Automated Whole-Breast Ultrasound Market Analysis By Product Type (Automated Breast Ultrasound System, Automated Breast Volume Scanner), By Application (Evaluation, Breast Cancer Screening, Breast Lesion Detection, Monitoring and Follow-up, Others), By End-Use (Hospitals, DIagnostic Imaging Centres, Breast Health Clinics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Apr 2024

- Report ID: 83357

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

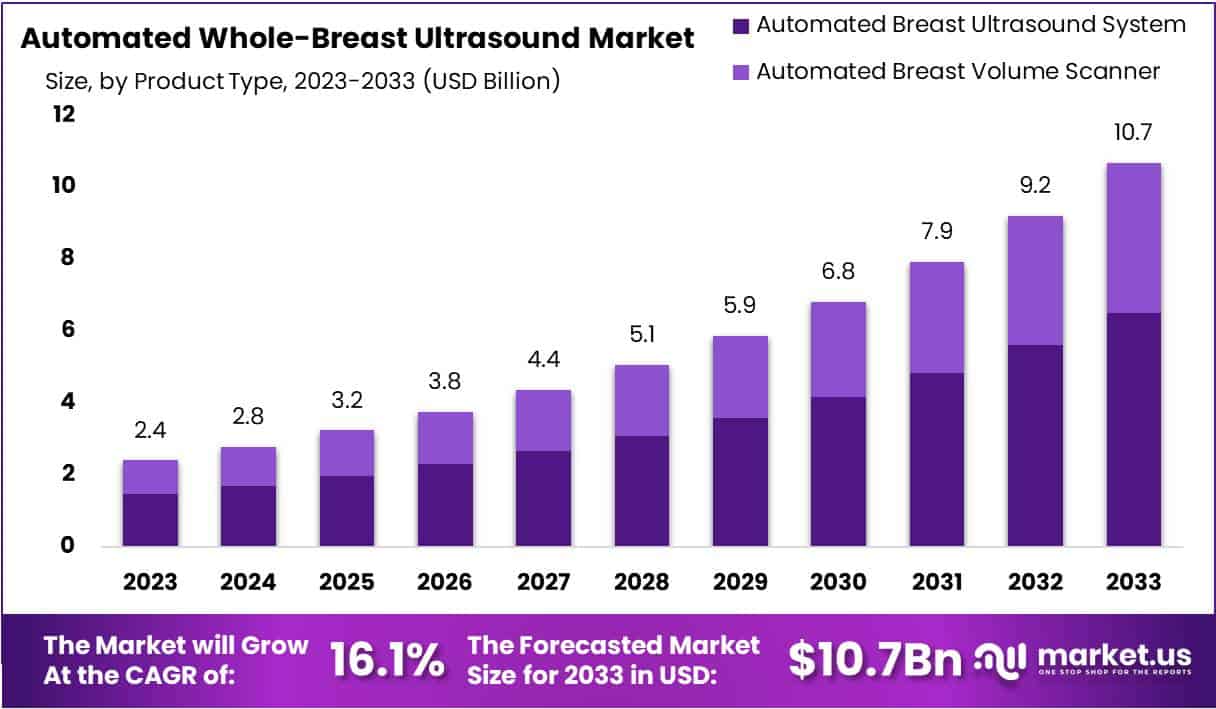

The Global Automated Whole-Breast Ultrasound Market Size is expected to be worth around USD 10.7 Billion by 2033, from USD 2.4 Billion in 2023, growing at a CAGR of 16.1% during the forecast period from 2024 to 2033.

Automated Breast Ultrasound Systems (ABUS) represent a significant advancement in medical imaging technology, specifically designed to enhance breast cancer detection in women with dense breast tissue. Unlike traditional ultrasound, ABUS automates the scanning process, providing comprehensive 3D images that allow for a more thorough examination.

