Biopesticides Market Size, Share, And Strategic Business Review By Type (Bioinsecticide, Biofungicide, Bionematicide, Others), By Formulation (Liquid, Solid), By Source (Microbes, Plant Extracts, Others), By Mode of Application (Foliar Application, Seed Treatment, Soil Application, Others), By Crop (Cereals, Oilseeds, Fruits and Vegetables, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: February 2025

- Report ID: 135888

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Strategic Business Review of Biopesticides

- By Type Analysis

- By Formulation Analysis

- By Source Analysis

- By Mode of Application Analysis

- By Crop Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

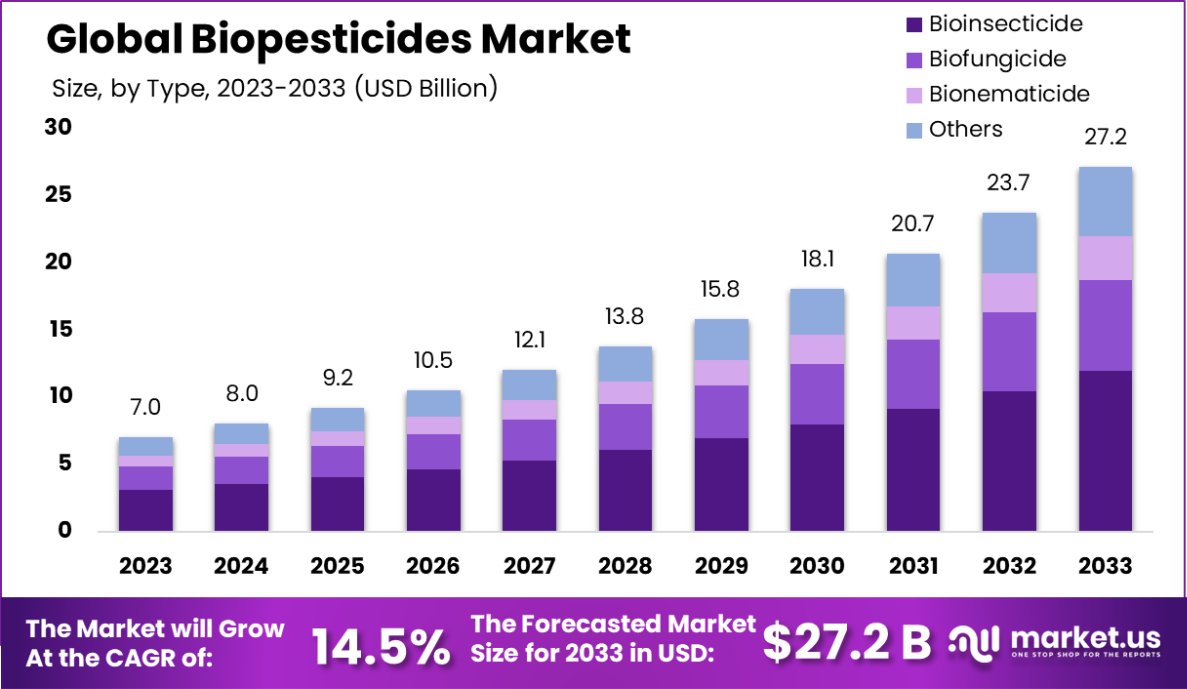

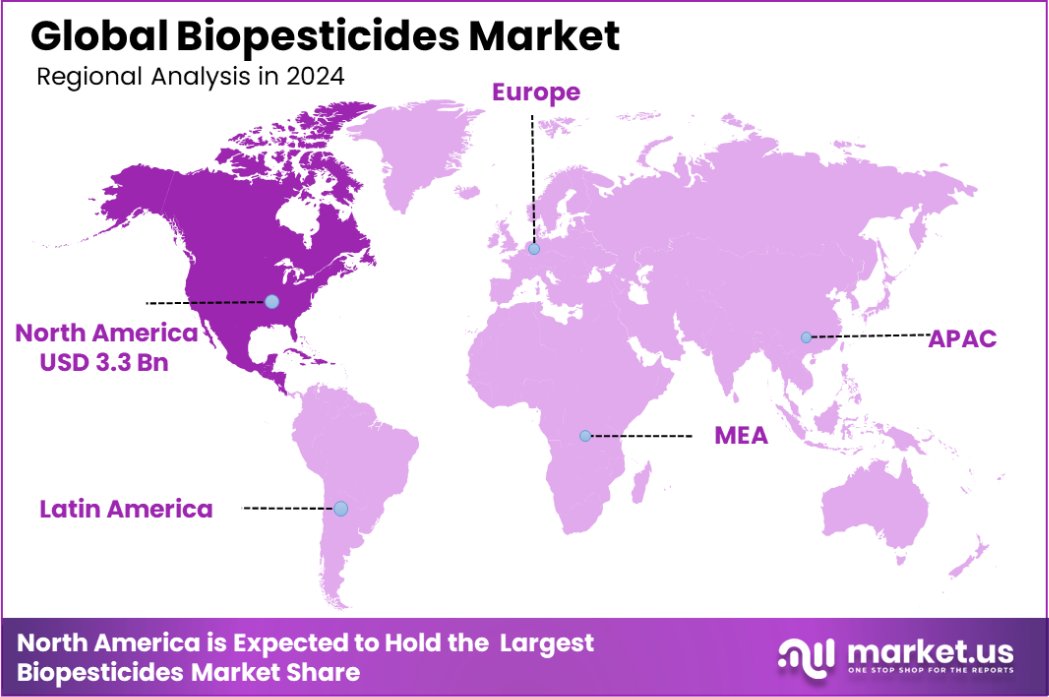

The Global Biopesticides Market is expected to be worth around USD 27.2 Billion by 2033, up from USD 7.0 Billion in 2023, and grow at a CAGR of 14.5% from 2024 to 2033. North America holds 47.2% of the Biopesticides Market, USD 3.3 billion.

Biopesticides are a type of pesticide derived from natural materials like animals, plants, bacteria, and certain minerals. These products offer a more environmentally friendly alternative to conventional chemical pesticides, aligning with sustainable agriculture practices by targeting specific pests while minimizing harm to beneficial organisms and reducing chemical residues in the environment.

The biopesticides market is experiencing significant growth due to increasing global demand for organic food products, stringent regulatory norms regarding chemical pesticide residues, and growing awareness of environmental sustainability.

As a result, manufacturers are investing in research and development to expand their biopesticide product lines and explore new application methods, which is likely to boost market growth further.

Key growth factors for the biopesticides market include technological advancements in microbial fermentation and formulation, which enhance the efficacy and shelf-life of biopesticides. Moreover, government support through incentives for organic farming practices and the registration of biopesticide products underlines the market’s growth potential.

Demand for biopesticides is driven by the organic agriculture sector’s expansion, consumer preference for organic foods, and integrated pest management programs emphasizing environmentally benign pest control methods. These factors are expected to increase the adoption of biopesticides globally.

