Global Autonomous Agents Platform Market Size, Share, Industry Analysis Report By Component (Platform/Solutions (Agent Development Frameworks, Orchestration & Management Hubs, Others), Services (Professional Services, Managed Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Customer Service & Support, Sales & Marketing, Data Analysis & Business Intelligence, Software Development & IT Operations (DevOps & AIOps), Personal Assistant Agents, Others), By End-User Industry (IT & Telecommunications, Banking Financial Services and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Manufacturing & Logistics, Media & Entertainment, Government & Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167634

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Quick Market Facts

- Enterprise Adoption and Benefits

- Consumer Perception

- By Component: Platform/Solutions

- By Deployment Mode: Cloud-based

- By Organization Size: Large Enterprises

- By Application: Customer Service & Support

- By End-User Industry: IT & Telecommunications

- By North America Share: 41.2%

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Future Outlook

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

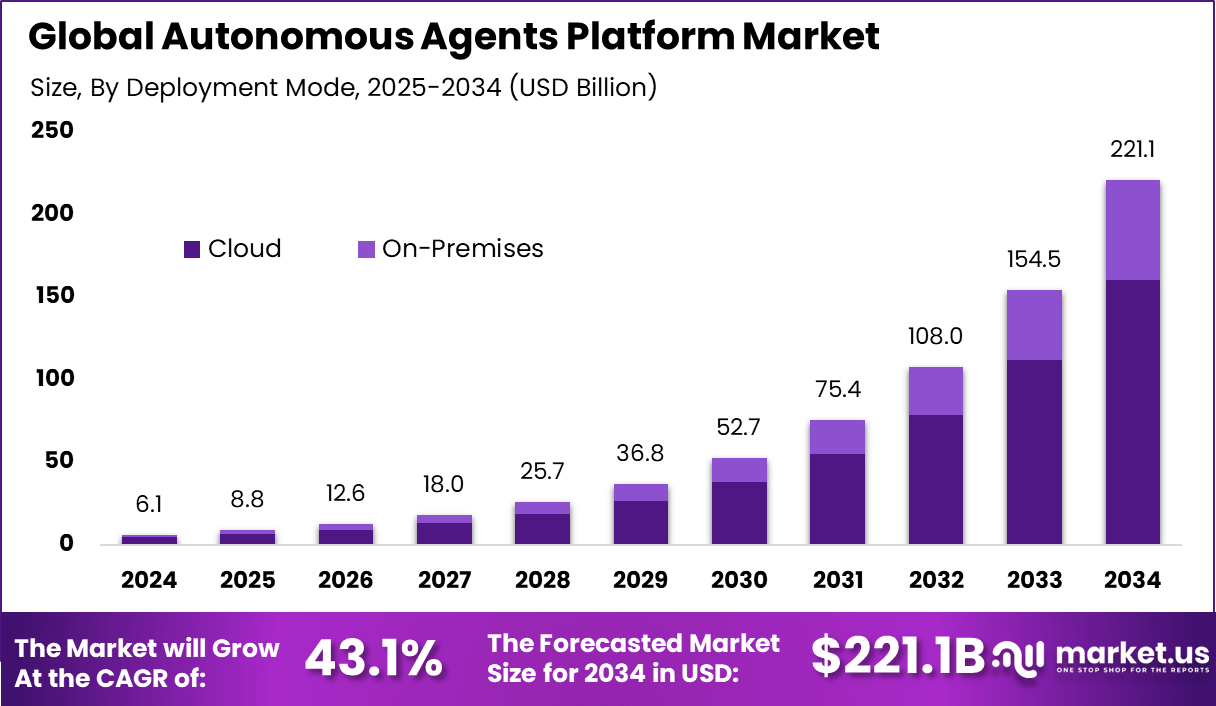

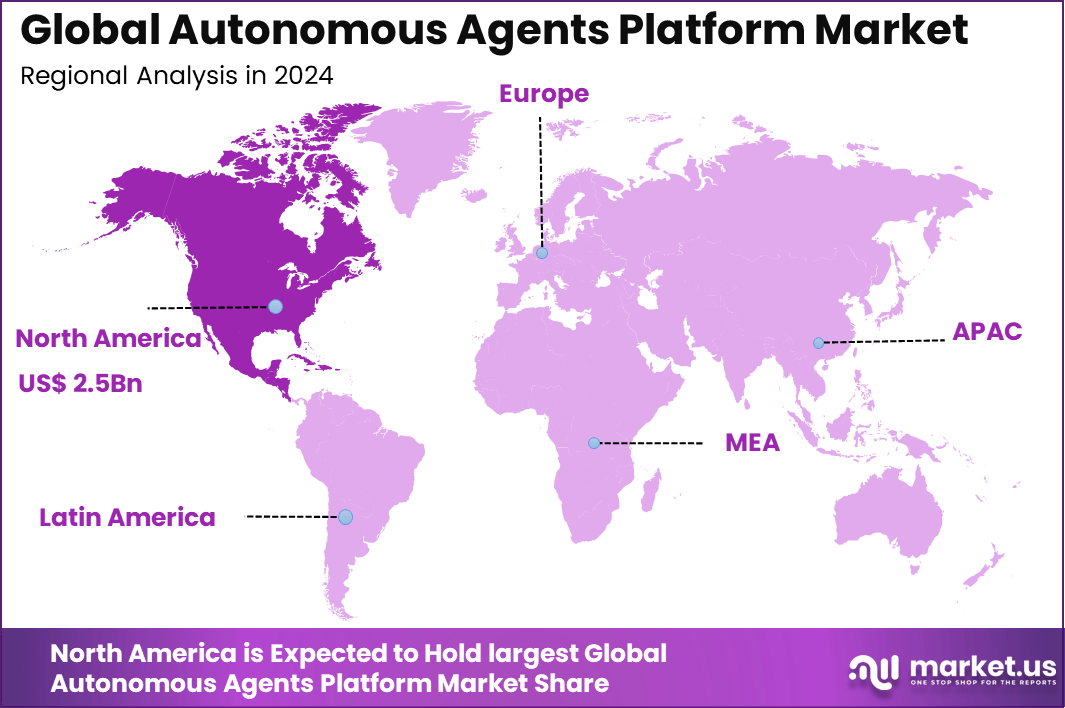

The Global Autonomous Agents Platform Market generated USD 6.1 billion in 2024 and is predicted to register growth from USD 8.8 billion in 2025 to about USD 221.1 billion by 2034, recording a CAGR of 43.1% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 41.2% share, holding USD 2.5 Billion revenue.

The Autonomous Agents Platform market is growing rapidly due to the increasing adoption of AI-powered automation across various industries. These platforms enable AI systems to perform complex tasks independently, enhancing productivity and operational efficiency. Organizations widely use autonomous agents to automate tasks like customer support, compliance, logistics, and decision-making, which helps them focus on strategic goals while the agents handle routine functions.

The key forces driving this market growth include rising demand for automation, advancements in machine learning and natural language processing, and expanding use cases across sectors such as finance, healthcare, and transportation. Increasing computational power and improved AI algorithms allow agents to adapt and learn in real-time, making them more effective in diverse environments. Additionally, enterprises seek to reduce costs and improve process efficiency, motivating more investments in autonomous agents.

Quick Market Facts

- By component, platform/solutions dominate with 69.7%, driven by demand for end-to-end autonomous agent orchestration and workflow automation tools.

- By deployment mode, cloud-based platforms lead with 72.6%, reflecting strong preference for scalability, rapid deployment, and integration flexibility.

