Global Automated Algo Trading Market Share, AI Impact Analysis Report By Application (Statistical Arbitrage, Trade Execution, Stealth/Gaming, Strategy Implementation, Electronic Market-making, Liquidity Detection), By End User (Personal Investors, Credit Unions, Trusts, Pension Funds, Insurance Firms, Prime Brokers, Investment Funds), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153563

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

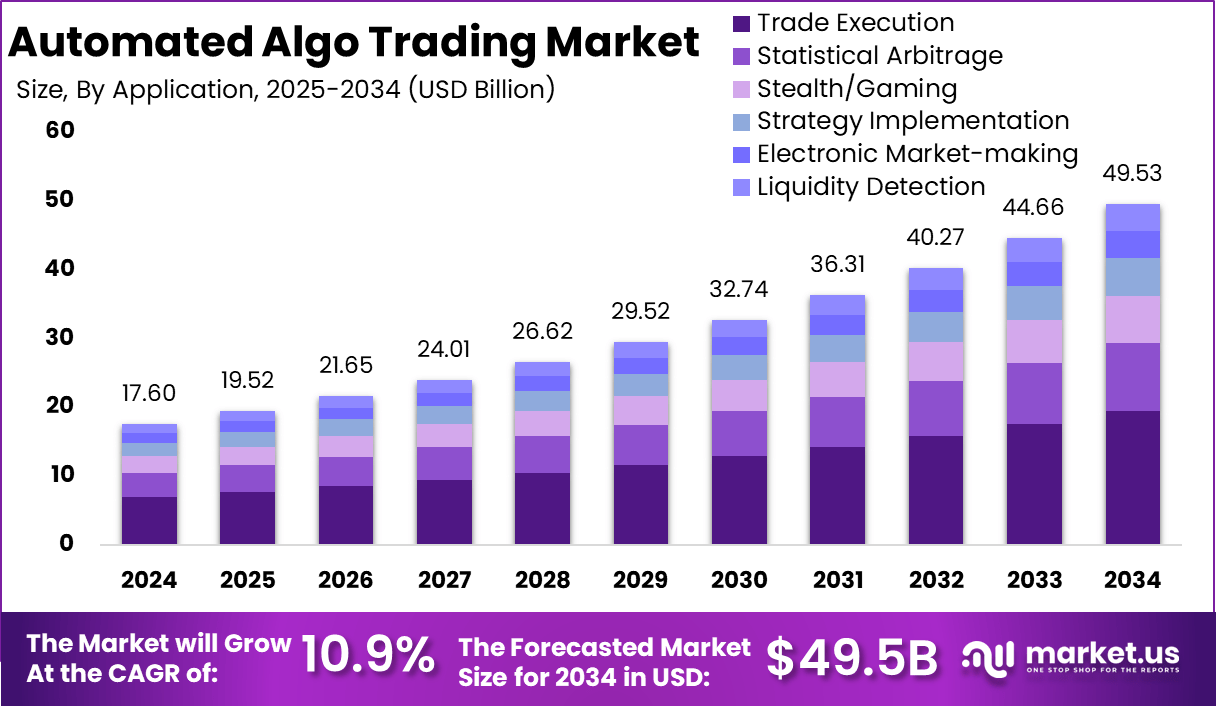

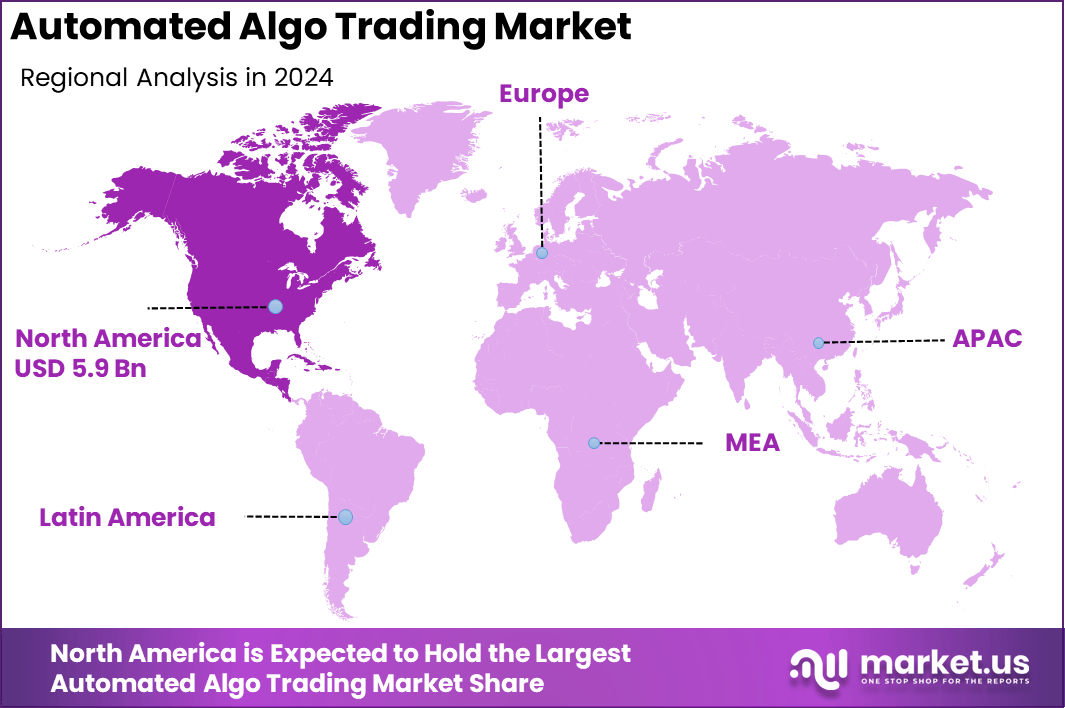

The Global Automated Algo Trading Market size is expected to be worth around USD 49.53 Billion By 2034, from USD 17.6 billion in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 33.6% share, holding USD 5.9 Billion revenue.

The Automated Algorithmic Trading Market refers to the deployment of computer‑driven systems that execute purchase and sale orders in financial markets based on predefined rules and real‑time data. Such systems, encompassing sophisticated high‑frequency and quantitative strategies, aim to enhance trade execution speed, accuracy, and consistency. In recent years, the adoption of advanced algorithms, artificial intelligence, and machine learning has increased, enabling more responsive and adaptive trading platforms.

According to Analyzing Alpha, equities are projected to contribute $8.61 bn to the algorithmic trading market share by 2027. In 2018, algorithmic trading accounted for 60% to 73% of all U.S. equity trading. Data from Coalition Greenwich revealed that the top 12 investment banks generated approximately $2 bn from portfolio and algorithmic trading in 2020. Around 52% of institutional investors consider workflow efficiency the key factor for best execution in algorithmic trading.

