Global Automotive E-Tailing Market Size, Share, Growth Analysis By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheeler), By Components (Infotainment, Interior Accessories, Engine Components, Tires, Electrical Products), By Vendor (OEM Vendor, Third-Party Vendor), By Product Label (Branded, Counterfeit), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173005

- Number of Pages: 331

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

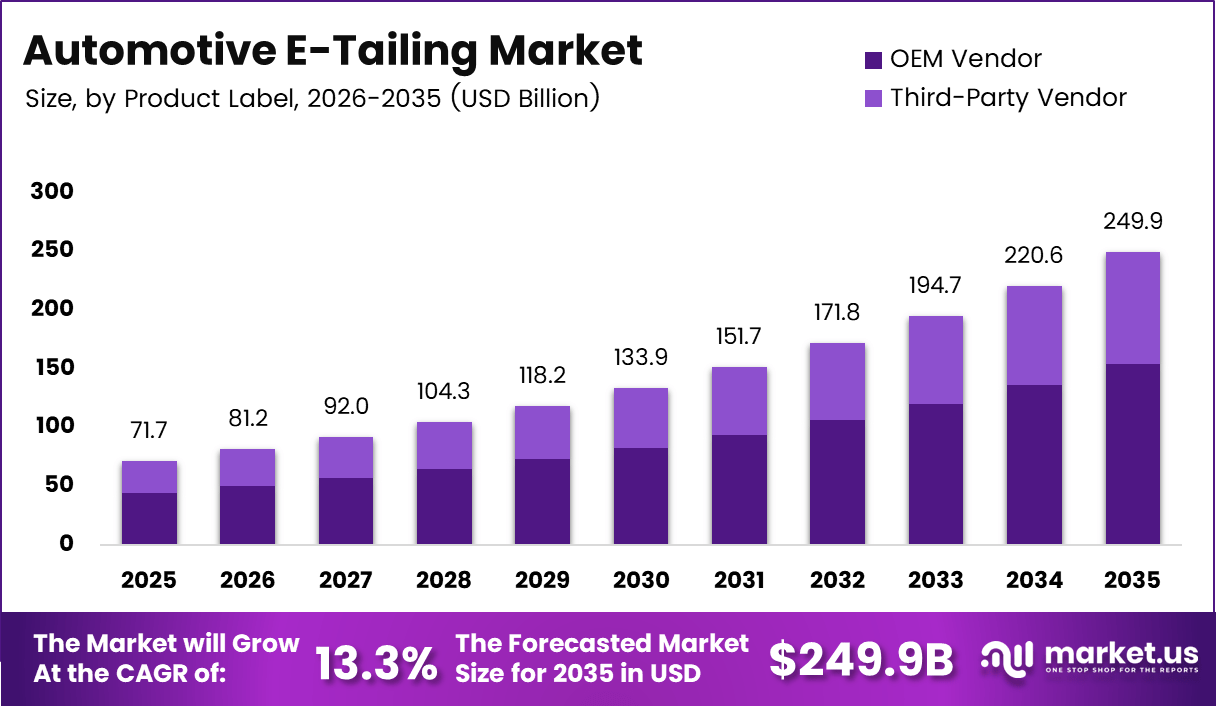

The Global Automotive E-Tailing Market size is expected to be worth around USD 249.9 billion by 2035, from USD 71.7 billion in 2025, growing at a CAGR of 13.3% during the forecast period from 2026 to 2035.

Automotive E-Tailing refers to the digital sale of automotive parts, accessories, tires, and maintenance products through online platforms. It enables buyers to research, compare, and purchase components remotely. Consequently, digital catalogs, VIN matching, and logistics integration increasingly define how vehicle owners and workshops source automotive products efficiently.

Automotive E-Tailing emphasizes convenience, assortment depth, and data driven purchasing behavior across B2C and B2B buyers. Moreover, the model reduces dependency on physical storefronts while expanding geographic reach. Therefore, online automotive retail supports faster price discovery, improved inventory visibility, and scalable distribution economics.

