Automated Liquid Handling Technologies Market By Product Type (Automated Liquid Handling Workstations (By Assembly (Integrated Workstations and Standalone Workstations) and By Type (Workstation Module, Specialized Liquid Handler, Pipetting Workstation, and Multipurpose Workstation)), Reagents & Consumables (Reagents and Accessories)), By Application (Drug Discovery & ADME-Tox Research, Bioprocessing/Biotechnology, Cancer & Genomic Research, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and Academic & Research Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153852

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

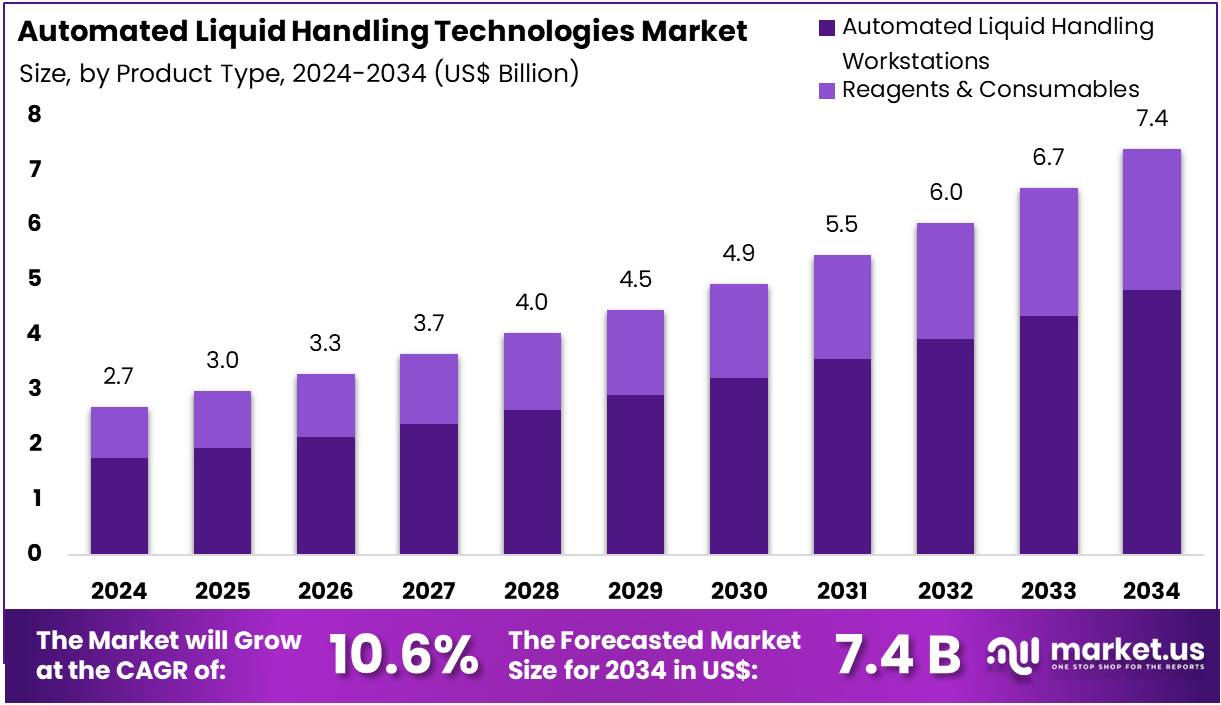

The Automated Liquid Handling Technologies Market Size is expected to be worth around US$ 7.4 billion by 2034 from US$ 2.7 billion in 2024, growing at a CAGR of 10.6% during the forecast period 2025 to 2034.

Increasing demand for efficiency and accuracy in laboratory operations is driving the growth of the automated liquid handling technologies market. These technologies automate the process of transferring liquids in laboratory settings, ensuring precise measurements, reducing human error, and improving overall productivity. Automated liquid handling systems are essential in applications such as drug discovery, genomics, proteomics, and clinical diagnostics, where accuracy and consistency are critical.

