Global Automotive Shielding Market Size, Share, Growth Analysis By Shielding Type (Heat Shield, EMI Shield), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Material (Aluminum, Copper, Stainless Steel, Nickel, Plastics, Foam, Others), By Application (Infotainment Systems, Advanced Driver Assistance Systems, Electronic Control Modules, Electromagnetic Compatibility, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172423

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

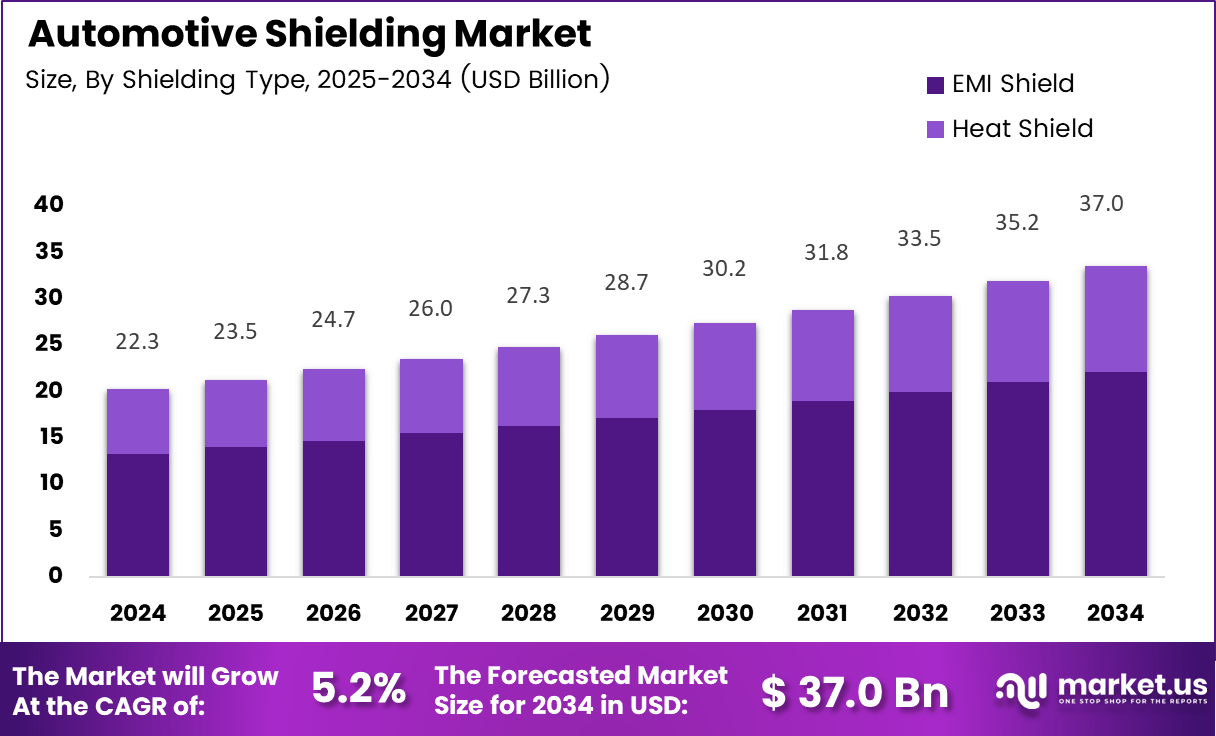

The Global Automotive Shielding Market size is expected to be worth around USD 37.0 billion by 2034, from USD 22.3 billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

The Automotive Shielding market refers to materials and solutions used to protect vehicle electronic systems from electromagnetic interference, thermal stress, and signal disruption. As vehicles integrate more electronics, shielding becomes essential for ensuring reliability, safety, and regulatory compliance across power electronics, wiring harnesses, sensors, and control units in modern automotive platforms.

Automotive Shielding continues evolving as vehicles transition toward electrification, connectivity, and software driven architectures. Consequently, OEMs increasingly prioritize electromagnetic compatibility and thermal stability across components. Shielding solutions therefore move from optional protection to a core design requirement supporting performance consistency, system longevity, and passenger safety expectations.

Market growth remains closely tied to the rapid expansion of electric vehicles, hybrid systems, and advanced driver assistance technologies. As power densities increase, shielding demand rises across battery systems, inverters, charging modules, and high speed data cables. Moreover, connected car features accelerate adoption of lightweight, flexible shielding materials supporting signal integrity.

