Global Automotive Chemicals Market Size, Share, Growth Analysis Report By Product Type (Material Plastics, Lubricants, Coatings, Adhesives, Cleaning Products, Others), By Application ( Two-Wheelers, Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (Aftermarket, Original Equipment Manufacturers (OEMs)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143388

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

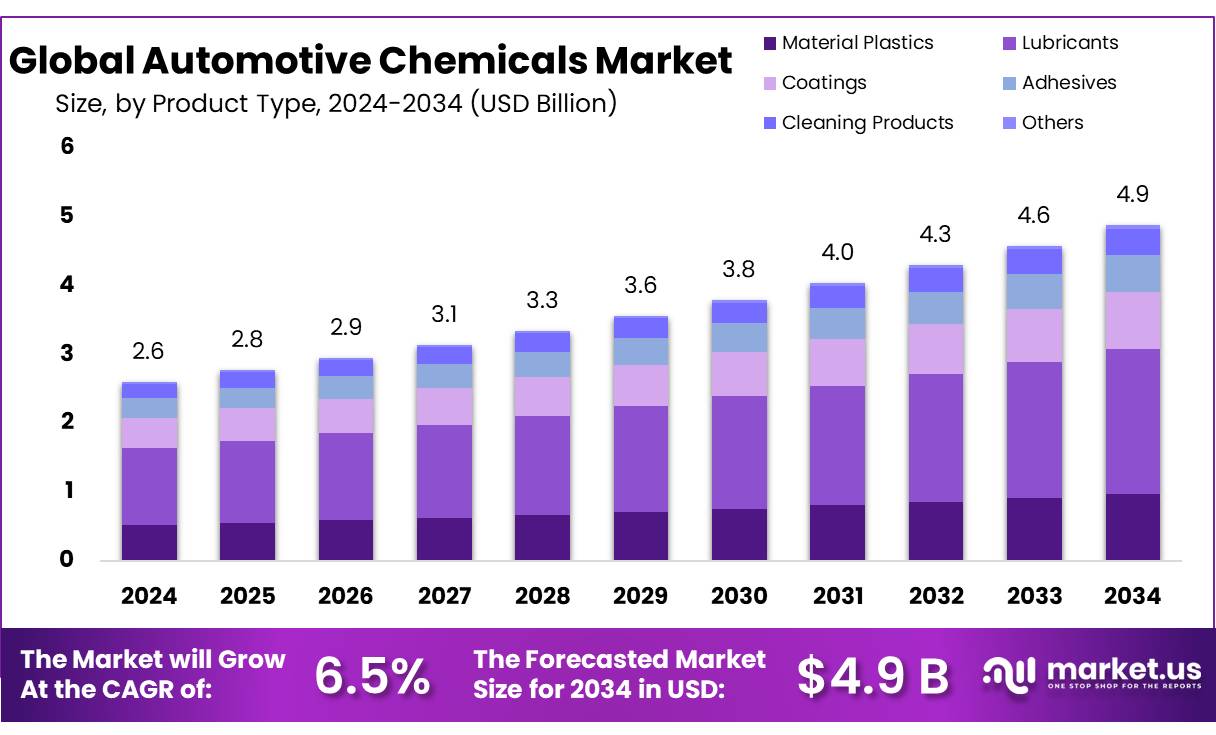

The Global Automotive Chemicals Market size is expected to be worth around USD 4.9 Bn by 2034, from USD 2.6 Bn in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

The automotive chemicals market plays a vital role in the global automotive industry by providing a wide range of essential products that improve vehicle performance, safety, and environmental sustainability. Automotive chemicals include lubricants, fuel additives, coolants, coatings, and various other products that support vehicle maintenance and production. These chemicals are critical in improving engine efficiency, reducing wear and tear, enhancing fuel economy, and meeting increasingly stringent environmental standards.

One of the primary drivers is the increasing demand for fuel-efficient and environmentally friendly vehicles. As governments around the world enforce stricter emissions regulations, manufacturers are increasingly turning to advanced automotive chemicals to reduce the environmental impact of vehicles.