The growing complexity of scientific experiments and the rising need for high-throughput screening in research and pharmaceutical industries further boost the demand for these solutions. Additionally, the ongoing trend toward laboratory automation, as researchers seek to optimize workflows and reduce manual labor, has created significant opportunities for automated liquid handling technologies.

In June 2023, Biosero, Inc. entered into a co-marketing agreement with Analytik Jena to jointly promote their integrated laboratory automation technologies. This partnership aims to enhance the reach and impact of their combined solutions, showcasing the growing trend of collaboration to provide more comprehensive and efficient automation solutions.

Recent innovations in automated liquid handling technologies include the development of more advanced robotic systems, integration with AI for smarter decision-making, and systems designed for smaller volumes, expanding their applications in personalized medicine and small-scale research. As laboratories continue to prioritize precision, speed, and reproducibility, automated liquid handling systems are becoming integral tools in modern scientific research, creating substantial growth potential in the market.

Key Takeaways

- In 2024, the market for automated liquid handling technologies generated a revenue of US$ 2.7 billion, with a CAGR of 10.6%, and is expected to reach US$ 7.4 billion by the year 2034.

- The product type segment is divided into automated liquid handling workstations, reagents & consumables, with automated liquid handling workstations taking the lead in 2023 with a market share of 65.2%.

- Considering application, the market is divided into drug discovery & ADME-Tox research, bioprocessing/biotechnology, cancer & genomic research, and others. Among these, drug discovery & ADME-Tox research held a significant share of 41.9%.

