Global Autonomous Last Mile Delivery Market Size, Share Analysis Report By Platform (Ground Delivery Vehicles, Aerial Delivery Drones), By Solution (Hardware, Software, Service), By Range (Short Range (20 Kilometers), By End-use (Logistics & Transportation, Healthcare & Pharmacies, Retail & Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152975

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

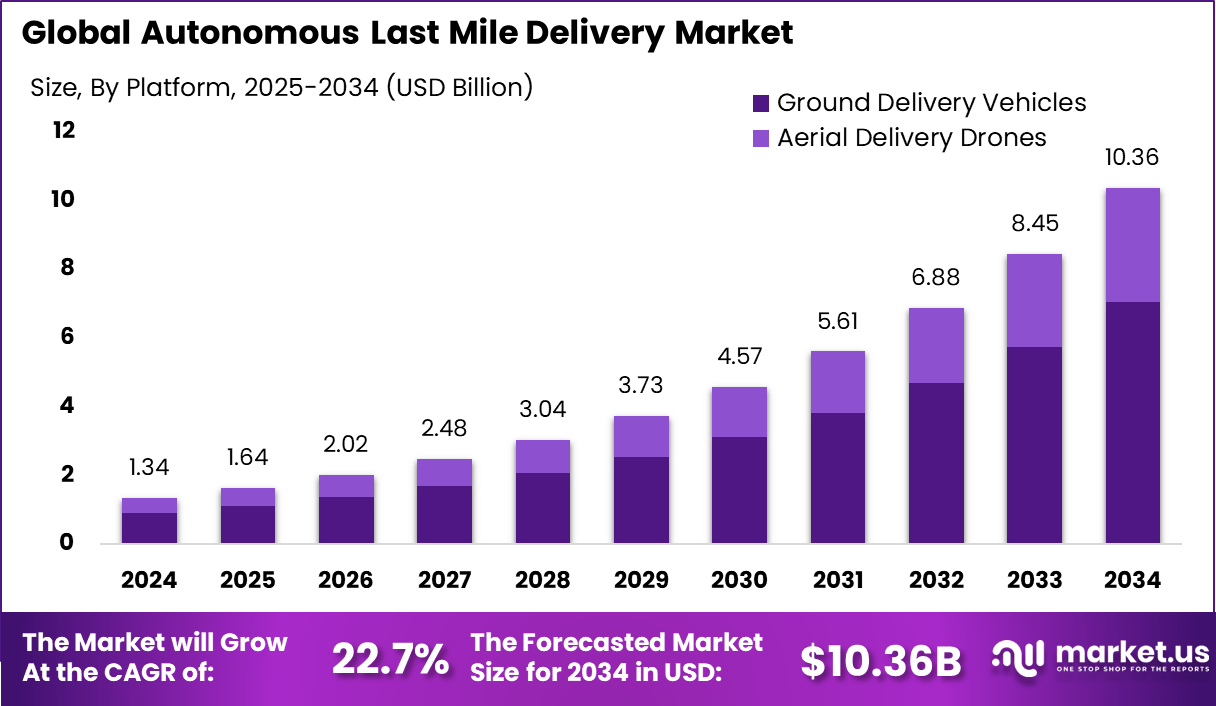

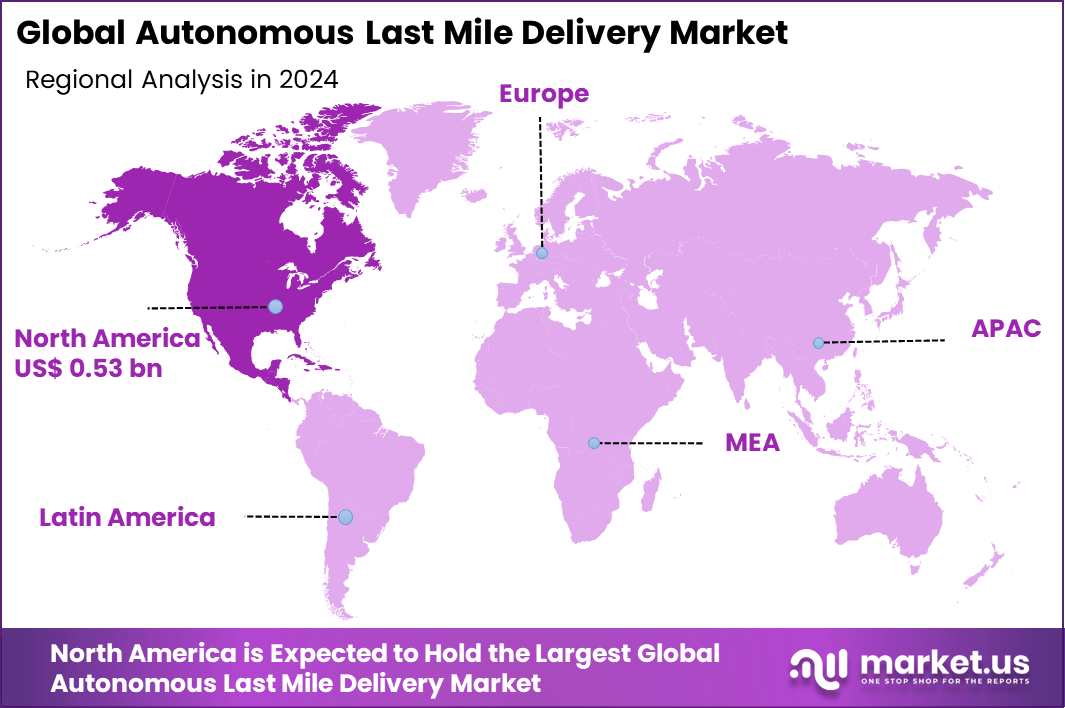

The Global Autonomous Last Mile Delivery Market size is expected to be worth around USD 10.36 billion by 2034, from USD 1.34 billion in 2024, growing at a CAGR of 22.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 0.53 Billion in revenue.

The autonomous last mile delivery market sits at the intersection of logistics and breakthrough technology. It revolves around using self-driving vehicles, delivery robots, and aerial drones to automate the transport of packages from a distribution point or local hub directly to the customer’s door. This sector is gaining traction because traditional last mile delivery is costly, labor-intensive, and a critical touchpoint in the customer experience.

A defining driver for the rise of autonomous last mile delivery is the explosive growth in e-commerce and increasing consumer expectations for fast, reliable delivery. The need to tackle costly logistics inefficiencies and the rising demand for contactless deliveries, especially following global disruptions, are also pushing businesses to innovate.

Technological progress in artificial intelligence, machine learning, and advanced hardware (like LiDAR and computer vision) is lowering traditional barriers and making real-time autonomous navigation a practical reality. Urbanization and traffic congestion are other key motivators nudging markets to embrace smarter solutions for their growing delivery needs.

For instance, In January 2025, RoboSense partnered with Coco Robotics to enhance autonomous last-mile delivery. RoboSense will supply AI-powered LiDAR sensing systems to boost the safety and performance of Coco’s delivery robots. This collaboration is expected to improve urban delivery operations by making them more reliable and scalable.

Scope and Forecast

Report Features Description Market Value (2024) USD 1.34 Bn Forecast Revenue (2034) USD 10.36 Bn CAGR (2025-2034) 22.7% Largest market in 2024 North America [40% market share] According to data from LLCBuddy, consumer expectations for delivery speed and transparency are intensifying. Around 30% more is willingly paid by millennials for same-day delivery, with even higher premiums accepted for guaranteed delivery. Meanwhile, 47% of customers are unlikely to reorder from companies that lack delivery visibility, and 93% expect continuous updates throughout the delivery journey.

