Global Automotive Semiconductor Market Size, Share, Growth Analysis By Component (Processor, Discrete Power, Sensor, Memory, Others), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)), By Application (Powertrain, Chassis, Safety, Telematics & Infotainment, Body Electronics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 127264

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

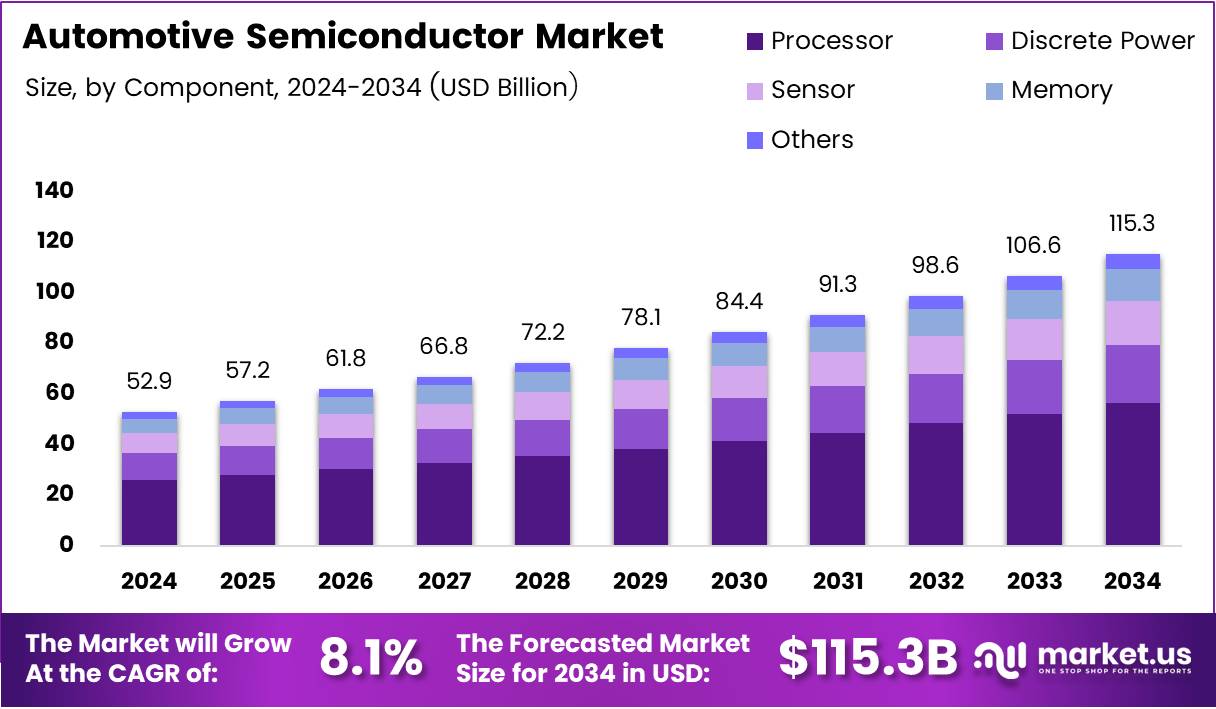

The Global Automotive Semiconductor Market is poised for substantial expansion, projected to grow from USD 52.9 billion in 2024 to USD 115.3 billion by 2034, advancing at a CAGR of 8.1% during the forecast period. This growth trajectory reflects the automotive industry’s digital transformation.

Automotive semiconductors form the electronic backbone of modern vehicles. These components enable critical functions ranging from engine control to safety systems. Processors, sensors, and power devices work together to support vehicle operations. The market encompasses various semiconductor types integrated across vehicle platforms.

The industry witnesses significant momentum driven by vehicle electrification and connectivity trends. Electric vehicles require sophisticated power management semiconductors to optimize battery performance and efficiency. Meanwhile, connected cars demand high-performance processors for data processing and communication. These technological shifts create substantial growth opportunities.

Advanced driver-assistance systems represent a major demand catalyst for automotive semiconductors. ADAS features like adaptive cruise control and collision avoidance rely heavily on sensor fusion and real-time processing. Consequently, semiconductor content per vehicle continues rising steadily. Autonomous driving architectures further amplify this trend.