For instance, in 2024, the European Union reported a 24% reduction in carbon dioxide emissions from new cars since 2015, largely attributed to the use of advanced automotive chemicals. Additionally, the global push toward electric vehicles (EVs) is reshaping the automotive chemicals market. With EVs gaining traction, the demand for specialized chemicals, such as those used in battery production and lightweight materials, is expected to rise significantly in the coming years.

Government initiatives and regulatory frameworks are also playing a crucial role in shaping the automotive chemicals market. In North America, the U.S. Environmental Protection Agency (EPA) continues to set stringent emissions standards for both conventional vehicles and electric vehicles, which is driving demand for cleaner and more efficient automotive chemicals.

Similarly, the European Union’s Green Deal, which aims to make the region climate-neutral by 2050, includes provisions for the promotion of bio-based and sustainable automotive chemicals. These regulatory pressures encourage manufacturers to innovate and develop chemicals that meet increasingly stringent environmental and performance standards.

As EV adoption accelerates, there is a growing need for specialized chemicals such as advanced lubricants, cooling fluids, and battery chemicals. According to the International Energy Agency (IEA), the global stock of electric cars surpassed 10 million in 2023, and this number is expected to grow rapidly, with electric vehicles potentially making up 30% of global vehicle sales by 2030. This transition to electric mobility is expected to create substantial demand for new chemical solutions that enhance EV performance and efficiency.

Key Takeaways

- Automotive Chemicals Market size is expected to be worth around USD 4.9 Bn by 2034, from USD 2.6 Bn in 2024, growing at a CAGR of 6.5%.

- Lubricants held a dominant market position, capturing more than a 43.10% share of the automotive chemicals market.

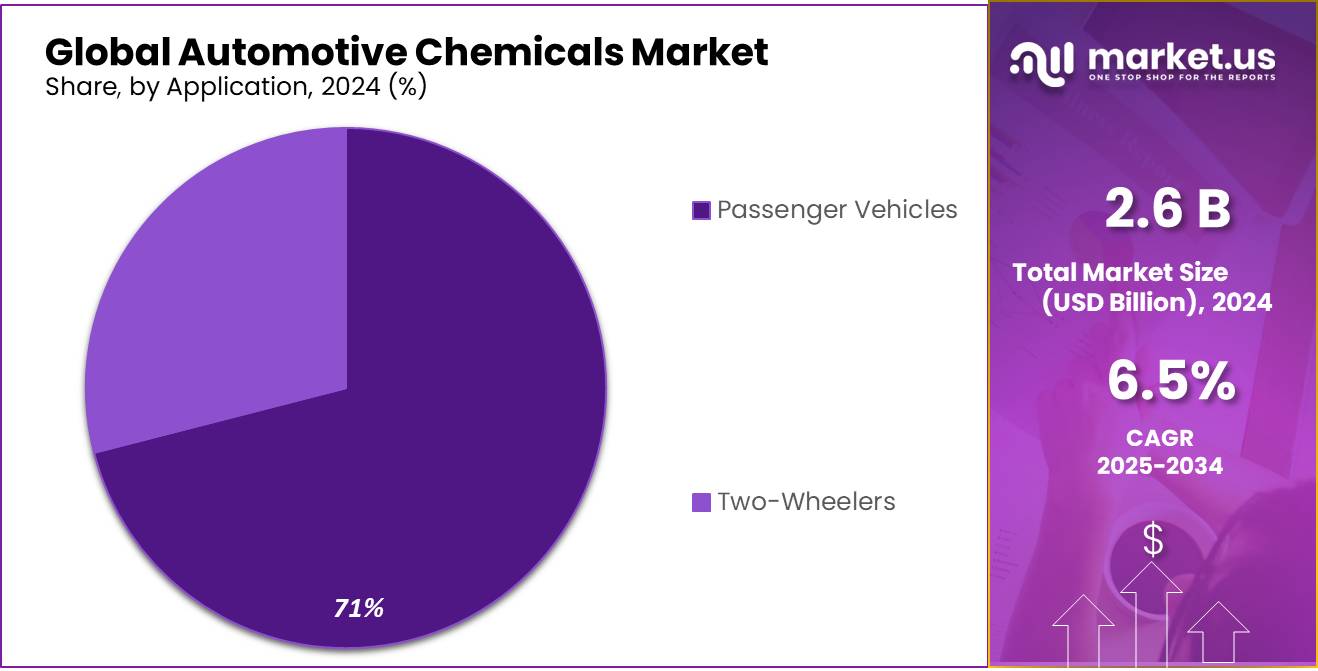

- Two-Wheelers held a dominant market position, capturing more than a 71.10% share.

