Global Biocomposites Market By Type(Structural, Non-Structural), By Fiber Type(Wood Fiber Composites, Non-wood Fiber Composites, Jute fiber, Flax fiber, Kenaf fiber, Hemp fiber, Others), By Polymer Type(Natural Polymer Composites, Synthetic Polymer Composites), By Product(Hybrid Biocomposites, Green Biocomposites), By Process Type(Compression Molding, Injection Molding, Resin Transfer Molding, Extrusion molding process, Others), By End-use Industries(Building and Construction, Transportation, Consumer Goods, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Aug 2024

- Report ID: 127718

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

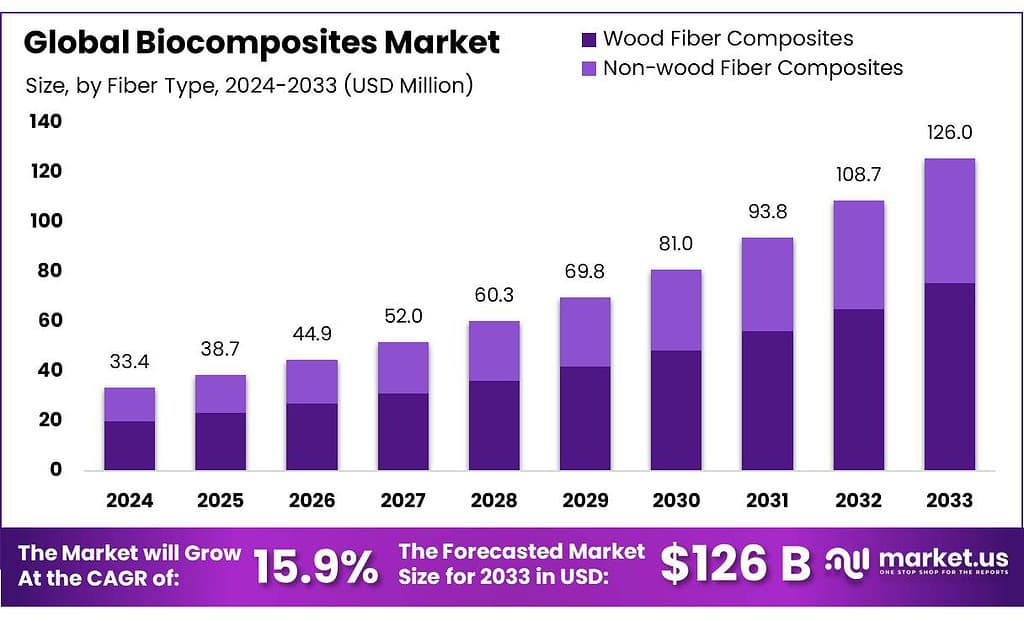

The global Biocomposites Market size is expected to be worth around USD 126.0 billion by 2033, from USD 33.4 billion in 2023, growing at a CAGR of 15.9% during the forecast period from 2023 to 2033.

The biocomposites market, an industry dedicated to creating materials from both biological and synthetic elements, is witnessing significant growth. These materials typically combine natural fibers like wood, flax, or hemp with polymers, which can be derived from both petroleum sources and natural bases such as starches and cellulose.

The versatility of biocomposites allows their use in diverse applications including automotive parts, building materials, and packaging solutions, driven by their environmental benefits like reduced carbon footprints and improved biodegradability compared to fully synthetic materials.

This market’s expansion is fueled by a global increase in environmental consciousness and a push for sustainable materials. Stringent governmental regulations promote the adoption of eco-friendly products and have led to the implementation of various initiatives across multiple industries such as automotive, construction, and packaging. These efforts are aimed at reducing environmental impacts and enhancing the sustainability of production processes.

Additionally, government incentives and funding have significantly supported the research and development within the biocomposites sector. This investment has spurred technological advancements and led to the creation of high-performance materials that not only meet ecological standards but are also cost-effective. Such developments are crucial for fostering innovation and sustaining market growth, aligning with worldwide efforts to minimize carbon emissions and enhance the sustainability of material production.

