Global Beer Line Cooling System Market Size, Share, Growth Analysis By System Type (Glycol-based System, Air-cooled System), By Application (Bars, Hotels, Restaurants, Household), By End-Use (Draft Beer, Bottled Beer), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171267

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

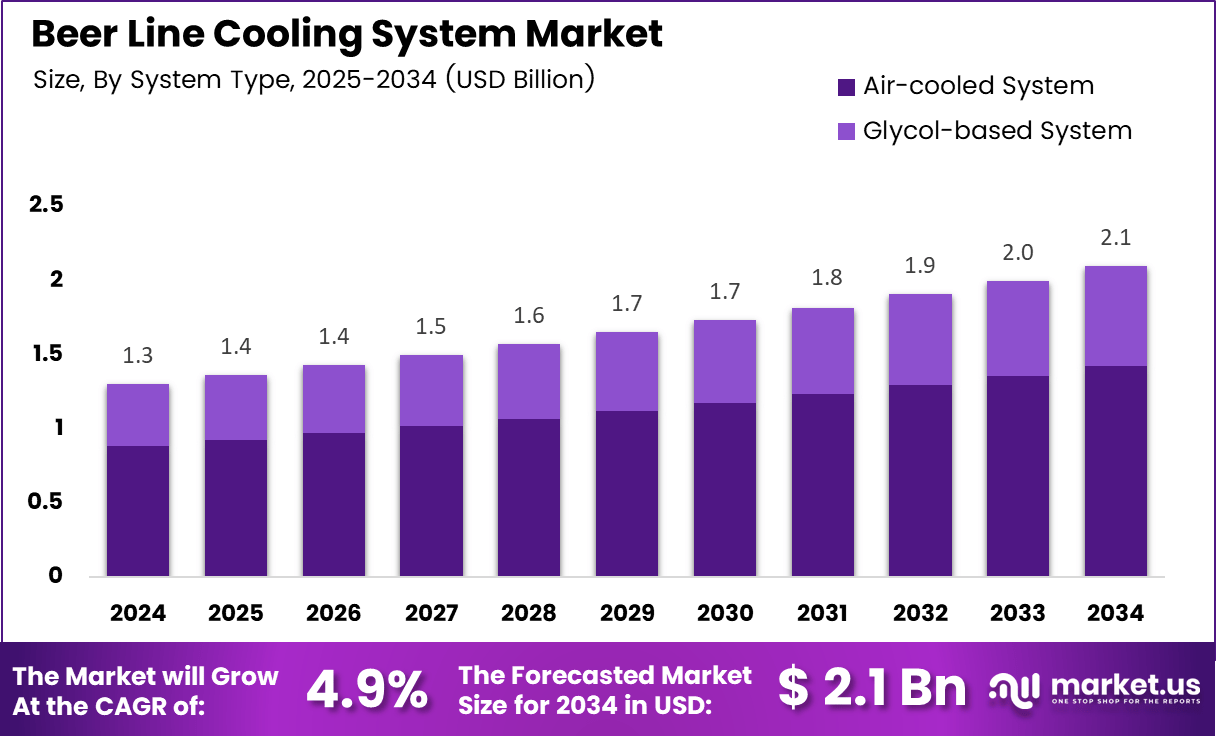

The Global Beer Line Cooling System Market size is expected to be worth around USD 2.1 billion by 2034, from USD 1.3 billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Beer Line Cooling System Market refers to equipment designed to maintain optimal beer temperature from keg to tap in draft dispensing environments. These systems play a critical role in preserving flavor integrity, reducing foam loss, and supporting consistent beverage quality across commercial hospitality settings, including bars, restaurants, hotels, and entertainment venues.

From an analyst perspective, this market continues to expand as on premise alcohol consumption stabilizes and premium draft offerings gain traction. Moreover, operators increasingly recognize temperature control as a revenue protection measure. As a result, beer line cooling systems are now viewed as essential infrastructure rather than optional bar accessories.

