Global Automotive Rental and Leasing Market Size, Share, Growth Analysis By Vehicle Type (Passenger Cars, Commercial Vehicles), By Service Type (Rental, Leasing), By Propulsion Type (Internal Combustion Engine (ICE), Electric Vehicles (EVs)), By Mode of Booking (Online, Offline), By End User (Individual, Corporate), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176619

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

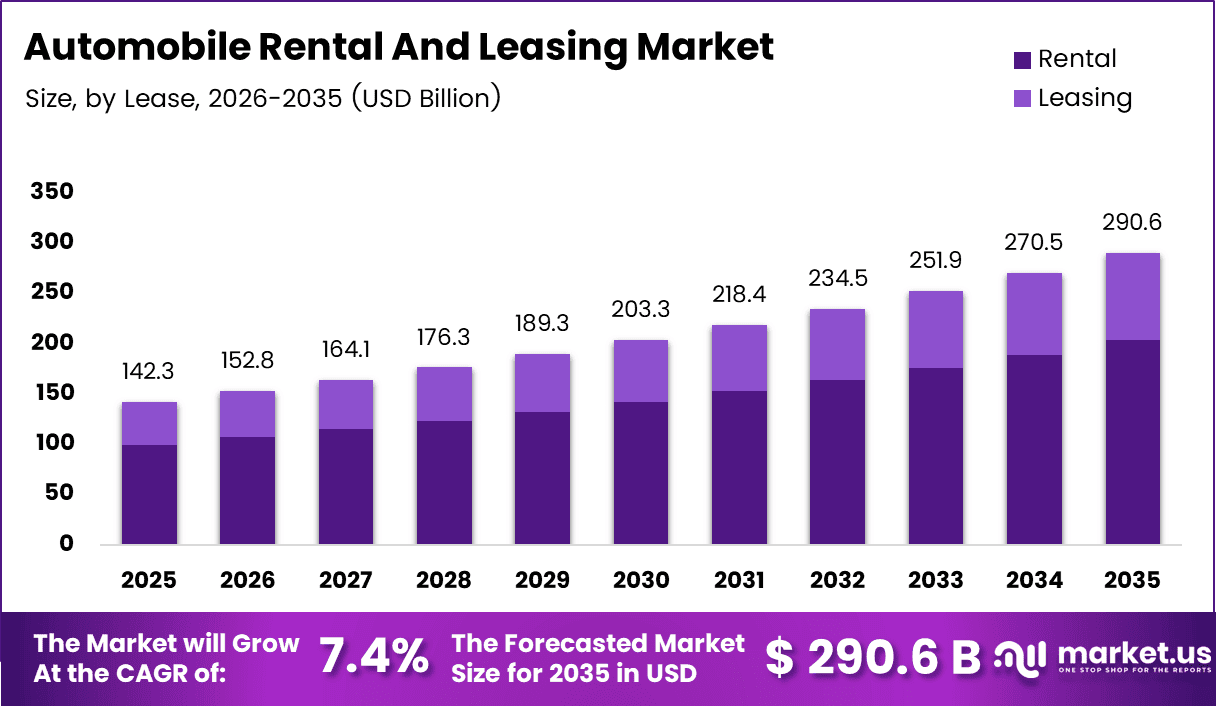

Global Automotive Rental and Leasing Market size is expected to be worth around USD 290.6 Billion by 2035 from USD 142.3 Billion in 2025, growing at a CAGR of 7.4% during the forecast period 2026 to 2035.

The automotive rental and leasing market encompasses services that provide temporary or long-term vehicle access without ownership commitments. These services include short-term rentals, long-term leasing arrangements, and subscription-based models. The market serves both individual consumers and corporate clients seeking flexible mobility solutions.

Market growth is driven by shifting consumer preferences toward shared mobility over vehicle ownership. Urban populations increasingly favor rental services due to high insurance costs, parking limitations, and maintenance responsibilities. Moreover, digital transformation has simplified booking processes, making vehicle access more convenient and transparent for users.

The tourism and business travel sectors continue generating substantial demand for rental vehicles globally. Airport partnerships and strategic location placements enhance accessibility for travelers. Additionally, corporate fleet management solutions are expanding as multinational enterprises seek efficient transportation management across multiple geographies and operational requirements.