Government initiatives worldwide support semiconductor manufacturing and electric vehicle adoption. Many countries implement policies encouraging domestic chip production to strengthen supply chain resilience. Additionally, emissions regulations accelerate electrification, boosting demand for power electronics. Infrastructure investments in charging networks complement these regulatory frameworks.

According to the International Organization of Motor Vehicle Manufacturers (OICA), global motor vehicle production reached 93.5 million units in 2023, up 10% from 2022. In 2024, worldwide motor vehicle production exceeded 92.5 million units, with passenger cars comprising approximately 73% or nearly 68 million units. This production volume directly correlates with semiconductor demand across automotive applications.

Key Takeaways

- Global Automotive Semiconductor Market valued at USD 52.9 billion in 2024, expected to reach USD 115.3 billion by 2034

- Market projected to grow at a CAGR of 8.1% from 2024 to 2034

- Processor segment dominates with 34.7% market share in component analysis

- Passenger vehicles lead vehicle type segment with 67.9% share

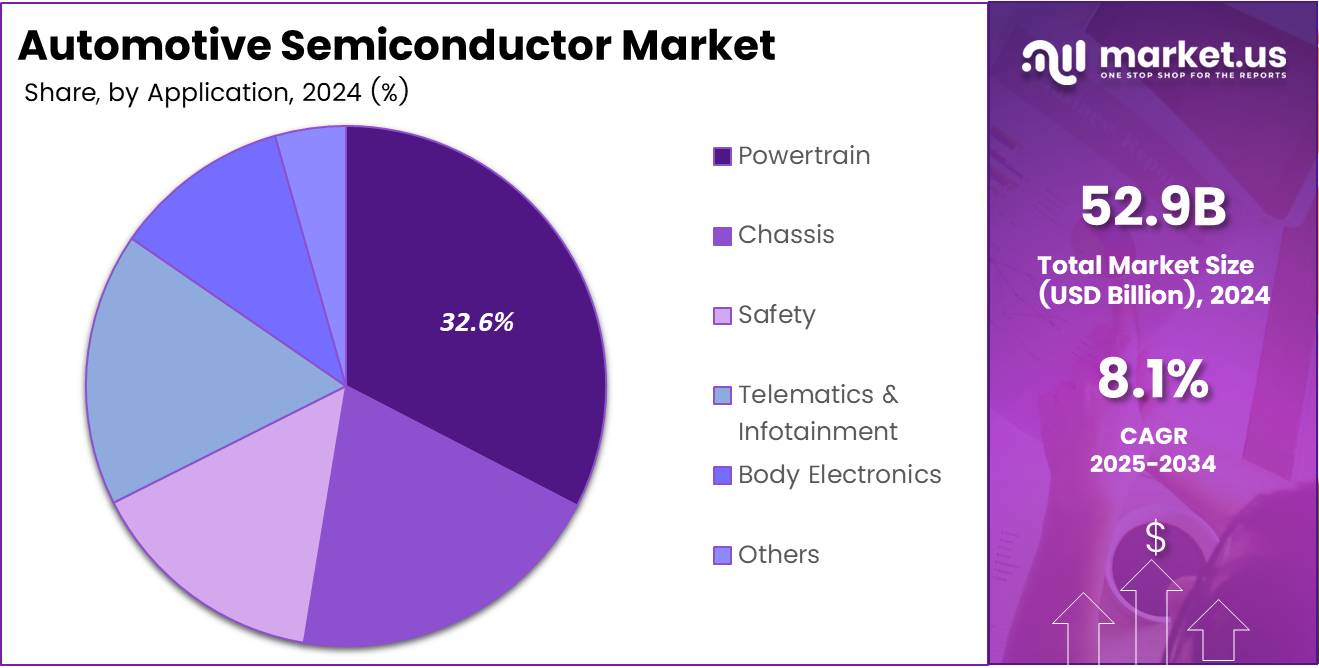

- Powertrain application holds largest share at 32.6% of total market

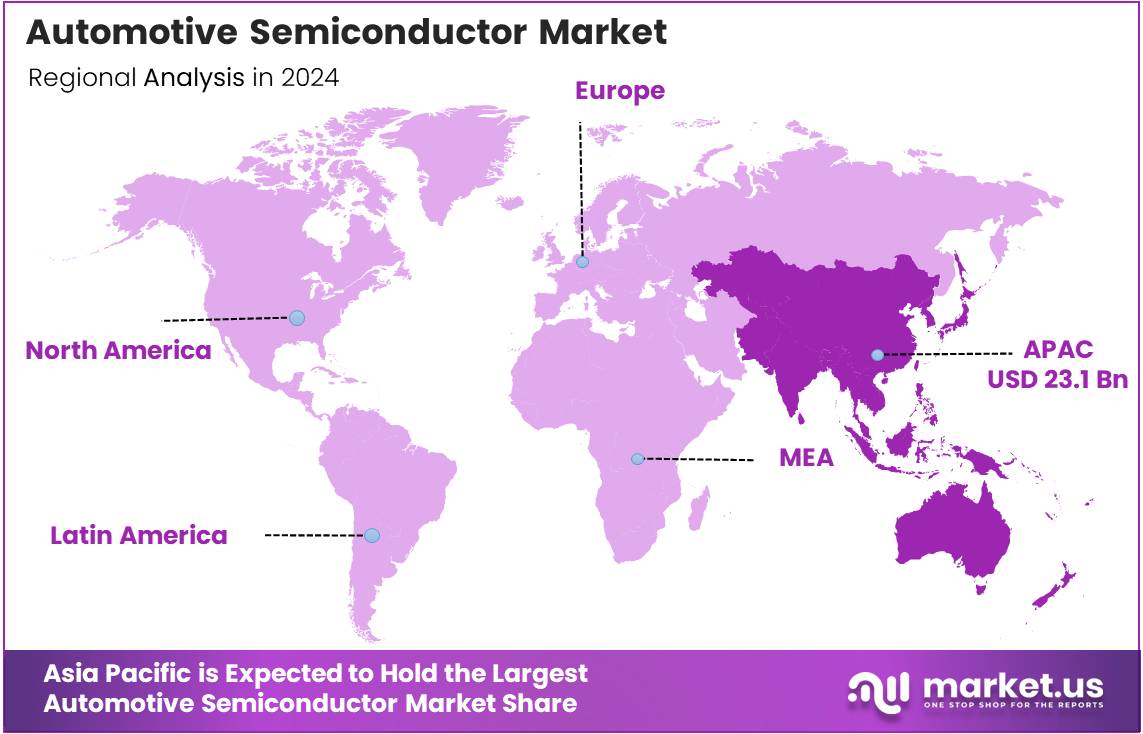

- Asia Pacific region dominates with 43.8% market share, valued at USD 23.1 billion

Processor Analysis

Processor dominates with 34.7% due to increasing computational demands in connected and autonomous vehicles.

