Global Autonomous Mobile Robots Market By Components (Software, Hardware, and Services), By Type (Autonomous Inventory Robots, Self-driving Forklifts, and Others ), By Battery Type, By End-use Industry, By Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 22894

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

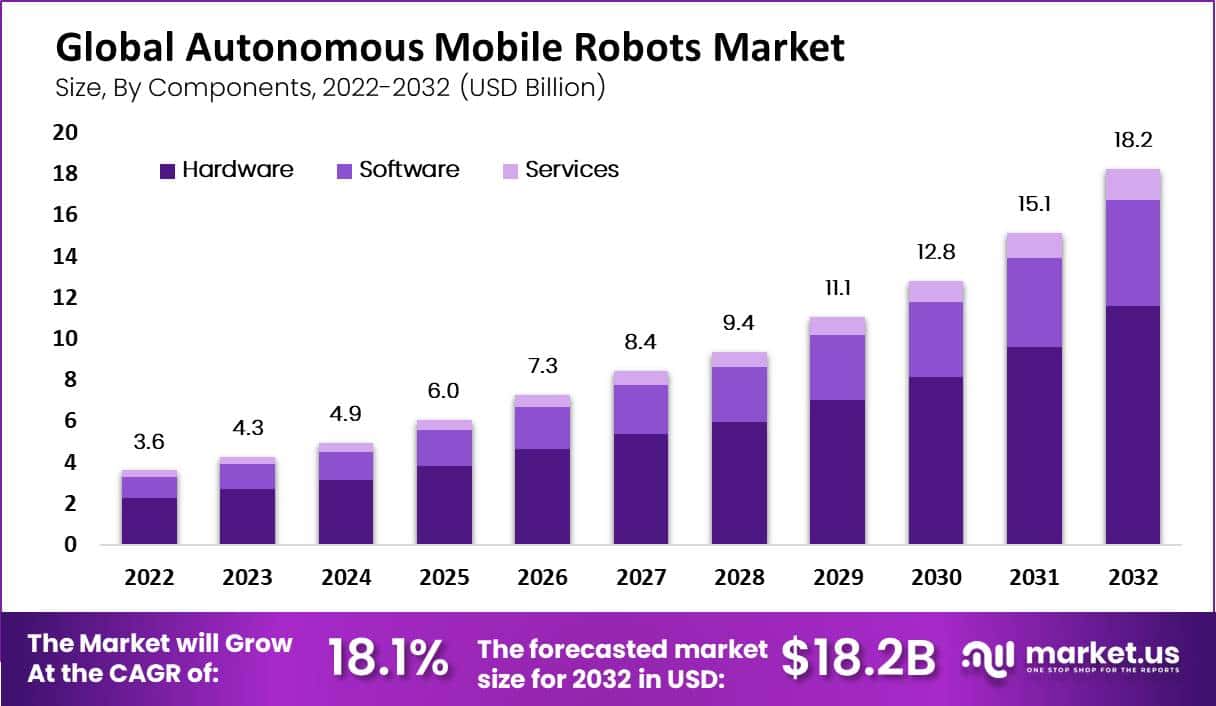

In 2023, the Global Autonomous Mobile Robots Market was valued at USD 4.3 Billion and will reach USD 18.2 Billion by 2032. Between 2023 and 2032, this market is estimated to register the highest CAGR of 18.1%.

Autonomous mobile robots are the type of robots that are mainly used in various industries for different uses like sorting, transporting, and picking products. These autonomous mobile robots are integrated with different sensors, cameras, manufacturing facility maps, and different software for seamless operations within the manufacturing facility. The benefits of autonomous mobile robots over manual labor, like low labor cost, product damage prevention, automated processes, and enhanced productivity, act as a growth factor for the autonomous mobile robots market.

Note: Actual Numbers Might Vary In The Final Report

With the wide uses and benefits of autonomous mobile robots, many industries are adopting these robots in their operations. Some of the industries using autonomous mobile robots are chemical, automotive, aerospace, electronics, pharmaceuticals, defense, FMCG, and many other industries. All these industries use autonomous mobile robots in their industrial operations to enhance productivity and prevent product damage.

Key Takeaways

- Market Growth: The Autonomous Mobile Robots Market is expected to grow at a CAGR of 18.1%, reaching US$ 18.2 Billion by 2032.

