Global Behavioral Threat Analysis Market Size, Share Analysis Report By Component (Software, Services), By Deployment (Cloud-Based, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Application (Fraud Detection & Prevention, Risk & Compliance Management, Identity & Access Management (IAM), Customer Experience Management, Insider Threat Detection, Cybersecurity & Threat Intelligence, Others), By Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Government & Defense, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150511

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

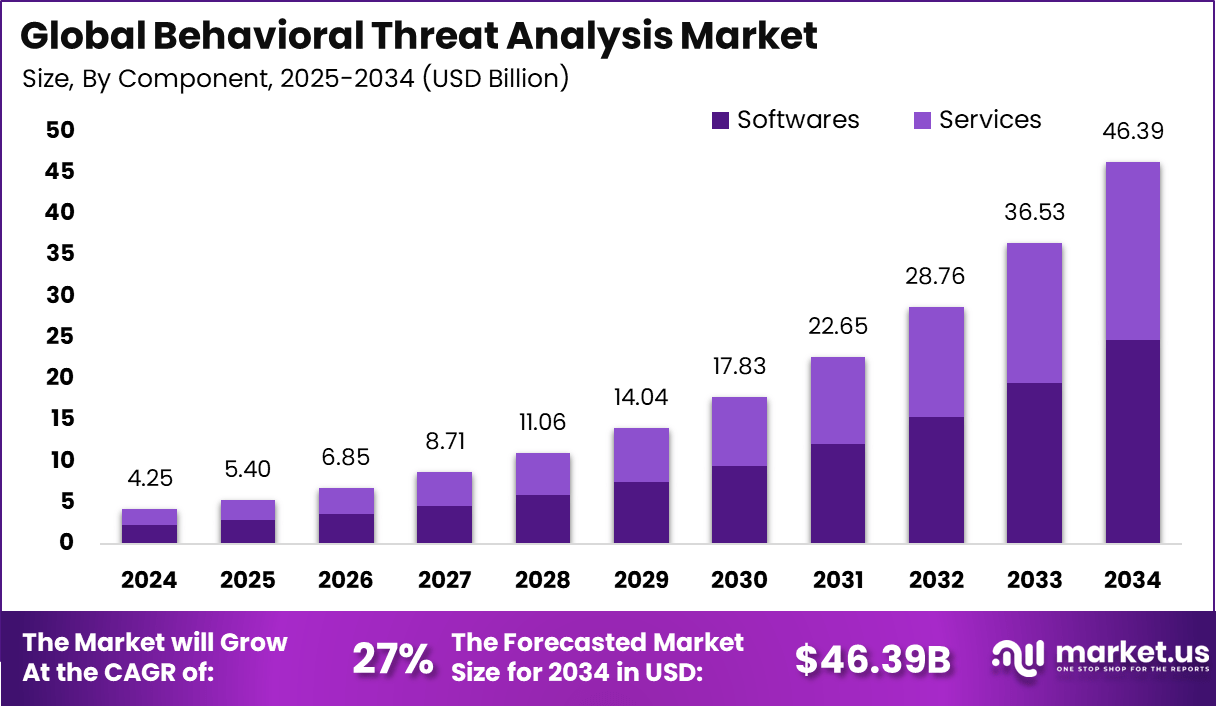

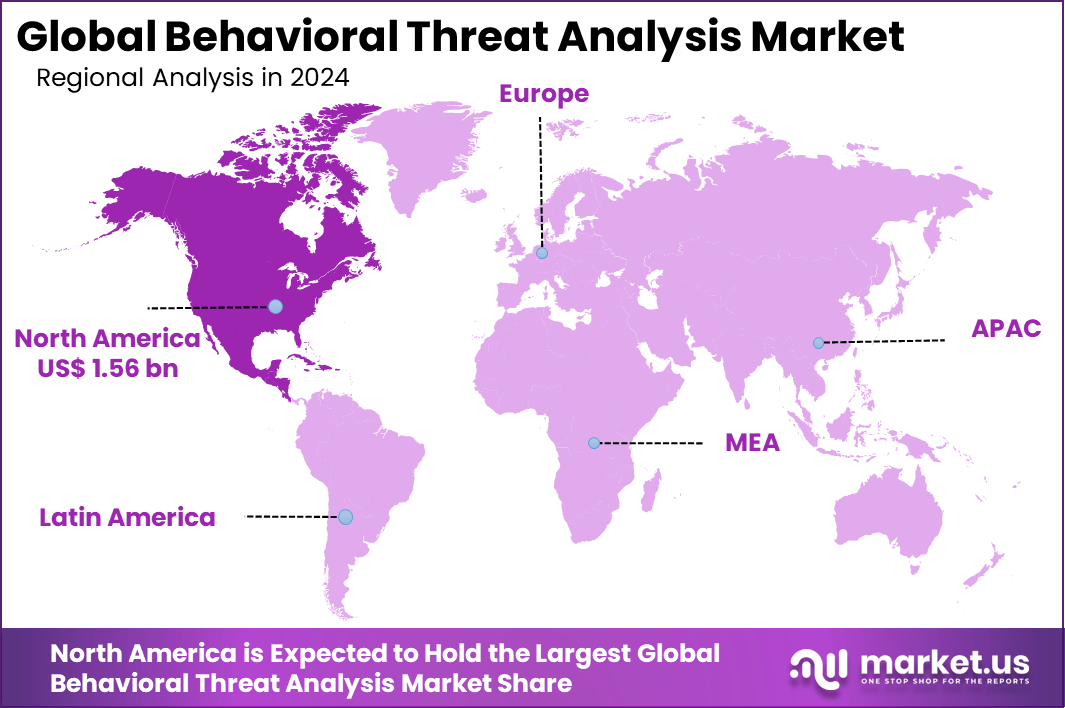

The Global Behavioral Threat Analysis Market size is expected to be worth around USD 46.39 billion by 2034, from USD 4.25 billion in 2024, growing at a CAGR of 27% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.8% share, holding USD 1.56 billion in revenue.

The Behavioral Threat Analysis market has been experiencing sustained expansion as cybersecurity risks evolve. This growth can be attributed to robust demand for real-time anomaly detection, enabled by advances in machine learning and AI that empower proactive defense strategies. Organizations are increasingly recognizing the limitations of legacy perimeter security, making behavior-based monitoring an essential component for detecting malicious patterns in user and entity behavior.

One of the primary drivers is the increasing prevalence of internal (insider) threats. Remote and hybrid work models have expanded the attack surface and allowed subtle malicious activities to persist undetected. Additionally, stricter regulatory landscapes and a heightened emphasis on data privacy compel companies to invest in intelligent behavioral detection systems. These systems support compliance efforts and bolster organizational resilience.

Demand for behavioral threat analysis solutions is rising across multiple sectors, especially finance, healthcare, and government. These industries prioritize protection of sensitive data and are substantial early adopters . The increasing costs and sophistication of cyberattacks have elevated corporate awareness and budget allocation towards preventive technologies. The resulting demand reflects a strategic pivot from cost-centric to risk-aware security investments.

For instance, in April 2025, at the RSA Conference 2025, OpenText showcased its latest end-to-end cybersecurity innovations, emphasizing AI-driven behavioral threat detection and response capabilities. The company introduced enhancements to its Core Threat Detection & Response (Core TDR) platform, integrating real-time behavioral analytics to better identify insider threats and advanced attack patterns.

Key Insights

- The Software segment led the market by accounting for 53.4% of the global revenue, driven by increasing integration of real-time analytics in enterprise security systems.

- Cloud-based deployment captured a dominant 68.3% share due to its scalability, remote access, and reduced infrastructure costs.

- Large Enterprises held a majority stake with 58.1% market share, reflecting their greater investment in behavioral analytics to mitigate sophisticated cyber threats.

- The Fraud Detection & Prevention application emerged as the top use case, commanding 34.9% share amid rising digital transaction volumes and identity fraud risks.