The Automotive E-Tailing Market represents the broader commercial ecosystem supporting online transactions, including fulfillment networks, payment systems, and digital enablement tools. As vehicle parc ages globally, replacement demand rises steadily. Additionally, expanding internet penetration and digital payment adoption strengthen online aftermarket activity across multiple vehicle categories.

Growth remains supported by inefficiencies in traditional procurement models. According to industry channel surveys, 62% of B2B automotive orders are still placed via phone calls or physical retailers. As a result, digitization opportunities remain significant. Governments further support this transition through investments in digital infrastructure, logistics modernization, and MSME digitization initiatives.

From a transactional lens, buyers increasingly prioritize faster delivery, transparent pricing, and accurate part fitment. Consequently, Automotive E-Tailing platforms invest in data standardization, inventory synchronization, and returns optimization. Regulatory focus on consumer protection, product traceability, and counterfeit control further improves buyer confidence in online automotive purchasing.

Demand trends also reflect strong category level momentum. According to an eBay Motors Parts and Accessories survey, the segment generates over $10B in annual GMV, indicating robust digital adoption. This momentum signals sustained volume growth as workshops, fleets, and consumers shift toward online procurement models.

Product specific demand acceleration further validates market expansion. According to the study, online demand increased by 48% for cruise control components, 26% for transmission rebuild kits, 19% for brake component kits, 17% for oil filters, and 6% for wheels and tires. Collectively, these indicators reinforce Automotive E-Tailing as a scalable, efficiency driven aftermarket channel.

Key Takeaways

- The global Automotive E-Tailing Market is projected to reach USD 249.9 billion by 2035, growing from USD 71.7 billion in 2025 at a CAGR of 13.3%.

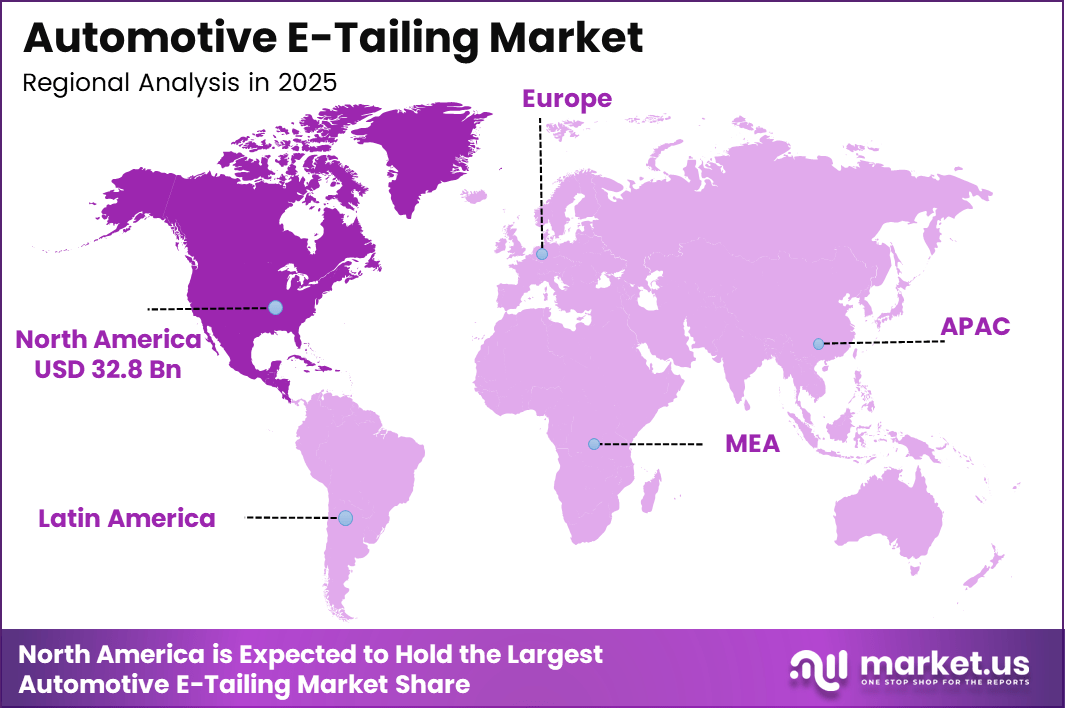

- North America dominates the Automotive E-Tailing Market with a regional share of 45.8%, valued at USD 32.8 billion.

