Global Automotive Catalysts Market By Material (Palladium, Platinum, Rhodium, and Others), By Type (Two-Way Catalysts, Three-Way Catalysts, Diesel Oxidation Catalysts (DOC), and Selective Catalytic Reduction (SCR)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), and Others), By Sales Channel (OEM, and Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160991

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

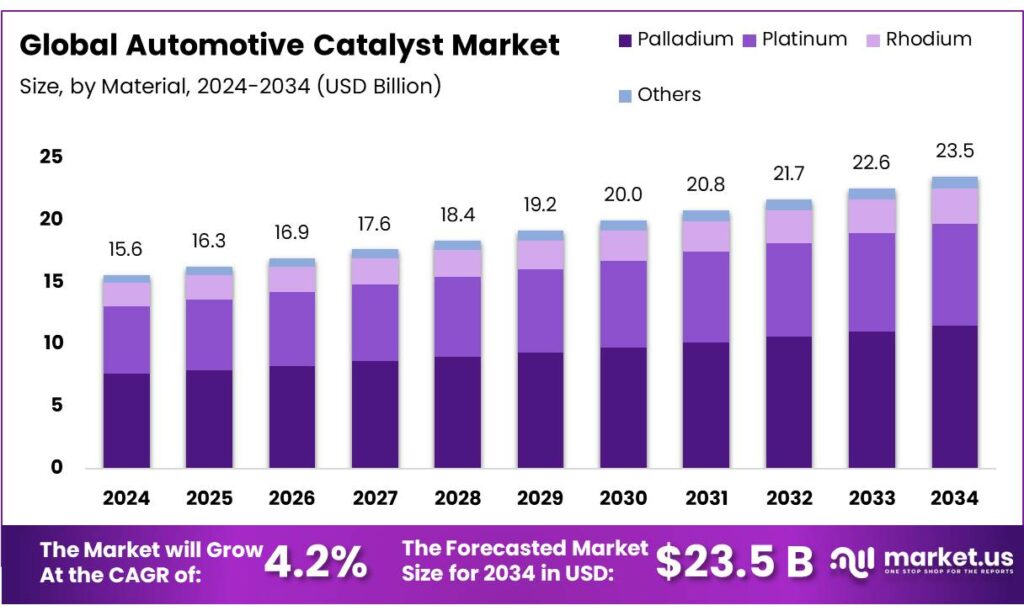

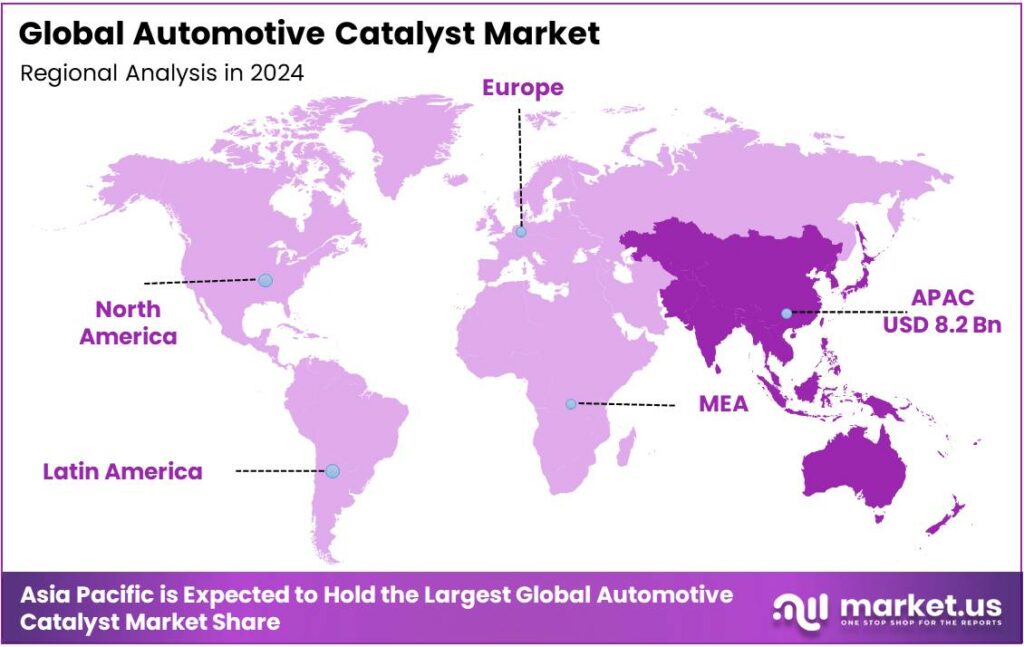

The Global Automotive Catalysts Market size is expected to be worth around USD 23.5 Billion by 2034, from USD 15.6 Billion in 2024, growing at a CAGR of 4.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 52.6% share, holding USD 8.2 Billion in revenue.

