Global Autonomous Tractors Market By Component (Sensors, GPS, LiDAR, and Other Components), By Automation (Fully Autonomous Tractors and Semi-Autonomous Tractors), By Application (Planting & Seeding, Spraying & Fertilizing, Tillage, and Other Applications), By Power Output (Up to 30 HP, 30 HP to 100 HP, and Above 100 HP), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 114576

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

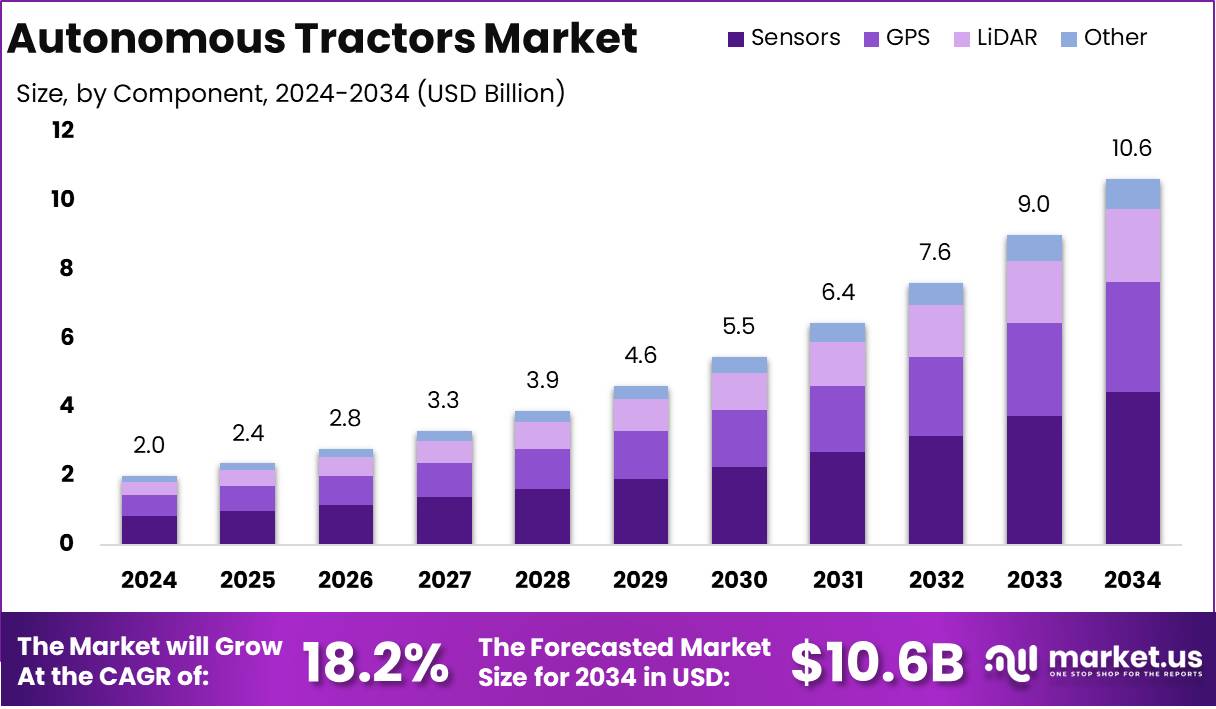

The Global Autonomous Tractors Market size is expected to be worth around USD 10.6 Billion by 2034 from USD 2.0 Billion in 2024, growing at a CAGR of 18.2% during the forecast period from 2025 to 2034.

Autonomous tractors are advanced agricultural vehicles equipped with artificial intelligence (AI), sensors, and autonomous navigation systems that allow them to operate without direct human intervention. These tractors are designed to perform essential farming tasks such as plowing, planting, harvesting, and spraying with minimal human supervision.

The integration of autonomous technologies, including GPS, machine learning, and vision systems, enables tractors to navigate fields, optimize routes, and ensure precision in farm operations, enhancing overall productivity and reducing labor dependency. These tractors offer real-time data analysis for improving operational efficiency and enabling smart decision-making in agriculture.

The autonomous tractors market refers to the sector focused on the development, manufacturing, and deployment of self-driving tractors in agriculture. This market includes various players, ranging from established agricultural equipment manufacturers to new entrants specializing in autonomous technologies. It also encompasses the systems that support autonomous tractors, such as AI, GPS, and machine learning solutions.