- Passenger Cars lead the By Vehicle Type segment with a dominant share of 52.3%.

- Infotainment represents the largest By Components segment, accounting for 31.2% of total market demand.

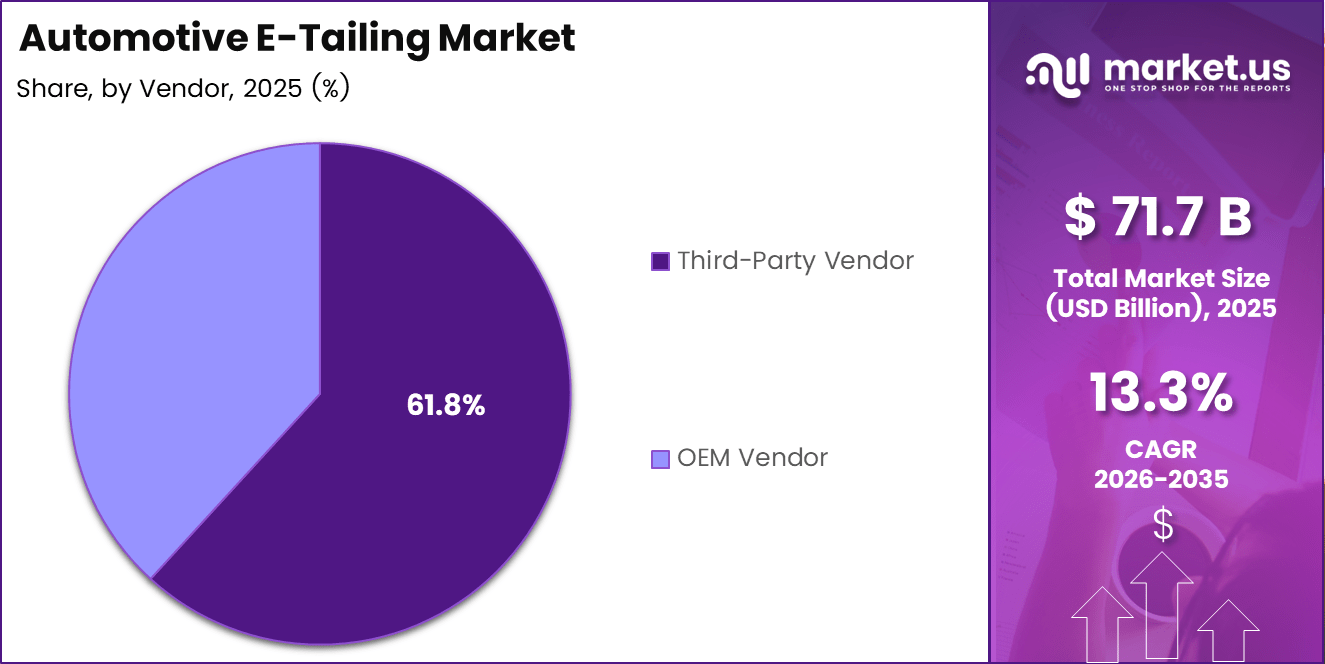

- Third-Party Vendors dominate the By Vendor segment with a market share of 61.8%.

- Branded products hold the leading position in the By Product Label segment with a share of 69.6%.

By Vehicle Type Analysis

Passenger Cars dominate with 52.3% due to higher online replacement part demand and broader consumer digital adoption.

In 2025, Passenger Cars held a dominant market position in the By Vehicle Type Analysis segment of Automotive E-Tailing Market, with a 52.3% share. This dominance reflects higher vehicle ownership volumes, frequent maintenance cycles, and strong consumer preference for online purchasing of car accessories and spare parts across urban regions.

Commercial Vehicles represent a steadily expanding sub-segment, supported by fleet digitization and cost optimization priorities. Moreover, logistics operators increasingly rely on online platforms for bulk procurement of standardized components. As a result, downtime reduction and price transparency drive gradual adoption of e-tailing channels within commercial vehicle maintenance ecosystems.

