Global Augmented Reality Navigation Market Size, Share Report By Component (Hardware, Software, Services), By Type (Indoor Navigation, Outdoor Navigation), By Application (Real-Time Location Data Management, Routing & Navigation, Asset Tracking, Reverse Geocoding, Other Applications), By End-Use (Aerospace & Defense, Gaming & Entertainment, Healthcare, E-Commerce & Retail, Military & Defense, Education, Industrial & Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154026

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

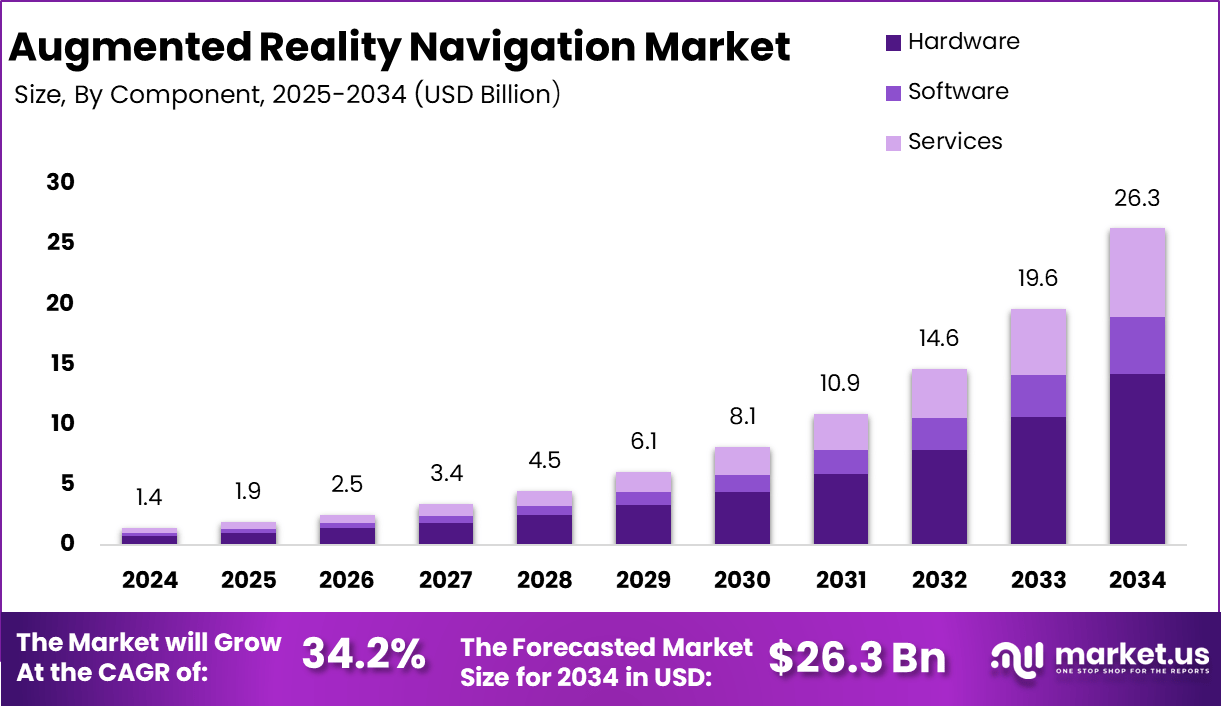

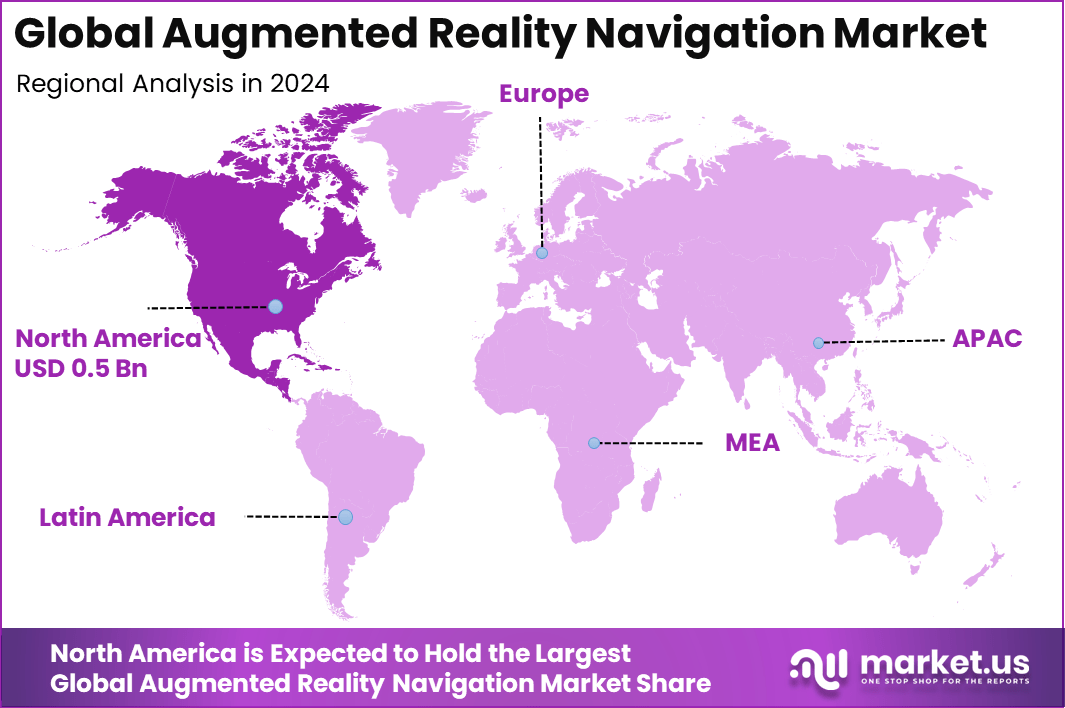

The Global Augmented Reality Navigation Market size is expected to be worth around USD 26.3 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 34.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 38% share, holding USD 0.5 Billion revenue.

The augmented reality navigation market is positioned as a transformative segment within the broader AR ecosystem. It involves overlaying digital guidance, landmarks, and routing information directly onto the user’s real‑world view via smart devices, head‑mounted displays, wearables, or vehicle head‑up systems. This integration of spatial awareness and visual guidance is reshaping navigation experiences across outdoor and indoor environments.

According to Market.us insights, the global Augmented Reality Market is projected to reach USD 591.7 billion by 2033, growing from USD 29.6 billion in 2024 at a robust CAGR of 39.5% during 2024 to 2033. Similarly, the AI in Augmented Reality Market is expected to expand from USD 16.0 billion in 2023 to approximately USD 446.5 billion by 2033, maintaining the same CAGR of 39.5% over the forecast period.

