Global Banknote Printing Machine Market By Component (Solution, Services), By Type (Intaglio Printing, Offset Printing, Silk Screen Printing), By Application (Government Authorities and Private Enterprises, Central Banks), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: Dec. 2023

- Report ID: 12424

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

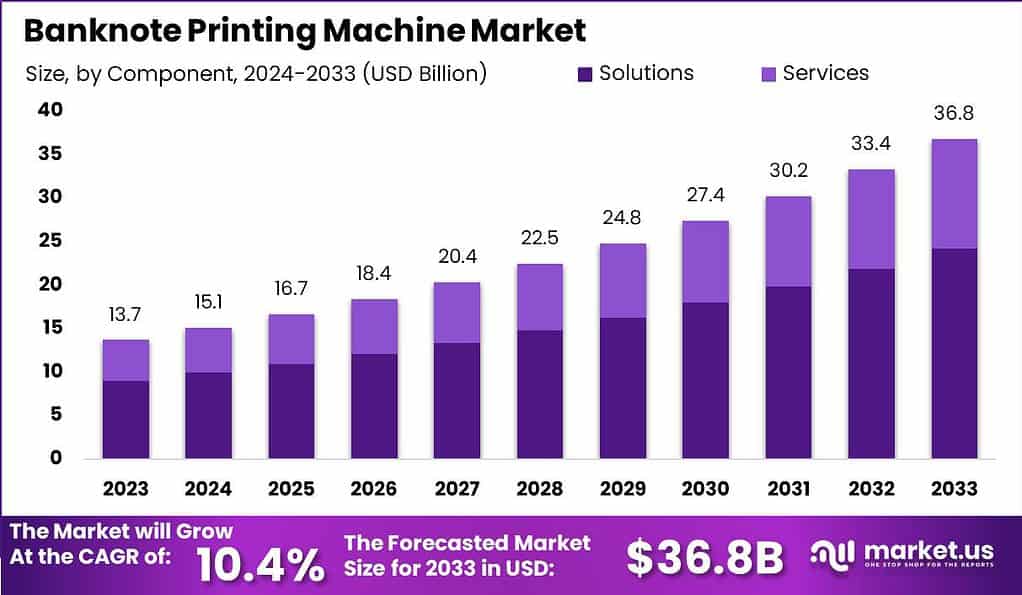

In 2023, the worldwide banknote printing machine market reached a value of USD 13.7 Billion. Over the forecast period from 2024 to 2033, it is anticipated to display a CAGR of 10.4% in terms of revenue, ultimately reaching a value of USD 36.8 Billion by the year 2033.

A banknote printing machine is a specialized printing device used for the production of banknotes or paper currency. It employs advanced printing techniques and security features to ensure the authenticity and integrity of the banknotes. These machines are designed to meet the stringent requirements of central banks and government authorities responsible for currency issuance.

The banknote printing machine market includes companies that make and supply these machines, meeting the needs of central banks and government entities globally. This market’s growth is influenced by different factors, such as economic expansion, cycles of replacing currency, and improvements in printing technology.

Note: Actual Numbers Might Vary In Final Report

The market is characterized by the presence of prominent manufacturers who specialize in the production of banknote printing machines. These manufacturers leverage their expertise in printing technology, security features, and customization capabilities to deliver high-quality and secure banknote production solutions.

Key Takeaways

- Growth Projection: The Banknote Printing Machine Market is projected to exhibit a remarkable CAGR of 10.4%. In 2023, it reached a value of USD 13.7 billion and is expected to reach USD 36.8 billion by 2033.

- Market Drivers: The market’s growth is influenced by factors such as economic expansion, currency replacement cycles, and advancements in printing technology. These factors drive the demand for secure and efficient banknote production.

- Component Analysis: In 2023, the Solutions segment held over 65% of the market share. It covers hardware, software, and security features necessary for effective and secure banknote production.