Two-Wheeler demand continues to gain traction through online channels due to rising urban mobility and delivery fleet expansion. Additionally, affordability of parts and ease of comparison encourage younger consumers to purchase two-wheeler components digitally. Consequently, e-tailing platforms strengthen category depth for this fast-moving vehicle segment.

By Components Analysis

Infotainment dominates with 31.2% driven by rising demand for connected and in-vehicle digital features.

In 2025, Infotainment held a dominant market position in the By Components Analysis segment of Automotive E-Tailing Market, with a 31.2% share. Growth reflects increasing consumer upgrades toward navigation, connectivity, and in-car entertainment systems, supported by clear online specifications and compatibility tools.

Interior Accessories benefit from personalization trends and lifestyle driven vehicle customization. Moreover, online platforms enable broader design choices and price comparison. Therefore, seat covers, lighting, and interior trims remain popular impulse purchase categories within automotive e-commerce channels.

Engine Components maintain stable online demand due to replacement requirements and aging vehicle fleets. However, buyers emphasize authenticity and fitment accuracy. Consequently, platforms offering verified listings and technical documentation gain higher trust among repair professionals and experienced consumers.

Tires and Electrical Products continue expanding online due to improved logistics handling and simplified returns. Additionally, consumers increasingly rely on reviews and ratings to evaluate performance. As a result, these categories steadily strengthen their presence across digital automotive storefronts.

By Vendor Analysis

Third-Party Vendor dominates with 61.8% supported by broad assortment and competitive pricing strategies.

In 2025, Third-Party Vendor held a dominant market position in the By Vendor Analysis segment of Automotive E-Tailing Market, with a 61.8% share. This leadership stems from extensive product availability, multi-brand compatibility, and aggressive online pricing across aftermarket platforms.

OEM Vendor participation continues to expand gradually through direct-to-consumer initiatives. Moreover, OEMs focus on digital channels to protect brand integrity and ensure part authenticity. Therefore, OEM-led e-tailing strengthens trust among warranty focused buyers and premium vehicle owners.

By Product Label Analysis

Branded products dominate with 69.6% due to stronger trust, quality assurance, and regulatory compliance.

In 2025, Branded products held a dominant market position in the By Product Label Analysis segment of Automotive E-Tailing Market, with a 69.6% share. Buyers increasingly prioritize certified quality, warranty coverage, and long-term reliability when purchasing automotive parts online.

Counterfeit products remain present but face growing regulatory scrutiny and platform controls. Additionally, enhanced traceability systems reduce visibility of unverified listings. As a result, consumer awareness and enforcement measures gradually limit counterfeit penetration within organized automotive e-tailing ecosystems.

Key Market Segments

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheeler

By Components

- Infotainment

- Interior Accessories

- Engine Components

- Tires

- Electrical Products

By Vendor

- OEM Vendor

- Third-Party Vendor

By Product Label

- Branded

- Counterfeit

Drivers

Rapid Expansion of Digital Automotive Marketplaces With Integrated Parts Compatibility Tools Drives Market Growth

The automotive e-tailing market continues to expand as digital automotive marketplaces become more advanced and user friendly. Platforms now offer integrated parts compatibility tools that allow customers to match components accurately with their vehicle make, model, and year. This reduces buying errors and builds confidence among vehicle owners purchasing online. this technical reassurance plays a major role in shifting demand away from traditional brick-and-mortar stores.

Another strong driver is the increasing preference for contactless purchasing of vehicle components and accessories. Consumers value the ability to compare products, place orders, and receive deliveries without visiting physical outlets. This behavior strengthened after periods of mobility restrictions and remains embedded due to convenience and time savings. As a result, online channels continue gaining share across both replacement and aftermarket segments.

Rising penetration of smartphones and mobile payment platforms further accelerates market adoption. Easy access to apps, digital wallets, and buy-now-pay-later options simplifies transactions for vehicle owners. Additionally, growing price transparency and frequent discounting online attract cost-conscious consumers. Compared with offline auto parts retail, e-tailing platforms enable faster price comparison and promotional visibility, supporting sustained market growth.

