Global Autonomous Mining Equipment Market Size, Share, Growth Analysis By Component (Hardware, Excavators, Load Haul Dump, Robotic truck, Drillers and Breakers, Others, Software, Services), By Mining (Surface Mining, Underground Mining), By Application (Metal, Coal, Mineral, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159383

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

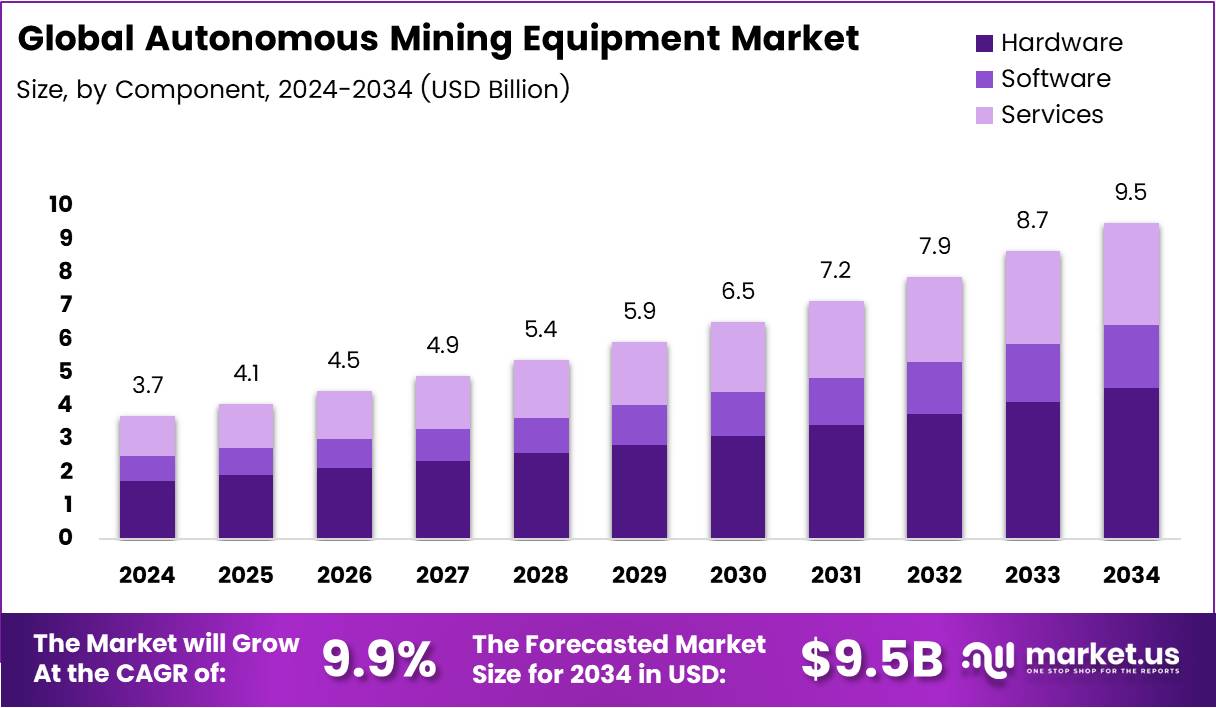

The Global Autonomous Mining Equipment Market size is expected to be worth around USD 9.5 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 9.9% during the forecast period from 2025 to 2034.

The Autonomous Mining Equipment Market is experiencing significant growth as the industry embraces innovation to enhance productivity and safety. With automation technologies transforming mining operations, autonomous vehicles and equipment are being deployed to improve efficiency and reduce operational costs. Key players are investing in advanced AI, machine learning, and automation to meet these demands.

Autonomous mining equipment is playing a crucial role in transforming traditional mining methods. These technologies, such as autonomous haul trucks and drilling systems, allow for more precise, efficient, and safer operations. Moreover, as demand for minerals increases, mining companies are turning to automation to maximize output while maintaining safety standards.