Emerging technologies are reshaping service delivery models within the automotive rental landscape. Mobile applications enable contactless pickup and return systems, improving customer experience significantly. Furthermore, dynamic pricing algorithms optimize revenue generation based on seasonal demand fluctuations and real-time availability patterns across different vehicle categories.

Electric vehicle integration represents a significant growth opportunity for rental operators. Companies are expanding EV fleets to meet environmental regulations and sustainability goals. However, traditional internal combustion engine vehicles still dominate the market, accounting for the majority of rental transactions due to established infrastructure and consumer familiarity.

Regulatory compliance across multiple jurisdictions creates operational complexity for rental companies. Licensing requirements vary significantly between regions, increasing administrative burdens. Consequently, vehicle depreciation and residual value fluctuations continue impacting profitability margins, requiring sophisticated fleet management strategies to optimize asset utilization and replacement cycles.

Subscription-based models are attracting younger demographics seeking flexible vehicle access without ownership commitments. Peer-to-peer sharing platforms are disrupting traditional rental business models by connecting vehicle owners directly with renters. Therefore, established operators are investing in technology infrastructure and strategic partnerships to maintain competitive positioning in this evolving market landscape.

Key Takeaways

- Global Automotive Rental and Leasing Market is projected to reach USD 290.6 Billion by 2035 from USD 142.3 Billion in 2025, growing at a CAGR of 7.4%

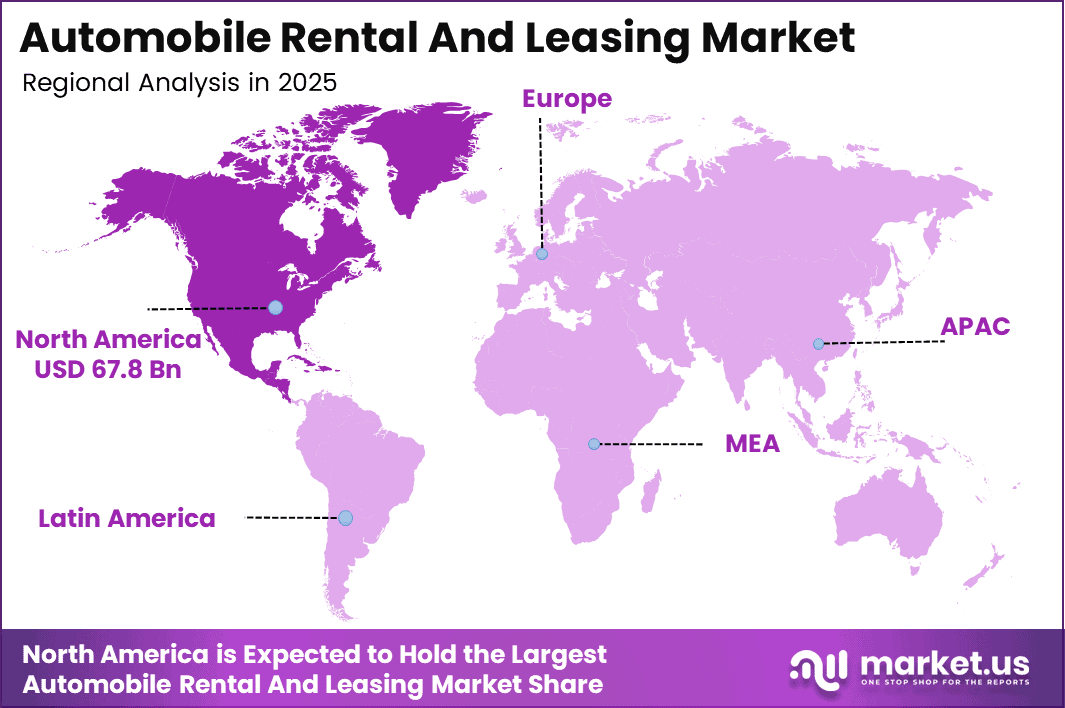

- North America dominates the market with a 47.7% share, valued at USD 67.8 Billion

