Global Automotive 3D Printing Market Based on Application(Prototyping & Tooling, Research Development & Innovation, Production), Based on Technology(Stereo Lithography, Selective Laser Sintering, Electronic Beam Melting, Fused Deposition Modeling), Based on Materials(Metals, Plastic, Composites and Resins), Based on Vehicle Type(ICE Vehicles, Electric Vehicles), Based on Offering(Hardware, Software), Based on Component(Interior Components, Exterior Components), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: October 2024

- Report ID: 60731

- Number of Pages: 354

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Application Analysis

- Based on Technology Analysis

- Based on Materials Analysis

- Based on Vehicle Type Analysis

- Based on Offering Analysis

- Based on Component Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

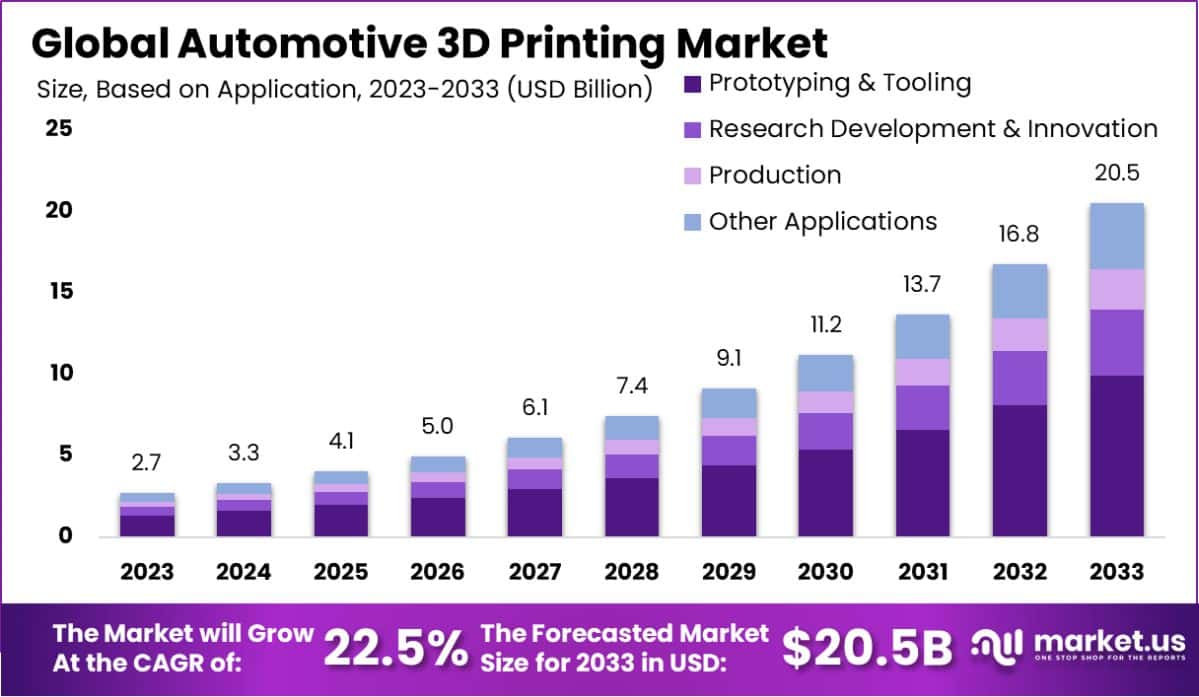

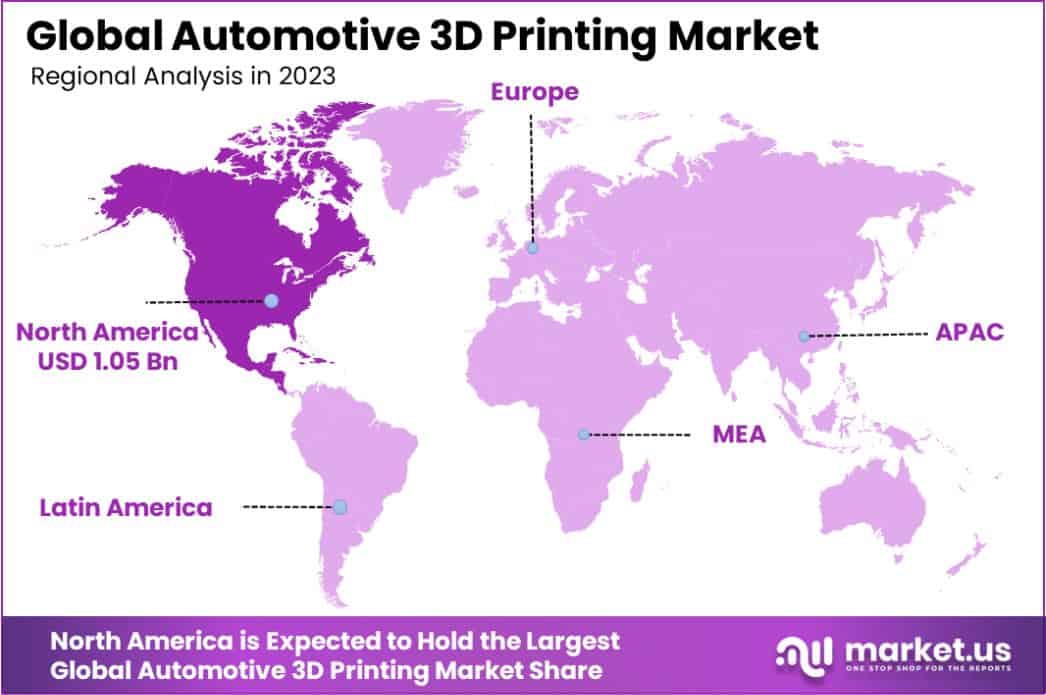

The Global Automotive 3D Printing Market size is expected to be worth around USD 20.5 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 22.5% during the forecast period from 2024 to 2033. North America dominated a 39.2% market share in 2023 and held USD 1.05 Billion in revenue from the Automotive 3D Printing Market.

Automotive 3D Printing refers to the use of three-dimensional printing technologies to manufacture automotive components directly from digital files. This process enables rapid prototyping, tooling, and the direct production of complex parts with enhanced precision and efficiency.

Automotive 3D printing reduces material waste, shortens design to production cycles, and allows for the creation of lighter and more complex structures that are otherwise difficult to achieve through traditional manufacturing methods.

The automotive 3D Printing Market encompasses the sales of 3D printers, materials, and related services used in the automotive industry. This market is driven by the growing demand for customized automotive parts, lightweight materials for better fuel efficiency, and advancements in printing technologies.

The market benefits significantly from the increasing adoption of electric vehicles, which require innovative smart manufacturing approaches to accommodate complex electrical architectures.

The growth of the Automotive 3D Printing Market is primarily fueled by the automotive industry’s need for faster product development cycles. Companies leverage 3D printing to rapidly prototype designs without the need for costly tooling and setup, significantly reducing the time and cost from design to production.

Demand within this market is driven by the push for greater fuel efficiency and performance in automotive design. 3D printing allows for the creation of complex, lightweight structures that traditional methods cannot produce, supporting the industry’s shift towards lightweight materials and more efficient, high-performance vehicles.

The future opportunities in the Automotive 3D Printing Market lie in expanding applications for production parts, particularly in luxury vehicles and sports cars, where customization and performance are critical. Additionally, as technology matures, there is significant potential for mass production applications, further revolutionizing how vehicles are manufactured.

In the swiftly evolving landscape of the global 3D Printing Market, recent developments underscore a significant influx of venture capital and strategic investments, reflecting robust confidence in the sector’s growth trajectory.

