Global Bio-based Chemicals Market By Type(Bio-Lubricants, Bio-Solvents, Tetrahydrofuran, Cyclopentanone, Tetrahydropyran, Others, Bioplastics, Biodegradable Bioplastics, Non-Biodegradable Bioplastics, Bio-Alcohols, 1,3-propanediol, 1,6-hexanediol, 1,10-decanediol, Others, Bio-Surfactants, Bio-Based Acids, Succinic acid, Furfural, Butadiene, 1-4 BDO, Others), By Feedstock(Corn, Sugarcane, Vegetable Oils, Agricultural Waste, Forest Biomass, Algae, Others), By Application(Automotive, Personal Care, Food and Beverages, Agriculture, Industrial, Pharmaceuticals Packaging, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 129119

- Number of Pages: 369

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

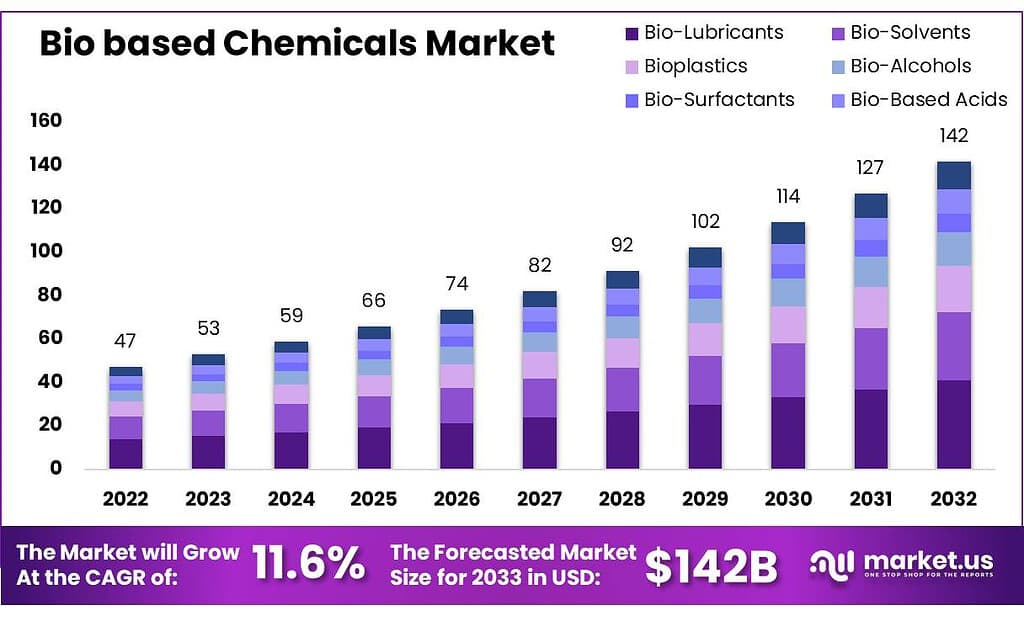

The global Bio-based Chemicals Market size is expected to be worth around USD 142 billion by 2033, from USD 47 billion in 2023, growing at a CAGR of 11.6% during the forecast period from 2023 to 2033.

The bio-based chemicals market represents a growing segment of the chemical industry that focuses on producing chemicals from renewable biological resources, such as plants, agricultural waste, and biomass, rather than traditional fossil fuels.

The demand for biodegradable and sustainable materials is driving significant growth. The European Bioplastics Association estimates that the global bioplastics market, a key part of bio-based chemicals, will reach approximately USD 2.74 billion by 2024.

Similarly, in the automotive industry, the use of bio-based chemicals is expected to rise as manufacturers seek sustainable alternatives to traditional plastics. According to the American Chemistry Council, bio-based materials could potentially reduce CO2 emissions by up to 50% compared to conventional options.