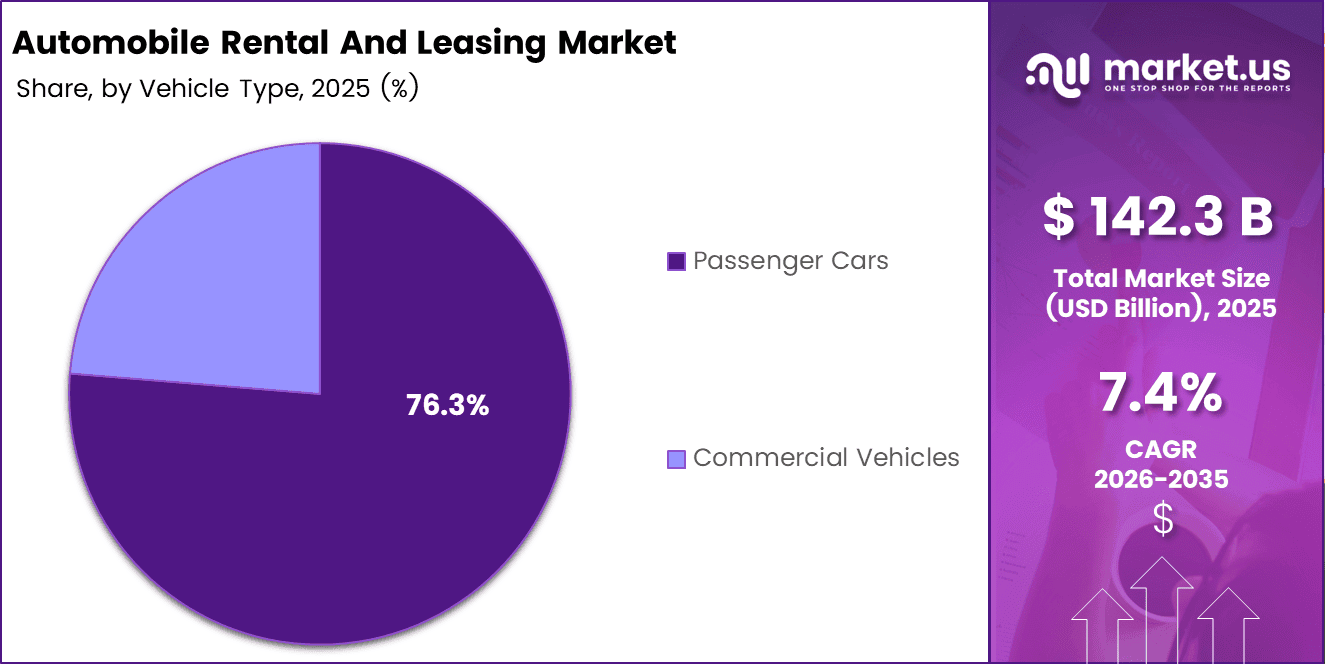

- Passenger Cars segment holds a dominant market position with 76.3% share in the Vehicle Type segment

- Rental services account for 69.9% of the Service Type segment, leading over leasing options

- Internal Combustion Engine vehicles represent 84.6% of the Propulsion Type segment

- Online booking mode captures 67.8% share, reflecting digital transformation in customer preferences

- Individual end users constitute 59.1% of the market, demonstrating strong consumer demand

Vehicle Type Analysis

In 2025, ‘Passenger Cars’ held a dominant market position in the ‘Vehicle Type’ segment of Automotive Rental and Leasing Market, with a 76.3% share.

Passenger Cars dominate the vehicle rental landscape due to widespread consumer preference for personal mobility solutions. Urban travelers and business professionals favor sedan and compact car rentals for city navigation and short-distance travel. Moreover, extensive availability and competitive pricing make passenger cars the most accessible option across rental locations globally.

Commercial Vehicles serve specialized transportation needs for businesses requiring cargo capacity and utility functions. Construction companies, delivery services, and moving operations drive demand for truck and van rentals. Additionally, fleet management solutions for commercial vehicles provide cost-effective alternatives to ownership for enterprises managing logistics operations across multiple locations.

Service Type Analysis

In 2025, ‘Rental’ held a dominant market position in the ‘Service Type’ segment of Automotive Rental and Leasing Market, with a 69.9% share.

Rental services dominate due to flexibility and short-term commitment requirements appealing to tourists and business travelers. Daily and weekly rental arrangements provide immediate vehicle access without long-term obligations. Furthermore, airport locations and convenient pickup points enhance accessibility, making rental services the preferred choice for temporary transportation needs across diverse customer segments.

