Global Black Hair Care Market By Type (Shampoo, Conditioner, Hair Dye, Hair Oil, Hair Serum, Other), By Application (Household, Commercial Use), By Distribution Channel (Online, Offline), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 48155

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

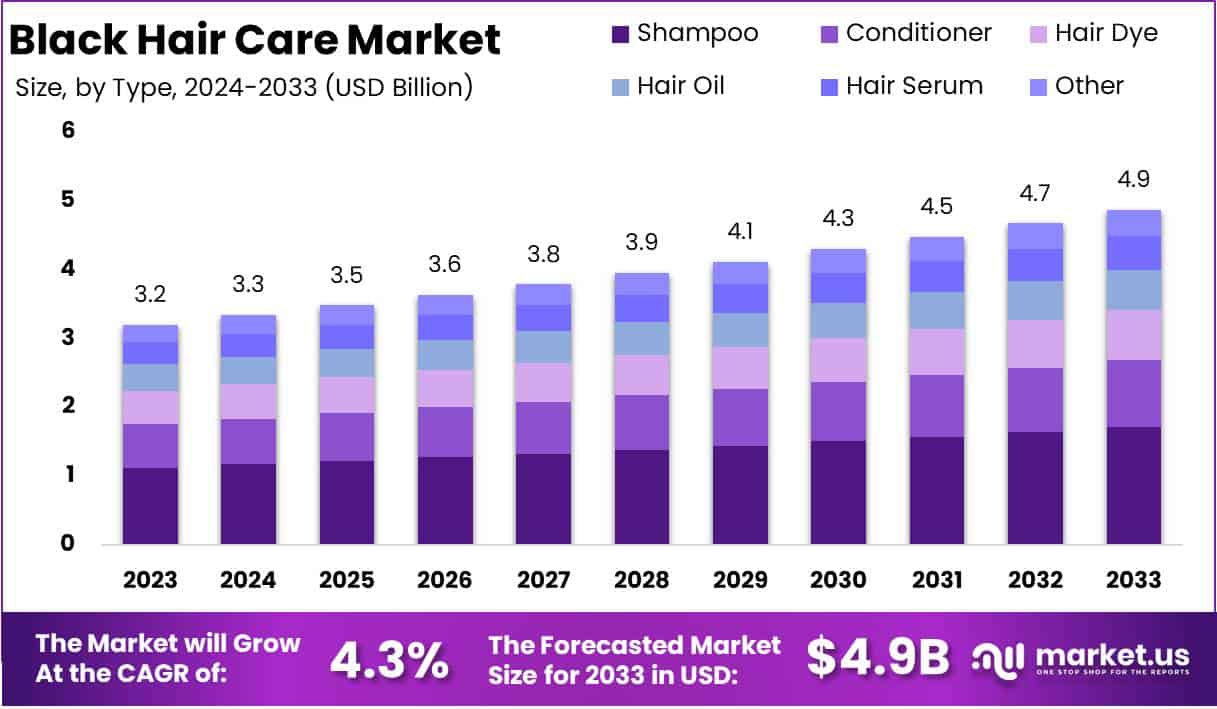

The Global Black Hair Care Market size is expected to be worth around USD 4.9 Billion by 2033, from USD 3.2 Billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

Black Hair Care encompasses a diverse range of products and services tailored specifically to meet the unique needs of textured hair types commonly associated with people of African descent. These products include shampoos, conditioners, styling gels, oils, and treatments designed to address the specific challenges of curly, coily, and kinky hair textures.

Beyond functionality, Black Hair Care also includes cultural and personal expressions of identity, with styles such as braids, locs, and twists playing significant roles in heritage and self-expression.

The Black Hair Care Market refers to the global industry that develops, manufactures, and sells products and services specifically tailored to Black consumers’ hair care needs. This market is characterized by a wide variety of offerings, including hair care products (moisturizers, conditioners, shampoos), styling tools (curling irons, straighteners), and protective styling solutions (wigs, weaves, and extensions).

Additionally, the market has seen significant growth in niche segments such as natural and organic hair care products, reflecting a broader consumer preference for sustainable and health-conscious solutions.

The Black Hair Care Market is experiencing steady growth, driven by several key factors. First, there is a rising awareness and celebration of natural hair, spurred by movements advocating for the beauty and health of textured hair. This has fueled demand for products that enhance natural curls and provide hydration and protection without harsh chemicals.

