79 Billion market value for the year.

The Blood Collection Devices Market includes medical tools used to collect venous and capillary blood samples for diagnostic testing, transfusion, and research. These devices include needles, syringes, vacuum tubes, lancets, blood bags, and safety-engineered sets. They are designed to provide sterile and painless blood withdrawal. According to industry studies, advanced devices have helped reduce contamination and improve sample quality. The market remains essential because accurate diagnostics depend on reliable blood collection in hospitals, laboratories, and blood banks.

The global market is expanding due to rising healthcare spending and greater demand for testing. Growth in structural needs for testing and transfusion continues steadily. For example, global blood donations were reported at about 118.5 million, while most transfusions in high-income countries are given to people aged over 60. This continuous demand drives repeated procurement of tubes, lancets, and closed systems. Initiatives such as the World Health Organization’s (WHO) World Blood Donor Day 2024 support awareness and safe blood use.

Demographic changes strongly support market growth. A study by the United Nations indicates the population aged 65 years and older will increase from 761 million in 2021 to 1.6 billion by 2050. Older adults require frequent blood tests to manage chronic diseases and surgical care. This leads to more routine phlebotomy in hospitals and outpatient settings. Increased need for transfusions among aging populations also drives demand in both developed and developing healthcare systems.

Chronic disease prevalence is increasing test volumes. According to WHO, around 830 million people were living with diabetes in 2022, especially in low- and middle-income countries. Diabetes monitoring requires regular blood testing. Cardiovascular diseases continue as the leading cause of death worldwide. These disease burdens raise the need for venous and capillary devices. The International Agency for Research on Cancer estimates 20 million new cancer cases in 2022, with 53.5 million survivors within five years of diagnosis. Oncology requires repeated blood draws throughout treatment.

Hospital activities also contribute to rising use. OECD data recorded about 130 hospital discharges per 1,000 population in 2021, indicating high inpatient care volumes that require diagnostic tests. Policies and regulations are shaping product innovation. For instance, the U.S. Food and Drug Administration promotes sharps-injury-prevention features in devices. The U.S. CDC reports around 385,000 sharps injuries each year among hospital staff, increasing adoption of safety needles and closed systems that protect healthcare workers.

Strengthened diagnostic systems expand testing access. WHO Resolution WHA76.5 (May 2023) promotes improved laboratory capacity. Tools like the Essential Diagnostics List and MeDevIS (2024) guide procurement and standard test menus. Decentralized care and primary healthcare growth drive demand for microtainers and point-of-care devices. Taken together, aging populations, chronic diseases, active hospital care, global donation campaigns, and strong safety regulations ensure stable, long-term demand for blood collection tools worldwide.

Key Takeaways

- The global blood collection devices market is projected to reach about US$ 15.88 billion by 2034, increasing from US$ 7.85 billion in 2024 with a 7.3% CAGR.

- Industry analysts reported that needles and syringes accounted for over 38.5% of the product segment in 2024, demonstrating strong dominance.

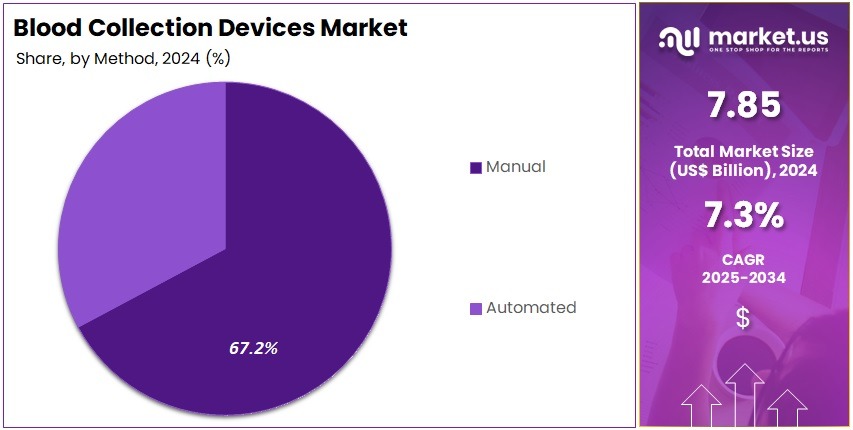

- Manual blood collection methods held significant prominence in 2024, securing more than 67.2% share within the method category due to widespread adoption.

- Diagnostic applications controlled above 65.3% of the total market in 2024, indicating increased usage of blood collection devices for disease testing requirements.