Notably, Fortius Metals has enhanced its capabilities in metal 3D printing through an additional $2 million in seed funding, culminating in a total of $5 million for the round, with noteworthy backing from industry giants such as Finindus and ArcelorMittal.

This move aligns with broader trends of integrating 3D printing in critical manufacturing processes, especially highlighted by the U.S. Department of Defense’s $4.5 million grant aimed at pioneering energy-efficient methods for producing ceramics vital for aerospace and defense applications.

Furthermore, the Massachusetts Technology Collaborative’s initiative, endorsed by Governor Maura Healey, has injected over $3.5 million into local manufacturing firms, bolstering the state’s economic resilience and technological stature.

Concurrently, Mosaic Manufacturing Ltd.’s recent $28 million financing underscores a shift towards the industrial adoption of automated 3D printing platforms, enhancing operational efficiencies across manufacturing floors.

Moreover, the investment landscape is further enriched by Chromatic 3D Materials and H3X, which have secured $6 million and $20 million respectively. These funds are earmarked for scaling production capabilities and expanding technological boundaries, particularly in high-power density electric motors.

Such strategic capital allocations not only reinforce the market’s vitality but also highlight the increasing integration of 3D printing technologies across diverse industrial sectors, promising revolutionary impacts on production methodologies and supply chain dynamics.

Key Takeaways

- The Global Automotive 3D Printing Market size is expected to be worth around USD 20.5 Billion by 2033, from USD 2.7 Billion in 2023, growing at a CAGR of 22.5% during the forecast period from 2024 to 2033.

- In 2023, Prototyping & Tooling held a dominant market position in the Based on Application segment of the Automotive 3D Printing Market, with a 48.2% share.

- In 2023, Fused Deposition Modeling held a dominant market position in the Based on Technology segment of the Automotive 3D Printing Market, with a 29.3% share.