Government investment and regulatory frameworks are pivotal in driving the adoption of autonomous mining technologies. Governments across major mining regions are funding R&D and providing incentives for the transition to automated mining solutions. This, in turn, is encouraging mining companies to adopt these technologies, ensuring they align with environmental and safety regulations.

The market for autonomous mining equipment is poised for continued expansion, driven by operational efficiency and safety. According to industry reports, AI-powered mining vehicles can increase operational efficiency by up to 20% compared to traditional machinery. Additionally, by 2025, over 60% of new mining equipment purchases are expected to feature autonomous or automated technologies.

The safety benefits of autonomous mining equipment are also significant. Automated mining equipment can reduce workplace accidents by up to 30% compared to traditional machinery. Moreover, the number of autonomous mining vehicles has grown from 500 to over 1,000 globally since the late 2010s, indicating a steady adoption trajectory. As this technology continues to evolve, the market is expected to expand further, reshaping the future of mining operations.

Key Takeaways

- The Global Autonomous Mining Equipment Market size is expected to be worth around USD 9.5 Billion by 2034, from USD 3.7 Billion in 2024, growing at a CAGR of 9.9%.

- In 2024, Hardware held a dominant market position in the By Component Analysis segment of Autonomous Mining Equipment Market, with a 47.8% share.

- In 2024, Surface Mining held a dominant market position in the By Mining Analysis segment of Autonomous Mining Equipment Market, with a 69.3% share.

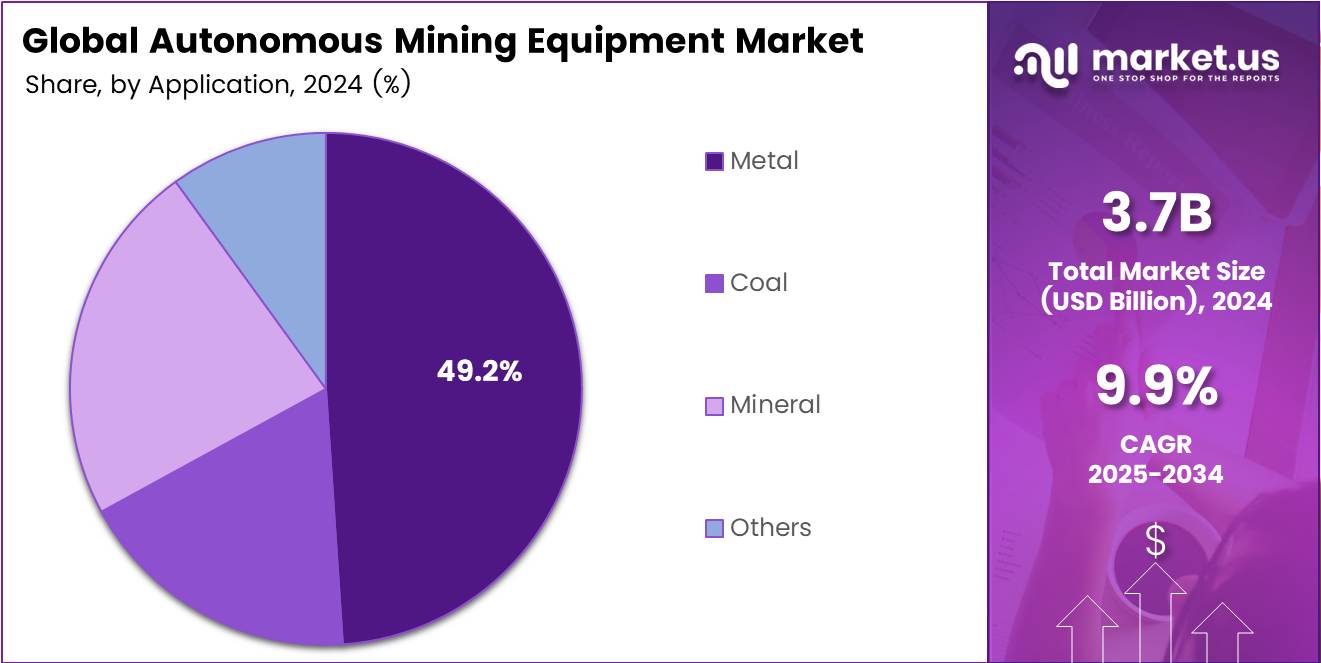

- In 2024, Metal held a dominant market position in the By Application Analysis segment of Autonomous Mining Equipment Market, with a 49.2% share.

