Global Bis(2-Dimethylaminoethyl) Ether Market Size, Share, And Business Benefits By Concentration (High Concentration, Low Concentration), By Application (Polymer Industry, Pharmaceuticals, Textile Industry, Adhesives and Sealants), By End-Use (Chemical, Pharmaceutical Industry, Textile Manufacturing, Adhesive Industry, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 166109

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

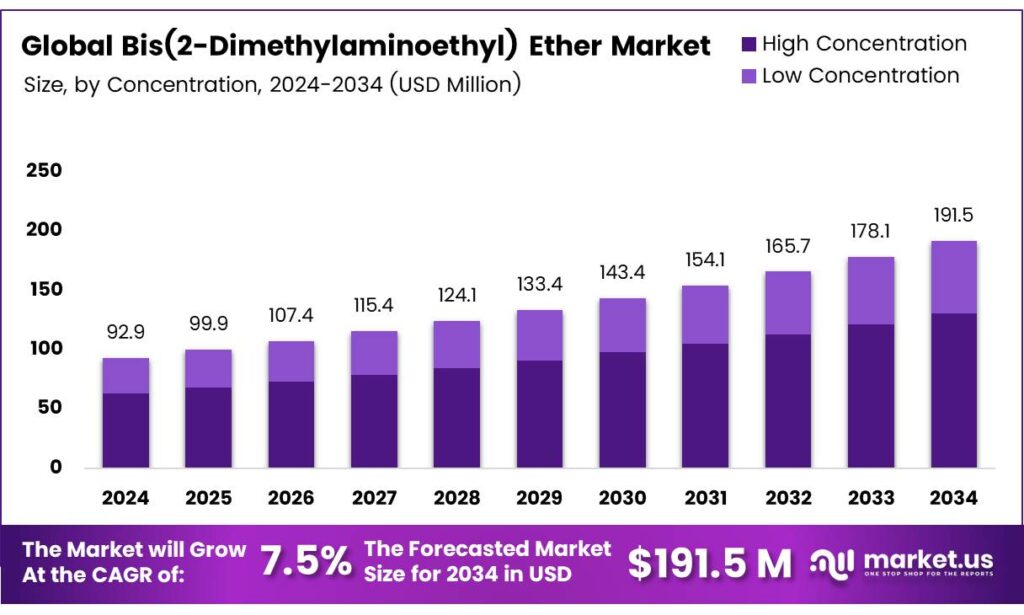

The Global Bis(2-Dimethylaminoethyl) Ether Market size is expected to be worth around USD 191.5 Million by 2034, from USD 92.9 Million in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

Bis(2-Dimethylaminoethyl) Ether is a specialized organic chemical used primarily as a catalytic agent within polyurethane foam production, offering reactivity control, balanced cell structure, and improved flexibility in industrial foam processing. It acts as a tertiary amine catalyst supporting rigid, semi-rigid, and flexible PU formulations used in insulation, automotive padding, construction boards, and bedding materials.

Bis(2-dimethylaminoethyl) ether, also known as Bis(2-(dimethylamino)ethyl) ether, is a colorless to transparent liquid that may sometimes appear brownish or yellow. It has a boiling point of 188 °C and is fully soluble in water as well as in organic solvents such as alcohol and benzene. This compound is a highly efficient tertiary amine catalyst widely used in the polyurethane industry for the production of nearly all types of foam products.

- Bis(2-dimethylaminoethyl) ether (CAS 3033-62-3), also known as 2,2′-oxybis(N, N-dimethylethanamine), is a colorless to light yellow clear liquid with the molecular formula C8H20N2O and a molecular weight of 160.26 g/mol. It has a boiling point of 189 °C at 760 mmHg, a density of 0.841 g/mL at 25 °C, and a refractive index of n20/D 1.430. The compound exhibits a vapor pressure of 49 Pa at 20 °C, a flash point of 151 °F (66 °C), and a predicted pKa of 9.12 ± 0.28.

Bis-(2-Dimethylaminoethyl)Ether is the established blowing catalyst for all types of flexible polyurethane foam. Its strong catalytic effect on the blowing reaction can be effectively balanced by adding a strong gelling catalyst. When used in flexible slabstock formulations, this catalyst improves the processing of all grades of foam, ranging from low to high density and from filled to high-resiliency grades. The unique performance characteristics of Bis-(2-Dimethylaminoethyl)Ether make it an effective choice for high-resiliency molded foam.