- Diagnostic end-users also led the market in 2024, capturing more than a 34.3% share, driven by growing clinical laboratory utilization.

- North America remained the leading regional market with over 35.6% share, representing nearly US$ 2.79 billion market value during 2024.

Product Analysis

In 2024, the Needles & Syringes section held a dominant market position in the Product segment of the Blood Collection Devices Market, and captured more than a 38.5% share. This segment has been widely used in venipuncture and routine diagnostic procedures. High testing volumes have supported strong demand. The adoption of safety devices has increased. Infection control protocols have guided market use. Testing for chronic and infectious diseases has risen. These factors have reinforced the leading share for this category.

Blood collection tubes accounted for the second-largest share. These products are used to store and transport samples. Clinical laboratories depend on them. Rising diagnostic needs have improved their use. Automation in sample handling has also supported growth. Blood bags have shown stable demand. More blood donations have been recorded. Surgical cases have expanded in developing nations. New storage solutions are improving transfusion workflows. These advancements have strengthened the market outlook for both product groups.

Collection systems and monitors have gained attention. Healthcare facilities have adopted closed systems to reduce contamination. Better accuracy is achieved. Lancets have grown fast. Home care users rely on them for glucose checks. Disposable designs have improved comfort. Accessories like holders and tourniquets support safety. Their demand rises with consumable use. Product innovation remains continuous. Regulatory rules have encouraged safer solutions. Rising test volumes will support the overall expansion of these product categories.

Method Analysis

In 2024, the Manual Section held a dominant market position in the Method Segment of the Blood Collection Devices Market, and captured more than a 67.2% share. Manual techniques remained widely adopted. The preference was driven by lower equipment cost. It also allowed clinical staff to maintain direct control during routine blood collection. The usage rate increased in developing countries. The demand was linked to rising patient numbers. It was also supported by a growing network of hospitals and diagnostic laboratories.

Manual devices were commonly used in venipuncture and capillary blood draws. Healthcare professionals found them reliable. The approach required minimal training. It supported quick procedures in both public and private facilities. The large customer base continued to boost product usage. Flexibility and accessibility contributed to its strong position. Clinical settings with limited automation budgets preferred manual methods. The segment remained essential in general medical practice. Adoption was supported by stable reimbursement structures.

The Automated Section represented the remaining market share. Automation gained attention due to the need for high efficiency. These systems helped reduce contamination risks. They also minimized human errors. Large laboratories with heavy workloads invested in automated solutions. Advanced healthcare environments drove growth. Improved accuracy and workflow optimization encouraged adoption. The shift toward automation was expected to increase. However, manual systems were forecast to remain important due to cost advantages and broad clinical compatibility.

Application Analysis

In 2024, the Diagnostics Section held a dominant market position in the Application Segment of Blood Collection Devices Market, and captured more than a 65.3% share. This leadership was supported by strong demand for blood-based diagnostic testing. Chronic disease cases continued to rise across major regions. Hospitals and laboratories increased their test volumes. Preventive health check-ups also grew. The focus on early detection remained high. These trends resulted in greater adoption of safe, sterile, and efficient blood collection solutions.

Diagnostics applications were viewed as essential in both routine and specialized healthcare settings. The need for rapid and accurate results contributed to sustained demand. Healthcare providers invested in advanced collection systems. Laboratory automation supported further market expansion. Government programs encouraged regular screening. The availability of improved devices raised testing efficiency. These elements strengthened the dominance of diagnostics. The segment is expected to remain the primary revenue contributor. Continuous enhancements in infrastructure will further support market stability and growth.

Therapeutic applications represented the second-largest share. They were used for procedures including blood transfusion and apheresis. Growing surgical volumes supported this demand. Rising blood disorders increased the need for therapeutic interventions. Patient awareness improved access to essential treatments. Healthcare facilities adopted better equipment for safety and accuracy. The segment is projected to grow at a moderate pace. It will benefit from investments in clinical care. Both applications will continue contributing to the overall expansion of blood collection devices.

End‑User Analysis

In 2024, the Diagnostics Section held a dominant market position in the End-User Segment of the Blood Collection Devices Market, and captured more than a 34.3% share. This leadership was supported by demand for blood tests in hospitals and laboratories. Higher numbers of chronic disease cases increased testing needs. Routine health checks expanded. Clinical laboratories handled large volumes of samples. Adoption of advanced diagnostic tools improved workflow. These factors contributed to consistent device usage. Diagnostics remained the key contributor.