Overall, the biocomposites market is positioned for continued growth, with government and industry collaboration playing a key role in its expansion. The focus on sustainable practices is expected to drive further innovations and applications of biocomposites, making them a critical component in the pursuit of global sustainability goals.

Key Takeaways

- The global biocomposites market is projected to grow from USD 33.4 billion in 2023 to USD 126.0 billion by 2033, with a 15.9% CAGR.

- 60% of the biocomposites market in 2023 was dominated by structural biocomposites, driven by demand in automotive and construction for their strength and durability.

- Wood fiber composites captured a 59.8% market share in 2023, widely used in construction and automotive sectors due to their sustainability and mechanical properties.

- Natural polymer composites held 59.7% of the market share in 2023, favored for their renewable resource base, biodegradability, and lower environmental impact.

By Type

In 2023, Structural biocomposites held a dominant market position, capturing more than a 60% share. This segment benefits significantly from the increasing demand in industries such as automotive and construction, where the strength and durability of structural biocomposites are essential.

These materials are favored for their robust mechanical properties, making them ideal for load-bearing applications. The shift towards more sustainable building practices and the automotive industry’s push for lighter, more fuel-efficient vehicles have greatly contributed to this segment’s growth.

Non-structural biocomposites, while holding a smaller market share, play a crucial role in various applications that require less mechanical strength but still benefit from the ecological advantages of biocomposites.

Commonly used in interior applications such as panels, trims, and aesthetic components, these materials are valued for their environmental benefits and ease of use. The demand for non-structural biocomposites is driven by industries focused on reducing their environmental impact and enhancing the sustainability of their products.

By Fiber Type

In 2023, Wood Fiber Composites held a dominant market position, capturing more than a 59.8% share. This segment’s strength lies in its widespread adoption in various industries, including construction and automotive, where wood fiber composites are valued for their robustness and sustainability. They are often used in applications requiring structural strength combined with environmental benefits, such as in eco-friendly building projects or car interiors.

Non-wood Fiber Composites, while holding a smaller share, are gaining traction due to their unique properties and applications. These composites include materials like bamboo and sugarcane, which are becoming popular in consumer goods and packaging due to their rapid renewability and lower environmental impact.

Jute fiber composites are noted for their biodegradability and strength, making them suitable for use in geotextiles and packaging. This segment benefits from the fiber’s natural properties, including its significant tensile strength and low thermal conductivity.

Flax fiber composites are particularly valued in the automotive and sports equipment industries for their high strength-to-weight ratio. This fiber type is also appreciated in the aerospace sector for its vibration-damping properties, which contribute to enhanced performance.

Kenaf fiber composites are emerging as a popular choice due to their environmental and mechanical advantages. Common applications include automotive components and building materials, where the fiber’s light weight and strength are highly beneficial.

Hemp fiber composites are recognized for their sustainability and strength, used in applications ranging from building materials to automotive panels. The market for hemp fiber composites continues to grow as industries seek more sustainable material solutions.

By Polymer Type

In 2023, Natural Polymer Composites held a dominant market position, capturing more than a 59.7% share. This segment has gained significant traction due to its eco-friendly properties, aligning with global sustainability goals.

Natural polymer composites are made from renewable resources such as starch, cellulose, and proteins, making them highly desirable in industries like packaging, automotive, and construction. Their biodegradability and lower environmental impact are key factors driving their increased adoption.

Synthetic Polymer Composites, while holding a smaller market share compared to natural polymers, are crucial in applications demanding high strength and durability. These composites, which include polymers such as polyethylene and epoxy, are extensively used in areas where robust material properties are needed, such as in high-performance automotive parts and advanced construction materials.

Despite their synthetic origin, efforts are ongoing to improve their environmental footprint through recycling and the use of bio-based additives.