Restraints

High Incidence of Counterfeit Automotive Components Restrains Market Expansion

One of the major restraints affecting the automotive e-tailing market is the high incidence of counterfeit and substandard components sold through online platforms. Customers often struggle to differentiate between genuine and fake parts, especially when sellers operate across borders. this creates trust issues that slow repeat purchases and limit adoption among cautious buyers.

Another restraint is the complexity of return management for large, heavy, or installation-sensitive auto parts. Items such as engines, transmissions, and suspension components involve high logistics costs and handling challenges. Returns often require repackaging, inspections, and reverse logistics coordination, which increases operational expenses for e-tailers. These difficulties discourage some platforms from expanding high-value categories online.

Additionally, improper installation risks further complicate returns. Customers may damage parts during installation attempts, leading to disputes over return eligibility. This creates friction between buyers and sellers and negatively impacts customer experience. As a result, some consumers continue relying on offline retailers that provide in-person guidance and installation support, slowing the overall pace of market expansion.

Growth Factors

Integration of AI-Driven VIN Matching Creates New Growth Opportunities

The integration of AI-driven vehicle identification number matching presents a strong growth opportunity for automotive e-tailing platforms. By accurately linking VIN data to compatible parts, platforms reduce incorrect purchases and improve customer satisfaction. Analysts view this as a critical step toward handling complex vehicle configurations at scale.

Expansion of same-day and hyperlocal delivery models also opens new opportunities, particularly for critical automotive components. Faster fulfillment supports urgent repair needs and increases competitiveness against local auto parts stores. As logistics networks mature, e-tailers gain the ability to serve professional mechanics and fleet operators more effectively.

Increasing OEM-led direct-to-consumer e-tailing platforms further strengthen market potential. OEMs use online channels to distribute genuine parts, improve brand control, and reduce counterfeit risks. At the same time, rising demand for electric vehicle-specific components through online channels creates a new revenue stream. As EV ownership grows, consumers increasingly rely on digital platforms to source specialized parts.

Emerging Trends

Adoption of Augmented Reality Tools Shapes Emerging Market Trends

Augmented reality tools are becoming a key trend in automotive e-tailing by enabling virtual fitment and product visualization. These tools help customers see how parts or accessories may look and fit on their vehicles, improving buying confidence. Analysts expect this technology to reduce return rates and enhance user engagement.

Subscription-based models for routine maintenance and consumables also gain traction. Products such as filters, wiper blades, and fluids are increasingly offered through recurring delivery plans. This supports predictable revenue for e-tail while offering convenience for vehicle owners.

Collaboration between e-tail and local service garages represents another important trend. Installation partnerships bridge the gap between online purchasing and offline service needs. Finally, expansion of cross-border automotive e-commerce continues as logistics processes become more streamlined. Improved customs handling and tracking systems allow platforms to serve international demand more efficiently, supporting long-term market evolution.

Regional Analysis

North America Dominates the Automotive E-Tailing Market with a Market Share of 45.8%, Valued at USD 32.8 Billion

North America holds the leading position in the Automotive E-Tailing Market, accounting for 45.8% of global demand and valued at USD 32.8 billion. This dominance is driven by high digital commerce penetration, strong aftermarket spending, and widespread adoption of online procurement by both consumers and repair networks. Mature logistics infrastructure further supports rapid order fulfillment and returns management.

Europe Automotive E-Tailing Market Trends

Europe represents a well established market supported by stringent vehicle safety regulations and high replacement part demand. Consumers increasingly rely on online channels for standardized components and accessories. Additionally, cross border e commerce and strong consumer protection frameworks continue to support steady digital aftermarket growth across the region.

Asia Pacific Automotive E-Tailing Market Trends

Asia Pacific is emerging as a high growth region due to expanding vehicle ownership and rapid smartphone adoption. Increasing digital payment usage and urbanization further accelerate online auto parts purchasing. Moreover, rising two wheeler and passenger car parc sizes strengthen long term e-tailing potential across developing economies.