- Industrial Adoption: Various industries, including automotive, pharmaceuticals, and defense, are integrating autonomous mobile robots to enhance productivity and prevent product damage.

- Drivers of Growth: The market is primarily driven by the benefits of high productivity and the increased adoption of automated solutions, particularly in the e-commerce sector.

- Challenges: The high initial investment and maintenance costs hinder the adoption of autonomous mobile robots among small and medium enterprises.

- Components Analysis: Hardware holds the dominant position in the components segment, constituting 63.4% of the market revenue.

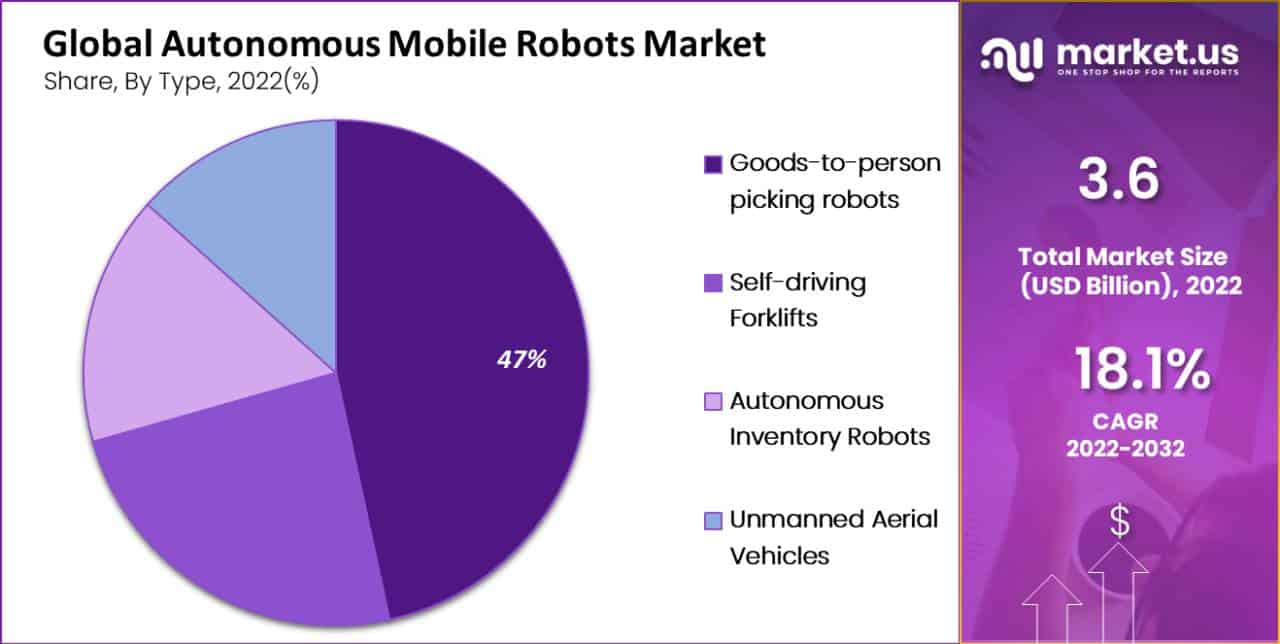

- Type Analysis: Goods-to-person picking robots lead the market, capturing 46.6% of the revenue share, owing to their efficiency in navigating flexible routes and transporting goods within warehouses.

- Battery Type Analysis: Lead batteries hold a significant share of 48.6%, favored for their cost-effectiveness and stable voltage provision to robots.

- End-Use Industry Analysis: The automotive sector accounts for the major share, utilizing autonomous mobile robots for various functions such as painting and lifting.