Scope and Forecast

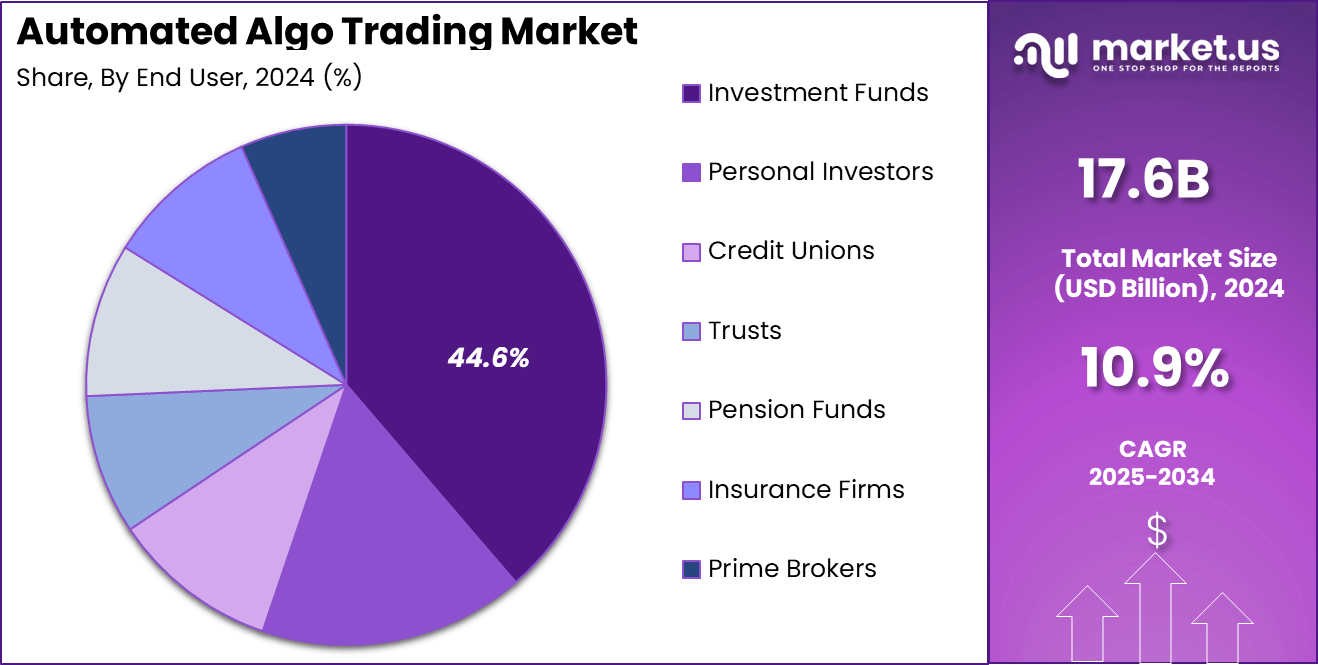

Report Features Description Market Value (2024) USD 17.60 Bn Forecast Revenue (2034) USD 49.5 Bn CAGR (2025-2034) 10.9% Largest Segment Investment Funds Largest Market North America [33.6% market share] One of the main forces behind the growth of the automated algo trading market is the need for reliable and high-speed order execution. Market participants want to minimize manual errors and avoid the delays associated with human intervention. Regulations that promote transparency and market surveillance, combined with advancements in artificial intelligence and machine learning, are also propelling adoption.

The demand for automated algo trading continues to rise sharply due to several reasons. First, volatility in the markets has made it important to execute large volumes of trades rapidly while mitigating risk. Automated systems enable institutions and investors to respond instantly to fluctuations, ensuring that trades are executed at the most favorable prices available.

Key Insight Summary

- The global automated algo trading market is poised for consistent growth, projected to reach USD 49.53 billion by 2034, driven by increasing reliance on speed, precision, and data-driven decision-making in financial markets.

- North America led the market with a 33.6% share in 2024, contributing approximately USD 5.9 billion in revenue.

- Trade execution emerged as the leading application segment with a 39.2% share, reflecting the demand for faster order placement and reduced transaction costs.

- Investment funds accounted for the highest adoption at 44.6%, as institutional players increasingly embrace algorithmic strategies to gain competitive edge.

North America Market Size

In 2024, North America held a dominant market position, capturing more than a 33.6% share, holding USD 5.9 Billion revenue. The region’s leadership is supported by widespread adoption of high-frequency trading, robust infrastructure, and strong institutional participation.

U.S. financial hubs like New York and Chicago host a large concentration of trading firms that rely heavily on algorithmic platforms to manage large volumes of transactions with minimal latency. The presence of advanced data centers and direct market access systems further reinforces North America’s advantage in terms of execution speed and reliability.