Leasing arrangements attract corporate clients and individuals seeking predictable monthly costs without ownership responsibilities. Long-term leasing contracts typically range from 12 to 48 months, offering vehicle access with maintenance packages. Therefore, businesses utilize leasing solutions to manage fleet expenses efficiently while avoiding depreciation risks and capital investment requirements associated with vehicle purchases.

Propulsion Type Analysis

In 2025, ‘Internal Combustion Engine (ICE)’ held a dominant market position in the ‘Propulsion Type’ segment of Automotive Rental and Leasing Market, with an 84.6% share.

Internal Combustion Engine (ICE) vehicles maintain market dominance due to established infrastructure and widespread fuel station availability. Consumers demonstrate familiarity and confidence with traditional gasoline and diesel vehicles across all geographic markets. Moreover, longer driving ranges and faster refueling times make ICE vehicles practical choices for long-distance travel and commercial applications requiring extended operational capabilities.

Electric Vehicles (EVs) represent the fastest-growing segment as rental companies expand sustainable transportation options. Environmental regulations and corporate sustainability commitments drive EV fleet expansion across major metropolitan areas. Additionally, younger demographics increasingly request electric vehicle rentals, particularly in regions with robust charging infrastructure and government incentives supporting electric mobility adoption initiatives.

Mode of Booking Analysis

In 2025, ‘Online’ held a dominant market position in the ‘Mode of Booking’ segment of Automotive Rental and Leasing Market, with a 67.8% share.

Online booking channels dominate as digital platforms offer convenience, price transparency, and instant confirmation capabilities. Mobile applications and website interfaces enable customers to compare vehicle options, review pricing, and complete reservations efficiently. Furthermore, contactless pickup systems and digital key technologies enhance user experience by eliminating traditional counter interactions and reducing transaction times significantly.

Offline booking methods remain relevant for customers preferring personal assistance and on-site vehicle inspection before rental. Walk-in customers at airport locations and travel hubs continue utilizing traditional counter services. However, the shift toward digital channels continues accelerating as rental companies invest in technology infrastructure to streamline operations and reduce staffing requirements at physical locations.

End User Analysis

In 2025, ‘Individual’ held a dominant market position in the ‘End User’ segment of Automotive Rental and Leasing Market, with a 59.1% share.

Individual consumers drive market demand through vacation travel, temporary vehicle needs, and special occasion rentals. Personal mobility requirements during vehicle repairs or maintenance periods create consistent demand. Moreover, urban residents without car ownership increasingly utilize rental services for weekend trips and specific transportation needs, contributing to sustained growth in individual customer segments.

Corporate clients utilize rental and leasing services for business travel, fleet management, and employee transportation programs. Multinational enterprises require standardized vehicle access across multiple geographic locations for traveling executives and field personnel. Additionally, corporate accounts benefit from negotiated rates, centralized billing systems, and comprehensive insurance coverage, making professional rental arrangements cost-effective alternatives to company-owned vehicle fleets.

Key Market Segments

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Service Type

- Rental

- Leasing

By Propulsion Type

- Internal Combustion Engine (ICE)

- Electric Vehicles (EVs)

By Mode of Booking

- Online

- Offline

By End User

- Individual

- Corporate

Drivers

Increasing Urban Mobility Demands and Expanding Service Categories Drive Market Growth

Urban congestion and limited parking infrastructure make vehicle ownership impractical for city residents globally. Shared mobility solutions provide flexible transportation alternatives without ownership burdens. Moreover, rising insurance premiums and maintenance costs further discourage individual vehicle purchases, particularly among younger demographics seeking cost-effective mobility options in metropolitan areas.

The tourism industry generates substantial demand for rental vehicles across leisure and business travel segments. International and domestic travelers require temporary transportation at destination locations worldwide. Additionally, airport partnerships and strategic placement at travel hubs enhance accessibility, creating consistent revenue streams for rental operators during peak travel seasons and major events.

Ride-sharing platforms and last-mile delivery services require extensive vehicle fleets to meet operational demands. E-commerce growth drives commercial vehicle rental for logistics and distribution operations. Furthermore, subscription-based models attract customers seeking vehicle access without long-term commitments, expanding market reach beyond traditional rental and leasing categories.