Middle East and Africa Automotive E-Tailing Market Trends

The Middle East and Africa market shows gradual adoption driven by improving logistics networks and digital infrastructure investments. Demand is supported by growing vehicle imports and rising awareness of online automotive platforms. Consequently, organized e tailing gains traction in urban centers and commercial vehicle segments.

Latin America Automotive E-Tailing Market Trends

Latin America demonstrates growing interest in Automotive E-Tailing as internet access and digital commerce mature. Consumers increasingly seek price transparency and wider product selection online. As a result, online channels steadily complement traditional aftermarket distribution models across the region.

U.S. Automotive E-Tailing Market Trends

The U.S. market remains a key growth engine within North America, supported by high vehicle ownership and frequent replacement cycles. Strong consumer trust in online transactions and efficient last mile delivery drive continued adoption. Consequently, digital automotive retail maintains a central role in aftermarket sourcing behavior.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive E-Tailing Company Insights

Flipkart continues to strengthen its position in the global automotive e-tailing market by leveraging its large digital user base and advanced logistics ecosystem. The company focuses on expanding automotive parts and accessories categories while improving vehicle compatibility filters. From an analyst viewpoint, Flipkart’s data-driven merchandising and regional fulfillment strategy support higher order frequency and faster delivery expectations across emerging markets.

Wal-Mart Stores Inc. maintains a strong competitive edge by integrating its physical retail network with its growing online automotive marketplace. The company emphasizes omnichannel fulfillment models, enabling customers to order online and pick up in-store or receive home delivery. Analysts observe that Walmart’s pricing discipline and private-label automotive offerings enhance value perception and customer trust in online auto parts purchasing.

O’Reilly Automotive Inc. leverages its deep aftermarket expertise to expand digitally while preserving its service-oriented brand identity. The company prioritizes professional-grade parts availability and rapid fulfillment through its store network. From an analyst perspective, O’Reilly’s hybrid e-tailing model supports both DIY consumers and commercial repair shops, strengthening customer loyalty and repeat transactions.

Robert Bosch GmbH plays a strategic role in automotive e-tailing by focusing on OEM-quality components and technology-led differentiation. The company uses digital channels to distribute genuine parts, diagnostics, and EV-related solutions. Analysts note that Bosch’s strong brand credibility, combined with investments in digital catalogs and technical content, positions it well for long-term growth in premium and technologically advanced automotive segments.

Top Key Players in the Market

- Flipkart

- Wal-Mart Stores Inc.

- O’ Reilly Automotive Inc.

- Robert Bosch GmbH

- E-bay Inc.

- Continental AG

- Delticom AG

- Alibaba Group Holding Ltd

- AutoZone Inc.

- Advance Auto Parts Inc.

Recent Developments

- In May 2024, Keyloop completed the acquisition of ATG following the definitive agreement signed on 10 April 2024, strengthening its automotive technology portfolio with advanced omnichannel retail solutions and expanding its digital retail capabilities across global automotive markets.

- In Augst2024, Smart Eye announced a major new order for its Driver Monitoring System software, securing 35 new design wins and expanding deployment across 5 automotive OEMs, including Volvo Cars, Audi, Porsche, and General Motors, along with a new European mass-market OEM customer.

Report Scope

Report Features Description Market Value (2025) USD 71.7 billion Forecast Revenue (2035) USD 249.9 billion CAGR (2026-2035) 13.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Vehicle Type (Passenger Cars, Commercial Vehicles, Two-Wheeler), By Components (Infotainment, Interior Accessories, Engine Components, Tires, Electrical Products), By Vendor (OEM Vendor, Third-Party Vendor), By Product Label (Branded, Counterfeit) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Flipkart, Wal-Mart Stores Inc., O’ Reilly Automotive Inc., Robert Bosch GmbH, E-bay Inc., Continental AG, Delticom AG, Alibaba Group Holding Ltd, AutoZone Inc., Advance Auto Parts Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive E-Tailing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Automotive E-Tailing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Flipkart

- Wal-Mart Stores Inc.

- O' Reilly Automotive Inc.

- Robert Bosch GmbH

- E-bay Inc.

- Continental AG

- Delticom AG

- Alibaba Group Holding Ltd

- AutoZone Inc.

- Advance Auto Parts Inc.