Global Backup Power Market Size, Share, And Industry Analysis Report By Type (Diesel Generators, Gas Generators, Solar Generators, Others), By Power Rating (Up to 50 kVA, 51 to 280 kVA, 281 to 500 kVA, 501 to 2000 kVA, Above 2000 kVA), By Application (Standby Power, Prime Power, Peak Shaving), By End User (Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170392

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

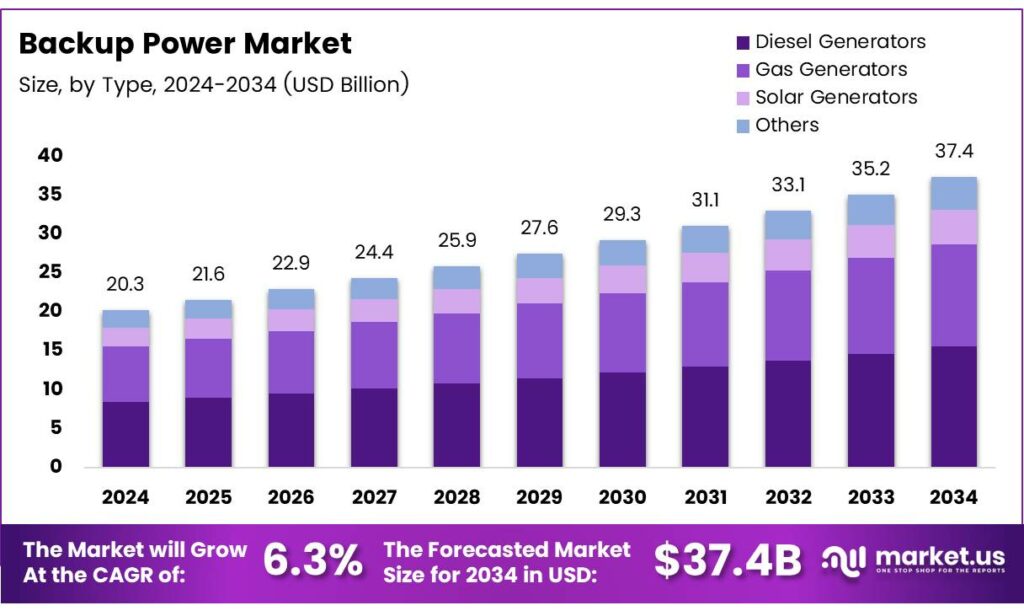

The Global Backup Power Market size is expected to be worth around USD 37.4 billion by 2034, from USD 20.3 billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

Backup power refers to systems that supply electricity during grid outages to protect operations, safety, and data continuity. In simple terms, it ensures power availability when the primary supply fails. Therefore, backup power solutions are increasingly essential for homes, businesses, healthcare facilities, data centers, and public infrastructure facing frequent outages.

Backup power adoption grows as electricity demand rises and grid reliability becomes inconsistent. Moreover, digitalization, remote work, and automation intensify dependency on uninterrupted power. Buyers increasingly evaluate backup solutions not only for emergency use, but also for power quality, voltage stability, and operational resilience. The Backup Power Market represents the commercial ecosystem covering generators, UPS systems, batteries, and hybrid solutions.

- Modern online UPS systems highlight strong performance benchmarks. For example, a 50 KVA three-phase online UPS uses IGBT-PWM switching with a maximum 2% total harmonic distortion. It accepts 300–450 V input and delivers 415 V ±1% output, with 80–90% efficiency and 120% overload tolerance for 10 minutes. Such systems use SMF-VRLA or stationary lead-acid batteries rated at 200 Ah, delivering up to 240 minutes of backup time.

Opportunities further expand as users shift from basic generators toward intelligent UPS-based systems. Compared with home generators providing 10–50 kW, commercial solutions start around 50 kW and scale to several hundred kilowatts. Therefore, large homes, campuses, and commercial estates prefer higher-capacity systems supporting complex electrical loads efficiently.

Key Takeaways

- The Global Backup Power Market is projected to grow from USD 20.3 billion in 2024 to USD 37.4 billion by 2034, registering a 6.3% CAGR during 2025–2034.

- Diesel Generators dominate the market by type, accounting for a leading share of 69.2% due to reliability and high load-handling capability.