Opportunities in the biopesticides market are abundant, particularly in developing regions where agriculture plays a crucial role in economic development. Innovations in product and application technologies, coupled with growing regulatory support for bio-based products, provide significant opportunities for market expansion and the introduction of new, effective, and safe pest management solutions.

The biopesticides market is experiencing substantial growth, driven by escalating environmental concerns, tightening regulations on chemical pesticides, and increasing consumer demand for organic products.

Biopesticides, derived from natural materials like bacteria, fungi, and viruses, offer a sustainable alternative to traditional chemical pesticides. They are gaining traction due to their eco-friendly properties and minimal impact on non-target species, aligning with global sustainability goals.

Significant investment trends highlight the sector’s promising outlook. The USDA’s National Institute of Food and Agriculture has allocated over $7 million to projects focused on developing new biopesticide technologies specifically for mushroom crops. This funding underscores the government’s support for advancing sustainable agricultural practices.

Additionally, private sector enthusiasm is evident from recent funding activities. AgroSpheres, a provider of crop protection chemical solutions, has successfully closed its Series B funding, securing $37 million. This capital influx will enhance their capabilities in biopesticide innovation and market penetration.

Similarly, SOLASTA Bio, a UK-based agricultural biotechnology company, recently closed a $14 million oversubscribed Series A round, bringing its total funding to $19 million. These investments reflect robust confidence in biopesticides’ market potential and their role in modern agriculture.

As these trends continue, the biopesticides market is poised for significant expansion. Investors and companies are increasingly recognizing the strategic importance of sustainable crop protection technologies, which not only address regulatory and market demands but also offer competitive advantages in terms of product differentiation and market positioning.

