Global Benzaldehyde Market Size, Share, And Business Benefits By Process (Toluene Oxidation Process, Toluene Chlorination Process, Others), By Derivative (Benzoic Acid, Sodium Benzoate, Benzyl Alcohol, Cinnamic Acid, Others), By Application (Food and Beverages, Pharmaceuticals, Agrochemicals, Cosmetics and Personal Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: November 2025

- Report ID: 164685

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

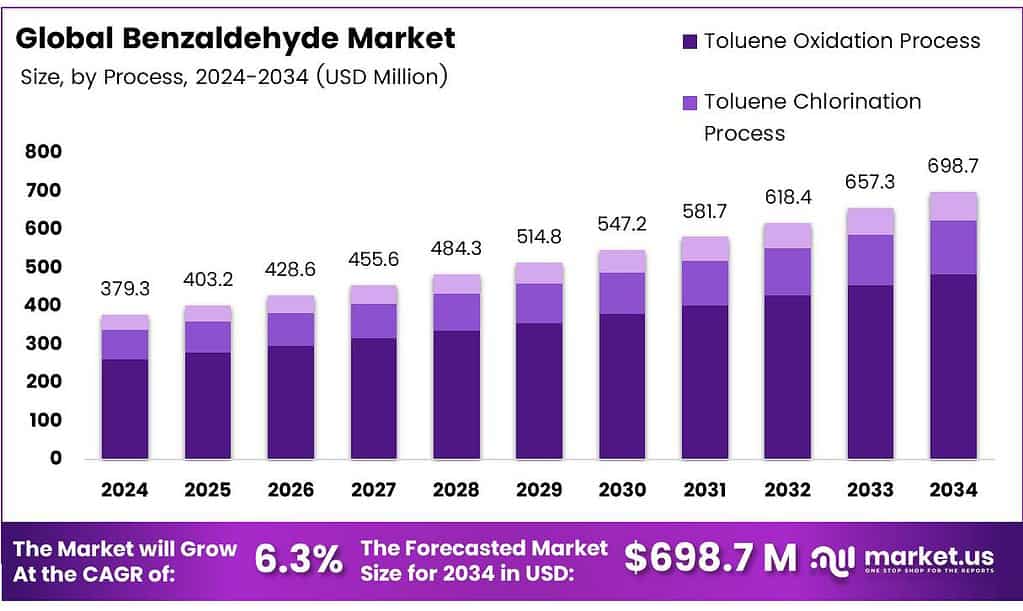

The Global Benzaldehyde Market size is expected to be worth around USD 698.7 Million by 2034, from USD 379.3 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Benzaldehyde (C₆H₅CHO) is the simplest aromatic aldehyde, consisting of a benzene ring bearing a single formyl substituent. It occurs naturally as the glycoside amygdalin, which is responsible for its characteristic bitter-almond odor. Synthetically prepared benzaldehyde is widely used in the manufacture of dyes, cinnamic acid, and other organic compounds, as well as in perfumes and flavouring agents. The USFDA classifies it as Generally Recognized as Safe (GRAS) for these applications.

Physically, benzaldehyde is a clear, colorless to yellow liquid with a flash point near 145 °F (63°C). It is denser than water, insoluble in it, and therefore sinks while readily penetrating soil to contaminate groundwater and nearby waterways. Its vapors are heavier than air, posing a primary environmental hazard; immediate steps must be taken to limit spread in case of release. Biologically and pharmacologically, benzaldehyde exhibits antitumor and antifungal activities, though high concentrations can cause respiratory and ocular irritation.

In the human body, it is rapidly metabolized to benzoic acid. It also functions as a flavouring agent, fragrance, odorant receptor agonist, plant metabolite, and inhibitor of enzymes such as nitrilase and triacylglycerol lipase. In catalytic studies, benzaldehyde hydrogenation is typically performed in a glass batch reactor equipped with a reflux condenser, mechanical stirrer, and external thermostating jacket.

- The palladium catalyst 4 mg Pd is first suspended in 100 ml ethanol and pretreated under H₂ flow 30 ml/min at 80°C for 1 hour. After cooling to 20°C, 1.0 ml benzaldehyde and 0.3 ml n-octane internal standard are injected. The reaction proceeds at atmospheric pressure under hydrogen flow with vigorous stirring at 1500 rpm. Progress is monitored by gas chromatography of withdrawn samples, with preliminary tests confirming the absence of external diffusion limitations under varying stirring conditions.