Opportunities emerge from innovation in conductive polymers, metal coated textiles, and integrated shielding designs that reduce weight and assembly complexity. Additionally, suppliers offering multifunctional shielding combining EMI protection, thermal management, and mechanical durability gain strategic relevance. As production volumes scale, cost optimized shielding solutions attract both mass market and premium vehicle manufacturers.

Government investment and regulations significantly influence market momentum. Authorities increasingly enforce strict electromagnetic compatibility standards to ensure vehicle safety and interoperability. Public funding for electric mobility infrastructure indirectly stimulates shielding demand by accelerating EV adoption. Compliance focused procurement therefore strengthens long term contracts for qualified shielding material providers.

Thermal performance requirements further reinforce the importance of shielding. According to Survey, standard automotive electronic components operate reliably between -40°C and 125°C, highlighting the need for effective thermal and electromagnetic protection under extreme conditions. Shielding solutions help maintain component stability within these operating limits.

Overall, the Automotive Shielding market demonstrates steady expansion driven by electrification, regulatory enforcement, and rising electronic content per vehicle. As OEMs balance performance, weight reduction, and compliance, shielding technologies remain strategically critical. This market outlook supports both informational evaluation and transactional investment decisions across automotive electronics value chains.

Key Takeaways

- The Global Automotive Shielding Market is projected to grow from USD 22.3 billion in 2024 to USD 37.0 billion by 2034, expanding at a CAGR of 5.2%.

- Heat Shield is the leading shielding type, accounting for a dominant 59.7% market share due to rising thermal protection needs.

- Passenger Cars represent the largest vehicle type segment with a share of 69.4%, supported by high electronic integration levels.

- Aluminum leads the material segment with a 31.4% share, driven by lightweight and effective shielding performance.

- Electronic Control Modules dominate the application segment, holding 37.8% of the market as core vehicle control hubs.

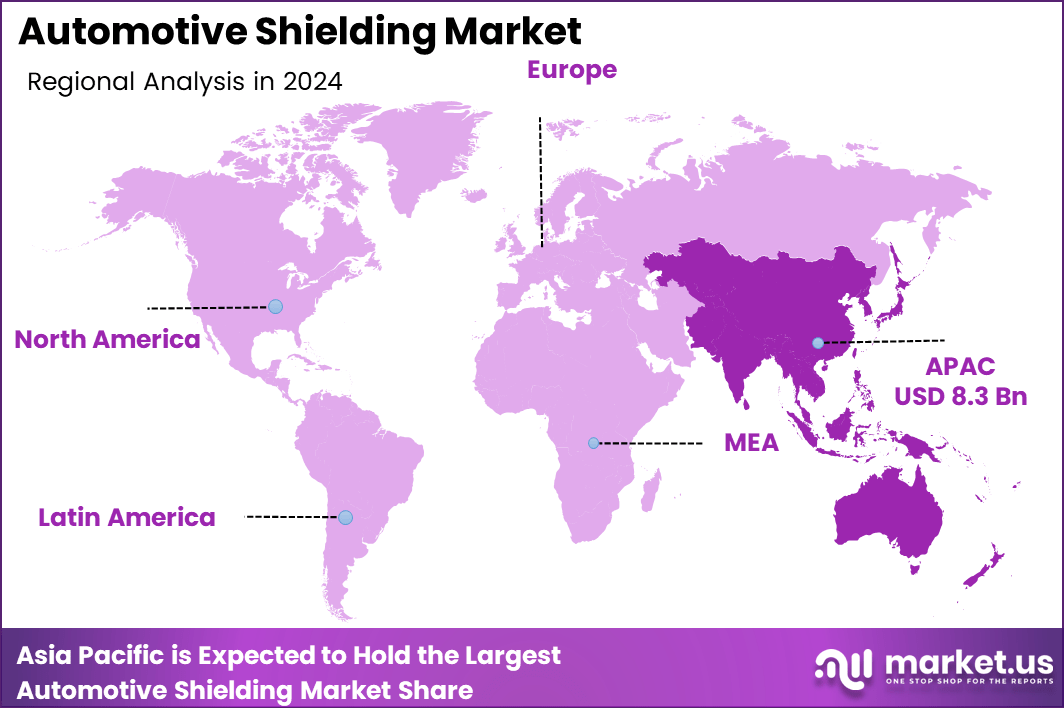

- Asia Pacific is the largest regional market with a 37.5% share, valued at USD 8.3 billion, supported by high vehicle production and electrification.