Urbanization is further shaping last-mile logistics. As reported by the U.S. Census Bureau, 83% of Americans currently reside in urban areas, a figure projected to reach 89% by 2050. Amid this urban growth, over 37% of last-mile delivery businesses identify driver shortages as their most pressing operational challenge.

Key Takeaway

- The Global Autonomous Last Mile Delivery market is projected to grow from USD 1.34 billion in 2024 to approximately USD 10.36 billion by 2034, registering a robust 22.7% CAGR, driven by rising demand for contactless, efficient delivery solutions.

- In 2024, North America dominated the market with over 40% share, generating about USD 0.53 billion, supported by advanced logistics infrastructure and early adoption of autonomous technologies.

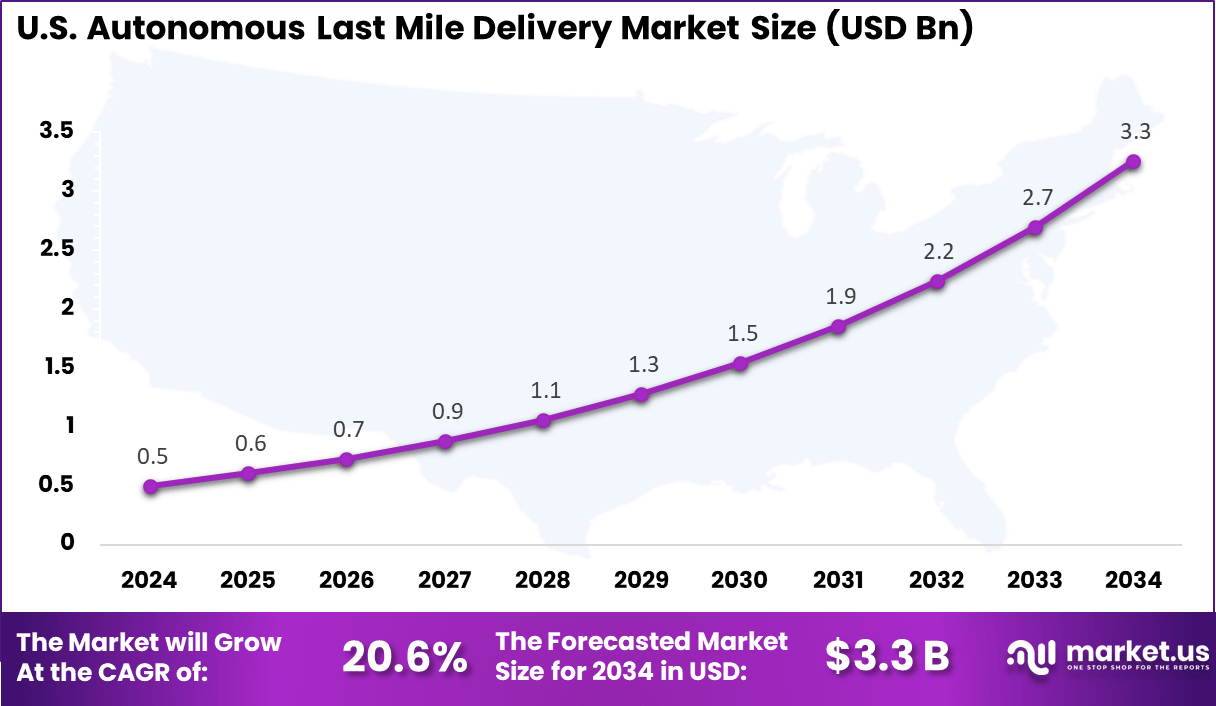

- The United States alone accounted for nearly USD 0.5 billion, with a projected 20.6% CAGR, reflecting strong investment in delivery automation by retailers and logistics firms.

- By platform, Ground Delivery Vehicles led the market with a commanding 68% share, highlighting their practicality for urban and suburban deliveries.

- By solution, Hardware accounted for the largest share at 42%, driven by demand for sensors, cameras, and autonomous control units.