- The 51 to 280 kVA segment leads with a market share of 31.5%, driven by demand from commercial and mid-scale industrial users.

- Standby Power applications hold a dominant share of 62.8%, reflecting strong demand for outage protection across critical facilities.

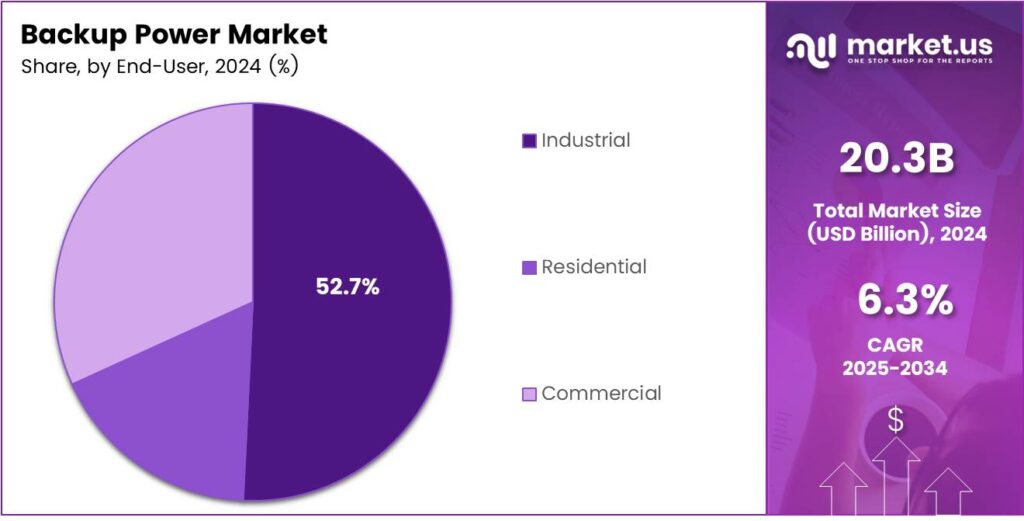

- The Industrial end-user segment leads the market with a share of 52.7%, supported by high dependency on uninterrupted operations.

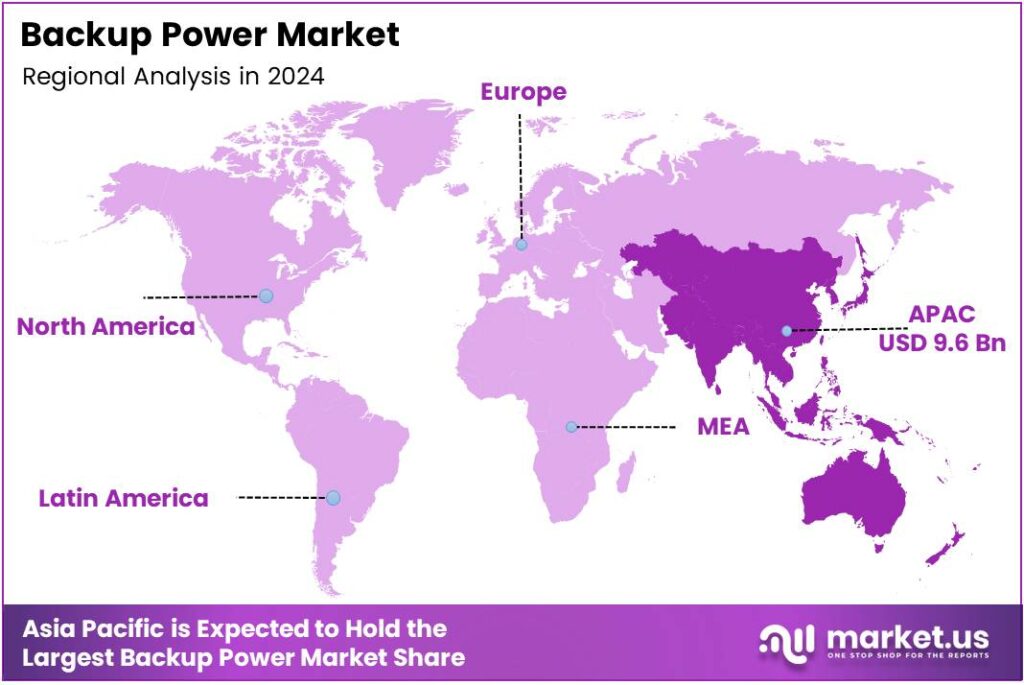

- Asia Pacific is the leading region, capturing 47.3% of the global market and reaching a value of USD 9.6 billion in 2024.