Second, the increasing purchasing power of Black consumers, coupled with their desire for tailored solutions, has prompted both multinational corporations and independent brands to expand their product lines. Lastly, the influence of social media and digital platforms has amplified the visibility of Black hair care routines, styles, and products, further driving market growth.

Demand for Black hair care products is robust and growing, supported by a shift in consumer behavior toward more personalized and culturally relevant offerings. Consumers are increasingly seeking products that cater to specific needs such as moisture retention, scalp health, and protective styling.

The Black Hair Care Market presents significant opportunities for both established players and emerging brands. One notable area of opportunity lies in the development of innovative products that leverage natural and organic ingredients, aligning with the growing consumer preference for sustainability.

Additionally, personalized hair care solutions driven by advancements in AI and data analytics offer potential for growth, enabling brands to cater to individual hair needs more precisely.

Another promising avenue is the expansion into underserved geographic regions, including parts of Africa and Asia, where demand for tailored Black hair care solutions is rising. Furthermore, investment in education and community-driven marketing can strengthen brand loyalty and foster deeper connections with consumers.

According to Worldmetrics, the Black hair care market demonstrates remarkable growth and consumer influence. Black women spend approximately six times more on hair care than other ethnic groups, contributing significantly to the $473 million that Black consumers in the U.S. allocate annually to hair care products.

Notably, around 40% of women in the U.S. use products designed for Black hair, reflecting the category’s broad appeal. In the hair extension market, Black consumers drive over 70% of total sales. Additionally, 80% of Black consumers emphasize the necessity for products tailored to their specific needs, underscoring opportunities for innovation and market differentiation.

According to AfroLovely, Black-owned hair products constitute a mere 3% of the ethnic hair and beauty market, with the majority of major Black hair care retailers not being Black-owned. This limited representation contributes to 20% of Black consumers experiencing difficulty in finding a variety of products suited to their needs, and 19% struggling to find hair products that align with their hairstyling preferences.

Notably, hair care accounts for 24% of the beauty and personal care industry’s revenues, with the U.S. hair care sector valued at over $83 billion, making it the largest globally. Despite this substantial market size, the underrepresentation of Black-owned brands highlights a significant opportunity for growth and diversification within the industry.

Key Takeaways

- The Global Black Hair Care Market is set to expand from USD 3.2 billion in 2023 to USD 4.9 billion by 2033, driven by a steady CAGR of 4.3% during 2024-2033

- Shampoo led the market in 2023 with a 35% share, underscoring its pivotal role in scalp health and cleansing routines.

