Global Beer Festival Insurance Market Size, Share and Analysis Report By Coverage Type (General Liability, Liquor Liability, Property Insurance, Equipment Insurance, Event Cancellation, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Event Organizers, Breweries, Vendors, Others), By Distribution Channel (Direct, Indirect), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174774

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights Summary

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Coverage Type Analysis

- Provider Analysis

- End-User Analysis

- Distribution Channel Analysis

- North America Regional Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

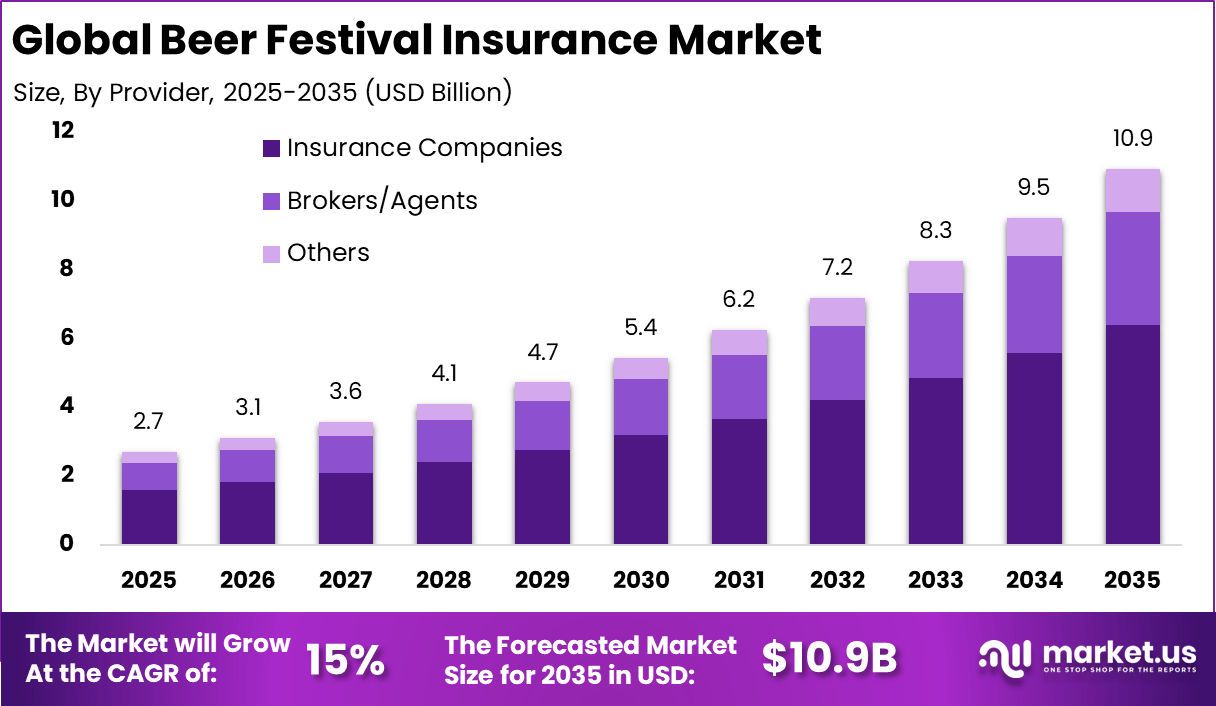

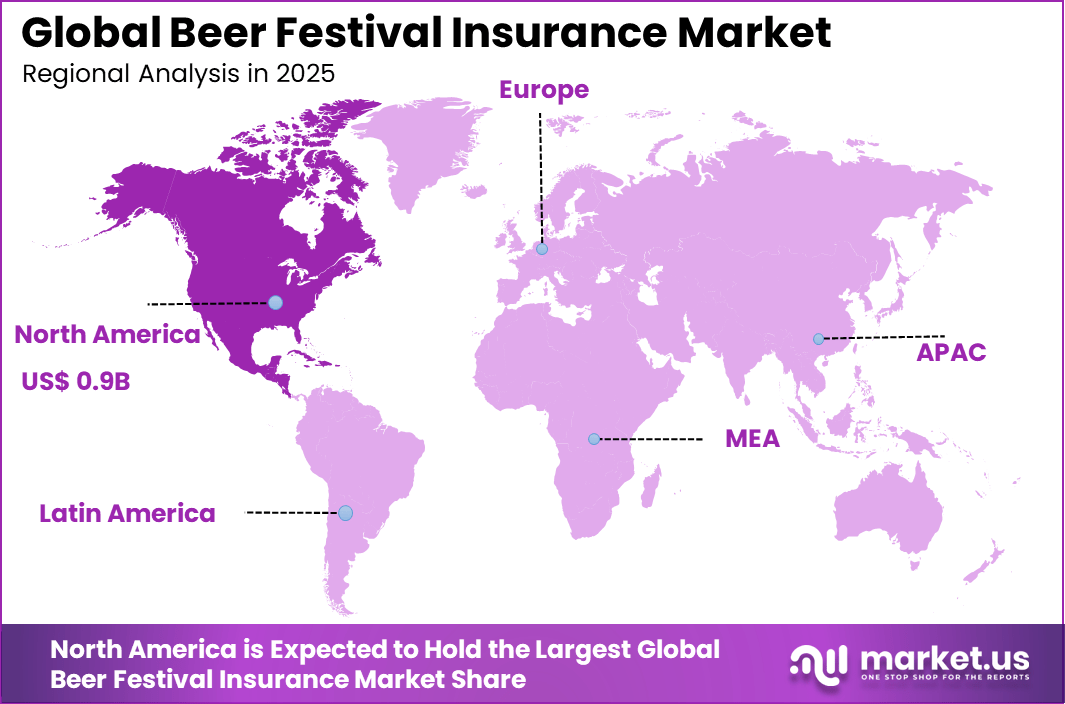

The Global Beer Festival Insurance Market size is expected to be worth around USD 10.9 Billion By 2035, from USD 2.7 billion in 2025, growing at a CAGR of 15% during the forecast period from 2026 to 2035. North America held a dominan Market position, capturing more than a 35.8% share, holding USD 0.9 Billion revenue.

The beer festival insurance market refers to specialized insurance coverage designed to protect organizers of beer and alcohol-focused public events. These policies typically cover risks related to liability, property damage, event cancellation, and alcohol-related incidents. Beer festivals often involve large crowds, temporary venues, and alcohol consumption, which increases risk exposure. Insurance coverage supports safe event execution and financial protection.