In 2024, Processor held a dominant market position in the By Component segment of Automotive Semiconductor Market, with a 34.7% share. Processors serve as the computational core for modern vehicles, handling complex algorithms for navigation, entertainment, and driver assistance. Furthermore, advanced infotainment systems require powerful processing capabilities for seamless user experiences. The shift toward software-defined vehicles amplifies processor demand significantly.

Discrete Power components manage electrical energy flow throughout vehicle systems efficiently. These semiconductors enable voltage conversion and power distribution across multiple electronic control units. Electric vehicles particularly rely on discrete power devices for battery management and motor control. Additionally, power efficiency improvements drive continuous innovation in this segment.

Sensor semiconductors capture critical environmental and operational data for vehicle systems. These components include image sensors, radar chips, and LiDAR processing units essential for autonomous driving. Moreover, sensor fusion technologies combine multiple data streams to enhance vehicle awareness. The proliferation of ADAS features accelerates sensor semiconductor adoption.

Memory components store operational data and support real-time processing requirements in automotive applications. Flash memory enables over-the-air updates and stores navigation maps and software configurations. Meanwhile, DRAM supports high-speed data processing for AI-driven vehicle functions. Growing software complexity drives increasing memory content per vehicle.

Passenger Vehicle Analysis

Passenger Vehicle dominates with 67.9% due to high production volumes and increasing electronic content per vehicle.