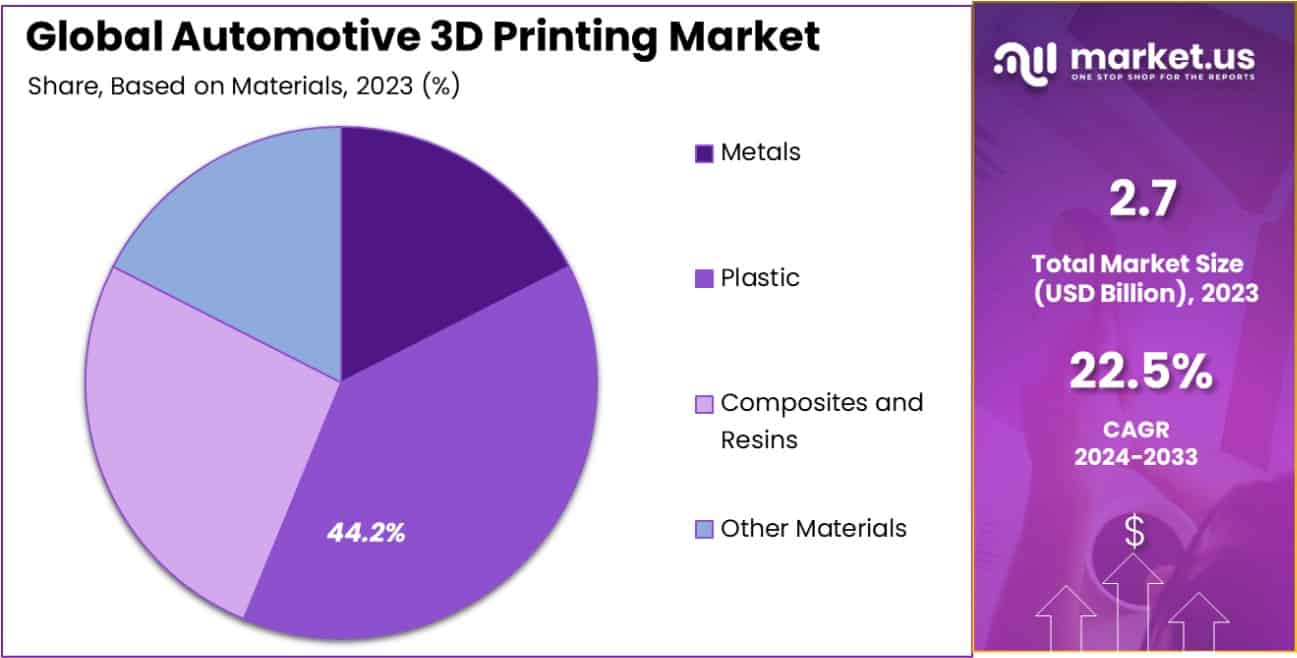

- In 2023, Plastic held a dominant market position in the Based on Materials segment of the Automotive 3D Printing Market, with a 44.2% share.

- In 2023, ICE Vehicles held a dominant market position in the Based on Vehicle Type segment of the Automotive 3D Printing Market, with a 56.1% share.

- In 2023, Hardware held a dominant market position in the Based on Offering segment of the Automotive 3D Printing Market, with a 57.2% share.

- In 2023, Exterior Components held a dominant market position in the Based on Component segment of the Automotive 3D Printing Market, with a 61.2% share.

- North America dominated a 39.2% market share in 2023 and held USD 1.05 Billion in revenue from the Automotive 3D Printing Market.

Based on Application Analysis

In 2023, Prototyping & Tooling held a dominant market position in the “Based on Application” segment of the Automotive 3D Printing Market, commanding a 48.2% share.

This substantial market penetration is attributed to the accelerated adoption of 3D printing for rapid prototyping and tooling across automotive manufacturers, seeking to reduce development time and cost while enhancing customization capabilities.

Following closely, the Research Development & Innovation application has emerged as a critical area, capturing a 26.3% market share. This segment benefits from the ongoing push towards integrating cutting-edge technologies to foster product innovation and improve material properties and production techniques.

The Production segment also shows significant activity, accounting for 18.5% of the market. Here, the focus is on employing 3D printing for final part production, which is increasingly being adopted to manufacture complex, lightweight automotive components that contribute to overall vehicle efficiency and performance.

Other Applications, encompassing various minor but emerging uses of automotive 3D printing such as repairs and small-scale manufacturing, hold a 7% share of the market. This segment is expected to grow as 3D printing technology continues to advance, offering broader applications within the automotive sector, and reinforcing the technology’s integral role in shaping future automotive manufacturing landscapes.

Based on Technology Analysis

In 2023, Fused Deposition Modeling held a dominant market position in the “Based on Technology” segment of the Automotive 3D Printing Market, with a 29.3% share. This technology is favored for its cost-effectiveness and versatility in creating durable automotive components. Fused Deposition Modeling is particularly advantageous for small-scale production and prototyping due to its simplicity and speed.

Stereo Lithography, the pioneer of 3D printing technologies, maintained a solid presence with a 22.1% market share. It is highly valued for producing high-precision and aesthetically superior prototypes. Selective Laser Sintering followed closely, accounting for 20.8% of the market, appreciated for its ability to fabricate complex parts without the need for support structures.

Electronic Beam Melting and Laminated Object Manufacturing captured smaller segments of 9.7% and 8.4%, respectively. These technologies are noted for their use in high-performance applications requiring materials that withstand extreme conditions.

Three-dimensional inkjet Printing held a 7.2% share, utilized for its multi-material printing capabilities, making it ideal for complex multi-functional parts. Other Technologies, encompassing emerging and niche 3D printing methods, accounted for the remaining 2.5% of the market, highlighting the continuous innovation within the automotive 3D printing landscape.