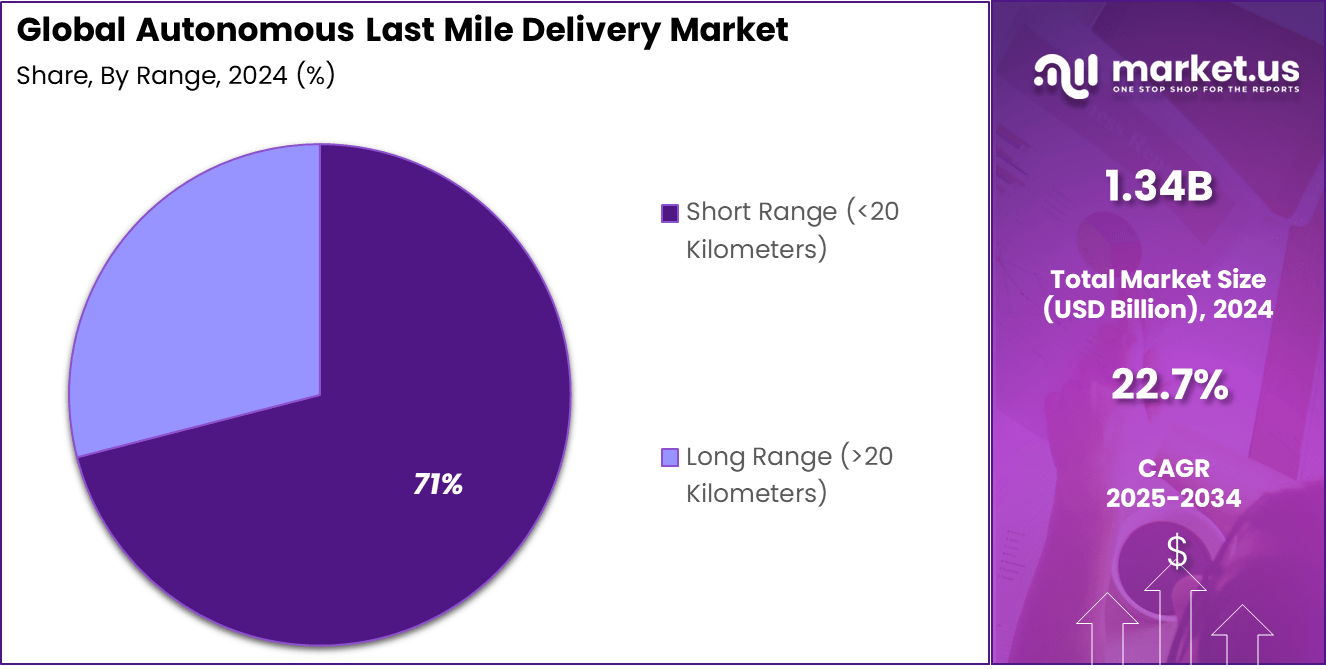

- By range, Short Range (<20 Kilometers) dominated with 71% share, aligning with typical urban delivery routes and operational feasibility.

- By end-use, the Retail & Food segment led the market with 38% share, driven by growing e-commerce, food delivery services, and consumer preference for rapid fulfillment.

U.S. Market Size

The market for Autonomous Last Mile Delivery within the U.S. is growing tremendously and is currently valued at USD 0.5 billion and growing at a CAGR of 20.6%. The market for Autonomous Last Mile Delivery within the U.S. is growing due to the rapid expansion of e-commerce, rising consumer demand for faster and more convenient deliveries, and significant advancements in technologies such as artificial intelligence, robotics, and electric vehicles.

Major U.S. companies like Amazon, Walmart, and FedEx are actively experimenting with autonomous delivery solutions to streamline operations and save costs, while the increasing amount of urban congestion in cities and on highways is driving demand for last-mile logistics. Urbanization is also contributing to this trend.

