Global Blackout Fabric Market By End-use (Hotels and Restaurants, Industrial, Photography Laboratories, Schools and Colleges, Others), By Thickness (2-3 Ply, Up to 1 Ply, Above 3 Ply), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137272

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

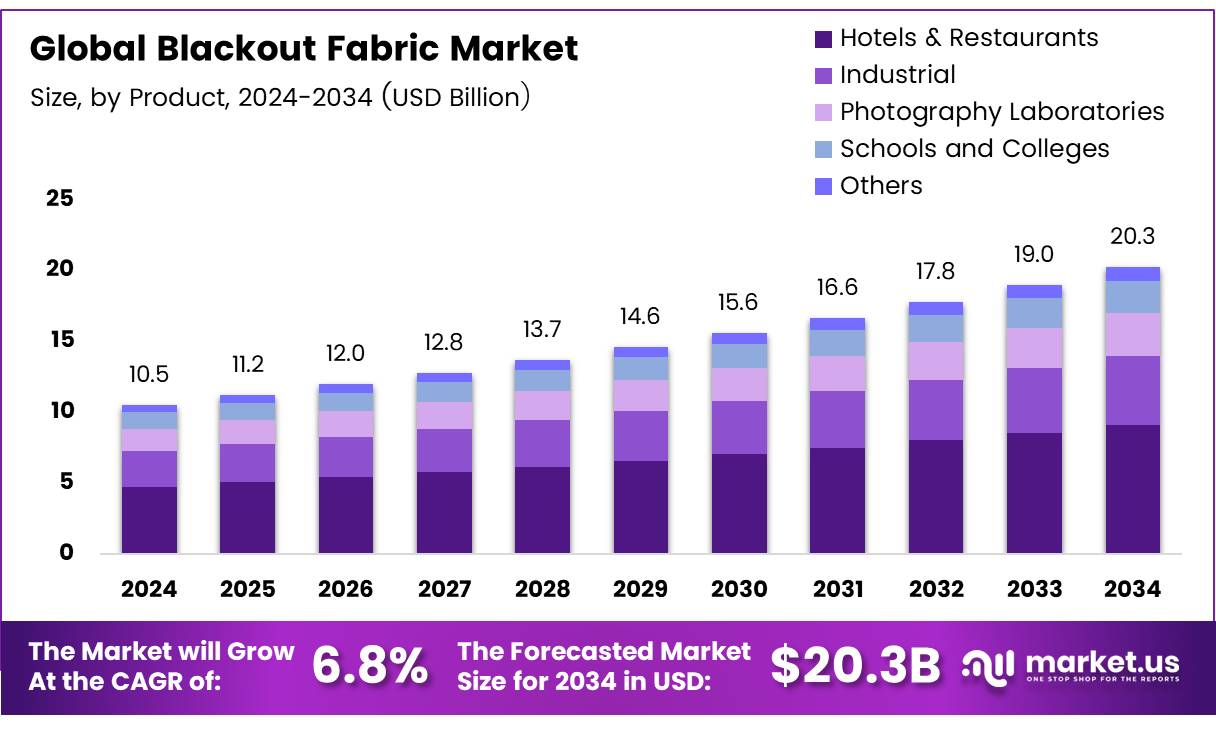

The Global Blackout Fabric Market size is expected to be worth around USD 20.3 Billion by 2034, from USD 10.5 Billion in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034.

Blackout fabric is a specially engineered textile designed to block out all light from entering a room. Its primary function is to provide complete darkness, making it ideal for various applications, including residential and commercial use in environments where light control is critical, such as in bedrooms, movie theaters, and hospitals.

Typically, blackout fabrics are constructed from materials such as polyester, cotton, or blends thereof, with multiple layers or coatings that prevent light from passing through. In addition to light control, these fabrics also help in thermal insulation by preventing heat loss or gain, enhancing energy efficiency in buildings.

The global demand for blackout fabric has steadily increased as consumers and businesses continue to seek solutions for improved light management and energy efficiency. Blackout fabrics are commonly used in conjunction with curtains or blinds to enhance their effectiveness.