Based on Materials Analysis

In 2023, Plastic held a dominant market position in the “Based on Materials” segment of the Automotive 3D Printing Market, commanding a 44.2% share. This dominance is primarily due to plastics’ versatility and ease of use in 3D printing processes, alongside their cost-efficiency and ability to produce lightweight parts which are highly valued in automotive design for reducing vehicle weight and improving fuel efficiency.

Metals followed, representing a substantial portion of the market with a 21% share, driven by the demand for durable and heat-resistant components. Within this category, Stainless Steel and Titanium were notable for their use in high-performance automotive applications, capturing 7.5% and 6.8% market shares, respectively.

Aluminum and Metal Alloys also made significant contributions, with shares of 5.4% and 1.3% respectively, favored for their strength-to-weight ratio and corrosion resistance.

Other materials such as Acrylonitrile Butadiene Styrene, Polylactic Acid, and Nylon also featured prominently, collectively accounting for 13.3% of the market. These materials are selected for their specific properties such as durability, flexibility, and high-temperature resistance. Composites and Resins, which offer enhanced functionalities like improved thermal stability and mechanical properties, held a 5.5% share.

The segment of Other Materials, which includes emerging and specialized materials, rounded out the market with a 4.3% share, highlighting ongoing material innovations in automotive 3D printing.

Based on Vehicle Type Analysis

In 2023, ICE Vehicles held a dominant market position in the “Based on Vehicle Type” segment of the Automotive 3D Printing Market, with a 56.1% share.

This prominence reflects the ongoing substantial demand for internal combustion engine vehicles, which continue to benefit from 3D printing technologies, particularly in the prototyping, tooling, and production of complex engine components and lightweight structures.

The use of 3D printing in ICE vehicles significantly enhances efficiency and reduces production costs, thereby maintaining their competitive edge in the market.

Conversely, Electric Vehicles also represented a significant segment, capturing a 43.9% market share. The growth in this segment is driven by the automotive industry’s shift towards electric mobility and the need for highly specialized components that traditional manufacturing struggles to produce economically.

3D printing in electric vehicles is particularly instrumental in developing battery housings, custom electronics enclosures, and other bespoke components that are crucial for optimizing performance and efficiency. As the EV market continues to expand, the adoption of 3D printing technologies is expected to increase, reflecting broader trends toward sustainable and innovative automotive manufacturing solutions.

Based on Offering Analysis

In 2023, Hardware held a dominant market position in the “Based on Offering” segment of the Automotive 3D Printing Market, with a 57.2% share. This segment’s prominence is largely due to the critical need for advanced 3D printers and associated equipment capable of producing high-quality, precision parts essential for automotive manufacturing.

The demand for hardware is driven by its capacity to facilitate rapid prototyping, production of complex parts, and customization, which are integral to reducing time to market and enhancing product innovation in the automotive industry.

On the other hand, Software also plays a pivotal role, accounting for 42.8% of the market. Software solutions are essential for driving the capabilities of 3D printers, enabling detailed design and simulation before physical production.

The software segment includes advanced slicing platforms, simulation tools, and workflow optimization solutions that are key to maximizing the efficiency and quality of 3D printed components.

As the technology and applications of automotive 3D printing evolve, the integration of sophisticated software solutions that enhance the functionality and flexibility of 3D printing processes continues to be a significant area of growth and innovation within the market.

Based on Component Analysis

In 2023, Exterior Components held a dominant market position in the “Based on Component” segment of the Automotive 3D Printing Market, with a 61.2% share. This significant market share underscores the widespread adoption of 3D printing for manufacturing exterior parts, such as bumpers, panels, and complex aerodynamic components.

The technology’s ability to produce lightweight, durable, and geometrically intricate designs is highly valued for enhancing vehicle performance and fuel efficiency, which are critical factors in competitive automotive markets.

Interior Components also captured a substantial portion of the market, accounting for 38.8% of the segment. This area of the market is driven by the automotive industry’s increasing focus on customized and functional interiors that enhance passenger experience.