For instance, in February 2024, Starship Technologies, an Estonian autonomous delivery company, secured $90 million in a funding round co-led by Plural and Iconical. To expand into new markets and enhance its technology stack, the company has received $230 million in additional funding. Over 80 locations worldwide, including the U.S., UK, Germany, Denmark, Estonia, and Finland, have received over six million autonomous robot deliveries from the spacecraft fleet.

With a single charge, each robot can operate for up to 18 hours, using the same energy as an electric kettle to heat ten cups of tea. It has also pioneered wireless charging so robots can charge themselves between deliveries. Starship aims to enhance its AI and wireless charging infrastructure while also expanding its global delivery as a service (DaaS) offering with the new funding.

In 2024, North America held a dominant market position in the global Autonomous Last Mile Delivery Market, capturing more than a 40% share, holding USD 0.53 Billion in revenue. North America holds a dominant position in the autonomous last-mile delivery market due to a confluence of factors. It has a strong e-commerce presence, and high online shopping rates have led to vast demand for efficient delivery services.

For instance, In November 2023, Amazon launched its first 100% electric last-mile fleet program in India. Over 300 Delivery Service Partners now use custom three-wheeler EVs with built-in safety features. The program includes support for maintenance, charging, and parking, promoting cleaner deliveries and safer working conditions.

Platform Analysis

In 2024, Ground Delivery Vehicles segment held a dominant market position, capturing a 68% share of the Global Autonomous Last Mile Delivery Market. This dominance is mainly due to the cost-effectiveness, scalability, and operational efficiency of ground-based autonomous systems such as delivery robots and self-driving vans or trucks.

These vehicles are ideal for urban and suburban settings, providing a practical solution to the increasing demand for last-mile transportation services. In addition, the development of AI, robotics, and sensors has increased the capabilities of ground-delivery vehicles to operate autonomously with improved accuracy and dependability.

For instance, In November 2024, Rakuten expanded its autonomous delivery service in Tokyo’s Harumi area using advanced robots from U.S. based Avride. These robots, equipped with LiDAR and ultrasonic sensors, safely navigate sidewalks at speeds of up to 6 km/h. Residents can choose from 5,000 items, delivered in 15-minute intervals to over 90 pickup spots.

Solution Analysis

In 2024, the Hardware segment held a dominant market position, capturing a 42% share of the Global Autonomous Last Mile Delivery Market. The significance of hardware components in autonomous delivery systems is the driving force behind this dominance. Hardware that is primarily used in space exploration includes LiDAR sensors, cameras, and GPS modules, as well as processors, batteries, and special delivery containers.

These technological advancements in autonomous delivery vehicles make them more reliable, effective, and efficient in the delivery of goods in urban transportation. The considerable amount of capital needed for the design/testing and deployment of these hardware systems also contributes to making the segment the dominant player in the market.

For instance, in October 2024, Serve Robotics unveiled its third-generation autonomous delivery robots, announcing that these advanced units equipped with state-of-the-art hardware such as LiDAR, ultrasonic sensors, multiple cameras, and AI-powered computing modules entered manufacturing at that time. The company plans to deploy 2,000 of these robots across U.S. markets on the Uber Eats platform in 2025.

Range Analysis

In 2024, the Short Range (<20 Kilometers) segment held a dominant market position, capturing a 71% share of the Global Autonomous Last Mile Delivery Market. This segment held a dominant position due to its suitability for urban and suburban last-mile deliveries. Autonomous delivery solutions are optimized for short distances, making them ideal for local deliveries in dense city environments.

These systems offer faster delivery times, lower operational costs, and improved efficiency, particularly for food, groceries, and small packages. Short-range autonomous delivery services are becoming increasingly popular due to the increasing need for cost-effective and efficient delivery solutions, as well as advancements in vehicle technology. This range also decreases the complexity of navigation and regulatory issues.

For instance, In March 2025, Uber Eats introduced autonomous delivery robots in Miami through a partnership with Serve Robotics. These electric robots now operate in areas like Miami Beach and Brickell for short-distance deliveries. Capable of traveling up to 11 mph and carrying 15 gallons of food, the robots serve customers from select partners such as Mister 01 and Shake Shack.