- Original Equipment Manufacturers (OEMs) held a dominant market position, capturing more than a 61.20% share.

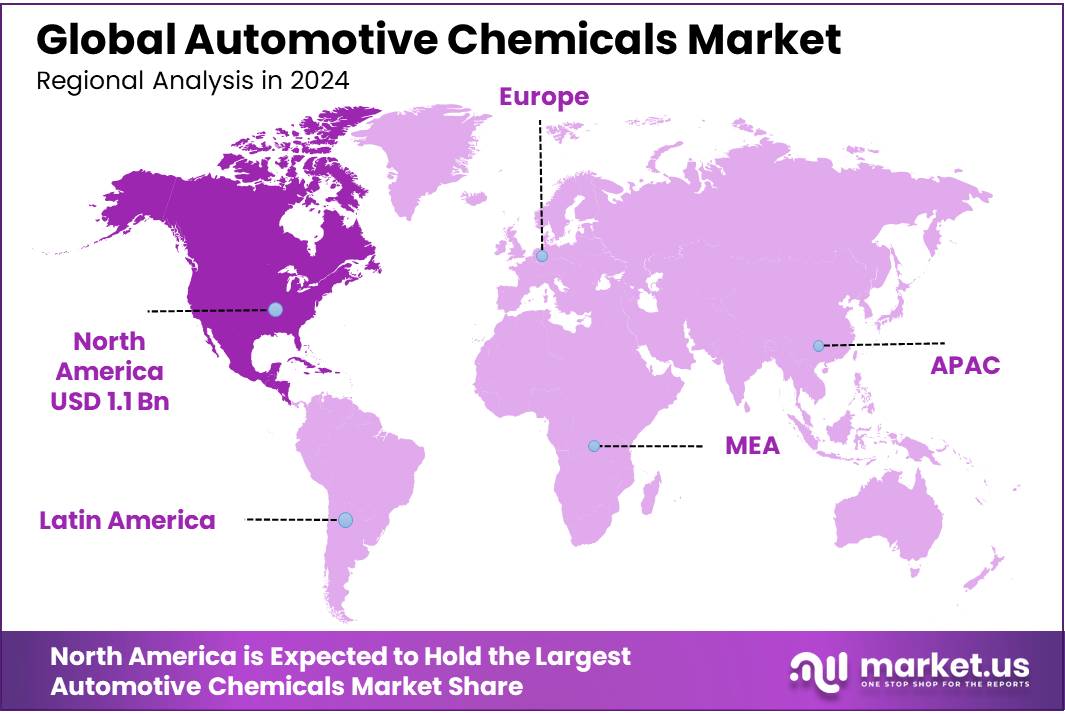

- North America dominated the automotive chemicals market, capturing a significant share of 43.60%, valued at approximately USD 1.1 billion.

By Product Type

Lubricants Lead the Automotive Chemicals Market with 43.10% Share in 2024

In 2024, Lubricants held a dominant market position, capturing more than a 43.10% share of the automotive chemicals market. This segment continues to be the largest due to the essential role lubricants play in reducing friction and wear in vehicle engines. As vehicle production and the demand for automotive maintenance increase, lubricants remain a crucial component in vehicle performance, driving the market’s growth. The demand for high-quality lubricants is expected to rise steadily, particularly in regions with growing automotive industries. By 2025, lubricants are projected to maintain their strong market position, reflecting ongoing advancements in engine technologies and the continuous need for vehicle maintenance and performance optimization.

By Application

Two-Wheelers Dominate the Automotive Chemicals Market with 71.10% Share in 2024

In 2024, Two-Wheelers held a dominant market position, capturing more than a 71.10% share of the automotive chemicals market. This segment continues to thrive due to the growing popularity of motorcycles and scooters, especially in emerging economies where they provide an affordable and efficient mode of transport. As urbanization increases and demand for two-wheelers rises, so does the need for automotive chemicals used in engine maintenance, fuel efficiency, and performance. In 2025, this trend is expected to continue, with the two-wheeler market maintaining a stronghold, driven by the demand for cost-effective and fuel-efficient vehicles.