Given their ability to offer privacy, reduce noise, and contribute to energy savings, the market for blackout fabrics has expanded into diverse sectors, including hospitality, healthcare, and commercial real estate, reflecting growing consumer awareness of the benefits provided by these materials.

The blackout fabric market refers to the economic sector that produces, sells, and distributes fabrics designed to block light. This market is influenced by consumer preferences for energy efficiency, the growing need for privacy in residential and commercial spaces, and increasing awareness regarding the benefits of light control.

The global blackout fabric market is witnessing significant growth driven by several key factors, including rising awareness of energy conservation, increasing demand for energy-efficient building materials, and growing consumer preferences for comfort and privacy.

According to Textile Exchange, global fiber production reached an all-time high of 124 million tonnes in 2023, a 7% increase from 116 million tonnes in 2022, signaling robust growth in the textile industry that supports the increasing demand for products like blackout fabrics.

An important growth opportunity within this market is the integration of sustainable and eco-friendly materials, particularly as governments and businesses alike increasingly prioritize environmental responsibility. Polyester, which comprised 54% of global fiber production in 2022, is a common material used in blackout fabrics. With polyester production continuing to rise, the material’s availability will likely influence market expansion.

Government investments in energy-saving programs and initiatives further present opportunities for the blackout fabric industry. A notable example is the UK government’s consideration of asking households to close their curtains early to reduce energy bills, which could save the Treasury up to £34 million annually, according to Textile Exchange.

Key Takeaways

- The global Blackout Fabric Market is projected to reach USD 20.3 billion by 2034, growing at a CAGR of 6.8% from 2025 to 2034.

- Hotels & Restaurants accounted for 40.5% of the Blackout Fabric Market in 2023, driven by demand for energy efficiency and enhanced guest experiences.