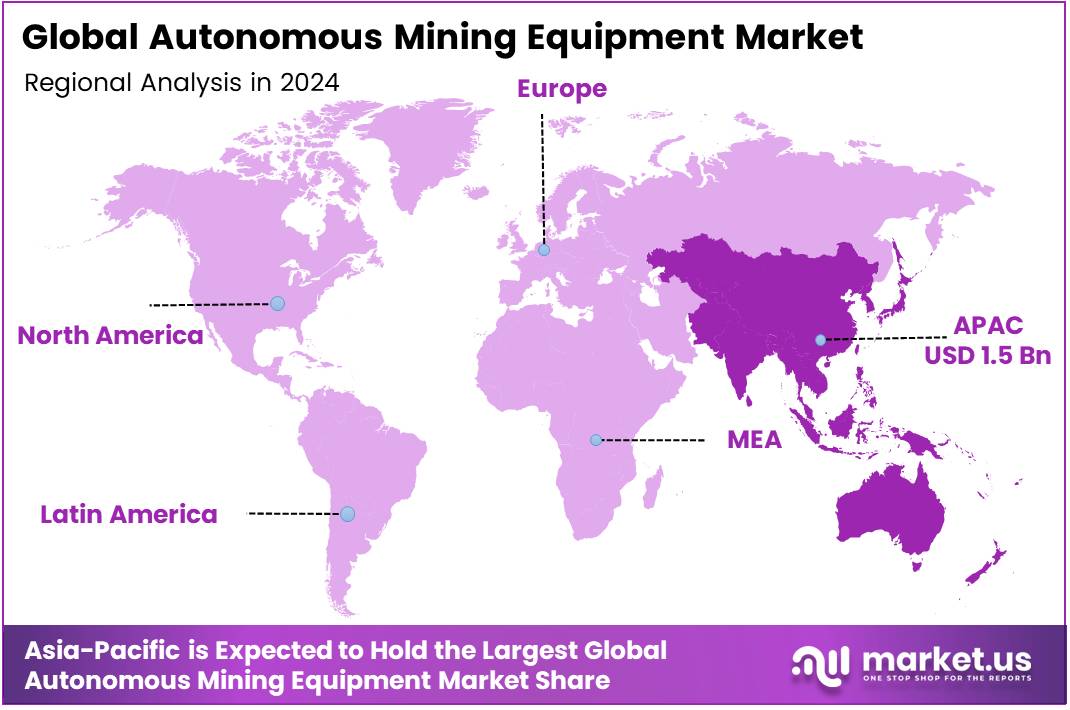

- In 2024, Asia Pacific held the dominant position in the Autonomous Mining Equipment Market, with a share of 42.8%, amounting to USD 1.5 Billion.

By Component Analysis

Hardware dominates with 47.8%, driven by its critical role in the operational efficiency of autonomous mining equipment.

In 2024, Hardware held a dominant market position in the By Component Analysis segment of Autonomous Mining Equipment Market, with a 47.8% share. This is primarily due to the essential role hardware components such as excavators, haul dumps, and robotic trucks play in autonomous operations. These machines provide the backbone for automation, ensuring efficiency and productivity in mining operations.

Excavators represent a significant sub-segment in the hardware category, playing an integral part in excavation tasks. Their advanced technology allows for precise digging, reducing operational costs and enhancing safety. Excavators are projected to see continued growth as the demand for efficient surface and underground mining increases.

Load Haul Dumps (LHD) contribute greatly to the autonomous mining market as they help transport mined materials across the mining site with minimal human intervention. With automated technology integrated into their systems, these machines are expected to dominate in terms of market growth.

