Global Blockchain in Oil and Gas Market Size, Share, Statistics Analysis Report By Component (Solution, Services), By Application (Supply Chain Management, Smart Contracts, Asset Management, Other Applications), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: January 2025

- Report ID: 136924

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

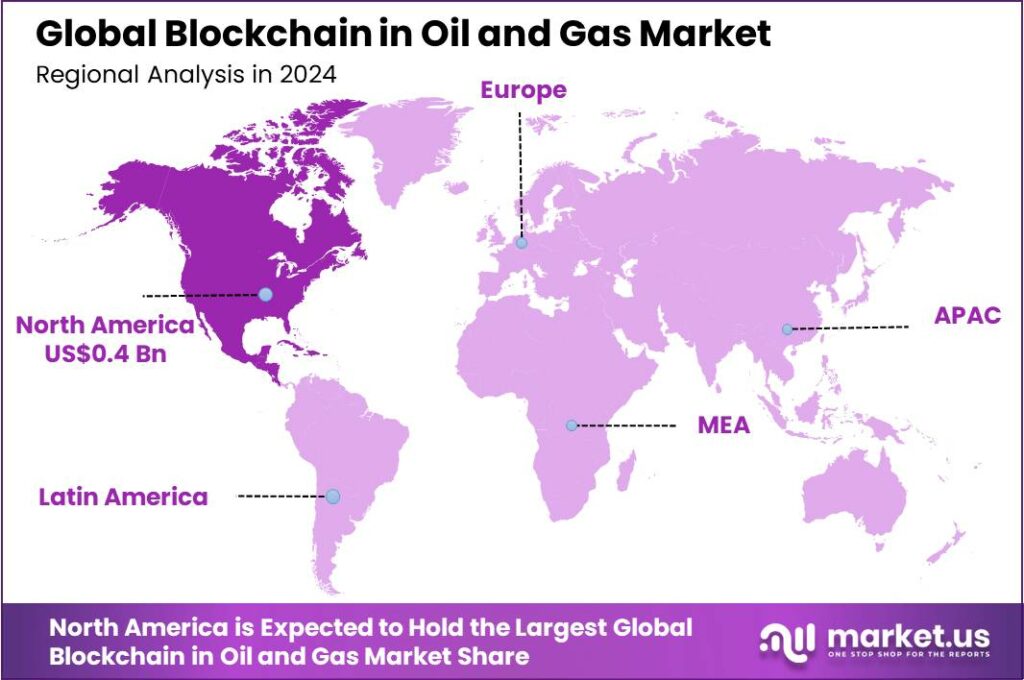

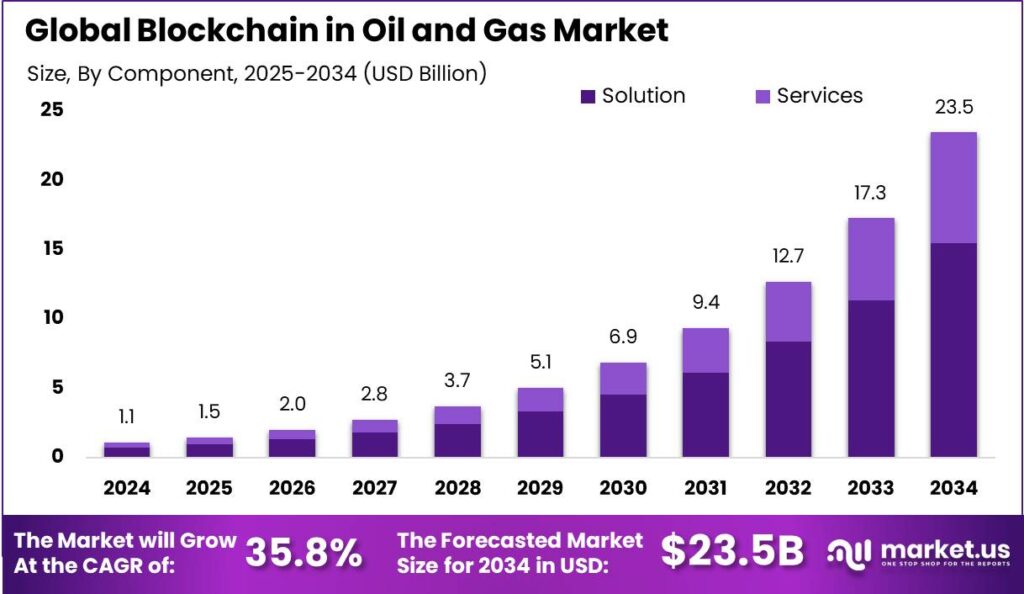

The Global Blockchain in Oil and Gas Market size is expected to be worth around USD 23.5 Billion By 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 35.80% during the forecast period from 2025 to 2034. In 2024, North America dominated the blockchain in oil and gas market, capturing over 37.4% of the share, with revenues reaching USD 0.4 billion.

