Global Bakery Product Market By Product, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 43440

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

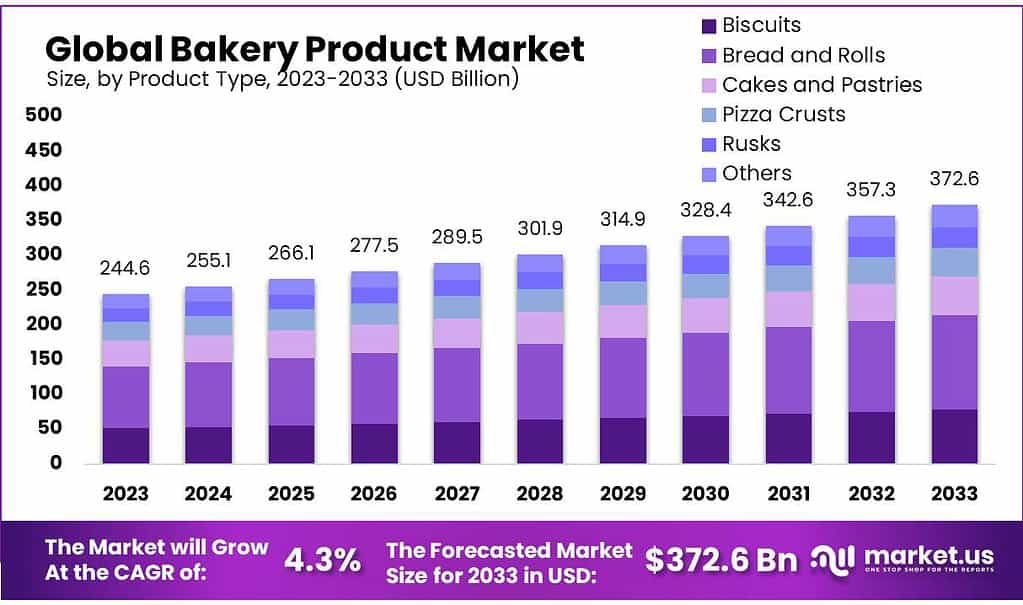

The global Bakery Product market size is expected to be worth around USD 372.6 billion by 2033, from USD 244.6 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

Over the next few years, the global demand for bakery products will increase due to the increasing consumption of ready-to-eat foods. There has been an increase in European bakery product demand because of the growing popularity of ethnic foods and the success of Mexican and Thai cuisines in restaurants.

Organic products are healthier and significantly increase demand for whole wheat, light, and natural bakery products. Bakery products gaining popularity among the health-conscious consumer category because bakery products claim to be salt-free, fat-free, sugar-free, whole wheat, and gluten-free product.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: The Bakery Product market is set to expand significantly, with a projected worth of around USD 372.6 billion by 2033, growing at a steady CAGR of 4.3% from USD 244.6 billion in 2023.

- Product Trends and Preferences: Popular Items: Bread and rolls dominate the market, accounting for over 36.5% of sales in 2023, followed by cakes & pastries with anticipated growth due to new flavors and increased disposable income. Specialty Types: Gluten-free products claimed a substantial market share of 26.4%, reflecting the rising demand for healthier alternatives. Organic, low-calorie, fortified, and sugar-free products also gained traction among health-conscious consumers.

