Global Automotive Powertrain Sensors Market Size, Share, Growth Analysis By Sensor Type (Pressure Sensors, Temperature Sensors, Position Sensors, Speed Sensors, Others), By Propulsion Type (Internal Combustion Engine Vehicles, Electric Vehicles, Fuel Cell Vehicles), By Vehicle Type (Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheelers), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 168649

- Number of Pages: 223

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

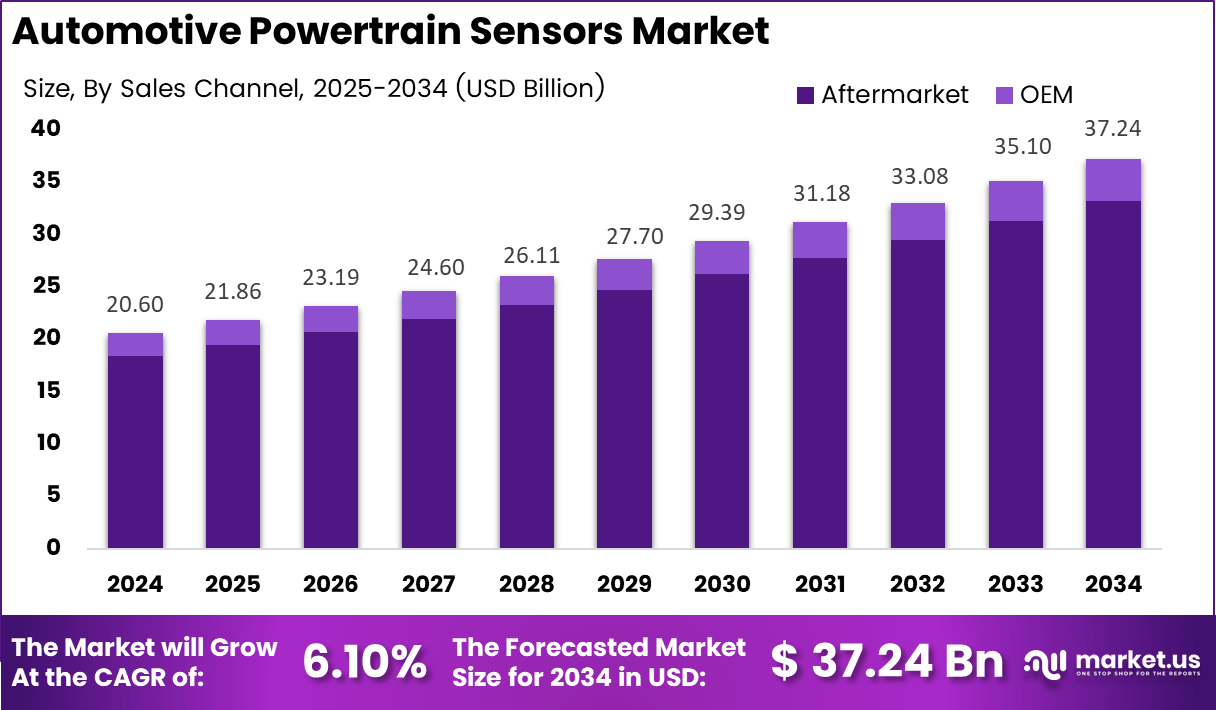

The Global Automotive Powertrain Sensors Market size is expected to be worth around USD 37.24 Billion by 2034, from USD 20.6 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Automotive Powertrain Sensors Market represents a technology-driven ecosystem that enables real-time monitoring of engine efficiency, emission output, fuel systems, drivetrain load, and thermal conditions. These sensors optimize vehicle performance by supporting advanced combustion control, electrified drivetrains, and regulatory compliance. They remain essential in modern powertrain architectures as OEMs adopt smarter, cleaner, and connected mobility solutions.

The market grows steadily as automakers integrate high-accuracy sensing technologies to enhance efficiency and meet tightening emission norms. Rising adoption of hybrid and electric architectures further elevates demand as vehicles require precise thermal, torque, and position sensing. Moreover, digital powertrain controls accelerate the urgency for robust sensing layers across all drivetrain components.

The sector advances as governments prioritize cleaner mobility through mandates that limit nitrogen oxide emissions, improve fuel economy, and accelerate EV transition. These initiatives encourage OEMs to incorporate next-generation powertrain sensors that maintain combustion precision, reduce particulate output, and improve drivetrain durability. Additionally, rising consumer interest in more responsive vehicles increases adoption across volume and premium segments.