By Type Analysis

Diesel Generators dominate with 69.2% due to reliability and fuel availability.

In 2024, Diesel Generators held a dominant market position in the By Type Analysis segment of the Backup Power Market, with a 69.2% share. Moreover, diesel systems remain preferred for critical operations because they offer fast startup, high load handling, and proven durability across industrial and commercial facilities.

In contrast, Gas Generators are steadily gaining attention as cleaner-burning alternatives. They are increasingly adopted in urban locations where emission norms are stricter. Additionally, gas units provide quieter operation and lower fuel costs, making them suitable for hospitals, offices, and data centers seeking dependable backup solutions.

Meanwhile, Solar Generators are emerging as sustainable backup options, especially in residential and remote settings. These systems support energy transition goals and reduce dependency on fossil fuels. However, their usage remains limited to smaller loads, as storage capacity and weather dependence still restrict large-scale adoption.

Other backup power types include hybrid and battery-supported systems. These solutions are gradually finding niche applications where space efficiency and low noise are required. Although adoption is moderate, innovation and falling battery prices are expected to improve their acceptance in specialized backup power applications.

By Power Rating Analysis

51 to 280 kVA dominates with 31.5% driven by balanced capacity needs.

In 2024, 51 to 280 kVA held a dominant market position in the By Power Rating Analysis segment of the Backup Power Market, with a 31.5% share. Notably, this range meets the balanced power needs of commercial buildings, hospitals, and small industrial units requiring reliable mid-scale backup.

Up to 50 kVA systems are mainly used in residential buildings and small offices. These units support essential appliances and lighting during outages. Furthermore, their lower cost, compact size, and easy installation make them suitable for households and small retail spaces.

Meanwhile, 281 to 500 kVA generators serve medium industrial operations and large commercial facilities. They are often installed in manufacturing units and malls where uninterrupted power is essential. Consequently, demand remains steady in regions with frequent grid instability.

Generators ranging from 501 to 2000 kVA and above 2000 kVA are deployed in heavy industries, utilities, and infrastructure projects. These high-capacity systems ensure operational continuity for energy-intensive facilities, although their adoption is limited to specialized, large-scale backup power requirements.

By Application Analysis

Standby Power leads with 62.8% as outage protection remains critical.

In 2024, Standby Power held a dominant market position in the By Application Analysis segment of the Backup Power Market, with a 62.8% share. Primarily, standby systems protect homes, businesses, and institutions from unexpected outages, ensuring continuity during grid failures.

Prime Power applications are used where grid access is unreliable or unavailable. These systems act as the main electricity source for construction sites, mining operations, and remote locations. As infrastructure expands in developing regions, demand for prime power solutions continues to grow steadily.

Meanwhile, Peak Shaving applications support energy cost management by reducing grid load during peak demand periods. Organizations adopt these systems to control electricity bills and improve energy efficiency. Although adoption is selective, interest is increasing among large commercial and industrial users.

By End User Analysis

Industrial end users dominate with 52.7% due to operational dependency.

In 2024, Industrial held a dominant market position in the By End User Analysis segment of the Backup Power Market, with a 52.7% share. Importantly, industries depend heavily on continuous power to avoid production losses, equipment damage, and safety risks during power interruptions.

Commercial users, including offices, hospitals, and retail centers, represent a significant portion of demand. These users rely on backup power to maintain essential services, protect data systems, and ensure customer safety, particularly in regions experiencing frequent grid disruptions.

Residential end users increasingly adopt backup power solutions to support lighting, appliances, and home offices. Rising urbanization and work-from-home trends are encouraging households to invest in compact and affordable backup systems for improved power reliability.

