Global Automotive Airbag and Seatbelt Market Size, Share, Growth Analysis By Airbag (Frontal, Knee, Side or Curtain), By Seatbelt (2-Point Seatbelt, 3-Point Seatbelt, Five-Point Seatbelt, Belt In Seat (BIS), Automatic Seatbelt), By Vehicle (Passenger Cars, Commercial Vehicles, Hybrid Electric Vehicle (HEV), Specialty Vehicles or Purpose Built Vehicles (PBVs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: May 2024

- Report ID: 73428

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

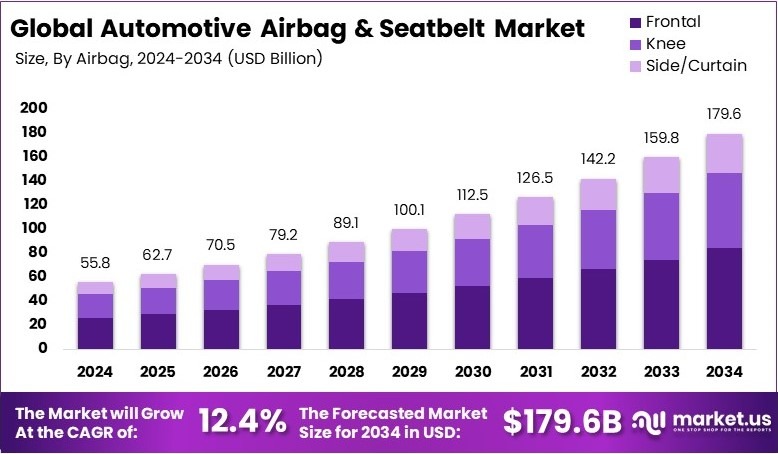

The Global Automotive Airbag and Seatbelt Market size is expected to be worth around USD 179.6 Billion by 2034, from USD 55.8 Billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034.

Automotive airbags and seatbelts are essential safety features in vehicles. Airbags inflate during a crash to protect passengers, while seatbelts secure occupants to reduce injury. These systems work together to enhance passenger safety. Governments and manufacturers continue improving these technologies to reduce accident fatalities and injuries.

The automotive airbag and seatbelt market includes companies that design, manufacture, and sell safety systems for vehicles. Market growth is driven by strict safety regulations, technological advancements, and increased vehicle production. Leading manufacturers focus on innovation, integrating smart airbags and advanced seatbelt systems for better protection.

According to the NHTSA, new rules require vehicles to include rear-seat belt reminders starting in September 2027. This regulation aims to save around 50 lives and prevent 500 injuries each year. Consequently, automotive airbag and seatbelt makers will likely experience increased demand, creating growth opportunities within the next few years.

Similarly, automatic emergency braking (AEB) systems must work effectively at speeds up to 62 mph by 2029, according to NHTSA guidelines. As a result, this advancement could save approximately 360 lives and avoid around 24,000 injuries annually. Therefore, the market for safety systems like airbags and seatbelts will further expand.

Additionally, strict safety laws directly boost demand for airbags and seatbelts. For example, automakers must comply with these new safety standards or face penalties. Hence, manufacturers specializing in vehicle safety products can anticipate steady business, especially those supplying innovative safety features to major automakers like Ford or Toyota.

However, market competition remains high among major safety-system providers, such as Autoliv and ZF Friedrichshafen. On the flip side, smaller companies can find opportunities by creating specialized or cost-effective safety technologies. For instance, a small company successfully developing affordable AEB sensors could attract significant market attention.

Finally, these regulations have positive impacts at both local and national levels. Specifically, safer vehicles reduce accident costs nationwide and decrease medical expenses for communities. In this context, government investments in road safety indirectly encourage growth for automotive airbag and seatbelt producers, benefiting the economy and public health alike.

Key Takeaways

- The Automotive Airbag and Seatbelt Market was valued at USD 55.8 billion in 2024 and is expected to reach USD 179.6 billion by 2034, with a CAGR of 12.4%.

- In 2024, Frontal Airbags led with 46.7%, owing to regulatory mandates and increasing safety awareness among consumers.

- In 2024, 3-Point Seatbelt dominated the seatbelt segment with 28.8%, driven by its superior restraint system and widespread adoption.