3D printing is instrumental in creating sophisticated dashboard components, ergonomic seats, and intricate console features. The flexibility of 3D printing allows manufacturers to innovate rapidly with designs that cater to evolving consumer preferences and stringent safety regulations.

As automotive design continues to prioritize both aesthetic appeal and functionality, the role of 3D printing in interior components is expected to grow, reflecting broader trends toward personalization and advanced manufacturing techniques in the industry.

Key Market Segments

Based on Application

- Prototyping & Tooling

- Research Development & Innovation

- Production

- Other Applications

Based on Technology

- Stereo Lithography

- Selective Laser Sintering

- Electronic Beam Melting

- Fused Deposition Modeling

- Laminated Object Manufacturing

- Three-Dimensional Inject Printing

- Other Technologies

Based on Materials

- Metals

- Stainless Steel

- Titanium

- Aluminium

- Metal Alloys

- Plastic

- Acrylonitrile Butadiene Styrene

- Polylactic Acid

- Nylon

- Composites and Resins

- Other Materials

Based on Vehicle Type

- ICE Vehicles

- Electric Vehicles

By Offering

- Hardware

- Software

By Component

- Interior Components

- Exterior Components

Drivers

3D Printing Drives Auto Innovation

The Automotive 3D Printing Market is experiencing significant growth, primarily driven by the automotive industry’s need for faster and more cost-effective production methods. This technology allows manufacturers to rapidly prototype new vehicle parts, reducing the time and expense associated with traditional prototyping and tooling.

3D printing supports the production of complex parts that are lighter yet more durable, which is critical for improving fuel efficiency and performance in modern vehicles. Additionally, the ability to customize parts easily and at relatively low costs is revolutionizing how manufacturers meet specific consumer demands and adapt to evolving market trends.

As this technology continues to advance, its integration into automotive production processes is expected to deepen, further driving efficiency and innovation in the sector.

Restraint

Challenges Limiting 3D Printing Adoption

Despite its growing popularity, the Automotive 3D Printing Market faces significant restraints that hinder its broader adoption. One of the main challenges is the high cost of 3D printing equipment and materials, which can be prohibitive for smaller manufacturers or those just beginning to explore this technology.

Additionally, there are technical limitations related to the size of printable components and the speed of production, which may not yet match the efficiencies of traditional manufacturing methods for large-scale production runs. Furthermore, the industry grapples with a shortage of skilled professionals who are proficient in 3D printing technologies.

This skills gap can slow down innovation and implementation of 3D printing in automotive manufacturing processes. These factors collectively pose challenges that must be addressed to fully leverage the potential benefits of 3D printing in the automotive sector.

Opportunities

Expanding Horizons in 3D Printing

The Automotive 3D Printing Market offers promising opportunities, particularly as the technology continues to evolve. The potential for increased adoption in the production of electric and autonomous vehicles stands out, where customized and complex components are essential.

3D printing enables the manufacturing of lightweight parts that are crucial for improving the range and efficiency of electric vehicles. Additionally, as sustainability becomes increasingly important, 3D printing offers an environmentally friendly solution by minimizing waste during the production process.

The technology’s ability to shorten development times and enhance product customization also opens new doors for automotive designers and manufacturers to innovate rapidly and efficiently.

As these trends gain momentum, the demand for 3D printing in the automotive sector is expected to rise, presenting significant growth opportunities in both mature and emerging markets.

Challenges

Navigating 3D Printing Market Hurdles

The Automotive 3D Printing Market is navigating through several challenges that could impact its growth trajectory. A major hurdle is the technical limitations associated with the quality and durability of printed components, which are often not on par with those produced by traditional manufacturing methods.

This raises concerns about the reliability and longevity of 3D-printed parts in critical automotive applications. Additionally, regulatory and safety standards specific to automotive parts are stringent and continuously evolving, making compliance a complex and ongoing challenge for manufacturers using 3D printing.