An automotive catalyst, more commonly known as a catalytic converter, is a device in a vehicle’s exhaust system that converts harmful pollutants from the engine into less toxic substances like water vapor, carbon dioxide, and nitrogen gas through chemical reactions. It works by passing exhaust gases over a honeycomb-like ceramic structure coated with precious metals, such as platinum, palladium, and rhodium, facilitating oxidation and reduction reactions that reduce atmospheric pollution and improve air quality.

These platinum group metals tend to have a very high cost, which pushes manufacturers to invest in research and development for the introduction of advanced materials. As there is a shift towards a sustainable economy, government regulations create more opportunities in the market. As regulations grow stricter and the demand for vehicles is high, there is a constant demand for automotive catalysts during the production of vehicles. Despite the constant demand, the extreme variability of operating conditions poses a significant challenge for automotive catalysts.

- More than 56% of platinum group metals (PGMs) have been used in the production of automotive catalytic converters over the past decade to minimize the adverse effects of exhaust emissions on environmental and human health by converting CO, HC, and NO in the exhaust gases to CO2, H2O, and N2.

Key Takeaways

- The global automotive catalysts market was valued at USD 15.6 billion in 2024.

- The global automotive catalysts market is projected to grow at a CAGR of 4.2% and is estimated to reach USD 23.5 billion by 2034.

- Based on the materials for automotive catalysts, palladium dominated the market in 2024, comprising about 48.9% share of the total global market.

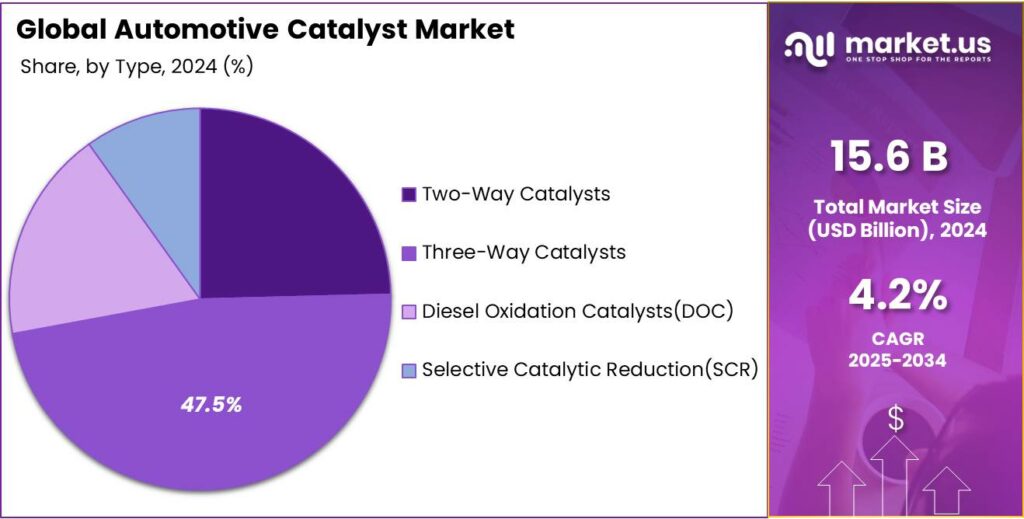

- On the basis of the types of automotive catalysts, three-way catalysts were at the forefront of the market in 2024, accounting for 47.5% share of the total global market.

- Among the types of vehicles, the passenger vehicle dominated the market in 2024, accounting for around 55.1% of the market share.

- In 2024, most automotive catalysts were sold to original equipment manufacturers (OEMS) as they are an essential component of every new vehicle at the point of production.

- Asia Pacific was the largest market for automotive catalysts in 2024, accounting for around 52.6% of the total global consumption.

Material Analysis

Palladium Automotive Catalysts were the Leading Segment in the Market.