ABUS stands out for its ability to improve cancer detection rates by up to 35.7% over traditional mammography, an advancement crucial for early and precise cancer diagnosis. This technology, leveraging high-frequency sound waves, produces detailed 3D images of the breast, facilitating comprehensive coverage and ensuring consistency in imaging. The process, taking about 15 minutes, is not only efficient but also minimizes discomfort for the patient. Its introduction into medical practice has been pivotal, particularly in addressing the challenges posed by dense breast tissue, which significantly impedes the efficacy of mammography due to its appearance similarity to tumors.

The advancement of ABUS technology is further propelled by strategic collaborations between industry giants and academic institutions. A notable example includes the partnership between GE Healthcare and the University of California, San Diego, aimed at incorporating artificial intelligence with ABUS to refine cancer detection capabilities. Such initiatives highlight the critical role of innovation in enhancing diagnostic accuracy and patient care, focusing on early detection and tailored treatment approaches.

The demand for ABUS technology is driven by the escalating prevalence of breast cancer worldwide, alongside technological advancements facilitating more effective detection in dense breast tissue. Awareness campaigns and government initiatives aimed at breast cancer diagnosis and treatment further fuel the market’s growth. With approximately 264,000 annual breast cancer cases reported in the United States alone, the significance of early detection methods such as ABUS cannot be overstated. This technology not only promises a leap in diagnostic capabilities but also represents a proactive shift towards personalized patient care in the fight against breast cancer.

Key Takeaways

- Market Growth Projection: By 2033, the global Automated Whole-Breast Ultrasound market is projected to reach USD 10.7 billion, growing at a CAGR of 16.1% from 2024.

- Product Dominance: In 2023, Automated Breast Ultrasound Systems (ABUS) dominated the market with over 61% share.

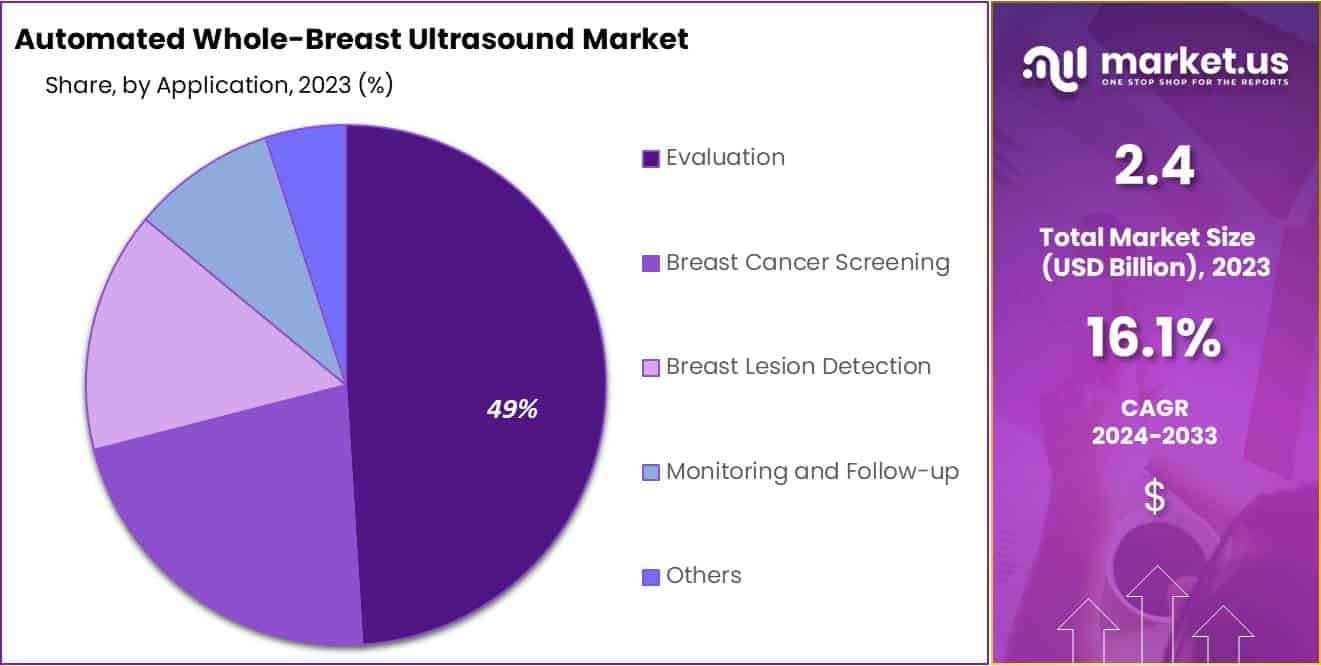

- Application Dynamics: The Evaluation segment led the market’s application segment in 2023, holding over 49% share.