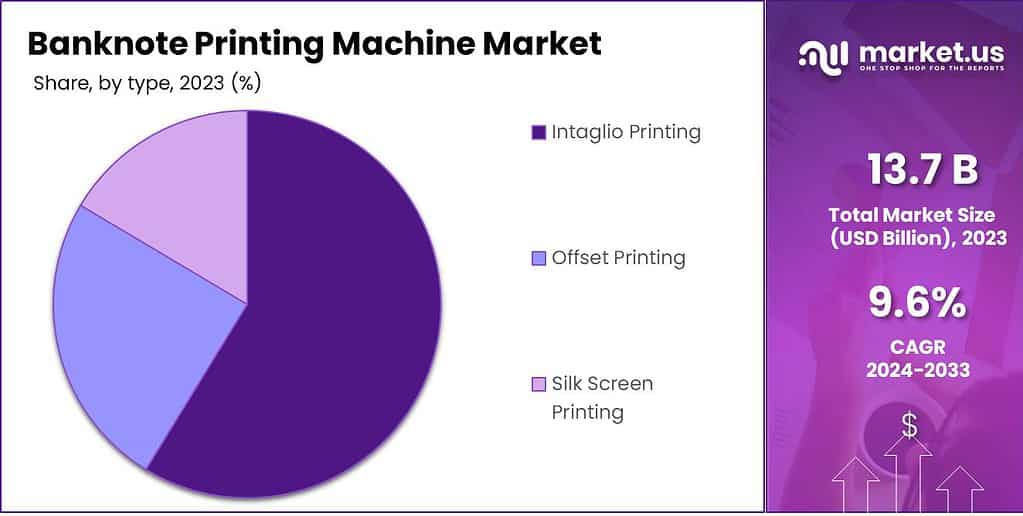

- Type Analysis: In 2023, the Intaglio Printing segment held over 40% of the market share. It is known for its high-security printing technique, creating tactile and visually distinct banknotes.

- Application Analysis: Government Authorities and Private Enterprises: In 2023, this segment held over 68% of the market share. It encompasses entities responsible for currency production, focusing on security and quality.

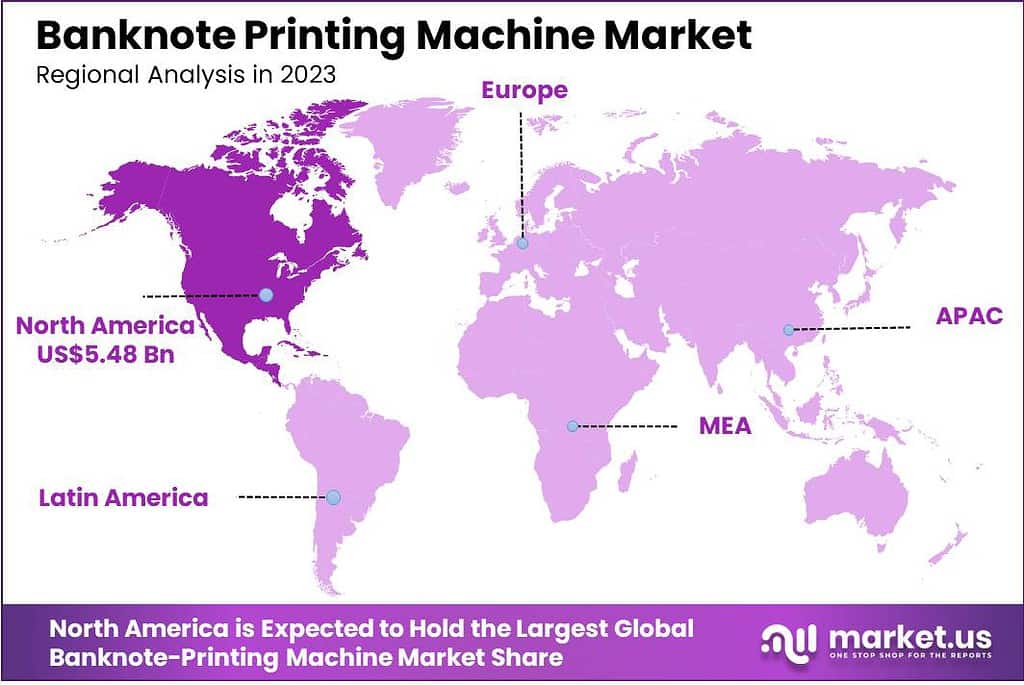

- Regional Analysis: In 2023, North America held over 40% of the market share due to advanced economies and a strong emphasis on security in currency production.

