Global Beverage Membrane Filtration Market By Filtration Type(Liquid Filtration, Air Filtration), By System Technology((Tangential Flow Filtration, Ultrafiltration, Nanofiltration, Reverse Osmosis, Microfiltration), Normal Flow Filtration(Ultrafiltration, Nanofiltration, Microfiltration)), By Membrane Material(Polymer, Ceramic, Glass Fiber, Others), By Application(Wine, Beer, Bottled Water, Soft Drinks, Juice, Spirits, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: June 2024

- Report ID: 123131

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

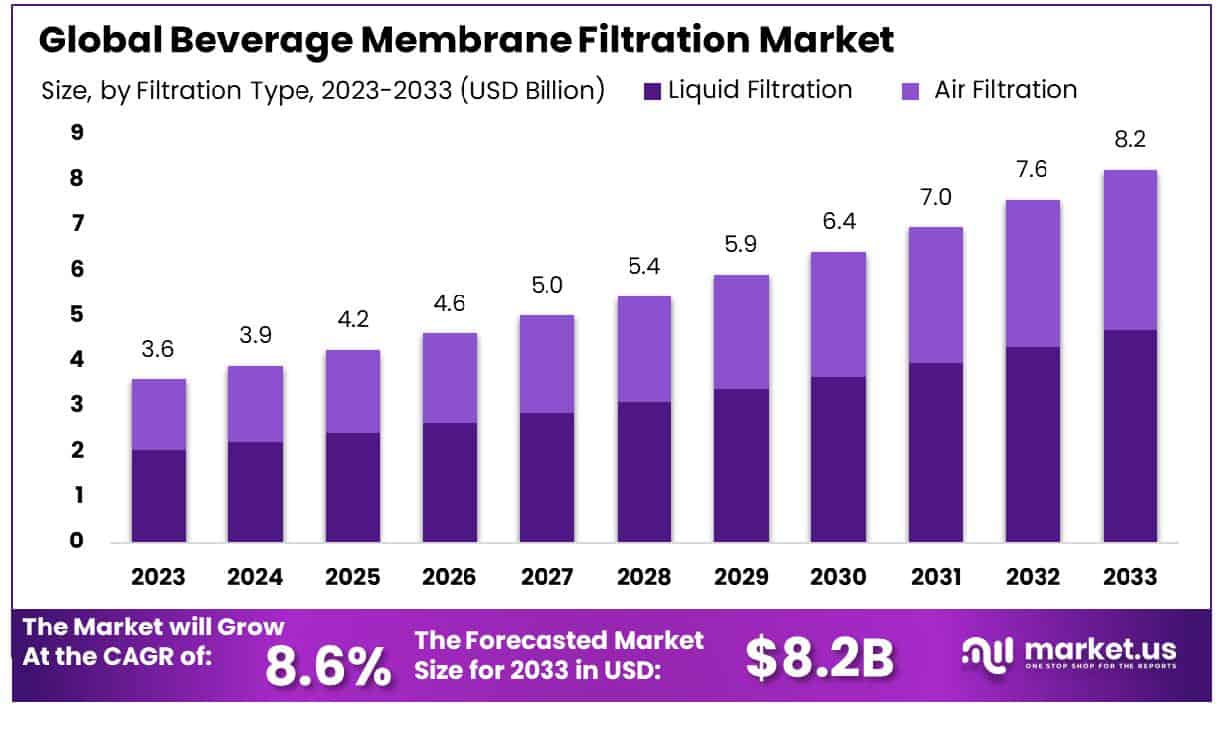

The Global Beverage Membrane Filtration Market size is expected to be worth around USD 8.2 Billion by 2033, From USD 3.6 Billion by 2023, growing at a CAGR of 8.6% during the forecast period from 2024 to 2033.

The Beverage Membrane Filtration Market pertains to the specialized segment of the beverage industry that employs membrane filtration technology to refine and purify beverages. This technology enhances product quality, safety, and shelf life by removing impurities, microorganisms, and fine particulates. Key applications include the filtration of water, dairy products, juices, and alcoholic beverages.

As beverage producers increasingly prioritize sustainability and efficiency, membrane filtration offers a vital solution that supports these goals while complying with stringent regulatory standards. The market is characterized by its adoption of advanced filtration technologies such as microfiltration, ultrafiltration, nanofiltration, and reverse osmosis.