Key Takeaways

- The Global Biopesticides Market is expected to be worth around USD 27.2 Billion by 2033, up from USD 7.0 Billion in 2023, and grow at a CAGR of 14.5% from 2024 to 2033.

- The biopesticides market shows a dominant 44.6% share held by bioinsecticides in pesticide types.

- Liquid formulations lead the market, constituting 66.5% of biopesticides, indicating significant consumer preference.

- Microbes as a source dominate the biopesticides sector, comprising 58.6% of the market.

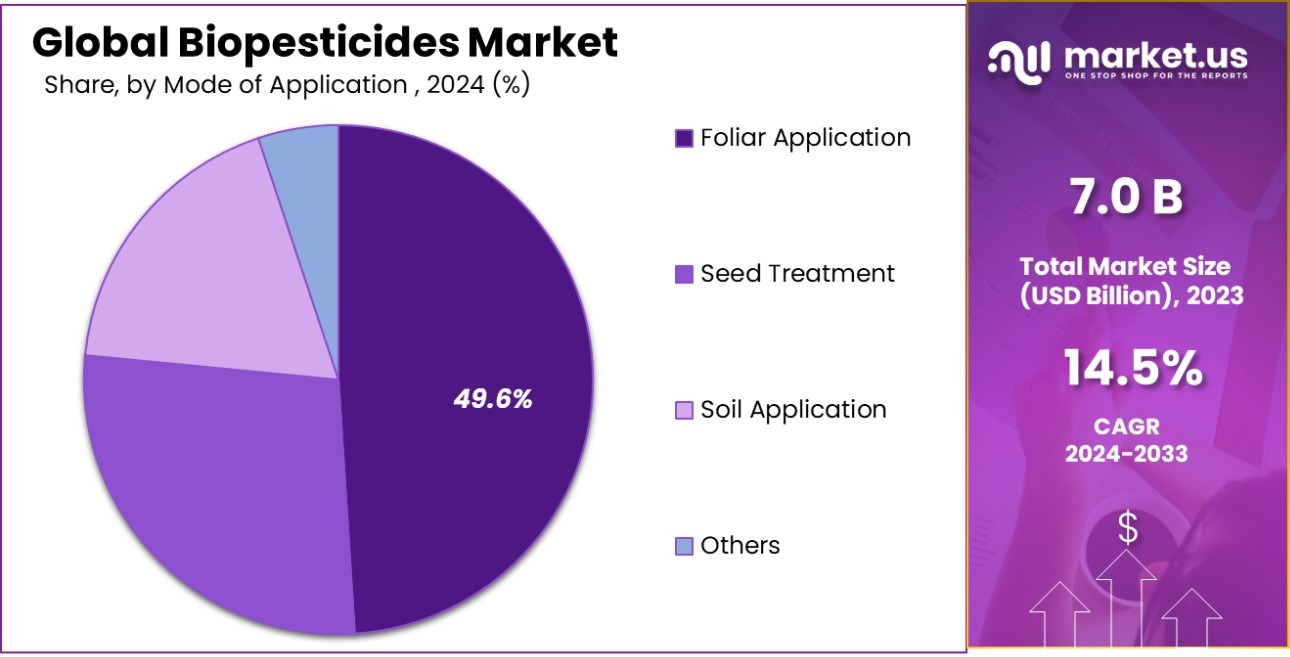

- Foliar application is the most common mode, accounting for 49.6% of the biopesticide market.

- Cereals as a crop category utilize 39.5% of biopesticides, highlighting their importance in agriculture.

- In North America, the biopesticides market holds a 47.2% share, valued at USD 3.3 billion.

Strategic Business Review of Biopesticides

The strategic business review of biopesticides for 2023 and 2024 reveals notable developments in regulatory actions and market adaptability, underscored by significant contributions from governmental websites such as the EPA.

In 2023, the U.S. Environmental Protection Agency (EPA) issued guidance to improve the Endangered Species Act (ESA) analyses for new outdoor uses of biopesticide active ingredients.

This guidance is part of the Pesticide Registration Improvement Act (PRIA 5), aiming to protect listed species from pesticide exposure and streamline the approval processes for biopesticides, thus enhancing environmental safety and compliance.

In 2024, the EPA proposed a streamlined registration review process for several low-risk biopesticides. This initiative reflects the agency’s commitment to efficiency and flexibility in managing resources while ensuring the safety and efficacy of biopesticides in various applications including agriculture and residential use.