By Shielding Type Analysis

Heat Shield dominates with 59.7% due to its critical role in protecting automotive components from extreme temperature exposure.

In 2024, Heat Shield held a dominant market position in the By Shielding Type Analysis segment of Automotive Shielding Market, with a 59.7% share. Heat shielding solutions remain essential as powertrain electrification increases thermal loads. Consequently, OEMs increasingly integrate Automotive heat shields to maintain component reliability, safety, and long term operational stability across vehicle platforms.

In contrast, EMI Shield continues gaining relevance as electronic density rises. Although it holds a smaller share, EMI shielding supports signal integrity and prevents electromagnetic interference across vehicle systems. As connectivity expands, EMI shields increasingly complement heat shields, particularly in control units, wiring harnesses, and communication modules.

By Vehicle Type Analysis

Passenger Cars dominates with 69.4% due to higher production volumes and rapid adoption of electronic features.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive Shielding Market, with a 69.4% share. Rising consumer demand for comfort, infotainment, and safety systems drives extensive shielding integration. As a result, shielding solutions become standard across mass market and premium passenger vehicles.

Commercial Vehicles represent a smaller yet stable segment. Shielding demand here focuses on durability, thermal resistance, and regulatory compliance. Moreover, increasing electrification of buses and trucks gradually expands shielding requirements, particularly for battery packs, power electronics, and control systems.

By Material Analysis

Aluminum dominates with 31.4% due to its lightweight nature and effective thermal and EMI shielding properties.

In 2024, Aluminum held a dominant market position in the By Material Analysis segment of Automotive Shielding Market, with a 31.4% share. Aluminum offers an optimal balance between weight reduction and shielding efficiency. Consequently, OEMs favor aluminum to meet fuel efficiency and electric range optimization goals.

Copper remains widely used for its superior conductivity, particularly in EMI shielding. Meanwhile, Stainless Steel and Nickel support high durability and corrosion resistance in harsh environments. Plastics and Foam enable lightweight, flexible designs, while Others address niche performance requirements across specialized applications.

By Application Analysis

Electronic Control Modules dominates with 37.8% due to their central role in managing vehicle electronics.

In 2024, Electronic Control Modules held a dominant market position in the By Application Analysis segment of Automotive Shielding Market, with a 37.8% share. Shielding protects these modules from thermal stress and electromagnetic disruption, ensuring stable vehicle operation. As system complexity grows, this dominance strengthens further.

Infotainment Systems and Advanced Driver Assistance Systems also rely heavily on shielding to preserve signal clarity and user experience. Electromagnetic Compatibility applications ensure compliance with regulatory standards, while Others include emerging use cases driven by connectivity and electrification trends.

Key Market Segments

By Shielding Type

- Heat Shield

- EMI Shield

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Material

- Aluminum

- Copper

- Stainless Steel

- Nickel

- Plastics

- Foam

- Others

By Application

- Infotainment Systems

- Advanced Driver Assistance Systems

- Electronic Control Modules

- Electromagnetic Compatibility

- Others

Drivers

Escalating Electromagnetic Interference Risks from High Density Vehicle Electronics Drive Market Growth

The automotive shielding market is strongly driven by the rapid increase in electronic content inside modern vehicles. Infotainment systems, connectivity modules, power electronics, and control units operate close to each other, creating higher electromagnetic interference risks. As electronic density rises, signal disturbances become more frequent, increasing the need for effective shielding solutions that protect sensitive components.

Advanced driver assistance systems further strengthen this demand. Features such as adaptive cruise control, lane keeping, and collision warning depend on uninterrupted data transmission. Even small signal disturbances can reduce system reliability. Automotive manufacturers increasingly rely on shielding materials to maintain signal stability and ensure consistent system performance across different driving conditions.

Electrification of powertrains adds another strong driver. Electric and hybrid vehicles operate with high voltage systems that are more sensitive to electromagnetic compatibility failures. Power inverters, battery management systems, and onboard chargers require strong shielding to prevent interference with nearby electronics. As electrification expands, shielding becomes a design priority.

Global automotive safety and EMC regulations also support market growth. OEMs must comply with strict testing standards before vehicle approval. Effective shielding helps manufacturers meet these requirements, reduce redesign risks, and shorten development cycles.

Restraints

High Material and Processing Costs Associated with Multi Layer Shielding Restrain Market Expansion

One major restraint in the automotive shielding market is the high cost of advanced materials and processing. Multi layer shielding solutions often use combinations of metals, conductive polymers, and coatings. These materials increase raw material expenses and require specialized manufacturing processes, raising overall system costs for vehicle manufacturers.