Government initiatives also play a crucial role in supporting this market. The European Union’s Circular Economy Action Plan encourages the adoption of sustainable products, while the U.S. Renewable Fuel Standard promotes the use of renewable fuels, indirectly bolstering the bio-based chemicals sector by incentivizing the use of bio-based feedstocks.

Moreover, the global trade of bio-based chemicals is on the rise, with a reported 15% increase in exports from the U.S. between 2020 and 2022. Key markets include Europe and Asia, where the demand for sustainable products is rapidly increasing.

Significant investments are being made in this sector, such as the USD 30 million funding program announced by the U.S. Department of Energy to support bio-based innovations. Additionally, major companies are making strategic moves, like BASF’s acquisition of Solvay’s polyamide business, which enhances their sustainable materials portfolio. Overall, the bio-based chemicals market is poised for continued growth, driven by innovation, regulatory support, and increasing market demand.

Key Takeaways

- The bio-based chemicals market is expected to grow from USD 47 billion in 2023 to USD 142 billion by 2033, at a CAGR of 11.6%.

- In 2023, corn accounted for over 29.4% of bio-based chemical feedstock, driven by its widespread availability and established supply chains.

- Bioplastics captured 29.7% of the bio-based chemicals market in 2023, with rising demand for both biodegradable and non-biodegradable materials.

- The Asia Pacific region holds a 34% market share in the bio-based chemicals market, valued at USD 16.3 billion in 2023, with China and India leading.

- The automotive sector represents 25.5% of the bio-based chemicals market in 2023, driven by sustainable alternatives for vehicle interiors and fuel additives.

By Type

In 2023, bioplastics held a dominant market position, capturing more than a 29.7% share of the bio-based chemicals market. This segment includes both biodegradable and non-biodegradable bioplastics, which are increasingly favored due to their environmental benefits. Biodegradable bioplastics are especially appealing for single-use applications, while non-biodegradable types are gaining traction in durable goods.

Bio-lubricants and bio-solvents also represent significant portions of the market. These products are derived from natural sources and are preferred for their lower environmental impact compared to traditional petroleum-based options. Their application spans industries like automotive and manufacturing, where sustainability is a key focus.

Additionally, bio-alcohols such as 1,3-propanediol, 1,6-hexanediol, and 1,10-decanediol are increasingly important for producing various chemicals and plastics. These bio-alcohols are used in cosmetics, personal care products, and textiles, driving further growth in this segment.

Bio-surfactants are gaining attention for their ability to replace synthetic surfactants in cleaning and personal care products. Their natural origins make them attractive to environmentally conscious consumers.

Bio-based acids, including succinic acid and furfural, are crucial for producing a variety of chemicals and are seeing increased demand in the food, beverage, and plastics industries. The versatility of these acids allows for their application in multiple sectors.

By Feedstock

In 2023, corn held a dominant market position, capturing more than a 29.4% share of the bio-based chemicals market. Corn is widely used for producing various bio-based chemicals, including bio-alcohols and bioplastics. Its abundance and established supply chain make it a preferred feedstock.

Sugarcane follows closely, recognized for its high sugar content, which is ideal for fermentation processes. This feedstock is crucial for producing bioethanol and other bio-based products, driving significant growth in this segment.

Vegetable oils also play a vital role in the bio-based chemicals market. They are commonly used to create bio-lubricants and bio-surfactants. Their renewable nature appeals to manufacturers seeking sustainable alternatives to petroleum-based products.

Agricultural waste, including residues from crops, is increasingly being utilized. This feedstock is advantageous as it reduces waste while providing a source for bio-based chemicals. Innovations in processing technology are enhancing the viability of agricultural waste as a feedstock.

Forest biomass contributes to the market by providing materials for bio-based acids and solvents. This feedstock is renewable and supports sustainable forest management practices, adding value to the bio-based chemicals supply chain.

Algae is an emerging feedstock with significant potential. It can be cultivated in various environments and offers a rich source of oils and bioactive compounds. Research and development in this area are expanding its applications in the bio-based chemicals market.