Growth is further reinforced by the rise of long draw draft systems in large venues such as stadiums and high volume outlets. Consequently, demand for reliable cooling solutions capable of maintaining stable temperatures over extended distances increases. In parallel, system upgrades accompany broader investments in bar automation and beverage dispensing efficiency.

Sustainability driven opportunities also influence purchasing decisions. Food safe, biodegradable glycol antifreeze solutions align with evolving environmental expectations and regulatory oversight. Therefore, operators prefer systems that balance performance with reduced chemical risk and lower environmental impact, supporting long term compliance and operational responsibility.

Government influence remains indirect but meaningful through hospitality infrastructure development, food safety enforcement, and energy efficiency standards. Additionally, regulatory emphasis on hygienic dispensing environments encourages replacement of outdated systems. This regulatory landscape supports steady aftermarket demand for modern beer line cooling installations.

Technologically, barrel storage glycol systems remain central due to consistent thermal performance. These systems cool glycol baths to 28–31°F, enabling beer to reach the tap at an ideal 36–38 °F serving temperature. This precise control is critical for maintaining carbonation balance and preventing quality degradation during dispensing.

Operational performance data highlights the commercial importance of cooling accuracy. Nearly 90% of draft beer foaming issues are temperature related, emphasizing the financial impact of improper thermal management. Consequently, beer line cooling systems directly support waste reduction, customer satisfaction, and improved profit margins.

Overall, the Beer Line Cooling System Market demonstrates stable, service driven growth. As hospitality operators prioritize quality consistency, regulatory alignment, and sustainable operations, investment in advanced beer line cooling infrastructure remains a practical and strategically sound business decision.

Key Takeaways

- The global Beer Line Cooling System Market is projected to reach USD 2.1 billion by 2034, up from USD 1.3 billion in 2024, growing at a 4.9% CAGR.

- By system type, Glycol-based Systems dominate the market with a share of 67.9%, reflecting strong adoption in long-draw and high-volume dispensing setups.

- By application, Bars represent the leading segment, accounting for 41.2% of total market demand due to high draft beer consumption.