Vehicle weight is another concern. Traditional metal based shielding can add extra mass to vehicles. Increased weight directly affects fuel efficiency in conventional vehicles and reduces driving range in electric models. Automakers carefully balance shielding performance with weight reduction goals, which can limit adoption in cost sensitive vehicle segments.

Design complexity also restrains market growth. Modern vehicles use compact and lightweight components with limited space. Integrating shielding into tight layouts without affecting airflow, thermal management, or assembly efficiency remains challenging. This complexity can increase development time and engineering costs.

Limited global standardization adds further difficulty. Shielding requirements vary across regions due to different regulatory frameworks. OEMs operating globally must customize designs for multiple markets, increasing costs and slowing large scale implementation of uniform shielding solutions.

Growth Factors

Expanding Adoption of Electric and Hybrid Vehicles Creates New Growth Opportunities

The rapid growth of electric and hybrid vehicles presents strong opportunities for the automotive shielding market. High voltage architectures used in these vehicles generate significant electromagnetic emissions. As a result, demand for reliable shielding around batteries, power electronics, and charging systems continues to rise across passenger and commercial segments.

Lightweight conductive composites offer another promising opportunity. Automotive manufacturers actively seek materials that deliver effective EMI protection without adding excess weight. Advanced polymer based shields and composite materials help achieve both performance and efficiency goals, making them attractive for next generation vehicle platforms.

Autonomous vehicle development further expands opportunity potential. Self driving systems rely on multiple sensors, cameras, radar, and communication modules working simultaneously. Dense electronic networks increase the risk of signal interference. Shielding solutions that support stable communication become essential for safe autonomous operation.

Together, electrification, lightweight material innovation, and autonomy create long term growth potential. Suppliers that provide cost effective, lightweight, and scalable shielding technologies are well positioned to benefit from these structural market shifts.

Emerging Trends

Shift Toward Nano Coated and Thin Film Shielding Technologies Shapes Market Trends

One key trend in the automotive shielding market is the move toward nano coated and thin film technologies. These solutions provide strong electromagnetic protection while occupying minimal space. Automakers favor thin shielding layers that fit easily into compact electronic assemblies without increasing component size.

The use of aluminum and copper laminated shielding is also increasing. These materials offer effective EMI control while supporting thermal management needs. Laminated structures help dissipate heat from power electronics, making them suitable for electric and hybrid vehicles with high thermal loads.

Another important trend is the integration of shielding directly into molded plastic parts and cable assemblies. Instead of adding separate shielding layers, manufacturers embed conductive materials during component production. This approach improves assembly efficiency and reduces overall part count.

Collaboration between material science companies and automotive OEMs continues to grow. Joint development efforts focus on innovative EMC solutions that meet future vehicle requirements. These partnerships accelerate material innovation and support faster adoption of advanced shielding technologies across vehicle platforms.

Regional Analysis

Asia Pacific Dominates the Automotive Shielding Market with a Market Share of 37.5%, Valued at USD 8.3 Billion

Asia Pacific represents the dominating region in the automotive shielding market, supported by its large scale vehicle production ecosystem and rapid adoption of advanced vehicle electronics. In 2024, the region accounted for a dominant 37.5% share, with the market valued at approximately USD 8.3 billion, reflecting strong demand from both conventional and electric vehicles. Rising electrification initiatives, increasing penetration of ADAS features, and expanding semiconductor integration across vehicles continue to increase EMC risks. As a result, OEMs in the region actively invest in shielding solutions to ensure signal stability, safety compliance, and long term system reliability.

North America Automotive Shielding Market Trends

North America demonstrates steady growth driven by high adoption of advanced driver assistance systems and early deployment of electric and autonomous vehicle platforms. OEMs in the region emphasize strict compliance with EMC and automotive safety regulations, reinforcing the need for reliable shielding solutions. Strong focus on vehicle connectivity, infotainment performance, and high voltage power electronics further supports market expansion. The region also benefits from continuous innovation in lightweight and integrated shielding materials.

Europe Automotive Shielding Market Trends

Europe remains a key region due to stringent automotive safety, emission, and EMC regulations across passenger and commercial vehicles. The region’s strong push toward electrification and sustainability increases sensitivity to electromagnetic interference in vehicle architectures. European automakers focus on weight optimized shielding solutions to balance performance and efficiency. Increasing adoption of multi material vehicle platforms also supports steady demand for advanced shielding technologies.

