Global Automotive Sensors Market By Type (Temperature Sensors, Pressure Sensors), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Application, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Nov. 2023

- Report ID: 13982

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

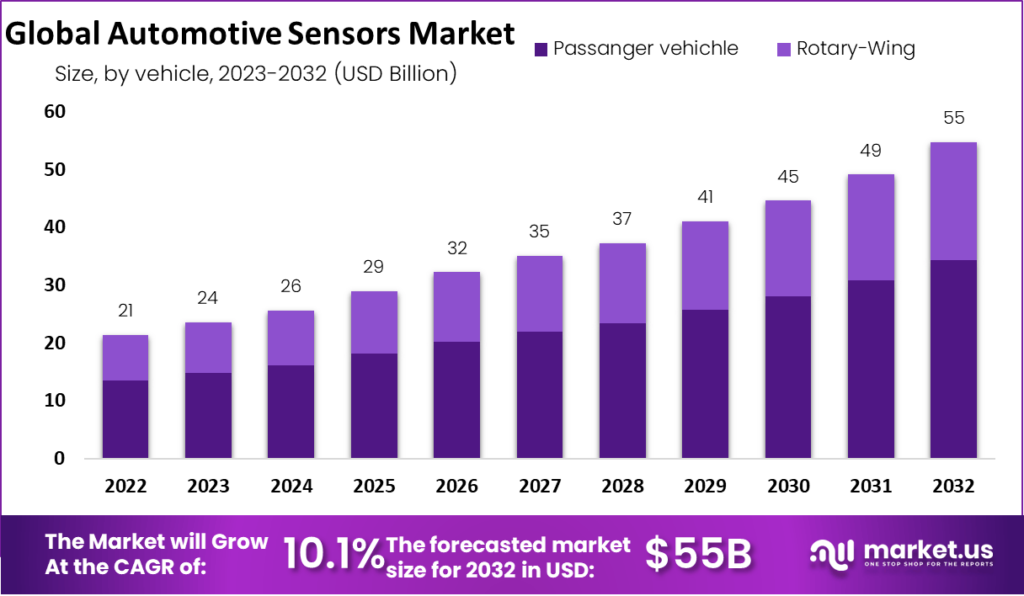

The global automotive sensors market is valued at USD 24 billion in 2023. With a projected CAGR of 10.1%, the market is set to reach USD 55 billion by 2032, showcasing its immense potential and promising opportunities for industry players.

Automotive sensors are integral parts of vehicles designed to sense, transmit, resolve, record, and display vehicle performance information in the vehicle’s internal and external environment. Demand for automotive sensors is anticipated to increase significantly during the forecast period, owing to the growing popularity of vehicle automation and growing demand for connected cars across the globe.

The key trends driving the global automotive sensors market are miniaturization and improved communication capabilities that enable integration into the vehicle without impacting the vehicle’s basic functionality. Increasing demand for automotive security and protection is the main factor driving the market growth.

Note: Actual Numbers Might Vary in the final report

Key Takeaways

- Market Growth: The Worldwide automotive sensors market is estimated to record a steady CAGR of 10.1% in the review period 2023 to 2032.

- Driving Factors: Need for improved vehicle safety and performance, as well as increasing government regulations concerning emissions control for emissions in vehicles are factors.

- Restraints Factors: High cost of automotive sensors and an absence of qualified personnel to design and develop them as restraints to business growth.

- Challenges: Increasing competition from low-cost manufacturers and Rapid technological advancements.

- Opportunities: Opportunities include development and deployment of innovative automotive sensors; increased adoption of cloud-based sensor data management solutions for sensor data.

- By Type Analysis: Pressure sensors play an essential part in automotive safety systems and engine operations.

- Vehicle Type Analysis: Passenger car sales held 62.8% market share for automotive sensors worldwide in 2022.

- Based on Application: Powertrain held the top revenue share in the global automotive sensor market in 2022.