Therapeutic applications showed steady growth. Rising surgical procedures increased the use of needles, blood bags, and secure collection systems. Demand for safe transfusion practices supported device adoption. Expansion of blood donation activities improved product needs. Hospitals focused on infection control. Better patient care standards encouraged reliable equipment. Access to healthcare improved in developing regions. Trauma treatments required more blood supplies. These factors helped therapeutic demand remain strong.

Research and academic centers increased usage of blood collection devices. Investments in biotechnology research rose. Clinical trials required more sample testing. This improved demand for advanced collection products. Personalized medicine studies used blood samples for analysis. Innovation in healthcare research remained strong. Adoption in universities supported steady consumption. Partnerships between hospitals and research groups improved workflows. The segment showed gradual growth with future opportunities expected to rise.

Key Market Segments

By Product

- Blood collection tubes

- Needles & syringes

- Blood bags

- Blood collection systems / monitors / devices

- Lancets

- Accessories

By Method

- Manual

- Automated

By Application

- Diagnostics

- Therapeutics

By End‑User

- Hospitals & clinics

- Diagnostic & pathology laboratories

- Blood banks

- Research & academic institutes

- Home care

Drivers

Digital Health Integration in Smart Blood Collection

Digital health integration is driving the adoption of smart blood collection devices in healthcare settings. The implementation of connected systems is enabling real-time tracking of samples during the entire diagnostic process. RFID and barcode technologies are improving identification accuracy. Errors linked with manual labeling are reduced. Healthcare providers benefit from timely access to critical data. The reliability of collected samples supports faster clinical decisions. This development strengthens confidence in diagnostic outcomes. Growth in connected medical technologies is increasing demand for advanced blood collection solutions.

Smart blood collection devices support seamless data transmission to laboratory information systems. Automation in sample handling is improving workflow efficiency. The turnaround time for test results is declining. The reduced labor requirement is cutting operational costs. Data accuracy is increased through continuous digital monitoring. It enhances compliance with regulatory standards. Clinical laboratories are adopting smart devices to keep pace with digital transformation. This trend is pushing manufacturers to integrate intelligent features into existing products.

Precision medicine is expanding in clinical practice. It depends on accurate and traceable biological samples. Smart blood collection devices ensure quality assurance throughout the patient journey. Real-time data provides better insight into patient health. Personalized treatment plans are supported. Market growth is influenced by rising investments in healthcare digitalization. Hospitals are prioritizing solutions that improve patient safety. These systems enhance communication between clinical teams. The focus on advanced diagnostics continues to strengthen the role of digital health in the blood collection devices market.

Restraints

Shortage of Skilled Phlebotomy Professionals as a Key Market Restraint

Shortages of skilled phlebotomy professionals are limiting the efficiency of blood collection processes. Healthcare demand is increasing rapidly. Workforce supply is not growing at the same rate. This gap is creating operational delays in hospitals and diagnostic centers. Inadequate staffing levels reduce the capacity for safe and accurate blood collection. The impact is more visible in regions with limited access to trained professionals. As a result, the adoption and utilization of blood collection devices are restricted, slowing market growth potential.

Training gaps are a major factor contributing to the shortage. Many healthcare systems face challenges in offering advanced skill development for phlebotomists. High workload pressure, low training investment, and slow hiring procedures increase the strain on available staff. This negatively affects procedural accuracy and patient safety. Mistakes in blood draws increase risks and operational costs. These conditions act as a restraint for the blood collection devices market as performance and reliability limitations hinder broader product usage.

Workforce pressure not only affects efficiency but also compliance with safety standards. Proper handling and utilization of blood collection devices require consistent training. Overburdened staff may struggle to maintain high-quality procedures. This can reduce confidence in advanced blood collection technologies. Healthcare providers may delay device procurement if performance concerns remain high. The inability to meet rising demand limits market expansion. Therefore, the shortage of skilled phlebotomy professionals stands as a significant barrier to growth within the blood collection devices market.

Opportunities

Growth of Home-Based and Decentralized Blood Collection Solutions

The increasing adoption of home-based diagnostics is creating a significant opportunity for blood collection devices. The demand is expanding beyond hospitals. Self-collection devices allow patients to obtain samples at home. This supports telemedicine services and remote consultations. Improved access to diagnostic testing encourages early detection and regular health monitoring. The market growth is driven by convenience and reduced clinical visits. Manufacturers are developing user-friendly capillary micro-collection kits. These devices ensure accuracy and safety. The shift toward decentralized healthcare is strengthening demand in global markets.