As farming becomes increasingly technology-driven, the demand for autonomous solutions grows, driven by the need for efficiency, sustainability, and cost reduction in agricultural practices. The market is influenced by advancements in robotics, AI, and IoT, which enhance the capabilities of these autonomous vehicles.

The growth of the autonomous tractors market can be attributed to several key factors. Technological advancements in AI, robotics, and sensor technologies have significantly improved the reliability and performance of autonomous systems.

The demand for autonomous tractors is on the rise due to the increasing need for higher productivity and efficiency in agriculture. Farmers are adopting these technologies to address the challenges of labor shortages, high operational costs, and the need for precision in farming activities. Autonomous tractors offer significant potential for increasing yields and reducing input costs by automating time-consuming tasks such as tilling, planting, and spraying.

As agricultural operations expand and the complexity of modern farming increases, the demand for autonomous tractors is expected to rise steadily, driven by the need for scalable, sustainable solutions that enhance operational efficiency while ensuring high-quality produce.

The growing adoption of autonomous tractors presents numerous opportunities for innovation and market expansion. One of the primary opportunities lies in the integration of autonomous tractors with other emerging technologies, such as drones and AI-driven farm management systems, to create fully integrated farming solutions.

According to Proag, the autonomous tractors market is forecasted to expand by 25% by 2030, primarily due to enhanced operational efficiency and continuous 24/7 performance.

According to Monarch Tractor, the Autonomous Tractors Market is gaining significant momentum, backed by technological innovation and investor confidence. In 2024, Monarch Tractor, the developer of the world’s first fully electric, driver-optional smart tractor the MK-V secured a record-breaking $133 million in Series C funding.

The Autonomous Tractors Market is poised for accelerated growth, supported by rising investments and scalable innovations. According to Agtonomy, the company raised an additional $10 million on October 16, 2024, closing its Series A round at $32.8 million. This funding, aligned with its commercial offerings and AI-enabled automation software, is expected to drive market expansion and technological adoption across the agriculture and land maintenance sectors.

Key Takeaways

- The global Autonomous Tractors Market is projected to reach USD 10.6 billion by 2034, growing at a robust CAGR of 18.2% from 2025 to 2034, up from USD 2.0 billion in 2024.

- In 2024, Sensors dominate the By Component segment, capturing over 41.7% of the market share within the Autonomous Tractors sector.