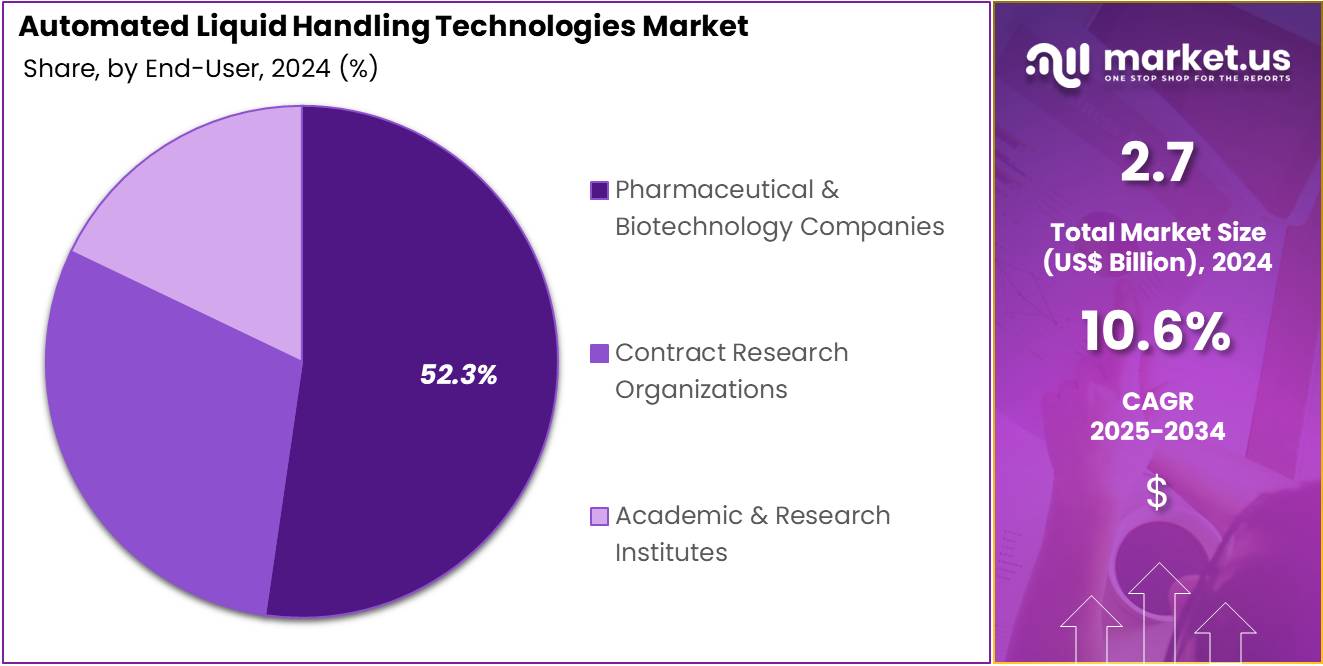

- Furthermore, concerning the end-user segment, the market is segregated into pharmaceutical & biotechnology companies, contract research organizations, and academic & research institutes. The pharmaceutical & biotechnology companies sector stands out as the dominant player, holding the largest revenue share of 52.3% in the automated liquid handling technologies market.

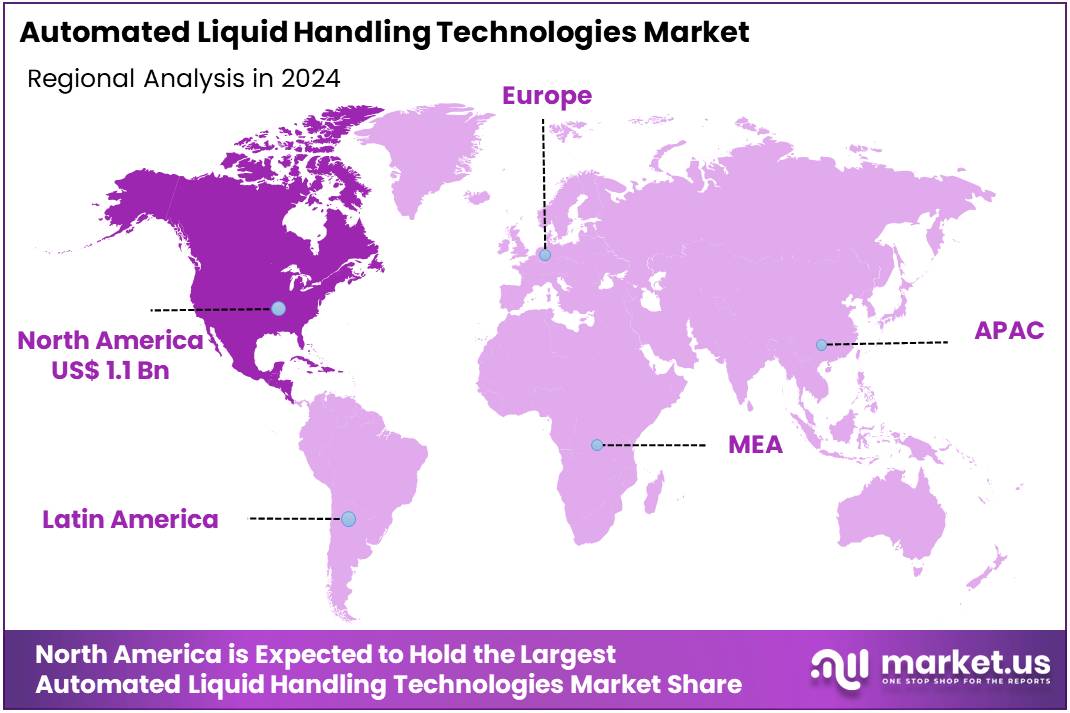

- North America led the market by securing a market share of 39.5% in 2023.

Product Type Analysis

Automated liquid handling workstations dominate the market with 65.2% of the share. This growth is expected to continue as these systems are integral in increasing the speed, accuracy, and efficiency of liquid handling in laboratories. Automated systems are increasingly being adopted to perform repetitive tasks, such as pipetting and sample preparation, that were traditionally carried out manually.

These systems are essential in high-throughput environments where precision and time are critical, especially in drug discovery and other research applications. The growing need for more accurate, reproducible results in biomedical research, including genomic studies, is anticipated to further drive demand for automated liquid handling workstations.