- End-Use Segment: Hospitals accounted for over 52% of the market share in 2023.

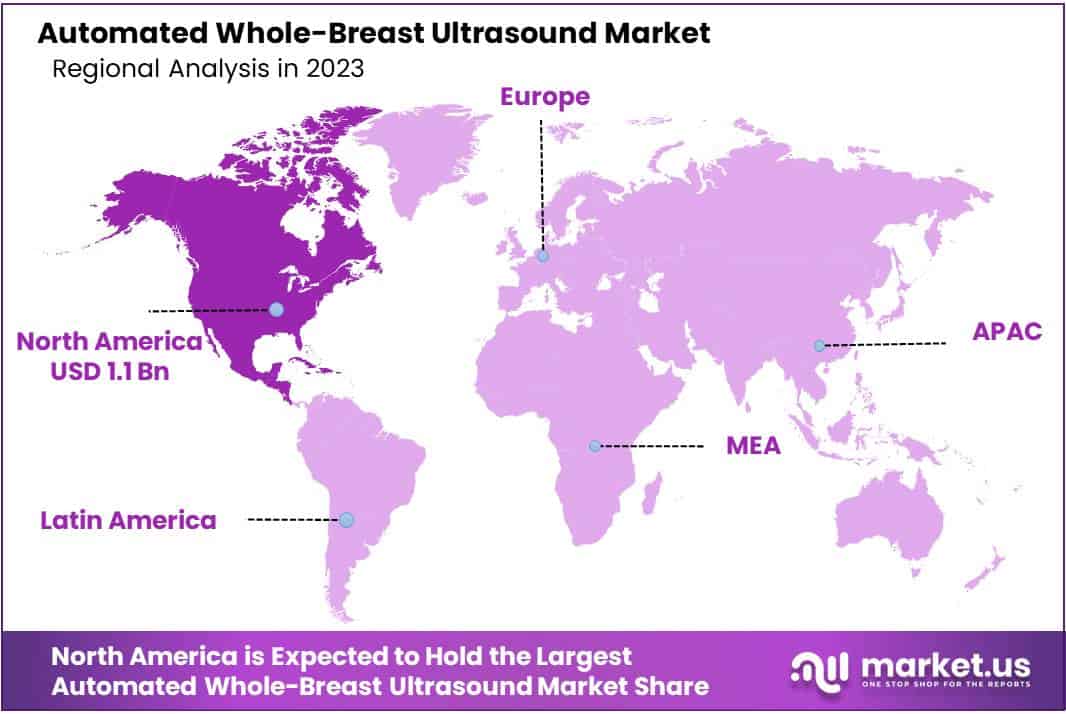

- Regional Analysis: North America held over 45.8% market share in 2023, with a market value of USD 1.1 billion.

Product Type Analysis

In 2023, the Automated Breast Ultrasound System (ABUS) segment led the Automated Whole-Breast Ultrasound Market by a significant margin, securing over 61% of the market share. This dominance is largely due to the global rise in breast cancer cases, which has heightened the demand for effective detection technologies. ABUS has been pivotal in this regard, especially for imaging dense breast tissues where traditional mammography falls short. Technological advancements have further enhanced ABUS’s appeal by improving its imaging precision and patient outcomes, solidifying its position as a preferred method for breast cancer screening and diagnosis.