By Application

In 2023, automotive held a dominant market position, capturing more than a 25.5% share of the bio-based chemicals market. The automotive industry increasingly uses bio-based materials for interior components and fuel additives, driven by a push for sustainability and reduced emissions.

The personal care sector is also significant, utilizing bio-based chemicals in cosmetics and skincare products. These ingredients appeal to consumers seeking natural and environmentally friendly options, enhancing their market growth.

In the food and beverages industry, bio-based chemicals are important for packaging and additives. The demand for biodegradable packaging solutions is rising as companies aim to reduce plastic waste. This segment supports sustainability while meeting consumer preferences.

Agriculture applications include bio-based fertilizers and pesticides, which are gaining popularity. These products help improve soil health and reduce chemical runoff, aligning with sustainable farming practices.

Industrial applications utilize bio-based chemicals in cleaning products and lubricants. The shift toward greener industrial processes is driving demand for bio-based solutions that are safer for workers and the environment.

The pharmaceutical sector is increasingly incorporating bio-based chemicals into drug formulations. This trend is driven by the need for safer, more effective products and a focus on sustainability in healthcare.

Key Market Segments

By Type

- Bio-Lubricants

- Bio-Solvents

- Tetrahydrofuran

- Cyclopentanone

- Tetrahydropyran

- Others

- Bioplastics

- Biodegradable Bioplastics

- Non-Biodegradable Bioplastics

- Bio-Alcohols

- 1,3-propanediol

- 1,6-hexanediol

- 1,10-decanediol

- Others

- Bio-Surfactants

- Bio-Based Acids

- Succinic acid

- Furfural

- Butadiene

- 1-4 BDO

- Others

By Feedstock

- Corn

- Sugarcane

- Vegetable Oils

- Agricultural Waste

- Forest Biomass

- Algae

- Others

By Application

- Automotive

- Personal Care

- Food & Beverages

- Agriculture

- Industrial

- Pharmaceuticals Packaging

- Others

Drivers

Increasing Government Support and Regulations

Governments around the world are increasingly promoting the use of bio-based chemicals to address environmental concerns and transition toward sustainable practices. This support is evident through various initiatives, policies, and regulations aimed at reducing reliance on fossil fuels and encouraging the adoption of renewable resources.

One major initiative is the European Union’s Green Deal, which aims to make Europe the first climate-neutral continent by 2050. The plan includes significant funding and incentives for industries to shift to bio-based alternatives. The EU has set ambitious targets, such as reducing greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. To achieve these goals, the EU has committed to investing €1 trillion in sustainable initiatives over the next decade.

In the United States, the Renewable Fuel Standard (RFS) program requires transportation fuel sold in the U.S. to contain a minimum volume of renewable fuels. This mandate supports the production of biofuels and bio-based chemicals, leading to an expected increase in production to 36 billion gallons by 2022. The U.S. government has also proposed funding of $30 million for research and development projects focused on bio-based chemicals, highlighting its commitment to innovation in this field.

Moreover, countries like Brazil are leveraging their abundant agricultural resources to boost bio-based chemical production. The Brazilian government has implemented policies to promote bioethanol, which accounted for approximately 27% of the country’s fuel supply in 2020. This approach not only helps reduce carbon emissions but also supports local agriculture.

In Asia, China is also making strides in this area. The government has set a target for bio-based products to account for 30% of total chemical output by 2030. To support this goal, China plans to invest over $20 billion in bio-based chemical production facilities, which will significantly enhance the country’s manufacturing capabilities in this sector.

International organizations are also playing a role in this transition. The International Energy Agency (IEA) emphasizes that transitioning to bio-based chemicals could help reduce global CO2 emissions by 1.3 gigatons annually by 2050. This statistic underscores the potential impact of bio-based chemicals on global climate goals.

Additionally, many countries are implementing financial incentives for companies that adopt bio-based practices. For instance, tax credits and grants for developing bio-based products can significantly reduce production costs. These incentives encourage investment in research, development, and the commercialization of bio-based chemicals.