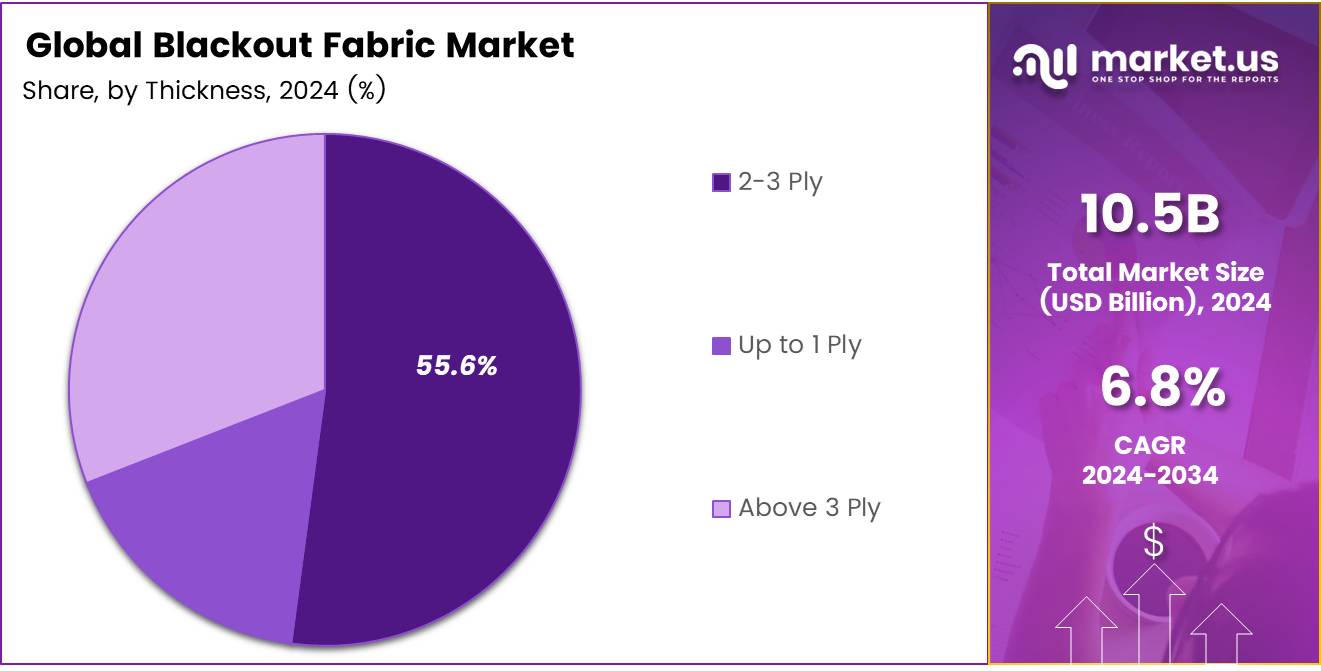

- The 2-3 Ply category dominated the Blackout Fabric Market in 2023, holding a 55.6% share due to its widespread use in both residential and commercial sectors.

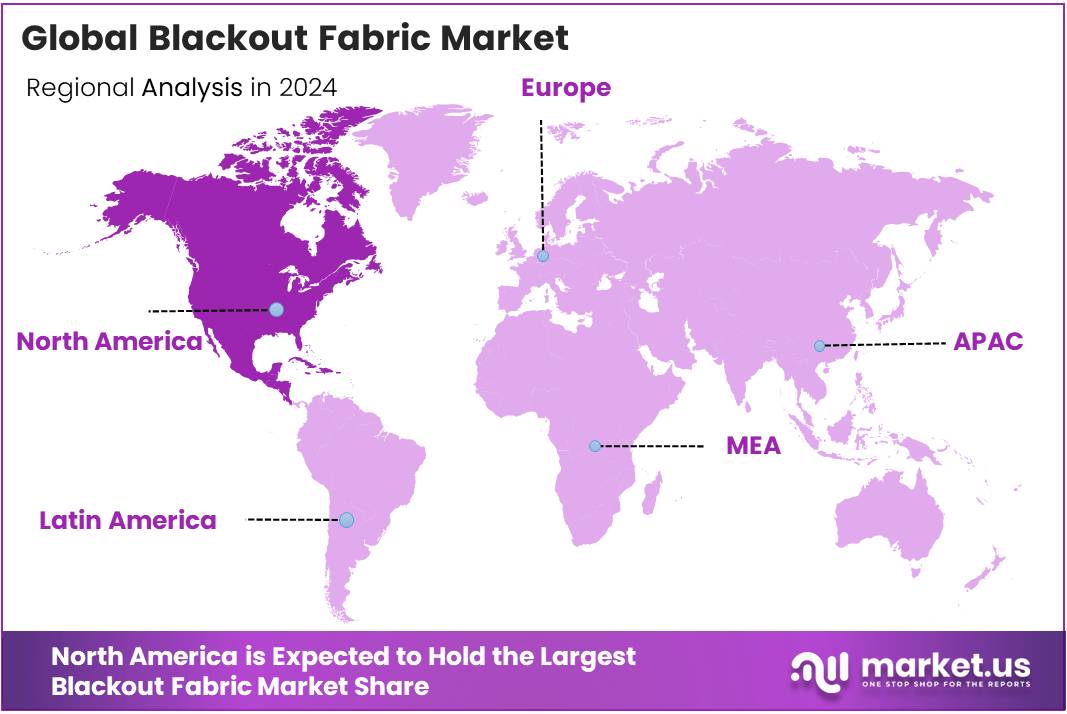

- North America led the global Blackout Fabric Market in 2023, holding 30.5% of the market share, valued at USD 3.15 billion.

End-use Analysis

Hotels & Restaurants Lead the Blackout Fabric Market with a 40.5% Share in 2023

In 2023, Hotels & Restaurants held a dominant market position in the By End-use Analysis segment of the Blackout Fabric Market, accounting for 40.5% of the total market share. This substantial share can be attributed to the growing demand for energy-efficient solutions and enhanced guest experience within the hospitality industry.