Restraints

Regulatory Compliance and Asset Management Challenges Limit Market Expansion

Operating across multiple jurisdictions requires compliance with diverse licensing requirements and regulatory frameworks. Regional variations in vehicle standards, insurance mandates, and taxation policies increase administrative complexity. Consequently, rental companies must invest substantially in legal expertise and compliance infrastructure to maintain operations across different geographic markets and regulatory environments.

Vehicle depreciation significantly impacts profitability as asset values decline throughout the ownership lifecycle. Residual value fluctuations create financial uncertainty when disposing of used fleet vehicles. Moreover, market conditions and economic downturns can accelerate depreciation rates, forcing operators to absorb losses when replacing aging inventory with newer models.

Operational costs including fleet maintenance, storage facilities, and personnel expenses continue rising globally. Fuel price volatility affects both rental rates and customer demand patterns unpredictably. Additionally, competition from peer-to-peer platforms and alternative transportation services pressures traditional rental companies to reduce pricing while maintaining service quality and profitability margins.

Growth Factors

Technology Integration and Corporate Solutions Accelerate Market Expansion

Corporate fleet management solutions for multinational enterprises represent significant growth opportunities globally. Businesses require standardized vehicle access across multiple locations for traveling employees and field operations. Moreover, centralized billing systems and comprehensive insurance packages make professional rental arrangements attractive alternatives to maintaining company-owned fleets with associated depreciation and maintenance responsibilities.

Subscription-based vehicle access models attract younger demographics seeking flexibility without ownership commitments. Monthly subscription services provide vehicle access with insurance and maintenance included in predictable pricing structures. Additionally, customers can switch between vehicle types based on changing needs, creating revenue opportunities through premium tier offerings and supplementary service packages.

Autonomous vehicle integration in rental fleets will create entirely new service categories and operational efficiencies. Self-driving technology enables vehicle repositioning without driver costs and expands accessibility for customers unable to operate traditional vehicles. Furthermore, airport and travel hub partnerships enhance customer convenience through streamlined pickup processes and integrated booking systems connecting transportation modes seamlessly.

Emerging Trends

Digital Transformation and Premium Services Reshape Market Landscape

Mobile applications and contactless vehicle pickup systems revolutionize customer experience in rental operations. Digital key technologies eliminate traditional counter interactions, reducing transaction times and staffing requirements significantly. Moreover, customers can locate, unlock, and return vehicles independently through smartphone applications, improving convenience and operational efficiency for rental companies worldwide.

Premium and luxury vehicle rental options are expanding as affluent consumers seek high-end transportation experiences. Exotic car rentals for special occasions and business travel attract customers willing to pay premium rates for superior vehicles. Additionally, rental companies are diversifying fleet portfolios to include luxury brands, creating differentiated market positioning and higher revenue per transaction.

Peer-to-peer car sharing platforms disrupt traditional business models by connecting vehicle owners directly with renters. These platforms leverage idle vehicle capacity, creating alternative income streams for car owners while providing competitive pricing for customers. Furthermore, dynamic pricing algorithms optimize revenue generation based on real-time demand, seasonality, and vehicle availability across different locations and time periods.

Regional Analysis

North America Dominates the Automotive Rental and Leasing Market with a Market Share of 47.7%, Valued at USD 67.8 Billion

North America leads the global automotive rental and leasing market due to extensive business travel infrastructure and established tourism industry. Major rental companies maintain significant fleet operations across airports and metropolitan areas throughout the region. Moreover, corporate fleet management solutions serve numerous multinational enterprises headquartered in the United States and Canada, generating consistent demand for both short-term rentals and long-term leasing arrangements.

Europe Automotive Rental and Leasing Market Trends

Europe demonstrates strong market growth driven by international tourism and cross-border business travel across the continent. Stringent environmental regulations accelerate electric vehicle adoption in rental fleets, particularly in Western European markets. Additionally, high vehicle ownership costs in major cities encourage shared mobility solutions, supporting sustained demand for rental and leasing services throughout the region.