Adoption is common among event organizers, breweries, sponsors, and venue operators. Market development has been influenced by the growing popularity of craft beer festivals and experiential events. Cities and communities host festivals to attract tourism and promote local breweries. These events require permits, compliance, and risk mitigation planning. Insurance plays a critical role in meeting regulatory and contractual requirements. As event frequency increases, demand for tailored insurance grows.

One major driving factor of the beer festival insurance market is increased liability risk associated with alcohol consumption. Alcohol-related incidents can lead to injuries, property damage, or legal claims. Event organizers seek coverage to protect against such risks. Insurance provides financial and legal support in case of claims. Liability concerns strongly drive adoption. Another key driver is regulatory and permit requirements imposed by local authorities.

Many municipalities require proof of insurance to approve public events involving alcohol. Organizers must demonstrate adequate coverage before receiving licenses. Insurance ensures compliance with these conditions. Regulatory enforcement supports market growth. Demand for beer festival insurance is influenced by the rising number of public beer events and tasting festivals. Craft beer culture continues to expand across regions. Organizers require short-term and event-specific coverage.

Top Market Takeaways

- General liability insurance leads coverage types with a 36.8% share, reflecting the need to protect against injury, property damage, and alcohol-related risks at large public events.

- Insurance companies dominate providers with 58.6%, supported by their underwriting capacity, regulatory compliance, and tailored event-risk policies.

