Global Autonomous Power Systems Market By Component(Software, Hardware), By Technology( Wireline, Wireless), By Application(Generation, Transmission, Distribution, Consumption), By End-User(Residential, Commercial, Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: March 2024

- Report ID: 116547

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

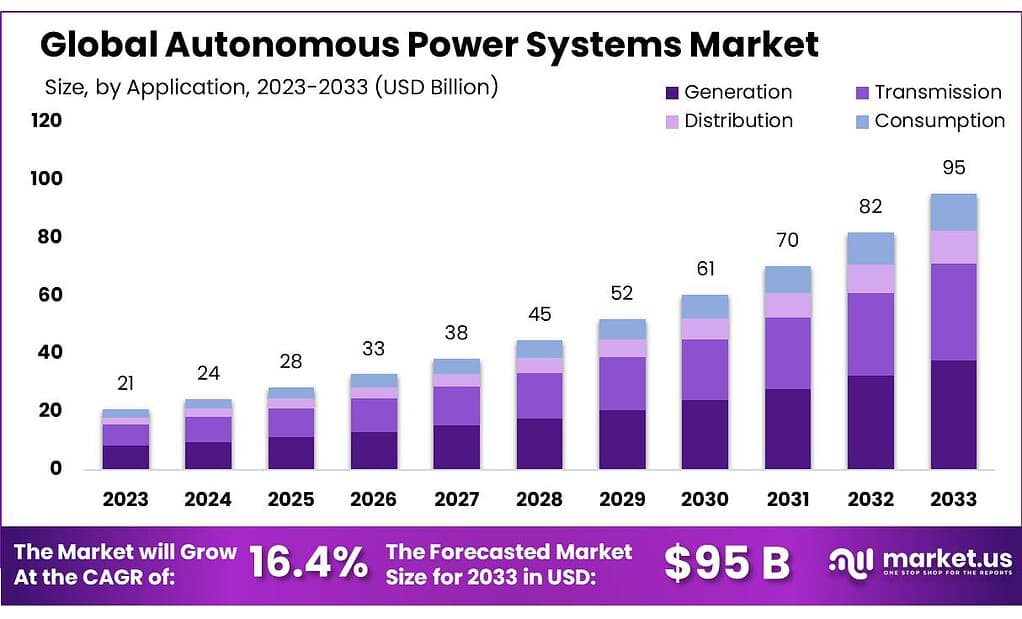

The global Autonomous Power Systems Market size is expected to be worth around USD 95 billion by 2033, from USD 21 billion in 2023, growing at a CAGR of 16.4% during the forecast period from 2023 to 2033.

The Autonomous Power Systems Market refers to the segment of the energy industry focused on the development, distribution, and implementation of power generation systems that operate independently of traditional centralized power grids. These systems are designed to generate, store, and manage energy autonomously, providing electricity to remote, off-grid, or grid-connected areas without the need for constant supervision or control by human operators.

Autonomous power systems typically incorporate renewable energy sources such as solar panels, wind turbines, and hydroelectric generators, alongside energy storage solutions like batteries and fuel cells, to ensure a continuous and reliable power supply. The integration of advanced technologies, including artificial intelligence (AI) and the Internet of Things (IoT), further enhances the efficiency and reliability of these systems by optimizing energy production, distribution, and consumption based on real-time data.

The Autonomous Power Systems Market encompasses a wide range of applications, including residential, commercial, industrial, and utility-scale projects. It caters to the needs of diverse sectors such as telecommunications, healthcare, education, and emergency services, where uninterrupted power supply is critical. As global demand for clean, reliable, and resilient energy solutions grows, the market for autonomous power systems is expected to expand, offering significant opportunities for innovation, investment, and development in the energy sector.

Key Takeaways

- Market Growth: The Autonomous Power Systems market is Forecasted to reach USD 95 billion by 2033, from USD 21 billion in 2023, with a CAGR of 16.4%.

- Dominant Component: Software holds over 63.5% share, crucial for efficient energy management.