In 2024, Passenger Vehicle held a dominant market position in the By Vehicle Type segment of Automotive Semiconductor Market, with a 67.9% share. Passenger cars integrate extensive semiconductor content across safety, comfort, and entertainment systems. Additionally, premium segment vehicles feature advanced driver-assistance technologies requiring sophisticated chip architectures. Consumer demand for connected features drives semiconductor integration steadily.

Light Commercial Vehicles incorporate semiconductor solutions for fleet management and telematics applications. These vehicles benefit from connectivity features that optimize logistics and route planning efficiently. Furthermore, electrification trends extend to commercial segments, requiring specialized power electronics. The growing e-commerce sector boosts LCV production and semiconductor demand.

Heavy Commercial Vehicles adopt semiconductors primarily for safety compliance and operational efficiency improvements. Advanced braking systems and stability control rely on sensor and processor technologies. Moreover, autonomous trucking initiatives drive investment in high-performance computing platforms. Regulatory mandates for emission control further increase electronic content in HCV segments.

Powertrain Analysis

Powertrain dominates with 32.6% due to critical role in vehicle electrification and emissions control.

In 2024, Powertrain held a dominant market position in the By Application segment of Automotive Semiconductor Market, with a 32.6% share. Powertrain systems require sophisticated semiconductors for engine management, transmission control, and hybrid/electric propulsion. Electric vehicle powertrains demand advanced power electronics for inverter and battery management functions. Consequently, electrification trends substantially elevate semiconductor content in powertrain applications.

Chassis applications utilize semiconductors for suspension control, steering assistance, and braking systems. Electronic stability control and anti-lock braking systems rely on real-time sensor data processing. Additionally, active suspension systems enhance ride comfort through continuous electronic adjustments. These safety-critical applications demand high-reliability automotive-grade semiconductors.

Safety applications encompass airbag control, collision avoidance, and occupant protection systems requiring instantaneous response. Semiconductors enable rapid signal processing for crash detection and mitigation technologies. Furthermore, advanced safety features like automatic emergency braking increase chip content significantly. Regulatory safety standards drive continuous innovation in this segment.

Telematics and Infotainment systems integrate connectivity, navigation, and entertainment functions through sophisticated processing platforms. These applications demand high-performance processors and wireless communication chips for seamless user experiences. Moreover, over-the-air update capabilities require secure memory and processing resources. Consumer expectations for smartphone-like interfaces accelerate semiconductor requirements.

Body Electronics manage comfort, lighting, and access control functions throughout the vehicle. Power window controls, climate management, and keyless entry systems incorporate semiconductor solutions. Additionally, ambient lighting and customizable interior features enhance user experience through electronic control. The trend toward personalization drives increasing body electronics complexity.

Key Market Segments

By Component

- Processor

- Discrete Power

- Sensor

- Memory

- Others

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Application

- Powertrain

- Chassis

- Safety

- Telematics & Infotainment

- Body Electronics

- Others

Drivers

Rapid Integration of Advanced Driver-Assistance Systems Accelerates Automotive Semiconductor Demand

The widespread adoption of ADAS features across vehicle segments drives substantial semiconductor consumption. Systems like adaptive cruise control, lane-keeping assistance, and automatic emergency braking require multiple sensors and processors. These safety technologies improve driver awareness and reduce accident rates significantly. Consequently, regulatory bodies increasingly mandate ADAS features in new vehicles.

Consumer demand for enhanced safety drives automakers to include ADAS as standard equipment. Camera-based systems, radar sensors, and ultrasonic detectors work collaboratively to monitor vehicle surroundings. Processing these sensor inputs requires advanced semiconductor solutions with high computational power. Furthermore, machine learning algorithms enable predictive safety features.

The complexity of ADAS architectures continues increasing with autonomous driving development. Level 2 and Level 3 automation require sophisticated sensor fusion and real-time decision-making capabilities. Therefore, semiconductor content per ADAS-equipped vehicle rises substantially compared to conventional vehicles. This trend creates sustained growth opportunities for semiconductor suppliers.

Restraints

High Qualification Costs and Supply Chain Constraints Challenge Market Growth

Automotive-grade semiconductor certification requires extensive testing and validation processes. Components must withstand extreme temperatures, vibrations, and electromagnetic interference throughout vehicle lifetimes. These stringent qualification requirements significantly increase development costs and time-to-market durations. Consequently, smaller semiconductor manufacturers face barriers entering automotive markets.