Additionally, the integration of these workstations with other laboratory equipment and software solutions enhances their value, providing researchers with a streamlined workflow that improves overall productivity. As advancements in laboratory automation continue to evolve, automated liquid handling workstations are expected to be at the forefront of innovation, supporting complex research and accelerating scientific discovery.

Application Analysis

Drug discovery and ADME-Tox (Absorption, Distribution, Metabolism, Excretion, and Toxicity) research hold the largest share of 41.9% in the application segment of the automated liquid handling technologies market. This segment is projected to grow significantly as pharmaceutical and biotechnology companies increasingly rely on automated systems to accelerate the drug discovery process. The need for high-throughput screening and accurate testing in drug development, especially in preclinical stages, is driving the demand for liquid handling technologies.

Automated systems facilitate the preparation of a large number of samples, which is crucial in ADME-Tox research to assess the pharmacokinetics and toxicity of potential drug candidates. As regulatory pressures for drug safety increase, pharmaceutical companies are expected to adopt more automated solutions to ensure faster, more consistent results. Furthermore, as the focus on personalized medicine and the development of biologics and small molecules intensifies, the role of automated liquid handling systems in drug discovery and ADME-Tox research is likely to expand, ensuring the continued growth of this segment.

End-User Analysis

Pharmaceutical and biotechnology companies represent the largest end-user segment in the automated liquid handling technologies market, holding 52.3% of the market share. This growth is expected to continue as these companies focus on improving the efficiency and accuracy of their research and development processes. The need to scale up drug discovery, testing, and manufacturing processes in the face of growing global demand for innovative therapies is driving the adoption of automation technologies.

Automated liquid handling systems offer pharmaceutical and biotechnology companies the ability to perform complex tasks quickly and with a high degree of accuracy, significantly reducing human error and increasing throughput. Additionally, the increasing use of these technologies in clinical trials, drug formulation, and regulatory compliance testing is expected to contribute to the growth of this segment. As companies continue to invest in drug development to meet global healthcare needs, automated liquid handling technologies will remain a critical component of the pharmaceutical and biotechnology industries, fostering ongoing growth in this end-user segment.

Key Market Segments

By Product Type

- Automated Liquid Handling Workstations

- By Assembly

- Integrated Workstations

- Standalone Workstations

- By Type

- Workstation Module

- Specialized Liquid Handler

- Pipetting Workstation

- Multipurpose Workstation

- By Assembly

- Reagents & Consumables

- Reagents

- Accessories

By Application

- Drug Discovery & ADME-Tox Research

- Bioprocessing/Biotechnology

- Cancer & Genomic Research

- Others

By End-User

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations

- Academic & Research Institutes

Drivers

Increasing Demand for High-Throughput Screening in Drug Discovery is Driving the Market

The escalating demand for high-throughput screening (HTS) in drug discovery and development, driven by the need to efficiently test vast numbers of compounds against various biological targets, is a significant driver propelling the automated liquid handling technologies market. HTS involves rapidly assaying thousands, sometimes millions, of samples, a task that is virtually impossible to perform manually with precision and consistency.

Automated liquid handlers perform repetitive pipetting, dispensing, and plate manipulation tasks with high accuracy and speed, dramatically accelerating the drug development pipeline. The U.S. National Institutes of Health (NIH), through its National Center for Advancing Translational Sciences (NCATS), actively supports HTS initiatives. NCATS reported that as of June 2024, its assay development and screening efforts have led to the screening of over 1.5 million unique small molecules across various disease areas since its inception, with significant portions of this work reliant on automation.

Furthermore, the NIH’s Biomedical Research and Development Authority (BARDA) has also funded partnerships that leverage advanced automation for rapid countermeasure development. For instance, in September 2023, BARDA announced a partnership with a company focusing on advanced manufacturing platforms, which often incorporate high levels of automation for vaccine and therapeutic production. The imperative to quickly identify promising drug candidates, reduce manual errors, and scale up research efforts continuously drives the adoption and innovation of automated liquid handling solutions in pharmaceutical and biotechnology companies.