- Technology Preference: Wireless technology commands a 59.3% market share for flexibility and scalability.

- Application Focus: The distribution segment leads with over 39.6% market share, ensuring reliable power supply.

- End-User Dynamics: The commercial sector dominates with more than 56.4% market share.

- The average energy storage capacity of an APS ranges from 10 kWh to 1 MWh, depending on the application and size.

- The use of APS can reduce greenhouse gas emissions by up to 90% compared to conventional fossil fuel-based power generation.

- In 2022, the residential sector accounted for over 60% of the global APS installations.

By Component

Software held a dominant market position, capturing more than a 63.5% share. This segment’s leadership stems from the critical need for sophisticated platforms to manage and optimize energy production, distribution, and consumption efficiently.

Software solutions, including Advanced Metering Infrastructure, Smart Grid Distribution Management, and Grid Asset Management, empower utilities and end-users with real-time monitoring, predictive maintenance, and energy management capabilities, making the software backbone of autonomous power systems.

Advanced Metering Infrastructure (AMI), as a subset of the software segment, is particularly noteworthy for enabling two-way communication between utilities and customers. This technology supports dynamic pricing, improves outage management, and encourages energy-saving behaviors among consumers.

Smart Grid Distribution Management systems are essential for optimizing the delivery of electricity. They enhance the reliability and efficiency of the grid by managing the flow of power and rapidly detecting and responding to any distribution issues.

Grid Asset Management software plays a pivotal role in maintaining the health and performance of grid infrastructure. It helps utilities minimize downtime and extend the lifespan of their assets through proactive maintenance and management.

In the hardware category, Smart Meters are crucial for the real-time tracking of electricity usage, providing the data necessary for optimizing energy consumption and reducing costs. Sensors within the grid detect changes in voltage, current, and frequency, enabling real-time adjustments to maintain grid stability and efficiency. Programmable Logic Controllers (PLCs) offer automated control over various grid operations, further enhancing the autonomous capabilities of power systems.

Services associated with autonomous power systems, including Consulting, Deployment and Integration, and Support and Maintenance, are indispensable for ensuring the successful implementation and ongoing operation of these technologies. Consulting services provide expert guidance on designing and deploying autonomous power solutions. Deployment and Integration services ensure that new technologies are seamlessly integrated into existing systems. Support and Maintenance services are crucial for the long-term reliability and performance of autonomous power systems.

By Technology

Wireless technology held a dominant market position, capturing more than a 59.3% share. This predominance is attributed to the flexibility, scalability, and cost-effectiveness that wireless solutions offer. Wireless technologies, including radio frequency (RF), Wi-Fi, and cellular communications, enable remote monitoring and control of power systems without the physical constraints of wired connections.

They are particularly advantageous in difficult-to-reach areas or where laying cables is impractical or too expensive. The adoption of wireless technology enhances the operational efficiency of autonomous power systems by facilitating seamless communication between various components of the grid, supporting real-time data transfer, and enabling rapid response to changing grid conditions.

Wireline technology, while holding a smaller share of the market, remains crucial for certain applications that require high reliability and security. Wireline connections, such as fiber optic cables, provide a stable and secure means of communication for critical infrastructure components of autonomous power systems.

They are often used in settings where the risk of interference or data loss must be minimized, such as in the transmission of high-volume data between control centers and substations or in areas with high electromagnetic interference. Despite the physical limitations and higher initial setup costs compared to wireless solutions, wireline technology is valued for its high-speed data transmission capabilities and robustness against external disruptions.

By Application

In 2023, the Autonomous Power Systems market witnessed a significant landscape, with various segments playing crucial roles in shaping its dynamics. Among these, Distribution emerged as a frontrunner, claiming a dominant market position by securing more than a 39.6% share.

Distribution, being a key application segment, showcased its prowess in efficiently managing and delivering power across diverse networks. This segment’s strategic importance lies in its ability to streamline the flow of energy to end-users, ensuring a reliable and seamless supply.