Asia Pacific Automotive Rental and Leasing Market Trends

Asia Pacific represents the fastest-growing regional market due to expanding middle-class populations and increasing business travel activity. China, Japan, and India lead regional demand as urbanization and economic development drive transportation requirements. Furthermore, digital booking platforms and mobile payment integration enhance accessibility for tech-savvy consumers across diverse markets in the region.

Middle East & Africa Automotive Rental and Leasing Market Trends

Middle East & Africa markets experience growth through tourism development and corporate expansion in major business hubs. Luxury vehicle rentals attract affluent tourists in Gulf Cooperation Council countries, while commercial vehicle leasing supports logistics operations. Moreover, infrastructure development projects create demand for specialized vehicle rentals across construction and industrial sectors throughout the region.

Latin America Automotive Rental and Leasing Market Trends

Latin America shows steady growth potential as economic conditions improve and tourism infrastructure expands across major destinations. Brazil and Mexico lead regional markets with established rental operations in major cities and tourist locations. Additionally, corporate fleet management solutions are gaining traction as multinational companies expand operations throughout the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Enterprise Holdings maintains market leadership through extensive geographic coverage and diversified service offerings across rental and leasing segments. The company operates multiple brands targeting different customer segments from budget-conscious travelers to premium corporate clients. Moreover, Enterprise Mobility’s diverse fleet includes Class 1-6 vehicles with comprehensive mobility offerings, including leading positions in fleet management and light and medium-duty truck rental services.

The Hertz Corporation leverages strong brand recognition and airport partnerships to serve business and leisure travelers globally. The company has expanded electric vehicle offerings to meet sustainability demands and regulatory requirements across major markets. Additionally, Hertz maintains strategic relationships with loyalty programs and corporate accounts, generating consistent revenue streams through negotiated rates and centralized billing systems for enterprise customers.

Avis Budget Group operates multiple brands serving distinct market segments from economy to premium vehicle categories worldwide. The company has invested substantially in digital booking platforms and mobile applications to enhance customer experience and operational efficiency. Furthermore, Avis Budget Group continues expanding fleet management solutions for corporate clients requiring standardized vehicle access across multiple geographic locations and business units.

Sixt SE demonstrates strong European market presence with premium vehicle offerings and technology-driven customer service innovations. The company has developed sophisticated mobile applications enabling contactless pickup and return systems across numerous locations. Moreover, Sixt maintains strategic airport partnerships and continues geographic expansion into new markets, positioning the company for sustained growth in competitive rental and mobility service segments.

Key Players

- Enterprise Holdings

- The Hertz Corporation

- Avis Budget Group

- Sixt SE

- Europcar Mobility Group

- Localiza

- LeasePlan

- Ryder System

- Penske Truck Leasing

- PACCAR Leasing

- United Rentals

Recent Developments

- December 2025 – Enterprise Mobility announced acquisition expanding its mobility portfolio through the integration of commercial transportation services. The acquisition adds approximately 3,000 team members and operations managing over 10,000 pieces of equipment across more than 50 locations throughout the United States, strengthening Enterprise’s position in commercial fleet solutions.

- September 2024 – Velocity Truck Rental & Leasing completed acquisition of Autow NationaLease Truck Rental, Inc., expanding its geographic footprint and service capabilities in the commercial vehicle rental segment. This strategic acquisition enhances Velocity’s market position and operational capacity to serve commercial clients requiring truck rental and leasing solutions across multiple regions.

Report Scope

Report Features Description Market Value (2025) USD 142.3 Billion Forecast Revenue (2035) USD 290.6 Billion CAGR (2026-2035) 7.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Cars, Commercial Vehicles), By Service Type (Rental, Leasing), By Propulsion Type (Internal Combustion Engine (ICE), Electric Vehicles (EVs)), By Mode of Booking (Online, Offline), By End User (Individual, Corporate) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Enterprise Holdings, The Hertz Corporation, Avis Budget Group, Sixt SE, Europcar Mobility Group, Localiza, LeasePlan, Ryder System, Penske Truck Leasing, PACCAR Leasing, United Rentals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Rental and Leasing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive Rental and Leasing MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Enterprise Holdings

- The Hertz Corporation

- Avis Budget Group

- Sixt SE

- Europcar Mobility Group

- Localiza

- LeasePlan

- Ryder System

- Penske Truck Leasing

- PACCAR Leasing

- United Rentals