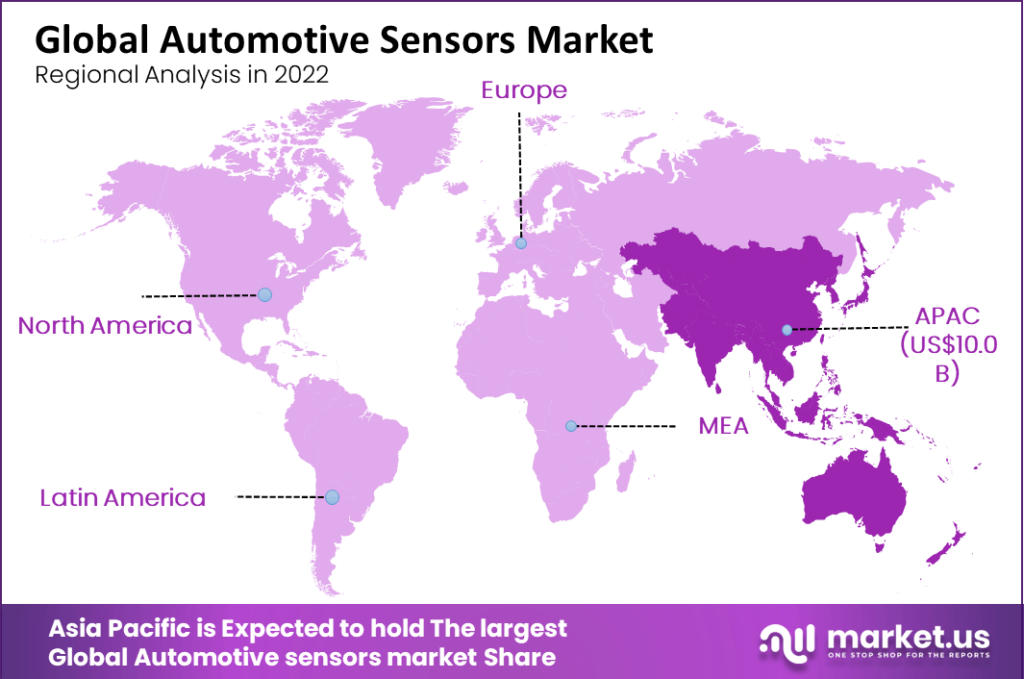

- Regional Analysis: Asia Pacific is the dominant region in the global automotive sensors market.

- Top Key Players in Automotive Sensors Market: Robert Bosch GmbH, DENSO Corporation, Infineon Technologies AG, NXP Semiconductor, ST Microelectronics, Valeo, Continental AG, Sensata Technologies, Delphi Automotive Company, Texas Instruments Incorporated, Elmos Semiconductor, and Other Key Players.

Driving Factors

Rising Disposable Income and Increasing Autonomous Features

In recent years, increasing disposable income in developing countries such as India, South-East Asia, and Latin America has increased the demand for medium-duty transportation vehicles. In addition, countries such as South Africa, Thailand, and Turkey are known to have robust vehicle assembly plants to support their domestic market and export to other regions.

Automaker’s R&D investments are driven by consumer demand for increased product variety, improved performance, improved safety, higher emissions standards, and reduced costs. This should lead to more midsize vehicles with better fuel efficiency and electrification technology, increasing demand for powertrain sensors.

Autonomous features in commercial vehicles are expected to develop rapidly over the next few years due to increasingly stringent regulations and safety tests (especially emergency brake assist), as well as increasing awareness of vehicle safety. For example, features such as cruise control and lane departure warning are mandatory in all vehicles in developed countries, and blind spot monitoring is regulated, especially in Europe.

The vehicles need long-range radar sensors for features such as adaptive cruise control and about two rear-facing medium-range radar sensors to allow blind spot detection. Additionally, functions such as parking assistance require up to 12 ultrasonic sensors. Therefore, the use of high-precision sensors is expected to increase as the demand for autonomous driving capabilities increases.

Restraints Factors

Bad Weather Conditions and High Cost

Most current sensors have a low measurement range and signal bandwidth, making it even more difficult to distinguish between system signals and noise, such as road obstructions. On the other hand, in bad weather, such as rain or snowstorms, tracking moving objects is even more difficult. As a result, these factors are expected to slow the growth rate of the automotive sensors market.

Due to low production volume, it is not possible to reduce the cost of the sensors used in driver assistance systems to the desired level. In addition, automotive sensors are too expensive, making them difficult for the general public to purchase, thereby reducing market expeditions. LIDAR sensors are much more expensive than radar sensors used in AVs due to the rare earth metals required during manufacturing.

