Global Automotive Chromium Finishing Market Size, Share, Growth Analysis By Base Material (Metal,[ Steel, Aluminum, Others], Plastics), By Application (Decorative Chrome, Hard Chrome), By End-user (OEM, Aftermarket), By Vehicle (Passenger car, [LCV, HCV], Two-wheelers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172342

- Number of Pages: 311

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

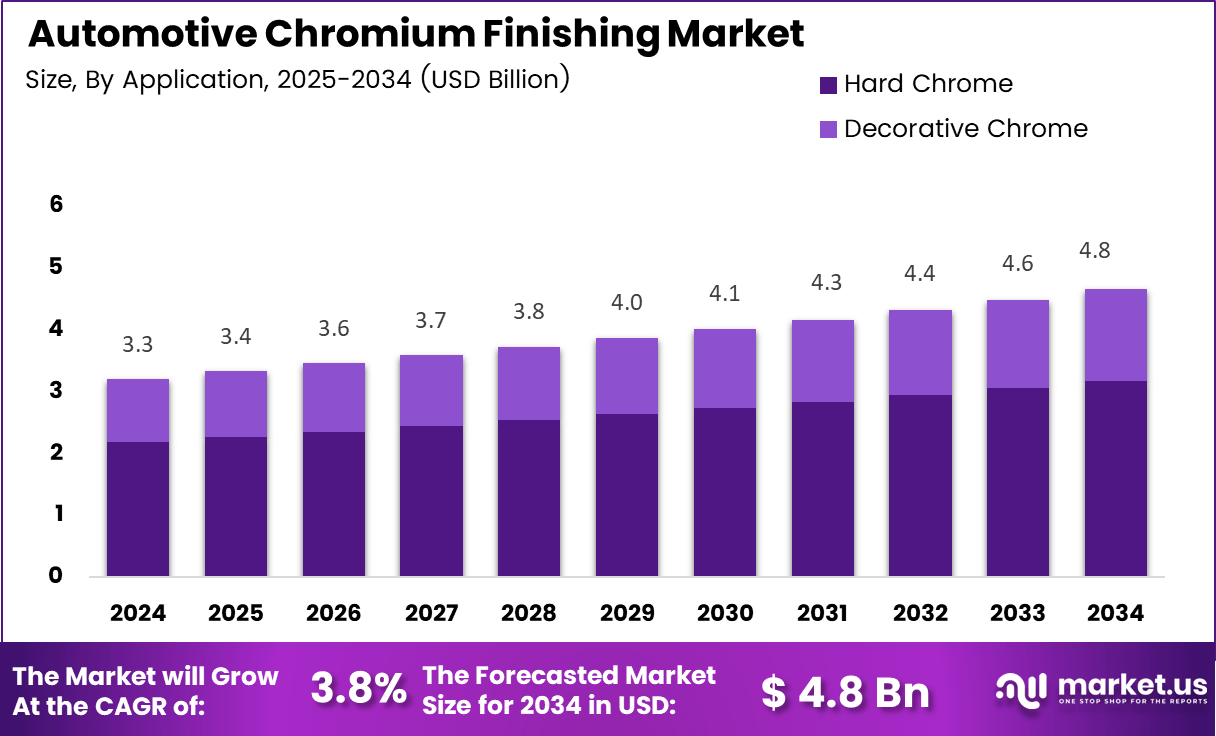

The Global Automotive Chromium Finishing Market size is expected to be worth around USD 4.8 bilion by 2034, from USD 3.3 billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

Automotive chromium finishing refers to the surface treatment process where chromium coatings enhance durability, corrosion resistance, and visual appeal of vehicle components. It is widely applied to trims, grilles, wheels, exhaust parts, and functional components. Consequently, this finishing supports both performance reliability and premium vehicle aesthetics across passenger and commercial segments.

From an analyst viewpoint, automotive chromium finishing continues evolving as automakers balance durability expectations with sustainability goals. Demand remains closely tied to vehicle production volumes and aftermarket refurbishment cycles. Moreover, rising consumer preference for long lasting finishes supports consistent adoption across exterior and interior automotive applications, particularly in regions with harsh climatic exposure.

The automotive chromium finishing market represents the commercial ecosystem supplying chemicals, equipment, and finishing services for chromium coated automotive components. Growth is supported by increasing vehicle parc size and replacement part demand. Additionally, surface finishing remains essential for extending component lifespan, reducing maintenance frequency, and preserving brand specific design identities.