On the basis of the materials for automotive catalysts, the market is segmented into palladium, platinum, rhodium, and others. Palladium-based automotive catalysts dominated the market in 2024 with a market share of 48.9%. They are more widely utilized, especially in gasoline engines, due to their high efficiency in oxidizing carbon monoxide (CO) and hydrocarbons at the higher temperatures typically found in such engines. In addition, palladium offers better thermal durability and is more resistant to poisoning from impurities such as sulfur compared to platinum in some environments.

Additionally, during periods when platinum prices surged higher than palladium, manufacturers increasingly shifted to palladium as a cost-effective alternative. Its performance balance, availability, and compatibility with modern engine technologies made it a preferred choice in three-way catalysts. While rhodium is extremely effective for NOx reduction, it is often used in combination with palladium or platinum due to its high cost and scarcity.

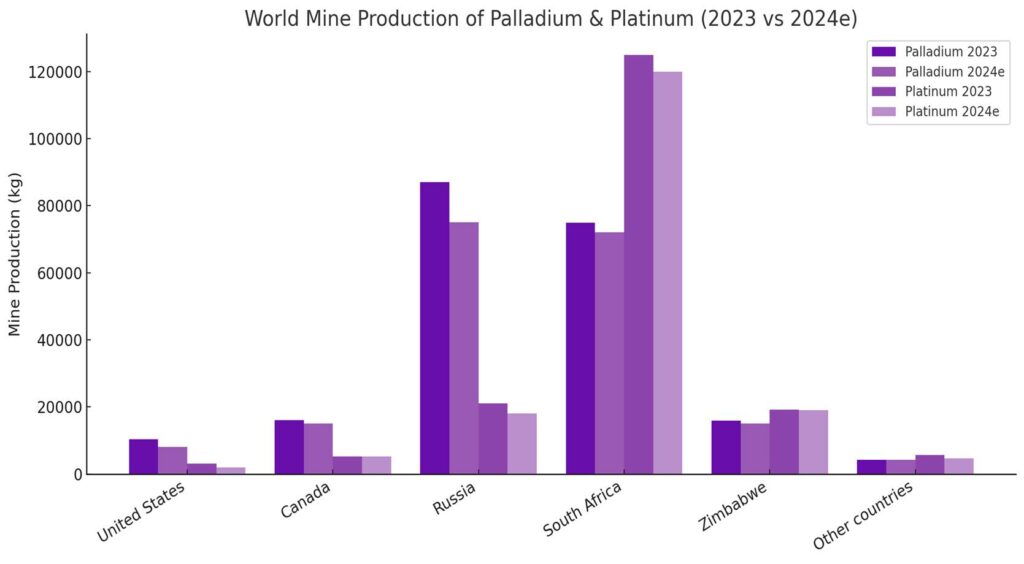

World Mine Production of Palladium And Platinum

Type Analysis

Three-Way Automotive Catalysts Dominated the Market in 2024.

Based on the types of automotive catalysts, the market is segmented into two-way catalysts, three-way catalysts, diesel oxidation catalysts (DOC), selective catalytic reduction (SCR), and others. The three-way automotive catalysts dominated the market in 2024 with a market share of 47.5%. Three-way automotive catalysts are more widely utilized as they are specifically designed to simultaneously reduce all three major pollutants emitted from gasoline engines, which are carbon monoxide (CO), unburned hydrocarbons (HC), and nitrogen oxides (NOx). Unlike two-way catalysts, which only target CO and HC, three-way catalysts also reduce NOx, making them far more effective at meeting modern emission standards.

Diesel engines, on the other hand, typically use diesel oxidation catalysts (DOC) and selective catalytic reduction (SCR) systems due to their different combustion characteristics and higher NOx output. However, for most passenger vehicles running on gasoline, three-way catalysts offer a simpler, more compact, and cost-effective solution, making them the dominant emission control technology in global light-duty vehicle fleets.

Vehicle Type Analysis

Passenger Cars That Used Automotive Catalysts Dominated the Market in 2024.

Based on the vehicle types, the market is segmented into passenger vehicles, commercial vehicles, and others. The passenger vehicles dominated the market in 2024 with a market share of 55.1%. More automotive catalysts are utilized by passenger vehicles primarily due to their significantly higher production and ownership numbers compared to commercial or specialized vehicles. In 2024, approximately 67.7 million passenger vehicles were produced compared to about 10 million commercial vehicles that were produced in the same year.