By Type Analysis

Pressure Sensors Leading and Capturing a Significant Revenue Share

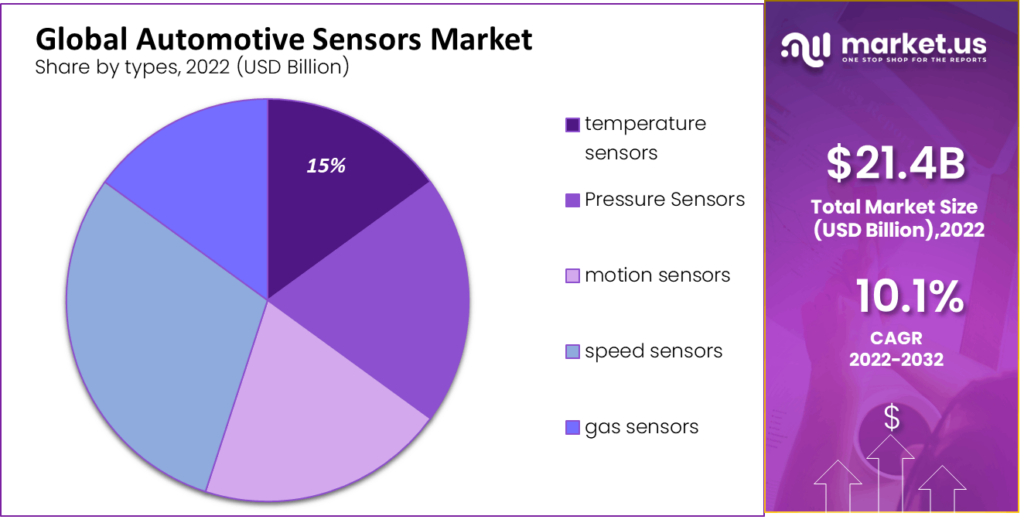

By type, the automotive sensors market is divided into temperature sensors, pressure sensors, motion sensors, speed sensors, and gas sensors. Pressure sensors are an important part of automotive safety systems and engine operation.

A major factor driving the growth of the segment is the increase in applications of airbag pressure sensors, which send a digital crash signal that enables rapid deployment of the airbag. The air pressure sensor can effectively control the ignition advance angle, thus improving performance. These factors contribute to the increased growth of the segment.

Note: Actual Numbers Might Vary in the final report

Speed sensors are the first sensors automakers will implement to improve vehicle safety, as speed has been identified as a leading cause of accidents on the rise worldwide. With worldwide increasing accidents due to over speed, the demand for speed sensors is rising.

The temperature sensor market segment is also projected to witness positive growth. Water temperature, engine oil temperature, fuel temperature, cooling water temperature, and Transmission oil & exhaust gas temperatures can be monitored by these sensors. It also ensures the reliable operation of the vehicle engine over its life.

Vehicle Type Analysis

The Passenger Car Segment Possesses the Largest Market Share

Based on vehicle type, the market is divided into passenger cars and commercial vehicles. The passenger cars segment held the major share of the automotive sensors market at 62.8% in 2022. Passenger car needs different types of sensors for monitoring emission rate and temperature changes, sending signals to the engine control unit, setting the ignition timing and achieving accurate fuel delivery, and controlling air mass flow to control coolant and oxygen to support the vehicle.

Therefore, for greater consumer demand for safe and environmentally friendly vehicles, the passenger car segment is expected to hold the largest market share. The need for sensors in passenger cars has increased due to optimizing fuel consumption and the growing demand for personal mobility solutions.

The commercial vehicle segment is set to witness a high growth rate during the forecast period owing to increasing awareness of safety and comfort and government regulations.

Based on Application

Powertrain Holds the Major Share

Powertrain held the top revenue share in the global automotive sensors market in 2022. This is primarily due to the numerous sensors used in the powertrain to monitor speed, position, throttle, temperature, and pressure for safe and efficient operation. Additionally, stringent emissions regulations and fuel efficiency standards set by governments in various countries are driving the growth of automotive sensors in powertrain applications.

Collecting analog temperature and pressure information from vehicles used in digital control units is critical to meeting emissions regulations and fuel efficiency. Sensors help vehicle engines burn fuel efficiently by using accurate engine data to optimize fuel economy according to vehicle needs.