Blackout fabrics are increasingly utilized in hotel rooms, restaurants, and event venues to improve privacy, control lighting, and contribute to energy savings by reducing the need for artificial lighting.

The Industrial sector also contributed significantly to the market, driven by applications in manufacturing plants, warehouses, and factories, where blackout fabrics are used to shield sensitive equipment from light exposure, ensuring optimal working conditions.

Photography laboratories, a smaller but notable segment, rely on blackout fabrics to maintain precise light control for high-quality image processing. Additionally, schools and colleges have been integrating blackout fabrics in classrooms and auditoriums to enhance focus and create optimal learning environments.

Other sectors, including healthcare and residential applications, also account for a portion of the market, though their combined share remains smaller. Overall, the increasing versatility and functionality of blackout fabrics across multiple industries are expected to continue driving their demand in the coming years.

Thickness Analysis

2-3 Ply Dominates Blackout Fabric Market by Thickness in 2023 with 55.6% Share

In 2023, the 2-3 Ply category held a dominant market position in the By Thickness Analysis segment of the Blackout Fabric Market, with a substantial 55.6% share. This high market share can be attributed to the widespread application of 2-3 Ply blackout fabrics in both residential and commercial sectors.

These fabrics offer an ideal balance between functionality and cost-effectiveness, providing superior light-blocking performance while remaining economically viable for large-scale production and installation.

In contrast, the Up to 1 Ply segment held a relatively smaller market share due to its limited ability to offer complete light-blocking properties.

While these fabrics are lightweight and affordable, their performance in terms of insulation and light reduction is typically lower compared to thicker variants. Consequently, they are mainly used in areas where partial light control is sufficient.

The Above 3 Ply category accounted for a modest share of the market. These fabrics, while offering superior blackout and thermal insulation properties, are generally more expensive to produce and install, which limits their adoption in price-sensitive markets.

Despite this, their use is expected to grow steadily in premium segments, particularly for specialized applications requiring enhanced light-blocking and thermal management.

Key Market Segments

By End-use

- Hotels & Restaurants

- Industrial

- Photography Laboratories

- Schools and Colleges

- Others

By Thickness

- 2-3 Ply

- Up to 1 Ply

- Above 3 Ply

Drivers

Increasing Demand for Blackout Fabrics Driven by Energy Efficiency and Light Pollution Concerns

The increasing focus on energy-efficient building solutions is one of the primary drivers of the blackout fabric market. These fabrics are known for their ability to block heat and sunlight, contributing to reduced energy consumption in both residential and commercial buildings.

As energy conservation becomes a critical consideration in modern construction, blackout fabrics have gained significant popularity. Another key factor is the rising awareness of light pollution, especially in urban areas.

As cities expand, the need to block external light that disturbs living and working environments has grown, making blackout fabrics a popular choice for minimizing light intrusion.

Furthermore, the expansion of the construction industry, including both residential and commercial sectors, has boosted demand for such materials. As new buildings emerge, there is a greater need for window treatments that offer privacy, comfort, and energy-saving benefits.

Lastly, the rapid pace of urbanization and population growth is also influencing demand. With more people moving to cities and high-rise apartment buildings becoming more common, effective solutions to control light, such as blackout fabrics, are increasingly sought after. These factors combined have led to a steady rise in the demand for blackout fabrics, making them an essential component of modern construction and interior design.

Restraints

High Production Costs and Availability of Substitutes

The blackout fabric market faces several constraints that may hinder its growth. One significant challenge is the high production cost, particularly for advanced fabrics made from specialized materials. These materials, which are often designed for better light-blocking and insulation, can increase the overall cost of manufacturing.

As a result, these fabrics may not be affordable for all consumers, especially in regions with lower disposable income, thus slowing down market adoption.

Furthermore, the availability of substitutes like solar shades, tinted glass, and more affordable curtain materials presents a competitive challenge. These alternatives can offer similar benefits at a lower price point, making it harder for premium blackout fabrics to gain widespread popularity.