Market growth opportunities increasingly emerge from electric vehicles and lightweight platforms. As manufacturers reduce base material thickness, chromium finishing helps restore wear resistance without compromising structural integrity. Furthermore, aftermarket customization trends encourage continued investment in decorative and functional chrome finishes, especially for premium and performance oriented vehicle categories.

Government investment and regulation significantly shape market direction. Environmental agencies across Europe, North America, and Asia increasingly restrict hazardous substances, encouraging shifts toward controlled and optimized chromium processes. Consequently, plating facilities invest in compliant infrastructure, waste treatment systems, and process monitoring technologies to align with occupational safety and environmental protection standards.

According to surface engineering expert Hoyer, electroplated chrome layers are approximately 100 times thicker than alternative coatings, reinforcing long term durability under automotive stress conditions. He further notes that traditional bath chemistry uses chromic acid and sulfate combinations, supporting consistent deposition quality across complex automotive geometries.

Additionally, according to Hoyer, chromium electroplating processes typically operate at controlled temperatures between 120°F and 140°F, ensuring coating adhesion and structural stability. These parameters highlight the process maturity supporting automotive scale production. As regulations tighten, optimized temperature control and chemistry management remain critical for compliant, high quality automotive chromium finishing operations.

Key Takeaways

- The global Automotive Chromium Finishing Market is projected to reach USD 4.8 billion by 2034, growing from USD 3.3 billion in 2024 at a CAGR of 3.8%.

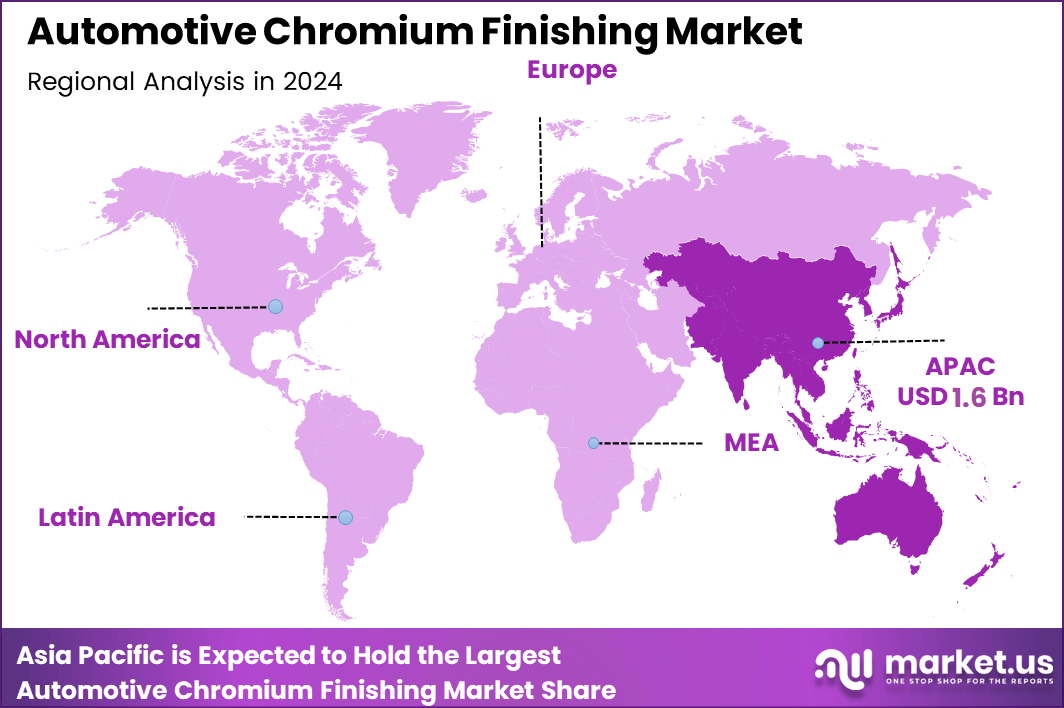

- Asia Pacific dominates the market with a 48.9% share, representing approximately USD 1.6 billion, driven by high automotive production and aftermarket demand.

- By base material, Metal leads the market with a dominant share of 78.3%, reflecting its strong compatibility with chromium finishing processes.