Key Takeaways

- The Global Benzaldehyde Market is expected to reach USD 698.7 Million by 2034 from USD 379.3 Million in 2024, growing at a 6.3% CAGR between 2025 and 2034.

- The Toluene Oxidation Process dominated with a 69.4% share, favored for purity and large-scale production.

- Benzoic Acid led the derivative segment with a 38.8% share, driven by demand in food and pharmaceutical uses.

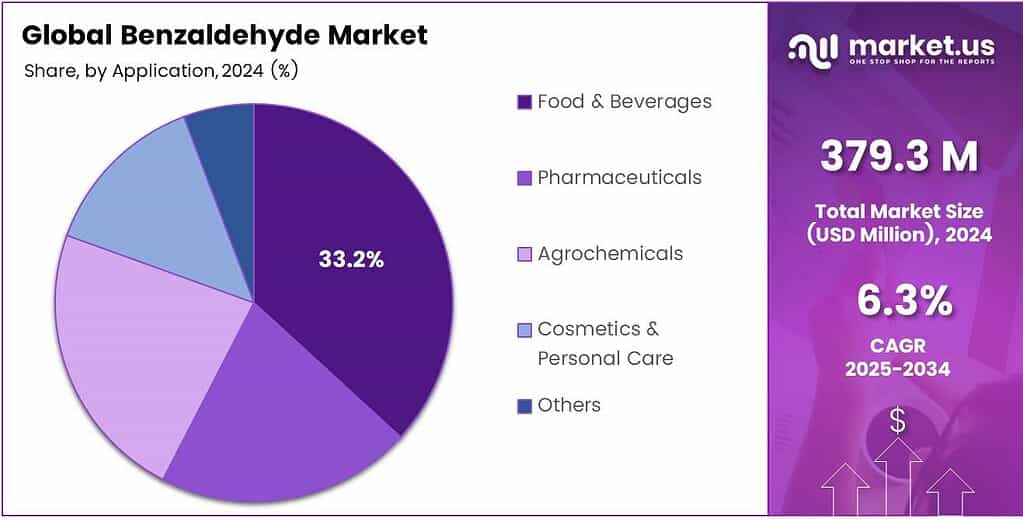

- The Food and Beverages sector accounted for 33.2% of market share due to benzaldehyde’s almond-like flavoring role.

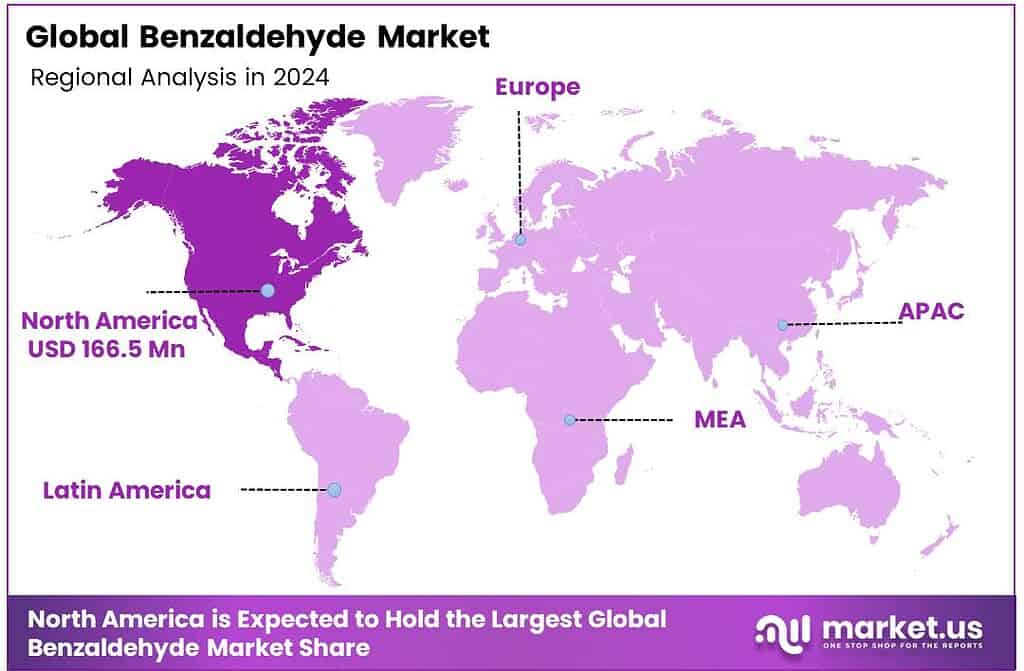

- North America emerged as the leading region, holding a 43.9% share worth USD 166.5 million in 2024.