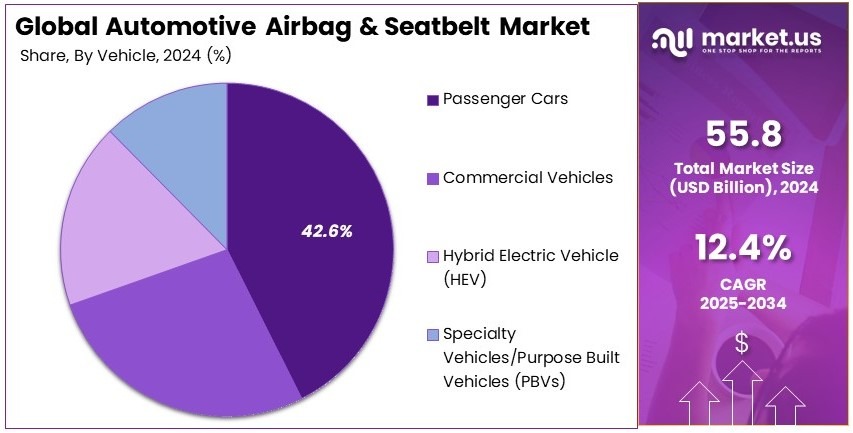

- In 2024, Passenger Cars accounted for 42.6% of the market, supported by increasing vehicle production and stringent safety standards.

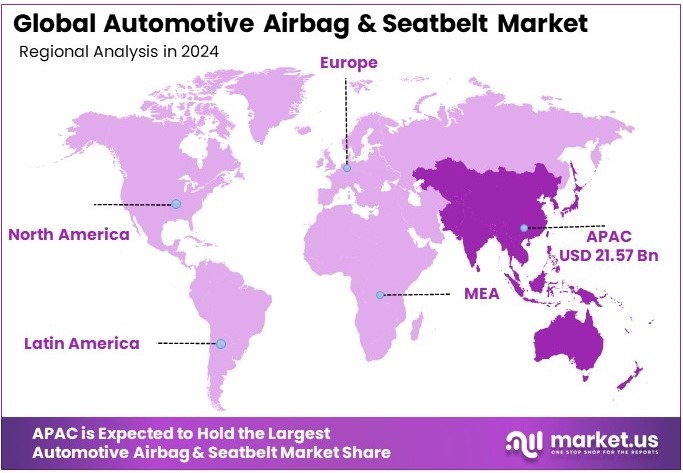

- In 2024, Asia Pacific held the largest share at 38.6%, contributing USD 21.57 billion, fueled by rising vehicle sales and safety regulations.

Airbag Analysis

Frontal airbags dominate with 46.7% due to their proven effectiveness in frontal collisions.

In the Airbag segment of the Automotive Airbag and Seatbelt Market, Frontal airbags lead significantly, holding a 46.7% market share. This dominance is attributed to their critical role in protecting occupants during frontal collisions, which are the most common type of vehicle accident. Frontal airbags have been standard in most vehicles due to stringent safety regulations, which have bolstered their adoption globally.

Knee airbags, although smaller in market share, provide added protection by reducing injuries to the lower extremities during severe impacts. Side and Curtain airbags are crucial for protecting the head and torso during side impacts and have seen increased implementation in vehicles as manufacturers aim to enhance side-impact safety ratings.

Seatbelt Analysis

3-Point Seatbelts lead with 28.8% due to their standardization and efficacy in securing occupants.

Seatbelts remain a fundamental safety feature in vehicles, with 3-Point Seatbelts dominating the market at 28.8%. Their design, which secures the upper and lower body, is critical in preventing occupant ejection during a crash. This type of seatbelt has become the standard due to its effectiveness, which is supported by decades of safety research and real-world evidence.

2-Point Seatbelts are mostly found in older models and less critical seating positions due to their simpler design, offering basic restraint. Five-Point Seatbelts are predominantly used in child safety seats and high-performance vehicles for enhanced security. Belt In Seat (BIS) and Automatic Seatbelts, though niche, are innovative alternatives focusing on improving user convenience and compliance.

Vehicle Analysis

Passenger Cars dominate with 42.6% driven by high production volumes and stringent safety norms.

The Vehicle segment is dominated by Passenger Cars, which account for 42.6% of the market in the Automotive Airbag and Seatbelt sector. This segment’s growth is fueled by the high volume of passenger car production and the stringent safety norms that mandate the inclusion of advanced safety systems like airbags and seatbelts. Passenger cars are the primary focus for many automakers due to their broad consumer base and the critical need for safety features to meet regulatory requirements.

Commercial Vehicles also incorporate these safety features, though the focus is more on durability and adaptability to different operational conditions. Hybrid Electric Vehicles (HEV) and Specialty Vehicles/Purpose Built Vehicles (PBVs) represent smaller, yet important segments that are increasingly adopting advanced safety measures to align with global sustainability and safety trends.