The market unlocks new opportunities as connected powertrains require continuous data acquisition to support predictive diagnostics and over-the-air optimization. Increasing investment in ADAS and intelligent driveline controls further strengthens demand for multi-functional sensors. Manufacturers also explore miniaturized semiconductor-based sensing platforms to reduce integration complexity and enhance real-time responsiveness.

The industry progresses with supportive policy frameworks such as the US EPA emission rules and the EU CO₂ reduction targets that push OEMs toward high-performance sensing technologies. Additionally, energy-efficiency regulations in Asia create long-term incentives for deploying advanced thermal, pressure, and speed sensors across internal combustion, hybrid, and fully electric powertrains.

The market outlook strengthens as electrification accelerates and OEMs deploy sensors that monitor battery temperature, inverter efficiency, and motor torque. Increasing government-backed R&D funding encourages local production of microelectronic sensing components. Furthermore, rising vehicle production across emerging economies reinforces long-term demand for durable and energy-efficient powertrain sensors.

Key Takeaways

- The Automotive Powertrain Sensors Market reached USD 20.6 billion in 2024 and is projected to hit USD 37.24 billion by 2034.

- The market grows at a steady CAGR of 6.1% from 2025 to 2034, driven by rising vehicle electrification.

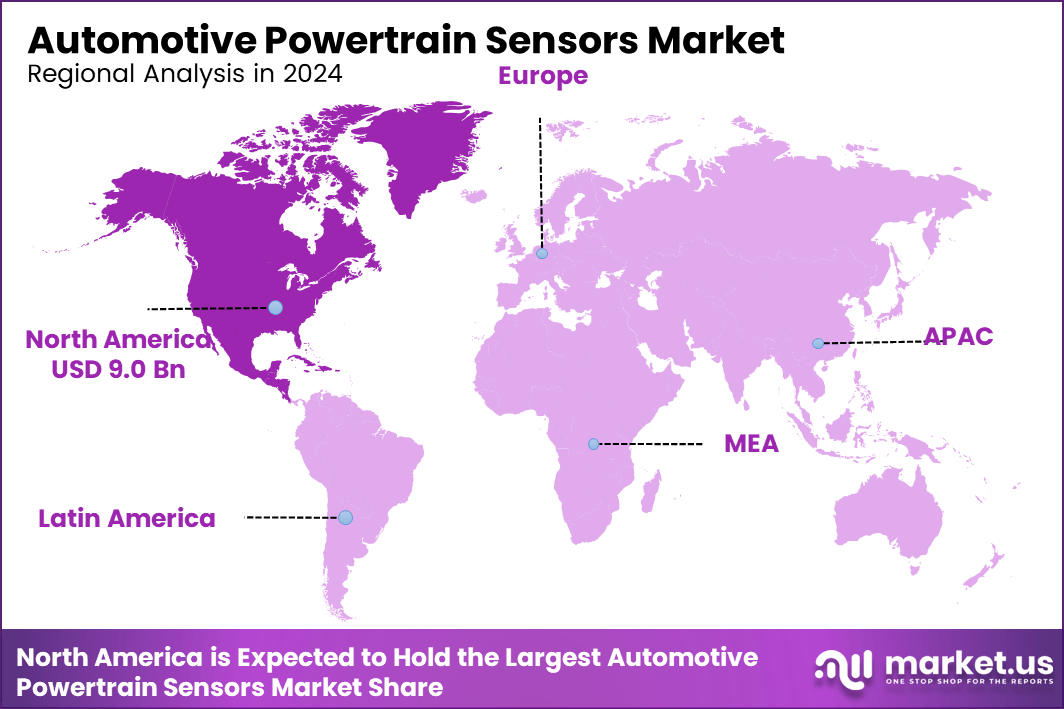

- North America leads the global market with a dominant share of 43.8%, valued at USD 9.0 Bn in 2024.

- Pressure Sensors dominate the sensor type segment with a market share of 34.9% in 2024.