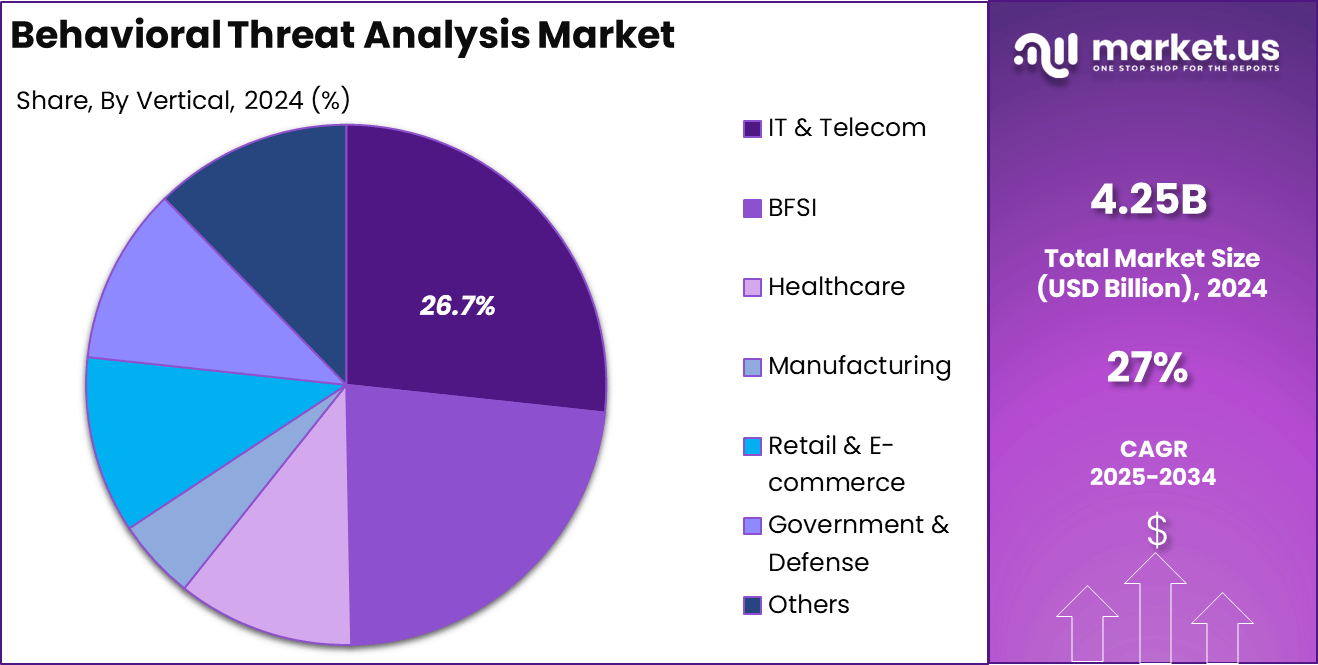

- IT & Telecom sector remained the largest vertical, holding 26.7% share, propelled by growing insider threats and endpoint monitoring requirements.