Robotic trucks are gaining traction in the autonomous mining sector. Their ability to operate in hazardous environments with high precision allows for safer and more efficient transport of materials in the mining process.

Software, while essential, represents a smaller segment compared to hardware but continues to advance in parallel with autonomous technologies. The software provides the necessary control systems and integration for various mining applications.

Services contribute to the growing market as well, offering maintenance, support, and upgrades for autonomous mining equipment, ensuring long-term operational success and longevity.

By Mining Analysis

Surface Mining dominates with 69.3%, owing to its extensive use in large-scale mining projects.

In 2024, Surface Mining held a dominant market position in the By Mining Analysis segment of Autonomous Mining Equipment Market, with a 69.3% share. The surface mining sector benefits significantly from autonomous technology, as it allows for more efficient extraction of resources from large open-pit mines. This technology boosts productivity and reduces the reliance on manual labor.

Underground Mining, though crucial, accounts for a smaller share compared to surface mining. It faces specific challenges, such as complex tunnel infrastructure and limited access, but continues to incorporate autonomous vehicles and equipment for increased safety and reduced operational costs.

By Application Analysis

Metal dominates with 49.2%, due to the increasing demand for metals in various industrial sectors.

In 2024, Metal held a dominant market position in the By Application Analysis segment of Autonomous Mining Equipment Market, with a 49.2% share. The rising demand for metals in industries such as construction, electronics, and automotive drives this dominance. Autonomous equipment allows for safer and more efficient metal mining operations, ensuring faster extraction and reducing costs.

Coal mining, while a significant segment, lags behind metal mining. Automation in coal mines improves safety by reducing human exposure to dangerous environments and optimizes the overall extraction process.

Mineral mining benefits from the integration of autonomous equipment, although it holds a smaller market share compared to metal mining. The demand for minerals in sectors like renewable energy and electronics is growing, contributing to the adoption of automation technologies.

Other applications, though smaller in scale, continue to adopt autonomous technologies to streamline operations and improve safety in niche mining sectors.

Key Market Segments

By Component

- Hardware

- Excavators

- Load Haul Dump

- Robotic truck

- Drillers and Breakers

- Others

- Software

- Services

By Mining

- Surface Mining

- Underground Mining

By Application

- Metal

- Coal

- Mineral

- Others

Drivers

Increasing Demand for Safety and Risk Reduction Drives Market Growth

The autonomous mining equipment market is experiencing significant growth as mining companies prioritize worker safety and operational efficiency. Safety concerns remain the primary driver, as mining operations face inherent risks including equipment accidents, hazardous environments, and worker injuries. Autonomous systems eliminate human exposure to dangerous conditions by operating remotely in underground tunnels and open-pit mines.

Rising labor costs across global mining operations further accelerate market adoption. Companies struggle with skilled labor shortages and increasing wage demands, making autonomous equipment a cost-effective alternative. These systems operate continuously without breaks, reducing operational downtime and improving productivity.

Technological advancements in artificial intelligence and machine learning have made autonomous mining equipment more reliable and efficient. Modern systems can navigate complex mining environments, make real-time decisions, and optimize extraction processes without human intervention. This technological progress has increased industry confidence in autonomous solutions.

Government regulations increasingly promote automation in mining operations to improve safety standards and environmental compliance. Regulatory bodies worldwide are establishing frameworks that encourage the adoption of autonomous technologies, creating a favorable environment for market expansion and investment in automated mining solutions.

Restraints

Technical Challenges in Autonomous System Integration Limit Market Growth

Despite promising growth prospects, the autonomous mining equipment market faces several significant restraints that challenge widespread adoption. Technical integration challenges represent the most substantial barrier, as existing mining operations must retrofit complex autonomous systems into established infrastructure. This process requires extensive modifications to current equipment, software compatibility issues, and substantial investment in new technologies.

Limited technological infrastructure in remote mining locations poses another major constraint. Many mining sites operate in isolated areas with poor internet connectivity, inadequate power supply, and limited technical support. These infrastructure limitations make it difficult to implement and maintain sophisticated autonomous systems that require constant communication and data processing capabilities.