End User Analysis

In 2024, the Retail & Food segment held a dominant market position, capturing a 38% share of the Global Autonomous Last Mile Delivery Market. The Retail & Food segment held a dominant market position due to the increasing demand for faster and more efficient delivery services.

Consumers are increasingly relying on online food delivery platforms and the convenience of online shopping, which has led to the adoption of autonomous last-mile delivery systems. The integration of these technologies into logistics is becoming more prevalent in the food service sector, as retailers and other organizations seek to reduce operational expenses, improve customer satisfaction, and increase delivery speed.

For instance, In April 2025, DoorDash expanded its collaboration with Coco Robotics by deploying autonomous sidewalk delivery robots in Los Angeles and Chicago. These cooler-sized robots are built for short-distance deliveries within one mile, supporting over 600 merchant partners. The initiative aims to reduce carbon emissions and improve delivery efficiency.

Key Market Segments

By Platform

- Ground Delivery Vehicles

- Delivery Bots

- Self-driving Vans & Trucks

- Aerial Delivery Drones

- Fixed-Wing

- Rotary-Wing

- Hybrid

By Solution

- Hardware

- Software

- Service

By Range

- Short Range (<20 Kilometers)

- Long Range (>20 Kilometers)

By End-use

- Logistics & Transportation

- Healthcare & Pharmacies

- Retail & Food

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends Analysis

Rise of AI and Smart Routing

One of the most influential trends shaping autonomous last mile delivery is the adoption of advanced artificial intelligence and machine learning to optimize delivery routes in real time. These systems can interpret data from weather, traffic, and customer behavior to calculate the most efficient routes for drones, vehicles, and robots, increasing speed and enhancing resource use.

This not only makes deliveries quicker but also helps reduce overall operational costs and environmental impact. The trend stretches beyond just technology, influencing how companies can predict and respond to consumer demand more accurately, which leads to greater satisfaction for customers and smoother delivery operations.

Driver Analysis

Changing E-Commerce and Consumer Expectations

A key driver energizing this industry is the dramatic rise in e-commerce, which has changed what people expect from delivery services. Shoppers are now demanding quicker, more reliable deliveries with high visibility and less human interaction, especially for items arriving at their doorstep. This shift in habit urges businesses to embrace technologies that promise fast, contactless drop-offs.

Autonomous delivery systems respond to this call, providing goods efficiently any time of day, and offer greater convenience for end consumers. Such changing habits are making logistics companies prioritize investments and innovations in automated delivery technologies that deliver on these promises.

Restraint Analysis

Regulatory and Infrastructure Barriers

While the technology holds promise, regulatory and infrastructure limitations present a real challenge. For fully autonomous delivery systems to work safely, they need roads, curb space, air corridors, and operational zones adapted to new vehicles and drones.

Many cities still lack reliable infrastructure or clear regulations to support these technologies, which leads to uncertainty, delays, and potentially higher costs as organizations wait for clearer rules or invest in new infrastructure. The slow pace of regulatory change and lack of harmonized rules are becoming significant speed bumps for wider adoption.

Opportunity Analysis

Expanding Services in Underserved Areas

There is a remarkable opportunity for autonomous last mile delivery to shine in places where traditional delivery faces either high costs or logistical hurdles, such as rural, remote, or hard-to-reach locations. Drones and self-driving robots can navigate areas where regular vehicles struggle or where there is limited road access.

By deploying these technologies, companies can bring essential goods to communities faster and more frequently, and even help during emergencies or when human delivery is limited, making these innovations not just profitable but genuinely impactful for society at large.

Challenge Analysis

Safety and Consumer Acceptance

Even with all the innovation, the industry faces an ongoing challenge to assure the safety of these vehicles and win over the trust of the public. People are understandably cautious about sharing sidewalks and streets with robots or drones.