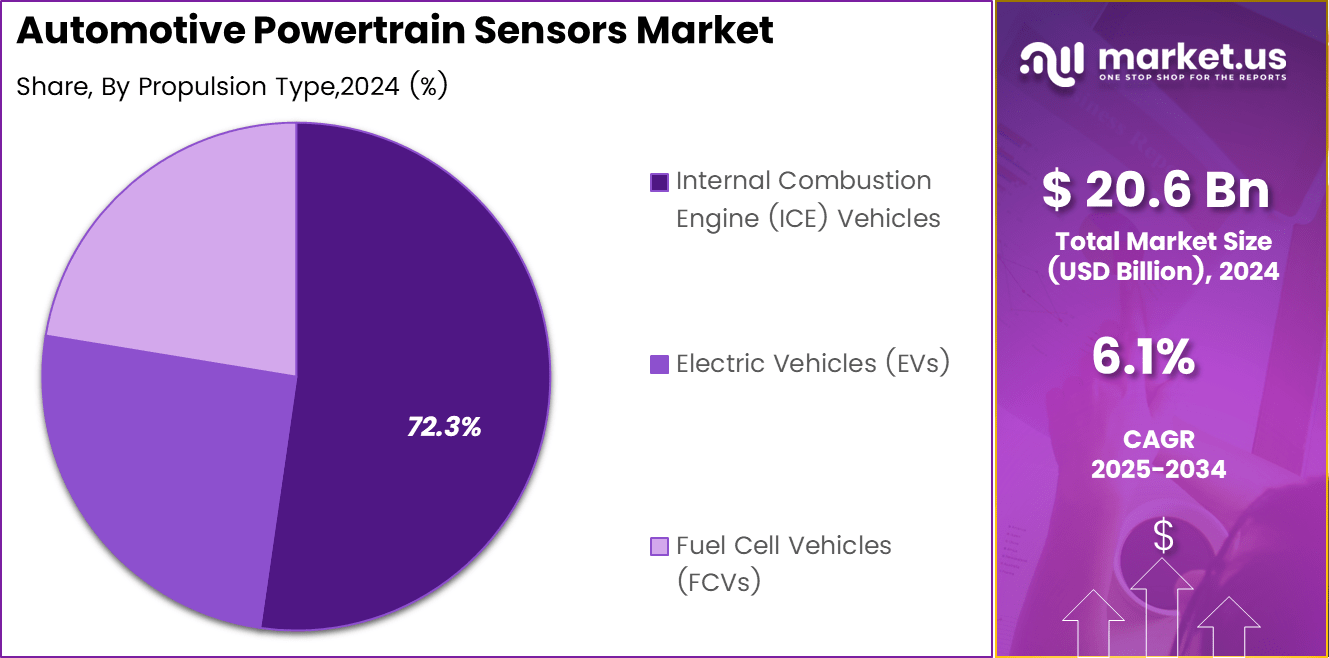

- Internal Combustion Engine Vehicles remain the leading propulsion type, accounting for 72.3% of total market demand.

- Passenger Cars represent the dominant vehicle category, contributing 59.2% to total sensor adoption.

- The OEM channel accounts for a major share of 89.2%, reflecting high reliance on factory-installed sensing systems.

By Sensor Type Analysis

Pressure Sensors dominate with a 34.9% share due to their essential role in engine control and efficiency monitoring.

In 2024, Pressure Sensors held a dominant market position in the By Sensor Type Analysis segment of the Automotive Powertrain Sensors Market, with a 34.9% share. These sensors gained traction as manufacturers focused on optimizing combustion, enhancing turbocharger function, and complying with strict emission norms across major automotive markets.

Temperature Sensors continued to expand as OEMs integrated advanced thermal management systems. Their adoption increased as vehicle platforms demanded precise monitoring of coolant, exhaust, and battery heat levels. Additionally, rising hybrid and EV production pushed demand for enhanced thermal regulation capabilities.

Position Sensors advanced steadily as modern powertrains relied on precise actuator and throttle positioning. Their growing integration into electronic control units supported smoother engine performance. The shift toward automated driving functions further strengthened their inclusion across global automotive production lines.

Speed Sensors gained adoption as drivetrain control systems became more sophisticated. Their ability to maintain traction, support ABS, and stabilize engine operations encouraged OEMs to embed advanced sensing modules, especially across premium vehicle categories experiencing drivetrain innovation.

Other sensor types supported niche requirements such as NVH monitoring and emission testing. Their relevance expanded as automakers explored new sensing technologies for predictive maintenance, integrated diagnostics, and evolving electronic system architectures in next-generation powertrains.

By Propulsion Type Analysis

Internal Combustion Engine Vehicles lead with a 72.3% share due to their global volume dominance and established powertrain architecture.