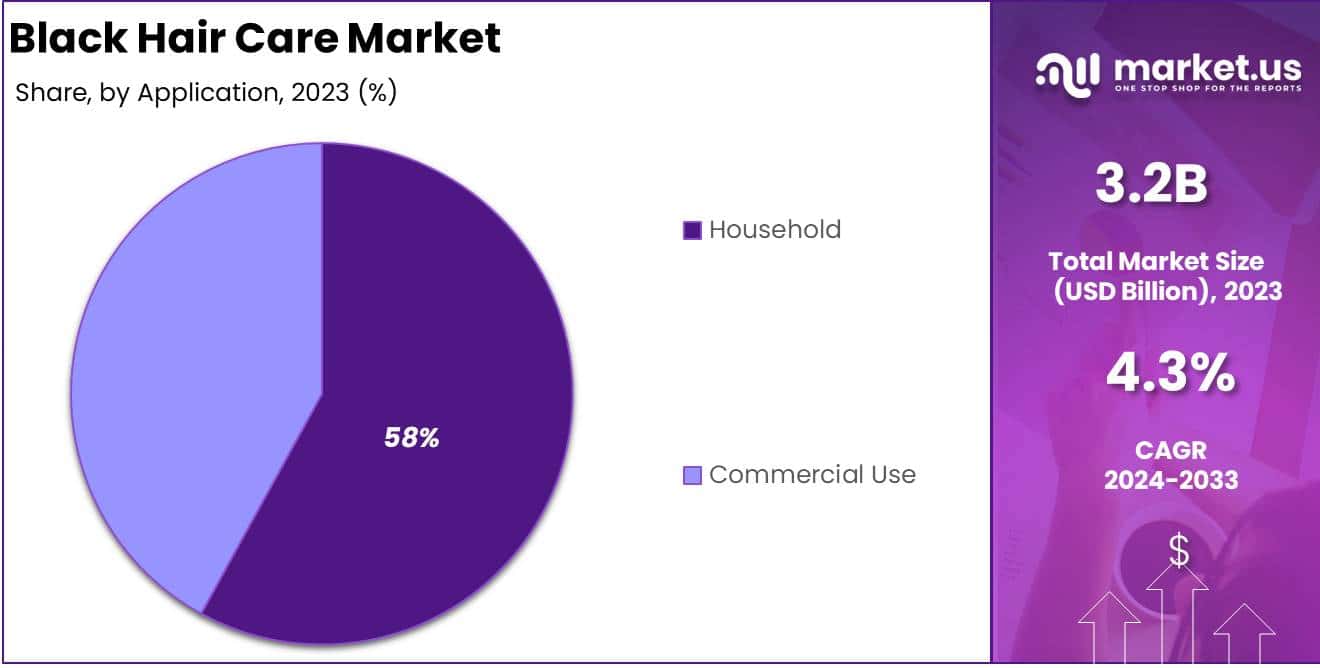

- The Household segment dominated with a 58% market share in 2023, reflecting the growing trend of DIY hair care routines.

- Offline channels held a 62% share in 2023, highlighting consumer preference for in-store product evaluation and personalized recommendations.

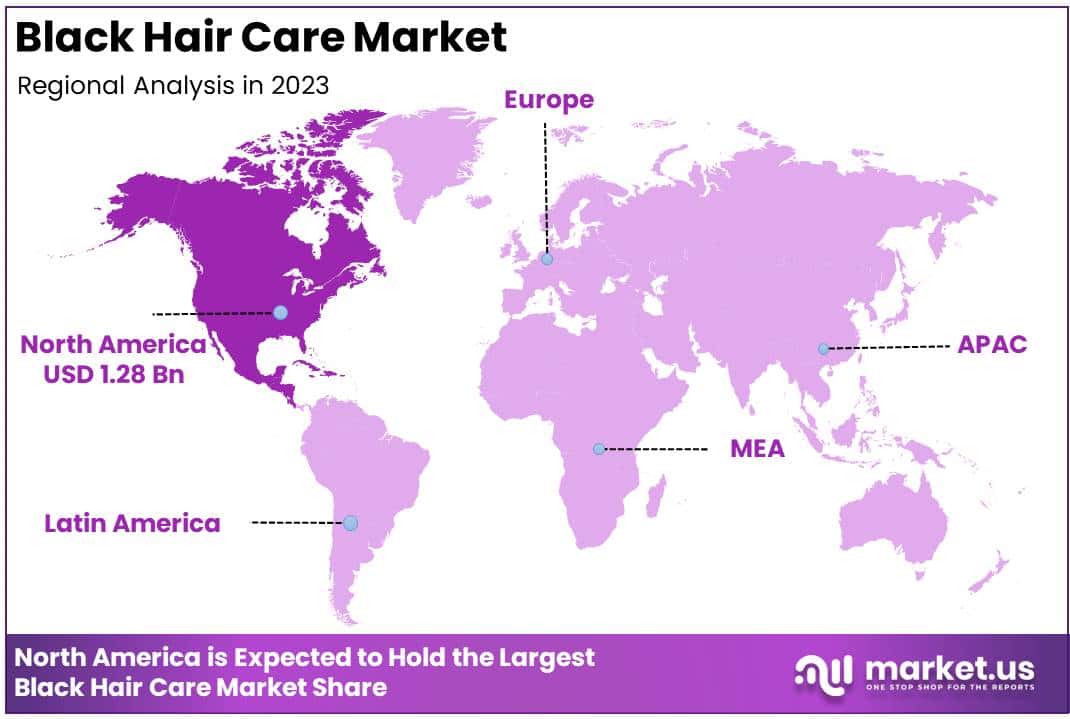

- North America commanded 40% of the global market in 2023, driven by a strong African-American consumer base and increasing expenditure on specialized hair care products.

By Type Analysis

Shampoo Dominating Segment in Black Hair Care with 35% Market Share

In 2023, Shampoo held a dominant market position in the Black Hair Care market, capturing more than a 35% share. This category continues to be a cornerstone in hair care routines, driven by increasing consumer focus on scalp health and cleansing solutions tailored for textured hair.