Key Market Segments

By Type

- Diesel Generators

- Gas Generators

- Solar Generators

- Others

By Power Rating

- Up to 50 kVA

- 51 to 280 kVA

- 281 to 500 kVA

- 501 to 2000 kVA

- Above 2000 kVA

By Application

- Standby Power

- Prime Power

- Peak Shaving

By End User

- Residential

- Commercial

- Industrial

Emerging Trends

Shift Toward Cleaner and Smarter Backup Power Solutions Shapes Trends

One major trend in the backup power market is the growing shift toward cleaner energy solutions. Users increasingly prefer systems with lower emissions and improved efficiency, driven by environmental concerns and regulatory pressure. Integration of smart technologies is another key trend.

- Modern backup power systems now include remote monitoring, automated controls, and predictive maintenance features. These capabilities improve reliability and reduce operational risks. The International Energy Agency (IEA) reports that battery storage in the power sector was the fastest-growing energy technology, with deployment more than doubling year-on-year and reaching a total of 42 GW of storage capacity added globally.

Hybrid systems combining generators with batteries and renewable sources are gaining attention. They offer better fuel efficiency, quieter operation, and reduced environmental impact, making them attractive for urban and commercial use. Portability and compact design are also trending factors.

Drivers

Frequent Power Outages and Grid Reliability Concerns Drive Market Growth

Frequent power outages remain one of the strongest drivers for the backup power market. Aging grid infrastructure, rising electricity demand, and extreme weather events often disrupt power supply across regions. Residential, commercial, and industrial users increasingly rely on backup power systems to ensure uninterrupted operations and daily comfort.

- Rapid urbanization and industrial expansion further support this demand. Data centers, hospitals, telecom towers, and manufacturing units cannot afford downtime. Backup power solutions help maintain operational continuity and protect sensitive equipment. The Energy Information Administration (EIA) forecasts that total electricity consumption will reach 4,199 billion kilowatt-hours (kWh) in 2025 and grow further to 4,267 billion kWh in 2026

Growing dependence on digital services is another important driver. Cloud computing, online transactions, and remote work require stable electricity. Backup power systems act as a safety layer, supporting critical loads during grid failures and voltage fluctuations.

Restraints

High Initial Investment and Maintenance Costs Limit Adoption

One major restraint in the backup power market is the high upfront cost of systems. Purchasing generators, batteries, or hybrid solutions requires significant capital, especially for small businesses and households. This often delays adoption in price-sensitive markets.

- Backup power systems need regular servicing, fuel management, and component replacement to remain reliable. The U.S. Department of Energy highlighted a stark challenge: utility systems are slated to retire about 104 gigawatts (GW) of firm power capacity by 2030, but only 22 GW of that will be replaced by new capacity that can provide firm, around-the-clock electricity.

Fuel dependency is another limiting factor, particularly for diesel-based systems. Fuel price fluctuations directly affect operating costs, making long-term budgeting difficult for users. In some regions, fuel availability during emergencies can also be uncertain.

Growth Factors

Rising Demand for Reliable Power in Emerging Economies Creates Opportunities

Emerging economies present strong growth opportunities for the backup power market. Rapid industrialization, infrastructure development, and expanding urban populations increase electricity demand faster than grid upgrades. Backup power systems fill this reliability gap.

The growth of small and medium enterprises also creates opportunities. Many new businesses require affordable and scalable backup solutions to protect operations. This drives demand for compact and modular systems suited to varied applications.

Expansion of healthcare, data centers, and telecom networks opens further potential. These sectors require uninterrupted power to ensure safety, data protection, and service continuity. Backup power remains a critical investment for such facilities.

Regional Analysis

Asia Pacific Dominates the Backup Power Market with a Market Share of 47.3%, Valued at USD 9.6 Billion

Asia Pacific leads the backup power market due to rapid urbanization, rising electricity demand, and frequent grid interruptions across emerging economies. In this region, the market held a dominant share of 47.3%, reaching a value of USD 9.6 billion, driven by industrial expansion and infrastructure development. Growing investments in manufacturing facilities, data centers, and healthcare infrastructure continue to strengthen backup power adoption.

North America represents a mature backup power market, supported by high awareness of power reliability and strong adoption across commercial and residential sectors. Aging grid infrastructure and climate-related power disruptions sustain steady demand for backup power solutions. Industrial users increasingly rely on backup systems to avoid downtime and financial losses. Regulatory focus on grid resilience further supports consistent market growth across the region.