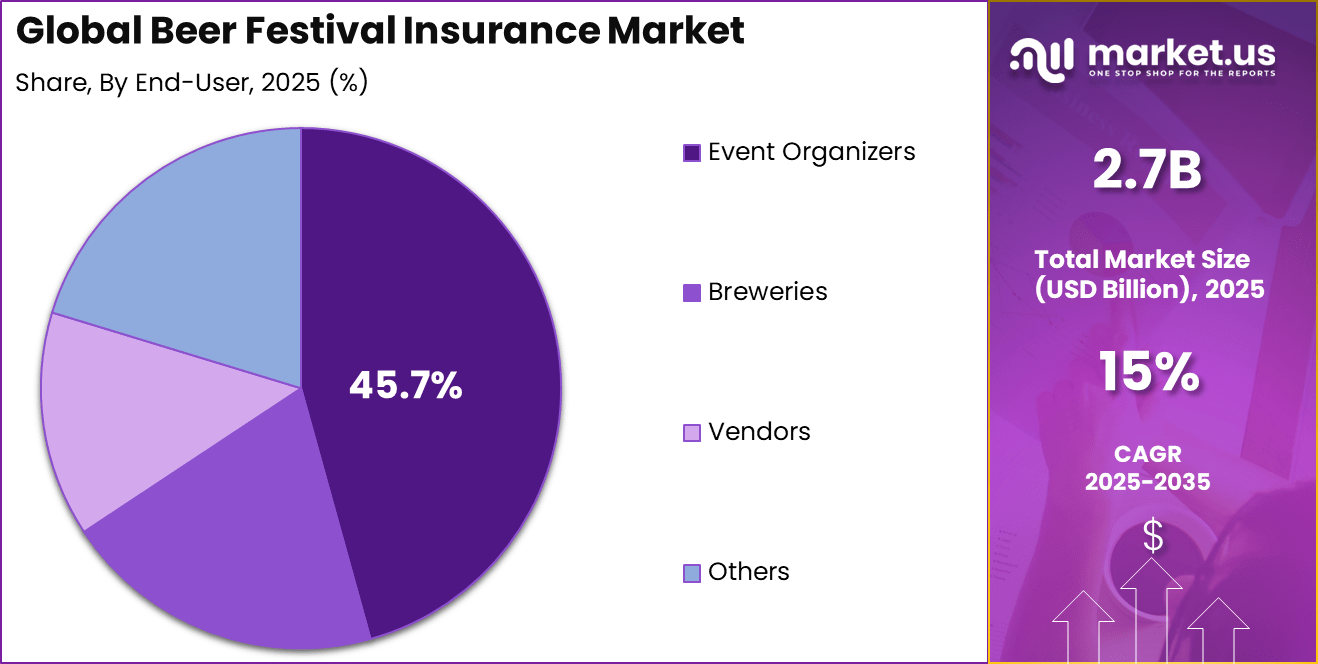

- Event organizers represent 45.7% of end users, as they remain primarily responsible for attendee safety, vendor coordination, and liability management.

- Direct distribution channels account for 58.9%, highlighting preference for faster policy issuance, clearer coverage terms, and reduced intermediary costs.

- North America holds 35.8% of the global market, driven by a high concentration of beer festivals and established event insurance practices.