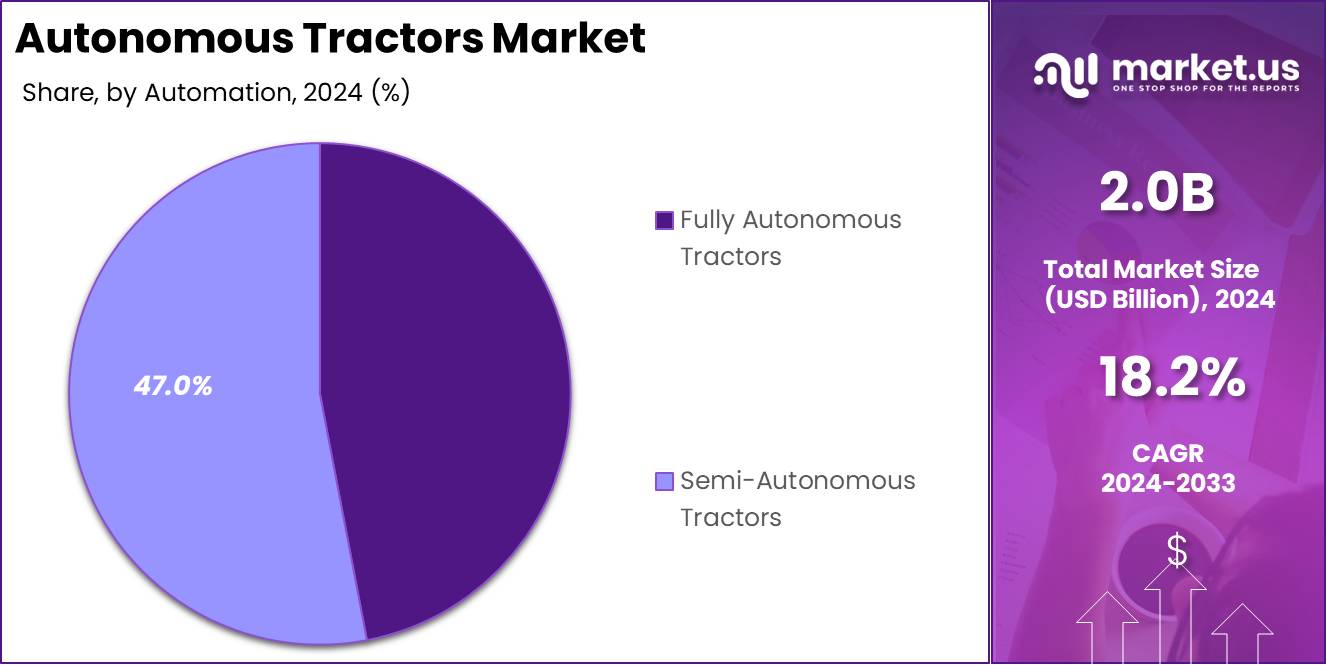

- Within the By Automation Analysis segment, Semi-Autonomous Tractors lead the market with more than 53% of the market share in 2024.

- Tillage applications are the leading segment in the Autonomous Tractors market, accounting for over 42% of the total market share in 2024.

- Autonomous tractors with power outputs above 100 HP hold a dominant position in the market, representing more than 49% of the total market share in 2024.

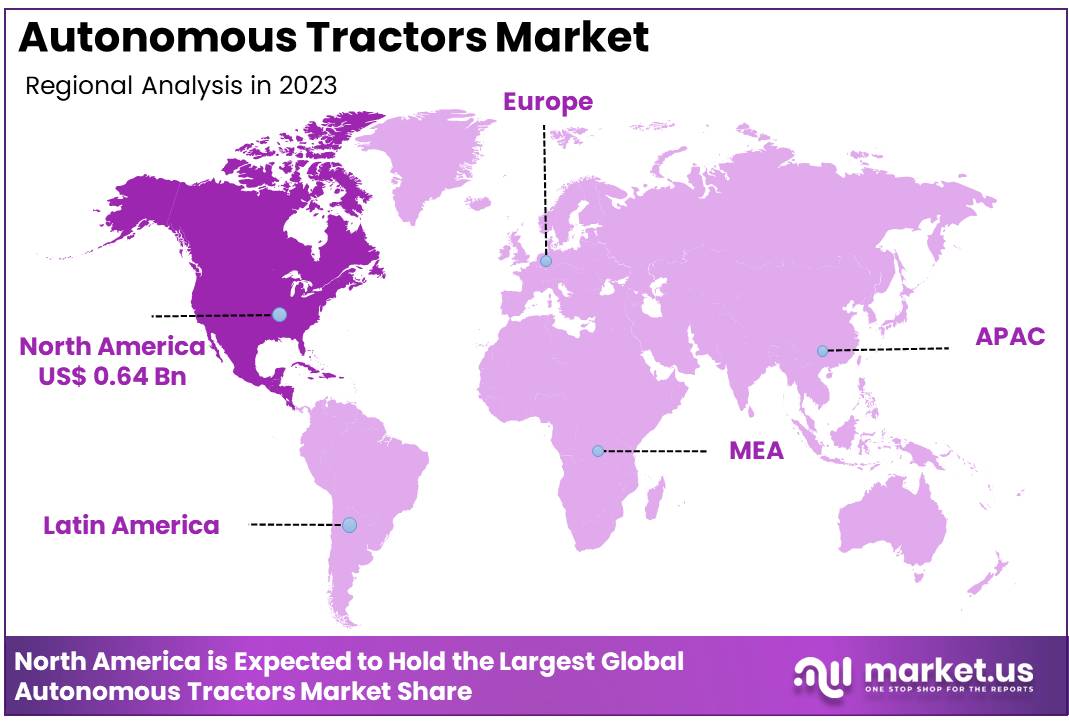

- The North American region is set to lead the global Autonomous Tractors Market, holding a significant market share of 32.0% in 2024, valued at USD 0.64 billion.

By Component Analysis

Sensors Dominate The Autonomous Tractors Market in 2024, Capturing Over 41.7% Share

In 2024, Sensors hold a dominant market position in the By Component segment of Autonomous Tractors, capturing more than 41.7% of the market share. Sensors are integral to the functioning of autonomous tractors, enabling accurate data collection and real-time decision-making capabilities. These sensors include technologies such as proximity sensors, vision sensors, and radar sensors, all of which contribute to enhanced automation and safety of autonomous tractors.