- Key Market Players: Prominent companies in the market include Oumolat Security Printing LLC, Cash Processing Solutions (CPS), Konica Minolta, and more.

Component Analysis

In 2023, the Solutions segment took a leading position in the Banknote Printing Machine market, holding over 65% of the market share. Solutions are vital in banknote printing, covering hardware, software, and security features needed for effective and secure banknote production. Within this segment, the hardware component, including printing presses, paper handling systems, and quality control equipment, held a substantial share. These machines are crafted to provide top-notch printing, precise registration, and advanced security features, ensuring the trustworthiness and authenticity of banknotes.

Moreover, the software component of the Solutions segment comprises exclusive software systems. These systems control and oversee the printing process, making it efficient and allowing for effective production, monitoring, and maintenance of banknote printing machines. Additionally, security features like special inks, holograms, security threads, and watermarks are integrated into the Solutions to safeguard banknotes from counterfeiting attempts. These security measures are essential for upholding the trust and confidence of central banks and governments in the banknote printing process.

In terms of Services, the market offers a range of post-sale support and maintenance services to ensure the optimal performance and longevity of banknote printing machines. These services include installation, training, preventive maintenance, troubleshooting, and spare parts provisioning. Service providers work closely with their customers, providing technical expertise and support to address any issues that may arise during the operation of the machines.

Additionally, service contracts and extended warranties are offered to provide ongoing support and ensure the smooth functioning of the banknote printing machines over their operational lifespan. These services contribute to the overall market growth by enhancing customer satisfaction, reducing downtime, and maximizing the return on investment for the banknote printing machines.

Type Analysis

In 2023, the Intaglio Printing segment held a dominant market position in the Banknote Printing Machine market, capturing more than a 40% share. Intaglio printing is a traditional and highly secure printing technique that involves engraving the banknote design onto a metal plate, which is then inked and pressed onto the paper, creating raised inked impressions.

This process results in the characteristic tactile feel and distinct visual appearance of banknotes, making it difficult to counterfeit. Intaglio printing machines are designed to deliver precise and intricate details, ensuring the authenticity and durability of the banknotes. The dominance of the Intaglio Printing segment can be attributed to the long-standing trust and preference of central banks and governments for this printing technique due to its high level of security.

The Offset Printing segment is another significant segment in the Banknote Printing Machine market. Offset printing involves transferring the inked image from a plate to a rubber blanket and then onto the banknote substrate. This technique provides high-quality and cost-effective printing, making it suitable for large-scale banknote production. Offset printing machines offer fast printing speeds, consistent image reproduction, and the ability to print on a variety of substrates. The segment has witnessed substantial growth due to the efficiency and versatility of offset printing for banknote production.

Silk Screen Printing, although holding a relatively smaller market share, plays a crucial role in the Banknote Printing Machine market. Silk screen printing involves forcing ink through a fine mesh screen onto the banknote substrate, creating a layered and textured appearance. This technique is often used for adding specific security features such as color-shifting inks, iridescent inks, and fluorescent inks, which enhance the banknote’s security. Silk screen printing machines are specialized equipment that ensures precise ink application and registration, contributing to the overall security and aesthetic appeal of banknotes.

The Banknote Printing Machine market’s segmentation by type reflects the diverse printing techniques employed in banknote production, each with its own advantages and security features. While the Intaglio Printing segment dominates the market with its established reputation for high-security printing, the Offset Printing and Silk Screen Printing segments offer efficient and specialized solutions for large-scale production and the incorporation of specific security features, respectively.