Key Takeaways

- The Global Bis(2-Dimethylaminoethyl) Ether Market is valued at USD 92.9 million in 2024 and projected to reach USD 191.5 million by 2034, at a strong 7.5% CAGR between 2025–2034.

- The High Concentration segment leads the market with a 68.1% share in 2024.

- The Polymer Industry dominates the application segment with a 44.2% share in 2024.

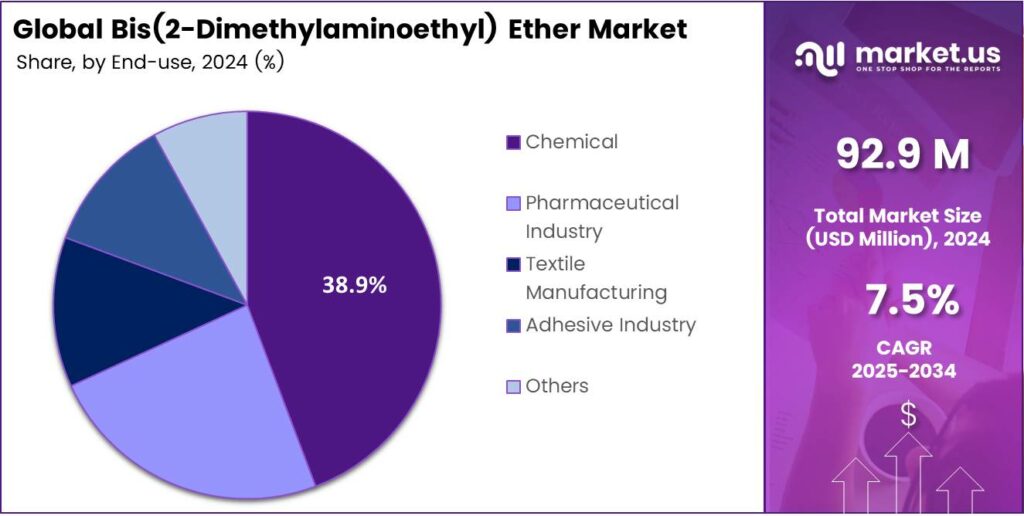

- The Chemical end-use sector leads with a 38.9% share in 2024.

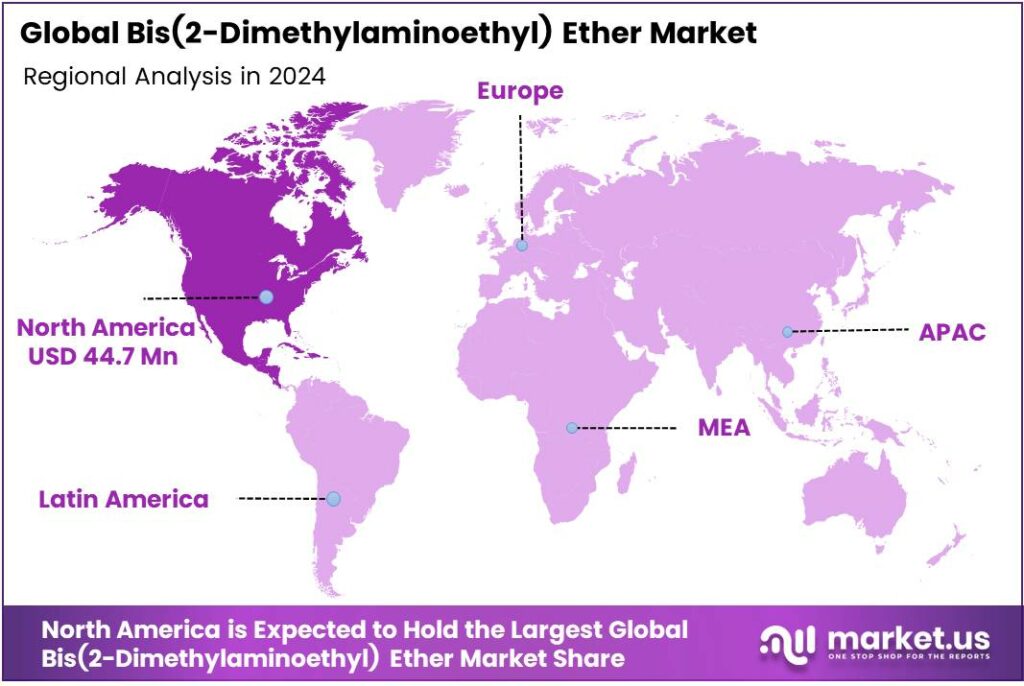

- North America holds the highest regional share at 48.2%, valued at USD 44.7 million in 2024.