The extensive use of sensors is driven by the increasing demand for precision farming and the need to automate agricultural processes. The market share of sensors is expected to remain significant, as advancements in sensor technology continue to improve the efficiency and functionality of autonomous vehicles. With their crucial role in object detection, collision avoidance, and navigation, sensors are a key component supporting the growth of autonomous tractors in the agricultural sector.

GPS technology holds a significant position in the By Component segment of Autonomous Tractors. GPS systems are vital for autonomous tractors as they provide precise positioning and navigation, enabling tractors to follow predefined paths with accuracy. This technology plays a key role in the smooth operation of autonomous tractors, guiding them through expansive agricultural fields and facilitating seamless integration with other automated farming systems.

The increasing adoption of precision agriculture practices has driven the demand for GPS systems in autonomous tractors. As GPS technology advances with real-time data integration and enhanced accuracy, its contribution to improving tractor autonomy and reducing manual labor is expected to grow, further solidifying its role in the market.

LiDAR (Light Detection and Ranging) technology is a crucial component in the By Component segment of Autonomous Tractors. LiDAR is responsible for generating high-resolution 3D maps of the environment, assisting autonomous tractors in navigating complex terrains. By emitting laser beams and measuring the time it takes for the beams to return, LiDAR enables the detection of obstacles and accurate mapping of the field, contributing to the safety and efficiency of autonomous tractors.

The adoption of LiDAR is anticipated to rise due to its capability to provide precise data across diverse environmental conditions, which is essential for the successful operation of autonomous tractors in various agricultural environments. As LiDAR technology evolves and becomes more cost-effective, its presence in the market is expected to expand.

Other components, such as cameras, radar systems, and various mechanical parts, play an essential role in the By Component segment of Autonomous Tractors. These components work in synergy with sensors, GPS, and LiDAR to optimize the performance of autonomous tractors. For example, cameras assist in visual recognition of crops, weeds, and other field features, while radar systems help detect objects under low-visibility conditions.

Although the market share of other components is smaller compared to sensors, GPS, and LiDAR, their importance remains critical in ensuring the seamless operation of autonomous tractors across a wide range of agricultural tasks. As technological advancements continue, these components will contribute significantly to the ongoing development and enhancement of autonomous farming solutions.

By Automation Analysis

Semi-Autonomous Tractors Dominate The Autonomous Tractors Market in 2024, Capturing Over 53% Share

In 2024, Semi-Autonomous Tractors hold a dominant market position in the By Automation Analysis segment of Autonomous Tractors, capturing more than 53% of the market share. Semi-autonomous tractors are designed to perform certain tasks autonomously while still requiring human intervention for certain operations. This level of automation provides a balance between human control and machine efficiency, making these tractors highly adaptable for various agricultural operations.

The increasing demand for flexible and cost-effective solutions in agriculture has contributed to the growth of semi-autonomous tractors. These tractors offer enhanced productivity and reduce labor costs while allowing operators to oversee operations when necessary. As technology improves, semi-autonomous tractors are expected to continue leading the market due to their versatility and ability to meet the needs of diverse agricultural tasks.

Fully Autonomous Tractors hold a significant position in the By Automation Analysis segment of Autonomous Tractors. These tractors are designed to carry out agricultural tasks independently, without the need for human intervention.

They rely on advanced technologies such as sensors, GPS, LiDAR, and other automation systems to navigate fields and complete farming operations with minimal oversight. Fully autonomous tractors represent a leap forward in agricultural automation, providing high levels of efficiency and precision in performing a wide range of tasks.

As the demand for automation in agriculture continues to grow, fully autonomous tractors are expected to see increasing adoption, especially in large-scale farming operations where the ability to operate without manual labor can offer considerable advantages.

Despite their potential, challenges such as high initial investment costs and the complexity of integrating these systems into existing farming practices may impact their broader market penetration in the near future.

By Application Analysis

Tillage Dominate The Autonomous Tractors Market in 2024, Capturing Over 42% Share

In 2024, tillage applications held a dominant position in the Autonomous Tractors market, capturing more than 42% of the total market share.

The significant adoption of autonomous tillage tractors can be attributed to their efficiency in soil preparation, which is crucial for increasing agricultural productivity. With the ability to perform consistent and accurate tillage operations, these autonomous systems reduce the need for human labor while enhancing operational efficiency and soil health. The market for autonomous tillage tractors is expected to maintain its leadership as demand for precision farming tools continues to rise globally.