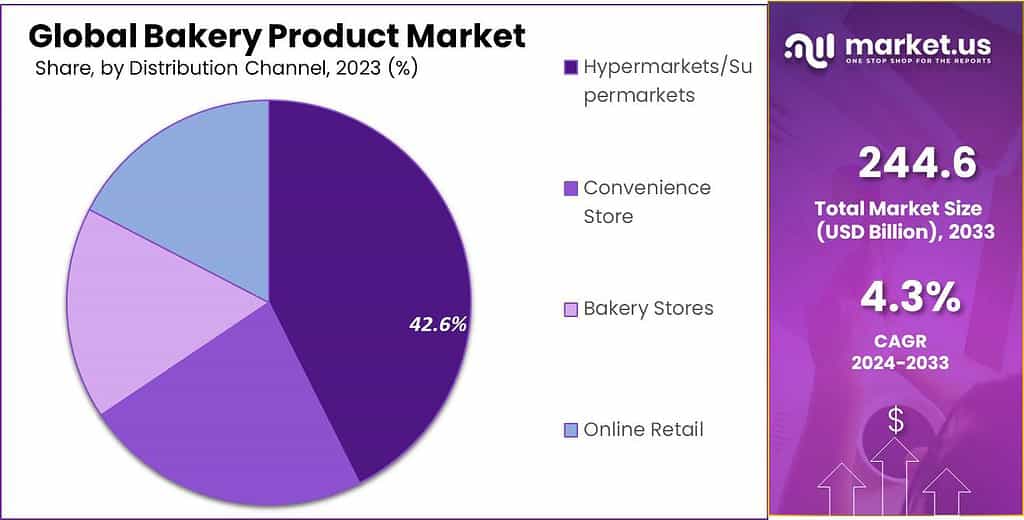

- Distribution Channels: Market Leaders: Hypermarkets/Supermarkets secured over 42.6% of the market due to their convenience and diverse offerings. Emerging Trends: Specialty stores, focusing on artisanal and health-conscious bakery goods, are gaining ground and expanding the market’s scope.

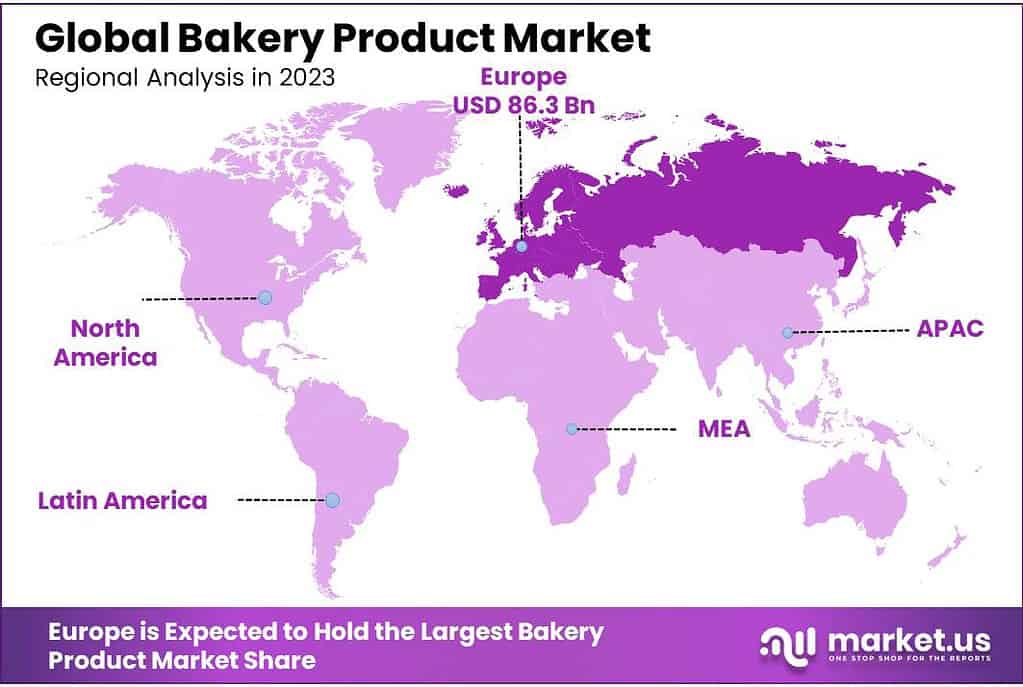

- Regional Insights: Europe Dominance: Europe led the market in 2023 with a 35.3% revenue share, attributed to high demand for baked goods, including specialty products like gluten-free and trans-fat items.

- Industry Challenges and Opportunities: Challenges: The lack of robust cold chain infrastructure in developing countries poses a hurdle to market expansion, particularly in ensuring the freshness and safety of frozen bakery goods. Opportunities: Rising disposable incomes in emerging economies, coupled with increased international trade, present growth opportunities for frozen foods, allowing for diversity in products and tastes.

- Major Players and Strategies: Key Companies: Industry giants like Nestle, Mondelez International, and others focus on brand loyalty, substantial investments, joint ventures, mergers & acquisitions, and strategic partnerships to drive growth.

Product Analysis

In 2023, rolls and bread were the big players, owning more than 36.5% of the market. People just couldn’t get enough of these bakery basics.