Restraints

High Initial Investment and Need for Skilled Personnel are Restraining the Market

The substantial initial capital investment required for automated liquid handling systems, coupled with the ongoing need for highly skilled personnel for operation, programming, and maintenance, represents a considerable restraint on the market. These sophisticated robotic systems, including complex pipetting platforms and integrated workstations, can be very expensive to acquire and install. The cost encompasses not only the hardware but also specialized software, integration with existing laboratory information management systems (LIMS), and facility modifications.

A typical high-end automated liquid handling workstation can range from US100,000 to over US500,000, depending on its features and throughput capabilities, excluding ongoing operational costs. Furthermore, while automation reduces manual labor, it shifts the labor requirement from repetitive manual tasks to more complex roles involving system programming, troubleshooting, and data analysis. Laboratories need to invest in extensive training for their staff to operate these advanced systems effectively and efficiently.

The American Society for Clinical Pathology (ASCP) consistently highlights the critical need for laboratory professionals with advanced technical skills in automation and informatics, noting in their 2023 workforce report that adapting to new technologies requires significant upskilling. These high upfront costs and the specialized human capital requirements can be prohibitive for smaller laboratories, academic institutions, or those with limited budgets, thereby slowing market penetration.

Opportunities

Growing Adoption in Clinical Diagnostics and Personalized Medicine is Creating Growth Opportunities

The increasing adoption of automated liquid handling technologies in clinical diagnostics, particularly for molecular diagnostics and personalized medicine applications, is creating substantial growth opportunities in the market. As diagnostic tests become more complex, involving DNA/RNA extraction, PCR setup, and next-generation sequencing library preparation, the need for precision, throughput, and reduced contamination risk is paramount.

Automated systems can handle these intricate protocols with high reproducibility, ensuring reliable results crucial for patient care. The U.S. Centers for Disease Control and Prevention (CDC) continuously emphasizes the importance of laboratory automation for public health surveillance and clinical testing. For example, during the COVID-19 pandemic, the CDC worked with diagnostic manufacturers to scale up testing capacity, which heavily relied on automated liquid handling systems for processing millions of samples.

Furthermore, a 2024 review published in Clinical Chemistry discussed the ongoing transformation of clinical laboratories through automation, noting that automated platforms are now routinely used for high-volume infectious disease testing, genetic screening, and pharmacogenomics. This shift towards personalized medicine, which requires precise and reproducible handling of numerous patient samples for genomic and proteomic analysis, is significantly driving the integration of automated liquid handling solutions into routine clinical laboratory workflows, broadening their application beyond traditional research settings.

Impact of Macroeconomic / Geopolitical Factors

Global macroeconomic conditions, including inflation and the overall health of research and development funding, significantly influence the automated liquid handling technologies market by affecting capital expenditure budgets and operational costs for laboratories. Inflation can increase the cost of manufacturing sophisticated robotic systems, including electronic components, precision mechanics, and specialized software, potentially leading to higher prices for automated liquid handlers. This can pressure academic institutions and smaller biotech companies to delay equipment upgrades or expansion.

However, governments globally continue to prioritize scientific research, particularly in areas like drug discovery and diagnostics, recognizing their long-term societal and economic benefits. The U.S. National Institutes of Health (NIH) received a total appropriation of US$48.6 billion in fiscal year 2024, which supports a wide array of biomedical research, a significant portion of which involves laboratory automation.

Geopolitical stability also plays a role in maintaining stable supply chains for critical components required for these complex systems. Despite economic fluctuations, the fundamental drive for scientific advancement and the ongoing need for efficient research tools ensure sustained investment in laboratory automation, fostering resilience and continued growth in the automated liquid handling technologies market.