By Sales Channel

OEMs Lead the Automotive Chemicals Market with 61.20% Share in 2024

In 2024, Original Equipment Manufacturers (OEMs) held a dominant market position, capturing more than a 61.20% share of the automotive chemicals market. This significant share is driven by the close relationship between OEMs and chemical suppliers, ensuring that the highest quality chemicals are used in the manufacturing of vehicles. As global vehicle production continues to grow, OEMs are expected to remain the largest sales channel for automotive chemicals. By 2025, OEMs are projected to sustain their lead, with an increased focus on producing advanced, eco-friendly chemicals for the next generation of vehicles.

Key Market Segments

By Product Type

- Material Plastics

- Polyurethane

- Polyvinyl Chloride

- Acrylonitrile Butadiene Styrene

- Polystyrene

- Polyethylene

- Polyoxymethylene

- Others

- Lubricants

- Engine oil

- Gear Oil

- Greases

- Penetration Lubricants

- Dry Lubricants

- Others

- Coatings

- Ceramic Paint Coating

- Paint Sealant

- Wax

- Polymer Coatings

- Graphene

- Adhesives

- Structural Adhesives

- Non-Structural Adhesive

- Heat-Cured Adhesives

- Room Temperature-Cured Adhesives

- Cleaning Products

- Waxes

- Polishes

- Vinyl Protectants

- Others

- Others

By Application

- Two-Wheelers

- Passenger Vehicles

- Light Commercial Vehicles

- Heavy Commercial Vehicles

By Sales Channel

- Aftermarket

- Original Equipment Manufacturers (OEMs)

Drivers

Growing Demand for Eco-Friendly and Fuel-Efficient Vehicles

One major driving factor for the automotive chemicals market is the increasing demand for eco-friendly and fuel-efficient vehicles. Governments worldwide have been implementing stricter regulations on emissions, encouraging automakers to develop cleaner and more efficient vehicles. This has led to a surge in the adoption of advanced automotive chemicals that help improve fuel efficiency and reduce harmful emissions.

Moreover, the global push towards electric vehicles (EVs) is also contributing to this trend. Governments like those in the U.S. and China are offering incentives and subsidies for EVs, promoting the use of clean technologies. For example, the U.S. government has set a target to have 50% of new vehicle sales be electric by 2030. This shift towards electric vehicles demands the development and use of specialized chemicals that enhance battery performance, lubricants, and materials for lightweight and durable vehicle components.

These regulations, along with consumer demand for sustainable and energy-efficient solutions, are expected to fuel the continued growth of the automotive chemicals market. By 2025, this trend will likely result in an even higher demand for chemicals that contribute to the efficiency, safety, and environmental sustainability of modern vehicles.

Restraints

High Production Costs of Automotive Chemicals

One major restraining factor for the automotive chemicals market is the high production costs associated with these chemicals, especially as manufacturers seek to meet increasingly stringent environmental regulations. The development of advanced, eco-friendly chemicals that help reduce emissions and improve fuel efficiency comes with a significant cost. These chemicals often require complex research and development, specialized manufacturing processes, and the use of expensive raw materials, all of which drive up the cost of production.

For example, the cost of producing high-performance lubricants and fuel additives has risen due to the need for cleaner ingredients that meet strict environmental standards. According to the American Chemistry Council (ACC), the cost of producing eco-friendly chemicals has increased by over 15% over the past five years, partly due to the high cost of compliance with regulations and the need for more advanced technologies.

This rising cost puts pressure on automotive manufacturers, especially smaller companies, as they have to balance environmental compliance with maintaining competitive pricing for their products. Additionally, consumers are often reluctant to pay a premium for vehicles using high-cost chemicals, further limiting the market growth.

Government initiatives aimed at reducing carbon emissions are also contributing to these high costs. In the U.S., for instance, the Environmental Protection Agency (EPA) has set forth stringent fuel efficiency standards, which require automakers to use advanced chemical solutions. While these regulations are crucial for environmental protection, they increase the financial burden on manufacturers who need to invest in specialized chemicals and technologies to meet the standards.