Blockchain technology in the oil and gas sector refers to the application of a decentralized and distributed digital ledger that records transactions across multiple computers in such a way that the registered transactions cannot be altered retroactively. This technology offers enhanced transparency, security, and efficiency in transactional processes.

The blockchain in oil and gas market is rapidly expanding as companies seek to leverage these technologies to gain a competitive edge in efficiency and security. This market includes various applications such as supply chain management, transaction management, and compliance. It is driven by the need to reduce operational costs and increase efficiency in trading and logistics.

Several factors drive the adoption of blockchain in the oil and gas industry. The increasing need for transparency and traceability in operations compels companies to implement technologies that offer real-time data sharing and monitoring. Additionally, the rise in cyberattacks and data breaches has heightened the demand for secure systems to protect sensitive information.

The demand for blockchain solutions in the oil and gas sector is on the rise, driven by the industry’s complex supply chains and the necessity for efficient operations. Blockchain facilitates real-time tracking of oil and gas shipments, automates procurement processes, and enhances security measures, thereby improving overall operational efficiency.

The technology’s ability to provide an immutable record of transactions ensures data integrity and fosters trust among stakeholders, further fueling its demand. Technological advancements in blockchain, such as the development of smart contracts and integration with the Internet of Things (IoT), have further enhanced its applicability in the oil and gas sector.

Smart contracts automate and enforce contractual agreements, reducing the potential for disputes and errors. The combination of blockchain with IoT devices allows for real-time monitoring and data collection, improving decision-making processes and operational efficiency. These advancements contribute to the growing adoption of blockchain technology in the industry.

For instance, The energy and utilities sector is rapidly adopting digital technologies to enhance efficiency and transparency. In March 2024, the U.S. Department of Homeland Security (DHS) awarded a Phase 4 contract valued at nearly USD 200,000 to blockchain firm Neoflow. This initiative represents a significant step toward modernizing the tracking of energy products like natural gas and crude oil between Canada and the U.S.

Blockchain technology presents significant opportunities for innovation and collaboration within the oil and gas industry. By creating a transparent and decentralized platform, it enables peer-to-peer energy trading and promotes the integration of renewable energy sources. This fosters a more sustainable and efficient energy ecosystem. Additionally, blockchain’s capability to streamline complex transactions and reduce the need for intermediaries opens avenues for cost savings and operational improvements.

Key Takeaways

Component Analysis

In 2024, the Solution segment held a dominant market position in the blockchain in oil and gas market, capturing more than a 65.9% share. This leading position can primarily be attributed to the essential role that blockchain solutions play in enhancing operational efficiencies across various oil and gas processes.

The predominance of the Solution segment is further reinforced by the oil and gas industry’s drive towards digital transformation. Blockchain-based solutions support this shift by providing a secure and immutable platform for automating core operations and reducing the potential for errors and fraud.

Additionally, the high adoption rate of blockchain solutions in the oil and gas sector is influenced by the technology’s ability to significantly reduce operational costs. By automating routine tasks and eliminating the need for intermediaries, companies can achieve more efficient transaction processing and better allocation of resources.

The Solution segment’s growth is supported by continuous advancements in blockchain technology, which are expanding its applications in the oil and gas sector. New developments in smart contracts and decentralized applications are making blockchain solutions more robust and adaptable to industry-specific needs.