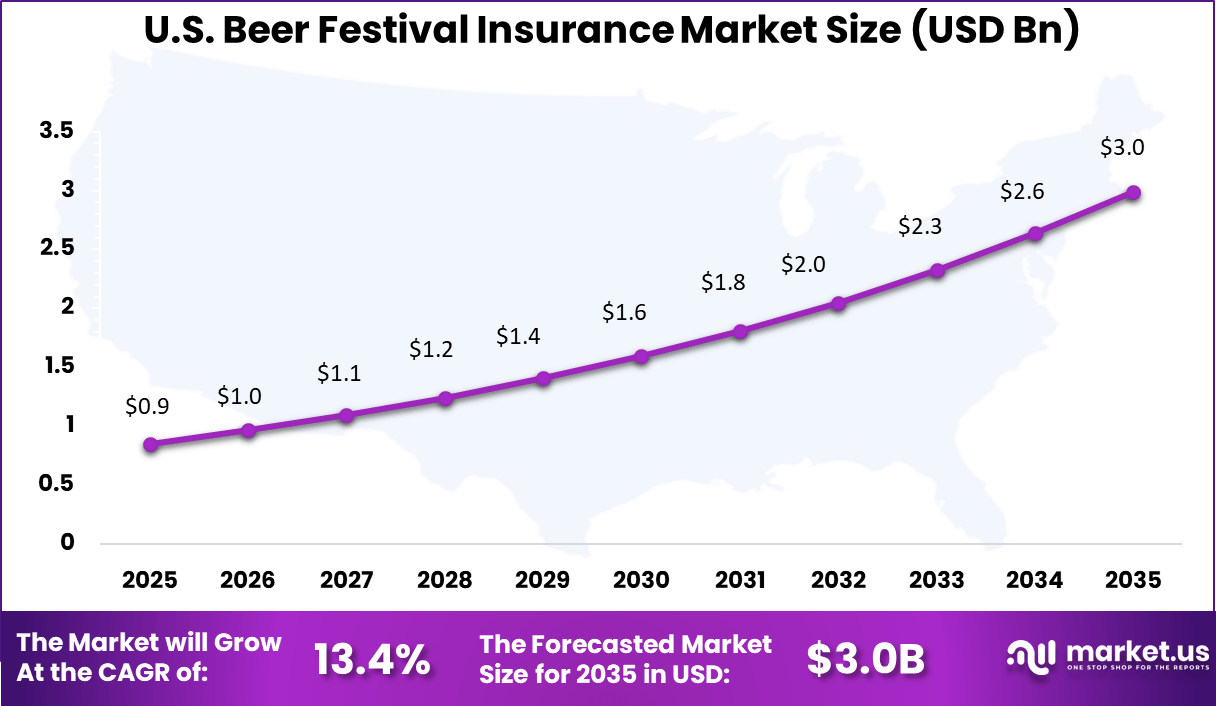

- The U.S. market reached USD 0.85 billion, expanding at a 13.4% CAGR, supported by rising event frequency, regulatory requirements, and increased risk awareness among organizers.

Key Insights Summary

Insurance Costs and Premium Trends

- Event cancellation insurance typically costs 1% to 1.5% of the total festival budget for large music and beer events.

- Small breweries and micro-festivals usually pay between USD 77 and USD 109 per month for standard general liability coverage with USD 1M/ USD 2M limits.

- Premium demand is rising in emerging markets, with festival insurance costs increasing more than threefold in markets such as India due to larger event scales and higher risk exposure.

Common Risks and Claims

- Liquor liability remains a core coverage requirement, protecting against injuries or damages caused by intoxicated attendees and is mandatory for most operating permits.

- Lost property incidents are common at large beer festivals, with more than 4,500 items recorded in lost-and-found inventories during major events in 2025.

- Theft prevention is critical, as high-profile festivals reported around 116,000 attempted beer stein thefts in 2025, highlighting persistent security risks.