By Process Analysis

Toluene Oxidation Process dominates with 69.4% due to its efficiency in producing high-purity, food-grade benzaldehyde at scale.

In 2024, the Toluene Oxidation Process held a dominant market position in the By Process segment of the Benzaldehyde Market, with a 69.4% share. This method leads globally because it delivers chlorine-free benzaldehyde, ideal for flavors and pharmaceuticals. Moreover, it supports large-volume production while meeting strict purity standards.

Additionally, advancing catalysts have boosted yields, making it cost-effective. Consequently, manufacturers prefer it for sustainable operations. Meanwhile, the Toluene Chlorination Process remains relevant for specific industrial grades. However, it faces challenges from environmental regulations due to chlorine byproducts. Despite lower shares, it offers high selectivity in controlled settings.

Yet, shifting preferences toward greener alternatives limit its growth. Others include emerging bio-based or novel catalytic methods. Though minor, they gain traction for eco-friendly appeals. Furthermore, research focuses on reducing energy use. Thus, these alternatives represent future potential in niche markets.

By Derivative Analysis

Benzoic Acid dominates with 38.8% due to its critical role as a preservative and intermediate in multiple industries.

In 2024, Benzoic Acid held a dominant market position in the Benzaldehyde Market, with a 38.8% share. Benzoic Acid commands the segment through widespread use in food preservation and pharmaceuticals. Additionally, it serves as a building block for plastics and dyes.

Rising demand for processed foods further drives its consumption. Hence, stable supply chains solidify their leadership. Sodium Benzoate follows closely as a popular preservative derivative. It excels in acidic beverages and cosmetics for shelf-life extension.

Moreover, regulatory approvals enhance its appeal. Transitioning from benzoic acid, it offers water solubility advantages. Benzyl Alcohol finds applications in solvents and fragrances. Although smaller in share, it grows in personal care products. Furthermore, its mild antiseptic properties boost pharmaceutical uses. Overall, versatility supports steady demand.

By Application

Food and Beverages dominate with 33.2% due to benzaldehyde’s essential flavoring and preservation functions.

In 2024, Food and Beverages held a dominant market position in the Benzaldehyde Market, with a 33.2% share. Food and Beverages lead owing to benzaldehyde’s almond-like flavor in cherries and baked goods. Moreover, derivatives like benzoates prevent microbial growth.

Increasing processed food consumption worldwide fuels this segment. Thus, it remains indispensable for natural taste enhancement. Pharmaceuticals utilize benzaldehyde in drug synthesis and intermediates. It supports anti-fungal treatments and API production. Additionally, high purity requirements drive specialized demand.

Shifting to health-focused products aids innovation. Agrochemicals employ it in pesticide and herbicide formulations. Though narrower, it contributes to crop protection efficiency. Furthermore, growing agriculture needs to sustain its role. Consequently, it ensures effective intermediate supply.

Key Market Segments

By Process

- Toluene Oxidation Process

- Toluene Chlorination Process

- Others

By Derivative

- Benzoic Acid

- Sodium Benzoate

- Benzyl Alcohol

- Cinnamic Acid

- Others

By Application

- Food and Beverages

- Pharmaceuticals

- Agrochemicals

- Cosmetics and Personal Care

- Others

Emerging Trends

Compliance-first, bio-lean reformulation across flavors, fragrances, and cosmetics

Benzaldehyde is riding a very practical trend: brand owners are reformulating to meet tougher, science-based safety standards while keeping natural cues. Food and beverage players lean on long-standing safety assessments: JECFA maintains a group ADI of 0–5 mg/kg body-weight (as benzoic acid equivalents) for benzaldehyde and related aromatics, which keeps the molecule squarely in the toolkit for flavorists when used responsibly.