Tillage autonomous tractors are specifically designed to work efficiently on large farmland, providing benefits such as reduced fuel consumption, minimized soil compaction, and improved crop yields. The growing demand for sustainable farming solutions further supports the increase in adoption rates of autonomous tillage tractors, especially in regions where labor costs are rising or labor shortages are prominent.

Autonomous tractors in the planting and seeding segment are designed to enhance the precision and speed of planting operations, ensuring optimal seed placement and soil-to-seed contact. The integration of autonomous technology in this area is driven by the need to improve planting accuracy, reduce operational costs, and enable round-the-clock operations, particularly for large-scale farming.

The ongoing trend towards smart agriculture solutions, aimed at efficient resource management and improving crop yield, is contributing to the increasing demand for autonomous planting and seeding tractors. These systems also aid in reducing seed wastage, enhancing planting precision, and minimizing the environmental impact of traditional planting techniques.

Autonomous tractors used in spraying and fertilizing applications are critical for the precise application of pesticides, herbicides, and fertilizers. This ensures crop health, improves yields, and minimizes the use of chemicals. The ability of these autonomous systems to reduce human error and offer high accuracy in spraying contributes to better crop protection and environmental sustainability.

The growing need for efficient and accurate spraying methods is expected to continue driving the market for autonomous tractors in this segment. These systems allow farmers to optimize chemical usage, reduce costs, and minimize the environmental impact of spraying operations, aligning with the increasing focus on sustainable agricultural practices.

The Other Applications segment of the Autonomous Tractors market encompasses a variety of agricultural operations where autonomous tractors are increasingly being utilized, including harvesting, cultivation, and land management. While this segment is not as dominant as tillage or planting applications, it represents a rapidly expanding area of interest for autonomous technology as it finds use in diverse farming practices.

The versatility of autonomous tractors, combined with advancements in artificial intelligence (AI) and machine learning, is a key factor in driving the growth of the Other Applications segment. These tractors are able to perform multiple tasks on the farm, providing enhanced operational efficiency, particularly in larger farming operations where labor flexibility and task automation are highly valued.

By Power Output Analysis

Above 100 HP Dominate The Autonomous Tractors Market in 2024, Capturing Over 49% Share

In 2024, autonomous tractors with a power output of above 100 HP held a dominant market position in the Autonomous Tractors market, capturing more than 49% of the total market share. These high-power tractors are primarily used in large-scale farming operations, where heavy-duty tasks such as tilling, planting, and harvesting require significant horsepower for maximum efficiency and productivity. The adoption of autonomous technology in this segment is driven by the need to reduce labor costs, enhance operational efficiency, and increase the overall capacity of agricultural equipment.

The growing demand for precision farming solutions and the increasing focus on large-scale mechanized agriculture are expected to further propel the market for autonomous tractors with power outputs above 100 HP. These tractors allow for greater operational flexibility and are essential in improving farming practices on expansive farms, leading to more sustainable and productive agricultural systems.

The 30 HP to 100 HP power output segment of the Autonomous Tractors market is widely used in medium to large-sized farms for various applications such as tillage, seeding, and spraying. The versatility of tractors in this power range makes them highly adaptable for different farming needs, offering a balance between performance and fuel efficiency. These tractors provide an ideal solution for farms requiring reliable equipment that can perform multiple tasks while maintaining operational cost-effectiveness.

The increasing preference for medium-powered autonomous tractors is driven by their ability to handle a variety of tasks without the high costs associated with larger, more powerful models. As the adoption of precision farming technologies continues to rise, these tractors are expected to gain further traction, especially as farmers seek cost-efficient and adaptable solutions for their operations.

The Up to 30 HP segment of the Autonomous Tractors market is primarily utilized in small-scale farming and specialized applications, such as orchards, vineyards, and gardens. These low-power autonomous tractors are ideal for tasks that require precision and agility, particularly in more confined spaces or delicate farming environments. Though they may not have the heavy-duty capabilities of larger models, they provide significant benefits in terms of maneuverability and operational efficiency.

The growing demand for autonomous tractors with power outputs of up to 30 HP is driven by the need for compact, efficient solutions in small-scale and niche agricultural operations. Their cost-effectiveness, ease of use, and ability to operate in tight spaces make them a preferred choice for farmers with smaller landholdings or those operating in specialized sectors of agriculture.