As central banks and governments continue to prioritize secure currency issuance, the demand for banknote printing machines across these segments is expected to grow, driven by the need for advanced security features, superior print quality, and cost-effective production techniques.

Note: Actual Numbers Might Vary In The Final Report

Application Analysis

Government Authorities and Private Enterprises

In 2023, the Government Authorities and Private Enterprises segment held a dominant market position in the Banknote Printing Machine market, capturing more than a 68% share. This segment encompasses a wide range of entities responsible for the production and management of currency, from national mints and security printers to private companies contracted for banknote production. The significant share of this segment is indicative of the extensive infrastructure and investment these entities commit to ensuring the secure and efficient production of banknotes.

Government authorities often have strict security and quality requirements, driving the need for advanced printing machinery capable of producing highly secure and durable banknotes. Meanwhile, private enterprises contribute by innovating and providing additional printing capacities, often collaborating with governments to meet the growing demand for secure currency.

Central Banks

Central Banks, while representing a smaller share of the Banknote Printing Machine market, play a crucial and strategic role. As the primary issuers of national currency, Central Banks are responsible for overseeing the production and integrity of their country’s banknotes. They are deeply involved in the decision-making process regarding the design, security features, and production methods of banknotes. Central Banks often operate their own printing facilities or closely regulate and oversee the process, ensuring that the currency reflects the necessary security, durability, and quality standards. The involvement of Central Banks is critical in adopting new technologies and methods in banknote production, as they set the standards and requirements that drive innovation and security in the market.

Driving Factors

- Increasing Demand for Banknotes: The rising demand for banknotes, driven by factors such as the growing global economy and the need for physical currency, is a significant driving factor for the banknote printing machine market.

- Rising Security Needs: The need for high-security banknotes to protect against counterfeiting and other forms of fraud is driving the demand for advanced banknote printing machines.

- Increasing Use of Electronic Payments: Despite the growing popularity of electronic payments, cash remains the most common form of payment in many parts of the world, driving the demand for banknote printing machines.

- Technological Advancements: The integration of advanced technologies, such as high-resolution printing and security features, is driving the market’s growth and making banknote printing machines more efficient and secure.

- Government Regulations: Governments in some countries have strict regulations regarding the quality and security of banknotes, which is driving the demand for advanced banknote printing machines.

- Increasing Use of Banknotes for Non-Currency Purposes: The increasing use of banknotes for non-currency purposes, such as loyalty programs and promotions, is driving the demand for banknote printing machines

Restraining Factors

- High Initial Costs: The high initial costs of banknote printing machines can be a restraining factor for the market, as small and medium-sized enterprises may find it difficult to invest in these machines.

- Environmental Concerns: The environmental impact of banknote printing machines, particularly in terms of energy consumption and waste generation, is a restraining factor for the market.

- Outsourcing Challenges: Challenges associated with outsourcing banknote manufacture can limit the growth of the banknote printing machine industry.

- Regulatory Challenges: Strict regulations governing the banknote printing industry can be a restraining factor for the market, as companies need to comply with these regulations to operate.

- Intense Competition: The banknote printing machine market is characterized by intense competition, which can be a restraining factor for the growth of the market. The presence of numerous market players and the similarity in the services offered make it challenging for companies to differentiate themselves and gain a competitive edge.

Growth Opportunities

- Increasing Demand for Banknotes: The increasing demand for banknotes is presenting a significant growth opportunity for the banknote printing machine market.

- Technological Advancements: The integration of advanced technologies, such as high-resolution printing and security features, is presenting a growth opportunity for the banknote printing machine market, as banknotes become more secure and visually appealing.

- Growing Need for High-Security Banknotes: The growing need for high-security banknotes to protect against counterfeiting and other forms of fraud is presenting a growth opportunity for the banknote printing machine market.

- Increasing Use of Banknotes for Non-Currency Purposes: The increasing use of banknotes for non-currency purposes, such as loyalty programs and promotions, is presenting a growth opportunity for the banknote printing machine market.