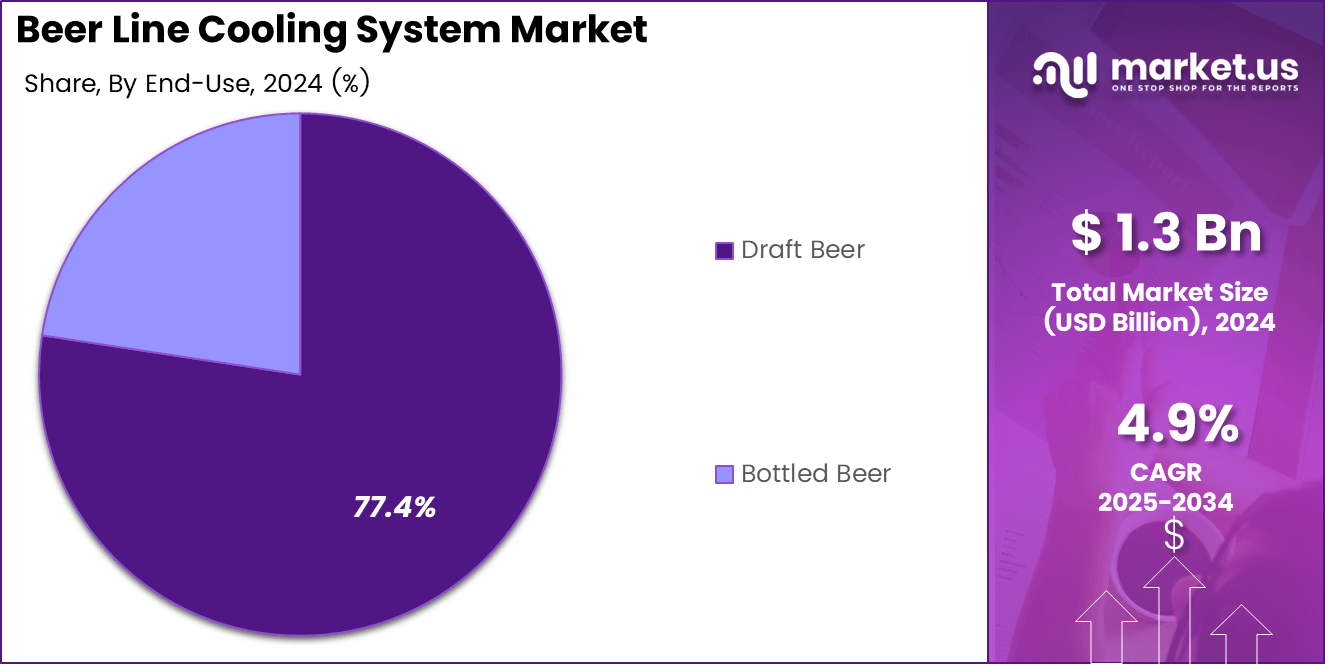

- By end-use, Draft Beer remains the primary driver, holding a dominant share of 77.4% of the overall market.

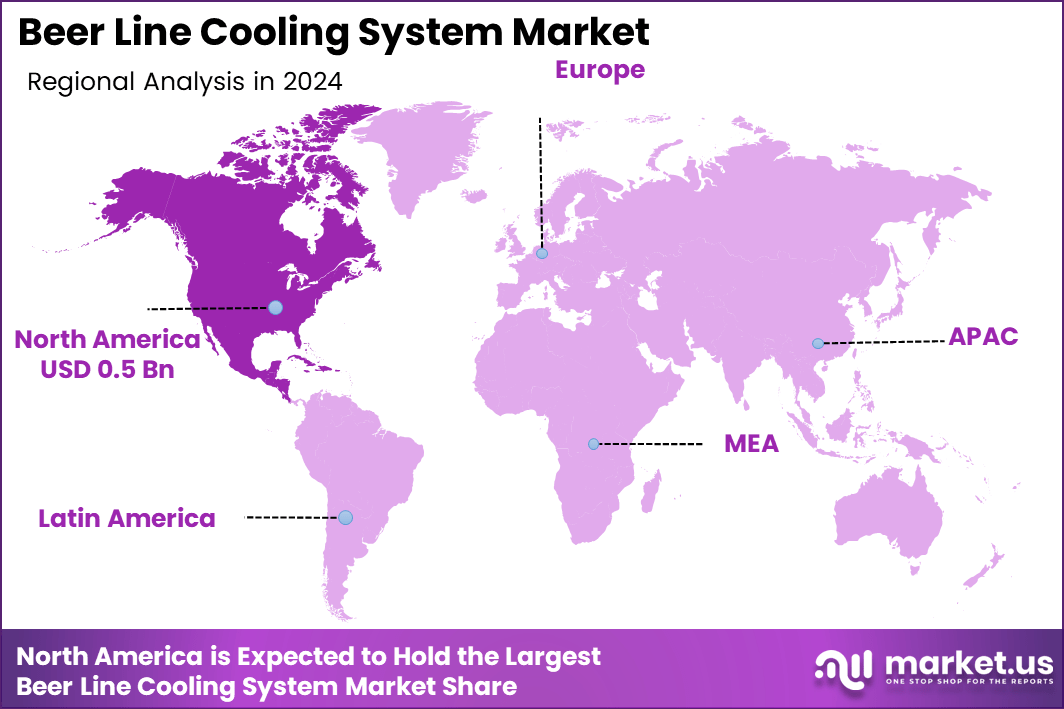

- Regionally, North America leads the global market with a share of 41.8%, valued at USD 0.5 billion in 2024.

By System Type Analysis

Glycol-based System dominates with 67.9% due to its superior temperature stability and long-distance cooling efficiency.

In 2024, Glycol-based System held a dominant market position in the By System Type Analysis segment of Beer Line Cooling System Market, with a 67.9% share. Moreover, this system supports consistent beer temperature control across extended dispensing lines. As a result, it remains widely preferred in high-volume commercial draft beer environments.