The Beverage Membrane Filtration Market is poised to navigate through an environment marked by fluctuating industrial demand and regulatory pressures. The market’s resilience is underscored by its critical role in ensuring beverage quality and safety, utilizing advanced filtration technologies such as ultrafiltration and reverse osmosis. However, the broader chemical industry context presents significant challenges. In 2023, the European Union witnessed a 7.6% decline in chemical production, influenced by reduced demand for industrial goods and strong import competition from China.

This downturn was more pronounced in Germany, where chemical production plummeted by 9.7%, following a 12.1% decline in 2022. The United Kingdom also reported a decline of 8.4% in chemical production during the same period. These trends suggest potential headwinds for the Beverage Membrane Filtration Market, particularly in terms of raw material supply and cost implications. Nonetheless, the sector’s focus on sustainable production processes and technological advancements continues to drive its strategic importance within the beverage industry.

Key Takeaways

- The Global Beverage Membrane Filtration Market is projected to grow from USD 3.6 billion in 2023 to USD 8.2 billion by 2033, at a CAGR of 8.6%.

- North America holds 41.2% of the USD 1.5 billion Beverage Membrane Filtration Market.

- Liquid filtration dominates with a 56.5% market share.

- Tangential flow filtration holds 66.4% of system technology.

- Polymer materials constitute 43.2% of filtration membranes.

- Wine applications represent 22% of the market segment.

Driving Factors

Increased Demand for Premium and Functional Beverages

The beverage membrane filtration market is experiencing significant growth driven by heightened consumer interest in premium and functional beverages. As consumers become more health-conscious, there is an increased demand for beverages that offer added health benefits, such as enhanced hydration, vitamin fortification, and improved digestive health. This shift is prompting beverage manufacturers to innovate and expand their product lines to include these value-added options.

Membrane filtration plays a crucial role in this process by ensuring the purity and quality of these high-value products. The technology’s ability to effectively separate and concentrate valuable components while removing undesirables like bacteria and sediments is pivotal. Consequently, the demand for advanced filtration solutions is surging, reflected in the market’s growth projections.

Stringent Regulatory Standards for Beverage Quality and Safety

Regulatory bodies worldwide are imposing stricter standards for beverage quality and safety, compelling manufacturers to invest in reliable and efficient filtration technologies. Membrane filtration offers a proven solution for achieving compliance with these regulations, as it effectively removes pathogens and contaminants that can compromise beverage safety.

This compliance is particularly critical in the production of dairy and non-dairy beverages, where safety concerns are paramount. As regulations become more rigorous, the adoption of membrane filtration technology is expected to rise, thus propelling the market growth. The technology’s ability to meet these stringent standards without compromising the beverage’s taste or nutritional value is a key market driver.

Technological Advancements in Membrane Filtration Technology

Technological advancements in membrane filtration technology are revolutionizing the beverage industry. Innovations such as nanofiltration and reverse osmosis are enhancing the efficiency and effectiveness of beverage processing. These advancements not only improve the filtration process but also reduce operational costs by minimizing energy consumption and waste production. Additionally, newer membranes are being developed to withstand harsher cleaning chemicals and higher temperatures, thereby extending their lifespan and reducing the frequency of replacements.

The integration of smart technologies and automation in membrane filtration systems is further boosting their appeal by ensuring consistent product quality and optimizing production processes. This technological evolution is a critical factor in the sustained growth of the beverage membrane filtration market, as it enables manufacturers to meet both consumer expectations and regulatory requirements more effectively.

Restraining Factors

High Cost of Installation and Maintenance of Membrane Filtration Systems

The growth of the beverage membrane filtration market is notably hampered by the high initial costs associated with the installation and ongoing maintenance of these systems. Membrane filtration technology, while effective, requires significant capital investment, which can be a substantial barrier for small to medium-sized beverage producers.

Additionally, the operational expenses related to the maintenance, including periodic replacement of membranes and energy consumption, further contribute to the overall cost burden. These financial challenges can deter companies from adopting advanced filtration technologies, instead opting for more traditional, less costly methods even if they are less efficient. This factor restrains the market’s expansion, particularly in regions where cost sensitivity is more pronounced among businesses.