These biopesticides, noted for their very low toxicity and minimal environmental impact, include substances such as Alpha methyl mannoside and Duddingtonia flagrans strain IAH 1297, among others, which are found to pose minimal risks to human health and the environment.

Moreover, financial allocations for EPA’s pesticide program have been adjusted, with the budget for FY 2024 set at approximately $132.5 million, marking a decrease from the previous fiscal year. This reduction impacts the EPA’s capacity to expedite pesticide registration reviews and manage its resources effectively, thus potentially delaying the introduction of new biopesticides into the market.

These key points underscore the ongoing evolution in the biopesticide sector, driven by regulatory enhancements and fiscal adjustments, reflecting a dynamic interplay between environmental stewardship and agricultural needs

By Type Analysis

The biopesticides market sees bioinsecticides leading with a 44.6% share, showcasing their significant role in sustainable agriculture practices.

In 2023, Bioinsecticide held a dominant market position in the “By Type” segment of the Biopesticides Market, capturing a 44.6% share. This substantial portion underscores the growing preference among farmers and agricultural professionals for sustainable and environmentally friendly pest control solutions.

Bioinsecticides, derived from natural materials, have gained traction due to their effectiveness in managing a broad spectrum of insect pests while maintaining ecological balance.

Following closely, Biofungicides accounted for 35.2% of the market. These products are favored for their role in combating fungal diseases, which can devastate crops if uncontrolled. Biofungicides are particularly appreciated for their ability to prevent the development of resistant fungal strains, a common issue with traditional chemical fungicides.

Bionematicides, though smaller in market share at 20.2%, are also gaining ground. These biological agents target nematodes—microscopic worms that attack plant roots, causing significant yield losses. The increasing adoption of bionematicides reflects a shift towards integrated pest management practices that prioritize crop safety and environmental health.

Together, these segments illustrate a robust interest in biopesticides as essential tools for sustainable agriculture, highlighting a shift away from chemical pesticides towards solutions that support long-term agricultural productivity and environmental sustainability.

By Formulation Analysis

Liquid formulations dominate the biopesticides market at 66.5%, preferred for their ease of application and effective distribution.

In 2023, Liquid formulations held a dominant market position in the “By Formulation” segment of the Biopesticides Market, with a commanding 66.5% share. This preference for liquid biopesticides is largely due to their ease of application and effectiveness in ensuring uniform distribution across treated areas.

Farmers find liquid forms more manageable, as they can be easily mixed and applied using existing irrigation systems, which enhances their appeal and practicality in diverse agricultural settings.

Solid biopesticides, on the other hand, accounted for 33.5% of the market. These products are valued for their longer shelf life and lower risk of drift during application, making them suitable for targeted treatments. Solid forms, such as powders or granules, are particularly useful in dry conditions where they remain effective for extended periods.

The distinction in market share between liquid and solid biopesticides highlights a clear preference for the former, driven by practical application benefits. However, the solid form maintains a significant presence, underscoring its relevance in specific agricultural scenarios where conditions favor its use. This dynamic reflects ongoing developments in biopesticide formulations, aiming to meet the diverse needs of modern agriculture.

By Source Analysis

Microbes are the primary source for biopesticides, constituting 58.6% of the market, highlighting the shift towards biological solutions.

In 2023, Microbes held a dominant market position in the “By Source” segment of the Biopesticides Market, securing a 58.6% share. This prominence is attributed to the effectiveness of microbial biopesticides in controlling a wide range of agricultural pests and diseases. Microbial agents, including bacteria, fungi, and viruses, are highly valued for their targeted pest control capabilities, which minimize environmental impact and reduce the risk of chemical residues in crops.

Plant extracts, which comprised 41.4% of the market, also play a crucial role in the biopesticides arena. These natural derivatives are appreciated for their biodegradability and lower toxicity compared to synthetic pesticides. Plant-based biopesticides are increasingly popular among organic farmers and those transitioning to more sustainable agricultural practices.

The strong performance of microbes in the market reflects a growing recognition of their potential to enhance crop productivity and sustainability. As research continues to advance, microbial products are being developed to address specific agricultural challenges, further solidifying their status as a cornerstone of effective pest management strategies.

By Mode of Application Analysis

Foliar application is the most common mode of applying biopesticides, accounting for 49.6% of the market, due to its directness.