Key Market Segments

By Component

- Sensors

- GPS

- LiDAR

- Other Components

By Automation

- Fully Autonomous Tractors

- Semi-Autonomous Tractors

By Application

- Planting & Seeding

- Spraying & Fertilizing

- Tillage

- Other Applications

By Power Output

- Up to 30 HP

- 30 HP to 100 HP

- Above 100 HP

Driver

Increased Demand for Efficiency and Productivity in Agriculture

The growth of the global autonomous tractors market is significantly driven by the increasing demand for efficiency and productivity in the agricultural sector. Autonomous tractors offer several advantages, such as enhanced precision, reduced labor costs, and the ability to operate round-the-clock without human intervention. With the world’s population steadily growing, the need to produce more food while minimizing resource use is more pressing than ever.

Autonomous tractors provide an effective solution by optimizing operations such as planting, tilling, and harvesting, which directly contributes to higher crop yields and reduced waste.

Moreover, the shift toward precision agriculture has amplified the adoption of autonomous tractors. Precision agriculture relies on advanced technologies to optimize field-level management, and autonomous tractors are perfectly suited for this purpose. They can utilize GPS, sensors, and real-time data to monitor and adjust farming processes, ensuring that resources like water, fertilizers, and pesticides are used more efficiently.

As a result, farmers are increasingly turning to these machines to maximize output while minimizing environmental impact. The substantial efficiency gains offered by autonomous tractors are expected to continue driving market growth, as they help modernize farming practices and meet the growing demand for sustainable agriculture.

Restraint

High Initial Investment and Infrastructure Requirements

Despite the promising benefits of autonomous tractors, one of the key restraints limiting their widespread adoption is the high initial investment required. Autonomous tractors are equipped with advanced sensors, GPS systems, and artificial intelligence (AI) software, which makes them significantly more expensive than traditional tractors.

For small and medium-sized farms, the high upfront costs can be prohibitive, particularly in regions where agriculture is primarily subsistence-based or cost-sensitive. This financial barrier can delay or limit the adoption of autonomous tractors in certain markets, as farmers may be reluctant to make such a large investment without clear short-term returns.

In addition to the high purchase costs, autonomous tractors also require significant investments in infrastructure and support systems. For optimal operation, these tractors depend on reliable connectivity, such as high-speed internet or satellite links, which may not be available in rural or remote areas. The integration of autonomous technology into existing agricultural machinery and systems also presents logistical challenges.

Many farmers may lack the expertise or resources to integrate these new technologies into their operations, further hindering adoption. The combination of high costs and infrastructure challenges represents a significant restraint on the growth of the autonomous tractors market, especially in developing economies where budgets are tighter, and the agricultural sector is more traditional.

Opportunity

Growing Demand for Sustainable Farming Solutions

A key opportunity for the autonomous tractor market lies in the increasing global demand for sustainable farming solutions. Environmental concerns, such as soil degradation, water scarcity, and the need to reduce carbon emissions, are driving the agricultural sector towards more sustainable practices. Autonomous tractors, with their precision and efficiency, are well-positioned to contribute to these efforts.

By minimizing the overuse of resources like water, fertilizers, and fuel, autonomous tractors can reduce the environmental footprint of farming operations. This shift towards sustainability is likely to encourage greater adoption of autonomous technologies, as both governments and consumers place increasing importance on eco-friendly farming practices.

The demand for sustainability is not only driven by environmental factors but also by economic considerations. As the global agricultural industry faces growing pressure to cut costs while improving output, autonomous tractors offer a viable solution. These machines can reduce the need for manual labor, mitigate the risk of human error, and optimize operational efficiency.

Furthermore, many autonomous tractors are designed to operate with lower emissions, making them a more attractive option for environmentally-conscious farmers and consumers. As sustainable practices continue to gain importance in the agricultural sector, the demand for autonomous tractors is expected to grow, providing significant opportunities for market expansion.

Trends

Integration of Artificial Intelligence and Machine Learning

One of the most prominent trends shaping the future of the global autonomous tractors market is the integration of artificial intelligence (AI) and machine learning (ML) technologies. These innovations are enhancing the capabilities of autonomous tractors, allowing them to perform more complex tasks with greater accuracy and efficiency.

AI and ML algorithms enable autonomous tractors to analyze vast amounts of data collected from sensors and cameras in real-time, which helps in decision-making processes like adjusting speed, steering, and positioning. This advanced technology is making autonomous tractors smarter, more adaptive, and capable of optimizing farming operations with minimal human intervention.