Supply chain vulnerabilities stemming from limited foundry capacity create production bottlenecks periodically. The automotive industry competes with consumer electronics for manufacturing allocation at leading foundries. Additionally, geopolitical tensions and trade restrictions complicate global semiconductor supply chains. These challenges result in extended lead times and potential supply shortages.

The transition to advanced process nodes requires substantial capital investment in manufacturing facilities. Automotive applications increasingly demand cutting-edge semiconductor technologies for performance and efficiency improvements. However, establishing automotive-qualified production at new process nodes involves significant technical and financial risks. These factors constrain rapid market expansion and innovation deployment.

Growth Factors

Emerging Technologies and Electrification Drive Semiconductor Market Expansion

Silicon carbide and gallium nitride power devices enable superior efficiency in electric vehicle powertrains. These wide-bandgap semiconductors operate at higher temperatures and voltages than traditional silicon devices. Furthermore, they reduce energy losses in inverters and charging systems substantially. The growing electric vehicle market accelerates adoption of these advanced materials.

Vehicle-to-Everything communication technologies require specialized semiconductor solutions for wireless connectivity. V2X enables vehicles to communicate with infrastructure, pedestrians, and other vehicles for enhanced safety. Consequently, governments worldwide invest in V2X infrastructure deployment to support intelligent transportation systems. This creates sustained demand for communication semiconductors.

Over-the-air software update capabilities transform vehicles into updatable platforms throughout their operational lives. This functionality requires secure processors and adequate memory resources for software management. Additionally, automakers leverage OTA updates to introduce new features and improve vehicle performance post-purchase. Smart mobility adoption in emerging markets further expands semiconductor addressable market opportunities.

Emerging Trends

Architectural Innovation and AI Integration Shape Future Semiconductor Requirements

The automotive industry transitions toward centralized zonal electrical and electronic architectures. This approach consolidates multiple electronic control units into fewer, more powerful computing platforms. Consequently, domain controllers require high-performance semiconductors with enhanced processing capabilities. Zonal architectures reduce vehicle wiring complexity and enable efficient software management.

AI accelerators become increasingly integrated into vehicle computing platforms for real-time intelligence applications. These specialized processors handle neural network inference for computer vision and decision-making tasks. Furthermore, edge computing capabilities reduce latency and improve autonomous driving system responsiveness. The proliferation of AI-enabled features drives demand for dedicated acceleration hardware.

Chiplet-based semiconductor designs offer flexibility and cost optimization for automotive electronic control units. This modular approach combines specialized dies for processing, memory, and connectivity functions. Additionally, chiplet architectures enable faster innovation cycles and customization for specific automotive applications. Growing cybersecurity concerns drive development of specialized secure semiconductors protecting connected vehicle data and communications.

Regional Analysis

Asia Pacific Dominates the Automotive Semiconductor Market with 43.8% Share, Valued at USD 23.1 Billion

Asia Pacific leads the global automotive semiconductor market with a commanding 43.8% share, valued at USD 23.1 billion. This dominance stems from the region’s substantial vehicle manufacturing base and strong semiconductor industry presence. China, Japan, and South Korea host major automotive production facilities and leading semiconductor companies. Moreover, government initiatives supporting electric vehicle adoption and domestic chip manufacturing accelerate regional market growth. The region benefits from integrated supply chains connecting semiconductor fabs with automotive assembly plants efficiently.

North America Automotive Semiconductor Market Trends

North America maintains significant market presence driven by advanced vehicle technology adoption and stringent safety regulations. The region leads in autonomous vehicle development and connected car technologies requiring sophisticated semiconductors. Additionally, major automotive manufacturers and semiconductor companies collaborate on next-generation vehicle platforms. Government investments in semiconductor manufacturing strengthen domestic supply chain resilience and technological capabilities.

Europe Automotive Semiconductor Market Trends

Europe demonstrates strong commitment to vehicle electrification and emission reduction through regulatory frameworks. The region hosts premium automotive brands integrating cutting-edge semiconductor technologies in their vehicle lineups. Furthermore, European semiconductor companies specialize in automotive-grade components for safety-critical applications. Strategic partnerships between automakers and chip manufacturers accelerate innovation in autonomous and electric vehicle technologies.