Opportunity

Rising Demand for Electric Vehicles (EVs) Presents Growth Opportunities

One of the most significant growth opportunities for the automotive chemicals market lies in the increasing adoption of electric vehicles (EVs). As more consumers and governments turn towards sustainable mobility solutions, the demand for EVs is set to accelerate, driving the need for specialized automotive chemicals. These chemicals are used in key components like batteries, lightweight materials, and lubricants that help optimize performance and efficiency in electric vehicles.

According to the International Energy Agency (IEA), the global stock of electric cars surpassed 10 million in 2023, marking a 60% increase from the previous year. This rapid growth is expected to continue, with some forecasts suggesting that by 2030, electric vehicles could make up 30% of global vehicle sales. As the number of EVs increases, so does the demand for chemicals that enhance battery performance, reduce vehicle weight, and improve overall energy efficiency.

In response to this growing trend, governments worldwide are actively supporting the transition to electric mobility. For example, the European Union has set a target of making at least 30 million electric cars a part of the EU’s vehicle fleet by 2030. In the U.S., the Biden administration has announced plans to provide $5 billion in funding to help expand the nation’s EV charging infrastructure, further boosting the market for EVs.

This shift presents a huge opportunity for automotive chemical manufacturers to supply innovative solutions specifically tailored for electric vehicles. As EVs use different chemical components compared to traditional internal combustion engine vehicles, the demand for new types of lubricants, cooling fluids, and lightweight materials is expected to rise sharply in the coming years. This presents an exciting opportunity for companies that can innovate and meet the specialized needs of the growing electric vehicle market.

Trends

Growing Focus on Sustainable and Bio-Based Automotive Chemicals

A major trend shaping the automotive chemicals industry is the growing emphasis on sustainable and bio-based chemicals. As environmental concerns continue to rise, automotive manufacturers are under increasing pressure to reduce their carbon footprint and switch to more eco-friendly alternatives. This trend is gaining momentum as governments around the world push for stricter regulations on emissions and environmental impact, and as consumers become more conscious of the environmental implications of their purchases.

The use of bio-based automotive chemicals—such as biodegradable lubricants, plant-derived plasticizers, and renewable raw materials for tires and other parts—has been steadily increasing. According to the U.S. Department of Energy, the shift towards bio-based chemicals is expected to grow by more than 20% annually, with the bio-based products market reaching $21 billion by 2025. This reflects a significant shift from traditional petrochemical-based products to those derived from renewable sources, driven by both regulatory pressures and consumer preferences for more sustainable options.

Government initiatives also play a key role in driving this trend. For instance, the European Union’s Green Deal, which aims to make the region climate-neutral by 2050, includes measures to promote the use of bio-based and renewable chemicals in various industries, including automotive. Additionally, in the U.S., the Department of Energy has been supporting research and development for bio-based chemicals, aiming to reduce dependency on fossil fuels and encourage the growth of a sustainable chemical industry.

As part of this shift, many automotive manufacturers are investing in technologies to develop greener, more sustainable chemicals. This includes innovations in bio-based lubricants, coatings, and adhesives that are safer for the environment and human health. The rising demand for these sustainable alternatives is expected to continue, making it one of the most significant trends in the automotive chemicals market.

Regional Analysis

North America Leads the Automotive Chemicals Market with 43.60% Share

In 2024, North America dominated the automotive chemicals market, capturing a significant share of 43.60%, valued at approximately USD 1.1 billion. This region remains a key player due to its robust automotive industry, which is one of the largest in the world. The demand for automotive chemicals in North America is driven by the continuous growth in vehicle production, the need for advanced maintenance solutions, and the increasing trend toward fuel efficiency and eco-friendly vehicles.

The United States, in particular, is a major contributor to the market, supported by ongoing innovation in automotive technology and stringent regulations on vehicle emissions. The U.S. government’s push towards sustainability, including the promotion of electric vehicles (EVs), has further boosted the demand for specialized chemicals, such as those used in batteries, lubricants, and lightweight materials. According to the U.S. Environmental Protection Agency (EPA), there has been a steady decrease in vehicle emissions, largely due to advancements in automotive chemicals, which have been crucial in meeting these regulatory standards.