Limited Awareness and Adoption in Emerging Markets

Another significant challenge facing the beverage membrane filtration market is the limited awareness and adoption of these technologies in emerging markets. Many regions lack the infrastructure and technical expertise necessary to implement and maintain advanced filtration systems. Moreover, the benefits of membrane filtration technology are not widely recognized among local manufacturers in these markets, which impedes its adoption.

The combination of high setup costs and low awareness creates a significant barrier to market penetration in these areas. This not only limits the market’s growth potential but also slows down the technological advancement and quality improvement of beverage production in developing economies, where such enhancements could be most beneficial.

By Filtration Type Analysis

Liquid filtration dominates the market, comprising 56.5% of the sector’s total filtration applications.

In 2023, Liquid Filtration held a dominant market position in the By Filtration Type segment of the Beverage Membrane Filtration Market, capturing more than a 56.5% share. This filtration type is pivotal in the beverage industry, primarily due to its critical role in ensuring the clarity, purity, and taste consistency of products ranging from alcoholic spirits to soft drinks and bottled water.

Liquid Filtration involves several sub-processes such as clarifying, sterilizing, and reducing particulate matter in beverages. The technology’s superiority in maintaining the integrity of the liquid’s composition while removing undesirable contaminants underlines its widespread adoption. It is also crucial for adhering to global safety standards and consumer expectations for quality.

On the other hand, Air Filtration, while essential, commands a smaller segment of the market. This technology is primarily employed in beverage production to maintain clean and sterile air environments, particularly crucial in preventing product contamination during the bottling and packaging processes. Air filters are integral to protecting the production environment from airborne pathogens and particulates, thus safeguarding product integrity from production line to shelf.

The market trends indicate a growing investment in Liquid Filtration technology driven by increasing consumer demands for premium and safe beverage options. Advances in filtration materials and techniques are likely to propel this trend further, enhancing efficiency and environmental sustainability. As regulatory standards tighten and consumer preferences shift towards healthier and purer beverages, the role of sophisticated filtration technologies like Liquid Filtration is set to become even more central in the industry’s operational strategies.

By System Technology Analysis

Tangential flow filtration is highly prevalent, representing 66.4% of system technology usage.

In 2023, Tangential Flow Filtration held a dominant market position in the By System Technology segment of the Beverage Membrane Filtration Market, capturing more than a 66.4% share. This predominant technology encompasses various sub-technologies, including Ultrafiltration, Nanofiltration, Reverse Osmosis, and Microfiltration, each serving distinct roles in beverage production by targeting specific molecule sizes and separation needs.

Ultrafiltration is widely utilized for its efficiency in protein concentration and clarification processes, while Nanofiltration finds its niche in softening water and reducing pesticide levels without altering the liquid’s ionic composition. Reverse Osmosis is pivotal in demineralization and desalination processes, essential for standardizing taste and purity, particularly in the production of mineral-sensitive beverages like beer and tea. Microfiltration plays a critical role in sterilizing and reducing microbial content to ensure safety and extend shelf life.

Normal Flow Filfiltration, although less dominant, still maintains a significant presence in the market. It includes Ultrafiltration, Nanofiltration, and Microfiltration technologies. These are primarily used for simpler, high-throughput tasks that require less precision in separation processes, catering effectively to industries prioritizing cost over nuanced filtration needs.

The market dynamics are significantly influenced by the burgeoning demand for premium and health-centric beverages. As consumers increasingly prefer beverages with enhanced purity and specific health benefits, the adoption of advanced filtration technologies like Tangential Flow Filtration is expected to grow. Manufacturers are likely to continue investing in these technologies to improve product quality and adhere to stringent health regulations.

By Membrane Material Analysis

Polymer materials are widely used in membrane technologies, accounting for 43.2% of the market.

In 2023, Polymer held a dominant market position in the By Membrane Material segment of the Beverage Membrane Filtration Market, capturing more than a 43.2% share. This segment’s growth can be attributed to the widespread adoption of polymer-based membranes due to their cost-effectiveness and versatility in various filtration processes. Ceramics followed with a substantial market share, offering benefits such as high-temperature resistance and long service life, which are critical in the beverage industry’s stringent operational environments.