Ensuring that these machines can reliably detect obstacles, interact safely with pedestrians, and respond correctly to unexpected situations is critical. Building confidence with communities through transparent operations, regular safety updates, and positive customer experiences is vital so that technology and society can progress together.

Key Players Analysis

Alibaba, Amazon.com, and FedEx are leading the Autonomous Last Mile Delivery market with strong logistics infrastructure and heavy investment in robotics. Alibaba has expanded its fleet of delivery bots across urban regions. Amazon continues testing drones and sidewalk robots for faster, contactless delivery. FedEx has introduced autonomous ground bots to enhance same-day services.

UPS, Kiwibot, Yandex, and Zipline are making notable progress. UPS has partnered with robotics firms to automate short-range routes. Kiwibot operates widely on campuses. Yandex focuses on AI-driven navigation, while Zipline specializes in drone deliveries, especially for healthcare.

DHL, DPDgroup, and Drone Delivery Canada are expanding their autonomous delivery pilots. Flytrex, Matternet, and Starship Technologies are pushing innovations in both aerial and ground-based systems. Firms like Robby Technologies, Relay Robotics, SkyDrop, and Udelv are refining route automation and safety. Together, these players are accelerating the transition toward efficient and sustainable last mile delivery.

Top Key Players in the Market

- Alibaba

- FedEx

- com

- Kiwibot

- UPS

- Yandex

- Zipline

- com Inc.

- Continental AG

- DHL (Deutsche Post AG)

- DPDgroup (La Poste)

- Drone Delivery Canada

- Flytrex Inc.

- Matternet

- Relay Robotics Inc.

- Robby Technologies Inc.

- SkyDrop

- ST Engineering Aethon Inc.

- Starship Technologies

- Udelv Inc.

- Others

Recent Developments

- In May 2025, Amazon unveiled seven new robots at its Dortmund delivery station to boost safety and speed in package handling. These innovations represent the company’s broader push toward automation in logistics.

- In January 2025, RoboSense and Coco Robotics formed a strategic alliance to improve last-mile delivery. RoboSense’s advanced perception systems now power Coco’s delivery fleet, enhancing obstacle detection and navigation. That same month, NEOLIX secured a key license for unmanned vehicle operations in Chengdu, expanding its presence across major Chinese cities.

- In February 2025, Avride launched sidewalk delivery bots for Uber Eats in Jersey City. This move followed earlier deployments in Austin and Dallas, part of a broader partnership integrating Avride’s robotic technologies into the Uber platform to streamline urban deliveries.

- In October 2024, Wing Aviation and Serve Robotics partnered to pilot a hybrid delivery system, combining AI-powered sidewalk robots with drones to scale autonomous food delivery.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Platform (Ground Delivery Vehicles, Aerial Delivery Drones), By Solution (Hardware, Software, Service), By Range (Short Range (<20 Kilometers), Long Range (>20 Kilometers), By End-use (Logistics & Transportation, Healthcare & Pharmacies, Retail & Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Alibaba, FedEx, JD.com, Kiwibot, UPS, Yandex, Zipline, Amazon.com Inc., Continental AG, DHL (Deutsche Post AG), DPDgroup (La Poste), Drone Delivery Canada, Flytrex Inc., Matternet, Relay Robotics Inc., Robby Technologies Inc., SkyDrop, ST Engineering Aethon Inc., Starship Technologies, Udelv Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Last Mile Delivery MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Last Mile Delivery MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alibaba

- FedEx

- com

- Kiwibot

- UPS

- Yandex

- Zipline

- com Inc.

- Continental AG

- DHL (Deutsche Post AG)

- DPDgroup (La Poste)

- Drone Delivery Canada

- Flytrex Inc.

- Matternet

- Relay Robotics Inc.

- Robby Technologies Inc.

- SkyDrop

- ST Engineering Aethon Inc.

- Starship Technologies

- Udelv Inc.

- Others