The private sector is also responding positively to these government initiatives. Major companies are forming partnerships and collaborations to explore bio-based alternatives. For instance, BASF has committed to investing €1.2 billion in the development of sustainable products by 2025, including bio-based chemicals.

Restraints

High Production Costs

One of the major restraining factors for the bio-based chemicals market is the high production costs associated with developing and manufacturing these products. Despite the growing demand for bio-based alternatives, the financial investment required to produce them at scale remains a significant barrier to widespread adoption.

The production costs of bio-based chemicals are often higher than those of conventional petrochemical products. For example, studies indicate that bio-based polyols used in polyurethane production can cost between 30% to 50% more than traditional petrochemical polyols. This price disparity can deter manufacturers from making the switch, especially in industries where cost competitiveness is crucial.

In addition, the raw materials for bio-based chemicals, such as agricultural feedstocks, can be subject to price volatility. The Food and Agriculture Organization (FAO) reported that global prices for key crops like corn and sugar have fluctuated significantly, with prices for corn rising by nearly 15% from 2020 to 2021. Such fluctuations can affect the cost structure of bio-based chemical production, making it difficult for manufacturers to maintain consistent pricing.

The processing and refining of bio-based feedstocks often require advanced technology and specialized equipment, which can lead to high capital expenditure. According to the U.S. Department of Energy, bio-refineries, which convert biomass into bio-based chemicals, typically have high initial setup costs, estimated to be around $10 million to $30 million. These upfront costs can deter small and medium enterprises from entering the market.

Moreover, the lack of economies of scale in bio-based chemical production compared to the well-established petrochemical industry contributes to higher costs. The petrochemical sector benefits from a mature infrastructure and large-scale production facilities that allow for cost efficiencies. In contrast, bio-based chemical facilities are often smaller and less optimized, leading to increased production costs.

Regulatory challenges also add to the expense. Compliance with environmental regulations can require additional investments in technology and processes. The Environmental Protection Agency (EPA) mandates that bio-based chemical producers adhere to stringent safety and environmental standards, which can result in increased operational costs.

Furthermore, research and development (R&D) costs for bio-based chemicals can be substantial. According to the International Energy Agency (IEA), the bio-based chemicals sector requires continuous investment in R&D to improve efficiency and reduce production costs. Industry experts estimate that companies need to allocate approximately 10% to 20% of their revenue for R&D to remain competitive in this evolving market.

Opportunity

Expanding Demand for Sustainable Products

One of the most significant growth opportunities for the bio-based chemicals market is the expanding demand for sustainable products across various industries. As consumers become increasingly environmentally conscious, there is a noticeable shift toward products that reduce carbon footprints and promote sustainability. This trend is supported by both consumer behavior and government initiatives aimed at fostering greener practices.

In recent years, consumer demand for sustainable products has surged. According to a report by Nielsen, nearly 73% of global consumers are willing to change their consumption habits to reduce environmental impact. This shift is evident in industries such as packaging, automotive, and personal care, where companies are actively seeking bio-based alternatives to traditional materials. For example, the global biodegradable plastics market is expected to reach USD 6.52 billion by 2027, growing at a CAGR of 13.2% from 2020 to 2027. This indicates a strong preference for sustainable options, creating a lucrative opportunity for bio-based chemicals.

Government policies are further enhancing this growth opportunity. Initiatives like the European Union’s Circular Economy Action Plan aim to encourage the adoption of sustainable practices across industries. The EU has set targets to ensure that 70% of plastic packaging is recycled by 2030, pushing companies to explore bio-based alternatives that align with these goals. Similarly, the U.S. Department of Agriculture (USDA) is promoting the use of biobased products through its BioPreferred program, which encourages federal purchasing of biobased products and aims to increase market demand.