The industry’s growth is affected by many factors, such as flavors and fats, texture, and sweetness. Due to significant increases in product demand in the Asia Pacific and North America, the pieces of bread & rolls market segment is expected to see significant growth.

The largest market share is expected to be held by cakes & pastries, which will see the most bakery products market growth due to new flavors and increasing consumer disposable income.

Long-term opportunities will be available for industry players as a result of the growing population in the Asia Pacific. Due to the introduction of new flavors, shapes, and textures, the cookies segment will see healthy growth.

By Specialty Type

In 2023, gluten-free products ruled the bakery scene, grabbing over 26.4% of the market share. More people sought these options due to gluten sensitivities or a preference for healthier alternatives.

Fortified baked goods followed suit, with a steady rise in demand. Consumers looking for extra nutrients in their treats contributed to this segment’s growth.

Organic products carved out a niche too, attracting those keen on natural, pesticide-free ingredients. Their share of the market reflected a growing interest in sustainable and healthier choices.

Low-calorie options emerged steadily, appealing to health-conscious consumers aiming to balance indulgence with mindful eating habits.

Sugar-free specialties also gained ground, meeting the needs of those seeking sweetness without the sugar rush. Their presence in the market highlighted a growing demand for healthier alternatives in baked goods.

Distribution Channel Insights

In 2023, Hypermarkets/Supermarkets took the lead, snatching over 42.6% of the market share for bakery products. These big retail spaces became go-to spots for a wide range of baked goods due to convenience and variety.

The majority of specialty stores, including independent ones, sell artisanal bakery goods. The rising health concerns have prompted bakery producers to include functional ingredients in their products, such as legumes and oats, probiotics-fortified margarine, cereals, and probiotics. This will increase market growth by ensuring that new products are constantly developed.

In the product type, the biscuit segment contains various types of biscuits like cream biscuits, Marie biscuits, glucose biscuits, non-salt cracker biscuits, milk biscuits, and others. The bakery product market is categorized based on product type, and distribution channel.

Note: Actual Numbers Might Vary In the Final Report

Key Market Segments

By Product

- Biscuits

- Cookies

- Non-Salt Cracker Biscuits

- Salt Cracker Biscuits

- Milk Biscuits

- Cream Biscuits

- Glucose Biscuits

- Others

- Bread and Rolls

- Cakes and Pastries

- Pizza Crusts

- Rusks

- Others

By Specialty Type

- Gluten-free

- Fortified

- Organic

- Low-calorie

- Sugar-free

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Store

- Convenience Stores

- Other Distribution Channel

Drivers

Rapid growth in the packaged food and beverage drives growth in the frozen market. Frozen foods are getting popular because our lives are changing. We all want food that’s easy to make, stays fresh, and doesn’t take up too much time. Packaged foods, like frozen meals, are just right for our busy days.

They’re quick to cook or sometimes even ready to eat, which is a huge help on hectic days. These companies are good at making sure you can find their food everywhere. With more and more people loving frozen foods for how easy they are, it’s a win-win for everyone! It means folks have more simple choices that fit right into their busy lives. Getting a good meal becomes a whole lot easier!

Restraints

Rising Preference for Fresh and Natural Food Products. Nowadays, lots of folks really like fresh and natural foods. They think these are healthier and better for them because they have more nutrients and fewer extra things added in. It’s a bit hard for frozen food companies at the moment.

They’re trying hard to tell everyone that their frozen meals are just as amazing as fresh ones. But many folks believe that fresh food is always healthier, so they might not even give frozen options a chance. Also, people are really into getting food from local farms.

They want that connection to where their food comes from and support farmers nearby. So, they’re sticking more to fresh foods. It’s like this: because many people like fresh and natural foods, it’s tricky for frozen food companies to make people think their food is just as good. Nowadays, folks really love the idea of fresh, locally sourced foods.

Opportunities

Rising disposable incomes in emerging economies, driving frozen foods segment. More people in developing countries have more money to spend, and that’s helping the frozen foods market. Also, because there’s a lot of trading of processed foods between countries, frozen foods are getting a big chance to grow. With all this trading happening, frozen foods are getting popular in a few ways.

Nowadays, folks have the chance to taste frozen meals from all around the globe. It’s like having a variety of different cuisines to pick from! Plus, companies can get ingredients for frozen foods more easily from other countries.

That means they can keep prices low and make more profit. Also, because of all this trading, companies are making frozen foods that match the tastes of different places. So, you might find a bunch of different options depending on where you are.