In 2023, Foliar Application held a dominant market position in the “By Mode of Application” segment of the Biopesticides Market, with a 49.6% share. This method involves applying biopesticides directly onto plant leaves, where many pests and diseases attack, making it a direct and efficient form of treatment. Its popularity stems from the immediacy of its effects, as the treatment reaches the pests quickly and can be timed to manage infestations effectively.

Seed Treatment accounted for 25.4% of the market. This application protects seeds from pests and diseases right from the start, enhancing germination and early growth, which is crucial for the establishment of healthy crops. It is especially valued for its ability to give plants an intrinsic defense mechanism that lasts into the early growth stages.

Soil Application made up the remaining 25% of the market share. This method targets soil-dwelling pests and diseases and improves overall soil health, fostering a nurturing environment for plant growth. It is particularly effective for controlling nematodes and soil-borne pathogens that can significantly impact crop yields.

These methods collectively represent the diverse strategies employed in modern agriculture to harness the benefits of biopesticides, each playing a vital role in integrated pest management systems aimed at sustainable crop production.

By Crop Analysis

Cereals, as a crop category, utilize 39.5% of biopesticides, reflecting the growing demand for organic cereal products globally.

In 2023, Cereals held a dominant market position in the “By Crop” segment of the Biopesticides Market, securing a 39.5% share. This leading position reflects the critical role cereals play as staple foods globally, driving demand for sustainable and effective pest management solutions that ensure high yield and quality. Biopesticides are increasingly favored in cereal production due to their environmental benefits and ability to comply with strict residue regulations.

Oilseeds followed with a 30.5% market share. These crops, including soybeans and canola, benefit from biopesticides that help manage a broad spectrum of pests and diseases while maintaining the oil quality and supporting sustainable agricultural practices.

Fruits and Vegetables accounted for 30% of the market. This segment underscores the importance of biopesticides in producing clean, residue-free produce and meeting consumer demands for healthier food options. The application of biopesticides in fruits and vegetables is crucial, as these crops are often more susceptible to pest attacks and require frequent treatments.

Together, these segments illustrate the growing reliance on biopesticides across diverse agricultural sectors, driven by the need for sustainable crop protection methods that align with global food safety standards.

Key Market Segments

By Type

- Bioinsecticide

- Biofungicide

- Bionematicide

- Others

By Formulation

- Liquid

- Solid

By Source

- Microbes

- Plant Extracts

- Others

By Mode of Application

- Foliar Application

- Seed Treatment

- Soil Application

- Others

By Crop

- Cereals

- Oilseeds

- Fruits and Vegetables

- Others

Driving Factors

Increasing Demand for Organic Produce

Consumers globally are becoming more health-conscious, fueling a significant increase in demand for organic food products. This shift is prompting farmers to adopt biopesticides, which are compliant with organic farming regulations.

Biopesticides, being derived from natural sources, are essential for maintaining the organic integrity of crops, thereby meeting consumer expectations for healthier, residue-free fruits, vegetables, and grains.

Regulatory Support for Environmentally Friendly Solutions

Governments worldwide are tightening regulations on chemical pesticides due to growing environmental and health concerns. This regulatory landscape is encouraging the adoption of biopesticides, which are seen as safer alternatives.

Supportive policies and incentives for sustainable farming practices further drive the growth of the biopesticides market by making them more accessible and financially viable for farmers.

Advances in Biopesticide Effectiveness and Stability

The biopesticides industry has seen significant technological advancements that improve the effectiveness and shelf-life of these products. Innovations in formulation technology not only enhance the efficacy of biopesticides against a broad range of pests and diseases but also make them easier to handle and apply.

This progress is crucial for their adoption on a larger scale, appealing to farmers looking for reliable and efficient crop protection methods.

Restraining Factors

Limited Awareness and Understanding of Biopesticides

Despite their benefits, a significant challenge facing the biopesticides market is the limited awareness among farmers, especially in developing regions. Many growers are either unfamiliar with biopesticides or skeptical about their efficacy compared to traditional chemical pesticides.

This lack of knowledge and confidence in biopesticides can hinder their adoption, as farmers may hesitate to switch from tried-and-tested conventional methods without clear, accessible information and demonstration of benefits.

Higher Costs Compared to Chemical Pesticides

Biopesticides often come at a higher upfront cost than synthetic pesticides. This cost difference can be a significant barrier for small to medium-sized farms, which operate on tight budgets and may not be able to afford the initial investment.