Moreover, the North American automotive chemicals market benefits from significant investments in research and development, with manufacturers focusing on producing more efficient and environmentally friendly chemicals. As the market continues to embrace new technologies and greener solutions, North America is expected to maintain its dominant position, with the demand for automotive chemicals projected to grow in line with the increasing adoption of electric vehicles and advancements in automotive engineering. This trend is anticipated to sustain the region’s market leadership over the next few years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ExxonMobil is a global leader in the automotive chemicals market, providing a wide range of products including lubricants, additives, and fuels. The company is known for its innovative solutions that enhance engine performance and fuel efficiency. ExxonMobil’s focus on sustainability has led to the development of environmentally friendly products, aligning with growing global demand for cleaner energy solutions. The company continues to expand its market presence through strategic partnerships and investments in advanced chemical technologies.

Chevron Corporation is a major player in the automotive chemicals market, specializing in high-performance lubricants, fuels, and additives. The company is recognized for its strong focus on research and development, particularly in the area of advanced lubrication technology. Chevron’s automotive chemicals are designed to improve engine efficiency, reduce emissions, and enhance fuel economy. The company also emphasizes its commitment to sustainability, with a growing portfolio of eco-friendly products aimed at meeting the stringent regulations in various markets.

BASF SE is a leading supplier of automotive chemicals, offering a diverse range of products such as lubricants, coatings, and fuel additives. The company is renowned for its focus on innovation and sustainability, producing high-quality chemicals that enhance vehicle efficiency, performance, and environmental compatibility. BASF’s products are designed to meet the demands of both conventional and electric vehicles, positioning the company as a key player in the shift towards greener automotive technologies. Its extensive global network supports its market dominance.

TotalEnergies is a key player in the automotive chemicals market, providing advanced lubricants, fuel additives, and oils that enhance vehicle performance. The company is committed to sustainable development, developing products that reduce emissions and improve energy efficiency. TotalEnergies has a strong focus on innovation and has significantly invested in research to create more eco-friendly automotive chemicals. The company continues to strengthen its position in global markets by introducing environmentally conscious solutions aligned with regulatory standards.

Top Key Players

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell plc

- TotalEnergies

- BASF SE

- FUCHS Group

- The Dow Chemical Company

- BP plc

- Idemitsu Kosan Co., Ltd.

- Sinopec Corporation

- PPG Industries

- 3M Company

- Kao Corporation

- Jax Wax Inc.

- Malco Products Inc.

- Koch-Chemie GmbH

Recent Developments

ExxonMobil’s total earnings for 2024 reached $33.7 billion, with cash flow from operations amounting to $55.0 billion, underscoring the company’s robust position in the automotive chemicals market.

TotalEnergies maintained a strong financial position, ending the year with a gearing ratio below 10% and returning nearly 15% on average capital employed, the best among major competitors for the third consecutive year.

Report Scope

Report Features Description Market Value (2024) USD 2.6 Bn Forecast Revenue (2034) USD 4.9 Bn CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Material Plastics, Lubricants, Coatings, Adhesives, Cleaning Products, Others), By Application ( Two-Wheelers, Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (Aftermarket, Original Equipment Manufacturers (OEMs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ExxonMobil Corporation, Chevron Corporation, Royal Dutch Shell plc, TotalEnergies, BASF SE, FUCHS Group, The Dow Chemical Company, BP plc, Idemitsu Kosan Co., Ltd., Sinopec Corporation, PPG Industries, 3M Company, Kao Corporation, Jax Wax Inc., Malco Products Inc., Koch-Chemie GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Chemicals MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Chemicals MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ExxonMobil Corporation

- Chevron Corporation

- Royal Dutch Shell plc

- TotalEnergies

- BASF SE

- FUCHS Group

- The Dow Chemical Company

- BP plc

- Idemitsu Kosan Co., Ltd.

- Sinopec Corporation

- PPG Industries

- 3M Company

- Kao Corporation

- Jax Wax Inc.

- Malco Products Inc.

- Koch-Chemie GmbH