In 2024, Internal Combustion Engine (ICE) Vehicles held a dominant market position in the By Propulsion Type Analysis segment of the Automotive Powertrain Sensors Market, with a 72.3% share. Their high-volume manufacturing, strong presence in developing regions, and continued demand for fuel-efficient engines sustained strong sensor adoption.

Electric Vehicles expanded as battery technology improved and governments accelerated EV incentives. Powertrain sensors targeting thermal regulation, inverter efficiency, and motor control experienced significant growth. Automakers increasingly redesigned sensing systems to enhance EV reliability, driving steady market penetration.

Fuel Cell Vehicles (FCVs) remained small but gained momentum due to rising hydrogen mobility pilots. Their advanced stack management demanded specialized sensors for pressure, humidity, and temperature tracking. As fuel cell buses and commercial fleets expanded, sensor integration moved toward higher precision and reliability standards.

By Vehicle Type Analysis

Passenger Cars dominate with a 59.2% share, driven by high production volumes and rising integration of advanced powertrain monitoring systems.

In 2024, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of the Automotive Powertrain Sensors Market, with a 59.2% share. High consumer demand, rapid electrification, and advanced performance optimization led OEMs to embed sophisticated sensing architectures across all passenger car models.

Light Commercial Vehicles (LCVs) increased their sensor adoption as logistics and small fleet operators prioritized fuel efficiency and uptime. Enhanced monitoring systems supported load-handling capability and emissions compliance, strengthening the use of precision powertrain sensors across LCV platforms globally.

Heavy Commercial Vehicles (HCVs) upgraded sensing technologies to improve torque management, durability, and long-haul efficiency. Fleet digitalization encouraged integration of advanced control systems relying on real-time powertrain sensing to reduce downtime and comply with evolving emission limits.

Two-Wheelers incorporated more sensors as manufacturers pursued improved combustion tuning, safety compliance, and premium segment differentiation. Growing demand for performance motorcycles and connected two-wheelers supported the steady integration of modern powertrain sensing technologies.

By Sales Channel Analysis

OEM dominates with a 89.2% share because manufacturers rely heavily on factory-installed sensing systems for powertrain optimization.

In 2024, OEM held a dominant market position in the By Sales Channel Analysis segment of the Automotive Powertrain Sensors Market, with a 89.2% share. Automakers increasingly prioritized integrated sensing systems to enhance fuel economy, meet emission standards, and maintain consistent performance across all new vehicle platforms.

Aftermarket demand grew moderately as consumers replaced worn sensors or upgraded systems for better performance. Independent service networks also contributed to sales as vehicle owners sought cost-effective replacements. Expansion of older vehicle fleets in developing countries further supported the aftermarket segment.

Key Market Segments

By Sensor Type

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Speed Sensors

- Others

By Propulsion Type

- Internal Combustion Engine (ICE) Vehicles

- Electric Vehicles (EVs)

- Fuel Cell Vehicles (FCVs)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Two-Wheelers

By Sales Channel

- OEM

- Aftermarket

Drivers

Increasing Integration of Advanced Powertrain Monitoring in Hybrid and Electric Vehicles Drives Market Growth

The Automotive Powertrain Sensors Market experiences steady growth as automakers increase the use of advanced monitoring systems in hybrid and electric vehicles. These vehicles depend heavily on accurate temperature, torque, and voltage sensing to maintain safe battery performance and smooth power delivery. As EV adoption rises globally, manufacturers focus on high-accuracy sensors that support better vehicle control and extend component life.

Stricter global emission standards further accelerate demand for precision powertrain sensors. Countries across North America, Europe, and Asia enforce tighter rules on nitrogen oxide and carbon emissions, requiring vehicles to maintain cleaner combustion and more efficient fuel usage. Automakers deploy high-performance pressure, temperature, and position sensors to achieve precise engine calibration and meet regulatory expectations, boosting market expansion.

At the same time, the increasing adoption of drivetrain efficiency optimization systems by OEMs strengthens the need for advanced sensing technologies. Modern powertrains rely on real-time data to adjust gear shifts, manage heat levels, and improve energy recovery. Manufacturers integrate multiple sensors to ensure smooth operation under different driving conditions, resulting in better fuel economy, reduced mechanical stress, and improved driving comfort. This shift toward smarter and more responsive powertrains continues to support long-term sensor demand.