By Product

In 2023, Hybrid Biocomposites have captured a significant market share due to their versatility and performance in demanding applications. These composites combine natural and synthetic materials to leverage the benefits of both, offering enhanced mechanical properties, durability, and environmental sustainability.

Widely used in the automotive, aerospace, and construction industries, hybrid biocomposites are ideal for applications requiring robust material solutions that also reduce environmental impact. Their ability to be customized for specific needs makes them highly attractive for manufacturers looking to meet stringent regulatory standards while maintaining performance.

Green Biocomposites, also holding a substantial share of the market, are made entirely from natural materials, such as plant fibers and bio-based polymers. These composites are favored in applications where environmental impact is a critical concern, such as in packaging, disposable consumer goods, and interior automotive parts.

The appeal of green biocomposites lies in their complete biodegradability and lower carbon footprint, making them a preferred choice for industries aiming to enhance their sustainability practices. The demand for green biocomposites is driven by increasing regulatory pressure to reduce the use of non-renewable materials and the growing consumer preference for eco-friendly products.

By Process Type

In 2023, Compression Molding held a dominant market position, capturing more than a 39.7% share. This process is widely favored for its ability to produce large, fairly complex parts with good surface finish and high dimensional stability. It is particularly prevalent in the automotive and aerospace sectors where high-strength parts are required. Compression molding is also appreciated for its cost-effectiveness and efficiency in high-volume production settings, making it a cornerstone in the manufacturing of biocomposites.

Injection Molding is another critical process in the biocomposites market, known for its precision and ability to produce complex geometries with high repeatability. This process is essential for producing smaller, more intricate components that require tight tolerances and fine details. It is extensively used in consumer electronics, automotive components, and medical devices, where high performance and precision are paramount.

Resin Transfer Molding is noted for its ability to produce high-performance parts with excellent structural integrity. This process is particularly suited for creating large and complex items that require superior strength-to-weight ratios, such as automotive structural parts and wind turbine blades. The process involves injecting resin into a fiber preform contained within a mold, making it ideal for customized production runs.

The extrusion molding process holds a key position in the biocomposites market for its efficiency in producing continuous profiles with uniform cross-sections. This method is widely utilized for manufacturing pipes, frames, and other components that benefit from continuous fiber reinforcement. It is particularly valued in the construction and industrial sectors for its scalability and continuous production capability.

By End-use Industries

In 2023, the Building & Construction sector held a dominant market position in the biocomposites industry, capturing more than a 39.6% share. This sector relies heavily on biocomposites for their sustainability and strength, making them ideal for applications ranging from structural components to interior finishes. The drive towards more eco-friendly building practices has significantly influenced this trend, with biocomposites offering a reduced carbon footprint compared to traditional building materials.

The Transportation sector also leverages biocomposites, primarily for their ability to reduce vehicle weight and enhance fuel efficiency. In industries like automotive and aerospace, biocomposites are used in everything from dashboard panels to exterior body parts. This market segment is driven by stringent global emissions regulations and the ongoing shift towards more sustainable transportation solutions.

In Consumer Goods, biocomposites are valued for their aesthetic appeal and environmental benefits. Common applications include furniture, packaging, and household items where the demand for greener consumer products continues to rise. Biocomposites in this sector are popular due to their biodegradability and lower environmental impact compared to fully synthetic materials.

Key Market Segments

By Type

- Structural

- Non-Structural

By Fiber Type

- Wood Fiber Composites

- Non-wood Fiber Composites

- Jute fiber

- Flax fiber

- Kenaf fiber

- Hemp fiber

- Others

By Polymer Type

- Natural Polymer Composites

- Synthetic Polymer Composites

By Product

- Hybrid Biocomposites

- Green Biocomposites

By Process Type

- Compression Molding

- Injection Molding

- Resin Transfer Molding

- Extrusion molding process

- Others

By End-use Industries

- Building & Construction

- Transportation

- Consumer Goods

- Others

Drivers

Increased Environmental Awareness and Government Support

A primary driver of the biocomposites market is the increasing global emphasis on environmental sustainability. This surge in eco-consciousness is significantly influencing consumer preferences and regulatory frameworks across various industries.