Glass Fiber and other materials, including metallic and mixed matrix membranes, collectively accounted for the remainder of the market share. These materials are selected based on their specific properties, such as chemical resistance or mechanical stability, which are pivotal in ensuring the integrity and quality of beverages during filtration.

The overall market dynamics are influenced by the increasing demand for filtered beverages, encompassing both alcoholic and non-alcoholic beverages. This trend is driven by consumer preferences shifting towards healthier and higher-quality beverage options. Technological advancements in membrane materials are also playing a significant role, as manufacturers seek to improve efficiency and reduce costs.

Investments in research and development are expected to continue, focusing on enhancing the efficacy of existing materials and exploring new materials that comply with regulatory standards and sustainability goals. The market’s future trajectory will likely see an increased adoption of innovative and environmentally friendly materials, responding to both consumer demands and regulatory pressures.

By Application Analysis

Wine production significantly utilizes specific filtration methods, constituting 22% of the application segment.

In 2023, Wine held a dominant market position in the By Application segment of the Beverage Membrane Filtration Market, capturing more than a 22% share. This was followed by Beer at 19%, Bottled Water at 18%, Soft Drinks at 16%, Juice at 12%, Spirits at 8%, and Others at 5%. The robust position of wine can be attributed to the stringent quality requirements and the proliferation of premium wine production, which necessitates advanced filtration solutions to ensure clarity, stability, and flavor integrity.

The beverage membrane filtration technology is increasingly favored in the wine industry due to its efficiency in removing undesirable components while retaining essential flavor compounds. Additionally, environmental regulations pushing for more sustainable production practices have bolstered the adoption of membrane filtration technologies, as they significantly reduce water usage and waste.

Beer, holding the second-largest share, has seen steady adoption of membrane filtration driven by the need to achieve precise control over flavor profiles and maintain consistency in production. The technology’s ability to offer scalable solutions aligns well with the varied size and output requirements across breweries, from craft to large scale.

The segments of Bottled Water and Soft Drinks also show substantial integration of membrane filtration technologies, emphasizing the critical role of these systems in ensuring regulatory compliance with safety standards for portability and consumer safety. The expansion of these segments is closely tied to consumer trends favoring healthier lifestyle choices and the global increase in health awareness.

Key Market Segments

By Filtration Type

- Liquid Filtration

- Air Filtration

By System Technology

- Tangential Flow Filtration

- Ultrafiltration

- Nanofiltration

- Reverse Osmosis

- Microfiltration

- Normal Flow Filtration

- Ultrafiltration

- Nanofiltration

- Microfiltration

By Membrane Material

- Polymer

- Ceramic

- Glass Fiber

- Others

By Application

- Wine

- Beer

- Bottled Water

- Soft Drinks

- Juice

- Spirits

- Others

Growth Opportunities

Expansion into Developing Regions with Growing Beverage Industries

The global Beverage Membrane Filtration Market in 2023 presents significant growth opportunities through expansion into developing regions. These areas are experiencing rapid growth in their beverage industries, driven by increasing population, urbanization, and rising disposable incomes. As local consumers’ preferences shift towards more sophisticated and healthier beverage options, the demand for advanced filtration technology to ensure product quality and safety is expected to rise.

The market stands to gain considerably by entering these emerging markets, where the adoption of such technologies is just beginning to take off. By establishing a presence in these regions, companies can capitalize on first-mover advantages, potentially securing long-term growth and establishing strong relationships with local businesses as they develop their beverage production capabilities.

Development of More Energy-Efficient and Cost-Effective Filtration Technologies

In 2023, another critical growth opportunity for the Beverage Membrane Filtration Market lies in the development of more energy-efficient and cost-effective filtration technologies. As environmental sustainability becomes a more pressing global issue, the beverage industry is under increasing pressure to reduce its carbon footprint and operational costs. Innovations in membrane filtration that decrease energy usage and enhance operational efficiency can meet these needs, providing a compelling value proposition to beverage manufacturers.

Furthermore, reducing the overall cost of these systems could lower the entry barrier for smaller players and make the technology more accessible to a broader range of companies. This not only expands the market but also reinforces the industry’s commitment to sustainable practices, aligning with global trends towards environmental responsibility and cost efficiency.