Key Market Segments

By Airbag

- Frontal

- Knee

- Side/Curtain

By Seatbelt

- 2-Point Seatbelt

- 3-Point Seatbelt

- Five-Point Seatbelt

- Belt In Seat (BIS)

- Automatic Seatbelt

By Vehicle

- Passenger Cars

- Commercial Vehicles

- Hybrid Electric Vehicle (HEV)

- Specialty Vehicles/Purpose Built Vehicles (PBVs)

Driving Factors

Stricter Safety Regulations and Technological Advancements Drive Market Growth

Governments worldwide are implementing stricter safety regulations, making airbags and seatbelts mandatory in vehicles. These laws push automakers to integrate advanced safety systems, increasing demand for airbags and seatbelts.

Rising consumer awareness is also playing a key role. More people now prioritize vehicle safety, leading to higher demand for crash protection features. Buyers actively look for models with advanced airbags and seatbelt systems, encouraging manufacturers to invest in safety technology.

Technological advancements further boost the market. Multi-stage and adaptive airbags provide better protection by adjusting deployment force based on crash severity. These innovations improve passenger safety and meet regulatory requirements.

Additionally, the rise of electric and autonomous vehicles is reshaping the industry. EVs and self-driving cars require advanced safety solutions to compensate for new structural designs and driving dynamics. Automakers are integrating intelligent airbag and seatbelt systems to enhance occupant protection.

Restraining Factors

High Costs and Integration Challenges Restrain Market Growth

The cost of advanced airbags and seatbelt systems is a major barrier to market growth. High-end safety technologies, such as multi-stage airbags and smart seatbelts, increase vehicle production costs. This makes them less accessible in budget-friendly car models, limiting market reach.

Another challenge is airbag deployment efficiency under extreme conditions. In very high or low temperatures, airbag sensors may not function optimally, affecting response time. Manufacturers must constantly refine their designs to ensure reliable performance in all environments.

Integration with autonomous vehicle technology adds further complexity. Self-driving cars require intelligent safety systems that work seamlessly with AI-based crash detection. Ensuring proper coordination between sensors, airbags, and seatbelts remains a technological challenge.

Product recalls also create setbacks. Defective airbags, sensor malfunctions, or seatbelt failures lead to recalls, damaging consumer confidence. High-profile incidents can slow market growth as buyers become wary of safety system reliability.

Growth Opportunities

Smart Airbags and Eco-Friendly Materials Provide Growth Opportunities

The development of smart airbags presents a major opportunity for the market. These airbags use sensors to detect crash intensity and passenger position, ensuring optimal deployment. Such innovations enhance safety and reduce injuries, attracting more consumers.

Emerging markets are also fueling demand for seatbelt reminder systems. Many developing countries are introducing stricter safety regulations, making seatbelt alerts mandatory. This is driving automakers to integrate advanced reminder features, boosting the market.

Expanding airbag production in low-cost regions is another key opportunity. Manufacturers are setting up production units in countries with lower labor and material costs. This move helps reduce expenses while meeting rising global demand for airbags and seatbelts.

Sustainability is also shaping market growth. Automakers are exploring bio-based and recyclable materials for airbags to reduce environmental impact. Using eco-friendly materials aligns with global sustainability goals and appeals to environmentally conscious buyers.

Emerging Trends

AI-Driven Crash Prediction and Inflatable Seat Belts Are Latest Trending Factors

Artificial intelligence (AI) is transforming airbag technology. AI-driven crash prediction systems analyze real-time data to anticipate collisions. This enables airbags to deploy faster and more accurately, reducing injury risks.

Seatbelt pretensioners are gaining popularity for improving passenger safety. These devices tighten seatbelts before a crash occurs, reducing forward movement and minimizing injuries. Automakers are increasingly integrating pretensioners into new vehicle models.

Another rising trend is the adoption of inflatable seat belts. These seat belts expand upon impact, distributing force more evenly across the passenger’s chest. They are especially beneficial for child safety, making them a preferred feature among family car buyers.

External airbags are also making waves in the industry. Designed for pedestrian safety, these airbags deploy outside the vehicle in the event of a collision. As urban traffic increases, automakers are investing in external airbags to protect pedestrians from serious injuries.

Regional Analysis

Asia Pacific Dominates with 38.6% Market Share

Asia Pacific leads the Automotive Airbag and Seatbelt Market with a 38.6% share, totaling USD 21.57 billion. This significant market presence is driven by high vehicle production rates, increasing safety regulations, and growing consumer awareness about vehicle safety.

The region’s robust automotive manufacturing infrastructure and rapid economic growth significantly contribute to its market dominance. The increasing adoption of new safety technologies by Asian automakers, coupled with government mandates for vehicle safety, further boost the demand for airbags and seatbelts.

Looking forward, Asia Pacific is expected to continue its dominance in the Automotive Airbag and Seatbelt Market. Increasing penetration of electric vehicles and advanced safety features in emerging markets is likely to enhance the region’s market share. The push towards higher safety standards across the region will also drive future market growth.

