Global Automotive Water Separation Systems Market Size, Share, Growth Analysis By Material Type (Metal, Plastic, Composite), By Technology (Coalescing Filtration, Centrifugal Separation, Hydrocyclone Separation), By Application (Fuel Filtration, Oil Filtration, Air Filtration), By End-User (Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 161489

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

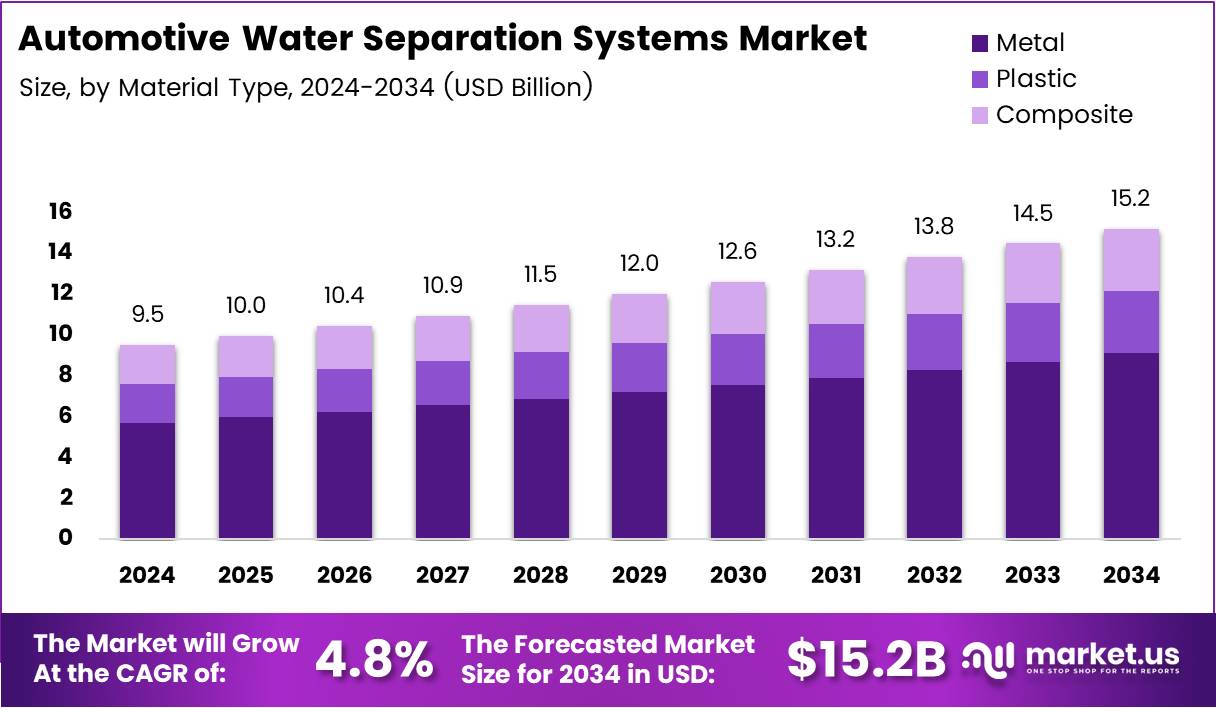

The Global Automotive Water Separation Systems Market size is expected to be worth around USD 15.2 Billion by 2034, from USD 9.5 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

The Automotive Water Separation System is a crucial component designed to remove water and contaminants from fuel before combustion. It ensures optimal engine performance, longer injector life, and improved fuel efficiency. As diesel engines remain prominent in commercial fleets, these systems play a vital role in vehicle reliability and emissions control.

Moreover, the industry is evolving with integration of advanced filtration materials and sensor-based technologies. These innovations enhance separation efficiency, reduce downtime, and support predictive maintenance. Manufacturers are also emphasizing lightweight and compact designs, aligning with the broader shift toward energy-efficient automotive systems and sustainability-driven innovations.

Additionally, stringent emission regulations across regions like North America and Europe are accelerating the demand for efficient fuel-water separation systems. Governments are encouraging OEMs to adopt cleaner and more reliable solutions. This regulatory push, combined with consumer demand for durable and low-maintenance vehicles, strengthens market expansion prospects globally.