- Equipment breakdown poses significant financial exposure, as failures in brewing or cooling systems have resulted in claims reaching USD 138,000 in lost business income from a single incident.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth in experiential events Rising number of large scale beer festivals ~4.6% North America, Europe Short Term Increasing liability exposure Crowd density and alcohol related risks ~3.9% Global Short Term Stricter event regulations Mandatory insurance requirements ~3.2% North America, Europe Mid Term Expansion of craft beer culture Growth of regional and pop up festivals ~2.1% Global Mid Term Professionalization of event management Risk transfer through insurance planning ~1.2% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Event cancellations Weather or regulatory shutdowns ~4.4% Global Short Term High claim frequency Alcohol related incidents ~3.6% North America, Europe Short Term Underwriting complexity Diverse venue and crowd profiles ~2.9% Global Mid Term Pricing pressure Competitive insurance offerings ~2.2% Global Mid Term Fraud risk Inflated or disputed claims ~1.7% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High premium costs Budget constraints for small organizers ~4.8% Emerging Markets Short to Mid Term Limited awareness Inadequate risk planning by new organizers ~3.7% Global Mid Term Coverage exclusions Gaps in alcohol related incidents ~2.9% Global Mid Term Complex policy terms Difficulty in policy comparison ~2.1% Global Long Term Dependence on weather risk Unpredictable loss exposure ~1.6% Global Long Term Coverage Type Analysis

General Liability – 36.8%

General liability insurance accounts for 36.8% of the beer festival insurance market, reflecting its essential role in event risk management. Beer festivals involve large crowds, alcohol consumption, and temporary infrastructure, which increases exposure to bodily injury and property damage claims. General liability coverage helps protect organizers against common incidents that may occur during public events.

Event organizers rely on this coverage to meet venue requirements and local regulatory conditions. Many venues mandate general liability policies before granting permits or space usage approvals. This makes the coverage a standard component of insurance planning for beer festivals.

As festivals continue to grow in scale and attendance, the importance of general liability coverage remains strong. Organizers seek comprehensive protection to reduce financial uncertainty. This keeps general liability as the most widely adopted coverage type in the market.

Provider Analysis

Insurance Companies – 58.6%

Insurance companies represent 58.6% of the provider segment, indicating strong reliance on established insurers. These providers offer structured policies, underwriting expertise, and claims handling capabilities tailored to event-related risks. Their experience with large public gatherings supports confidence among festival organizers.

Traditional insurance companies also provide bundled coverage options, including liquor liability and property coverage. This simplifies policy management for event organizers. Access to regulatory-compliant products further strengthens their market position.

The dominance of insurance companies reflects trust and long-term relationships with event planners. Their ability to scale coverage based on event size is a key advantage. As festivals become more complex, insurance companies continue to lead provider adoption.

End-User Analysis

Event Organizers – 45.7%

Event organizers account for 45.7% of market demand, making them the primary end users of beer festival insurance. Organizers are responsible for overall event safety, compliance, and financial risk. Insurance coverage helps protect against unexpected disruptions and liability claims.

Organizers require insurance to secure permits, sponsorships, and vendor participation. Coverage reassures stakeholders that risks are managed professionally. This is especially important for festivals involving alcohol service and high attendance.

As the number of regional and large-scale beer festivals increases, organizers continue to invest in insurance solutions. Risk awareness among organizers has improved over time. This sustains steady demand from this end-user group.

Distribution Channel Analysis

Direct – 58.9%

Direct distribution accounts for 58.9% of the market, showing a preference for purchasing policies directly from insurers. This approach allows organizers to communicate specific event details and coverage needs without intermediaries. Direct engagement supports clearer policy terms and faster decision-making.

Direct channels also help reduce administrative costs and processing time. Event organizers benefit from quicker quotations and customized coverage options. This is particularly valuable when events are planned within short timelines.

The growth of digital platforms has further strengthened direct distribution. Online portals and insurer-managed systems improve accessibility. As a result, direct channels remain the preferred distribution method.

North America Regional Analysis

Market Share 35.8% | United States USD 0.85 Bn | CAGR 13.4%

North America holds a 35.8% share of the beer festival insurance market, supported by a strong culture of organized public events. The region hosts a large number of beer festivals each year, increasing demand for event-specific insurance. Regulatory emphasis on liability coverage further supports adoption.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America High density of large scale beer festivals 35.8% USD 1.00 Bn Advanced Europe Strong beer culture and public events 31.4% USD 0.87 Bn Advanced Asia Pacific Growing urban festivals and tourism 21.6% USD 0.60 Bn Developing Latin America Expansion of cultural beer events 6.4% USD 0.18 Bn Developing Middle East and Africa Early stage festival insurance demand 4.8% USD 0.13 Bn Early

The United States contributes USD 0.85 billion in market value, driven by large-scale festivals and professional event management practices. Organizers in the country prioritize insurance to manage legal and financial risks. Alcohol-related liability concerns increase the need for comprehensive coverage.