Furthermore, glycol-based systems use food-safe glycol mixtures that maintain beer quality while minimizing foaming issues. Consequently, bars and restaurants handling multiple taps favor these systems for operational reliability. In addition, their scalability aligns well with large venues requiring centralized cooling performance and precise temperature management.

In contrast, Air-cooled Systems serve smaller installations where short-distance dispensing is common. However, these systems rely heavily on ambient air conditions, which limits performance consistency. Nevertheless, air-cooled options remain suitable for compact setups due to lower upfront costs and simplified maintenance requirements.

Additionally, air-cooled generator systems appeal to operators seeking straightforward installation without glycol handling. Although performance constraints exist, these systems continue to find adoption in low-volume dispensing settings. Thus, both system types co exist, addressing distinct operational needs within the market.

By Application Analysis

Bars dominate with 41.2% driven by high draft beer consumption and continuous dispensing requirements.

In 2024, Bars held a dominant market position in the By Application Analysis segment of Beer Line Cooling System Market, with a 41.2% share. Notably, bars depend heavily on draft beer sales. Therefore, reliable line cooling systems are essential to maintain serving quality and reduce beverage wastage.

Moreover, Hotels adopt beer line cooling systems to support banquet services and premium guest experiences. As hospitality standards rise, consistent beverage temperature becomes critical. Consequently, hotels invest in durable cooling infrastructure to ensure service consistency across restaurants, lounges, and event spaces.

Restaurants also contribute significantly to market demand as draft beer complements dine-in experiences. Additionally, growing casual dining formats increase tap installations. As a result, restaurants integrate compact yet efficient cooling systems to maintain operational efficiency during peak service hours.

Meanwhile, Household applications remain niche but steadily emerging. Home draft systems gain traction among enthusiasts seeking bar-like experiences. Although volume remains limited, household adoption reflects evolving consumer preferences for premium beverage dispensing at home.

By End-Use Analysis

Draft Beer dominates with 77.4% due to its sensitivity to temperature and quality preservation needs.

In 2024, Draft Beer held a dominant market position in the By End-Use Analysis segment of Beer Line Cooling System Market, with a 77.4% share. Importantly, draft beer quality depends directly on precise temperature control. Therefore, cooling systems play a central role in preserving taste and carbonation.

Furthermore, draft beer systems require continuous cooling from keg to tap. As a result, bars and restaurants prioritize advanced line cooling solutions. This dependency reinforces sustained demand for efficient systems capable of minimizing foam and product loss.

On the other hand, Bottled Beer applications show comparatively lower dependence on line cooling systems. Since bottles are pre-chilled, dispensing infrastructure requirements are limited. However, cooling systems still support storage consistency in commercial environments.

Additionally, bottled beer usage supports mixed beverage offerings in hospitality venues. While less dominant, this segment complements draft operations. Consequently, end-use segmentation reflects the central importance of draft beer in driving overall market demand.

Key Market Segments

By System Type

- Glycol-based System

- Air-cooled System

By Application

- Bars

- Hotels

- Restaurants

- Household

By End-Use

- Draft Beer

- Bottled Beer

Drivers

Rising On Premise Draft Beer Consumption Across Hospitality Venues Drives Market Growth

The Beer Line Cooling System market is strongly driven by rising on premise draft beer consumption across bars, pubs, and restaurants. Consumers increasingly prefer fresh draft beer over bottled alternatives, encouraging outlets to install reliable cooling systems. This trend supports steady demand for consistent beer dispensing solutions.

Another important driver is the growing emphasis on beer quality consistency and precise temperature control. Even minor temperature fluctuations can affect taste, foam formation, and customer satisfaction. As a result, hospitality operators focus on maintaining optimal serving conditions, directly increasing adoption of efficient beer line cooling systems.

The global expansion of commercial bars and quick service restaurants further supports market growth. Urbanization, nightlife culture, and tourism growth have led to higher numbers of beer serving outlets. Each new location requires dependable cooling infrastructure to support draft beer operations.