Passenger cars make up the majority of the global vehicle fleet, leading to greater cumulative emissions and, consequently, a higher demand for catalytic converters to meet environmental regulations. Additionally, these vehicles are subject to stricter emission standards in many countries, especially in urban areas where air quality concerns are more pressing. Furthermore, passenger vehicles typically operate more frequently and in diverse driving conditions, such as stop-and-go city traffic, where effective emission control is critical.

Sales Channel Analysis

OEM Sales Channel Emerged as a Leading Segment in the Automotive Catalysts Market.

Based on the sales channels, the market is divided into OEM and aftermarket. The OEM sales channel for automotive catalysts dominated the market in 2024 with a market share of 84.8%. Automotive catalysts are more commonly sold to Original Equipment Manufacturers (OEMs) than the aftermarket, as they are an essential component of every new vehicle to meet emission regulations at the point of production. Governments around the world require all new vehicles to be equipped with certified emission control systems, making catalysts a mandatory installation during manufacturing.

In addition, OEMs prefer integrated catalyst systems that are specifically designed to match the engine and exhaust configuration for optimal performance and regulatory compliance. In contrast, the aftermarket demand is limited to replacement needs, which occur only after years of use, damage, or failure. Furthermore, aftermarket catalysts often face stricter approval processes to ensure they meet the same standards as original parts, limiting their widespread use.

Key Market Segments

By Material

- Palladium

- Platinum

- Rhodium

- Others

By Type

- Two-Way Catalysts

- Three-Way Catalysts

- Diesel Oxidation Catalysts (DOC)

- Selective Catalytic Reduction (SCR)

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Others

By Sales Channel

- OEM

- Aftermarket

Drivers

Growing Demand for Vehicles Drives the Automotive Catalysts Market.

The increasing number of vehicles on the road is a major driver of the automotive catalysts market. As global populations grow and urbanization expands, demand for personal and commercial vehicles continues to rise.

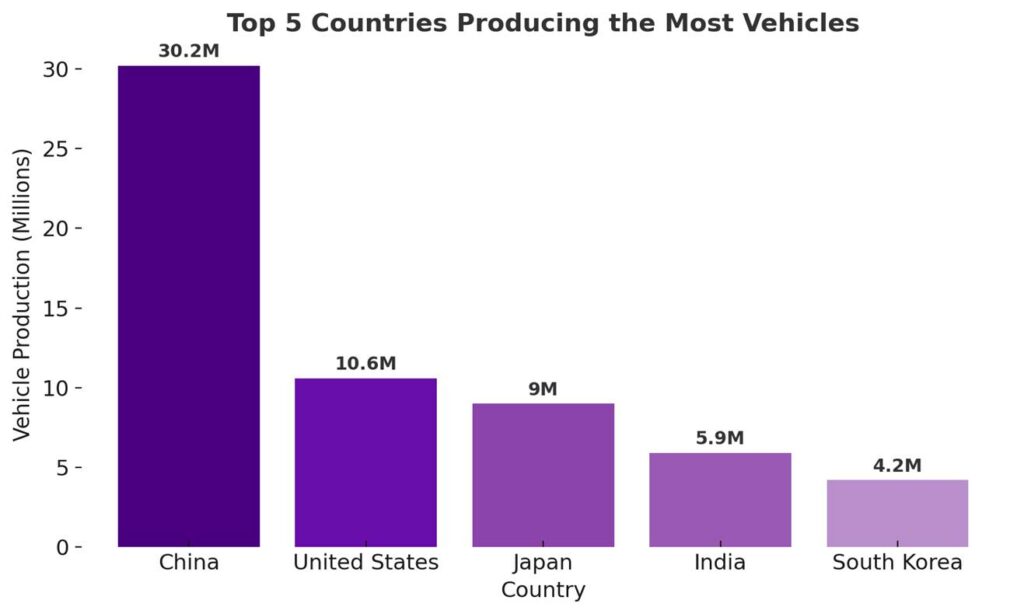

- According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 93 million vehicles were produced globally in 2024, a significant increase from 77.7 million units in 2020. This growing vehicle fleet directly correlates with higher emissions, pushing governments to enforce stricter environmental regulations.