There is also a significant learning curve involved in adopting new technologies, requiring substantial investments in training and development. These challenges, combined with the high initial costs of setting up 3D printing facilities, create barriers that can slow down the adoption and optimization of 3D printing in the automotive sector.

Growth Factors

Key Growth Drivers in 3D Printing

The Automotive 3D Printing Market is witnessing robust growth driven by several key factors. Firstly, the technology’s ability to accelerate the design process and reduce manufacturing costs significantly boosts its adoption among automakers. This is crucial in a competitive industry where speed to market can be a game-changer.

Secondly, 3D printing facilitates the production of complex designs that are otherwise difficult or impossible to achieve with traditional manufacturing methods. This capability is particularly valuable for creating lightweight and more efficient vehicle components, aligning with the industry’s push towards sustainability and better fuel efficiency.

Additionally, the increasing demand for customized and high-performance automotive parts offers a vast potential for 3D printing technologies. As the automotive sector continues to evolve towards electric and autonomous vehicles, 3D printing is expected to play an even more critical role in the development and production of innovative vehicle components.

Emerging Trends

Emerging Trends in Auto 3D Printing

Emerging trends in the Automotive 3D Printing Market are shaping the future of automotive manufacturing. A significant trend is the increasing integration of artificial intelligence with 3D printing processes, which optimizes the design and manufacturing for efficiency and precision.

Another notable trend is the growing focus on sustainability; 3D printing reduces waste by using only the necessary materials for component production, supporting the industry’s shift towards greener manufacturing practices.

Additionally, there is a move towards using 3D printing for final part production, not just prototyping, as the technology advances and materials become more durable and cost-effective.

This shift is especially prevalent in the production of bespoke parts for luxury vehicles and customized modifications. These trends highlight the expanding capabilities and acceptance of 3D printing within the automotive sector, promising further innovations and enhancements in how vehicles are designed and built.

Regional Analysis

In the Automotive 3D Printing Market, regional dynamics significantly influence market penetration and growth trajectories. North America dominates the market with a 39.2% share, valuing approximately USD 1.05 billion, driven by robust technological advancements and substantial investments in R&D from major automotive and tech companies.

This region benefits from a well-established automotive industry and a strong culture of innovation, particularly in the U.S., which leads to the adoption of new technologies for automotive manufacturing.

Europe is closely, recognized for its stringent environmental regulations that encourage the adoption of sustainable and efficient manufacturing practices, including 3D printing. The region’s focus on reducing vehicle emissions and improving fuel efficiency has spurred the growth of 3D printing in lightweight automotive components.

Asia Pacific is emerging as a fast-growing region in this market due to the rapid expansion of automotive manufacturing capabilities in countries like China, Japan, and South Korea. These countries are investing heavily in 3D printing technologies to enhance their competitive edge and meet both domestic and global automotive demands.

Meanwhile, the Middle East & Africa, and Latin America are gradually adopting automotive 3D printing, with growth driven by increasing industrialization and the modernization of manufacturing practices. These regions present untapped potential due to growing technological investments and the increasing presence of automotive manufacturers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the global Automotive 3D Printing Market in 2023, three key companies—Autodesk Inc., Desktop Metal Inc., and EOS GmbH—have played pivotal roles in shaping the industry’s trajectory.

Autodesk Inc. stands out for its comprehensive suite of software solutions that cater to the design and simulation needs of automotive 3D printing. Autodesk’s offerings, particularly its AutoCAD and Fusion 360 platforms, provide powerful tools for 3D modeling and simulation, which are crucial for optimizing designs and reducing time-to-market for new automotive components.

Their software enables manufacturers to experiment with complex designs without the high costs associated with physical prototyping, making them a leader in innovation and design efficiency in the automotive sector.