Furthermore, rapid urbanization and the rise of commercial transportation fleets present lucrative opportunities. Developing economies are investing in infrastructure and logistics, increasing the need for heavy-duty vehicles. As a result, demand for effective water separation technology in diesel engines is witnessing steady growth, particularly in emerging markets across Asia-Pacific and Latin America.

According to an industry report, in the U.S., 76% of Class 3–8 commercial vehicles run on diesel (2022), representing a significant in-service base requiring reliable fuel-water separators. Additionally, as noted by the same industry source, telematics and predictive maintenance can reduce maintenance costs by up to 20%, further supporting adoption of smart, sensor-equipped automotive water separation systems that enhance operational efficiency and reduce long-term costs.

Key Takeaways

- The Global Automotive Water Separation Systems Market is projected to reach USD 15.2 Billion by 2034, up from USD 9.5 Billion in 2024, growing at a CAGR of 4.8% (2025–2034).

- Metal held the leading share in 2024 at 48.9% (By Material Type), driven by its durability, pressure resistance, and longevity.

- Coalescing Filtration dominated the Technology segment in 2024 with a 44.2% share, ensuring efficient fine water particle separation for cleaner fuel.

- Fuel Filtration led the Application segment in 2024 with a 52.7% share, fueled by stricter emission norms and focus on clean fuel systems.

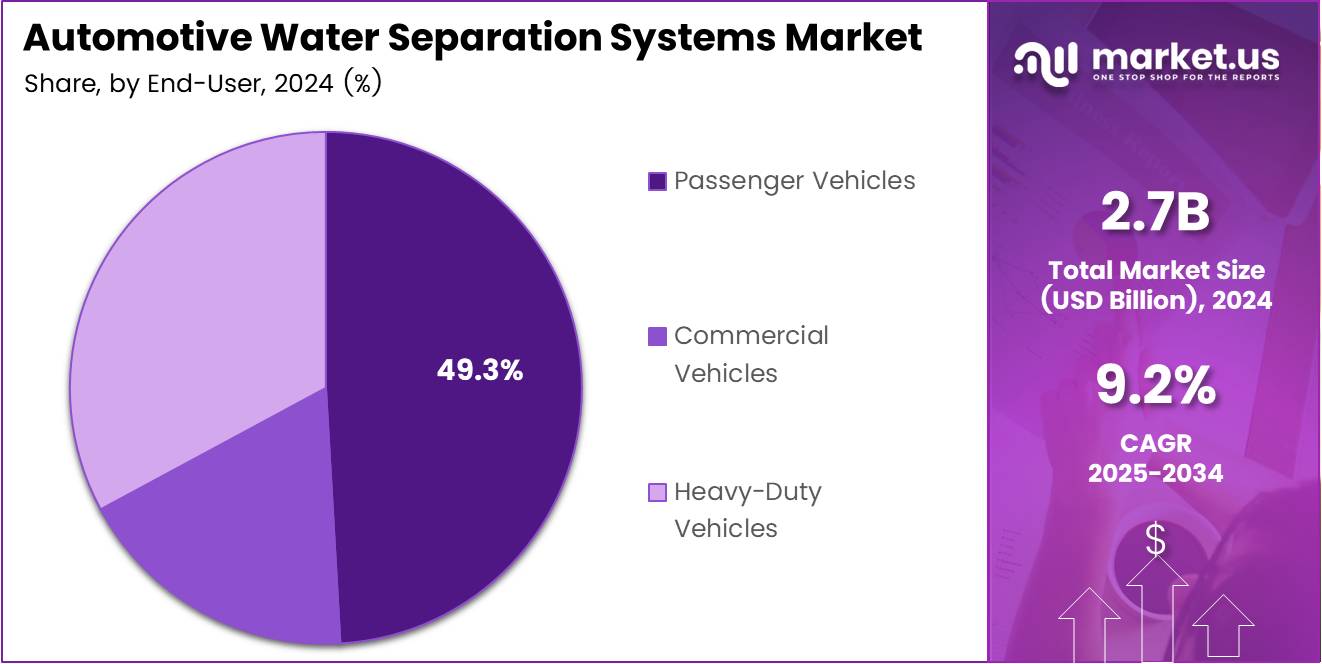

- Passenger Vehicles accounted for 49.3% of the market (By End-User) in 2024, supported by growing adoption of advanced emission systems.