Restraints

Increasing Integration of Advanced Powertrain Monitoring in Hybrid and Electric Vehicles Drives Market Growth

The increasing integration of advanced powertrain monitoring systems in hybrid and electric vehicles drives strong market momentum as automakers aim for higher efficiency and longer battery life. Precision sensors support real-time analysis of torque, temperature, and motor speed, helping manufacturers optimize vehicle performance under varying driving conditions.

Stricter global emission regulations encourage OEMs to deploy precision powertrain sensors that ensure compliance across diesel, gasoline, hybrid, and EV platforms. These sensors track combustion quality, exhaust temperature, and fuel efficiency, supporting regulatory adherence and reducing harmful emissions during global transitions toward cleaner mobility.

Rising OEM adoption of drivetrain efficiency optimization systems further strengthens demand for robust sensor technologies. Automakers increasingly use sensors to fine-tune gearshift patterns, improve thermal balance, and enhance energy recovery systems, enabling improved vehicle responsiveness and better overall powertrain life-cycle performance.

Growth Factors

Rapid Expansion of EV Battery Thermal-Management and Motor-Control Sensing Creates New Growth Opportunities

The rapid expansion of EV battery thermal-management requirements generates strong demand for specialized sensors that help maintain safety, efficiency, and battery longevity. Growing EV adoption encourages deeper investment in temperature, voltage, and current sensors designed for harsh battery environments.

Increasing adoption of smart, self-diagnosing sensor modules across premium vehicles unlocks new growth avenues as automakers prioritize predictive maintenance and performance optimization. These intelligent sensors monitor component health and notify drivers or service centers before issues arise, strengthening long-term reliability.

Growth in integrated powertrain control units drives multi-sensor fusion applications by combining torque sensing, heat mapping, and electrical monitoring into unified systems. This trend promotes compact architectures, reduced wiring, and enhanced real-time decision-making across next-generation hybrid and electric drivetrains.

Emerging Trends

Shift Toward Miniaturized Solid-State Sensors Shapes Emerging Market Trends

The shift toward miniaturized solid-state sensors shapes major industry trends as EV manufacturers seek compact, lightweight solutions for dense powertrain layouts. These sensors offer higher durability and faster response times, supporting efficient battery and motor operations.

Growing use of AI-enabled predictive maintenance sensors enhances performance in high-performance drivetrains by enabling real-time fault detection and optimized power distribution. OEMs increasingly integrate these systems to minimize downtime and improve long-term drivetrain reliability.

Rising penetration of wireless powertrain sensors reduces wiring harness complexity, improves installation flexibility, and enhances vehicle efficiency. This trend aligns with lightweight EV design goals as manufacturers try to lower energy losses and simplify architecture.

Development of high-temperature silicon carbide–based sensors supports next-generation electric motors operating under extreme heat. These sensors deliver long-term stability and allow high-power EV motors to function efficiently, driving innovation in electric propulsion technologies.

Regional Analysis

North America Dominates the Automotive Powertrain Sensors Market with a Market Share of 43.8%, Valued at USD 9.0 Bn

North America holds a strong lead in the Automotive Powertrain Sensors Market, capturing a significant 43.8% share with a valuation of USD 9.0 Bn. The region benefits from the rapid adoption of hybrid and electric vehicles, supported by strict emission standards and strong technological readiness. Growing integration of real-time powertrain monitoring and increasing vehicle electrification continue to push demand for high-precision sensors across the US and Canada.

Europe Automotive Powertrain Sensors Market Trends

Europe shows steady growth driven by stringent European Union emission regulations and rising production of battery electric and hybrid vehicles. The region’s focus on powertrain efficiency, thermal optimization, and low-carbon mobility strengthens sensor adoption across premium and mass-market vehicle categories. Advancements in drivetrain electrification and increasing R&D in power electronics further support market expansion.

Asia Pacific Automotive Powertrain Sensors Market Trends

Asia Pacific emerges as a high-growth market due to expanding automotive manufacturing hubs in China, Japan, India, and South Korea. Rising EV production capacity, strong government policies promoting electrification, and high demand for fuel-efficient vehicles drive large-scale sensor deployment. Growing investments in smart mobility and rapid industrialization further accelerate market penetration across the region.

Middle East & Africa Automotive Powertrain Sensors Market Trends

The Middle East & Africa region experiences gradual growth as countries diversify their automotive sectors and adopt cleaner mobility initiatives. Increasing demand for efficient drivetrains in commercial and passenger vehicles encourages the integration of advanced powertrain sensors. Rising awareness of emission control and emerging EV infrastructure projects contribute to long-term opportunities.