Meanwhile, the Generation segment also played a pivotal role, contributing to the overall market vitality. Responsible for producing power from various sources, Generation maintained a substantial market share, demonstrating its indispensability in the autonomous power systems ecosystem.

The Transmission segment, another vital component, facilitated the smooth movement of electricity across vast distances, ensuring minimal loss and optimal utilization. Its role in connecting power sources to distribution networks underscored its significance within the market.

On the consumption front, end-users experienced the benefits of autonomous power systems, with applications ranging from residential to industrial. As a collective entity, Consumption served as the ultimate beneficiary, reaping the advantages of a reliable, autonomous power infrastructure.

By End-User

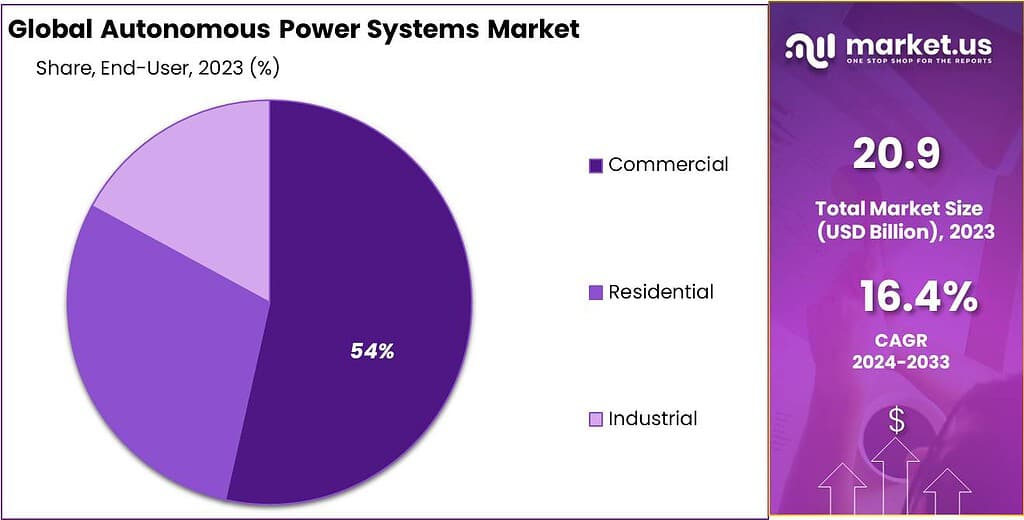

In 2023, the Autonomous Power Systems market showcased a dynamic landscape, with different end-user segments significantly influencing its trajectory. Notably, the Commercial segment emerged as a powerhouse, securing a dominant market position with an impressive share of more than 56.4%.

Commercial establishments played a pivotal role in driving the demand for autonomous power systems, emphasizing the sector’s growing reliance on innovative energy solutions. The need for consistent, uninterrupted power to sustain business operations contributed to the Commercial segment’s robust market standing.

Meanwhile, the Residential segment demonstrated a notable presence, reflecting the increasing adoption of autonomous power systems in homes. With a focus on providing reliable energy solutions for households, this segment contributed substantially to the overall market dynamics.

The Industrial sector, marked by its diverse energy needs and large-scale operations, also played a crucial role. While facing unique challenges, the Industrial segment recognized the advantages of autonomous power systems in ensuring a stable and resilient power supply for complex manufacturing processes.

Key Market Segmentation

By Component

- Software

- Advanced Metering Infrastructure

- Smart Grid Distribution Management

- Smart Grid Network Management

- Grid Asset Management

- Substation Automation

- Smart Grid Security

- Billing and Customer Information System

- Hardware

- Smart Meters

- Sensors

- Programmable Logic Controller (PLC)

- Others

- Services

- Consulting

- Deployment and Integration

- Support and Maintenance

By Technology

- Wireline

- Wireless

By Application

- Generation

- Transmission

- Distribution

- Consumption

By End-User

- Residential

- Commercial

- Industrial

Driving Factors

Growing Emphasis on Sustainable Energy Sources

The Autonomous Power Systems market is being propelled forward by a significant driver – the global emphasis on sustainable energy sources. Governments worldwide are increasingly recognizing the importance of reducing carbon footprints and transitioning towards cleaner energy solutions. In response to this, the demand for autonomous power systems, which often integrate renewable energy sources, has surged.