Additionally, North America’s leadership is driven by a supportive regulatory environment and high technology penetration. While regulations are strict, they are clearly defined and transparent, encouraging responsible deployment of automated systems. The adoption of AI-powered trading algorithms by asset managers and hedge funds has surged, owing to rising demand for intelligent strategies that adapt to fast-changing market conditions.

Leading Application: Trade Execution

Trade execution stands out as the core application in the automated algorithmic trading market, commanding approximately 39.2% of total market share. The dominance of this segment is closely tied to the relentless demand for rapid, precise, and cost-efficient order placement. Financial markets have evolved dramatically, with high-frequency trading and short-lived price opportunities now commonplace.

In this environment, the ability to execute trades automatically with minimal latency is crucial. Market participants increasingly turn to sophisticated algorithms to manage large transaction volumes and execute complex strategies within milliseconds.

Automated systems are not only able to respond instantly to volatile market changes, but also significantly lower transaction costs and reduce the risks of slippage. As electronic markets grow more fragmented and competition intensifies, the imperative for fast and frictionless trade execution continues to escalate, positioning this application at the heart of modern capital markets.

Highest Adoption: Investment Funds

Investment funds are the biggest adopters of automated algorithmic trading, representing around 44.6% of the user base. This trend underscores the sector’s drive toward maximizing returns, managing risk, and maintaining a competitive lineage in increasingly sophisticated trading environments.

Institutional investors – such as mutual funds, hedge funds, and pension funds – see automation as essential for processing vast amounts of market data, identifying opportunities, and executing strategies that would be unmanageable without technology. Automation enables funds to optimize portfolio management, minimize human error, and achieve scalable execution across multiple asset classes.

Additionally, regulatory changes emphasizing risk management and transparency have further prompted institutional adoption. By leveraging advanced algorithms, investment funds can swiftly react to market opportunities, mitigate operational risks, and comply with stringent reporting standards – all of which reinforce their leadership in the adoption of algorithmic trading.

Key Market Segments

By Application

- Statistical Arbitrage

- Trade Execution

- Stealth/Gaming

- Strategy Implementation

- Electronic Market-making

- Liquidity Detection

By End User

- Personal Investors

- Credit Unions

- Trusts

- Pension Funds

- Insurance Firms

- Prime Brokers

- Investment Funds

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trend Analysis

Rise of Intelligent Adaptive Algorithms

The world of automated algorithmic trading is undergoing a notable transformation, with intelligent adaptive algorithms becoming the standout trend. Instead of simple, rule-based systems, traders are now gravitating towards platforms that leverage artificial intelligence and machine learning to make smarter decisions.

These advanced systems are not only capable of analyzing massive amounts of market data in real time, but they also adapt their strategies as conditions change. This shift means that trading algorithms in 2025 are more responsive to sudden news, market swings, or new patterns that would have been difficult to capture before. The drive for “market intelligence” is making automated trading both more accessible and effective for individual and institutional traders alike.

Driver Analysis

Rapid Integration of Cloud and Real-Time Analytics

A primary driver behind the adoption of automated trading is the rapid integration of cloud technology and real-time analytics. Cloud-based platforms empower traders to access fast, reliable, and cost-effective tools regardless of their location. This accessibility helps level the playing field, enabling even smaller market participants to use high-powered trading algorithms.

Real-time analytics bring an additional advantage: by catching opportunities or risks as soon as they appear, these systems help traders respond instantly rather than relying on delayed, manual decisions. This combination of speed and insight addresses the constant demand for greater efficiency in financial markets.

Restraint Analysis

Concerns Over Systemic Risks and Failures

Despite its benefits, the widespread use of automated trading faces significant restraints, particularly around the risk of systemic failures. As financial markets grow increasingly dependent on algorithms, the potential for a single technical glitch, network outage, or programming error to cause widespread disruption increases.