By Concentration Analysis

High Concentration dominates with 68.1% due to strong suitability in industrial-grade synthesis and rapid reactivity.

In 2024, High Concentration held a dominant market position in the By Concentration Analysis segment of Bis(2-Dimethylaminoethyl) Ether Market, with a 68.1% share. This grade is preferred for large-scale polymerization and catalyst manufacturing because it ensures enhanced curing speed, consistent performance, and better compatibility with chemical intermediates, thereby supporting steady demand from industrial users.

In 2024, Low Concentration showed growing utilization within regulated and controlled formulation environments. This grade is selected for applications requiring safer handling, moderated reaction intensity, and cost-effective blending flexibility. It continues gaining traction in R&D, laboratory testing, and small-batch formulations where gradual compound activation is preferred over high-reaction systems.

By Application Analysis

Polymer Industry dominates with 44.2% driven by expanding demand for efficient catalysts and flexible polymer formulations.

In 2024, the Polymer Industry held a dominant market position in the By Application Analysis segment of Bis(2-Dimethylaminoethyl) Ether Market, with a 44.2% share. The compound is widely utilized as a polyurethane foam catalyst, supporting insulation foams, furniture cushioning, and automotive interior applications where stability and reactivity are essential.

Pharmaceuticals recorded a steady growth outlook due to their relevance as a formulation intermediate and processing agent. It is used in controlled synthesis stages, particularly where tertiary amine-based compounds are required, improving processing precision across APIs and excipient-linked formulation activities.

The Textile Industry utilized the compound in selective finishing, coating, and fiber-processing chemical blends. Its presence in textile auxiliaries enhances surface treatment efficiency and chemical uptake, supporting evolving demand for chemically modified functional and performance-based fabrics across industrial and consumer apparel markets.

Adhesives and Sealants continued expanding due to increased polyurethane-based bonding product manufacturing, especially for the automotive and construction sectors. It serves as an efficient catalytic agent supporting controlled curing, improved adhesion strength, and flexible performance under varied temperature and humidity conditions.

By End-Use Analysis

Chemical Sector leads with 38.9% driven by large-scale synthesis, catalyst demand, and continuous production cycles.

In 2024, Chemical held a dominant market position in the Bis(2-Dimethylaminoethyl) Ether Market, as per the End-Use Analysis segment, with a 38.9% share. The industry uses the compound for intermediates, catalyst blends, and derivative manufacturing, improving scalability, reactivity control, and downstream formulation productivity.

The Pharmaceutical Industry demonstrated stable development, utilizing specialized compound synthesis pathways, clean-processing formulations, and intermediary amine-linked applications, particularly in controlled chemical reactions involving precision-driven process environments.

Textile Manufacturing applied the compound in selective finishing agents, reactive coating chemistry, and chemical-aided strength modification, supporting modern textile performance and industrial wearability improvements through chemically engineered surface enhancement.

Adhesive Industry utilized the compound in polyurethane curing chemistry, promoting reliable bonding strength and environmental resistance across industrial bonding applications, packaging, automotive, and construction materials, where long-term durability is required.

Key Market Segments

By Concentration

- High Concentration

- Low Concentration

By Application

- Polymer Industry

- Pharmaceuticals

- Textile Industry

- Adhesives and Sealants

By End-Use

- Chemical

- Pharmaceutical Industry

- Textile Manufacturing

- Adhesive Industry

- Others

Emerging Trends

Sustainable & Bio-Based Synthesis Pathways

One major emerging trend for Bis(2‑Dimethylaminoethyl) Ether (BDMAEE) is the shift toward sustainable and bio-based synthesis pathways, driven by the specialty chemicals industry’s broader decarbonisation agenda and the increasing demand for greener intermediates in advanced materials and pharmaceuticals. Chemical companies are under growing pressure to cut carbon emissions and reduce reliance on fossil-derived feedstocks.