Government Initiatives and Regulations: Governments around the world are implementing stringent regulations and initiatives to promote clean energy. For instance, the Paris Agreement has encouraged many nations to commit to reducing greenhouse gas emissions. In line with this, various countries have introduced policies favoring the adoption of autonomous power systems powered by renewable energy, contributing to the market’s growth.

Investments in Renewable Energy: Both government and private sector investments in renewable energy infrastructure have been on the rise. Governments are allocating substantial budgets for projects involving solar, wind, and hydroelectric power, which directly boosts the autonomous power systems market. For instance, a report by the International Renewable Energy Agency (IRENA) indicates that global renewable capacity additions reached a record-breaking 280 gigawatts in 2021.

Restraining Factors

High Initial Costs and Limited Awareness

While the Autonomous Power Systems market is witnessing growth, it is not without challenges. One significant restraint is the high initial costs associated with implementing autonomous power solutions. The upfront investment required for technologies like solar panels, energy storage systems, and advanced control systems can pose a barrier to widespread adoption.

Limited Government Subsidies: Although government initiatives are supporting the market, subsidies and financial incentives for autonomous power systems vary across regions. Some governments provide substantial support, while others may offer limited incentives, affecting the overall affordability of these systems for end-users.

Import-Export Dynamics: The import-export dynamics of key components such as solar panels and batteries can also impact costs. Trade restrictions, tariffs, and supply chain disruptions can lead to fluctuations in prices, further influencing the overall cost of autonomous power systems.

Growth Opportunities

Increasing Demand for Off-Grid Solutions

Amidst the challenges, the Autonomous Power Systems market finds a significant opportunity in the increasing demand for off-grid solutions. Remote and rural areas often face challenges in accessing a reliable power supply through traditional means. Autonomous power systems, especially those leveraging renewable energy sources, present a viable solution to address this demand gap.

Electrification in Remote Areas: The opportunity lies in electrifying remote and off-grid areas where extending traditional power infrastructure is economically unfeasible. Governments and organizations are recognizing the potential of autonomous power systems to provide sustainable energy solutions to underserved communities.

Market Growth in Developing Regions: Developing regions, in particular, present a vast opportunity for market expansion. According to the International Energy Agency (IEA), around 770 million people still lack access to electricity globally, and autonomous power systems offer a scalable and decentralized approach to address this issue.

Community-Based Energy Projects: Community-based autonomous power projects are gaining traction as a means of promoting energy self-sufficiency. Opportunities arise for both public and private sector entities to invest in and collaborate on community-level projects, fostering sustainable development and energy independence.

Latest Trends

A prominent trend shaping the Autonomous Power Systems market is the integration of advanced technologies. The industry is witnessing a rapid evolution, with technologies like artificial intelligence (AI), the Internet of Things (IoT), and smart grids being incorporated into autonomous power systems to enhance efficiency, reliability, and overall performance.

IoT in Power Management: The adoption of IoT in power management systems allows for real-time monitoring and control of energy consumption. Smart sensors and devices enable autonomous power systems to optimize energy distribution, identify potential faults, and improve overall grid management.

AI for Predictive Maintenance: Artificial intelligence is playing a crucial role in the predictive maintenance of power systems. AI algorithms analyze data from various sensors to predict potential equipment failures, allowing for proactive maintenance and reducing downtime. This trend aligns with the market’s focus on providing reliable and uninterrupted power supply.

Smart Grids for Efficient Power Distribution: The implementation of smart grids is gaining momentum as a trend within the autonomous power systems market. Smart grids enable efficient two-way communication between power utilities and end-users, facilitating dynamic adjustments in energy distribution. This trend is driven by the need for more flexible and responsive power systems to accommodate the growing complexity of energy networks.