These failures can trigger sudden market swings or what is known as “flash crashes.” The reliance on automation also makes it challenging to intervene manually when problems arise, putting both investors and entire markets at risk. Such concerns prompt ongoing debates about how to ensure system reliability and protect market stability.

Opportunity Analysis

Expanding Access in Emerging Markets

An exciting opportunity for automated algorithmic trading lies in its expansion across emerging markets. With greater digital transformation and increasing financial literacy, regions that previously had limited access to modern trading tools are now seeing rapid adoption.

Improved internet connectivity and mobile platforms allow both individuals and financial institutions to adopt algorithmic strategies that were once the domain of advanced economies. As the boundaries of digital finance widen, there is strong potential for innovative trading systems to drive more participation and efficiency in new markets.

Challenge Analysis

Navigating Complexity and Constant Evolution

One of the most persistent challenges in automated trading is managing the complexity and rapid evolution of these systems. As trading strategies become more sophisticated, understanding, monitoring, and updating algorithms require advanced skills and continual investment in research.

Traders must constantly refine their approaches so strategies remain effective and safe against new competitors and market realities. Regulatory oversight is also intensifying to keep pace with technological advances and to prevent potential abuse or instability in markets. For anyone involved, staying ahead means ongoing education and adaptability in the face of never-ending technological change.

Key Player Analysis

In the Automated Algo Trading Market, AlgoTerminal LLC, Vela, and AlgoTrader GmbH have established strong positions by offering comprehensive trading platforms tailored for institutional investors. These platforms support high-frequency and low-latency trading, which are essential for modern electronic markets. Their systems are designed to handle diverse asset classes, providing powerful strategy development tools.

Cloud9Trader, Quantopian, and InfoReach, Inc. have gained attention for empowering retail traders and developers with open, cloud-based algorithmic trading infrastructure. These platforms emphasize ease of use, with visual coding tools, backtesting capabilities, and marketplace integrations. Quantopian’s role in open-sourcing algorithmic strategies created a robust learning environment, while InfoReach delivers enterprise-grade execution management systems.

Trading Technologies International, Inc., QuantConnect, Tethys Technology, and Citadel play a crucial role in advancing the sophistication of automated trading. Trading Technologies and Citadel are known for handling massive volumes with ultra-low-latency execution, which is crucial for hedge funds and market makers. QuantConnect contributes significantly with its Lean Algorithm Framework, allowing cross-platform algorithm deployment.

Top Key Players Covered

- AlgoTerminal LLC

- Vela

- AlgoTrader GmbH

- Cloud9Trader

- Quantopian

- InfoReach, Inc.

- Trading Technologies International, Inc.

- QuantConnect

- Tethys Technology

- Citadel

Recent Developments

- In March 2025, Motilal Oswal introduced STRATX, positioning it as an all-in-one automated trading platform. STRATX brings advanced strategy automation, optimized trade execution, and real-time performance analytics to Indian traders and investment professionals – catering to futures, options, and derivatives trading with a focus on efficiency and transparency.

- In August 2024, Vela successfully launched a new Digitalized Logistics Platform, bolstering its technology stack related to data and analytics which can indirectly influence trading infrastructure capabilities.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Application (Statistical Arbitrage, Trade Execution, Stealth/Gaming, Strategy Implementation, Electronic Market-making, Liquidity Detection), By End User (Personal Investors, Credit Unions, Trusts, Pension Funds, Insurance Firms, Prime Brokers, Investment Funds) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vela, AlgoTerminal LLC, AlgoTrader GmbH, Cloud9Trader, Quantopian, InfoReach, Inc., Trading Technologies International, Inc., QuantConnect, Tethys Technology, Citadel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automated Algo Trading MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Automated Algo Trading MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AlgoTerminal LLC

- Vela

- AlgoTrader GmbH

- Cloud9Trader

- Quantopian

- InfoReach, Inc.

- Trading Technologies International, Inc.

- QuantConnect

- Tethys Technology

- Citadel