Although biopesticides can be more cost-effective in the long run due to their sustainable properties and the potential to reduce pest resistance issues, the initial expense remains a deterrent for many farmers considering a switch.

Slower Action and Variable Efficacy

Biopesticides typically act slower than chemical pesticides and their effectiveness can be influenced by environmental factors such as temperature and humidity. This variability can lead to inconsistent results, which might discourage farmers used to the immediate and predictable effects of chemical treatments.

The dependence on specific conditions for optimal performance makes it challenging for biopesticides to gain trust and widespread acceptance in the agricultural community.

Growth Opportunity

Expansion into Emerging Markets with Agricultural Growth

Emerging markets with expanding agricultural sectors present significant opportunities for the biopesticides market. These regions are experiencing rapid agricultural development and are increasingly open to sustainable farming practices.

By entering these markets, biopesticide companies can tap into new customer bases that are eager for innovative solutions to enhance crop yield and quality while adhering to environmental standards. The growth in these markets is fueled by an increasing awareness of sustainable agriculture and the need for safer food production methods.

Integration with Integrated Pest Management Programs

Biopesticides fit perfectly into Integrated Pest Management (IPM) programs, which are gaining traction globally as a balanced approach to pest control that reduces reliance on chemical pesticides. As governments and environmental organizations promote IPM for its ecological and health benefits, the demand for biopesticides is expected to increase.

Companies can capitalize on this trend by offering products that are compatible with IPM strategies, providing comprehensive solutions that enhance crop resilience and yield, particularly in environmentally sensitive and high-value crops.

Technological Innovations in Product Development

The biopesticides market stands to benefit greatly from ongoing research and technological advancements that enhance the efficacy, stability, and application methods of biopesticides. Innovations such as microencapsulation, improved formulation techniques, and genetically engineered microbial strains could dramatically improve product performance and farmer satisfaction.

These advancements can lead to more robust and versatile biopesticide solutions that are easier to use and more effective across a variety of environmental conditions, thus broadening their appeal to conventional and organic farmers alike.

Latest Trends

Rise of Biopesticides in Urban and Indoor Farming

Urban and indoor farming are trending as innovative approaches to agriculture within city environments and controlled conditions. These methods require pest control solutions that are safe and non-toxic due to their proximity to dense human populations and the enclosed nature of growing spaces.

Biopesticides are increasingly favored in these settings for their low toxicity and environmental impact, aligning with the sustainability goals of urban farms and indoor agricultural facilities. This trend reflects a broader shift towards greener, more sustainable urban food production methods.

Increasing Collaboration Between Agri-Biotech Companies

There’s a growing trend of collaboration among biotechnology companies and agricultural researchers to develop new biopesticide solutions. These partnerships are driven by the shared goal of enhancing the effectiveness and range of biopesticides available in the market.

By combining expertise in genetics, industrial microbiology, and agronomy, these collaborations are producing innovative products that are more targeted, effective, and environmentally friendly. Such cooperative efforts not only accelerate product development but also improve the adoption rates of biopesticides across different agricultural sectors.

Consumer Demand for Residue-Free Produce

Consumers are increasingly concerned about the safety and quality of their food, particularly the presence of pesticide residues. This concern has spurred a significant trend towards the use of biopesticides, which leave minimal to no residues on crops, making them ideal for producing cleaner, safer food.

As market demand for residue-free produce grows, farmers and producers are turning to biopesticides to meet certification standards and consumer expectations, thereby driving further growth in the biopesticides market. This trend is closely linked to the rising health consciousness among consumers worldwide.

Regional Analysis

In 2023, North America held 47.2% of the Biopesticides Market, valued at USD 3.3 billion.

In the global landscape of the biopesticides market, North America emerges as the dominating region, holding a substantial 47.2% market share, valued at USD 3.3 billion. This leadership is driven by stringent regulatory standards on chemical pesticides, a robust organic farming sector, and heightened consumer awareness about sustainable agricultural practices.

Following North America, Europe also represents a significant portion of the market, thanks to proactive environmental policies and increasing adoption of integrated pest management (IPM) practices across its member countries. The region’s focus on reducing the environmental footprint of agriculture bolsters the demand for biopesticides.