- By application, Decorative Chrome remains the largest segment, accounting for 66.2%, supported by premium vehicle styling and aesthetic demand.

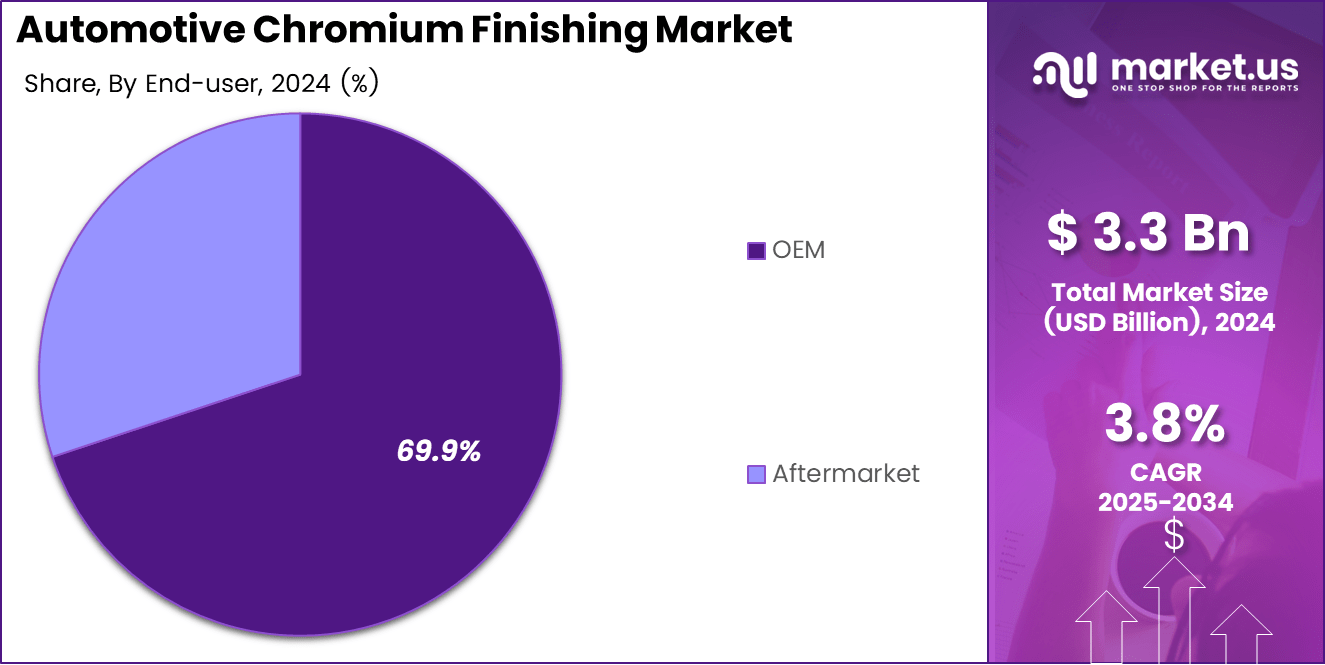

- By end user, OEMs hold a leading share of 69.9%, backed by large scale vehicle manufacturing and integrated finishing operations.

- By vehicle type, Passenger Cars dominate with a market share of 63.7%, aligned with higher production volumes and design focused chrome usage.

By Base Material Analysis

Metal dominates with 78.3% due to its superior durability, adhesion compatibility, and long-standing use in automotive chromium finishing applications.

In 2024, Metal held a dominant market position in the By Base Material Analysis segment of Automotive Chromium Finishing Market, with a 78.3% share. This dominance reflects strong reliance on metallic substrates for chrome finishing across structural and aesthetic components. Consequently, manufacturers favor metal due to proven corrosion resistance, surface hardness, and consistent plating outcomes.

Steel remains a widely used sub-segment within metal-based chromium finishing, supported by its high strength and cost efficiency. Moreover, steel components accept chrome layers effectively, enhancing wear resistance and visual appeal. As a result, steel continues to support steady demand across bumpers, trims, and functional automotive parts.

Aluminum chromium finishing continues to gain attention due to lightweight vehicle design trends. However, complex surface preparation requirements limit its broader adoption. Still, manufacturers increasingly apply chrome finishes on aluminum parts where weight reduction and premium appearance align with performance objectives.

Others and Plastics serve niche requirements within the market. While Automotive plastics require advanced metallization before chromium finishing, they support decorative applications. Meanwhile, other base materials address specialized components, contributing incremental value without challenging metal’s dominance.