The growth of sulfate-free and moisturizing shampoos has particularly resonated with this demographic, enhancing product adoption rates.

Conditioners accounted for approximately 20% of the Black Hair Care market in 2023. The segment benefits from the rising demand for deep-conditioning treatments and leave-in conditioners, which address common concerns like dryness and breakage. Innovation in ingredients, such as shea butter and argan oil, has fueled growth in this category.

The Hair Dye segment captured a 15% share of the market in 2023. This segment has witnessed increased demand due to a surge in at-home coloring solutions and growing interest in bold, vibrant shades. Additionally, the rise of ammonia-free and vegan hair dye formulations aligns with consumer preferences for safer, more sustainable options.

Hair Oils represented 12% of the Black Hair Care market in 2023, driven by their multifunctional benefits such as hydration, scalp nourishment, and hair growth stimulation. Products infused with natural oils like castor, coconut, and jojoba have gained significant traction among consumers seeking holistic hair care solutions.

Hair Serums held a 10% market share in 2023, offering targeted solutions for frizz control, shine enhancement, and heat protection. The premium positioning of serums, coupled with their perceived efficacy, has ensured steady growth within this segment.

The Other category, including edge controls, hair masks, and styling gels, accounted for 8% of the Black Hair Care market in 2023. This segment caters to diverse consumer needs, particularly in styling and hair repair, making it an essential complement to core product categories.

By Application Analysis

Household Dominating Segment in Black Hair Care Market with 58% Share

In 2023, the Household segment held a dominant position in the global Black Hair Care market, capturing more than 58% of the market share. This dominance is primarily driven by the increasing demand for hair care products tailored for at-home use, as consumers seek personalized solutions for managing and styling their hair.

Key drivers include the rise in DIY hair care routines, greater awareness of natural hair care, and the growing trend of using chemical-free and organic products.

The Commercial Use segment, encompassing salons, beauty parlors, and other professional establishments, is witnessing steady growth. Although it accounted for a smaller share of the market in 2023, this segment is gaining momentum due to the increasing number of specialized Black hair care services.

Factors such as the rising demand for professional treatments and the growing emphasis on premium, high-quality products contribute to its expansion.

By Distribution Channel Analysis

Offline Dominating Segment in Black Hair Care Market by Distribution Channel with 62% Share

In 2023, the Offline distribution channel held a dominant position in the Black Hair Care market, capturing more than 62% of the market share. This segment’s success is largely driven by the preference for in-store purchasing, where consumers can physically assess products, benefit from immediate availability, and seek personalized recommendations.

Brick-and-mortar stores, including supermarkets, specialty beauty stores, and local retailers, continue to play a crucial role in shaping consumer buying behavior.

The Online distribution channel, while accounting for a smaller share in 2023, is experiencing rapid growth. The convenience of e-commerce platforms, along with access to a wider variety of products and targeted marketing strategies, is driving this segment’s expansion.

Key factors include the increasing use of digital platforms for product discovery and the rising trend of direct-to-consumer (DTC) brands in the Black Hair Care market.

Key Market Segments

By Type

- Shampoo

- Conditioner

- Hair Dye

- Hair Oil

- Hair Serum

- Other

By Application

- Household

- Commercial Use

By Distribution Channel

- Online

- Offline

Driver

Cultural Embrace of Natural Hair

The global Black hair care market is experiencing significant growth, primarily driven by a cultural shift towards embracing natural hair textures among Black consumers. This movement has led to a surge in demand for products that cater specifically to the unique needs of natural hair, such as moisturizers, curl enhancers, and gentle cleansers.

As more individuals move away from chemical relaxers and heat-based styling, there’s an increased preference for products that promote hair health and celebrate natural beauty. This trend has encouraged manufacturers to innovate and expand their product lines to meet the evolving preferences of consumers, thereby fueling market expansion.

Moreover, the rise of social media platforms has amplified this cultural shift, with influencers and everyday users sharing their natural hair journeys, tips, and product recommendations. This online community fosters a sense of pride and acceptance, further propelling the demand for natural hair care products.

Brands that align with this movement and offer products free from harsh chemicals are gaining traction, as consumers become more conscious of the ingredients they apply to their hair. This cultural embrace of natural hair not only drives product innovation but also encourages brands to adopt more inclusive marketing strategies, resonating with a broader audience and contributing to sustained market growth.