As AI and ML continue to evolve, they are expected to further revolutionize the performance of autonomous tractors. For instance, predictive analytics can help anticipate maintenance needs, reducing downtime and preventing costly repairs. Additionally, AI-powered systems can optimize planting and harvesting schedules based on weather forecasts and soil conditions, leading to improved crop quality and yield.

This trend toward advanced data-driven farming is not only transforming the efficiency of agricultural operations but also aligning with the broader trend of digitalization in agriculture. The integration of AI and ML will continue to be a driving force in the evolution of autonomous tractors, expanding their capabilities and accelerating their adoption across the global agricultural landscape.

Regional Analysis

North America with Largest Market Share in Autonomous Tractors Market – 32.0% in 2024

The North American region is poised to dominate the global Autonomous Tractors Market, holding a significant market share of 32.0% in 2024. The market in North America is valued at USD 0.64 billion, reflecting a strong presence of technological advancements and widespread adoption of autonomous solutions in agriculture.

The region benefits from a well-established agricultural infrastructure, where the demand for automation technologies has been growing steadily, driven by the need to improve efficiency, reduce operational costs, and address labor shortages. The adoption of autonomous tractors in North America is further supported by favorable government policies, investments in research and development, and increasing awareness of the benefits of autonomous farming equipment.

In Europe, the market for autonomous tractors is also expanding, albeit at a slightly slower pace compared to North America. This region is expected to experience steady growth due to rising environmental concerns and the push for sustainable farming practices. European governments have been actively promoting precision farming and the use of technology to enhance productivity while minimizing environmental impact.

Additionally, the increasing preference for automation to address labor shortages in the agricultural sector contributes to the overall market growth in Europe. However, the market share of Europe is projected to remain smaller than that of North America in 2024.

Asia Pacific, with its vast agricultural landscape and rapidly evolving technology infrastructure, holds a significant portion of the global autonomous tractors market. While the adoption of autonomous tractors is at an earlier stage compared to North America and Europe, the region is expected to grow at a robust rate.

Factors such as population growth, the need for food security, and government initiatives to promote advanced agricultural technologies will play a crucial role in driving market expansion in the Asia Pacific region. However, the market share in Asia Pacific is anticipated to be lower than in North America in 2024.

The Middle East & Africa (MEA) region is expected to witness moderate growth in the autonomous tractors market due to limited agricultural activity and lower technological adoption compared to other regions. While there is potential for growth in certain countries within the region, the overall market size is still relatively small.

Similarly, Latin America’s market share remains modest in comparison to North America, but the region is showing signs of potential growth driven by the need for modern agricultural solutions and the increasing trend of automation in farming practices.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global autonomous tractors market is experiencing significant growth, propelled by technological advancements and the pressing need to address labor shortages in agriculture. Key players such as Mahindra & Mahindra, Deere & Company, Bear Flag Robotics, Trimble Inc., AG Leader Technology, Iseki & Co., Ltd., Kubota Corporation, CNH Industrial N.V., AGCO Corporation, Autonomous Solutions, Inc., Escorts Limited, Agjunction, Inc., Yanmar Holdings Co., Ltd., and Autonomous Tractor Corporation are at the forefront of this transformation.

Mahindra & Mahindra continues to innovate in autonomous farming solutions, focusing on integrating advanced technologies to enhance operational efficiency. Deere & Company has unveiled a new lineup of autonomous tractors, including models for soil tilling and tree spraying, equipped with computer vision, AI, sensors, and cameras to address labor shortages and improve productivity. Bear Flag Robotics specializes in retrofitting existing tractors with autonomous capabilities, enabling farmers to upgrade their machinery with advanced automation features.

Trimble Inc. offers precision agriculture solutions, integrating autonomous tractor systems with GPS and sensor technologies to optimize field operations. AG Leader Technology, Inc. provides hardware and software solutions that enhance the autonomy and efficiency of farming equipment. Iseki & Co., Ltd. and Kubota Corporation are actively developing autonomous tractor models, incorporating AI and machine learning to improve farming precision and reduce labor dependency.