Additionally, breweries are increasing investments in premium draft infrastructure to strengthen brand presence at the point of sale. Breweries often support advanced cooling installations to ensure their beer is served at ideal quality. This collaboration between breweries and hospitality venues continues to push market expansion.

Restraints

High Installation and Retrofit Costs for Existing Beverage Lines Limit Market Adoption

High installation and retrofit costs represent a key restraint in the Beer Line Cooling System market. Older bars and restaurants often operate legacy beverage lines that require costly modifications. These upfront expenses can delay or limit adoption, especially for small operators.

Complex maintenance requirements in long draw beer systems further challenge market growth. These systems involve multiple components, including pumps, chillers, and insulated lines. Regular cleaning and servicing are essential, increasing operational effort and technical dependency.

Energy consumption concerns also restrain adoption, particularly in regions with high electricity costs. Beer line cooling systems often operate continuously to maintain stable temperatures. This ongoing power usage can impact operating margins for hospitality businesses.

Smaller venues may also lack trained staff to manage system upkeep effectively. Maintenance complexity and energy efficiency concerns combined can reduce interest among cost sensitive operators. These factors collectively slow adoption despite strong demand for quality draft beer.

Growth Factors

Increasing Adoption of Long Draw Systems in Large Venues Creates New Growth Opportunities

Growth opportunities in the Beer Line Cooling System market are expanding with increasing adoption of long draw systems in large venues and stadia. These environments require beer to travel long distances from storage to taps. Advanced cooling solutions are essential to maintain quality at scale.

The expansion of craft breweries also presents strong opportunities. Craft beer producers focus heavily on taste consistency and brand experience. Many prefer advanced line cooling solutions to ensure their unique flavors are delivered accurately at retail outlets.

Growing demand for modular and scalable cooling system designs further supports opportunity creation. Modular systems allow operators to expand capacity as needed without full replacement. This flexibility is attractive for growing hospitality chains and event venues.

Emerging markets also offer untapped potential as hospitality infrastructure develops. Rising disposable incomes and tourism growth drive new bar and restaurant openings. These developments create long term demand for modern beer line cooling systems.

Emerging Trends

Shift Toward Glycol Based Cooling Systems Shapes Market Trends

One major trend in the Beer Line Cooling System market is the shift toward glycol based cooling systems. These systems are preferred for extended beer lines due to stable temperature control. They are increasingly adopted in complex and high volume dispensing setups.

Integration of smart temperature monitoring and control technologies is another key trend. Digital sensors and automated controls help operators monitor performance in real time. This reduces beer waste and improves consistency across multiple taps.

Rising use of energy efficient and eco friendly cooling units is also shaping market direction. Manufacturers focus on reducing power consumption and using environmentally safer materials. Sustainability goals are influencing purchasing decisions among large hospitality chains.

Customization of beer line cooling systems for multi beverage dispensing is gaining attention. Venues now serve beer alongside wine, cocktail, and cold brew coffee. Customized systems support diverse beverage menus, improving operational flexibility and customer experience.

Regional Analysis

North America Dominates the Beer Line Cooling System Market with a Market Share of 41.8%, Valued at USD 0.5 Billion

North America represents the leading regional market for beer line cooling systems, supported by a mature hospitality industry and strong draft beer consumption culture. In 2024, the region accounted for a dominant 41.8% share of the global market, with a total value reaching USD 0.5 Billion. High penetration of long draw draft systems in bars, stadiums, and casual dining outlets continues to support system demand. Additionally, strict expectations around beer quality, foam control, and temperature consistency reinforce adoption across both urban and suburban venues.

Europe Beer Line Cooling System Market Trends

Europe holds a significant position due to its long-standing beer brewing traditions and dense concentration of pubs and on-premise serving locations. Countries with strong draft beer cultures emphasize precise temperature management to maintain taste integrity. Regulatory focus on food safety and beverage hygiene further supports the use of reliable cooling systems across hospitality establishments.