Desktop Metal Inc. has revolutionized the market with its focus on metal 3D printing solutions. Their technology allows automotive manufacturers to produce metal parts more quickly and cost-effectively than traditional manufacturing methods.

In 2023, Desktop Metal’s production systems were highly sought after for their ability to produce lightweight, high-strength metal parts, which are essential for the next generation of energy-efficient vehicles.

Their advancements in metal 3D printing technologies are significantly lowering barriers for small and medium-sized enterprises to adopt these innovations.

EOS GmbH, a German engineering company, has been at the forefront of delivering high-quality 3D printing systems. Their expertise in providing durable and precise polymer and metal printing systems has made them a trusted partner for automotive manufacturers worldwide.

EOS’s laser sintering technologies are particularly valued for their reliability and the superior quality of the finished product, essential for both prototyping and end-part manufacturing in the automotive industry.

Collectively, these companies underscore a trend toward greater integration of 3D printing technologies in automotive manufacturing, driving innovation, sustainability, and efficiency in an increasingly competitive market.

Top Key Players in the Market

- 3D Systems Corporation

- Autodesk Inc.

- Desktop Metal Inc.

- EOS GmbH

- General Electric Company

- Hoganas AB

- Materialise NV

- Stratasys Ltd.

- Ultimaker BV

- Voxeljet AG

- ExOne Company

- Arcam AB

- Renishaw plc.

- HP

- com

- SLM Solutions Group AG

- Farsoon Technologies

- Sinterit

- Protolabs Electronics Pvt. Ltd.

- Nexa3D

- EPlus3D Tech GmbH

- Other Key Players

Recent Developments

- In May 2024, Voxeljet AG announced a partnership with a leading European car manufacturer to develop lightweight 3D-printed components for next-generation vehicles.

- In March 2024, Ultimaker BV secured $15 million in funding to advance its research and development in high-precision 3D printers for automotive applications.

- In January 2024, Stratasys expanded its market reach by launching a new 3D printer designed specifically for automotive parts, featuring enhanced speed and material range.

Report Scope

Report Features Description Market Value (2023) USD 2.7 Billion Forecast Revenue (2033) USD 20.5 Billion CAGR (2024-2033) 22.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Application(Prototyping & Tooling, Research Development & Innovation, Production, Other Applications), Based on Technology(Stereo Lithography, Selective Laser Sintering, Electronic Beam Melting, Fused Deposition Modeling, Laminated Object Manufacturing, Three-Dimensional Inject Printing, Other Technologies), Based on Materials(Metals(Stainless Steel, Titanium, Aluminium, Metal Alloys), Plastic(Acrylonitrile Butadiene Styrene, Polylactic Acid, Nylon), Composites and Resins, Other Materials), Based on Vehicle Type(ICE Vehicles, Electric Vehicles), Based on Offering(Hardware, Software), Based on Component(Interior Components, Exterior Components) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape 3D Systems Corporation, Autodesk Inc., Desktop Metal Inc., EOS GmbH, General Electric Company, Hoganas AB, Materialise NV, Stratasys Ltd., Ultimaker BV, Voxeljet AG, ExOne Company, Arcam AB, Renishaw plc., HP, com, SLM Solutions Group AG, Farsoon Technologies, Sinterit, Protolabs Electronics Pvt. Ltd., Nexa3D, EPlus3D Tech GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive 3D Printing MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample

Automotive 3D Printing MarketPublished date: October 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- 3D Systems Corporation

- Autodesk Inc.

- Desktop Metal Inc.

- EOS GmbH

- General Electric Company

- Hoganas AB

- Materialise NV

- Stratasys Ltd.

- Ultimaker BV

- Voxeljet AG

- ExOne Company

- Arcam AB

- Renishaw plc.

- HP

- com

- SLM Solutions Group AG

- Farsoon Technologies

- Sinterit

- Protolabs Electronics Pvt. Ltd.

- Nexa3D

- EPlus3D Tech GmbH

- Other Key Players