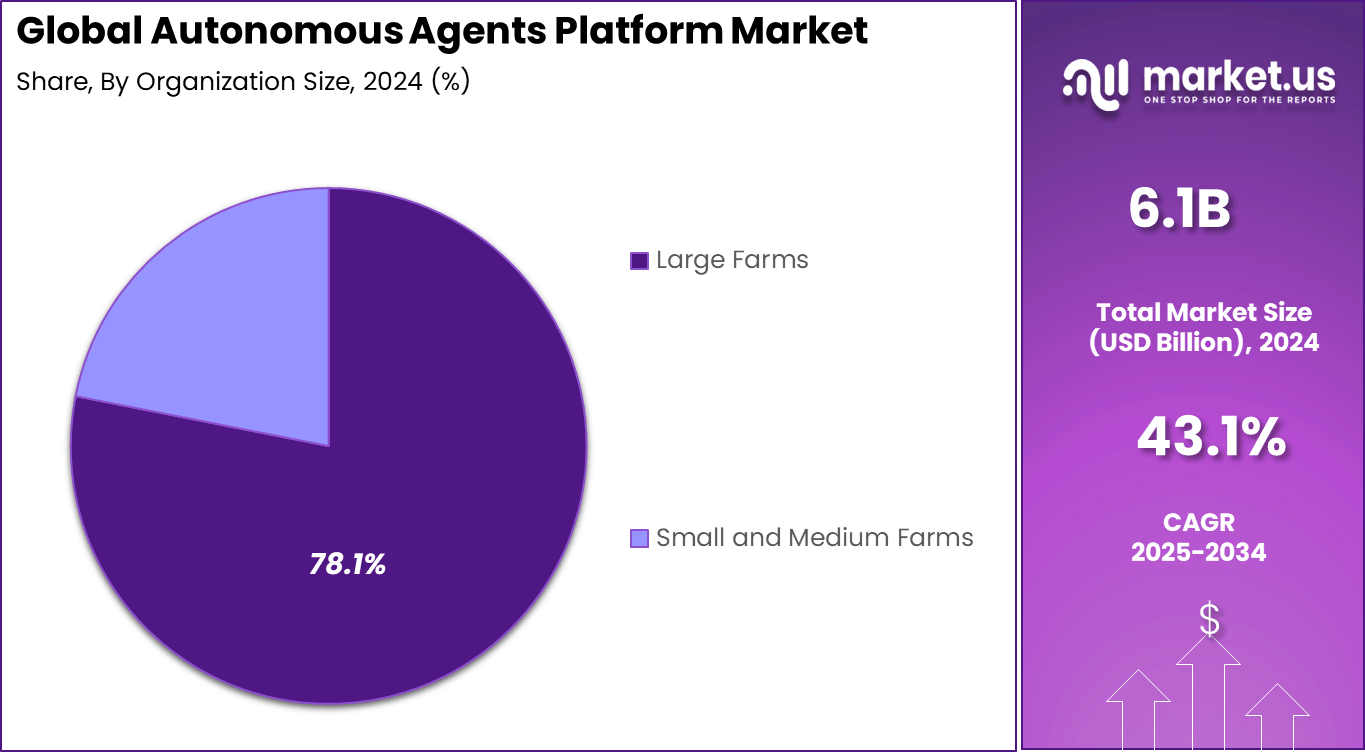

- By organization size, large enterprises hold 78.1%, as they adopt autonomous agents to enhance operational efficiency and manage complex, high-volume workflows.

- By application, customer service and support accounts for 33.1%, supported by rising use of autonomous agents for real-time interaction, ticket resolution, and self-service automation.

- By end-user industry, IT & telecommunications represents 21.7%, indicating strong adoption for network automation, service assurance, and digital operations.

- North America leads with 41.2%, backed by advanced AI adoption, strong enterprise investments, and a mature digital ecosystem.