Asia Pacific Beer Line Cooling System Market Trends

Asia Pacific is emerging as a high-growth region, driven by rapid urbanization and the expansion of modern bars, hotels, and quick service restaurants. Rising disposable incomes and increasing acceptance of Western-style draft beer experiences contribute to system installations. Tourism growth in major cities further accelerates demand for professionally managed beverage dispensing infrastructure.

Middle East and Africa Beer Line Cooling System Market Trends

The Middle East and Africa market shows steady development, primarily supported by premium hotels, international restaurant chains, and controlled hospitality environments. Demand is concentrated in tourist hubs where temperature-controlled draft systems are essential due to warm climatic conditions. Gradual investments in foodservice infrastructure continue to support market expansion.

Latin America Beer Line Cooling System Market Trends

Latin America demonstrates consistent growth, supported by a strong social drinking culture and expanding urban nightlife scenes. Bars and entertainment venues increasingly focus on improving draft beer quality to differentiate customer experience. Growing investments in hospitality modernization are encouraging the adoption of efficient beer line cooling solutions across key metropolitan areas.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Beer Line Cooling System Company Insights

Key manufacturers focus on reliability, temperature consistency, and system integration rather than aggressive branding, aligning closely with bar, restaurant, and large venue requirements. Among the listed companies, the first four demonstrate distinct strengths shaping competitive dynamics.

KegWorks holds a strong position due to its broad portfolio of draft beer accessories and cooling components tailored for small to mid sized commercial installations. Its solutions emphasize ease of installation and compatibility with existing draft systems, making it a preferred choice for independent bars and growing taproom formats seeking dependable beer line cooling performance.

Value (Billion) operates with a practical, cost conscious approach, addressing demand from budget sensitive hospitality operators. The company’s offerings are positioned toward functional cooling efficiency and basic thermal control, supporting consistent beer dispensing while enabling operators to manage upfront capital expenditure more effectively across standard draft setups.

Chicago Faucets brings engineering expertise and precision manufacturing into beverage dispensing infrastructure. While traditionally recognized for flow control solutions, its involvement in cooling and dispensing systems supports integrated draft environments. The company benefits from strong institutional and commercial relationships, particularly in regulated hospitality and food service environments.

Beerjet differentiates itself through compact, high performance beer cooling technologies designed to improve dispense consistency at the point of service. Its systems appeal to operators prioritizing foam reduction, rapid cooling response, and premium draft presentation. This positioning supports adoption in high turnover venues where quality control directly influences customer experience.

Top Key Players in the Market

- KegWorks

- Chicago Faucets

- Beerjet

- Elkay Manufacturing Company

- Continental Refrigerator

- Franke Holding AG

- Fagor

- 3M Company

- Hays Fluid Controls

- Beverage-Air

Recent Developments

- In Aug 25, 2025, Mitsubishi Electric Corporation signed a collaboration agreement with the Industrial Technology Research Institute (ITRI) and Taiwan Tobacco & Liquor Corporation (TTL) Jhunan Brewery to conduct demonstration tests for CO₂ capture and utilization. Under the agreement, captured and purified CO₂ from the Jhunan Brewery will be reused in a beer production line, supporting carbon recycling and decarbonization initiatives.

Report Scope

Report Features Description Market Value (2024) USD 1.3 billion Forecast Revenue (2034) USD 2.1 billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By System Type (Glycol-based System, Air-cooled System), By Application (Bars, Hotels, Restaurants, Household), By End-Use (Draft Beer, Bottled Beer) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape KegWorks, Chicago Faucets, Beerjet, Elkay Manufacturing Company, Continental Refrigerator, Franke Holding AG, Fagor, 3M Company, Hays Fluid Controls, Beverage-Air Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Beer Line Cooling System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Beer Line Cooling System MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- KegWorks

- Chicago Faucets

- Beerjet

- Elkay Manufacturing Company

- Continental Refrigerator

- Franke Holding AG

- Fagor

- 3M Company

- Hays Fluid Controls

- Beverage-Air