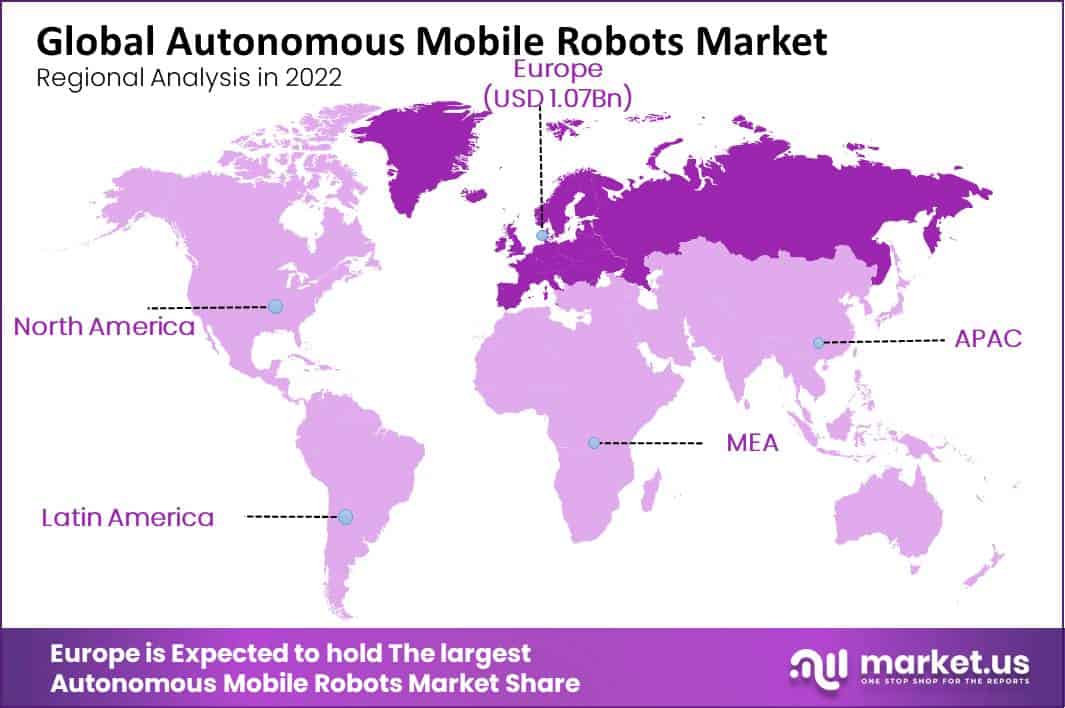

- Regional Analysis: Europe dominates the market with a 29.4% revenue share, followed by significant growth expected in the Asia Pacific region, particularly in countries like China, Japan, South Korea, and India.

Drivers Factors

Benefits like High Productivity in the Industrial Operations to Drive the Growth of the Autonomous Mobile Robots Market

The massive growth of the e-commerce industry over the last few years has allowed them to adopt automated solutions in their operations for better functioning. Therefore, the increased adoption of autonomous mobile robots by the e-commerce industry in distribution centers and warehouses is driving the growth of the autonomous mobile robots market. The major companies in the e-commerce industry are using various types of autonomous mobile robots for their application in sorting, packaging, lifting, and many such functions. This has optimized the workload in the e-commerce industry and helped them to perform seamless operations.

Also, the increasing cost of manual labor across the world has forced industries to adopt autonomous mobile robots. Manual labor costs more to the industries than autonomous mobile robots, and it also has the threat of product damage and low productivity. Therefore, due to advantages of autonomous mobile robots over manual labor are propelling the growth of the autonomous mobile robots market.

Restraints

High Cost of Installation and Maintenance is Hindering the Growth of the Autonomous Mobile Robots Market

Autonomous mobile robots cost less than the increasing manual labor cost. But the high initial investment and high maintenance restrict small and medium enterprises from adopting autonomous mobile robots. In addition, the cost to establish the proper autonomous mobile robots for distribution, sorting, and packaging for better productivity and high efficiency is very high than manual labor. Therefore, small and medium enterprises opt for manual labor over autonomous mobile robots. This is restricting the growth of the autonomous mobile robots market.

Components Analysis

Hardware Dominates the Components Segment in the Autonomous Mobile Robots with Major Share in Account.

The autonomous mobile robots market is classified based on components into hardware, software, and services. Out of these components, the hardware dominates the component segment with a massive market revenue share of 63.4%. This exponential growth of the hardware segment is due to the high demand for spare parts used in autonomous mobile robots. The hardware of AMRs includes brakes, motors, sensors, batteries, and many other gears. Therefore, the high use of these gears in autonomous mobile robots drives the hardware growth in the components segment of the market.

However, the software segment is expected to grow at the fastest CAGR during the forecast period. Software is an important part of autonomous mobile robots. The AMRs require various types of software to perform various functions. Therefore, with the growing demand for the global autonomous robots market, the software’s also anticipated to grow significantly over the forecast period.

Type Analysis

The Goods-to-Person Picking Robots Covers Major Share in the Type Segment of the Autonomous Mobile Robots Market.