Governments worldwide are implementing policies and regulations that encourage the adoption of environmentally friendly materials, directly boosting the biocomposites market. Initiatives such as investments in green technologies and subsidies for sustainable manufacturing processes are facilitating this growth.

Technological Advancements and Material Innovation

Technological innovations are pivotal in driving the biocomposites market. Advances in material science have led to the development of high-performance biocomposites that meet the rigorous demands of various applications, including automotive, construction, and packaging.

Innovations in biocomposite formulations are enabling the production of materials that offer enhanced properties such as increased strength, durability, and reduced weight, which are particularly valuable in industries striving for efficiency and sustainability.

Urbanization and Infrastructure Development

Rapid urbanization globally is another significant factor contributing to the demand for biocomposites. As urban areas expand, there is an increasing need for sustainable building materials that can support environmentally responsible development. Biocomposites are being integrated into modern architectural designs, offering sustainable alternatives to traditional construction materials.

Market Growth and Opportunities

The biocomposites market is experiencing robust growth, projected to continue expanding as industries increasingly adopt sustainable materials.

The automotive sector, for example, uses biocomposites to reduce vehicle weight and enhance fuel efficiency, aligning with global efforts to decrease carbon emissions. Similarly, the packaging industry is turning to biocomposites to reduce the environmental impact of disposable materials.

Restraints

High Production Costs: One significant challenge impeding the growth of the biocomposites market is the high production costs associated with manufacturing these materials. Biocomposites often require specialized raw materials and more complex manufacturing processes compared to traditional composites, which can substantially raise production expenses.

Impact on Market Dynamics: The higher cost of production for biocomposites can make these materials less competitive against conventional materials, especially in price-sensitive markets. This economic barrier is particularly challenging in industries where cost efficiency is a priority, such as consumer goods and automotive manufacturing, where manufacturers may hesitate to switch from cheaper, traditional materials to more expensive biocomposites despite their environmental benefits.

Industry Responses and Potential Solutions: To mitigate these challenges, industry stakeholders are exploring ways to optimize manufacturing processes and reduce material costs. Advances in production technology and increased scale can lead to cost reductions over time. Moreover, ongoing research into more cost-effective raw material sources, such as agricultural waste and recycled biopolymers, may also help lower prices.

Government and Regulatory Support: Government incentives and support for research and development in sustainable materials could also play a crucial role in addressing these cost issues. Subsidies, tax incentives, or funding for research could help make biocomposites more economically viable and competitive in the broader materials market.

Opportunity

Expansion in Green Building Materials: One significant growth opportunity for the biocomposites market lies in the expanding sector of green building materials. The increasing global focus on sustainability, supported by stringent environmental regulations and a rising consumer preference for eco-friendly products, is driving demand for biocomposites in the construction industry. These materials are valued for their reduced environmental impact, enhanced biodegradability, and compatibility with green building standards.

Market Expansion and Technological Innovation: The biocomposites market is poised for substantial growth, with projections estimating its value could rise significantly in the coming years due to technological advancements and the broader adoption of sustainable practices across industries. This growth is further supported by government incentives aimed at promoting eco-friendly materials, which help make biocomposites a competitive alternative to traditional construction materials.

Regional Growth Dynamics: The Asia-Pacific region, in particular, exhibits robust growth potential for biocomposites due to rapid urbanization and industrial development, creating a large market for construction materials that meet new sustainability standards. Similarly, North America and Europe are seeing increased adoption of biocomposites in construction applications, driven by regulatory support and consumer awareness about the environmental benefits of biocomposites.

Trends

Increasing Adoption in Green Building Materials: One of the most significant latest trends in the biocomposites market is the increasing adoption of these materials in the green building sector. This trend is fueled by the global push towards sustainable construction practices, driven by environmental concerns and supported by both government initiatives and private sector investments.