A CAGR of 13.4% indicates steady market growth across the region. Rising event frequency and increasing risk awareness support expansion. North America remains a key market for beer festival insurance solutions.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Event organizers Very High ~45.7% Liability protection and compliance Annual policy purchases Insurance companies Very High ~58.6% Premium growth and niche specialization Product expansion Municipal authorities Moderate ~14% Public safety assurance Mandatory coverage enforcement Venue owners Moderate ~11% Property and liability protection Bundled insurance Sponsors Low ~6% Brand risk mitigation Selective coverage Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Digital underwriting platforms Faster risk assessment ~3.6% Growing Event risk analytics Crowd and incident modeling ~3.0% Developing Online policy distribution Direct to organizer sales ~2.5% Mature Claims automation systems Faster settlement cycles ~2.0% Developing Data driven pricing tools Event specific premium accuracy ~1.4% Developing Driver Analysis

The beer festival insurance market is being driven by the increasing popularity and scale of beer festivals as social, cultural, and tourism events that attract large crowds. Event organisers face diverse risk exposures including property damage, liquor-related liability, public safety incidents, and cancellations due to weather or unforeseen circumstances.

Insurance products tailored to beer festivals help transfer these risks, enabling organisers to secure financial protection and meet contractual obligations with vendors, venue owners, and sponsors. Growing awareness of event-specific liabilities and the desire to safeguard reputation and financial stability have reinforced the role of insurance in comprehensive event planning and risk management.

Restraint Analysis

A key restraint in the beer festival insurance market relates to the perception of limited awareness among smaller organisers and amateur event planners about the true scope of event risks and the corresponding need for tailored coverage. Many festival organisers may underestimate exposures related to liquor liability, participant behaviour, and third-party claims, treating insurance as an optional cost rather than a fundamental safeguard.

This underappreciation can reduce demand for specialised insurance products and limit market penetration. Additionally, navigating the range of coverage options and understanding policy terms can be complex without professional guidance, creating barriers for first-time or resource-constrained organisers.

Opportunity Analysis

Emerging opportunities in the beer festival insurance market are linked to the development of modular, scalable insurance solutions that align with varied event profiles and budget levels. Flexible policies that allow organisers to scale coverage based on attendance, venue type, and risk appetite can attract a broader base of festival projects, from small community gatherings to large commercial events.

Embedded insurance offerings that integrate directly with event-planning platforms, ticketing systems, and vendor agreements can streamline the purchasing experience and reduce administrative friction. Partnerships between insurers and festival associations or industry networks can also promote risk education and improve product adoption.

Challenge Analysis

A central challenge confronting this market relates to accurately assessing and pricing risk in environments where crowd behaviour, alcohol consumption, outdoor conditions, and third-party liabilities interact in complex ways. Underwriters must evaluate variables such as anticipated attendance, venue setup, safety protocols, and historic incident data to develop appropriate coverage terms.

Inaccurate risk assessment can lead to inadequate pricing, coverage disputes, or unanticipated financial exposures for organisers. Ensuring consistent underwriting standards while balancing affordability remains a nuanced challenge for insurers serving the beer festival segment.

Emerging Trends

Emerging trends in the beer festival insurance landscape include the integration of digital risk-assessment tools that use historical data, predictive modelling, and behavioural indicators to refine coverage recommendations.

Insurers are also offering value-added services such as risk consultation, safety planning resources, and vendor contract reviews to support organisers beyond traditional indemnity protection. Another trend involves micro-coverage and short-term policies that can be purchased close to event dates, improving flexibility for organisers facing fast-changing planning timelines.