Based on type, autonomous mobile robots are classified into autonomous inventory robots, goods-to-person picking robots, self-driving forklifts, and unmanned aerial vehicles. From these types, the goods-to-person picking robots leads the type segment by accounting for the major revenue share of 46.6%.

The ability of the goods-to-person picking robots to navigate the flexible routes and carry the carts to transport the goods between the stations and workers is driving the growth of the goods-to-person picking robots in the type segment of the autonomous mobile robots market. The goods-to-person picking robots provide high efficiency in warehousing and manufacturing operations within the industries. This is attracting more industries to adopt the goods-to-person picking robots. Also, the self-driving forklifts are expected to grow during the forecast period. The growth of self-driving forklifts is due to the ability of these robots in the repetitive load-handling operations.

Note: Actual Numbers Might Vary In The Final Report

Battery Type Analysis

Lead Battery Covers Major Share in the Battery Type Segment of the Autonomous Mobile Robots Market.

The autonomous mobile robots market is classified into lithium-ion batteries, lead batteries, nickel-based batteries, and other battery types, on the basis of battery types. Among these battery types, the lead battery dominates the battery type segment by covering a revenue share of 48.6%. This massive growth of lead batteries is owing to the advantages of lead batteries over the others in the competition.

The lead battery costs much less than the other batteries in the competition and provides a stable voltage to the robot. Therefore, the lead battery is mostly preferred over the other batteries in the competition. However, lithium-ion batteries are anticipated to grow at considerable growth over the forecast period. The high energy density and long-life cycle are expected to switch the preferences of the industries to opt for lithium-ion batteries.

End-Use Industry Analysis

Automotive Industry Mostly Uses the Autonomous Mobile Robots in Various Applications Within the Industry.

Based on the end-use industry, the autonomous mobile robots market is classified into chemical, automotive, aerospace, electronics, pharmaceuticals, defense, FMCG, and other end-use industries. Out of these end-use industries, the automotive industry dominates the end-use industry segment by covering the major share of the segment.

The growth of the automotive industry is due to the use of autonomous mobile robots in the automotive industry for various functions like painting, lifting, sealing, coating, transporting, and many such functions. This wide use of autonomous mobile robots in the automotive industry is boosting the growth of the automotive industry in the end-use industry segment of the autonomous mobile robots market. Also, the aerospace and defense sector is also expected to grow significantly during the forecast period. The need for autonomous mobile robots to lift the heavy loads in these industries is expected to boost the growth of the aerospace and defense sector over the forecast period.

Market Key Segments

Components

- Software

- Hardware

- Services

Type

- Autonomous Inventory Robots

- Self-driving Forklifts

- Goods-to-person picking robots

- Unmanned Aerial Vehicles

Battery Type

- Lithium-Ion Battery

- Lead Battery

- Nickel-Based Battery

- Other Battery Types

End-Use Industry

- Automotive

- Chemical

- Electronics

- Aerospace

- Pharmaceuticals

- Defense

- FMCG

- Other End-Use Industries

Opportunity

Technological Developments and Governments Support are Anticipated to Create Many Opportunities During the Forecast Period

Autonomous mobile robots are still in the development process. They require complex programming for precise functioning. Therefore, many major companies are heavily investing in the research and development of autonomous mobile robots.

The companies are aiming to upgrade the available robots with more precise and advanced technology. This move from the companies is expected to create many lucrative opportunities in the market over the forecast period. Also, the governments of many countries are also supporting the growth of the autonomous mobile robots market by introducing new subsidies and schemes for industries to adopt autonomous mobile robots. This will help the countries to increase productivity and improve the country’s economy.

Trends

The Trend of Integrating New Technologies in the AMR is Boosting the Growth of the Market.

The ongoing trend of integrating advanced technologies in robots for more productive and efficient functioning is boosting the growth of the autonomous mobile robots market. The emergence of smart logistical services and automated warehouses has helped industries to synchronize all the resources and optimize them efficiently. These upgrading technologies it has created many opportunities in the market for companies to introduce advanced autonomous robots with extra features to meet the evolving distribution centers and warehouses.

Regional Analysis

Europe Region Leads the Global Autonomous Mobile Robots Market By Covering Major Revenue Share

The global autonomous mobile robots market is dominated by the Europe region, accounting for a major revenue share of 29.4%. This exponential growth of the Europe region is attributed to the increasing demand for advanced material-handling tools within the manufacturing and transportation facilities of the industries.