Latin America Automotive Powertrain Sensors Market Trends

Latin America witnesses moderate growth supported by improving automotive production activities in Brazil and Mexico. Rising focus on improving vehicle efficiency, along with regulatory improvements related to emissions, strengthens the need for advanced powertrain monitoring solutions. Expansion of hybrid vehicle models and gradual electrification initiatives further support regional market development.

U.S. Automotive Powertrain Sensors Market Trends

The US remains the core contributor within North America, driven by strong EV adoption, advanced automotive electronics, and strict EPA emission norms. Growing integration of smart drivetrains and rising consumer shift toward high-efficiency vehicles accelerate the demand for thermal, pressure, and speed sensors. Continuous advancements in vehicle digitalization and connected powertrain technologies reinforce the country’s leadership position.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Powertrain Sensors Market Company Insights

The global Automotive Powertrain Sensors Market in 2024 advances steadily as leading companies strengthen their portfolios with high-efficiency sensing technologies tailored for hybrid, electric, and next-generation combustion engines.

Robert Bosch GmbH continues to shape industry direction by expanding its powertrain-specific sensor lineup with solutions focused on precision monitoring, thermal regulation, and real-time diagnostics. Its strong integration capabilities with control units enhance OEM adoption, especially in advanced drivetrain architectures.

Continental AG reinforces its position by prioritizing intelligent sensing modules that support emission reduction, improved fuel efficiency, and EV-ready power electronics. Its sensor technologies align closely with regulatory shifts toward low-carbon mobility, enabling strong traction across European and global markets.

DENSO CORPORATION plays a key role in driving innovation with compact, high-accuracy sensors supporting motor control, torque management, and engine performance optimization. The company’s deep involvement in electrification ecosystems strengthens its influence in both Japanese and international markets.

Infineon Technologies AG strengthens the semiconductor foundation of automotive sensing by delivering powertrain-grade chipsets engineered for harsh environments and high thermal stability. Its focus on robust signal processing, safety-compliant architecture, and integration with EV inverters accelerates its relevance across the sensor value chain.

Together, these companies set the competitive benchmark by focusing on efficiency, miniaturization, and electrification readiness—three attributes that define the next era of powertrain sensor development. With rapid growth in EV platforms and increasing demand for multi-sensor fusion systems, the market is expected to experience continued innovation driven by semiconductor advancements, smarter calibration systems, and stronger alignment with global emission mandates.

Top Key Players in the Market

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Texas Instruments Incorporated

- Mitsubishi Electric Mobility Corporation

- NXP Semiconductors

- TE Connectivity

- Renesas Electronics Corporation

- Valeo SA

Recent Developments

- In Jul 2025, Sensata Technologies launched a high efficiency contactor with an integrated sensing solution to support seamless 400V/800V EV charging compatibility. The solution enhances powertrain safety and reliability, supporting next generation electric vehicle architectures and fast charging systems.

- In Sep 2024, Spectris plc acquired Piezocryst Advanced Sensorics GmbH for approximately $146 million, expanding its capabilities in high precision sensor technologies. The acquisition strengthens Spectris’ portfolio for engine development and powertrain testing, supporting advanced automotive and industrial measurement applications.

Report Scope

Report Features Description Market Value (2024) USD 20.6 Billion Forecast Revenue (2034) USD 37.24 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Sensor Type (Pressure Sensors, Temperature Sensors, Position Sensors, Speed Sensors, Others), By Propulsion Type (Internal Combustion Engine (ICE) Vehicles, Electric Vehicles (EVs), Fuel Cell Vehicles (FCVs)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-Wheelers), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Robert Bosch GmbH, Continental AG, DENSO CORPORATION, Infineon Technologies AG, Texas Instruments Incorporated, Mitsubishi Electric Mobility Corporation, NXP Semiconductors, TE Connectivity, Renesas Electronics Corporation, Valeo SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Powertrain Sensors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Powertrain Sensors MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Robert Bosch GmbH

- Continental AG

- DENSO CORPORATION

- Infineon Technologies AG

- Texas Instruments Incorporated

- Mitsubishi Electric Mobility Corporation

- NXP Semiconductors

- TE Connectivity

- Renesas Electronics Corporation

- Valeo SA