In the automotive sector, the shift toward electric vehicles (EVs) presents another growth opportunity. The International Energy Agency (IEA) projects that the number of electric vehicles on the road will reach 145 million by 2030, leading manufacturers to seek sustainable materials for vehicle components. This transition opens up avenues for bio-based chemicals to be used in manufacturing lightweight, sustainable components, thereby reducing the overall environmental impact of automotive production.

The food and beverage industry is also contributing to the growth of bio-based chemicals. With a growing focus on sustainable packaging solutions, companies are exploring bio-based materials for food packaging. The global market for sustainable food packaging is expected to reach USD 470 billion by 2027, growing at a CAGR of 10.3%. This trend not only meets consumer demand but also aligns with government regulations aimed at reducing plastic waste.

Trends

Advancements in Bioplastics Technology

As environmental concerns grow and consumer demand for sustainable materials increases, bioplastics are becoming a viable alternative to traditional petroleum-based plastics. This trend is supported by significant innovations in production processes, materials development, and applications across various industries.

Bioplastics are derived from renewable resources, such as corn, sugarcane, and vegetable oils. According to the European Bioplastics Association, the global bioplastics market is projected to reach 2.74 million tons by 2024, indicating a strong shift towards sustainable materials. This growth is largely driven by the demand for biodegradable and compostable options, particularly in packaging applications, where bioplastics can help reduce plastic waste.

Recent advancements in bioplastics technology have led to the development of new types of materials that exhibit enhanced performance characteristics. For instance, the introduction of polylactic acid (PLA) and polyhydroxyalkanoates (PHA) has expanded the range of applications for bioplastics. These materials are now used not only in packaging but also in automotive components, electronics, and medical devices. Reports suggest that the global market for PLA alone is expected to grow at a CAGR of 19.5%, reaching USD 1.54 billion by 2025.

Government initiatives are also playing a crucial role in promoting bioplastics. The European Union’s Single-Use Plastics Directive, implemented in 2021, aims to ban specific single-use plastic items and encourages the use of sustainable alternatives. This regulation has propelled many companies to invest in bioplastics research and development, further accelerating innovation in the sector.

In the United States, the Bioplastics Packaging Market is expected to grow significantly, with projections suggesting a rise to USD 6.28 billion by 2024, driven by consumer demand for eco-friendly packaging solutions. Major companies, such as Coca-Cola and Unilever, are already incorporating bioplastics into their packaging strategies, highlighting the growing acceptance of these materials in mainstream markets.

Moreover, advancements in production technology are making bioplastics more cost-competitive with traditional plastics. For instance, companies are exploring fermentation processes and enzyme technologies to improve the efficiency of bioplastics production. According to the U.S. Department of Energy, such innovations can lead to production cost reductions of up to 30%, making bioplastics more attractive to manufacturers.

Another noteworthy trend is the increasing focus on circular economy principles in the bioplastics sector. Many companies are now developing bioplastics that are not only biodegradable but also recyclable. This aligns with global sustainability goals and helps reduce the overall environmental impact of plastic waste. For example, the global market for recycled bioplastics is anticipated to grow at a CAGR of 14.2%, indicating a strong push toward more sustainable end-of-life solutions.

Regional Analysis

The bio-based chemicals market shows promising growth across multiple regions, with the Asia Pacific (APAC) region leading the market, holding a 34% share and valued at USD 16.3 billion. APAC’s dominance is driven by increasing industrialization, favorable government policies, and the growing demand for eco-friendly products. Countries like China and India are contributing significantly to this growth due to their large-scale agricultural output and advancements in bio-based technologies.

North America is another key market, contributing approximately 28.6% of the global market. This growth is attributed to strong technological innovations, well-established industries, and supportive regulatory frameworks, especially in the United States and Canada. The region’s market size is projected to grow steadily, supported by the growing awareness and demand for sustainable alternatives to petroleum-based chemicals.

Europe holds about 24.3% of the bio-based chemicals market, benefiting from stringent environmental regulations and ambitious sustainability goals, particularly in countries like Germany, France, and the Netherlands. The European Union’s aggressive push towards reducing carbon emissions is driving substantial investment in bio-based chemical production and infrastructure.