Many companies in the Europe region are adopting automation facilities in their industries to increase productivity and efficiency in the industry. These key factors are driving the growth of the Europe region in the global autonomous mobile robots market. After Europe, the Asia Pacific region is anticipated to grow significantly over the forecast period in the global autonomous robots market. This is because major countries like China, Japan, South Korea, and India in the Asia Pacific region are focusing on the adoption of advanced technologies like artificial intelligence-based services and 5G networks. This is also affecting the growth of the autonomous mobile robots market in the Asia Pacific region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

The autonomous mobile robots market is fragmented into many companies offering robots. The major companies in the market are adopting the strategies like mergers, acquisitions, collaboration, and partnership to expand their market share across different regions and strengthen their position in the market.

Market Key Players

- IAM Robotics

- Boston Dynamics

- Clearpath Robotics Inc.

- GreyOrange

- Harvest Automation

- Stanley Robotics

- inVia Robotics Inc.

- KUKA AG

- Teradyne Inc.

- ABB Ltd

- Other Key Players

Recent Developments

- In March 2022, Locus Robotics launched two new robots in the market, namely “Locus Vector” and “Locus Max.” These autonomous mobile robots have the capacity to lift the heavyweight payload.

- In July 2021, ABB acquired ASTI Mobile Robotics Group. The aim of this acquisition between ABB and ASTI Mobile Robotics Group is to expand the robots and automation offering of ABB across the world.

Report Scope

Report Features Description Market Value (2022) US$ 3.6 Bn Forecast Revenue (2032) US$ 18.2 Bn CAGR (2023-2032) 18.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Components – Software, Hardware, and Services; By Type – Autonomous Inventory Robots, Self-driving Forklifts, Unmanned Aerial Vehicles, and Goods-to-person picking robots; By Battery Type – Lithium-Ion Battery, Lead Battery, Nickel-Based Battery, and Other Battery Types; By End-Use Industry – Chemical, Automotive, Aerospace, Electronics, Pharmaceuticals, Defense, FMCG, and Other End-Use Industries. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape IAM Robotics, Clearpath Robotics Inc., GreyOrange, Boston Dynamics, Harvest Automation, Stanley Robotics, inVia Robotics Inc., KUKA AG, Teradyne Inc., ABB Ltd, and other key players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the Autonomous Mobile Robots Market?In 2022, the global Autonomous Mobile Robots Market was valued at US$ 3.6 Billion, and it is expected to reach US$ 18.2 Billion by 2032.

What is the estimated growth rate (CAGR) of the Autonomous Mobile Robots Market?The Autonomous Mobile Robots Market is estimated to register the highest CAGR of 18.1% between 2023 and 2032.

What are the benefits of using autonomous mobile robots in industrial operations?The benefits of using autonomous mobile robots over manual labor include low labor cost, prevention of product damage, automated processes, and enhanced productivity.

What are the industries that are using various types of autonomous mobile robots?Various industries such as the chemical, automotive, aerospace, electronics, pharmaceuticals, defense, FMCG, and many others are using various types of autonomous mobile robots.

What is driving the growth of the Autonomous Mobile Robots Market?The growth of the Autonomous Mobile Robots Market is driven by benefits like high productivity in industrial operations, the increased adoption of autonomous mobile robots by the e-commerce industry, and the increasing cost of manual labor across the world.

What are the advantages of lead batteries over other batteries in the competition?Lead batteries cost much less than other batteries in the competition and provide a stable voltage.

What are the key segments of the Autonomous Mobile Robots market?The key segments of the Autonomous Mobile Robots market are components, by type, by battery type, and end-use industry.

What are the major companies in the Autonomous Mobile Robots market?The Autonomous Mobile Robots market is fragmented, and the major companies in the market include IAM Robotics, Boston Dynamics, Clearpath Robotics Inc., GreyOrange, KUKA AG, Teradyne Inc., ABB Ltd, and other key players.

Autonomous Mobile Robots MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Autonomous Mobile Robots MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- IAM Robotics

- Boston Dynamics

- Clearpath Robotics Inc.

- GreyOrange

- Harvest Automation

- Stanley Robotics

- inVia Robotics Inc.

- KUKA AG

- Teradyne Inc.

- ABB Ltd