Growth in Green Building Materials: The demand for biocomposites in green building materials is on the rise due to their reduced environmental impact, durability, and biodegradability. These properties make biocomposites ideal for modern construction projects that prioritize sustainability. The shift towards eco-friendly materials is not only a response to regulatory pressures but also reflects a broader consumer preference for sustainable living environments.

Technological Innovations and Market Expansion: Technological advancements in biocomposite materials have enhanced their performance, making them more attractive for construction applications where strength, stability, and moisture resistance are crucial. Innovations in material science have allowed for the development of biocomposites that can meet or even exceed the performance of traditional construction materials.

Support from Government and Energy Organizations: Government policies and incentives aimed at reducing carbon footprints and enhancing building sustainability are facilitating the growth of biocomposites. Energy organizations are also recognizing the potential of biocomposites to contribute to energy efficiency in buildings, leading to support for research and development efforts in this field.

Regional Growth Insights: Regions like North America and Europe are leading in the adoption of biocomposites in construction due to their strict environmental regulations and high consumer awareness regarding sustainable practices. However, Asia-Pacific is also showing significant growth potential, driven by rapid urbanization and industrial development, which necessitates sustainable building materials to manage environmental impacts effectively.

Regional Analysis

The biocomposites market demonstrates significant regional variability, with Europe emerging as the dominant region, holding 33.5% of the global market share. In 2023, the market size in Europe was valued at USD 11.1 billion, driven by strong demand from the automotive and construction sectors. European regulations promoting sustainability and bio-based materials have fueled the adoption of biocomposites in various industries. Germany, France, and the UK are key contributors due to their focus on reducing carbon footprints and increasing the use of eco-friendly materials in automotive production and construction.

North America represents a substantial portion of the biocomposites market, with growing demand from the automotive, packaging, and consumer goods sectors. The U.S. leads this region, supported by technological advancements and increasing consumer awareness regarding sustainable products. Government initiatives aimed at promoting green materials further bolster the market.

The Asia Pacific region shows the fastest growth, driven by the expanding automotive and construction industries in countries like China and India. Increasing urbanization and industrialization, coupled with supportive government policies promoting sustainable materials, have led to heightened biocomposite adoption in this region.

In the Middle East & Africa, the market is gaining traction as a result of growing construction activities and the demand for lightweight, eco-friendly materials. The biocomposites market in this region is expected to grow steadily, with UAE and Saudi Arabia leading in infrastructure projects.

Lastly, Latin America is witnessing moderate growth, supported by the region’s increasing industrialization and the rising awareness of sustainable materials in construction and packaging sectors. Brazil and Mexico are key markets due to their growing infrastructure projects and focus on eco-friendly materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The biocomposites market is marked by the presence of several key players driving innovation and growth across industries. Companies like Trex Company, Inc., Fiberon, and UFP Industries, Inc. are major players in the North American market, particularly in the construction and decking segments.

Trex, known for its high-performance composite decking products, is recognized for its strong market presence, while Fiberon has established a reputation for producing eco-friendly, low-maintenance wood-alternative decking. UFP Industries (Universal Forest Products, Inc.) offers a wide range of wood-plastic composite solutions, catering to construction and industrial sectors.

In Europe, Stora Enso and UPM dominate, leveraging their expertise in sustainable forestry and bio-based materials. Stora Enso, a Finnish company, focuses on wood-based solutions for construction and packaging, while UPM leads in producing biocomposites from renewable materials. Other significant European players include Tecnaro GmbH and Flexform SpA, which offer innovative bio-based composites for various industrial applications.

In Asia, companies like Anhui Guofeng Wood-Plastic Composite Co., Ltd. and Hualong New Material Lumber Co. Ltd. are emerging leaders, providing wood-plastic composites primarily for construction and furniture applications. Additionally, companies such as BioComposites Group and Green Dot Corporation are pushing the envelope on sustainable material innovations, focusing on biodegradable and environmentally friendly biocomposites across global markets. These key players are fostering industry growth by prioritizing sustainability, innovation, and efficiency.