By Application Analysis

Decorative Chrome dominates with 66.2% driven by rising consumer demand for visual enhancement and premium vehicle aesthetics.

In 2024, Decorative Chrome held a dominant market position in the By Application Analysis segment of Automotive Chromium Finishing Market, with a 66.2% share. This leadership reflects strong usage in exterior trims, grilles, logos, and interior accents. As styling differentiation grows, decorative finishes remain commercially essential.

Decorative chrome continues to benefit from personalization trends and premium vehicle positioning. Automakers increasingly use chrome accents to enhance brand identity and perceived vehicle value. Consequently, this segment maintains consistent demand across passenger and luxury vehicle categories.

Hard Chrome serves functional applications requiring wear resistance and durability. Although smaller in share, it plays a critical role in components exposed to friction and stress. Therefore, hard chrome supports performance-driven use cases such as shafts and mechanical parts.

By End-user Analysis

OEM dominates with 69.9% supported by large-scale production volumes and standardized chromium finishing integration.

In 2024, OEM held a dominant market position in the By End-user Analysis segment of Automotive Chromium Finishing Market, with a 69.9% share. This dominance reflects direct integration of chromium finishing during vehicle manufacturing. As a result, OEM demand remains structurally strong.

OEMs prioritize consistent quality, regulatory compliance, and design uniformity. Therefore, they rely on established chromium finishing suppliers for large-volume contracts. Additionally, long-term supplier relationships reinforce OEM coating market leadership.

The Aftermarket segment supports replacement, customization, and refurbishment needs. Although smaller in share, it benefits from vehicle aging and personalization trends. Consequently, aftermarket chromium finishing maintains stable demand without overtaking OEM dominance.

By Vehicle Analysis

Passenger car dominates with 63.7% reflecting higher production volumes and strong emphasis on aesthetics.

In 2024, Passenger car held a dominant market position in the By Vehicle Analysis segment of Automotive Chromium Finishing Market, with a 63.7% share. This dominance aligns with high global passenger vehicle output and frequent use of decorative chrome features.

LCV applications rely on chromium finishing for both functional and visual components. While aesthetics matter less than durability, chrome-coated parts enhance corrosion resistance. As a result, LCV demand remains steady across logistics and commercial fleets.

HCV adoption focuses on durability-driven chromium finishing for heavy-duty components. Chrome plating improves wear resistance under extreme conditions. Therefore, this segment contributes consistent but limited volume to the overall market.

Two-wheelers increasingly adopt chromium finishing for styling differentiation. Although smaller in scale, chrome usage enhances visual appeal and brand recognition. Consequently, this segment supports incremental market expansion.

Key Market Segments

By Base Material

- Metal

- Steel

- Aluminum

- Others

- Plastics

By Application

- Decorative Chrome

- Hard Chrome

By End-User

- OEM

- Aftermarket

By Vehicle

- Passenger Car

- LCV

- HCV

- Two-Wheelers

Drivers

Rising Demand for Corrosion Resistant and Wear Durable Automotive Components Drives Market Growth

Rising demand for corrosion resistant and wear durable exterior automotive components remains a key driver for automotive chromium finishing. Chromium coatings protect parts such as bumpers, trims, grilles, and exhaust components from rust, abrasion, and weather exposure. This durability supports longer service life and reduces frequent replacement needs for vehicle owners.

At the same time, growing preference for premium aesthetic finishes in passenger and luxury vehicles is strengthening demand. Chrome finished components provide a glossy, high quality appearance that enhances vehicle styling and perceived value. Automakers continue to use chromium finishes to differentiate models and attract design focused consumers.

Increased use of chromium coatings to extend component life in harsh driving environments also supports market growth. Vehicles operating in coastal regions, industrial zones, or extreme climates benefit from chrome’s resistance to moisture, chemicals, and road debris. This functional advantage makes chromium finishing a reliable choice for long term performance.

Moreover, expansion of global automotive production and rising replacement parts demand further fuel adoption. As vehicle fleets grow worldwide, demand for original equipment and aftermarket chrome finished components continues to increase steadily.

Restraints

Strict Environmental Regulations Limiting Chromium Usage Restrain Market Expansion

Strict environmental regulations limiting the use of hexavalent chromium processes represent a major restraint for the automotive chromium finishing market. Hexavalent chromium is classified as hazardous due to its toxicity, leading to tighter emission limits, usage restrictions, and mandatory reporting requirements across several regions.