In cost-sensitive markets, where price is a crucial factor, such substitutes can significantly impact the demand for more expensive blackout fabrics. This situation forces manufacturers to balance between maintaining product quality and managing production costs to remain competitive.

Overall, while the demand for blackout fabrics remains steady in certain segments, these market constraints could limit the potential for growth in the broader market.

Growth Factors

Key Growth Opportunities in the Blackout Fabric Market Driven by Innovation and Consumer Trends

The blackout fabric market is experiencing multiple growth opportunities that can be leveraged by industry players. One of the most significant opportunities lies in the integration of blackout fabrics into smart home solutions.

By incorporating motorized and automated window treatments, manufacturers can offer consumers greater convenience and control over their indoor environments, contributing to the growing demand in the residential sector.

Additionally, customization and personalization options are becoming increasingly important. Consumers are seeking unique designs, patterns, and sizes, allowing brands to differentiate themselves and attract a wider audience.

Another emerging trend is sustainability. As more consumers prefer eco-friendly products, the demand for blackout fabrics made from organic or recycled materials is expected to rise, providing manufacturers with a chance to appeal to environmentally conscious buyers.

Finally, the focus on premium products presents an opportunity for higher revenue. By developing high-end blackout fabrics tailored to luxury residential and hospitality sectors, such as those with added soundproofing or insulation features, brands can tap into a more affluent market segment.

Overall, these factors suggest a promising future for the blackout fabric market, with growing interest from consumers in both practical and sustainable solutions.

Emerging Trends

Growing Demand for Multifunctional and Sustainable Blackout Fabrics Driven by Consumer Values and Environmental Awareness

The blackout fabric market is evolving with several prominent trends that are shaping consumer preferences and driving demand. One notable trend is the rise of smart fabrics, which can adjust to environmental factors such as light or temperature, offering enhanced functionality in a variety of settings. This innovation appeals to consumers seeking modern, responsive solutions for their living spaces.

Additionally, there is a growing demand for multipurpose blackout fabrics, which not only block light but also provide added benefits like soundproofing, thermal insulation, and UV protection. This shift reflects consumers’ increasing desire for versatile products that cater to multiple needs in a single fabric. Another significant trend is the increasing emphasis on sustainability.

Fabrics made from eco-friendly materials like organic cotton, bamboo, and recycled polyester are gaining popularity due to rising environmental awareness. This trend aligns with broader consumer preferences for sustainable, ethically produced goods. Finally, designer and decorative blackout fabrics are becoming more prevalent.

These fabrics, available in a variety of colors, textures, and patterns, appeal to consumers looking to combine functionality with aesthetic appeal.

The demand for these fabrics is driven by a desire for home décor solutions that not only meet practical needs but also complement modern interior design. Together, these trends highlight a growing market that values functionality, sustainability, and design in blackout fabric products.

Regional Analysis

North America Leads the Blackout Fabric Market with 30.5% Share at USD 3.15 Billion

North America dominates the global blackout fabric market, holding a significant market share of 30.5% equivalent to USD 3.15 billion. The dominance can be attributed to high demand across residential and commercial sectors, particularly in the United States and Canada, where energy-efficient solutions are increasingly prioritized.

The region’s strong manufacturing base and advanced technological integration in fabric production contribute to market growth. Moreover, the growing trend toward home automation and energy-saving solutions further drives the adoption of blackout fabrics in residential settings, alongside their use in hospitality and commercial establishments.

Regional Mentions:

Europe, the market is experiencing steady growth, driven by countries such as Germany, France, and the UK. The growing awareness of energy conservation and sustainability, along with stringent regulations on energy efficiency in buildings, has enhanced the uptake of blackout fabrics. The demand is also spurred by the increasing use of blackout fabrics in the automotive and healthcare industries, especially in Europe’s leading textile manufacturing hubs.

Asia Pacific is witnessing rapid expansion, primarily driven by the booming construction industry and the increasing urbanization in emerging economies like China and India. The region’s demand is projected to grow significantly, particularly due to rising consumer interest in home décor and the growing need for temperature regulation and privacy.