Other ADAS sensors include ultrasound, airbags, tire pressure, rain, and more to further enhance vehicle safety. These factors are therefore expected to drive the growth of this segment over the forecast period. In the chassis, these components monitor critical functions such as steering, acceleration, and braking. As more emphasis is placed on improving vehicle maneuverability and occupant safety, chassis segments are likely to adopt these components in the coming years.

However, safety, security, and telematics offer lucrative growth opportunities in the years to come. In recent years, the increase in traffic accidents has forced automakers to make their vehicles safer. The World Health Organization (WHO) also states that the leading cause of death is due to traffic accidents.

Key Market Segments

Based on Type

- Temperature Sensors

- Pressure Sensors

- Motion Sensors

- Speed Sensors

- Gas Sensors

Based on Vehicle Type

- Passenger Cars

- Commercial Vehicles

Based on Application

- Powertrain

- Chassis

- Exhaust

- Security

- Telematics

- ADAS

Growth Opportunity

Rising Demand for Infotainment Systems, Rear Sensors, and Security Measures

The rising need for vehicles and strict government rules to regulate the CO2 emissions from vehicles helps the automotive sensors market to grow. The automotive sensors market presents significant growth opportunities due to several key trends and evolving consumer demands in the automotive sector.

As the automotive industry increasingly shifts toward electric vehicles (EVs) and autonomous driving technologies, the demand for specialized sensors is on the rise. Sensors play a crucial role in vehicle safety, emission control, powertrain management, and driver assistance systems, making them integral to the future of transportation.

A major growth opportunity lies in the development and deployment of advanced sensors for autonomous vehicles, where technologies like LiDAR, radar, ultrasonic, and camera sensors are essential for vehicle navigation and safety. As more automakers focus on achieving Level 4 and Level 5 autonomy, the need for sophisticated and reliable sensors will increase.

Additionally, the rise of cloud-based sensor data management solutions offers a unique opportunity for automakers and sensor manufacturers to collect, analyze, and interpret vast amounts of data generated by sensors in real-time, improving vehicle performance and safety. AI-powered sensor analytics and predictive maintenance will enable real-time vehicle diagnostics and optimize fleet management.

Latest Trends

Customers Embracing Electric and Hybrid Vehicles

Growing acceptance of electric and hybrid vehicles, increasing consumer awareness of the benefits and conveniences afforded by using sensors, and a growing number of vehicles worldwide will see the growth of the automotive sensors market. We have more customers.

Hybrid electric vehicles have clear advantages in terms of lower CO2 emissions, higher efficiency, and lower maintenance costs. The demand and usage of the sensors will increase significantly during the forecast period, especially in North America and Europe, due to the rapid increase in the integration of security systems in vehicles.

The growing popularity of these vehicles has created a demand for various automotive sensors, including: As the current, temperature, cell voltage, and other components of the battery management system increase. Key trends driving the global automotive sensors market include miniaturization and improved communication capabilities that enable integration into vehicles without impacting the vehicle’s basic functionality.

Moreover, increasing demand for vehicle safety and protection is another key factor driving the growth of the global market. The implementation of stringent emission standards to reduce CO2 emissions and the growing demand for safety and comfort will continue to support growth.

Regional Analysis

Asia Pacific Region Dominating Due to Growing Disposable Income

Asia Pacific is the dominant region in the global automotive sensors market. The region will have a sizeable revenue share of 46.8% and shows lucrative growth in the coming years. The main factors affecting this are the increasing demand for vehicles with enhanced security and increasing sales in the region. The large consumer base in the region and the push for the green revolution has greatly benefitted the application of sensor technology in the automotive industry.

Note: Actual Numbers Might Vary in the final report

Passenger vehicle safety standards and fuel efficiency standards in Europe are strict. In addition, commercial vehicle safety regulations are becoming more strict due to environmental issues. From 2022, safety features such as tire pressure monitoring, hazard detection, and warning systems will be mandatory for trucks, buses, and vans. These factors are expected to increase the demand for automotive sensors in Europe during the forecast period. Extensive market growth is expected in North America with Rising EV sales and early adoption of technology for the growth of automotive sensors in North America.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Denso Corporation and Robert Bosch, with more than 25% of the market share to cement the leading position, are currently pursuing a market consolidation strategy. Both Denso Corporation and Robert Bosch are global companies with multiple offices in various regions.