On the other hand, the Automated Breast Volume Scanner (ABVS) segment, despite being smaller, is witnessing notable growth. Its capacity to produce 3D volumetric images offers a more detailed examination of breast tissues, crucial for comprehensive breast health assessment. The integration of ABVS with advanced algorithms is setting new standards in imaging, aiming to increase the accuracy of breast cancer detection. Although it faces challenges like higher costs and the need for specialized training, the evolving capabilities of ABVS promise to enrich the diagnostic landscape. As technology progresses, both ABUS and ABVS are expected to play pivotal roles in advancing breast cancer detection and patient care.

Application Analysis

In 2023, the Evaluation segment emerged as a frontrunner in the Automated Whole-Breast Ultrasound Market’s Application Segment, securing over 49% of the market share. This segment’s dominance is largely due to the growing adoption of automated whole-breast ultrasound systems in healthcare settings, propelled by their ability to provide detailed and high-resolution breast evaluations essential for early anomaly detection.

Additionally, the Breast Cancer Screening segment has seen notable growth. Increased awareness and the critical need for early screening, especially in individuals with dense breast tissue where traditional methods fall short, have bolstered the demand for advanced ultrasound technologies in breast cancer detection efforts.

Furthermore, the Breast Lesion Detection, Monitoring and Follow-up, and Others segments significantly contribute to the market’s dynamics. The precision and non-invasive characteristics of automated whole-breast ultrasound systems are indispensable in accurately identifying breast lesions, highlighting their importance in diagnostic protocols. The Monitoring and Follow-up application supports the continuous oversight of patients with pre-existing breast conditions, emphasizing the technology’s value in patient care without radiation exposure.

End-Use Analysis

In 2023, hospitals secured a leading position in the Automated Whole-Breast Ultrasound Market’s end-use segment, boasting over 52% of the market share. This segment’s dominance is largely due to hospitals’ comprehensive embrace of advanced diagnostic tools, including automated whole-breast ultrasound systems, to enhance the accuracy of breast health diagnoses.

The integration of these systems within hospitals is crucial for early detection and management of breast conditions, making them indispensable in healthcare settings. Additionally, Diagnostic Imaging Centers have carved out a significant niche by offering specialized diagnostic services with the help of these advanced imaging technologies, addressing the demand for high-quality diagnostic services beyond traditional hospital environments.

On the other hand, Breast Health Clinics have shown impressive growth by specializing in breast health services, including cancer detection, and integrating automated whole-breast ultrasound technologies to boost diagnostic precision. This specific focus has played a pivotal role in the market’s diversification and highlighted the importance of specialized healthcare solutions.

Meanwhile, other healthcare segments are gradually incorporating these ultrasound systems, reflecting their growing acceptance across various healthcare domains. This trend is propelled by the systems’ non-invasive, accurate, and efficient diagnostic capabilities. Technological advancements and increased investments in healthcare infrastructure are expected to continue driving growth across all segments, with a growing emphasis on personalized healthcare services further enriching the market landscape.

Key Market Segments

Product Type

- Automated Breast Ultrasound System

- Automated Breast Volume Scanner

Application

- Evaluation

- Breast Cancer Screening

- Breast Lesion Detection

- Monitoring and Follow-up

- Others

End-Use

- Hospitals

- DIagnostic Imaging Centres

- Breast Health Clinics

- Others

Drivers

Increasing Prevalence of Breast Cancer

The increasing prevalence of breast cancer globally acts as a significant catalyst for the growth of the Automated Whole-Breast Ultrasound Market. According to World Health Organization, In 2022, there were 2.3 million women diagnosed with breast cancer worldwide, and this condition resulted in 670,000 deaths. The universal incidence of breast cancer in women was recorded at over 2.26 million new cases in 2020, with an estimated rise to more than 2.31 million new cases by 2022. These figures underscore the urgent need for innovative and effective diagnostic tools for early detection and management.

Automated whole-breast ultrasound systems, being non-invasive and devoid of radiation, present an advantageous alternative, particularly for individuals with dense breast tissues where traditional mammography may not yield clear results. The global burden of breast cancer, characterized by its widespread occurrence across all countries and significant mortality rates, necessitates enhanced screening methods. The anticipated adoption of automated whole-breast ultrasound technologies is propelled by the critical necessity for early breast cancer detection, propelled by growing awareness and the imperative for precision in diagnosis.