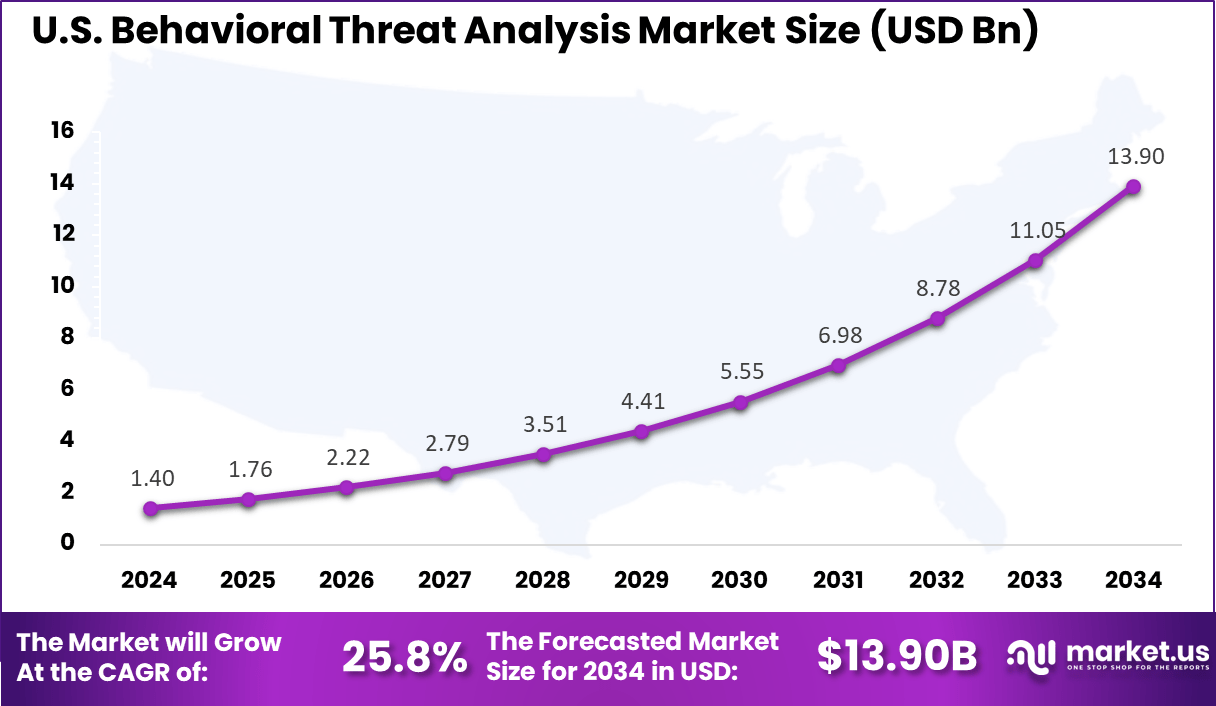

- The U.S. market was valued at USD 1.40 Billion in 2024, underscoring robust adoption across government, banking, and critical infrastructure sectors.

- North America led regionally, with over 36.8% of global market share, supported by advanced cybersecurity frameworks and high digitalization.

Analysts’ Viewpoint

The convergence of AI and machine learning has been instrumental in adoption. By integrating user and entity behavior analytics (UEBA) with SIEM (Security Information and Event Management), businesses achieve automated threat detection and response capabilities. Cloud deployment models further enhance scalability and real-time analysis.

Adoption is gaining traction as these technologies evolve to support predictive analytics, reducing incident response times and manual interventions. Predictive behavioral platforms identify anomalies before they escalate into full-scale incidents, reducing cleanup costs and downtime. They also foster operational efficiency by minimizing false positives via context-aware analysis.

Beyond security, these systems improve customer and employee insights, helping enterprises to personalize experiences and optimize workflows. These dual-use advantages enhance their value proposition across departments. The sector is attracting interest from investors and venture capital firms due to its projected high double‑digit growth.

Emerging opportunities lie in specialized platforms that combine behavioral intelligence with automation and cloud-native architectures. Niche segments – such as insider threat detection for regulated industries, and predictive analytics for cyber‑physical systems – are also gaining attention.

U.S. Market Size

The market for Behavioral Threat Analysis within the U.S. is growing tremendously and is currently valued at USD 1.40 billion, the market has a projected CAGR of 25.8%. The U.S. Behavioral Threat Analysis market is surging due to rising cyber threats, insider attacks, and rapid digital transformation. AI-driven analytics are increasingly vital for detecting anomalies, preventing fraud, and meeting strict compliance standards.

For instance, In April 2025, the DHS highlighted the importance of BTAM teams in preventing targeted violence. These teams analyze behavioral signs to detect risks early and provide support, reinforcing their role in protecting public safety through proactive threat assessment.

In 2024, North America held a dominant market position in the Global Behavioral Threat Analysis Market, capturing more than a 36.8% share, holding USD 1.56 billion in revenue. North America leads the global Behavioral Threat Analysis market due to its advanced tech infrastructure, widespread AI/ML adoption, and strong R&D investment.

The presence of major tech firms, strict data privacy regulations, and growing insider threat concerns drive demand for real-time behavioral analytics. This proactive security focus solidifies the region’s dominant position in the global market.

For instance, In January 2024, Safer Schools Together launched a groundbreaking Behavioral and Digital Threat Assessment (BDTA) Management Model aimed at improving threat detection and intervention in educational settings. The model integrates behavioral analysis with digital risk signals to provide a comprehensive approach to early threat identification.

Component Analysis

In 2024, the Software segment held a dominant market position, capturing more than a 53.4% share. This leadership can be attributed to the extensive deployment of Behavior Analytics and User & Entity Behavior Analytics (UEBA) solutions across diverse industries such as banking, healthcare, and technology.

These software platforms enable real-time monitoring, predictive risk scoring, and automated alerting -capabilities that are critical in detecting and mitigating advanced cyber threats and insider risks. The scalability and continuous updates offered by cloud-native deployments further reinforced software dominance, as organizations prioritized agility and proactive threat intel in response to increasingly sophisticated cyberattacks

For instance, in May 2025, GASROE partnered with Raptor Technologies to launch a statewide Behavioral Threat Assessment methodology for Georgia schools. This initiative combines Raptor’s advanced software platform with structured behavioral analytics to identify, assess, and manage potential threats in educational environments. The collaboration demonstrates how technology-driven solutions are enhancing safety protocols by enabling data-informed, real-time threat assessment across school systems.