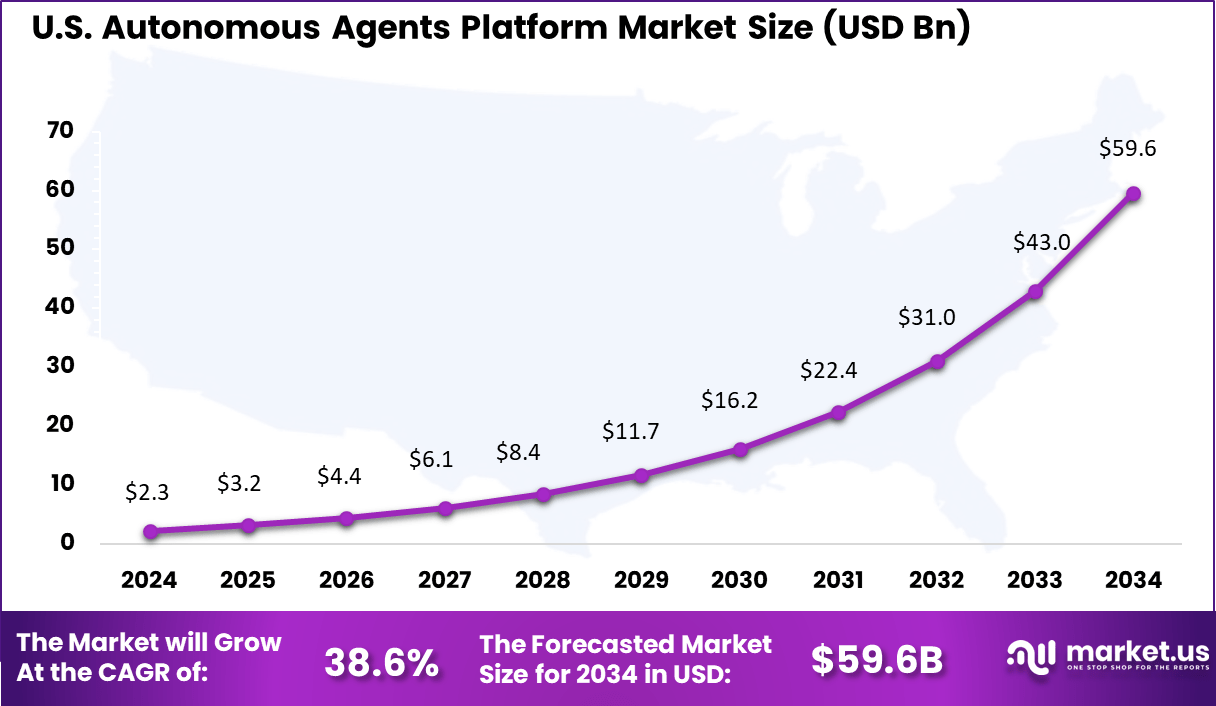

- The US market reached USD 2.28 billion and is expanding at a rapid CAGR of 38.6%, underscoring accelerating deployment of autonomous agent platforms across industries.

Enterprise Adoption and Benefits

- High adoption: About 79% of organizations report using AI agents in their operations.

- Growing investment: Nearly 88% of U.S. firms plan to increase spending on AI within the next year.

- Efficiency improvement: Companies using AI agents report about 55% higher operational efficiency.

- Cost reduction: Businesses achieve an average cost reduction of 35% after deploying AI agents.

- Development gains: One major retail company used AI agents in software development to reduce cycle times and cut production errors by half or more.

- Top applications: Research and summarization tasks account for 58% of usage. Customer service accounts for 45.8% of use cases. Personal productivity and workflow automation account for 53.5%.

Consumer Perception

- Speed preference: Around 54% of consumers prefer quick resolution of problems over interacting with a human.

- Task comfort: About 39% of consumers are comfortable with AI agents scheduling appointments.

- Purchasing comfort: Around 24% of consumers are comfortable allowing AI agents to make purchases on their behalf.

By Component: Platform/Solutions

The Platform/Solutions segment holds a commanding 69.7% share in the autonomous agents platform market. This reflects the preference of organizations for comprehensive platforms that offer ready-made frameworks, tools, and integrated solutions. Enterprises favor these platforms because they simplify automation workflows, governance, and security management.

The growing demand for turnkey solutions that can quickly be deployed across various use cases is a key driver behind this dominance. This component segment’s strong presence also highlights a broader market trend where organizations are seeking scalable and user-friendly platforms rather than building autonomous agent capabilities from scratch.

Solutions provide the flexibility to adopt multiple agent functionalities under one roof, facilitating faster time to value. As autonomous agents become more sophisticated, platforms are evolving to deliver multi-agent coordination and integration with other enterprise systems more effectively.