The Asia Pacific region is experiencing rapid growth in the biopesticides sector, spurred by expanding agricultural activities, particularly in countries like China and India. These nations are adopting biopesticides to increase crop yield and quality while addressing the rising scrutiny over food safety and environmental concerns.

Meanwhile, Latin America and the Middle East & Africa are witnessing gradual growth. Latin America benefits from its biodiversity, which is conducive to developing novel biopesticide products.

The Middle East & Africa region, although smaller in market share, is beginning to explore biopesticides as part of efforts to improve agricultural productivity and sustainability in arid conditions. Collectively, these regions reflect a global shift towards more eco-friendly pest management solutions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global biopesticides market will see significant contributions and strategic advancements from key players, each bringing unique innovations and market approaches to the forefront.

Andermatt has been pivotal in advancing microbial solutions, focusing on region-specific pests and diseases, thereby enhancing its global reach and applicability. BASF SE and Bayer AG stand out for their extensive research and development capabilities, which enable them to continually introduce effective and sustainable biopesticide solutions, thus maintaining their leadership in the market.

Bioceres S.A. specializes in genetically modified microbial products, tapping into niche markets with tailored solutions.

BioSafe Systems is known for its eco-friendly and organic-compliant products, appealing to North America’s substantial organic farming sector. Certis Biologicals leverages its global network to expand the reach of its bio-based products, emphasizing safety and effectiveness. Corteva Agriscience integrates traditional crop protection methods with biotechnological innovations, offering integrated solutions.

Floridienne SA and Gowan Group focus on specialty markets, enhancing their portfolios with unique biopesticide offerings that target specific crop needs. Koppert Biological Systems excels in the integration of natural pollination and biological control, and Novozymes leads in microbial and enzyme-based solutions, pushing the boundaries in biotechnological applications in agriculture.

Nutri-Tech Solutions offers comprehensive nutrient management solutions that complement its biopesticide range, whereas ProFarm focuses on enhancing crop yield and resilience. Sumitomo Chemical Co., Ltd. and Syngenta AG combine their global presence with innovative research to develop solutions that address a wide spectrum of agronomic challenges. Lastly, Valent Biosciences commits to sustainable agriculture practices, supporting the global demand for environmentally sound agricultural practices.

These companies, with their focused strategies and innovations, drive the dynamic growth of the biopesticides market, shaping it to be more responsive to the global need for sustainable agriculture.

Top Key Players in the Market

- Andermatt

- BASF SE

- Bayer AG

- Bioceres S.A.

- BioSafe Systems

- Certis Biologicals

- Corteva Agriscience

- Floridienne SA

- Gowan Group

- Koppert Biological Systems

- Novozymes

- Nutri-Tech Solutions

- ProFarm

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Valent Biosciences

Recent Developments

- In 2024, Andermatt Group AG acquired BioTEPP Inc., strengthening its global leadership in biological crop protection. This partnership enhances Andermatt’s portfolio with VirosoftTM CP4, a biopesticide that targets harmful moths while preserving beneficial insects.

- In 2024, the California Department of Pesticide Regulation approved an amendment to the label of OxiDate 5.0, a product by BioSafe Systems, to remove a toxic to bees warning and expand its use for new crops and pests. This product, which breaks down into harmless components like water and oxygen after use, plays a significant role in disease control in agricultural settings.

Report Scope

Report Features Description Market Value (2023) USD 7.0 Billion Forecast Revenue (2033) USD 27.2 Billion CAGR (2024-2033) 14.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bioinsecticide, Biofungicide, Bionematicide, Others), By Formulation (Liquid, Solid), By Source (Microbes, Plant Extracts, Others), By Mode of Application (Foliar Application, Seed Treatment, Soil Application, Others), By Crop (Cereals, Oilseeds, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Andermatt, BASF SE, Bayer AG, Bioceres S.A., BioSafe Systems, Certis Biologicals, Corteva Agriscience, Floridienne SA, Gowan Group, Koppert Biological Systems, Novozymes, Nutri-Tech Solutions, ProFarm, Sumitomo Chemical Co., Ltd., Syngenta AG, Valent Biosciences Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Andermatt

- BASF SE

- Bayer AG

- Bioceres S.A.

- BioSafe Systems

- Certis Biologicals

- Corteva Agriscience

- Floridienne SA

- Gowan Group

- Koppert Biological Systems

- Novozymes

- Nutri-Tech Solutions

- ProFarm

- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Valent Biosciences