Decentralized healthcare systems are transforming sample collection methods. Blood collection devices designed for lay users are essential in this transition. Clinical trial processes are adopting remote participant engagement. This reduces reliance on site-based operations. Capillary sampling devices enable participants to submit samples from home. It improves compliance and increases enrollment. The expansion of virtual trials is accelerating product demand. The market benefits from reduced costs. Technology-enabled sample tracking supports operational efficiency and data quality.

Chronic disease monitoring is increasingly managed outside clinical settings. Blood collection devices help patients track biomarkers regularly. Diabetes, cardiovascular disorders, and other long-term diseases require frequent testing. Home-based sampling reduces healthcare burden. It enables timely treatment decisions. The availability of compact and sterile micro-collection devices supports strong adoption. Partnerships between diagnostic companies and digital health platforms are rising. This collaboration ensures coordinated care pathways. The continued development of telehealth infrastructure is expected to sustain long-term growth in the blood collection devices market.

Trends

Growing Focus on Sustainable Blood Collection Devices

Sustainability is becoming a significant factor in procurement decisions for blood collection devices. Healthcare facilities are prioritizing products that minimize environmental impact. The use of eco-friendly designs, lower plastic content, and recyclable components is gaining attention. Manufacturers are working toward reducing carbon emissions in production. This shift is driven by global sustainability goals and regulatory encouragement. As hospitals seek greener solutions, suppliers must adapt to meet new expectations. Sustainability is now influencing purchase criteria along with quality, safety, and performance in the blood collection market.

Vendors are innovating materials and product formats to align with sustainability targets. Reusable blood collection accessories, biodegradable packaging, and reduced-waste systems are emerging. Energy-efficient manufacturing practices are also being adopted to lower overall carbon footprints. These changes are expected to support cost savings and waste reduction for healthcare providers. Stakeholder pressure for responsible procurement is increasing. This drives product redesign and investment in sustainable technology. Market participants responding early are likely to gain competitive advantages.

The preference for environmentally responsible options is expected to rise globally. Healthcare systems are integrating sustainability metrics into tenders and supplier evaluations. This supports the transition to circular-economy models in medical device usage. Governments and accreditation bodies are promoting compliance with eco-standards. As a result, sustainability is no longer optional in product strategy. It influences innovation pipelines and long-term market positioning. The growth of sustainable blood collection devices can be attributed to evolving environmental awareness and strategic purchasing behaviors.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 35.6% share and holds US$ 2.79 Billion market value for the year. According to industry studies, high demand, large healthcare budgets, and strict regulations reinforced this lead. The United States showed very high medical spending. National health expenditure reached US$ 4.9 trillion in 2023, equal to 17.6% of GDP. This strong and steady spending created a broad buyer base across hospitals, laboratories, and clinics. As a result, product adoption advanced at scale across the region.

Chronic disease prevalence increased diagnostic needs. Study by public health agencies indicated around 38.4 million people in the United States were living with diabetes. For instance, about one in ten Americans had the disease. Cancer incidence also remained high. For example, recent SEER data showed 445.8 new cases per 100,000 population every year. These large patient pools required routine blood testing for diagnosis and treatment monitoring. The demand supported consistent consumption of needles, tubes, and safety-engineered blood collection sets.

A large and mature laboratory base further strengthened market expansion. According to the Centers for Medicare & Medicaid Services, tens of thousands of CLIA-certified and waived labs were active across the country. This dense and regulated network enabled frequent testing and rapid uptake of newer devices. Regulation and worker safety rules also influenced procurement. The Needlestick Safety and Prevention Act and OSHA directives required safer, engineered sharps where possible. These policies encouraged hospitals and labs to purchase premium devices with injury-prevention features.

Regulatory clarity supported innovation. The FDA’s frequent guidance on donor screening, pathogen reduction, and blood component handling reduced risk for providers and accelerated device approvals. Canada also contributed to regional growth. Health spending in Canada was projected at CAD 372 billion in 2024. This equaled CAD 9,054 per person and about 12.4% of GDP. Health Canada ensured quality through risk-based classifications and premarket reviews. These measures supported steady procurement of collection consumables and enhanced manufacturer confidence across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The blood collection devices market is dominated by global manufacturers. Becton, Dickinson and Company maintains the largest presence. Its Vacutainer portfolio supports strong hospital and laboratory penetration. Terumo Corporation shows strength in apheresis and blood center systems. Fresenius Kabi focuses on transfusion technologies and tender markets. Haemonetics Corporation leads in plasma collection with integrated software. Greiner Bio-One competes with premium preanalytical solutions. These companies benefit from safety device upgrades, global distribution networks, and established procurement relationships. High switching costs protect their installed base.