Geopolitics and Recession Impact Analysis

The global geopolitical tensions have left a noticeable impact on the Autonomous Power Systems market, influencing various aspects of the industry. This conflict has disrupted the potential for a swift global economic recovery post the COVID-19 pandemic, leading to economic sanctions, a surge in commodity prices, and disruptions in the supply chain.

These geopolitical developments have reverberated across multiple markets, including the Autonomous Power Systems sector. Trade policies and sanctions imposed due to geopolitical tensions can directly affect the market dynamics. Restrictions on trade with key players in autonomous power systems can result in a shortage of supplies, impacting both global market prices and availability. Economic downturns typically lead to reduced industrial activities.

Autonomous Power Systems, essential for industrial applications such as semiconductor manufacturing, fluoropolymer production, and aluminum smelting, face a potential decline in demand during a recession. The hydrofluoric acid market, specifically, has encountered challenges due to geopolitical tensions, with disruptions in the supply chain affecting the availability and cost of raw materials required for autonomous power system production.

Economic sanctions and soaring commodity prices further compound these challenges, potentially increasing production costs and imposing pricing pressures on the Autonomous Power Systems market. The overall uncertainty and instability resulting from significant geopolitical events may prompt investors and industry players to adopt a more cautious approach, potentially slowing down growth or expansion plans.

Despite these hurdles, the Autonomous Power Systems market is anticipated to continue its growth, albeit at a more measured pace. This growth is fueled by the persistent demand for autonomous power systems in crucial application areas such as refrigerant production, herbicides, pharmaceuticals, high-octane gasoline, aluminum, plastics, electrical components, and fluorescent light bulbs. The market’s resilience can be attributed to the indispensable nature of these applications across various industries, emphasizing the fundamental role autonomous power systems play in modern industrial processes.

Regional Analysis

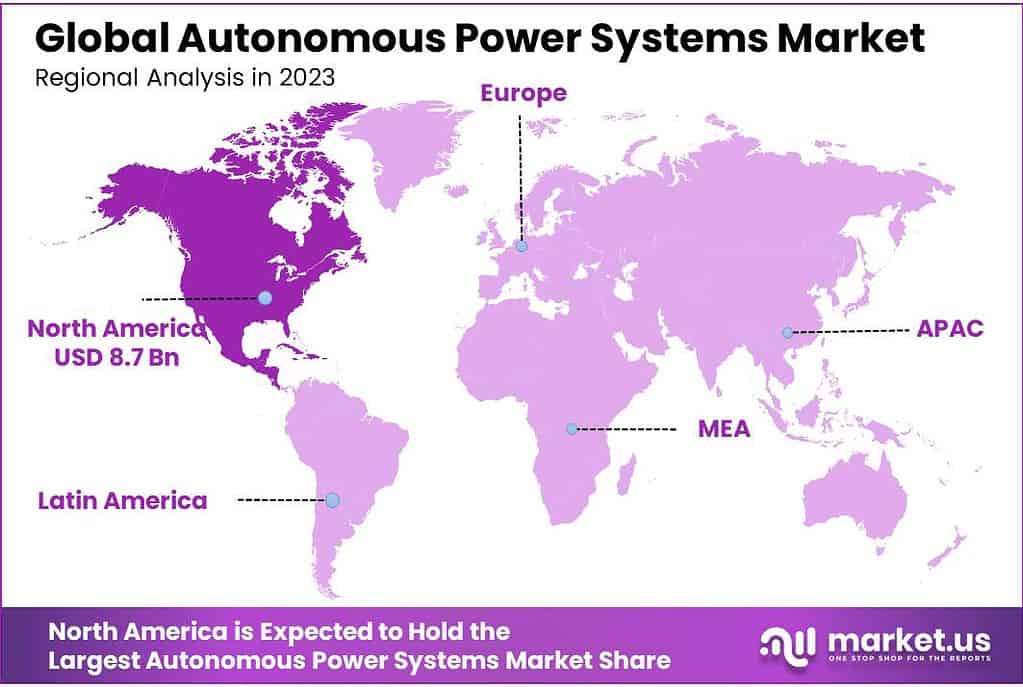

North America stands out as the largest market within the Global Autonomous Power Systems Market.