Evolving U.S. trade policies, including the imposition of tariffs on imported laboratory equipment, robotics components, and high-tech electronics, are shaping the automated liquid handling technologies market by influencing procurement costs and supply chain strategies for manufacturing. Manufacturers of automated liquid handlers often rely on intricate global supply chains for specialized parts, such as precision motors, sensors, and microfluidic components, many of which are manufactured internationally.

Tariffs on these imports can increase the manufacturing costs for companies operating in or importing into the U.S., potentially leading to higher prices for the end-user laboratory equipment. For example, the American Hospital Association (AHA) highlighted in a May 2025 fact sheet that tariffs on Chinese-made syringes and needles would increase to 50% from the previous 25%, and tariffs on semiconductors would increase to 50% in 2025. While these specific examples are not directly for automated liquid handling systems, semiconductors and various precision components are integral to their functionality.

The AHA also noted that nearly 70% of medical devices marketed in the U.S. are manufactured exclusively overseas, indicating a broad reliance on international supply chains that tariffs can disrupt. These policies, while sometimes aiming to encourage domestic production and resilience, primarily create a more complex and potentially more expensive operational environment for laboratories acquiring these sophisticated systems. The critical need for precision and efficiency in scientific research, however, drives efforts to mitigate these impacts through supply chain diversification and advocacy for exemptions on essential research tools.

Latest Trends

Increased Integration of AI and Machine Learning for Enhanced Automation is a Recent Trend

A prominent recent trend shaping the automated liquid handling technologies market in 2024 and continuing into 2025 is the accelerated integration of artificial intelligence (AI) and machine learning (ML) capabilities for enhanced automation and decision-making within laboratory workflows. This goes beyond simple robotic automation, enabling systems to optimize protocols, identify anomalies, predict potential failures, and even learn from previous experiments to improve efficiency and accuracy.

AI-powered liquid handlers can adapt to varying sample types, troubleshoot minor issues autonomously, and optimize dispensing parameters for complex assays, reducing human intervention and improving experimental reproducibility. A March 2025 article in Nature Biotechnology discussed the transformative potential of integrating AI into laboratory automation for accelerated discovery, highlighting how AI can analyze real-time data from liquid handlers to fine-tune experimental conditions and optimize resource utilization.

For instance, pharmaceutical companies are using AI-driven liquid handlers to optimize compound solubility and stability screening, leading to faster lead optimization in drug development. This advanced integration is making automated liquid handling systems more intelligent, flexible, and capable of handling increasingly complex and sensitive biological assays, representing a significant leap forward in laboratory automation and driving further adoption across research and development sectors.

Regional Analysis

North America is leading the Automated Liquid Handling Technologies Market

The automated liquid handling technologies market in North America, holding a significant 39.5% share, experienced substantial growth in 2024. This expansion was primarily driven by increasing investments in life science research and development, a burgeoning biotechnology and pharmaceutical sector, and the escalating demand for high-throughput screening and precision in laboratory workflows. The U.S. total R&D expenditure reached US$ 892 billion in 2022, with an estimated increase to US$940 billion in 2023, as reported by the National Science Foundation (NSF) in February 2025. This robust funding environment directly fuels the adoption of automated solutions that enhance efficiency and accuracy in drug discovery, genomics, and clinical diagnostics.

Major players in the life sciences tools sector, including automated liquid handling, have reported strong performance. Thermo Fisher Scientific, a global leader, reported full-year revenue of US$42.88 billion in 2024, remaining flat compared to US$42.86 billion in 2023, yet demonstrating consistent demand across its diverse portfolio supporting laboratory automation. Danaher Corporation, another key innovator in life sciences and diagnostics, reported revenues of US$23.9 billion in 2024, maintaining its position in the market. These figures highlight the critical role of automated liquid handling in advancing scientific research and development across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The automated liquid handling technologies market in Asia Pacific is expected to grow significantly during the forecast period. This anticipated expansion is driven by rising government and private sector investments in life sciences research, the rapid growth of pharmaceutical and biotechnology industries, and an increasing focus on improving healthcare infrastructure and diagnostic capabilities.