Middle East and Africa Automotive Semiconductor Market Trends

Middle East and Africa represent emerging markets with growing automotive production and vehicle electrification initiatives. Government investments in smart city infrastructure create opportunities for connected vehicle technologies. Additionally, increasing disposable incomes drive demand for vehicles with advanced safety and comfort features. The region’s focus on economic diversification supports automotive industry development and semiconductor adoption.

Latin America Automotive Semiconductor Market Trends

Latin America experiences gradual automotive semiconductor adoption driven by regional vehicle production growth. Manufacturers increasingly introduce models with enhanced safety features meeting updated regulatory requirements. Furthermore, expanding middle-class populations demand vehicles with modern infotainment and connectivity capabilities. Local assembly operations integrate imported semiconductor components into regionally produced vehicles.

Key Automotive Semiconductor Company Insights

The global automotive semiconductor market features established players driving innovation across powertrain, safety, and connectivity applications. These companies invest substantially in research and development to address evolving vehicle electrification and autonomous driving requirements.

Analog Devices, Inc. delivers precision signal processing and power management solutions for automotive applications. Their products enable accurate sensor data acquisition and efficient energy management in electric and hybrid vehicles.

Infineon Technologies AG leads in automotive power semiconductors and microcontrollers for electrification and ADAS applications. The company’s silicon carbide technologies enhance electric vehicle efficiency and charging performance significantly.

NXP Semiconductors specializes in automotive processing, connectivity, and security solutions supporting vehicle networking and infotainment systems. Their secure vehicle-to-everything communication chips enable next-generation connected car architectures.

Renesas Electronics Corporation provides comprehensive semiconductor portfolios for automotive control systems and autonomous driving platforms. Their integrated solutions address domain controller requirements for centralized vehicle architectures.

These industry leaders collaborate closely with automotive manufacturers to develop application-specific semiconductor solutions. Their technological expertise and manufacturing scale position them to capitalize on growing automotive electronics content. Furthermore, strategic acquisitions and partnerships expand their product portfolios and market reach. The competitive landscape emphasizes innovation in power efficiency, processing performance, and functional safety compliance.

Key Companies

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ROHM CO., LTD.

- Semiconductor Components Industries, LLC

- STMicroelectronics

- Texas Instruments Incorporated

- TOSHIBA CORPORATION

Recent Developments

- In December 2024, Black Semiconductor secured EUR 255 million in funding to launch new semiconductor technology in Europe. This investment strengthens European semiconductor manufacturing capabilities and supports regional automotive industry supply chain resilience.

- In August 2025, Hyundai Mobis acquired semiconductor development process certification for ISO 26262 ASIL-D. This achievement demonstrates the company’s commitment to developing safety-critical automotive semiconductor solutions meeting the highest functional safety standards.

- In August 2025, Infineon successfully completed acquisition of Marvell’s Automotive Ethernet business. This strategic move expands Infineon’s portfolio in vehicle networking technologies essential for next-generation centralized automotive architectures and software-defined vehicles.

Report Scope

Report Features Description Market Value (2024) USD 52.9 Billion Forecast Revenue (2034) USD 115.3 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Processor, Discrete Power, Sensor, Memory, Others), By Vehicle Type (Passenger Vehicle, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)), By Application (Powertrain, Chassis, Safety, Telematics & Infotainment, Body Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Analog Devices, Inc., Infineon Technologies AG, NXP Semiconductors, Renesas Electronics Corporation, Robert Bosch GmbH, ROHM CO., LTD., Semiconductor Components Industries, LLC, STMicroelectronics, Texas Instruments Incorporated, TOSHIBA CORPORATION Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Semiconductor MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Semiconductor MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Analog Devices, Inc.

- Infineon Technologies AG

- NXP Semiconductors

- Renesas Electronics Corporation

- Robert Bosch GmbH

- ROHM CO., LTD.

- Semiconductor Components Industries, LLC

- STMicroelectronics

- Texas Instruments Incorporated

- TOSHIBA CORPORATION