Competitive differentiation is based on product quality, safety features, and compliance with regulatory standards. Becton, Dickinson and Company invests in advanced tube additives and micro-collection devices. Terumo expands plasma capabilities through donor management tools. Fresenius Kabi supports modernization of blood banks in emerging regions. Haemonetics strengthens recurring revenue from disposables. Greiner Bio-One focuses on sample stability and PET tube adoption. Pricing pressure remains visible in government tenders. However, premium players sustain margins through innovation and strong customer support.

Additional players contribute to market competitiveness. Sarstedt AG & Co. KG differentiates through the S-Monovette system that improves sample quality. Nipro Corporation grows in needles and safety devices with scale advantages in Asia. Cardinal Health supports private-label products through major distribution networks. Abbott Laboratories participates selectively, driven by diagnostic synergy. Qiagen NV plays in molecular stabilization tubes for high-value testing. Smiths Medical (ICU Medical) strengthens vascular access solutions. Macopharma SA focuses on blood bags and filters in Europe. Retractable Technologies improves needlestick safety outcomes.

FL Medical supports laboratory automation and OEM demand with cost-efficient plastics. Regional firms from China, India, and Latin America expand production capacity. They compete mainly through price and local tender access. Quality standards vary, but regulatory certifications are increasing. Supply chain resilience has become a key factor in vendor selection. Sustainability programs and waste reduction influence procurement choices in Europe. Vendors with validated systems retain strong loyalty. Continuous safety conversions and growth in plasma collection support steady revenue expansion for leading companies.

Market Key Players

- Becton, Dickinson and Company

- Terumo Corporation

- Fresenius Kabi

- Haemonetics Corporation

- Greiner Bio‑One

- Sarstedt AG & Co. KG

- Nipro Corporation (Nipro Medical)

- Abbott Laboratories

- Cardinal Health

- Qiagen NV

- Smiths Medical (including ICU Medical)

- Macopharma SA

- Retractable Technologies Inc.

- FL Medical s.r.l.

- Other key players

Recent Developments

- In December 2024: A definitive agreement was announced to divest the company’s whole blood collection, processing, and filtration assets to GVS S.p.A for total consideration of up to $67.1 million, including transfer of related manufacturing facilities.

- In November 2024: Fresenius Kabi submitted a 510(k) to the U.S. FDA for Aurora Xi Plasmapheresis System Software Version 2.0, introducing an adaptive (linear) donor-specific nomogram to target plasma collection volume and improve source-plasma collection efficiency. (Subsequently, FDA clearance was granted in January 2025.)

- In October 2024: U.S. launch of the Reveos Automated Blood Processing System was initiated in partnership with Blood Centers of America. The device is positioned to streamline whole-blood processing into components and support platelet supply needs in the U.S. market. It had already been utilized in 50+ countries prior to this launch.

- In July 2024: FDA Class II recall of VACUETTE® 8 mL CAT Serum Separator Clot Activator tubes (16×100 mm; red cap with yellow ring) due to reports of missing additive leading to clotting/poor separation and potential need for sample recollection.

Report Scope

Report Features Description Market Value (2024) US$ 7.85 Billion Forecast Revenue (2034) US$ 15.88 Billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Blood collection tubes, Needles & syringes, Blood bags, Blood collection systems / monitors / devices, Lancets, Accessories), By Method (Manual, Automated), By Application (Diagnostics, Therapeutics), By End‑User (Hospitals & clinics, Diagnostic & pathology laboratories, Blood banks, Research & academic institutes , Home care) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Becton, Dickinson and Company, Terumo Corporation, Fresenius Kabi, Haemonetics Corporation, Greiner Bio‑One, Sarstedt AG & Co. KG, Nipro Corporation (Nipro Medical), Abbott Laboratories, Cardinal Health, Qiagen NV, Smiths Medical (including ICU Medical), Macopharma SA, Retractable Technologies Inc., FL Medical s.r.l., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blood Collection Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Blood Collection Devices MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton, Dickinson and Company

- Terumo Corporation

- Fresenius Kabi

- Haemonetics Corporation

- Greiner Bio‑One

- Sarstedt AG & Co. KG

- Nipro Corporation (Nipro Medical)

- Abbott Laboratories

- Cardinal Health

- Qiagen NV

- Smiths Medical (including ICU Medical)

- Macopharma SA

- Retractable Technologies Inc.

- FL Medical s.r.l.

- Other key players