Latest Trends

Rising Popularity of Non-Thermal Pasteurization Processes

In 2023, one of the most prominent trends in the global Beverage Membrane Filtration Market is the rising popularity of non-thermal pasteurization processes. Traditional thermal pasteurization, while effective, often compromises the nutritional value and flavor of beverages. Non-thermal methods, such as membrane filtration, offer a viable alternative by ensuring safety and extending shelf life without the use of heat.

This method preserves the natural taste and nutritional profile of beverages, aligning with consumer demand for minimally processed and healthier drink options. The increasing consumer awareness of the health benefits associated with these processes is driving the adoption of membrane filtration technologies. This trend not only broadens the application scope of membrane filtration in the beverage industry but also positions it as a key technology for future growth, particularly in sectors like juices, dairy alternatives, and functional beverages.

Adoption of Sustainable and Eco-Friendly Filtration Materials and Practices

Another significant trend shaping the Beverage Membrane Filtration Market in 2023 is the adoption of sustainable and eco-friendly filtration materials and practices. As environmental concerns continue to influence consumer choices and regulatory standards, the industry is shifting towards more sustainable practices. Companies are increasingly investing in membrane technologies that reduce water and energy consumption and utilize recyclable and less environmentally damaging materials.

This shift not only helps companies comply with stringent environmental regulations but also appeals to the growing segment of eco-conscious consumers. The market’s movement towards sustainability is not just a response to external pressures but also a strategic differentiation factor, enhancing brand reputation and competitive edge in a crowded market.

Regional Analysis

The North American Beverage Membrane Filtration Market holds a 41.2% share, valued at USD 1.5 billion.

The global Beverage Membrane Filtration Market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Each region presents unique growth prospects and challenges, influenced by local economic conditions, consumer preferences, and regulatory landscapes.

North America is the dominant region in the Beverage Membrane Filtration Market, holding a 41.2% market share and valued at USD 1.5 billion. The region’s leadership is attributed to advanced food and beverage manufacturing infrastructure, stringent safety standards, and a robust demand for premium beverages. The U.S. leads in adopting innovative filtration technologies to ensure beverage quality and safety.

Europe follows closely, driven by its strong regulatory framework which mandates high standards of quality and sustainability in beverage production. The region is seeing rapid adoption of membrane filtration technologies among craft breweries and wineries, which are striving to enhance product quality and operational efficiency.

The Asia Pacific region is poised for significant growth, fueled by increasing consumer demand for processed and functional beverages. Countries like China and India are becoming key markets due to rising urbanization and growing health awareness. This region benefits from improvements in manufacturing practices and a gradual shift towards more sophisticated technologies.

The Middle East & Africa, and Latin America are emerging markets in the beverage membrane filtration sector. These regions are experiencing gradual adoption driven by expanding local beverage industries and increasing awareness of health and safety standards. However, growth is tempered by economic variability and the slower pace of technological adoption.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

Key Players Analysis

In 2023, the global Beverage Membrane Filtration Market has continued to experience substantial growth, driven by the need for advanced filtration technologies that enhance product purity and comply with stringent regulatory standards. Within this dynamic landscape, several key companies have positioned themselves as leaders due to their innovative solutions and strategic market approaches.

Pentair and ALFA LAVAL have emerged as prominent players, offering a range of filtration solutions that cater to the diverse needs of the beverage industry, from wine to dairy products. Their technologies emphasize energy efficiency and reduced environmental impact, aligning with the global shift towards sustainability.

FUJIFILM Holdings Corporation and DuPont are notable for their advanced membrane technologies that deliver high filtration efficiency and reliability. These companies have leveraged their extensive material science expertise to develop membranes that not only meet but exceed the industry’s evolving demands for quality and safety.

3M and Eaton are distinguished by their robust product portfolios that include microfiltration and ultrafiltration solutions. These solutions are critical for ensuring the clarity and stability of beverages, a key consumer demand. Pall Corporation and Donaldson Company, Inc. further strengthen the market with their specialized filtration units that target specific contaminants, thereby enhancing beverage taste and shelf life.