Deployment Analysis

In 2024, the Cloud‑Based deployment segment held a dominant market position, capturing more than a 68.3% share of the global behavioral threat analysis market. This commanding lead is attributed to the inherent scalability, flexibility, and cost efficiency offered by cloud environments.

Organizations benefited from the ability to deploy behavioral threat analysis solutions rapidly without substantial upfront infrastructure investments, enabling prompt responses to evolving threat landscapes. The leadership of the cloud segment is further reinforced by its seamless integration capabilities with advanced technologies such as artificial intelligence and machine learning.

For instance, in March 2025, Everfox and General Dynamics Information Technology (GDIT) collaborated to deliver a cloud-based insider threat solution that leverages behavioral threat analysis to enhance organizational security. This partnership highlights the growing preference for cloud-based behavioral analytics to detect insider threats in real-time and across distributed systems.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 58.1% share of the Global Behavioral Threat Analysis Market. This dominance is due to their extensive financial and technical resources, which enable investment in sophisticated behavioral analytics solutions and ongoing security operations.

Large enterprises face high risks from insider threats, complex digital environments, and regulatory compliance requirements, making advanced behavioral threat analysis essential for safeguarding sensitive data and maintaining operational resilience.

For instance, In June 2025, Arkose Labs launched an advanced Threat Actor Behavior Analysis solution designed to help large enterprises counter rising cyber threats. By leveraging behavioral intelligence, the platform identifies and disrupts malicious actions through the analysis of threat actor patterns. This innovation highlights the growing reliance on behavioral analytics to safeguard critical assets and ensure business resilience.

Application Analysis

In 2024, Fraud Detection & Prevention segment held a dominant market position, capturing more than a 34.9% share of the global behavioral threat analysis market. This leadership was supported by the growing prevalence of digital transactions and the parallel increase in fraudulent activities.

Behavioral analytics has emerged as a critical component in fraud prevention, thanks to its ability to monitor real-time user interactions and detect deviations from established behavioral patterns, thereby enabling organizations to intervene before losses occur.

The Fraud Detection & Prevention segment holds a prominent position due to its critical role in high-risk sectors like banking, finance, telecom, and e-commerce, where even small breaches can lead to major financial and reputational losses. Growing regulatory pressure and strict compliance demands have further accelerated the adoption of advanced behavior monitoring solutions, making them essential for organizational risk management.

For Instance, in May 2025, at RSA 2025, Protectt.ai unveiled an AI-powered fraud prevention solution that integrates device intelligence with behavioral analytics to detect and mitigate threats in real-time. Designed to combat increasingly sophisticated cybercrime, the platform enables financial institutions and enterprises to identify fraud patterns by analyzing user behavior and device anomalies.

Vertical Analysis

In 2024, IT & Telecom segment held a dominant market position, capturing more than 26.7% share of the global behavioral threat analysis market. This leadership reflects the vertical’s inherent reliance on data-driven operations and its infrastructure complexity.

Telecommunication networks generate vast, high‑velocity data streams, while IT providers support extensive cloud services – creating critical need for real‑time behavioral monitoring. Consequently, behavioral threat analysis solutions are extensively deployed across this vertical to secure networks, detect anomalies, and optimize service delivery at scale .

The segment’s prominence is also supported by rapid technological advancements such as edge computing and 5G. These innovations have expanded the attack surface and magnified network complexity, requiring behavioral analytics tools capable of analyzing distributed data across endpoints and network nodes.

For instance, in June 2025, Qmulos launched Q-Behavior Analytics and Audit (Q-BA²), an AI-driven user behavior analytics solution designed to detect and mitigate insider threats within IT and telecom environments. By integrating advanced behavioral threat analysis with its Q-Audit platform, Qmulos enhances real-time monitoring and risk detection capabilities.