By Deployment Mode: Cloud-based

Cloud-based deployment captures a significant 72.6% of the autonomous agents market, underlining the widespread adoption of cloud infrastructure for AI-driven platforms. Cloud deployment offers scalability and flexibility, allowing organizations to scale resources up or down as needed without heavy upfront investments. This model enables easy remote access to autonomous agents and reduces the burden of maintenance, as updates and infrastructure management are handled by cloud providers.

Enterprises are increasingly choosing cloud deployment to benefit from cost efficiencies, on-demand computing power, and integration with other cloud-native services. This deployment mode supports rapid innovation cycles and is favored across industries where agility and accessibility are critical. The cloud model especially suits large enterprises with complex needs and fluctuating workloads.

By Organization Size: Large Enterprises

Large enterprises dominate the adoption of autonomous agents platforms with a substantial share of 78.1%. This reflects the extensive resources and IT infrastructure available to larger organizations, enabling them to integrate advanced AI agents into their workflows. Large enterprises benefit from deploying autonomous agents to improve operational efficiencies, automate repetitive tasks, and enhance customer engagement at scale.

The ability to invest in advanced AI capabilities, regulatory compliance, and data security also supports broad adoption among bigger organizations. These enterprises typically have diverse use cases spanning departments where autonomous agents can deliver significant value, from IT automation to customer service and supply chain management.

By Application: Customer Service & Support

Customer service and support account for 33.1% of autonomous agent applications, showing a strong focus on improving customer interactions through automation. Autonomous agents in this field handle routine inquiries, provide 24/7 responsiveness, and personalize experiences without constant human involvement. This use case helps reduce response times, increase customer satisfaction, and decrease operational costs.

The automation of customer support workflows also frees human agents to focus on complex issues requiring empathy and judgment. As customer expectations rise for instant and accurate assistance, autonomous agents are becoming central to service strategies across sectors such as telecom, retail, and finance.

By End-User Industry: IT & Telecommunications

The IT and telecommunications sector represents 21.7% of the autonomous agents market share by end-user industry. This segment benefits from these agents through network automation, security monitoring, and service management. Autonomous agents help telecom companies manage bandwidth allocation, detect faults proactively, and automate customer care.

The synergy between AI advancements and digital transformation in IT and telecom is driving increased adoption. Autonomous agents enable these industries to enhance operational resilience, reduce manual errors, and optimize service quality in a highly competitive environment.

North America holds a dominant 41.2% share of the global autonomous agents platform market in 2025. This leadership is driven by strong investments in AI, advanced digital infrastructure, and a high concentration of tech innovators.

The region’s market is supported by both public and private sector initiatives, with the U.S. accounting for the largest portion of this share. North America’s early adoption of autonomous agent technologies and supportive regulatory environment have accelerated enterprise deployments across industries.

The U.S. autonomous agents market is valued at USD 2.28 billion in 2025, reflecting robust demand and rapid adoption. The region is projected to grow at a compound annual growth rate (CAGR) of 38.6% over the next several years, outpacing most other global markets.

This growth is fueled by ongoing investments in AI research, digital transformation, and the integration of autonomous agents into core business operations. North America’s market leadership is expected to continue, setting the pace for global innovation and adoption in this space.

Emerging Trends

Key Trends Description Multi-Agent Ecosystems Businesses are adopting multiple collaborating autonomous agents that work together like digital departments to handle complex tasks seamlessly. This shift enables better problem-solving by sharing knowledge and coordinating actions across functions. Human-AI Collaboration Instead of replacing humans, autonomous agents are increasingly working alongside humans, augmenting their capabilities and making workflows more efficient. This approach balances autonomy with human oversight for higher accountability. Domain-Specific Agents Generic AI agents are giving way to agents specialized in specific industries such as finance, healthcare, and supply chain. These tailored agents address unique challenges in each field more effectively. Self-Learning and Adaptive AI Autonomous agents are evolving to learn from their environment and improve continuously without explicit reprogramming. This makes them more scalable and able to handle dynamic, unpredictable conditions. Integration with Web3 and Decentralized Systems Autonomous agents are becoming key players in decentralized finance and blockchain ecosystems, managing smart contracts and assets in real time, opening new opportunities beyond traditional enterprise uses. Growth Factors