- Rising Popularity of Electronic Payments: Despite the growing popularity of electronic payments, cash remains the most common form of payment in many parts of the world, which is driving the demand for banknote printing machines.

- Increasing Use of Big Data Analytics: The rise of big data analytics in banknote printing machines is likely to provide several growth opportunities for the market, as companies can better understand customer preferences and optimize their production processes.

Key Market Trends

- Increasing Demand for Banknotes: The increasing demand for banknotes is a key market trend shaping the banknote printing machine market, as the global economy grows and the need for physical currency increases.

- Technological Advancements: Technological advancements, such as high-resolution printing and security features, are a key market trend shaping the banknote printing machine market, as banknotes become more secure and visually appealing.

- Growing Need for High-Security Banknotes: The growing need for high-security banknotes to protect against counterfeiting and other forms of fraud is a key market trend shaping the banknote printing machine market.

- Increasing Use of Banknotes for Non-Currency Purposes: The increasing use of banknotes for non-currency purposes, such as loyalty programs and promotions, is a key market trend shaping the banknote printing machine market.

- Rising Popularity of Electronic Payments: Despite the growing popularity of electronic payments, cash remains the most common form of payment in many parts of the world, which is driving the demand for banknote printing machines.

Key Market Segments

Component

- Solution

- Services

Type

- Intaglio Printing

- Offset Printing

- Silk Screen Printing

Application

- Government Authorities and Private Enterprises

- Central Banks

Regional Analysis

In 2023, North America held a dominant market position in the Banknote Printing Machine market, capturing more than a 40% share. The region’s leadership can be attributed to several factors, including the presence of technologically advanced economies, a well-established financial sector, and a strong emphasis on security in currency production.

Central banks in North America have been at the forefront of adopting advanced banknote printing technologies to ensure the integrity and security of their currencies. Furthermore, the region’s robust regulatory framework and stringent quality standards drive the demand for high-quality banknote printing machines. The market in North America is characterized by the presence of leading manufacturers and suppliers, offering a wide range of technologically advanced solutions and services.

Europe is another significant region in the Banknote Printing Machine market. With the presence of several prominent central banks and a rich history of currency production, Europe holds a considerable market share. European countries are known for their adoption of cutting-edge printing technologies and stringent security features in banknote production.

The region’s demand is driven by factors such as currency replacement cycles, technological advancements, and the need for enhanced security features to combat counterfeiting. Additionally, the European Union’s strong focus on maintaining the integrity of the Euro currency contributes to the demand for banknote printing machines in the region.

The Asia Pacific (APAC) region exhibits substantial growth potential in the Banknote Printing Machine market. The region’s economic growth, large population, and expanding financial sector drive the demand for banknotes. Several countries in APAC are witnessing rapid currency modernization initiatives, leading to increased investments in banknote printing machines.

Additionally, the rising incidence of counterfeiting activities necessitates the adoption of advanced printing technologies and security features in banknote production. Countries like China, India, and Japan are key contributors to the growth of the APAC market, with their large-scale currency production and investments in printing infrastructure.

Latin America, the Middle East, and Africa (MEA) are regions with emerging economies that present opportunities for the Banknote Printing Machine market. These regions have a growing demand for banknotes due to factors such as population growth, economic development, and currency modernization efforts.

Central banks in these regions are investing in advanced banknote printing technologies to enhance security features and meet the increasing demand for banknotes. The market in MEA is driven by countries like South Africa, Nigeria, Saudi Arabia, and the United Arab Emirates, which are witnessing significant currency production and circulation.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Market Players

The banknote printing machine market comprises several key players that provide advanced printing solutions for the production of banknotes and security documents. These companies possess expertise in designing, manufacturing, and delivering high-quality printing machines to central banks and security printing companies worldwide.

Top Key Players

- Oumolat Security Printing LLC

- Cash Processing Solutions (CPS)

- Pasaban S.A.

- Shenzhen CBPM-KEXIN Banking Technology Co., Ltd.