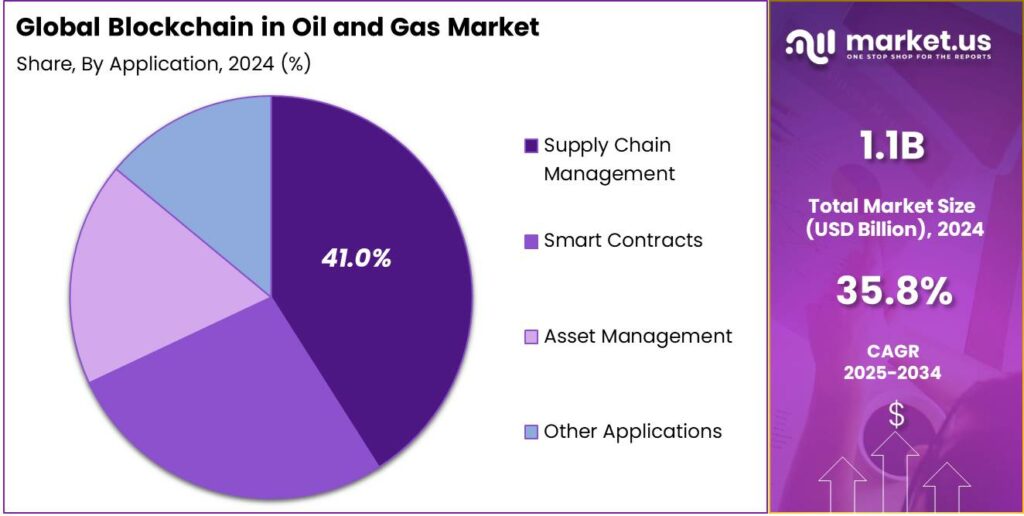

Application Analysis

In 2024, the Supply Chain Management segment held a dominant market position in the blockchain oil and gas industry, capturing more than a 41.0% share. This segment leads primarily due to its critical role in optimizing logistics and operational efficiency, which are pivotal concerns in the oil and gas sector.

Blockchain technology in supply chain management offers unparalleled transparency, real-time tracking, and automation of documentation processes. These capabilities help in reducing delays, preventing fraud, and improving compliance with environmental and safety regulations, making it a key driver of blockchain adoption in the industry.

The Smart Contracts segment is another significant application of blockchain in the oil and gas market. It automates contractual obligations and ensures compliance among parties without the need for intermediaries. This application reduces the likelihood of disputes and the associated legal costs, while also speeding up transactions.

Asset Management within blockchain utilizes the technology to enhance the tracking, maintenance, and management of assets throughout their lifecycle. This includes real-time monitoring of equipment health, predictive maintenance, and management of asset transfers.

Key Market Segments

By Component

- Solution

- Services

By Application

- Supply Chain Management

- Smart Contracts

- Asset Management

- Other Applications

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Enhancing Transparency and Efficiency in Supply Chain Management

The oil and gas industry operates through complex supply chains involving multiple stakeholders, including shippers, suppliers, and customers. This complexity often leads to inefficiencies, errors, and increased administrative overheads.

By implementing blockchain, all parties involved in the supply chain can access a single, tamper-proof record of transactions. This shared ledger ensures that every transaction is transparent and verifiable, reducing the likelihood of disputes and errors.

Moreover, blockchain facilitates real-time tracking of assets and products throughout the supply chain. This capability allows companies to monitor the movement of goods, verify their origin, and ensure compliance with regulatory standards.

Restraint

High Implementation Costs and Energy Consumption

Implementing blockchain solutions requires substantial investment in infrastructure, including advanced computing systems and secure networks. Additionally, integrating blockchain with existing legacy systems can be complex and costly, often necessitating specialized expertise and significant time.

Moreover, the energy consumption associated with blockchain technology is a critical concern. The process of validating and recording transactions on a blockchain, particularly in public blockchains that use proof-of-work consensus mechanisms, demands significant computational power. This leads to high energy usage, which not only increases operational costs but also raises environmental concerns.

Opportunity

Streamlining Payments and Reducing Transaction Costs

The oil and gas industry involves complex financial transactions, often across borders, leading to high transaction costs and delays. Blockchain technology presents an opportunity to streamline payments and reduce associated costs through its decentralized and transparent ledger system.

Blockchain’s ability to handle cross-border payments efficiently tackles currency fluctuations and regulatory challenges. Smart contracts automate payments, ensuring funds are released only when conditions are met, reducing disputes and building trust.

The transparency and immutability of blockchain records also contribute to reducing transaction costs. With all parties having access to a single source of truth, the need for extensive reconciliations and audits diminishes, leading to cost savings in administrative processes.

Challenge

Regulatory Uncertainty and Compliance Issues

The adoption of blockchain technology in the oil and gas industry faces significant challenges due to regulatory uncertainty and compliance issues. The lack of clear regulations and standards governing blockchain applications creates a complex environment for companies considering its implementation.

Different jurisdictions have varying legal frameworks concerning blockchain, leading to potential conflicts and legal ambiguities. This inconsistency makes it difficult for multinational oil and gas companies to develop a unified blockchain strategy that complies with all applicable laws and regulations. The absence of standardized protocols can result in interoperability issues, further complicating compliance efforts.

Emerging Trends

One notable trend is the tokenization of commodities, where physical assets like oil and natural gas are digitized into tokens on a blockchain. This process allows for fractional ownership, increased liquidity, and more accessible trading of these resources.

Another emerging application is the use of blockchain for supply chain management. By recording each transaction in a decentralized ledger, companies can track the movement of resources in real-time, ensuring authenticity and reducing the risk of fraud.