Regulatory concerns surrounding automation and job displacement create additional market resistance. Mining communities worry about unemployment as autonomous equipment replaces traditional mining jobs. Labor unions and local governments often oppose automation initiatives, leading to regulatory delays and implementation challenges. These concerns slow market adoption as companies navigate complex social and political considerations.

The high initial investment costs and lengthy return-on-investment periods also restrain market growth, particularly for smaller mining operations with limited capital resources.

Growth Factors

Expansion of Autonomous Systems in Emerging Markets Creates Growth Opportunities

The autonomous mining equipment market presents substantial growth opportunities as emerging economies modernize their mining sectors. Developing countries with rich mineral resources are increasingly adopting autonomous technologies to compete globally and improve operational efficiency. These markets offer significant expansion potential as they invest in modern mining infrastructure and seek competitive advantages.

The adoption of eco-friendly and energy-efficient autonomous equipment aligns with global sustainability trends. Mining companies face increasing pressure to reduce environmental impact and carbon emissions. Autonomous systems optimize fuel consumption, reduce waste, and minimize environmental disruption through precise operation patterns. This sustainability focus creates new market segments for environmentally conscious mining solutions.

Integration of Internet of Things technology for real-time data analytics opens innovative opportunities. IoT-enabled autonomous equipment provides comprehensive operational insights, predictive maintenance capabilities, and performance optimization. This data-driven approach helps mining companies make informed decisions and improve overall efficiency.

Strategic partnerships between mining companies and technology firms accelerate market growth. These collaborations combine mining expertise with cutting-edge technology development, creating customized autonomous solutions. Such partnerships reduce development costs, share risks, and accelerate product innovation, driving market expansion and technological advancement.

Emerging Trends

Development of Autonomous Mining Trucks and Drills Shapes Market Trends

Current market trends in autonomous mining equipment reflect rapid technological advancement and industry transformation. The development of autonomous mining trucks and drilling systems represents the most significant trend, with major manufacturers investing heavily in self-driving hauling vehicles and automated drilling platforms. These systems demonstrate improved efficiency, reduced operational costs, and enhanced safety compared to traditional equipment.

Machine learning and artificial intelligence adoption for predictive maintenance is revolutionizing equipment management. These technologies analyze operational data to predict equipment failures before they occur, reducing downtime and maintenance costs. Predictive maintenance systems help mining companies optimize equipment performance and extend machinery lifespan through data-driven maintenance scheduling.

Increasing drone usage for surveying and exploration activities represents another growing trend. Autonomous drones conduct geological surveys, monitor environmental conditions, and inspect mining sites more efficiently than traditional methods. These aerial systems provide real-time data collection and mapping capabilities that improve mining planning and operations.

The integration of 5G networks enhances communication capabilities in mining operations. High-speed connectivity enables real-time data transmission, remote equipment control, and improved coordination between autonomous systems. This communication infrastructure supports more sophisticated autonomous operations and enables centralized control of multiple mining sites.

Regional Analysis

Asia Pacific Dominates the Autonomous Mining Equipment Market with a Market Share of 42.8%, Valued at USD 1.5 Billion

In 2024, Asia Pacific held the dominant position in the Autonomous Mining Equipment Market, with a share of 42.8%, amounting to USD 1.5 Billion. The region’s growth is largely driven by rapid industrialization, increasing demand for mining automation, and significant government support for mining operations. Moreover, the adoption of AI and autonomous vehicles in the mining sector is expected to rise, boosting market growth in this region.

North America Autonomous Mining Equipment Market Trends

North America is expected to maintain a strong presence in the Autonomous Mining Equipment Market, with advancements in technology and increasing regulatory support for automation. The U.S. is a major contributor, fostering innovation in autonomous vehicles and expanding their deployment in mining operations, further driving market expansion.