China’s total expenditure on research and experimental development (R&D) exceeded 3.6 trillion yuan (approximately US$500 billion) in 2024, an increase of 8.3 billion yuan for fiscal year 2023-2024. This growth, along with significant domestic consumption and exports, is expected to drive demand for high-throughput solutions in drug development and manufacturing. Japan and Australia are also increasing their R&D spending, contributing to the region’s overall scientific advancement.

Thermo Fisher Scientific’s Asia Pacific revenue reached US$7.96 billion in 2024, increasing from US$7.87 billion in 2023, indicating a positive trajectory for life science tools in the region. Danaher Corporation continues to expand its presence, with its life sciences segment contributing to its global revenue of US$23.9 billion in 2024. These developments suggest a strong trajectory for the adoption of automated liquid handling technologies as research and industrial capabilities expand across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the automated liquid handling technologies market are employing a range of strategies to drive growth and improve laboratory efficiency. They are focusing on developing advanced automation solutions, such as non-contact dispensing systems and AI-powered platforms, to increase accuracy and throughput in applications like drug discovery and genomic research. Companies are also investing in research and development to refine their technologies, ensuring they meet the changing demands of modern laboratories.

Strategic collaborations with academic institutions and research organizations help integrate the latest technologies and expand market reach. Furthermore, market leaders are enhancing their product portfolios by offering customizable and scalable solutions that address a variety of laboratory needs. Emphasis on regulatory compliance and quality control ensures the reliability and safety of these systems, building trust among users.

Tecan Group Ltd., a key player in the market, specializes in laboratory instruments and solutions, including automated liquid handling systems. Established in 1980 and headquartered in Männedorf, Switzerland, Tecan provides automation solutions for pharmaceutical and biotechnology companies, research institutions, and diagnostic laboratories.

The company offers a diverse range of products, such as robotic systems, pipetting tools, workstations, and software, designed to enhance precision and efficiency in laboratory tasks. Tecan’s commitment to innovation and quality has positioned it as a global leader in the field. The company continues to invest in research and development to further advance liquid handling technologies, contributing to improved laboratory productivity and accuracy.

Top Key Players in the Automated Liquid Handling Technologies Market

- SPT Labtech

- Revvity

- Hudson Robotics

- Hamilton Company

- Formulatrix, Inc

- Eppendorf AG

- Danaher

- Corning Incorporated

Recent Developments

- In November 2023, SPT Labtech launched Firefly for LDT, a solution aimed at improving liquid handling in lab-developed tests (LDTs) based on Next-Generation Sequencing (NGS), offering a more streamlined approach to the process.

- In July 2023, Revvity introduced the Fontus Automated Liquid Handling Workstation, an advanced liquid handling system that incorporates technologies from its existing platforms. The workstation is specifically designed to optimize and accelerate workflows for both NGS and diagnostic research.

Report Scope

Report Features Description Market Value (2024) US$ 2.7 billion Forecast Revenue (2034) US$ 7.4 billion CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Automated Liquid Handling Workstations (By Assembly (Integrated Workstations and Standalone Workstations) and By Type (Workstation Module, Specialized Liquid Handler, Pipetting Workstation, and Multipurpose Workstation)), Reagents & Consumables (Reagents and Accessories)), By Application (Drug Discovery & ADME-Tox Research, Bioprocessing/Biotechnology, Cancer & Genomic Research, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Contract Research Organizations, and Academic & Research Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape SPT Labtech , Revvity, Hudson Robotics, Hamilton Company, Formulatrix, Inc, Eppendorf AG, Danaher, Corning Incorporated. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Liquid Handling Technologies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Automated Liquid Handling Technologies MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SPT Labtech

- Revvity

- Hudson Robotics

- Hamilton Company

- Formulatrix, Inc

- Eppendorf AG

- Danaher

- Corning Incorporated