Global chemical industry emissions are now estimated to account for around 5% of total greenhouse gas emissions worldwide. To address this, leading players in the specialty and fine chemicals ecosystem are investing in alternative routes — such as using bio-derived amines, low-energy processes, or greener solvents. One supplier states that current research centres on the compound’s unique properties for novel materials and sustainable chemistry.

- India’s specialty chemicals sector (including BDMAEE intermediates) is projected to grow at 11% by 2025, representing 47% of the domestic chemicals market. The government’s 2034 Vision targets raising India’s global chemical market share to 5-6% by 2030, doubling production, and adding USD 35-40 billion in exports. This strong policy support is boosting demand for sustainable intermediates like BDMAEE.

Drivers

Rising Polyurethane Foam Demand as a Key Driver

One strong driving factor for Bis(2-Dimethylaminoethyl) Ether (BDMAEE) is the global push for high-performance polyurethane (PU) foams in insulation, appliances, and automotive seating. BDMAEE is a key amine catalyst in PU foam production, so every policy or industry move that favours better insulation and lighter vehicles quietly boosts its demand in the background.

- Energy-efficient buildings are at the centre of this story. The International Energy Agency estimates that buildings account for around 30% of global final energy use and roughly 27% of energy-related CO₂ emissions, making improved insulation a top priority. To tackle this, many governments are tightening building-energy rules and encouraging advanced insulation materials, including PU foams where BDMAEE-based catalyst systems help fine-tune cell structure and performance.

Government climate targets quietly lock in this trend. Many countries have pledged mid-century net-zero goals under the Paris Agreement, and a big part of their roadmaps is reducing heating and cooling demand. Subsidies, green-building codes, and tax breaks for better insulation convert policy into real construction activity. That means more PU foam panels, more tailored catalyst packages, and a steady, structural pull for BDMAEE as a specialised component of these systems.

Restraints

Stricter Hazard & Worker-Safety Rules Putting Pressure on BDMAEE

One clear restraint for Bis(2-Dimethylaminoethyl) Ether (BDMAEE) is the tightening net of global chemical-safety regulation. BDMAEE is a tertiary amine, handled in relatively concentrated form in polyurethane plants. Regulators are becoming far less relaxed about substances that may add to workplace exposure, odour, or environmental load, even if they are used as intermediates and not in final consumer contact.

- In Europe, the share of all chemicals produced that are classified as hazardous to health has stayed stubbornly high: it only moved from about 78% to 77%, according to the European Environment Agency’s production and consumptio At the same time, the EU’s Chemicals Strategy for Sustainability under the Green Deal openly aims to ban the most harmful chemicals in consumer products and reduce overall exposure, while global chemical output is expected to double.

On top of this, environmental agencies highlight that hazardous chemicals may contribute to around 8% of global deaths, reinforcing the political will to cut overall chemical risk. For BDMAEE suppliers, this means higher compliance costs, possible re-classification discussions, and continuous toxicology work. For downstream polyurethane producers, it raises the risk that customers or auditors ask for alternative catalysts with greener labels.

Opportunity

Rapid Growth in Renewable Feedstocks Boosting BDMAEE

One major growth factor for Bis(2‑Dimethylaminoethyl) Ether (BDMAEE) is the accelerating shift toward renewable and bio-based feedstocks in the specialty chemicals industry. Companies are increasingly adopting sustainable raw materials for chemical intermediates, and this creates an expanded opportunity space for amine-based compounds like BDMAEE, which serve as catalysts or functional modifiers in specialty chemicals and polymer systems.

- Government and regulatory initiatives strengthen this trend further. For instance, in the European Union, documents suggest that roughly 53% of primary chemical-production capacity in the EU-27 will need reinvestment by 2030 in order to transition to low-carbon technologies — implying major industry restructuring and opportunity for specialty intermediates.

In practical terms, this means that companies utilising BDMAEE-type amines may see growing demand not only from traditional polyurethane or coating lines but increasingly from greener product variants. For users and suppliers of BDMAEE, focusing R&D and manufacturing on lower-carbon, bio-compatible grades may unlock a premium segment — aligned with both industrial-chemistry decarbonisation and downstream product trends in construction, insulation, and light-weight transport.