MANN+HUMMEL, Koch Separation Solutions, and Sartorius stand out for their focus on scalability and customization, offering tailored solutions that support beverage manufacturers in optimizing their production processes.

PARKER HANNIFIN CORP and Hangzhou Cobetter Filtration Equipment Co., Ltd round out the field with their high-performance filtration systems designed for both large-scale manufacturers and craft producers, highlighting the market’s versatility.

Market Key Players

- Pentair

- ALFA LAVAL

- FUJIFILM Holdings Corporation

- DuPont

- 3M

- Eaton

- Pall Corporation

- Donaldson Company, Inc.

- MANN+HUMMEL

- Koch Separation Solutions

- Sartorius,

- PARKER HANNIFIN CORP

- Hangzhou Cobetter Filtration Equipment Co., Ltd

Recent Development

- In 2023, Sartorius experienced a challenging year 2023 in the Beverage Membrane Filtration sector, marked by a decline in sales revenue to €3,395.7 million, a decrease of 16.6% compared to previous years.

- In 2023, Pall’s CFS NEO systems, introduced as a scalable solution, combine cluster configurations that optimize both filtration and cleaning processes, which are crucial for maintaining the quality and freshness of beer. These systems operate efficiently across various scales, from 50 to 800 hl/h, and include features like automated operations and integrated pre-filters, which further streamline the brewing process.

Report Scope

Report Features Description Market Value (2023) USD 3.6 Billion Forecast Revenue (2033) USD 8.2 Billion CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Filtration Type(Liquid Filtration, Air Filtration), By System Technology((Tangential Flow Filtration, Ultrafiltration, Nanofiltration, Reverse Osmosis, Microfiltration), Normal Flow Filtration(Ultrafiltration, Nanofiltration, Microfiltration)), By Membrane Material(Polymer, Ceramic, Glass Fiber, Others), By Application(Wine, Beer, Bottled Water, Soft Drinks, Juice, Spirits, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pentair, ALFA LAVAL, FUJIFILM Holdings Corporation, DuPont, 3M, Eaton, Pall Corporation, Donaldson Company, Inc., MANN+HUMMEL, Koch Separation Solutions, Sartorius,, PARKER HANNIFIN CORP, Hangzhou Cobetter Filtration Equipment Co.,Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Global Beverage Membrane Filtration Market Size in 2023?The Global Beverage Membrane Filtration Market Size is USD 3.6 Billion in 2023.

What is the projected CAGR at which the Global Beverage Membrane Filtration Market is expected to grow at?The Global Beverage Membrane Filtration Market is expected to grow at a CAGR of 8.6% (2024-2033).

List the segments encompassed in this report on the Global Beverage Membrane Filtration Market?Market.US has segmented the Global Beverage Membrane Filtration Market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Filtration Type(Liquid Filtration, Air Filtration), By System Technology((Tangential Flow Filtration, Ultrafiltration, Nanofiltration, Reverse Osmosis, Microfiltration), Normal Flow Filtration(Ultrafiltration, Nanofiltration, Microfiltration)), By Membrane Material(Polymer, Ceramic, Glass Fiber, Others), By Application(Wine, Beer, Bottled Water, Soft Drinks, Juice, Spirits, Others)

List the key industry players of the Global Beverage Membrane Filtration Market?Pentair, ALFA LAVAL, FUJIFILM Holdings Corporation, DuPont, 3M, Eaton, Pall Corporation, Donaldson Company, Inc., MANN+HUMMEL, Koch Separation Solutions, Sartorius,, PARKER HANNIFIN CORP, Hangzhou Cobetter Filtration Equipment Co.,Ltd

Name the key areas of business for Global Beverage Membrane Filtration Market?The US, Canada, Mexico are leading key areas of operation for Global Beverage Membrane Filtration Market.

Beverage Membrane Filtration MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample

Beverage Membrane Filtration MarketPublished date: June 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Pentair

- ALFA LAVAL

- FUJIFILM Holdings Corporation

- DuPont

- 3M

- Eaton

- Pall Corporation

- Donaldson Company, Inc.

- MANN+HUMMEL

- Koch Separation Solutions

- Sartorius,

- PARKER HANNIFIN CORP

- Hangzhou Cobetter Filtration Equipment Co.,Ltd