Market Key Players

- Anhui Guofeng Wood-Plastic Composite Co., Ltd.

- B.COMPOSITES PVT.LTD.

- Fiberon

- Flexform SpA

- Green Dot Corporation

- Hualong New Material Lumber Co. Ltd.

- Kudoti Pty Ltd

- Meshlin Composites ZRT

- Tecnaro GmbH

- Trex Company, Inc.

- UFP Industries, Inc.,

- Universal Forest Products, Inc.

- UPM

- Stora Enso

- Nanjing Jufeng Advanced Materials Co., Ltd..

- BioComposites Group

- Lingrove Inc

- EP Biocomposites Ltd.

Recent Development

In 2023, Fiberon expanded its product line with the introduction of Wildwood composite cladding, which offers a low-maintenance, eco-friendly alternative to traditional wood cladding.

In 2023, Flexform continued to enhance its product line by integrating eco-friendly materials into its designs, focusing on both durability and aesthetics.

Report Scope

Report Features Description Market Value (2023) US$ 33.4 Bn Forecast Revenue (2033) US$ 126.0 Bn CAGR (2024-2033) 15.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Structural, Non-Structural), By Fiber Type(Wood Fiber Composites, Non-wood Fiber Composites, Jute fiber, Flax fiber, Kenaf fiber, Hemp fiber, Others), By Polymer Type(Natural Polymer Composites, Synthetic Polymer Composites), By Product(Hybrid Biocomposites, Green Biocomposites), By Process Type(Compression Molding, Injection Molding, Resin Transfer Molding, Extrusion molding process, Others), By End-use Industries(Building and Construction, Transportation, Consumer Goods, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Anhui Guofeng Wood-Plastic Composite Co., Ltd., B.COMPOSITES PVT.LTD., Fiberon, Flexform SpA, Green Dot Corporation, Hualong New Material Lumber Co. Ltd., Kudoti Pty Ltd, Meshlin Composites ZRT, Tecnaro GmbH, Trex Company, Inc., UFP Industries, Inc.,, Universal Forest Products, Inc., UPM, Stora Enso, Nanjing Jufeng Advanced Materials Co., Ltd.., BioComposites Group, Lingrove Inc, EP Biocomposites Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Biocomposites Market?Biocomposites Market size is expected to be worth around USD 126.0 billion by 2033, from USD 33.4 billion in 2023

What is the CAGR for the Biocomposites Market?The Biocomposites Market is expected to grow at a CAGR of 15.9% during 2023-2032.List the key industry players of the Global Biocomposites Market?Anhui Guofeng Wood-Plastic Composite Co., Ltd., B.COMPOSITES PVT.LTD., Fiberon, Flexform SpA, Green Dot Corporation, Hualong New Material Lumber Co. Ltd., Kudoti Pty Ltd, Meshlin Composites ZRT, Tecnaro GmbH, Trex Company, Inc., UFP Industries, Inc.,, Universal Forest Products, Inc., UPM, Stora Enso, Nanjing Jufeng Advanced Materials Co., Ltd.., BioComposites Group, Lingrove Inc, EP Biocomposites Ltd.

-

-

- Anhui Guofeng Wood-Plastic Composite Co., Ltd.

- B.COMPOSITES PVT.LTD.

- Fiberon

- Flexform SpA

- Green Dot Corporation

- Hualong New Material Lumber Co. Ltd.

- Kudoti Pty Ltd

- Meshlin Composites ZRT

- Tecnaro GmbH

- Trex Company, Inc.

- UFP Industries, Inc.,

- Universal Forest Products, Inc.

- UPM

- Stora Enso

- Nanjing Jufeng Advanced Materials Co., Ltd..

- BioComposites Group

- Lingrove Inc

- EP Biocomposites Ltd.