Automotive catalysts, devices integrated into vehicle exhaust systems, are essential in reducing harmful gases such as carbon monoxide (CO), nitrogen oxides (NOx), and unburned hydrocarbons. For instance, in countries like India and China, where vehicle ownership has surged in recent years, mandating advanced catalyst technologies. With more vehicles on the road and a global shift toward cleaner air, the demand for effective catalytic converters continues to rise.

Restraints

Extreme Variability of Its Operative Conditions Poses a Significant Challenge for the Automotive Catalysts.

The extreme variability of operating conditions poses a significant challenge for automotive catalysts, as they must perform efficiently under a wide range of temperatures, engine loads, and fuel compositions. A catalyst in a vehicle experiences conditions that can vary from cold starts at -20°C to exhaust gas temperatures exceeding 900°C during high-speed driving. This wide temperature range affects the catalyst’s ability to convert harmful gases such as carbon monoxide (CO), nitrogen oxides (NOx), and unburned hydrocarbons into less harmful substances.

For instance, during cold starts, when emissions are at their peak, conventional catalysts are less effective as they require a certain light-off temperature to activate. According to the U.S. Environmental Protection Agency (EPA), up to 80% of total harmful emissions can occur in the first few minutes after engine ignition. Furthermore, driving behavior, fuel quality, and hybrid engine cycling add to the complexity. These variable conditions demand catalysts with fast activation, high thermal stability, and durability.

Opportunity

Regulatory Framework Creates Opportunities in the Automotive Catalysts Market.

The regulatory framework surrounding vehicle emissions plays a pivotal role in shaping opportunities within the automotive catalysts market. As governments worldwide intensify efforts to combat air pollution and climate change, stricter emission standards are being enforced, driving demand for advanced catalyst technologies.

- For instance, the European Union’s Euro 6 standard sets the maximum nitrogen oxide (NOx) emissions for diesel cars at 80 mg/km, a significant reduction from the previous Euro 5 limit of 180 mg/km.

Similarly, the United States follows Tier 3 standards, which aim to cut tailpipe and evaporative emissions substantially. This program lowers vehicle emissions of pollutants like NOx, PM, and CO and sets a new, lower gasoline sulfur standard to improve the effectiveness of vehicle emissions control systems.

Furthermore, emerging economies are tightening regulations around emissions. For instance, India’s shift from Bharat Stage IV to Bharat Stage VI was a leapfrogged transition, skipping BS-V, to align with Euro-VI standards and significantly reduce vehicle emissions. This involved adopting cleaner, ultra-low sulfur fuel, 10 ppm, mandating advanced exhaust after-treatment systems in vehicles to trap particulate matter and convert other pollutants, and requiring manufacturers to install more advanced engine management systems. These regulations compel automakers to upgrade catalytic converter systems in both gasoline and diesel engines, fostering innovation in catalyst materials like platinum, palladium, and rhodium. As standards evolve, they create continuous opportunities for catalyst manufacturers to develop cleaner, more efficient solutions.

Trends

Development of Advanced Catalyst Materials.

The development of advanced catalyst materials is an ongoing trend in the automotive catalysts market, driven by the need for higher efficiency, durability, and compliance with stringent emission standards. Traditional catalyst systems rely heavily on precious metals such as platinum, palladium, and rhodium, which are effective but expensive and scarce. To address these challenges, several companies are exploring alternatives such as nano-structured materials, mixed metal oxides, and zeolite-based catalysts that offer comparable or improved performance with lower metal content.

For instance, the advanced palladium-based catalysts can achieve over 90% conversion efficiency for carbon monoxide (CO) and hydrocarbons at lower temperatures, improving cold-start performance. Furthermore, automakers are investing in dual-layer catalysts and substrate innovations to enhance exhaust treatment under varied driving conditions. Additionally, with the rise of hybrid and plug-in hybrid vehicles, catalysts must function efficiently in intermittent engine operations, further driving innovation in material design. This trend supports both cost-effectiveness and environmental sustainability in the long term.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Automotive Catalysts Market.

Current geopolitical tensions are having wide‐ranging impacts on the automotive catalysts market, particularly through disruptions in the supply chain for platinum group metals (PGMs) such as palladium and platinum, which are essential for catalytic converters. For instance, Russia is responsible for around 40% of global mined palladium supply, making its role near‐critical in maintaining global availability. Sanctions, export restrictions, and trade financial barriers related to Russia’s involvement in conflicts with Ukraine have complicated procurement for automakers in Europe, North America, and the Asia Pacific.