This variety gets more people interested, making the market grow even more. Basically, because of all the trading happening between countries, frozen foods are becoming more diverse and available to lots of different people.

Challenges

Lack of Cold Chain Infrastructure in Developing Countries. In some developing countries like South Africa or Kenya, keeping frozen food fresh and safe is hard. There’s a system called cold chain infrastructure” that keeps food cold from when it’s made till it reaches stores.

But in these places, that system isn’t so good. So, if food isn’t kept cold enough during storage or transport, it might not stay good, and it could even make people sick. Plus, in far-off or less-developed areas, there might not be any frozen foods available because the infrastructure isn’t there to get it to those places.

Also, setting up and keeping this cold chain system running can cost a lot of money. That makes it tough for both the people making the frozen foods and the ones selling them. Overall, fixing this problem in developing countries is super important. If they can improve this system, it would help the frozen foods market grow a lot in those areas.

Regional Analysis

Europe is expected to be a dominant market with a revenue share of 35.3% in 2023, due to the high demand for baked goods, including gluten-free, high-fiber, and trans-fat products. These products are stapled foods.

The Asia Pacific is expected to grow the fastest in the coming years due to the presence of key companies in emerging markets such as China and India.

A rising population and increased per-capita earnings levels are expected to create growth opportunities in emerging markets. Further, the market will continue to grow due to rising demand in India and China for breakfast cereals.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

Brand loyalty and high capital investments will keep fierce competition at bay. Major companies concentrate on business growth. They implement various growth strategies including joint ventures. Mergers & Acquisitions. Strategic partnerships with regional producers. Diversification of distribution channels.

Nestle S.A., Mondelez International Inc., Britannia Industries, Associated British Foods Plc, Finsbury Food Group Plc, Yamazaki Baking Co., Ltd., The Great Canadian Bagel Ltd., Canada Bread Company, Frank Roberts and Sons Ltd., ARYZTA COMPANY are some of the major players in this industry.

Маrkеt Кеу Рlауеrѕ

- Nestle S.A.

- Mondelez International Inc.

- Britannia Industries

- Associated British Foods Plc

- Finsbury Food Group Plc

- Yamazaki Baking Co., Ltd.

- The Great Canadian Bagel Ltd.

- Canada Bread Company

- Frank Roberts and Sons Ltd.

- ARYZTA

Recent Developments

April 2022: Walker’s Shortbread partnered with retailer Dufry to launch a new Global Travel Retailer range at more than 55 travel sites worldwide. The product range will include several types of shortbreads and other products.

Report Scope

Report Features Description Market Value (2023) USD 244.6 Billion Forecast Revenue (2033) USD 372.6 Billion CAGR (2023-2032) 4.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product(Biscuits, Bread and Rolls), By Specialty Type (Gluten-free, Fortified, Organic, Low-calorie, Sugar-free), By Distribution Channel (Hypermarkets & Supermarkets, Specialty Store, Convenience Stores, Other Distribution Channel) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nestle S.A., Mondelez International Inc., Britannia Industries, Associated British Foods Plc, Finsbury Food Group Plc, Yamazaki Baking Co., Ltd., The Great Canadian Bagel Ltd., Canada Bread Company, Frank Roberts and Sons Ltd., ARYZTA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are the popular bakery products in the market?Common bakery products include bread, cakes, pastries, cookies, muffins, bagels, croissants, doughnuts, and more. Specialty items like artisanal bread, gluten-free products, and vegan baked goods are also gaining popularity.

How does consumer behavior influence the bakery product market?Changing consumer preferences impact product development, with a focus on healthier ingredients, convenience, and unique flavors. Social media also plays a significant role, influencing trends and creating demand for visually appealing products.

How is technology impacting the bakery industry?Technology has improved production processes, from automated baking equipment to sophisticated packaging solutions. Online ordering systems, e-commerce platforms, and social media marketing have also revolutionized how bakeries reach consumers.

-

-

- Nestle S.A.

- Mondelez International Inc.

- Britannia Industries

- Associated British Foods Plc

- Finsbury Food Group Plc

- Yamazaki Baking Co., Ltd.

- The Great Canadian Bagel Ltd.

- Canada Bread Company

- Frank Roberts and Sons Ltd.

- ARYZTA