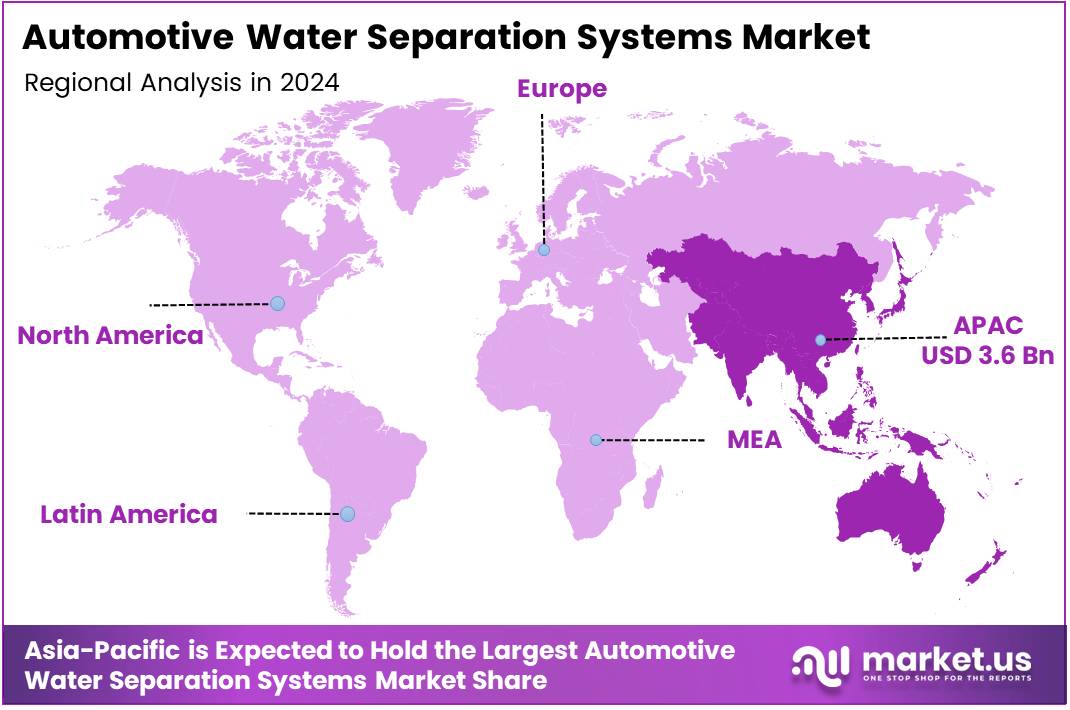

- The Asia Pacific region led globally with a 38.6% market share and USD 3.6 Billion value, driven by strong automotive production and tightening environmental regulations.

By Material Type Analysis

Metal dominates with 48.9% due to its superior strength, durability, and resistance to harsh automotive environments.

In 2024, Metal held a dominant market position in the By Material Type Analysis segment of the Automotive Water Separation Systems Market, with a 48.9% share. Metal-based systems are preferred for their robustness and long lifespan. Their ability to withstand high pressure and temperature conditions makes them ideal for heavy-duty applications, ensuring reliable water separation performance in fuel and oil systems.

Plastic materials are witnessing rising demand due to their lightweight and corrosion-resistant properties. Automakers are increasingly adopting plastic-based water separation systems to enhance fuel efficiency and reduce overall vehicle weight. These systems offer design flexibility and cost advantages, making them suitable for passenger vehicles and compact engine designs.

Composite materials are gaining traction as a next-generation alternative, combining the strength of metal with the lightness of plastic. They offer enhanced resistance to thermal stress and chemical corrosion. Manufacturers are investing in composite technologies to achieve better durability and improved performance, especially in advanced automotive platforms with stringent environmental regulations.

By Technology Analysis

Coalescing Filtration dominates with 44.2% due to its high efficiency and precision in separating water droplets from fuels and oils.