In 2023, North America claimed a substantial 41.9% share of the global autonomous power systems market. The United States, in particular, holds one of the highest rates of autonomous power system adoption globally, fueled by data from the National Autonomous Power System Adoption Survey. This high rate of adoption correlates with a heightened demand for associated products and services, such as autonomous power systems.

North America boasts an advanced autonomous power system infrastructure, supported by a plethora of skilled professionals and facilities dedicated to autonomous power systems. This infrastructure enables the region to develop and deploy autonomous power systems as prescribed or recommended by experts. Leading manufacturers in the autonomous power systems sector, based in North America or with significant presence across the region, allocate substantial resources to research and development, resulting in cutting-edge, high-quality offerings in the market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Key Players Analysis

The Autonomous Power Systems market is characterized by the presence of key players who play a pivotal role in shaping its dynamics. Among these influential entities are companies that consistently drive innovation, invest significantly in research and development, and contribute to the overall growth of the market.

Leading players such as ABB Ltd, Aclara Technologies LLC, and Cisco Systems Inc. have established themselves as key contributors, boasting a strong market presence and a comprehensive portfolio of autonomous power solutions. These companies are at the forefront of technological advancements, introducing novel features and functionalities to meet the evolving needs of diverse industries. Additionally, their strategic initiatives, such as mergers, acquisitions, and partnerships, contribute to market expansion and further solidify their positions.

The competitive landscape is marked by a commitment to sustainability, ensuring that autonomous power systems align with global initiatives for cleaner and more efficient energy solutions. As the market continues to evolve, these key players are expected to drive innovation, set industry benchmarks, and foster the widespread adoption of autonomous power systems across various sectors.

Top Key Players

- ABB Ltd

- Aclara Technologies LLC

- Cisco Systems Inc

- General Electric Company

- IBM Corporations

- Itron Inc

- Open Systems International Inc

- Oracle Corporations

- Schneider Electric SA

- Siemens AG

- Wipro Ltd

Report Scope

Report Features Description Market Value (2023) US$ 21 Bn Forecast Revenue (2033) US$ 95 Bn CAGR (2024-2033) 16.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Software, Advanced Metering Infrastructure, Smart Grid Distribution Management, Smart Grid Network Management, Grid Asset Management, Substation Automation, Smart Grid Security, Billing and Customer Information System, Hardware, Smart Meters, Sensors, Programmable Logic Controller (PLC), Others, Services, Consulting, Deployment and Integration, Support and Maintenance), By Technology( Wireline, Wireless), By Application(Generation, Transmission, Distribution, Consumption), By End-User(Residential, Commercial, Industrial) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape ABB Ltd, Aclara Technologies LLC, Cisco Systems Inc, General Electric Company, IBM Corporations, Itron Inc, Open Systems International Inc, Oracle Corporations, Schneider Electric SA, Siemens AG, Wipro Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Autonomous Power Systems Market?Autonomous Power Systems Market size is expected to be worth around USD 95 billion by 2033, from USD 21 billion in 2023

What CAGR is projected for the Autonomous Power Systems Market?The Autonomous Power Systems Market is expected to grow at 16.4% CAGR (2024-2033).Name the major industry players in the Autonomous Power Systems Market?ABB Ltd, Aclara Technologies LLC , Cisco Systems Inc , General Electric Company , IBM Corporations , Itron Inc , Open Systems International Inc , Oracle Corporations , Schneider Electric SA , Siemens AG , Wipro Ltd

Autonomous Power Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Autonomous Power Systems MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- Aclara Technologies LLC

- Cisco Systems Inc

- General Electric Company

- IBM Corporations

- Itron Inc

- Open Systems International Inc

- Oracle Corporations

- Schneider Electric SA

- Siemens AG

- Wipro Ltd