Restraint

Limited Accessibility and Higher Costs

Despite the positive momentum in the Black hair care market, challenges persist, notably in the form of limited accessibility and higher costs associated with specialized products. Many consumers, particularly those in rural or underserved urban areas, find it difficult to access products tailored to Black hair needs.

This scarcity often forces individuals to rely on general hair care products that may not effectively address their specific requirements, leading to dissatisfaction and potential damage. Additionally, specialized Black hair care products often come at a premium price point, which can be prohibitive for some consumers, limiting their ability to maintain consistent hair care routines.

The higher costs are frequently attributed to the use of premium, natural ingredients and the smaller scale of production compared to mainstream hair care products. This economic barrier can deter consumers from purchasing these products regularly, thereby constraining market growth.

Furthermore, the lack of widespread distribution channels exacerbates the issue, as consumers may incur additional expenses when ordering products online, such as shipping fees.

Addressing these challenges requires strategic efforts from manufacturers and retailers to enhance distribution networks and explore cost-effective production methods, ensuring that high-quality Black hair care products are both accessible and affordable to a broader consumer base.

Opportunity

Expansion into Emerging Markets

The global Black hair care market holds substantial growth potential through expansion into emerging markets with significant Black populations. Regions such as parts of Africa, the Caribbean, and South America present untapped opportunities for brands to introduce products tailored to local hair care needs.

As disposable incomes rise and consumer awareness of specialized hair care products increases in these areas, there is a growing demand for solutions that cater to the unique textures and styles prevalent among Black consumers. Companies that strategically enter these markets can establish a strong foothold and capitalize on the expanding consumer base.

To effectively penetrate these markets, brands must conduct thorough market research to understand local hair care practices, preferences, and cultural nuances. Collaborating with local influencers and leveraging region-specific marketing strategies can enhance brand acceptance and loyalty.

Additionally, offering products at various price points can cater to a wider audience, accommodating different economic segments. By addressing the specific needs of consumers in emerging markets and building robust distribution networks, companies can drive significant growth and contribute to the global expansion of the Black hair care industry.

Trends

Integration of Technology in Hair Care Solutions

A notable trend shaping the Black hair care market is the integration of technology to offer personalized and effective solutions. Advancements such as mobile applications that analyze hair type and condition, coupled with artificial intelligence, provide consumers with tailored product recommendations and hair care routines.

These technologies empower individuals to make informed decisions about their hair care, leading to improved satisfaction and loyalty to brands that offer such innovative solutions. The use of technology also extends to virtual consultations with hair care professionals, enabling consumers to receive expert advice without geographical constraints.

Furthermore, the development of smart hair care devices, such as heat styling tools with sensors that adjust temperature based on hair condition, reflects the industry’s commitment to combining technology with hair health. These innovations cater to the specific needs of Black hair, which often requires careful handling to prevent damage.

Brands that invest in research and development to create technologically advanced products and services are likely to gain a competitive edge, as consumers increasingly seek solutions that align with their individual hair care needs and lifestyles. This trend underscores a shift towards a more personalized and science-driven approach in the Black hair care market, fostering growth and consumer engagement.

Regional Analysis

North America Leads Black Hair Care Market with 40% Share

In 2023, North America emerged as the dominant region in the global black hair care market, capturing a substantial 40% share, equivalent to approximately USD 1.28 million. This leadership is attributed to the region’s significant African-American population and their increasing expenditure on specialized hair care products.

The cultural embrace of natural hair and the celebration of diverse hair textures have further propelled demand for products tailored to curly, coily, and textured hair. Additionally, North America is home to numerous well-established brands specializing in black hair care, contributing to the region’s market dominance.

Europe holds a notable position in the black hair care market, driven by a growing African and Caribbean diaspora. The increasing awareness and acceptance of natural hair movements have led to a surge in demand for products catering to diverse hair types.

However, the market share in Europe remains lower compared to North America, indicating potential for growth as inclusivity and representation in beauty products continue to advance.

The Asia Pacific region is experiencing a gradual increase in demand for black hair care products, particularly in countries with significant expatriate populations.

While the market share is currently modest, the rising awareness of diverse beauty standards and the influence of global beauty trends are expected to drive growth in this region. Additionally, the expansion of e-commerce platforms is making specialized products more accessible to consumers across Asia Pacific.