- Konica Minolta, Inc.

- SPS TechnoScreen GmbH

- Focus Technology Co., Ltd.

- Security Printing & Minting Corporation of India Ltd.

- Flint Group, Koenig & Bauer AG

- Komori Corporation, Tangem AG

- Crane Holdings, Co.

- Heidelberger Druckmaschinen AG

- Goebel Capital GmbH

- Barry-Wehmiller Companies

- Bobst Group SA

- Other key players

Recent Developments

- In 2023, Giesecke & Devrient (G&D) launched its new generation of banknote printing machines, the INTEVO 5. The INTEVO 5 is a high-speed, high-security banknote printing machine that can print up to 160 banknotes per minute. It also features a number of new security features, such as a holographic security thread and a watermark.

- In 2023, KOMORI announced the launch of its new banknote printing machine, the KM-1000. The KM-1000 is a high-speed, high-security banknote printing machine that can print up to 120 banknotes per minute. It also features a number of new security features, such as a microprinting security thread and color-shifting ink.

- CBPM launched (2023) its new banknote printing machine, the CBPM-2000. The CBPM-2000 is a high-speed, high-security banknote printing machine that can print up to 100 banknotes per minute. It also features a number of new security features, such as a fluorescent security thread and a tactile security feature.

Report Scope

Report Features Description Market Value (2022) US$ 13.7 Bn Forecast Revenue (2032) US$ 36.8 Bn CAGR (2023-2032) 10.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Type (Intaglio Printing, Offset Printing, Silk Screen Printing), By Application (Government Authorities and Private Enterprises, Central Banks) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Oumolat Security Printing LLC, Cash Processing Solutions (CPS), Pasaban S.A., Shenzhen CBPM-KEXIN Banking Technology Co., Ltd., Konica Minolta, Inc., SPS TechnoScreen GmbH, Focus Technology Co., Ltd., Security Printing & Minting Corporation of India Ltd., Flint Group, Koenig & Bauer AG, Komori Corporation, Tangem AG, Crane Holdings, Co., Heidelberger Druckmaschinen AG, Goebel Capital GmbH, Barry-Wehmiller Companies, Bobst Group SA, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a Banknote Printing Machine?A Banknote Printing Machine is a specialized device designed to print currency notes or banknotes. It incorporates advanced printing technologies to produce secure and counterfeit-resistant paper currency.

How do Banknote Printing Machines work?These machines utilize intricate printing processes, including intaglio and offset printing, to create detailed and secure features on banknotes. Security measures such as watermarks, holograms, and special inks are often integrated during the printing process.

Who uses Banknote Printing Machines?Central banks, government monetary authorities, and authorized printing facilities use Banknote Printing Machines to produce official currency for circulation.

What factors drive the demand for Banknote Printing Machines?The demand is primarily driven by the need for secure and technologically advanced currency production to prevent counterfeiting. It is also influenced by the replacement of old or damaged currency and changes in national currency designs.

How big is banknote printing machine market?In 2023, the worldwide banknote printing machine market reached a value of USD 13.7 Billion. Over the forecast period from 2024 to 2033, it is anticipated to display a CAGR of 10.4% in terms of revenue, ultimately reaching a value of USD 36.8 Billion by the year 2033.

Banknote Printing Machine MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample

Banknote Printing Machine MarketPublished date: Dec. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Oumolat Security Printing LLC

- Cash Processing Solutions (CPS)

- Pasaban S.A.

- Shenzhen CBPM-KEXIN Banking Technology Co., Ltd.

- Konica Minolta, Inc.

- SPS TechnoScreen GmbH

- Focus Technology Co., Ltd.

- Security Printing & Minting Corporation of India Ltd.

- Flint Group, Koenig & Bauer AG

- Komori Corporation, Tangem AG

- Crane Holdings, Co.

- Heidelberger Druckmaschinen AG

- Goebel Capital GmbH

- Barry-Wehmiller Companies

- Bobst Group SA

- Other key players