In 2024, Coalescing Filtration held a dominant market position in the By Technology Analysis segment of the Automotive Water Separation Systems Market, with a 44.2% share. This technology’s ability to efficiently separate fine water particles ensures cleaner fuel delivery and enhances engine longevity. It remains a preferred choice across modern vehicles and commercial fleets.

Centrifugal Separation technology is valued for its mechanical reliability and low maintenance requirements. It uses centrifugal force to separate water and contaminants from fluids without requiring filter replacements. Its adoption is expanding in commercial vehicles, where continuous operation and durability are essential for long-haul efficiency and minimal downtime.

Hydrocyclone Separation is emerging as a sustainable solution that leverages fluid dynamics to enhance separation efficiency. It eliminates the need for consumable filters, reducing operational costs. Automotive manufacturers are increasingly exploring this technology to achieve cleaner fuel systems while supporting eco-friendly production and maintenance processes.

By Application Analysis

Fuel Filtration dominates with 52.7% due to its critical role in ensuring engine performance and protecting fuel injectors from water contamination.

In 2024, Fuel Filtration held a dominant market position in the By Application Analysis segment of the Automotive Water Separation Systems Market, with a 52.7% share. The rising focus on clean fuel systems and stricter emission norms drives demand for advanced filtration systems to remove water and particulates effectively from fuel supplies.

Oil Filtration applications are gaining importance as vehicle engines become more sophisticated. These systems help maintain lubrication integrity by preventing water-induced corrosion and sludge formation. The trend toward longer oil-change intervals in modern vehicles further supports the adoption of efficient water separation technologies.

Air Filtration systems are expanding their role in maintaining air intake quality and improving combustion efficiency. Although a smaller segment, it contributes to overall engine protection and performance consistency. The ongoing shift toward hybrid vehicles is expected to create new growth opportunities for air filtration technologies.

By End-User Analysis

Passenger Vehicles dominate with 49.3% due to growing automotive production and demand for efficient fuel systems in urban mobility.

In 2024, Passenger Vehicles held a dominant market position in the By End-User Analysis segment of the Automotive Water Separation Systems Market, with a 49.3% share. The increasing adoption of advanced fuel and emission systems in passenger cars boosts the need for water separation systems that enhance fuel purity and performance reliability.

Commercial Vehicles represent a significant growth area as fleet operators focus on fuel efficiency and maintenance reduction. Water separation systems in this category help extend engine life and lower repair costs, making them vital for logistics and transport businesses operating under demanding conditions.

Heavy-Duty Vehicles utilize robust water separation systems to manage high fuel volumes and harsh operational environments. The segment benefits from technological advancements that improve separation efficiency and durability, ensuring uninterrupted performance in construction, mining, and industrial transportation sectors.

Key Market Segments

By Material Type

- Metal

- Plastic

- Composite

By Technology

- Coalescing Filtration

- Centrifugal Separation

- Hydrocyclone Separation

By Application

- Fuel Filtration

- Oil Filtration

- Air Filtration

By End-User

- Passenger Vehicles

- Commercial Vehicles

- Heavy-Duty Vehicles

Drivers

Increasing Demand for High-Performance Fuel Filtration in Commercial Vehicles Drives Market Growth

The global automotive water separation systems market is witnessing steady growth due to the rising demand for high-performance fuel filtration solutions in commercial vehicles. With increasing vehicle usage in logistics, construction, and transportation sectors, there is a greater need to maintain fuel purity and engine reliability. These systems help remove water and contaminants from diesel, improving combustion efficiency and extending engine life.

Another key driver is the rising production of diesel engines in developing economies such as India, China, and Brazil. These regions are experiencing rapid industrialization and expansion of commercial fleets, which require effective water separation systems to ensure fuel efficiency and reduce maintenance costs.

Moreover, governments around the world are enforcing stringent emission regulations to control air pollution and enhance fuel efficiency. Automotive manufacturers are increasingly adopting advanced separation technologies to comply with these standards, further driving market demand.

Additionally, the expanding aftermarket for fuel and water separator replacements is boosting market growth. As commercial vehicles age, the need for regular maintenance and component replacement increases. This trend is creating a steady revenue stream for manufacturers and suppliers of automotive water separation systems.