In the Middle East and Africa, the black hair care market is witnessing steady growth, supported by a substantial population with diverse hair care needs. The market is characterized by a mix of multinational brands and local players offering products tailored to various hair textures.

However, challenges such as limited product availability and higher costs persist, indicating opportunities for market expansion and the introduction of affordable, high-quality products.

Latin America presents a growing market for black hair care products, particularly in countries with significant Afro-descendant populations. The increasing recognition of Afro-Latin culture and beauty standards is driving demand for products that cater to curly and textured hair.

Despite this positive trend, the market share remains relatively small, suggesting room for growth as awareness and acceptance of diverse hair types continue to rise.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global black hair care market is characterized by a diverse array of key players, each contributing uniquely to its growth and evolution. Procter & Gamble Co., a multinational consumer goods corporation, leverages its extensive distribution networks and brand recognition to offer products tailored to diverse hair types, including those catering to black hair care needs.

Similarly, Unilever PLC has expanded its portfolio to include brands that address the specific requirements of black hair, emphasizing inclusivity and diversity in its product lines. L’Oréal SA, with its acquisition of Carol’s Daughter, has strengthened its position in the ethnic hair care segment, providing products that resonate with black consumers seeking specialized hair care solutions.

Revlon Inc. continues to serve the black hair care market through its range of products designed for various hair textures and styles.

Amka Products (Pty) Ltd, a South African company, focuses on the African market, offering products that cater to the unique hair care needs prevalent in the region. Shea Moisture, known for its natural and organic ingredients, has garnered a loyal customer base among black consumers seeking chemical-free hair care options.

Alodia Hair Care and Ouidad specialize in products for curly and textured hair, addressing common concerns such as moisture retention and curl definition. Afrocenchix Ltd. and Uhuru Naturals LLC, both black-owned businesses, emphasize natural ingredients and ethical sourcing, appealing to consumers who prioritize sustainability and authenticity in their hair care choices.

Collectively, these companies contribute to a dynamic and competitive landscape in the black hair care market, driving innovation and catering to the diverse needs of black consumers worldwide.

Top Key Players in the Market

- Procter & Gamble Co.

- Unilever PLC

- L’Oréal SA

- Revlon Inc.

- Amka Products (Pty) Ltd

- Shea Moisture

- Alodia Hair Care

- Ouidad

- Afrocenchix Ltd.

- Uhuru Naturals LLC

- Amka Products

- Alodia Hair Care

Recent Developments

- In 2023, P&G Beauty welcomed Mielle Organics®, a leading textured hair care brand known for its natural ingredients, into its portfolio. Pending regulatory approval, this partnership aims to enhance global access to hair care solutions tailored for Black women.

- In 2023 Briogeo, a celebrated Black-owned hair care brand acquired by Wella in 2022, made a significant move in 2023. The brand partnered with Salon Centric to enter the professional channel, making its products available in 600 stores starting August 1.

- In 2024, CurlMix founders Kim and Tim Lewis, who famously declined a Shark Tank deal, launched another crowdfunding campaign. Following remarkable milestones like entering 460 Ulta Beauty stores and raising $5 million in 2021, the brand aims to engage its community once again by offering them equity.

- In 2024, Fearless Fund closed a grant contest as part of a legal settlement, reigniting discussions on funding disparities for Black founders. In the first half of the year, Black-founded U.S. startups secured just $228 million, a dramatic 60% drop from the previous year and only 0.3% of total U.S. startup funding.

Report Scope

Report Features Description Market Value (2023) USD 3.2 Billion Forecast Revenue (2033) USD 4.9 Billion CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Shampoo, Conditioner, Hair Dye, Hair Oil, Hair Serum, Other), By Application (Household, Commercial Use), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Procter & Gamble Co., Unilever PLC, L’Oréal SA, Revlon Inc., Amka Products (Pty) Ltd, Shea Moisture, Alodia Hair Care, Ouidad, Afrocenchix Ltd., Uhuru Naturals LLC, Amka Products, Alodia Hair Care Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Procter & Gamble Co.

- Unilever PLC

- L’Oréal SA

- Revlon Inc.

- Amka Products (Pty) Ltd

- Shea Moisture

- Alodia Hair Care

- Ouidad

- Afrocenchix Ltd.

- Uhuru Naturals LLC

- Amka Products

- Alodia Hair Care