Restraints

High Equipment Costs

One significant restraint facing the Automated Whole-Breast Ultrasound Market is the high cost associated with the procurement and operation of these systems. The advanced technology and software required for automated whole-breast ultrasounds involve substantial investment by healthcare facilities, which can be a deterrent, especially in developing regions where budget constraints are more pronounced. This high initial investment can impede the market’s growth as it limits accessibility and adoption rates across various healthcare settings. Automated Whole-Breast Ultrasound (AWBU) systems, like Invenia ABUS 2.0, are revolutionizing breast cancer detection with their advanced 3D imaging, particularly in detecting cancer in dense breast tissues. According to a GE Healthcare Ultrasound study, these systems can increase cancer detection by 57% alongside mammography, offering a substantial improvement in diagnostic efficiency.

Opportunities

Technological Advancements and AI Integration

The integration of Artificial Intelligence (AI) and technological advancements into automated whole-breast ultrasound systems marks a significant driver for market growth in the healthcare sector. AI’s role in enhancing the accuracy and efficiency of breast cancer screening and diagnosis is underscored by the anticipated expansion of the AI in Breast Imaging market, which is expected to grow from USD 451.6 million in 2023 to USD 5944.3 million by 2033, at a Compound Annual Growth Rate (CAGR) of 29.4%. This growth is facilitated by AI’s ability to analyze vast amounts of imaging data, identify potential abnormalities more reliably than human interpretation, and manage the increasing volume of imaging data, thereby accelerating diagnosis and improving patient outcomes.

Trends

Rising Preference for Non-ionizing Diagnostic Techniques

A prevailing trend in the Global Automated Whole-Breast Ultrasound Market is the increasing preference for non-ionizing imaging modalities due to growing health concerns associated with radiation exposure. Automated whole-breast ultrasound systems, being non-ionizing, are gaining favor as a safer alternative to mammography for regular breast cancer screening, particularly among younger populations and those at higher risk. This shift towards radiation-free diagnostic techniques is expected to propel the demand for automated whole-breast ultrasounds, further driving market growth.

Regional Analysis

In 2023, North America held a dominant market position in the Automated Whole-Breast Ultrasound (AWBU) sector, capturing more than a 45.8% share and boasting a market value of USD 1.1 Billion for the year. This significant market share can be attributed to several factors, including advanced healthcare infrastructure, higher adoption rates of innovative medical technologies, and increasing awareness regarding breast cancer screening among the population.

Moreover, the presence of key market players, coupled with substantial investments in research and development activities, further propelled the growth of the AWBU market in North America. Additionally, favorable reimbursement policies and initiatives aimed at promoting early detection of breast cancer have contributed to the widespread acceptance of automated whole-breast ultrasound systems across the region.

Furthermore, North America benefits from a well-established regulatory framework that ensures the safety and efficacy of medical devices, thereby fostering consumer confidence in AWBU technologies. These factors collectively create a conducive environment for market growth and position North America as a lucrative region for stakeholders in the AWBU market.

Moving forward, it is anticipated that North America will continue to maintain its leading position in the global AWBU market, driven by ongoing technological advancements, increasing healthcare expenditure, and growing emphasis on preventive healthcare measures. However, it is essential for market players to adapt to evolving regulatory requirements and address challenges related to cost-effectiveness and accessibility to sustain growth momentum in this dynamic landscape.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the automated whole-breast ultrasound market, several prominent players stand at the forefront of innovation and growth. Among these, Hitachi Ltd. is notable for its dedication to advancing medical imaging technologies. With a comprehensive portfolio that includes sophisticated ultrasound systems, Hitachi’s commitment to research and development shines through, especially in their efforts to improve early breast cancer detection. Siemens Healthcare GmbH, another key player, brings its expertise in medical technologies to the table. Siemens focuses on integrating artificial intelligence with its ultrasound systems, aiming to enhance imaging quality and patient comfort.