Meanwhile, South Africa, which contributes over 80% of global platinum group metals (PCM) output, is facing operational challenges such as power shortages, infrastructure constraints, and weather‐related disruptions. For instance, in February 2025, a major mine in South Africa temporarily ceased production at one shaft after flooding under heavy rain, affecting about 10% of that mine’s monthly output. These threats increase costs, force companies to seek alternative sources, including recycling or substitution, hold larger inventories to buffer risk, and accelerate R&D into catalyst materials that use less of the most constrained metals.

Regional Analysis

Asia Pacific is the Largest Market for Automotive Catalysts.

Asia Pacific held the major share of the global automotive catalysts market, valued at around US$8.2 billion, commanding an estimated 52.6% of the total revenue share. The region is the largest market for automotive catalysts, largely due to its high vehicle production and increasingly stringent emission regulations. Countries such as China, India, Japan, and South Korea are among the top global vehicle manufacturers.

In 2022, China alone produced over 27 million vehicles, making it the world’s largest automobile producer. India followed with nearly 5.5 million units, while Japan produced around 7.8 million. This massive automotive output directly increases the demand for catalytic converters to control emissions. Additionally, the region is adopting stricter environmental policies, such as China 6 and Bharat Stage VI norms in India, which require advanced catalyst systems to meet low-emission targets.

For instance, Bharat Stage VI norms reduced permissible NOx emissions in diesel cars by nearly 70% compared to the previous standard. With rapid urbanization and rising vehicle ownership, particularly in developing economies, the need for effective emission control technologies has positioned the Asia Pacific as the dominant player in the automotive catalysts market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the automotive catalysts market are BASF SE, Johnson Matthey, Umicore, Cataler Corporation, Forvia SE, Cummins, Clariant, DCL International, Ecocat India, Tenneco, Interkat Catalyst GmbH, Heraeus Precious Metals, Klarius Products, N.E. Chemcat, and Heesung Catalysts. Several companies in the market are fixated on their research and development projects for the development of advanced catalyst materials.

One of the major part of their strategy is to partner and collaborate with the automotive manufacturers. These companies primarily focus on their expansion through building more manufacturing facilities to cater to the growing demand for automotive catalysts.

The major players in the industry

- BASF SE

- Johnson Matthey

- Umicore

- Cataler Corporation

- Forvia SE

- Cummins Inc.

- Clariant

- DCL International Inc.

- Ecocat India Pvt. Ltd.

- Tenneco, Inc.

- Interkat Catalyst GmbH

- Heraeus Precious Metals

- Klarius Products Ltd

- E. Chemcat

- Heesung Catalysts Corp.

- Other Players

Key Developments

- In May 2025, Honeywell announced that it had agreed to acquire Johnson Matthey’s catalyst technologies business segment for Euros 1.8 billion in an all-cash transaction.

- In March 2025, DCL International, part of the DCL Technology Group and a global leader in advanced catalytic technologies, launched an automotive catalyst for hydrogen peroxide (H₂O₂) decomposition.

Report Scope

Report Features Description Market Value (2024) USD 15.6 Bn Forecast Revenue (2034) USD 23.5 Bn CAGR (2025-2034) 4.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Palladium, Platinum, Rhodium, Others), By Type (Two-Way Catalysts, Three-Way Catalysts, Diesel Oxidation Catalysts (DOC), Selective Catalytic Reduction (SCR)), By Vehicle Type (Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Others), By Sales Channel (OEM, Aftermarket) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, Johnson Matthey, Umicore, Cataler Corporation, Forvia SE, Cummins, Clariant, DCL International, Ecocat India, Tenneco, Interkat Catalyst GmbH, Heraeus Precious Metals, Klarius Products, N.E. Chemcat, Heesung Catalysts, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Automotive Catalysts MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Catalysts MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- Johnson Matthey

- Umicore

- Cataler Corporation

- Forvia SE

- Cummins Inc.

- Clariant

- DCL International Inc.

- Ecocat India Pvt. Ltd.

- Tenneco, Inc.

- Interkat Catalyst GmbH

- Heraeus Precious Metals

- Klarius Products Ltd

- E. Chemcat

- Heesung Catalysts Corp.

- Other Players