Growth Factors

Growth in the beer festival insurance market is supported by the ongoing expansion of experiential events, craft beverage culture, and community-centric entertainment formats that rely on public participation. As beer festivals become more commercialised and sophisticated, the financial stakes increase for organisers, sponsors, and venues, reinforcing the necessity of risk transfer mechanisms.

Increased regulatory scrutiny around alcohol service, crowd management, and public safety also drives organisers to adopt formal insurance as part of compliance and accountability practices. Continued education on risk exposures coupled with tailored insurance solutions helps reinforce the value of coverage in festival success and continuity.

Key Market Segments

By Coverage Type

- General Liability

- Liquor Liability

- Property Insurance

- Equipment Insurance

- Event Cancellation

- Others

By Provider

- Insurance Companies

- Brokers/Agents

- Others

By End-User

- Event Organizers

- Breweries

- Vendors

- Others

By Distribution Channel

- Direct

- Indirect

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Leading insurers such as Allianz SE, AXA XL, and Zurich Insurance Group focus on large scale event risk coverage. Their policies address public liability, property damage, weather disruption, and alcohol related risks. Chubb Limited and Munich Re support complex risk transfer and reinsurance needs. These players benefit from strong underwriting expertise. Demand is driven by growing festival size and stricter safety regulations.

Brokerage and advisory firms such as Aon plc, Marsh & McLennan Companies, and Willis Towers Watson play a key role in policy structuring. They help organizers manage crowd risk and compliance. Gallagher strengthens access for mid-sized festivals. Their advisory services improve coverage customization. This supports better risk planning for seasonal and regional beer festivals.

Specialty insurers such as Hiscox Ltd, Lloyd’s of London, and Beazley Group focus on niche event risks. Markel Corporation, Tokio Marine HCC, and American International Group expand coverage options globally. Other regional insurers improve local reach. This competitive landscape supports flexible and comprehensive beer festival insurance solutions.

Top Key Players in the Market

- Allianz SE

- Aon plc

- Marsh & McLennan Companies

- Chubb Limited

- AXA XL

- Zurich Insurance Group

- Willis Towers Watson

- Hiscox Ltd

- Lloyd’s of London

- Event Insurance Services Ltd

- Markel Corporation

- Intact Insurance

- Gallagher (Arthur J. Gallagher & Co.)

- Tokio Marine HCC

- Beazley Group

- Munich Re

- Travelers Companies, Inc.

- American International Group (AIG)

- Aviva plc

- Others

Recent Developments

- In August 2025, Allianz SE deepened its event insurance footprint via targeted acquisitions and partnerships with event platforms, improving integrated risk tools for beer festivals worldwide. This move supports real-time monitoring vital for large gatherings.

- In December 2024, Arthur J. Gallagher & Co. announced its $13.5 billion acquisition of AssuredPartners, a major step that expands brokerage capabilities in special event insurance, including beer festivals. This deal strengthens Gallagher’s position to handle complex risks for organizers

Report Scope

Report Features Description Market Value (2025) USD 2.7 Bn Forecast Revenue (2035) USD 10.9 Bn CAGR(2026-2035) 15% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability, Liquor Liability, Property Insurance, Equipment Insurance, Event Cancellation, Others), By Provider (Insurance Companies, Brokers/Agents, Others), By End-User (Event Organizers, Breweries, Vendors, Others), By Distribution Channel (Direct, Indirect) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, Aon plc, Marsh & McLennan Companies, Chubb Limited, AXA XL, Zurich Insurance Group, Willis Towers Watson, Hiscox Ltd, Lloyd’s of London, Event Insurance Services Ltd, Markel Corporation, Intact Insurance, Gallagher (Arthur J. Gallagher & Co.), Tokio Marine HCC, Beazley Group, Munich Re, Travelers Companies, Inc., American International Group (AIG), Aviva plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Beer Festival Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Beer Festival Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-