Meanwhile, Canon Medical Systems Corporation leverages its extensive history in medical imaging to deliver high-quality, reliable ultrasound solutions designed for superior performance and ease of use. Alongside these giants, other significant contributors enrich the market’s competitive environment. Their innovative products and strategic initiatives are vital in meeting the healthcare industry’s evolving demands. Collectively, these key players’ focus on innovation, strategic partnerships, and market expansion plays a crucial role in shaping the market, driving technological advancements, and ensuring improved patient outcomes.

Market Key Players

- Hitachi Ltd.

- Siemens Healthcare Gmbh

- Canon Medical Systems Corporation

- General Electric Company

- Koninklijke Philips N.V.

- Hologic Inc.

Recent Developments

- Hitachi Ltd. recently unveiled the SOFIA 3D Breast Ultrasound System, aiming to offer precise, efficient, and comfortable breast ultrasound examinations, particularly beneficial for women with dense breast tissue.

- Siemens Healthcare GmbH introduced the ACUSON S2000 Automated Breast Volume Scanner (ABVS), a versatile ultrasound solution capable of automatically capturing comprehensive breast anatomy volumes.

- In July 2023, Canon Medical announced the launch of its latest premium compact ultrasound systems, Aplio flex and Aplio go, designed to address modern healthcare challenges with clinically proven, intelligent features in a user-friendly design.

- Koninklijke Philips N.V. offers the Philips EPIQ and Affiniti ultrasound systems, equipped with an integrated eL18-4 transducer and anatomical intelligence, facilitating accurate breast imaging, especially in dense tissue.

- Hologic Inc. presented advancements in AI solutions at RSNA 2023, including the Genius AI Detection 2.0, aimed at enhancing breast cancer detection efficiency while minimizing false-positive results.

Report Scope

Report Features Description Market Value (2023) USD 2.4 Bn Forecast Revenue (2033) USD 10.7 Bn CAGR (2024-2033) 16.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Automated Breast Ultrasound System, Automated Breast Volume Scanner), By Application (Evaluation, Breast Cancer Screening, Breast Lesion Detection, Monitoring and Follow-up, Others), By End-Use (Hospitals, DIagnostic Imaging Centres, Breast Health Clinics, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Hitachi Ltd., Siemens Healthcare Gmbh, Canon Medical Systems Corporation, General Electric Company, Koninklijke Philips N.V., Hologic Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Automated Whole-Breast Ultrasound market in 2023?The Automated Whole-Breast Ultrasound market size is USD 2.4 billion in 2023.

What is the projected CAGR at which the Automated Whole-Breast Ultrasound market is expected to grow at?The Automated Whole-Breast Ultrasound market is expected to grow at a CAGR of 16.1% (2024-2033).

List the segments encompassed in this report on the Automated Whole-Breast Ultrasound market?Market.US has segmented the Automated Whole-Breast Ultrasound market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product Type the market has been segmented into Automated Breast Ultrasound System, Automated Breast Volume Scanner. By Application the market has been segmented into Evaluation, Breast Cancer Screening, Breast Lesion Detection, Monitoring and Follow-up, Others. By End-Use the market has been segmented into Hospitals, DIagnostic Imaging Centres, Breast Health Clinics, Others.

List the key industry players of the Automated Whole-Breast Ultrasound market?Hitachi Ltd., Siemens Healthcare Gmbh, Canon Medical Systems Corporation, General Electric Company, Koninklijke Philips N.V., Hologic Inc., Other Key Players.

Which region is more appealing for vendors employed in the Automated Whole-Breast Ultrasound market?North America is expected to account for the highest revenue share of 45.8% and boasting an impressive market value of USD 1.1 billion. Therefore, the Automated Whole-Breast Ultrasound industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Automated Whole-Breast Ultrasound?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Automated Whole-Breast Ultrasound Market.

Automated Whole-Breast Ultrasound MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample

Automated Whole-Breast Ultrasound MarketPublished date: Apr 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Hitachi Ltd.

- Siemens Healthcare Gmbh

- Canon Medical Systems Corporation

- General Electric Company

- Koninklijke Philips N.V.

- Hologic Inc.