Key Market Segments

By Component

- Software

- Services

By Deployment

- Cloud-Based

- On-premises

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By Application

- Fraud Detection & Prevention

- Risk & Compliance Management

- Identity & Access Management (IAM)

- Customer Experience Management

- Insider Threat Detection

- Cybersecurity & Threat Intelligence

- Others

By Vertical

- IT & Telecom

- BFSI

- Healthcare

- Manufacturing

- Retail & E-commerce

- Government & Defense

- Others

Market Dynamics

Aspect Description Emerging Trends Adoption of AI‑driven real‑time behavioral anomaly detection is gaining momentum. Advanced deep learning frameworks, such as evidential clustering, are being deployed to detect insider threats with higher precision and fewer false positives Driver A significant driver is the rise in insider-originated breaches, with research showing that approximately 82% of data breaches involve human factors. This emphasizes the need for behavior-based detection capabilities. Restraint Data privacy and regulatory concerns limit behavioral monitoring adoption. Employees and regulators raise alarms about surveillance, potentially exposing organizations to legal risks and compliance costs . Opportunity There is a strong opportunity for modular, cloud‑based SaaS offerings that deliver plug‑and‑play behavioral insights. SMEs and mid‑market firms, which often lack full-scale SIEM deployments, are ripe for tailored, lower‑cost behavioral tools. Challenge A key challenge lies in the dynamic, evolving nature of insider threats. Attackers continuously adjust tactics, and models trained on historical behavior may fail to detect new patterns without ongoing retraining and platform adaptability. Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Qualtrics has reinforced its position in experience and behavioral analytics by launching AI‑driven “Experience Agents” and expanding its Market Intelligence suite in 2025. At X4 2025, the company introduced Edge Audiences, which uses synthetic panels to cut survey costs by up to 70% while accelerating insight generation.

IBM Corporation has significantly enhanced its security portfolio with the introduction of ATOM (Autonomous Threat Operations Machine) in April 2025, which leverages agentic AI for automated threat triage, investigation, and remediation. In parallel, the 2025 X‑Force Threat Intelligence Index highlighted a sharp increase in credential theft, prompting IBM to embed predictive analytics in its X‑Force Predictive Threat Intelligence platform.

OpenText Corporation has advanced its cybersecurity offerings in 2025 with the rollout of Core Threat Detection and Response, a cloud‑based, AI‑powered platform that enhances XDR capabilities via behavioral and anomaly analytics. At RSA 2025, the firm emphasized its integration of generative AI across threat detection, identity management, and Microsoft endpoints.

Top Key Players in the Market

- Qualtrics

- Company Overview

- Product Portfolio

- Financial Performance

- Recent Developments/Updates

- Strategic Overview

- SWOT Analysis

- IBM Corporation

- Open Text Corporation

- Cisco Systems, Inc.

- Oracle

- Zoho Corporation Pvt. Ltd.

- Securonix

- Fortinet, Inc.

- Splunk Inc.

- Adobe Inc.

- Others

Note (*): Similar analysis will be provided for other companies as well.

Recent Developments

- In April 2025, Securonix introduced its GenAI Agentic Mesh within the EON platform, a major innovation aimed at transforming security operations. The solution employs generative AI agents to automate threat detection, investigation, and response, significantly reducing analyst workload and accelerating decision-making. This launch highlights Securonix’s commitment to advancing behavioral threat analysis by integrating AI-driven automation into modern security operations centers (SOCs).

- In May 2025, Zoho advanced its enterprise security stack by integrating behavioral analytics and AI-powered threat detection into its platform. The enhancements include tools for identifying phishing attempts, unauthorized access, and anomalous behavior patterns across user activities. This evolution reflects Zoho’s strategy to strengthen organizational defenses through native security features tailored for SMBs and large enterprises alike.

Report Scope

Report Features Description Market Value (2024) USD 4.25 Bn Forecast Revenue (2034) USD 46.39 Bn CAGR (2025-2034) 27% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment (Cloud-Based, On-premises), By Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs), By Application (Fraud Detection & Prevention, Risk & Compliance Management, Identity & Access Management (IAM), Customer Experience Management, Insider Threat Detection, Cybersecurity & Threat Intelligence, Others), By Vertical (IT & Telecom, BFSI, Healthcare, Manufacturing, Retail & E-commerce, Government & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Qualtrics, IBM Corporation, Open Text Corporation, Cisco Systems, Inc., Oracle, Zoho Corporation Pvt. Ltd., Securonix, Fortinet, Inc., Splunk Inc., Adobe Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Behavioral Threat Analysis MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Behavioral Threat Analysis MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Qualtrics

- IBM Corporation

- Open Text Corporation

- Cisco Systems, Inc.

- Oracle

- Zoho Corporation Pvt. Ltd.

- Securonix

- Fortinet, Inc.

- Splunk Inc.

- Adobe Inc.

- Others