Restraints

High Initial Cost and Maintenance of Advanced Separation Systems Restrains Market Growth

The adoption of automotive water separation systems faces certain challenges due to the high initial cost of advanced filtration technologies. Small-scale manufacturers and low-cost vehicle producers often hesitate to integrate these systems because of budget constraints. This limits their use, particularly in price-sensitive markets.

Another restraint is the limited compatibility of current systems with alternative and biofuel blends. As the automotive industry gradually shifts toward greener fuels, many traditional water separation technologies struggle to maintain performance consistency, slowing their adoption rate.

The technological complexity of modern separation systems also creates integration challenges in compact engines. Manufacturers must redesign engine layouts to fit advanced separators, which increases development time and production costs. This can discourage rapid implementation in new vehicle models.

Finally, the slow adoption rate in low-cost vehicle segments further hinders market growth. Many vehicles in emerging economies prioritize affordability over advanced filtration efficiency, leading to slower market penetration for high-end separation systems.

Growth Factors

Development of Smart Filtration Systems with Real-Time Monitoring Capabilities Creates Growth Opportunities

The development of smart filtration systems equipped with real-time monitoring capabilities presents a major growth opportunity for the automotive water separation systems market. These smart systems can detect contamination levels, water presence, and filter health, allowing predictive maintenance and reducing downtime for fleet operators.

Expanding manufacturing operations in emerging automotive hubs such as India, Thailand, and Mexico also opens new opportunities. These regions offer lower production costs and access to a growing customer base, attracting global players to establish local manufacturing units.

Collaboration between original equipment manufacturers (OEMs) and filtration technology providers is another key opportunity. Joint innovation can lead to the creation of more efficient, compact, and cost-effective separation systems that meet evolving emission and performance standards.

Additionally, the rising electrification of auxiliary systems in hybrid powertrains supports new applications for water separation technologies. Hybrid and plug-in hybrid vehicles require specialized filtration to protect fuel systems and improve overall efficiency, expanding the market scope.

Emerging Trends

Adoption of Nanofiber and Advanced Membrane Technologies in Separation Systems Influences Market Trends

One of the major trends in the automotive water separation systems market is the adoption of nanofiber and advanced membrane technologies. These materials enhance filtration efficiency by capturing finer particles and water droplets without restricting fuel flow, improving engine performance and longevity.

The increasing use of lightweight and corrosion-resistant materials is another strong trend. Manufacturers are replacing traditional metal components with advanced polymers and composites, reducing system weight and improving fuel economy.

Integration of IoT-based predictive maintenance solutions is also transforming the market. By using connected sensors, vehicle operators can monitor filter condition in real time, ensuring timely replacement and minimizing unexpected breakdowns.

Lastly, the industry is shifting toward modular and compact design configurations. These space-saving designs allow easier installation in modern engine compartments, optimizing system performance and meeting the evolving needs of automotive manufacturers.

Regional Analysis

Asia Pacific Dominates the Automotive Water Separation Systems Market with a Market Share of 38.6%, Valued at USD 3.6 Billion

The Asia Pacific region leads the global automotive water separation systems market, holding a dominant 38.6% share and reaching a market value of USD 3.6 billion. This growth is propelled by the robust automotive production base in countries such as China, India, and Japan, alongside increasing investments in fuel-efficient technologies. Furthermore, rising environmental concerns and the implementation of stringent emission regulations are driving the demand for advanced water separation systems across the region.

North America Automotive Water Separation Systems Market Trends

North America represents one of the prominent markets for automotive water separation systems, driven by the enforcement of strict fuel quality standards and advanced vehicle technologies. The region’s well-developed automotive infrastructure and significant presence of diesel-powered commercial vehicles enhance the need for efficient water separation mechanisms. Moreover, growing awareness about vehicle performance optimization and fuel system protection further supports market expansion.

Europe Automotive Water Separation Systems Market Trends

Europe remains a key market for automotive water separation systems, underpinned by rigorous environmental regulations and a strong focus on sustainable automotive solutions. The region’s extensive automotive manufacturing base and continuous innovation in fuel filtration technologies contribute to steady growth. Additionally, the rising adoption of electric and hybrid vehicles is encouraging manufacturers to develop integrated fluid management systems that align with cleaner mobility goals.