CNH Industrial N.V. and AGCO Corporation have introduced autonomous tractors equipped with advanced navigation and control systems, aiming to enhance productivity and address labor challenges in agriculture. Autonomous Solutions, Inc. focuses on integrating autonomous technology into various agricultural vehicles, providing scalable solutions for diverse farming operations. Escorts Limited and Agjunction, Inc. are also contributing to the development of autonomous farming equipment, emphasizing user-friendly interfaces and reliable performance.

Yanmar Holdings Co., Ltd. and Autonomous Tractor Corporation are investing in research and development to bring autonomous tractors to market, aiming to improve efficiency and sustainability in farming practices. These companies, among others, are driving the evolution of autonomous agriculture, offering solutions that enhance productivity, address labor shortages, and promote sustainable farming practices.

Top Key Players in the Market

- Mahindra & Mahindra

- Deere & Company

- Bear Flag Robotics

- Trimble Inc.

- AG Leader Technology, Inc.

- Iseki & Co., Ltd.

- Kubota Corporation

- CNH Industrial N.V.

- AGCO Corporation

- Autonomous Solutions, Inc.

- Escorts Limited

- Agjunction, Inc.

- Yanmar Holdings Co., Ltd.

- Autonomous Tractor Corporation

- Other Key Players

Recent Developments

- In March 5, 2025 – AGCO Corporation (NYSE: AGCO), a leading manufacturer of agricultural machinery and precision farming technology, announced a new partnership with SDF to expand its Massey Ferguson tractor lineup. Under this agreement, SDF will manufacture low-to-mid horsepower tractors, up to 85 HP, to be distributed globally under the Massey Ferguson brand. Production is expected to begin in mid-2025, aiming to enhance efficiency and accessibility for farmers worldwide.

- In February 10, 2025 – Applied Intuition, Inc., a key provider of software solutions for the commercial and defense sectors, has acquired EpiSys Science, Inc. (EpiSci), a company specializing in AI-driven autonomy software. This acquisition strengthens Applied Intuition’s position in the defense sector, broadening its capabilities across land, air, sea, and space applications. The integration of EpiSci’s technology is expected to accelerate advancements in autonomous military systems.

- In January 8, 2025 – John Deere unveiled its latest autonomous farming and construction machines at CES 2025, introducing an upgraded autonomy kit featuring AI-powered vision systems and sensor technology. This second-generation system builds on the company’s initial CES 2022 launch, offering enhanced navigation capabilities to improve efficiency in agriculture, construction, and landscaping operations.

- In 2024, Monarch Tractor secured a record-breaking $133 million in Series C funding, reinforcing its leadership in electric and autonomous farm vehicles. The company, known for its MK-V electric smart tractor, continues to drive innovation in sustainable agriculture. The funding will support global expansion and further development of its autonomous technology, strengthening its presence in the agricultural robotics market.

- In January 25, 2024 – Bluewhite, a provider of autonomous farming solutions, raised $39 million in Series C funding to scale its Robot-as-a-Service (RaaS) platform. The financing, led by Insight Partners with contributions from new and existing investors, will accelerate the adoption of its autonomous tractors and precision farming solutions. Bluewhite plans to expand its services to more agricultural markets, optimizing operations for permanent crop growers worldwide.

Report Scope

Report Features Description Market Value (2024) USD 2.0 Billion Forecast Revenue (2034) USD 10.6 Billion CAGR (2025-2034) 18.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Sensors, GPS, LiDAR, and Other Components), By Automation (Fully Autonomous Tractors and Semi-Autonomous Tractors), By Application (Planting & Seeding, Spraying & Fertilizing, Tillage, and Other Applications), By Power Output (Up to 30 HP, 30 HP to 100 HP, and Above 100 HP) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Mahindra & Mahindra, Deere & Company, Bear Flag Robotics, Trimble Inc., AG Leader Technology, Inc., Iseki & Co., Ltd., Kubota Corporation, CNH Industrial N.V., AGCO Corporation, Autonomous Solutions, Inc., Escorts Limited, Agjunction, Inc., Yanmar Holdings Co., Ltd., Autonomous Tractor Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Tractors MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Tractors MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Mahindra & Mahindra

- Deere & Company

- Bear Flag Robotics

- Trimble Inc.

- AG Leader Technology, Inc.

- Iseki & Co., Ltd.

- Kubota Corporation

- CNH Industrial N.V.

- AGCO Corporation

- Autonomous Solutions, Inc.

- Escorts Limited

- Agjunction, Inc.

- Yanmar Holdings Co., Ltd.

- Autonomous Tractor Corporation

- Other Key Players