They have adopted strategies such as mergers and acquisitions, collaborations, and regional strategies to outpace their growth in the automotive sensors market. Product development and advancement is another growth strategy adopted by a significant number of players to secure their market position.

Robert Bosch GmbH, DENSO Corporation, Infineon Technologies AG, NXP Semiconductor and ST Microelectronics are key companies in the global market. In recent years, developments in advanced technology have increased. For example, steer-by-wire systems use high-resolution sensors from companies such as NXP, Elmos, Infineon, and Allegro Microsystems.

Steering sensor data can be combined with other information, such as mileage and turn signals, via driver awareness algorithms to warn drivers when levels of drowsiness exceed certain thresholds. increase. Driver fatigue accounts for nearly 20% of traffic accidents. Therefore, sensor developers, especially Tier 1 suppliers, may increase their R&D funding to improve safety-focused sensors that offer high performance and low power consumption to increase marketability with automakers.

Top Key Players in Automotive Sensors Market

- Robert Bosch GmbH

- DENSO Corporation

- Infineon Technologies AG

- NXP Semiconductor

- ST Microelectronics

- Valeo

- Continental AG

- Sensata Technologies

- Delphi Automotive Company

- Texas Instruments Incorporated

- Elmos Semiconductor

- Other Key Players

Recent Developments

- In September 2022, STMicroelectronics launched a new hybrid sensor for monitoring the entire vehicle interior as part of a highly innovative car comfort and safety system. 3D Stacked B.S.I. / S.T. Backside Illuminated (B.S.I.) Wafer Technology New vehicle image sensors optimize the vehicle’s optical section and on-chip processing. This reduces the need for an external co-processor and allows the sensor to properly execute complex algorithms to achieve the best performance in NIR (near-infrared) imaging of automobiles.

- To achieve even higher levels of automated driving, in 2022, Valeo will equip both passenger and commercial vehicles with the groundbreaking SCALA LiDAR sensor. The sensor is manufactured in its own factory in Wemding, Germany. Since developing the first ultrasonically advanced sensor with parking assistance, Valeo Wemding has been a leader in the development of driving assistance sensors. To date, he has manufactured over 500 million of these sensors at this factory. The organization has produced various types of automotive sensors over the years, but these days it mainly produces front-facing cameras, domain controllers, and LiDAR sensors.

Report Scope

Report Features Description Market Value (2023) US$ 24 Bn Forecast Revenue (2032) US$ 55 Bn CAGR (2023-2032) 10.1% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type – Temperature Sensors, Pressure Sensors, Motion Sensors, Speed Sensors, and Gas Sensors; By Vehicle Type – Passenger Cars and Commercial Vehicles; By Application – Powertrain, Chassis, Exhaust, Security, Telematics, and ADAS. Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Robert Bosch GmbH, DENSO Corporation, Infineon Technologies AG, NXP Semiconductor, ST Microelectronics, Valeo, Continental AG, Sensata Technologies, Delphi Automotive Company, Texas Instruments Incorporated, Elmos Semiconductor, and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What will be the market size for Automotive Sensors Market in 2032?In 2032, the Automotive Sensors Market will reach USD 56 billion.

What CAGR is projected for the Automotive Sensors Market?The Automotive Sensors Market is expected to grow at 10.1% CAGR (2023-2032).

Name the major industry players in the Automotive Sensors Market.Robert Bosch GmbH, DENSO Corporation, Infineon Technologies AG, NXP Semiconductor, ST Microelectronics and Other Key Players are the main vendors in Cosmetic Packaging.

List the segments encompassed in this report on the Automotive Sensors Market?Market.US has segmented the Automotive Sensors Market by geographic (North America, Europe, APAC, South America, and MEA). By Type, market has been segmented into Temperature Sensors, Pressure Sensors and Motion Sensors. By Application, the market has been further divided into, Powertrain, Chassis, Exhaust and Security.

What are the main business areas for the Automotive Sensors Market?APAC and Europe are the largest market share in Automotive Sensors Market.

-

-

- Robert Bosch GmbH

- DENSO Corporation

- Infineon Technologies AG

- NXP Semiconductor

- ST Microelectronics

- Valeo

- Continental AG

- Sensata Technologies

- Delphi Automotive Company

- Texas Instruments Incorporated

- Elmos Semiconductor

- Other Key Players