High compliance and waste treatment costs for electroplating facilities further add pressure. Plating operations must invest in advanced filtration systems, wastewater treatment units, and worker safety measures. These added costs reduce profit margins, particularly for small and mid sized finishing service providers.

In addition, availability of alternative surface finishing technologies such as physical vapor deposition and powder coatings creates competitive challenges. These alternatives offer decorative appeal with lower environmental impact, encouraging some automakers to shift away from traditional chrome processes.

As regulatory scrutiny increases, approval timelines lengthen and operational complexity rises. This environment slows capacity expansion and discourages new entrants, limiting overall market growth momentum.

Growth Factors

Accelerating Shift Toward Eco Friendly Chromium Technologies Creates New Growth Opportunities

Accelerating shift toward trivalent chromium and eco friendly plating technologies presents strong growth opportunities. Trivalent chromium offers similar corrosion resistance and appearance while significantly reducing environmental and health risks. Adoption of these technologies allows manufacturers to comply with regulations without sacrificing performance.

Increasing demand for lightweight yet durable chrome finished parts in electric vehicles also supports opportunity growth. Electric vehicle designs require components that combine strength, corrosion resistance, and reduced weight. Advanced chromium finishing helps meet these requirements for exterior trims and functional parts.

Rising aftermarket customization trends across emerging automotive markets further expand opportunities. Vehicle owners increasingly seek chrome accessories for visual enhancement, driving demand for customized finishes and replacement components.

Additionally, technological advancements in automated and precision electroplating systems improve consistency, reduce material waste, and lower operational costs. These improvements make chromium finishing more efficient and attractive for modern automotive manufacturing.

Emerging Trends

Adoption of Sustainable and Digitally Controlled Chromium Finishing Solutions Shapes Market Trends

Adoption of sustainable chromium finishing solutions with reduced toxic emissions is a key trending factor. Manufacturers are prioritizing low emission processes, closed loop water systems, and safer chemical formulations to meet regulatory and customer expectations.

Integration of digital process control and automation in plating operations is also gaining traction. Automated monitoring systems improve coating thickness accuracy, reduce defects, and enhance production efficiency. Digital control supports better quality assurance across large scale automotive programs.

Growing use of chromium finishes for functional components beyond decorative applications reflects another trend. Chromium coatings are increasingly applied to suspension parts, engine components, and wear prone systems where durability is critical.

Furthermore, regional capacity expansion in Asia Pacific driven by automotive manufacturing hubs continues to influence market dynamics. Strong vehicle production growth in this region supports increased local demand for chromium finishing services and technologies.

Regional Analysis

Asia Pacific Dominates the Automotive Chromium Finishing Market with a Market Share of 48.9%, Valued at USD 1.6 billion

Asia Pacific leads the automotive chromium finishing market due to its strong automotive manufacturing base and high vehicle production volumes. In this region, the market accounted for a dominant share of 48.9%, with an estimated value of USD 1.6 billion, supported by rising demand for durable and visually appealing vehicle components. Rapid urbanization, increasing passenger vehicle ownership, and expanding aftermarket demand further strengthen regional growth. Cost competitive manufacturing and improving plating infrastructure also contribute to sustained market dominance.

North America Automotive Chromium Finishing Market Trends

North America represents a mature yet stable market driven by steady demand for corrosion resistant and high quality exterior automotive components. Strong replacement parts demand and long vehicle ownership cycles support consistent consumption of chromium finished products. Regulatory pressure encourages gradual adoption of cleaner chromium technologies, shaping technology upgrades. The region also benefits from advanced plating capabilities and a focus on premium vehicle aesthetics.

Europe Automotive Chromium Finishing Market Trends

Europe’s market growth is shaped by stringent environmental regulations and a strong focus on sustainable surface finishing practices. Demand remains steady for chromium finished components used in premium and performance vehicles. Manufacturers increasingly invest in compliant and efficient plating solutions to meet regulatory standards. The region’s emphasis on quality, safety, and design continues to support controlled market expansion.