Key Factors Description Increasing Automation Demand Across industries, companies seek to automate complex, repetitive tasks to improve productivity and reduce operational costs, driving strong adoption of autonomous agents. Advances in AI, ML, and NLP Innovations in machine learning, natural language processing, and reinforcement learning enable more capable and intelligent autonomous agents that can sustain complex workflows. Cloud and Edge Computing Expansion The growth of scalable cloud infrastructure and edge deployments supports widespread use of autonomous agents by providing the necessary computational power and low latency. Industry-Specific Investments Significant financial and research commitments in sectors like healthcare, logistics, and finance are accelerating tailored autonomous agent solutions adoption in these fields. Regulatory and Security Focus To ensure reliability and safe deployment, investments in governance frameworks and secure architectures are enabling broader enterprise acceptance of autonomous agents. Key Market Segments

By Component

- Platform/Solutions

- Agent Development Frameworks

- Orchestration & Management Hubs

- Others

- Services

- Professional Services

- Managed Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Customer Service & Support

- Sales & Marketing

- Data Analysis & Business Intelligence

- Software Development & IT Operations (DevOps & AIOps)

- Personal Assistant Agents

- Others

By End-User Industry

- IT & Telecommunications

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Life Sciences

- Retail & E-commerce

- Manufacturing & Logistics

- Media & Entertainment

- Government & Public Sector

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Cost Efficiency and Productivity Boost

The main driver for adopting autonomous agents platforms is the rising need for automation to reduce operational costs and improve productivity. These agents operate continuously, work faster, and reduce human errors while making real-time decisions based on data. Businesses see this as a way to cut down manual labor, speed up workflow processes, and enhance accuracy, especially in industries like finance, healthcare, and supply chain management.

The growing integration of cloud and IoT technologies also supports scalable implementations, making these systems more accessible and cost-effective than before. Automation helps companies save significant resources by handling repetitive or risky tasks independently. The continuous operation capability of autonomous agents means services and processes do not pause, leading to better output and service levels.

Restraint Analysis

Data Quality and Integration Issues

One restraint faced by autonomous agent platforms is the reliance on high-quality, unbiased, and comprehensive data. Many AI systems fail or underperform if fed inaccurate, incomplete, or outdated data. Businesses often struggle with integrating autonomous agents into existing legacy systems, which can be complex and costly. These challenges can slow down adoption and limit the effectiveness of automation, especially where real-time decision-making is crucial and data sources are numerous or inconsistent.

Additionally, companies may lack the in-house expertise to handle data governance, secure integration, and compliance with regulations like GDPR. Without consistent and good data, agents may make faulty decisions or fail to adapt properly. These technical barriers mean organizations need to invest significantly in data infrastructure before realizing full benefits from autonomous agent technologies.

Opportunity Analysis

Expanding Applications and Customization

There is a strong opportunity in expanding autonomous agents beyond traditional roles to complex workflows like compliance monitoring, financial approvals, and customer service automation. The growing advancements in generative AI enable agents to simulate and predict actions, manage multiple systems, and personalize interactions dynamically.

Platforms supporting plug-and-play agents allow businesses to tailor AI capabilities quickly, democratizing access to the technology across various sectors. This opportunity extends into industries such as healthcare, transportation, and autonomous vehicles where safety-critical decisions benefit from real-time AI agents.

Companies that pioneer these AI-driven workflows stand to gain a competitive edge through improved operational efficiency and customer experiences. The shift toward hybrid cloud and edge computing models also creates scope for agents that balance speed, security, and cost effectively.

Challenge Analysis

Ensuring Trust and Ethical Use

A key challenge with autonomous agents involves ensuring transparent, fair, and trustworthy decision-making. AI agents may inadvertently carry biases from training data, raising concerns about ethical use in sensitive fields like hiring or healthcare. Maintaining human oversight while scaling AI decision autonomy remains difficult, with risks of over-reliance and loss of control.

Security issues related to data privacy and vulnerabilities in autonomous systems compound these concerns. To address these challenges, enterprises must implement governance frameworks, continuous monitoring, and hybrid models combining AI with human review.