Middle East and Africa Automotive Water Separation Systems Market Trends

The Middle East and Africa region is gradually strengthening its position in the automotive water separation systems market due to growth in construction and logistics sectors. The expansion of commercial vehicle fleets, coupled with an increasing focus on vehicle reliability and maintenance, is stimulating demand. Furthermore, the establishment of regional assembly plants and government initiatives supporting industrial development are likely to enhance market opportunities.

Latin America Automotive Water Separation Systems Market Trends

Latin America is experiencing moderate yet consistent growth in the automotive water separation systems market, supported by rising vehicle production and improving fuel standards. Countries such as Brazil and Mexico are witnessing expanding automotive industries, creating new avenues for water separation technologies. Additionally, government policies promoting cleaner transportation and modernization of existing fleets are expected to fuel further adoption in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Water Separation Systems Company Insights

The Automotive Water Separation Systems Market in 2024 is marked by intensified competition among leading filtration and fuel system innovators striving to enhance engine efficiency and emission compliance.

Parker Hannifin Corporation continues to lead through its advanced fuel filtration technologies designed for heavy-duty and off-highway vehicles. The company’s integrated water separation modules have gained traction among OEMs for their reliability in harsh operating conditions and superior fuel-water coalescence performance.

Bosch Limited remains pivotal in shaping the market’s innovation landscape through precision-engineered fuel management systems. Its water separation solutions leverage electronic control and filtration integration, improving diesel engine durability while meeting evolving Euro 6 and EPA emission norms.

Donaldson Company, Inc. strengthens its foothold by expanding its range of fuel filtration and water separator assemblies tailored for both passenger and commercial vehicles. The firm emphasizes sustainability and extended filter life, reducing maintenance costs for fleet operators globally.

MANN+HUMMEL Group demonstrates leadership through modular water separation units combining mechanical filtration with advanced hydrophobic coatings. Its collaboration with leading automakers underscores its commitment to high-performance, low-emission vehicle development.

Together, these key players are steering technological transformation through sensor-based monitoring, compact filter architecture, and improved fuel-water drainage efficiency. With global diesel vehicle retention and stricter emission mandates, their R&D focus aligns toward lightweight, cost-effective, and efficient water separation systems supporting cleaner mobility.

Top Key Players in the Market

- Parker Hannifin Corporation

- Bosch Limited

- Donaldson Company, Inc.

- MANN+HUMMEL Group

- Cummins Inc.

- UFI Filters

- MAHLE GmbH

- Sogefi SpA

- GUD Holdings Limited

Recent Developments

- In 2024, Pacific Avenue Capital acquired Sogefi’s Filtration Business Unit — which includes fuel, oil, air, diesel, and cabin filters — for an enterprise value of about €374 million (~USD $400 million), expanding its footprint in the global filtration market.

- In January 2024, Vance Street Capital and Micronics completed the strategic acquisition of Solaft Filtration Solutions, strengthening their presence in industrial and process filtration across key global markets.

- In September 2024, Axius Water acquired MITA Water Technologies, an Italian company specializing in water and wastewater filtration and separation, enhancing Axius’s international reach and product portfolio in sustainable water solutions.

Report Scope

Report Features Description Market Value (2024) USD 9.5 Billion Forecast Revenue (2034) USD 15.2 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Metal, Plastic, Composite), By Technology (Coalescing Filtration, Centrifugal Separation, Hydrocyclone Separation), By Application (Fuel Filtration, Oil Filtration, Air Filtration), By End-User (Passenger Vehicles, Commercial Vehicles, Heavy-Duty Vehicles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Parker Hannifin Corporation, Bosch Limited, Donaldson Company, Inc., MANN+HUMMEL Group, Cummins Inc., UFI Filters, MAHLE GmbH, Sogefi SpA, GUD Holdings Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Water Separation Systems MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Water Separation Systems MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Parker Hannifin Corporation

- Bosch Limited

- Donaldson Company, Inc.

- MANN+HUMMEL Group

- Cummins Inc.

- UFI Filters

- MAHLE GmbH

- Sogefi SpA

- GUD Holdings Limited