Middle East and Africa Automotive Chromium Finishing Market Trends

The Middle East and Africa market is supported by growing vehicle parc size and rising demand for durable components suited for harsh climatic conditions. Chromium finishing is valued for its resistance to heat, sand, and corrosion, especially in exterior applications. Gradual expansion of automotive servicing and refurbishment activities also supports aftermarket demand. However, market growth remains moderate due to limited local plating capacity in some areas.

Latin America Automotive Chromium Finishing Market Trends

Latin America shows developing market characteristics driven by improving automotive production and increasing demand for replacement parts. Chromium finishing is widely used to extend component life under varied road and climate conditions. Economic recovery trends and gradual industrial investments support market stability. The region continues to offer long term growth potential as vehicle ownership rates rise.

U.S. Automotive Chromium Finishing Market Trends

The U.S. market is supported by strong aftermarket demand and a large installed vehicle base requiring replacement and refurbishment. Chromium finishing remains relevant for both decorative and functional automotive components. Regulatory compliance drives innovation toward safer and more efficient plating processes. Stable automotive output and consumer preference for premium finishes sustain consistent market activity.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Automotive Chromium Finishing Company Insights

Chromium Plating Company remains a notable player, leveraging extensive experience in decorative and functional chrome plating to serve diverse automotive OEM and aftermarket needs, with a particular focus on corrosion resistance and aesthetic quality.

Macdermid Enthone (Element Solutions, Inc.) brings strong formulation expertise to the market, enhancing coating performance through advanced chemical systems that support durability and consistent finish quality for high-end automotive components.

MICRO METAL FINISHINGhas carved a niche in precision finishing services, catering to manufacturers requiring tight tolerances and high surface integrity, which is increasingly valued in modern vehicle designs.

Chem Processing, Inc. continues to leverage its diversified plating technology portfolio to provide tailored solutions that balance environmental compliance with performance, addressing both decorative and engineered chromium finishing demands. These companies collectively underscore the importance of innovation, quality control, and regulatory alignment in sustaining market relevance.

Their competitive positioning is influenced by ongoing shifts toward eco-friendlier processes and automation integration, prompting investments in cleaner plating technologies and digital process controls. Companies that adapt their offerings to support lightweight materials and electric vehicle requirements are gaining traction. As environmental regulations tighten, firms with strong compliance frameworks and efficient waste management practices maintain resilience and attract partnerships with global automotive manufacturers.

Top Key Players in the Market

- Chromium Plating Company

- Macdermid Enthone (Element Solutions, Inc.)

- MICRO METAL FINISHING

- Chem Processing, Inc.

- American Electroplating Company

- Borough Ltd

- Custom Chrome Plating, Inc.

- Kakihara Industries Co., Ltd.

- Rotorua Electroplaters

- SARREL

- Okawa Asia Co., Ltd.

Recent Developments

- In January 2024, MacDermid Enthone Industrial Solutions, an Element Solutions Inc company, announced the acquisition of All-Star Chemical Company’s surface finishing and cleaning chemical solutions.This move expands MacDermid Enthone’s technology portfolio by integrating All-Star’s proprietary formulations into its global surface finishing offerings.

- In April 2025, Cooper Machinery Services completed the acquisition of the chroming assets of ICP Industries, LLC, including its proprietary hard chrome plating processes and operational infrastructure.The acquisition strengthens Cooper’s leadership position in the compression and engine systems market, particularly across power cylinder applications.

Report Scope

Report Features Description Market Value (2024) USD 3.3 billion Forecast Revenue (2034) USD 4.8 bilion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Base Material (Metal, [Steel, Aluminum, Others], Plastics), By Application (Decorative Chrome, Hard Chrome), By End-user (OEM, Aftermarket), By Vehicle (Passenger car,[LCV, HCV], Two-wheelers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Chromium Plating Company, Macdermid Enthone (Element Solutions, Inc.), MICRO METAL FINISHING, Chem Processing, Inc., American Electroplating Company, Borough Ltd, Custom Chrome Plating, Inc., Kakihara Industries Co., Ltd., Rotorua Electroplaters, SARREL, Okawa Asia Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Chromium Finishing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Chromium Finishing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Chromium Plating Company

- Macdermid Enthone (Element Solutions, Inc.)

- MICRO METAL FINISHING

- Chem Processing, Inc.

- American Electroplating Company

- Borough Ltd

- Custom Chrome Plating, Inc.

- Kakihara Industries Co., Ltd.

- Rotorua Electroplaters

- SARREL

- Okawa Asia Co., Ltd.