The Middle East & Africa region accounts for roughly 7.1% of the market, with gradual adoption of bio-based chemicals, driven by increasing awareness and regional efforts to diversify economies from petrochemical dependence. Lastly, Latin America, with a market share of 6%, shows growth potential due to its abundant agricultural resources, particularly in Brazil, where biomass production is expanding.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The bio-based chemicals market is highly competitive, with several key players driving innovation and expansion. Companies such as AGAE Technologies and GFBiochemicals Ltd. are at the forefront of developing advanced bio-based technologies, focusing on sustainable chemical production.

Larger, established corporations like Archer Daniels Midland Company, Cargill Incorporated, and BASF SE play a significant role in scaling bio-based chemical production, leveraging their vast resources and global networks. Braskem SA, a leader in bio-based polymers, continues to expand its renewable chemical portfolio, particularly in regions like Latin America where biomass is readily available.

Major global players such as Dow Chemicals, DuPont, and Evonik Industries focus on innovations in bio-based chemicals for various industries, including packaging, automotive, and pharmaceuticals. Companies like Mitsubishi Chemical Corporation, Koninklijke DSM N.V., and Toray Industries Inc. are emphasizing research and development to introduce eco-friendly alternatives to traditional petrochemicals.

LyondellBasell and Total Energies have also made substantial investments in sustainable chemical solutions to diversify their portfolios. Additionally, niche players like Vertec BioSolvents and IP Group PLC are innovating in specific bio-solvent applications, offering specialized solutions to industries seeking greener alternatives.

Market Key Players

- AGAE Technologies

- Archer Daniels Midland Company

- BASF SE

- Braskem SA

- Cargill Incorporated

- Koninklijke DSM N.V

- Dow Chemicals

- DuPont

- Evonik Industries

- GFBiochemicals Ltd.

- IP Group PLC LyondellBasell

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Total Energies

- Vertec BioSolvents

Recent Development

In 2023 AGAE Technologies, the company continued to focus on expanding its production capabilities to meet the increasing global demand for sustainable chemicals, particularly in sectors like oil recovery and personal care.

In 2023, ADM entered into a strategic partnership with Solugen to scale the production of bio-based specialty chemicals.

Report Scope

Report Features Description Market Value (2023) US$ 47 Bn Forecast Revenue (2033) US$ 142 Bn CAGR (2024-2033) 11.6% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Bio-Lubricants, Bio-Solvents, Tetrahydrofuran, Cyclopentanone, Tetrahydropyran, Others, Bioplastics, Biodegradable Bioplastics, Non-Biodegradable Bioplastics, Bio-Alcohols, 1,3-propanediol, 1,6-hexanediol, 1,10-decanediol, Others, Bio-Surfactants, Bio-Based Acids, Succinic acid, Furfural, Butadiene, 1-4 BDO, Others), By Feedstock(Corn, Sugarcane, Vegetable Oils, Agricultural Waste, Forest Biomass, Algae, Others), By Application(Automotive, Personal Care, Food and Beverages, Agriculture, Industrial, Pharmaceuticals Packaging, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape AGAE Technologies, Archer Daniels Midland Company, BASF SE, Braskem SA, Cargill Incorporated, Koninklijke DSM N.V, Dow Chemicals, DuPont, Evonik Industries, GFBiochemicals Ltd., IP Group PLC Lyondellbasell, Mitsubishi Chemical Corporation, Toray Industries Inc., Total Energies, Vertec BioSolvents Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AGAE Technologies

- Archer Daniels Midland Company

- BASF SE

- Braskem SA

- Cargill Incorporated

- Koninklijke DSM N.V

- Dow Chemicals

- DuPont

- Evonik Industries

- GFBiochemicals Ltd.

- IP Group PLC Lyondellbasell

- Mitsubishi Chemical Corporation

- Toray Industries Inc.

- Total Energies

- Vertec BioSolvents