Regional Analysis

North America Dominates the Bis(2-Dimethylaminoethyl) Ether Market with a Market Share of 48.2%, Valued at USD 44.7 Million

North America held the leading regional position in the Bis(2-Dimethylaminoethyl) Ether market, accounting for a strong 48.2% share and generating an estimated value of USD 44.7 million in 2024. The region benefits from expanding chemical synthesis applications, rising polyurethane foam consumption, and strong industrial manufacturing networks. Government initiatives supporting domestic specialty chemical production and technology-driven process optimization further reinforce market strength.

Europe shows steady growth driven by sustainable material development, regulatory-compliant chemical processing, and rising demand for high-performance catalysts and intermediates. The region experiences increased adoption of energy-efficient insulation materials and manufacturing practices aligned with circular chemistry. Research-focused clusters and industrial modernization also support long-term product utilization.

Asia Pacific is emerging as a high-potential growth hub, supported by rapid industrial expansion, rising polymer production, and growing end-use sectors including automotive components and construction foams. Large-scale capacity additions and cost-effective production environments enhance regional competitiveness. Increasing alignment with global quality standards further boosts market penetration.

The Middle East & Africa region demonstrates moderate yet stable growth, primarily supported by infrastructure-linked polymer applications, industrial investments, and growing chemical formulation capabilities. The U.S. holds a significant share within North America, driven by advanced chemical production infrastructure, high polymer consumption rates, and continuous research investments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Bis(2-Dimethylaminoethyl) Ether market is shaped by innovation, production scalability, and applications across polymer, textile, coating, and pharmaceutical intermediates. Strategic manufacturing expansions, product purity improvements, and sustainable chemistry are becoming central themes as companies integrate advanced synthesis, quality consistency, and global supply reliability.

BASF maintains a strong position driven by its wide chemical value chain, advanced R&D capabilities, and emphasis on high-purity amine-based intermediates. The company benefits from integrated production assets, enabling consistent quality supply and competitive pricing strategies aimed at serving polymer and specialty surfactant demand.

Sinocure Chemical demonstrates market relevance through specialization in chemical intermediates and photoinitiator-related compounds, helping meet demand in resin, adhesive, and coating formulations. The company is aligned with technical-grade supply for diverse industrial applications, emphasizing reliability and customization.

Vesta Chemicals is focused on specialty chemical performance and value-driven product solutions, supporting manufacturers with tailored amine derivatives. The company’s technical service-oriented approach strengthens long-term commercial relationships in niche industrial and formulation-based markets.

Dongguan Roumei New Materia contributes through active engagement in advanced material and chemical ingredient supply, supporting downstream manufacturing in Asia with agile production and export capabilities. The company benefits from flexible manufacturing structures aligned with mid-to-large volume industrial buyers.

Top Key Players in the Market

- BASF

- Sinocure Chemical

- Vesta Chemicals

- Dongguan Roumei New Materia

- Others

Recent Developments

- In 2024, Vesta Chemicals joined the STOCKMEIER Group, enhancing its distribution capabilities for specialty chemicals, including amines and polyurethane intermediates like BDMAEE. This integration aims to expand European market reach and supply chain efficiency for chemical distributors.

- In 2025, the Bureau of Indian Standards (BIS) and Department of Chemicals and Petrochemicals issued notifications for mandatory quality control orders (QCOs) on various chemicals, with amendments effective. These aim to standardize petrochemical and specialty chemical products, including intermediates, to improve safety and exports in the sector.

Report Scope

Report Features Description Market Value (2024) USD 92.9 Million Forecast Revenue (2034) USD 191.5 Million CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Concentration (High Concentration, Low Concentration), By Application (Polymer Industry, Pharmaceuticals, Textile Industry, Adhesives and Sealants), By End-Use (Chemical, Pharmaceutical Industry, Textile Manufacturing, Adhesive Industry, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape BASF, Sinocure Chemical, Vesta Chemicals, Dongguan Roumei New Materials, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Bis(2-Dimethylaminoethyl) Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample

Bis(2-Dimethylaminoethyl) Ether MarketPublished date: November 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF

- Sinocure Chemical

- Vesta Chemicals

- Dongguan Roumei New Material

- Others