Achieving this balance is essential to mitigate risks from opaque AI processes and ensure regulatory compliance. The complexity of aligning ethical standards with autonomous agent capabilities slows adoption and requires careful strategy from organizations.

Future Outlook

- Expansion of autonomous agents into autonomous transportation, smart cities, and personalized healthcare sectors.

- Increased integration with IoT and edge computing for real-time localized decision-making.

- Adoption of advanced generative AI and reinforcement learning techniques to boost agent reasoning and adaptability.

- Development of multi-agent systems handling end-to-end enterprise processes with minimal human intervention.

- Growing use of customizable agent marketplaces enabling rapid deployment of tailored autonomous solutions.

- Rising focus on governance frameworks to ensure data privacy, regulatory compliance, and ethical AI use.

- Emergence of autonomous agents in emerging markets due to improved digital infrastructure and AI awareness.

Competitive Analysis

Microsoft, Google, IBM, Amazon, and Salesforce lead the autonomous agents platform market with strong AI engines and cloud infrastructures that support autonomous task execution. Their platforms enhance decision-making, streamline workflows, and automate complex operations across customer service, IT, and business functions.

ServiceNow, Oracle, SAP, OpenAI, and Meta strengthen the market with adaptive agent frameworks tailored for conversational automation, knowledge management, and process optimization. Their platforms combine natural language capabilities with enterprise-grade security and robust workflow tools. These providers help organizations reduce manual work and improve operational efficiency.

Appian, UiPath, Automation Anywhere, Cognizant, Accenture, and other participants broaden the landscape with industry-specific autonomous agent solutions. Their systems emphasize low-code integration, intelligent automation, and end-to-end workflow orchestration. These companies serve enterprises seeking reliable, scalable autonomous operations.

Top Key Players in the Market

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation (IBM)

- Amazon.com, Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Oracle Corporation

- SAP SE

- OpenAI, L.L.C.

- Meta Platforms, Inc.

- Appian Corporation

- UiPath Inc.

- Automation Anywhere, Inc.

- Cognizant Technology Solutions Corporation

- Accenture plc

- Others

Recent Developments

- November 2025: Microsoft introduced Agent 365, a new program to securely manage and govern AI agents across Microsoft platforms. This launch focuses on controlling the growing number of AI agents enterprises deploy, offering unified observability, performance tracking, and security dashboards.

- October 2025: Oracle expanded its AI Agent Studio with new marketplace capabilities offering industry-specific AI agents for Fusion Cloud Applications. The release included broader support for leading LLMs from OpenAI, Anthropic, Google, and Meta, helping customers securely deploy tailored autonomous agents.

Report Scope

Report Features Description Market Value (2024) USD 6.1 Bn Forecast Revenue (2034) USD 221.1 Bn CAGR(2025-2034) 43.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Platform/Solutions (Agent Development Frameworks, Orchestration & Management Hubs, Others), Services (Professional Services, Managed Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Application (Customer Service & Support, Sales & Marketing, Data Analysis & Business Intelligence, Software Development & IT Operations (DevOps & AIOps), Personal Assistant Agents, Others), By End-User Industry (IT & Telecommunications, Banking Financial Services and Insurance (BFSI), Healthcare & Life Sciences, Retail & E-commerce, Manufacturing & Logistics, Media & Entertainment, Government & Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Google LLC, International Business Machines Corporation (IBM), Amazon.com, Inc., Salesforce, Inc., ServiceNow, Inc., Oracle Corporation, SAP SE, OpenAI, L.L.C., Meta Platforms, Inc., Appian Corporation, UiPath Inc., Automation Anywhere, Inc., Cognizant Technology Solutions Corporation, Accenture plc, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Autonomous Agents Platform MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Autonomous Agents Platform MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Google LLC

- International Business Machines Corporation (IBM)

- Amazon.com, Inc.

- Salesforce, Inc.

- ServiceNow, Inc.

- Oracle Corporation

- SAP SE

- OpenAI, L.L.C.

- Meta Platforms, Inc.

- Appian Corporation

- UiPath Inc.

- Automation Anywhere, Inc.

- Cognizant Technology Solutions Corporation

- Accenture plc

- Others