Regional Mentions:

- North America: North America is a strong competitor in the Automotive Airbag and Seatbelt Market, driven by stringent safety regulations and high consumer expectations for vehicle safety. The region’s advanced technological capabilities support ongoing innovations in safety features.

- Europe: Europe maintains a robust share in the Automotive Airbag and Seatbelt Market, supported by strict safety norms and the presence of leading automotive manufacturers. The region’s commitment to road safety continues to drive advancements in vehicle safety technologies.

- Middle East & Africa: The Middle East and Africa are gradually enhancing their presence in the Automotive Airbag and Seatbelt Market. Economic growth and increasing vehicle sales, coupled with rising awareness of vehicle safety, are primary drivers for the region.

- Latin America: Latin America’s market is growing due to improving economic conditions and stricter vehicle safety laws. The region is focusing more on enhancing vehicle safety features to reduce road fatalities, slowly driving up demand for airbags and seatbelts.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Automotive Airbag and Seatbelt Market is led by Autoliv, Inc., Continental AG, ZF Friedrichshafen AG, and Toyoda Gosei Co., Ltd. These companies hold the largest market shares due to their strong focus on safety innovations, regulatory compliance, and partnerships with major automakers.

Autoliv, Inc. is the global leader in automotive safety, specializing in airbags and seatbelt systems. Its commitment to reducing road fatalities through advanced safety solutions has cemented its position as the industry’s top player.

Continental AG is a key competitor, known for its cutting-edge seatbelt pre-tensioners and airbag control units. The company integrates intelligent safety technologies that improve vehicle occupant protection, making it a crucial supplier for major automakers.

ZF Friedrichshafen AG has a strong presence in passive safety systems, particularly airbags and seatbelt retractors. Its expertise in combining mechanical components with electronic safety solutions allows it to meet growing regulatory demands for enhanced vehicle safety.

Toyoda Gosei Co., Ltd. is recognized for its high-quality airbag modules and advanced seatbelt technologies. It focuses on lightweight and compact designs that improve vehicle efficiency without compromising safety.

These companies continue to lead by investing in new technologies such as smart airbags, adaptive seatbelt systems, and AI-driven crash detection solutions. As governments enforce stricter safety regulations, these key players are expected to expand their market influence.

Major Companies in the Market

- Autoliv, Inc.

- Continental AG

- Toyoda Gosei Co., Ltd.

- Joyson Safety Systems

- Robert Bosch GMBH

- ZF Friedrichshafen AG

- Hyundai Mobis Co., Ltd.

- Daicel Corporation

- ITW Automotive (Illinois Tool Works, Inc.)

- GWR Safety Systems, Inc.

- Others

Recent Developments

- Autoliv: On October 2024, Autoliv reported its third-quarter performance, with adjusted earnings per share (EPS) of $1.84 and revenues of $2.56 billion, reflecting a slight year-over-year decline of 0.8%. CEO Mikael Bratt emphasized the company’s strong performance in Europe and Asia (excluding China) and anticipated market share growth with Chinese original equipment manufacturers (OEMs).

- Stellantis: On February 2025, a London tribunal dismissed Stellantis’ €771 million lawsuit against Autoliv and ZF/TRW. Stellantis had accused the companies of inflating prices for seatbelts, airbags, and steering wheels through alleged cartel activities. The tribunal ruled that Stellantis failed to prove any overcharges resulting from cartel conduct.

Report Scope

Report Features Description Market Value (2024) USD 55.8 Billion Forecast Revenue (2034) USD 179.6 Billion CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Airbag (Frontal, Knee, Side/Curtain), By Seatbelt (2-Point Seatbelt, 3-Point Seatbelt, Five-Point Seatbelt, Belt In Seat (BIS), Automatic Seatbelt), By Vehicle (Passenger Cars, Commercial Vehicles, Hybrid Electric Vehicle (HEV), Specialty Vehicles/Purpose Built Vehicles (PBVs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Autoliv, Inc., Continental AG, Toyoda Gosei Co., Ltd., Joyson Safety Systems, Robert Bosch GMBH, ZF Friedrichshafen AG, Hyundai Mobis Co., Ltd., Daicel Corporation, ITW Automotive (Illinois Tool Works, Inc.), GWR Safety Systems, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Airbags and Seatbelts MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive Airbags and Seatbelts MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Autoliv, Inc.

- Continental AG

- Toyoda Gosei Co., Ltd.

- Joyson Safety Systems

- Robert Bosch GMBH

- ZF Friedrichshafen AG

- Hyundai Mobis Co., Ltd.

- Daicel Corporation

- ITW Automotive (Illinois Tool Works, Inc.)

- GWR Safety Systems, Inc.

- Others