In Europe, alignment with Regulation (EC) on flavorings continues to shape how benzaldehyde is specified, labeled, and used, pushing suppliers to document purity, origins, and technical justification for inclusion. The rule’s focus on high-level consumer protection has nudged companies toward cleaner specs, traceability, and conservative use levels, sustaining demand for well-characterized grades.

- Finally, safety dossiers are becoming more granular. RIFM’s material assessment references regional tonnage-band use 10–100 and 100–1,000 and risk characterization ratios below 1, which, while conservative, help brand owners justify continued use under modern safety cases. This evidence-first posture isn’t about hype—it’s a quiet but durable trend that rewards suppliers who can prove fitness-for-use, offer origin transparency, synthetic or natural, and support fast regulatory audits.

Drivers

Regulatory acceptance in food, plus broad utility as a compliant building block

In the U.S., the FDA’s CFSAN listing for benzaldehyde keeps a clear line of sight to GRAS determinations used by industry, which, together with Codex/JECFA specs, supports cross-border recipe portability and multi-site manufacturing. That harmonization reduces re-formulation risk and speeds commercial launches, especially for global SKUs.

Beyond flavor, policy, and tox profiles also enable use as an intermediate for downstream chemistries, benzoates, benzyl alcohol derivatives, and, in crop-protection formulations, as inert components under EPA frameworks where numerous inert ingredients are exempt from tolerance based on low-toxicity screens. That pathway simplifies registration packages for certain end-use products and strengthens the baseline offtake for compliant grades of benzaldehyde.

Europe’s umbrella flavoring regulation keeps the playing field predictable; suppliers who meet its documentation and purity expectations become preferred partners. Together, these approvals and standards form a sturdy demand floor: food and fragrance keep buying, and industrial customers value a molecule that can pass strict audits without derailing compliance budgets.

Restraints

Tightening EHS expectations raises handling costs and narrows operating windows

The restraint is not headline-grabbing; environmental, health, and safety (EHS) requirements are tightening across plants and logistics, and benzaldehyde is not exempt. OECD SIDS data show it is readily biodegradable, yet atmospheric photodegradation half-life and multimedia partitioning 29% air, 68.8% water, 1.8% soil, 4% sediment mean facilities must still manage off-gassing, wastewater, and odour at the fence line, each item adding equipment and monitoring costs.

- Aquatic toxicity triggers conservative discharge design. An LC50 for fish of 1.1 mg/L underscores the need for effective containment and treatment, particularly for batch operations with variable loadings. This isn’t about banning the molecule; it’s about paying for the controls, closed transfer, carbon polishing, and secondary containment that keep emissions and effluents comfortably within permits.

Emergency-planning references remind operators that benzaldehyde has a combustible flash point around 62–63 °C and can pose environmental hazards if spilled, again pointing toward higher insurance, training, and response-readiness costs for distributors and converters. These cumulative EHS burdens don’t kill demand, but they compress margins for small sites and raise the minimum efficient scale for compliant production and packaging.

Opportunity

Bio-aromatic routes: tapping lignin and spice value chains for natural benzaldehyde

The standout opportunity is bio-aromatic sourcing. IEA Bioenergy estimates that 50–70 million tonnes of lignin are produced annually, with >95% still burned onsite at pulp mills, an enormous underused carbon pool. Redirecting even a sliver into aromatic platforms can yield benzaldehyde or its direct precursors, offering a drop-in narrative with lower Scope 3 intensity for home-care, flavor, and fragrance customers.

- Scale is plausible: IEA Bioenergy illustrates that a single lignocellulosic ethanol plant producing 250 million L/year could co-generate roughly 215,000 t/year of lignin, anchoring feedstock for regional biorefinery clusters. As advanced biofuels scale under national mandates, the co-product lignin stream becomes a strategic aromatic feedstock rather than boiler fuel.

Combine these streams with maturing stewardship frameworks (IFRA/RIFM, JECFA specs) and you get a differentiated offering: certified origin, audited safety, and measurable carbon gains versus purely petrochemical routes. The prize is premium pricing in personal care and flavors, plus insulation from crude-derived volatility as pulp mills and bioethanol plants lock in long-term residue contracts.