Europe’s backup power market is shaped by stringent energy security policies and increasing focus on grid stability. Industrial automation, data centers, and public infrastructure drive steady demand for reliable backup power systems. The region benefits from strong regulatory frameworks encouraging resilience against power fluctuations. Rising renewable energy integration also increases the need for backup solutions to balance intermittent supply.

The U.S. backup power market benefits from high power consumption levels and strong demand for uninterrupted operations across industries. Extreme weather events and grid congestion increase the need for dependable backup solutions. Commercial buildings, data centers, and residential users continue to invest in backup power systems. Ongoing grid modernization efforts further reinforce steady market demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Caterpillar Inc. remains a backbone supplier in the backup power market because its generator sets are built for heavy-duty uptime in industrial sites, large commercial buildings, and critical infrastructure. In 2024, the company’s strength is its broad engine and alternator know-how, plus a wide dealer and service network that shortens repair cycles and supports long operating hours during outages.

Cummins Inc. continues to win in 2024, where customers want reliable standby power with strong after-sales support and flexible configurations across power ratings. Its edge is deep expertise in engines and power systems integration, helping data centers, healthcare sites, and manufacturing units reduce downtime and manage load requirements more smoothly.

Generac Power Systems Inc. stands out in 2024 for meeting rising residential and light-commercial demand, especially where grid reliability is a concern and users want fast installation and simple operation. The company’s focus on packaged solutions, automatic startup features, and user-friendly monitoring keeps it highly visible in home standby and small business backup applications.

Kohler Co. holds a solid position in 2024 by serving customers who value dependable standby systems for commercial facilities, hospitality, and premium residential needs. Its reputation is linked to durable generator offerings and strong channel support, which helps buyers prioritize long lifecycle performance, predictable maintenance, and steady power quality during extended outages.

Top Key Players in the Market

- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems Inc.

- Kohler Co.

- MTU Onsite Energy (Rolls-Royce)

- Atlas Copco AB

- Mitsubishi Heavy Industries Ltd.

- Briggs & Stratton Corporation

- Schneider Electric SE

- Eaton Corporation

- Aggreko Plc

- Wärtsilä Corporation

- Yanmar Co. Ltd.

- Doosan Corporation

- Vertiv Co

Recent Developments

- In 2025, partnered with Joule Capital Partners and Wheeler Machinery Co. to develop a distributed generation system for data centers, featuring Caterpillar generator sets, battery storage, and backup power from diverse fuels like natural gas and hydrogen. This solution prioritizes rapid U.S. manufacturing to meet surging compute demands.

- In 2025, Launched biofuel-capable backup generators for U.S. data centers, runnable on diesel or vegetable oil-based fuels, addressing sustainability while maintaining reliability for high-capacity loads. The company announced the debut of large-scale generators for hyper-scale data centers, positioning Generac to capture growth in this market despite policy shifts.

Report Scope

Report Features Description Market Value (2024) USD 20.3 billion Forecast Revenue (2034) USD 37.4 billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Diesel Generators, Gas Generators, Solar Generators, Others), By Power Rating (Up to 50 kVA, 51 to 280 kVA, 281 to 500 kVA, 501 to 2000 kVA, Above 2000 kVA), By Application (Standby Power, Prime Power, Peak Shaving), By End User (Residential, Commercial, Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar Inc., Cummins Inc., Generac Power Systems Inc., Kohler Co., MTU Onsite Energy (Rolls-Royce), Atlas Copco AB, Mitsubishi Heavy Industries Ltd., Briggs & Stratton Corporation, Schneider Electric SE, Eaton Corporation, Aggreko Plc, Wärtsilä Corporation, Yanmar Co. Ltd., Doosan Corporation, Vertiv Co Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Caterpillar Inc.

- Cummins Inc.

- Generac Power Systems Inc.

- Kohler Co.

- MTU Onsite Energy (Rolls-Royce)

- Atlas Copco AB

- Mitsubishi Heavy Industries Ltd.

- Briggs & Stratton Corporation

- Schneider Electric SE

- Eaton Corporation

- Aggreko Plc

- Wärtsilä Corporation

- Yanmar Co. Ltd.

- Doosan Corporation

- Vertiv Co