The Middle East & Africa region is seeing moderate growth, with demand largely driven by residential and commercial sectors, especially in countries like the UAE and Saudi Arabia. The market continues to expand as infrastructure development and energy-efficient solutions become more prominent in these regions.

In Latin America, demand remains relatively low compared to other regions, but the market is expected to grow steadily due to increasing awareness of energy efficiency and improved economic conditions.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global blackout fabric market is characterized by the presence of several key players that are driving innovation and setting the competitive landscape. These companies are leveraging advanced technologies and product diversification to capture significant market share.

UNITEC Textile Decoration Co., Ltd. stands out for its specialized offerings in high-quality blackout fabrics, serving both residential and commercial sectors. Their focus on customized solutions has allowed them to maintain a competitive edge, especially in the premium segment.

Etremonde Polycoaters Limited and Indiana Coated Fabrics are recognized for their technical expertise in fabric coating and finishing, which is critical for enhancing the light-blocking properties of blackout fabrics. These companies emphasize durability and performance, meeting stringent market demands.

Hunter Douglas, a dominant player in the global market, benefits from its extensive product range, which includes not only blackout fabrics but also innovative shading systems. The company’s strong brand presence and distribution network allow it to cater to diverse global markets effectively.

Dunmore and Herculite have positioned themselves as leaders in the production of specialized coated fabrics, which offer enhanced thermal and acoustic insulation properties in addition to blackout functionality. Their focus on high-performance materials meets the growing demand for multifunctional textiles.

P.W. Greenhalgh & Company Limited and Sotexpro provide a wide array of tailored blackout fabrics, focusing on customer-specific requirements, which has positioned them favorably in the custom solutions space.

Meanwhile, Bandalux and Création Baumann focus on offering premium, design-oriented products, targeting the high-end segment of the market. Their emphasis on aesthetics alongside functionality has appealed to both interior designers and end consumers seeking stylish yet efficient solutions.

These companies’ collective efforts indicate a robust market, with growth driven by technological advancements, customization, and an increasing preference for energy-efficient and design-conscious solutions.

Top Key Players in the Market

- UNITEC Textile Decoration Co., Ltd.

- Etremonde Polycoaters Limited

- Indiana Coated Fabrics

- Hunter Douglas

- Dunmore

- Herculite

- P.W. Greenhalgh & Company Limited

- Sotexpro

- Bandalux

- Création Baumann

Recent Developments

- In February 2024, Fabric, a leading supply chain technology startup, announces a $60 million Series A funding round, led by General Catalyst, to fuel its expansion and enhance its platform capabilities. The investment will be used to scale operations and innovate within the supply chain management space.

- In July 2024, Fabriclore, an emerging supply chain startup, raises $1.6 million in seed funding to further develop its innovative solutions for optimizing textile and apparel logistics. The round was led by prominent venture capital firms focused on supporting disruptive supply chain technologies.

- In January 2024, Fabric acquires a conversational AI startup aimed at improving the patient-to-clinician journey, enhancing healthcare communication and efficiency. This acquisition aligns with Fabric’s vision to revolutionize healthcare operations using advanced AI solutions.

Report Scope

Report Features Description Market Value (2023) USD 10.5 Billion Forecast Revenue (2033) USD 20.3 Billion CAGR (2024-2033) 6.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By End-use (Hotels and Restaurants, Industrial, Photography Laboratories, Schools and Colleges, Others), , By Thickness(2-3 Ply, Up to 1 Ply, Above 3 Ply) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UNITEC Textile Decoration Co., Ltd., Etremonde Polycoaters Limited, Indiana Coated Fabrics, Hunter Douglas, Dunmore, Herculite, P.W. Greenhalgh and Company Limited, Sotexpro, Bandalux, Création Baumann Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- UNITEC Textile Decoration Co., Ltd.

- Etremonde Polycoaters Limited

- Indiana Coated Fabrics

- Hunter Douglas

- Dunmore

- Herculite

- P.W. Greenhalgh & Company Limited

- Sotexpro

- Bandalux

- Création Baumann