Europe Autonomous Mining Equipment Market Trends

Europe holds a significant share of the Autonomous Mining Equipment Market, primarily due to stringent safety regulations and the region’s commitment to sustainable mining practices. European countries are focusing on advanced automation technologies, which are anticipated to drive market growth, especially in countries like Sweden and Finland.

Middle East and Africa Autonomous Mining Equipment Market Trends

The Middle East and Africa market is seeing gradual growth in autonomous mining equipment adoption. This growth is fueled by increasing mining operations in resource-rich countries and the push towards reducing operational costs through automation. However, the market faces challenges related to infrastructure and technological readiness in some areas.

Latin America Autonomous Mining Equipment Market Trends

In Latin America, the Autonomous Mining Equipment Market is projected to expand steadily due to the growth of mining activities in countries like Brazil and Chile. The shift towards automation is expected to enhance productivity and safety in the mining sector, although challenges related to regulatory frameworks and technological adoption remain.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Autonomous Mining Equipment Company Insights

The global Autonomous Mining Equipment Market in 2024 is dominated by several key players, each contributing significantly to the development and deployment of autonomous technologies.

Caterpillar continues to lead the market with its innovative autonomous trucks and machinery, offering robust solutions that enhance operational efficiency in mining operations. Its autonomous haulage systems are widely regarded for their scalability and integration with existing mining infrastructure, which has led to widespread adoption.

Komatsu Ltd. stands out for its focus on advanced automation technology that improves safety and reduces operational costs in mining environments. The company’s autonomous dump trucks and drilling machines are equipped with sophisticated AI and sensor systems, ensuring optimal performance in complex mining conditions.

Hitachi Construction Machinery Co., Ltd. is advancing its autonomous mining solutions through a combination of state-of-the-art machine control technologies and data analytics. By integrating remote monitoring and automated operation features, Hitachi enhances the productivity and safety of mining fleets.

Epiroc AB has made notable strides in autonomous mining equipment with a focus on increasing efficiency while minimizing risks. Its autonomous drill rigs and load haul dump systems are designed to provide real-time data to operators, optimizing mining processes and reducing downtime. Epiroc’s innovations are particularly valuable for large-scale mining operations looking to improve their sustainability and productivity.

These players are positioning themselves at the forefront of the autonomous mining equipment market through continuous innovation and strategic partnerships aimed at expanding the adoption of autonomous systems in mining operations globally.

Top Key Players in the Market

- Caterpillar

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Epiroc AB

- Sandvik AB

- Liebherr Group

- AB Volvo

- BELAZ-HOLDING

- XCMG Group

- Sany Group

Recent Developments

- In Jun 2025, EACON Mining Technology secures over $55 million in funding to further advance its autonomous mining technologies, enhancing operational efficiency and safety in mining operations.

- In May 2025, Sensmore secures $7.3 million to transform traditional mining machines into intelligent robots, enabling smarter operations and automation in the mining sector.

- In Apr 2025, Epiroc achieves a milestone with a $350 million autonomous equipment sale, marking its largest transaction in history and reinforcing its leadership in the autonomous mining equipment market.

- In Jul 2025, Mesabi Metallics announces the $110 million purchase of a new fleet of mining equipment, including ultra-class 400-ton haul trucks, to expand its mining operations and improve efficiency.

- In Jul 2025, Bedrock Robotics emerges from stealth mode, securing $80 million in funding to develop its autonomous construction technology, aimed at revolutionizing heavy equipment operations in mining and construction sectors.

Report Scope

Report Features Description Market Value (2024) USD 3.7 Billion Forecast Revenue (2034) USD 9.5 Billion CAGR (2025-2034) 9.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Mining (Surface Mining, Underground Mining), By Application (Metal, Coal, Mineral, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar, Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Epiroc AB, Sandvik AB, Liebherr Group, AB Volvo, BELAZ-HOLDING, XCMG Group, Sany Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Mining Equipment MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Mining Equipment MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Epiroc AB

- Sandvik AB

- Liebherr Group

- AB Volvo

- BELAZ-HOLDING

- XCMG Group

- Sany Group