Middle East and Africa Automotive Shielding Market Trends

The Middle East and Africa region shows gradual market growth supported by rising vehicle imports and increasing demand for modern safety and infotainment systems. While electronic integration levels remain lower compared to developed regions, adoption of connected vehicle features continues to increase. Growing regulatory awareness and infrastructure development encourage OEMs to enhance EMC protection. Shielding demand mainly concentrates in premium and utility vehicle segments.

Latin America Automotive Shielding Market Trends

Latin America exhibits moderate growth as regional automotive manufacturing gradually incorporates higher electronic content. Increasing penetration of basic ADAS features and infotainment systems supports shielding demand. OEMs in the region prioritize cost effective shielding solutions that balance regulatory requirements with affordability. Expanding local production and rising electrification initiatives are expected to improve long term market potential.

U.S. Automotive Shielding Market Trends

The U.S. automotive shielding market benefits from strong investment in electric vehicles, autonomous driving technologies, and connected mobility solutions. High reliance on advanced electronics increases the importance of electromagnetic compatibility across vehicle platforms. Regulatory focus on safety and system reliability encourages consistent adoption of shielding solutions. Continued innovation in lightweight and integrated shielding designs supports sustained market momentum.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Shielding Company Insights

In the context of the global automotive shielding market in 2024, Infotainment Systems remains a critical focus area as the volume and complexity of in-vehicle electronics grow. Demand for effective shielding solutions is intensifying with higher expectations for audio-visual performance and connectivity, pushing suppliers to innovate light-weight, high-efficiency materials that meet both performance and cost targets. This segment’s rapid integration of advanced displays and interfaces tests shielding designs against diverse frequency bands and environmental conditions.

The role of Advanced Driver Assistance Systems in driving automotive shielding adoption cannot be understated, as ADAS relies on high-precision sensors, radar, and LIDAR modules that are highly sensitive to electromagnetic interference. Manufacturers are prioritizing shielding solutions that ensure system reliability and safety compliance, particularly in urban environments with dense RF signals. Consequently, collaborations between shielding material specialists and ADAS developers are accelerating to deliver optimized, space-efficient shielding components.

For Electronic Control Modules, shielding is a foundational requirement to protect critical control units from EMI that could compromise vehicle performance or safety. With the proliferation of electronic control modules managing powertrain, body electronics, and connectivity subsystems, the shielding market is adapting through modular designs that can be tailored to different control architectures. Suppliers are focusing on materials that balance thermal management, durability, and electromagnetic attenuation.

Finally, the Others category encompasses emerging electronic subsystems and aftermarket integration needs where shielding solutions play a supportive but growing role. As vehicles become more software-defined with expansive sensor networks, bespoke shielding solutions are increasingly necessary to maintain system integrity across diverse applications. This broad category highlights the ongoing and expansive demand for innovative shielding technologies throughout the automotive value chain.

Top Key Players in the Market

- Tenneco Inc.

- Laird

- Autoneum

- 3M

- Marian, Inc.

- Kitagawa Corporation

- ElringKlinger AG

- Henkel AG & Co. KGaA

- Lydall, Inc.

- PARKER HANNIFIN CORP

Recent Developments

- In April 2025, TE Connectivity plc completed the acquisition of Richards Manufacturing Co., a North America focused provider of utility grid and underground distribution equipment.The acquisition strengthens TE Connectivity’s position in grid replacement and upgrade cycles, enhancing its ability to serve utility and energy customers across regional and global markets.

Report Scope

Report Features Description Market Value (2024) USD 22.3 billion Forecast Revenue (2034) USD 37.0 billion CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Shielding Type (Heat Shield, EMI Shield), By Vehicle Type (Passenger Cars, Commercial Vehicles), By Material (Aluminum, Copper, Stainless Steel, Nickel, Plastics, Foam, Others), By Application (Infotainment Systems, Advanced Driver Assistance Systems, Electronic Control Modules, Electromagnetic Compatibility, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Tenneco Inc., Laird, Autoneum, 3M, Marian, Inc., Kitagawa Corporation, ElringKlinger AG, Henkel AG & Co. KGaA, Lydall, Inc., PARKER HANNIFIN CORP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Shielding MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Shielding MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Tenneco Inc.

- Laird

- Autoneum

- 3M

- Marian, Inc.

- Kitagawa Corporation

- ElringKlinger AG

- Henkel AG & Co. KGaA

- Lydall, Inc.

- PARKER HANNIFIN CORP