Smart contracts, which are self-executing agreements coded on the blockchain, are also gaining traction. They automate processes such as payments and compliance checks, reducing administrative overhead and minimizing human error. This automation streamlines workflows and enhances operational efficiency.

Business Benefits

- Enhanced Transparency: Blockchain provides a single source of truth for all transactions within the supply chain, allowing participants to track the origin, movement, and ownership of oil and gas products with unparalleled transparency.

- Improved Efficiency: The distributed nature of blockchain eliminates the need for intermediaries, streamlining processes and reducing administrative costs. Smart contracts automate and enforce terms, further enhancing efficiency.

- Data Security: Blockchain’s decentralized and encrypted data storage mitigates the risk of data breaches and unauthorized access, ensuring the security and integrity of data related to the exploration, production, and distribution of oil and gas.

- Supply Chain Optimization: By providing a transparent and immutable record of each step in the supply chain, blockchain enhances accountability and reduces the likelihood of fraud, leading to more efficient and reliable operations.

- Regulatory Compliance: Blockchain can streamline compliance processes by providing regulators with real-time access to accurate data, improving regulatory oversight and reducing the administrative burden associated with compliance.

Key Player Analysis

In the blockchain in oil and gas market, several key players stand out due to their innovative solutions and substantial market influence.

IBM Corporation has established itself as a frontrunner in the blockchain in oil and gas sector through its IBM Blockchain platform. This technology is designed to enhance transparency and efficiency in complex supply chains. IBM’s solutions are particularly noted for their ability to improve operational efficiencies and ensure compliance with regulatory standards.

SAP SE is renowned for integrating blockchain technology into its business solutions, providing robust platforms for the oil and gas industry to manage everything from supply chain logistics to transactional transparency. SAP’s blockchain technology, integrated into its ERP systems, offers a comprehensive solution for oil and gas companies pursuing digital transformation for a competitive edge.

Wipro, another significant contributor, offers blockchain solutions that focus on enhancing the security and efficiency of oil and gas operations. Wipro’s services include blockchain consulting and technology deployment tailored to the specific needs of the energy sector.

Top Key Players in the Market

- IBM Corporation

- SAP SE

- Wipro

- VAKT Global Ltd.

- Accenture

- Blockchain For Energy

- Petrobloq LLC

- Other Key Players

Top Opportunities Awaiting for Players

Blockchain technology presents significant opportunities for the oil and gas industry, offering solutions to longstanding challenges and enhancing operational efficiency.

- Supply Chain Transparency and Efficiency: Blockchain enables real-time tracking of oil and gas products from extraction to distribution. This transparency reduces delays, errors, and disputes, leading to a more efficient supply chain.

- Digitalization of Crude Oil Transactions: By digitizing transactions, blockchain ensures enhanced security, improved transparency, and optimized efficiency in crude oil trading. This reduces administrative costs and minimizes the risk of fraud.

- Smart Contracts for Automated Processes: Smart contracts automate various processes in the oil and gas industry, such as lease agreements, royalty payments, and supply chain transactions. This reduces the need for intermediaries, minimizes disputes, and streamlines contract management.

- Reducing Operational Costs: By eliminating intermediaries and automating processes, blockchain can help reduce operational costs in the oil and gas industry. The technology’s ability to streamline transactions and reduce paperwork can lead to significant cost savings.

- Improved Security and Reduction of Cyberattacks: The decentralized and cryptographic nature of blockchain makes it an excellent tool for enhancing security in the oil and gas industry. Blockchain can protect sensitive data from cyberattacks and ensure that records are tamper-proof. This increased security can help oil and gas companies safeguard their assets and maintain the integrity of their operations.

Recent Developments

- In February 2025, Accenture introduced an advanced blockchain solution for oil and gas companies, integrating AI and IoT technologies to enhance operational efficiency4.

- In April 2024, B4E reimagined multi-party applications for the oil and gas sector by leveraging blockchain technology. Their approach supports a wide range of applications requiring simultaneous connections to multiple networks and chains, promoting industry standards and collaboration.

- In January 2024, IBM announced a partnership with a major oil company to implement blockchain solutions for supply chain management, aiming to improve transparency and efficiency in the industry.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 23.5 Bn CAGR (2025-2034) 35.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Application (Supply Chain Management, Smart Contracts, Asset Management, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, SAP SE, Wipro, VAKT Global Ltd., Accenture, Blockchain For Energy, Petrobloq LLC, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Blockchain in Oil and Gas MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Blockchain in Oil and Gas MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- SAP SE

- Wipro

- VAKT Global Ltd.

- Accenture

- Blockchain For Energy

- Petrobloq LLC

- Other Key Players