Regional Analysis

North America leads with a 43.9% share and a 166.5 Million market value.

North America stands as the dominating region in the global Benzaldehyde market, accounting for 43.9% share valued at approximately USD 166.5 million in 2024. The region’s dominance is anchored by its well-established pharmaceutical, fragrance, and agrochemical sectors, which collectively drive substantial demand for benzaldehyde as a key intermediate.

The United States, in particular, is a major producer and consumer, with strong utilization in the synthesis of cinnamic acid, benzyl alcohol, and flavoring compounds. The U.S. Food and Drug Administration (FDA) supports the controlled use of benzaldehyde as a flavoring agent, reinforcing its presence in food and beverage formulations.

The Environmental Protection Agency (EPA) regulations promoting sustainable and safer chemical production have encouraged regional manufacturers to shift toward bio-based benzaldehyde derived from natural toluene and benzoic acid sources. Canada’s expanding agrochemical industry also contributes to market strength, with benzaldehyde widely used in pesticide intermediates and crop protection chemicals.

The regional market further benefits from rising investments in specialty chemical production by major companies such as Eastman Chemical Company and LANXESS, which continue to expand synthesis capacities across the U.S. Gulf Coast. With increasing demand from aroma chemicals, pharmaceutical precursors, and synthetic resins, North America is expected to maintain its leadership over the next decade.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

LANXESS AG is a dominant force in the global benzaldehyde market. Its strength lies in large-scale, high-purity production, primarily serving the agrochemical and pharmaceutical industries as a critical intermediate. With a robust global distribution network and significant investment in research and development, LANXESS maintains a competitive edge through consistent quality and technical expertise, catering to the stringent demands of multinational industrial clients and reinforcing its position as a top-tier supplier.

Kadillac Chemicals has carved a significant niche in the benzaldehyde market. It strategically focuses on serving the flavor and fragrance industries, providing high-purity grades essential for food and personal care products. The company leverages cost-effective manufacturing and a strong regional presence to compete effectively. Its agility and specialization in downstream aromatic derivatives make it a key supplier for manufacturers seeking reliable.

GACL is a major Indian public sector enterprise and a key domestic producer of benzaldehyde. Its significant advantage is backward integration, as it produces benzaldehyde from toluene, a raw material it manufactures in-house. This vertical integration ensures stable supply and cost competitiveness. GACL primarily supplies the domestic market, serving various industrial sectors and strengthening India’s self-reliance in this essential chemical intermediate through its large-scale.

Top Key Players in the Market

- LANXESS AG

- Kadillac Chemicals Pvt. Ltd.

- Gujarat Alkalies and Chemicals Limited

- Shimmer Chemicals Pvt. Ltd.

- Valtris Specialty Chemicals

- Axxence Aromatic GmbH

- Ganesh Benzoplast Ltd.

Recent Developments

- In 2025, LANXESS transitioned its Botlek site in the Netherlands to exclusively use low-emission electricity for manufacturing benzoic acid, benzaldehyde, benzyl alcohol, and sodium benzoate, eliminating fossil fuels from the process.

- In 2025, GACL, a Government of Gujarat-promoted company, commissioned India’s largest Chlorotoluenes plant at Dahej, marking its entry as a major benzaldehyde producer.

Report Scope

Report Features Description Market Value (2024) USD 379.3 Million Forecast Revenue (2034) USD 698.7 Million CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Toluene Oxidation Process, Toluene Chlorination Process, Others), By Derivative (Benzoic Acid, Sodium Benzoate, Benzyl Alcohol, Cinnamic Acid, Others), By Application (Food and Beverages, Pharmaceuticals, Agrochemicals, Cosmetics and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape LANXESS AG, Cadillac Chemicals Pvt. Ltd., Gujarat Alkalies and Chemicals Limited, Shimmer Chemicals Pvt. Ltd., Valtris Specialty Chemicals, Axxence Aromatic GmbH, Ganesh Benzoplast Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- LANXESS AG

- Kadillac Chemicals Pvt. Ltd.

- Gujarat Alkalies and Chemicals Limited

- Shimmer Chemicals Pvt. Ltd.

- Valtris Specialty Chemicals

- Axxence Aromatic GmbH

- Ganesh Benzoplast Ltd.