Data from Ortmor Agency further indicates strong adoption trends. Smart glasses are leading this shift, with more than 150 million units forecasted to ship globally by 2024, showing significant growth. Global AR users are set to surpass 1.7 billion in 2024, while mobile AR users are expected to exceed 2.5 billion by year-end. Enterprise adoption is also rising, with 70% of Forbes Global 2000 companies anticipated to implement AR solutions within their operations in 2024.

The growth of market can be attributed to heightened consumer demand for intuitive, immersive navigation experiences, particularly in automotive and urban mobility contexts. Integration of AR into vehicle HUDs and mobile apps has enhanced situational awareness and reduced cognitive load for users. Fast progress in AR tech, 5G, and smart devices has sped up use in transport, retail, and industry.

Market Size and Growth

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 26.3 Bn CAGR(2025-2034) 34.2% Leading Segment Outdoor Navigation: 58% Largest Market North America [38% Market Share] Largest Country US: USD 0.49 Billion Market Revenue, CAGR: 30.6% Key Takeaway

- Hardware emerged as the leading component segment, accounting for 54% of the total share due to growing adoption of AR glasses, headsets, and HUDs.

- Outdoor navigation was the dominant type, capturing 58%, driven by demand in vehicle navigation, tourism, and pedestrian AR routing.

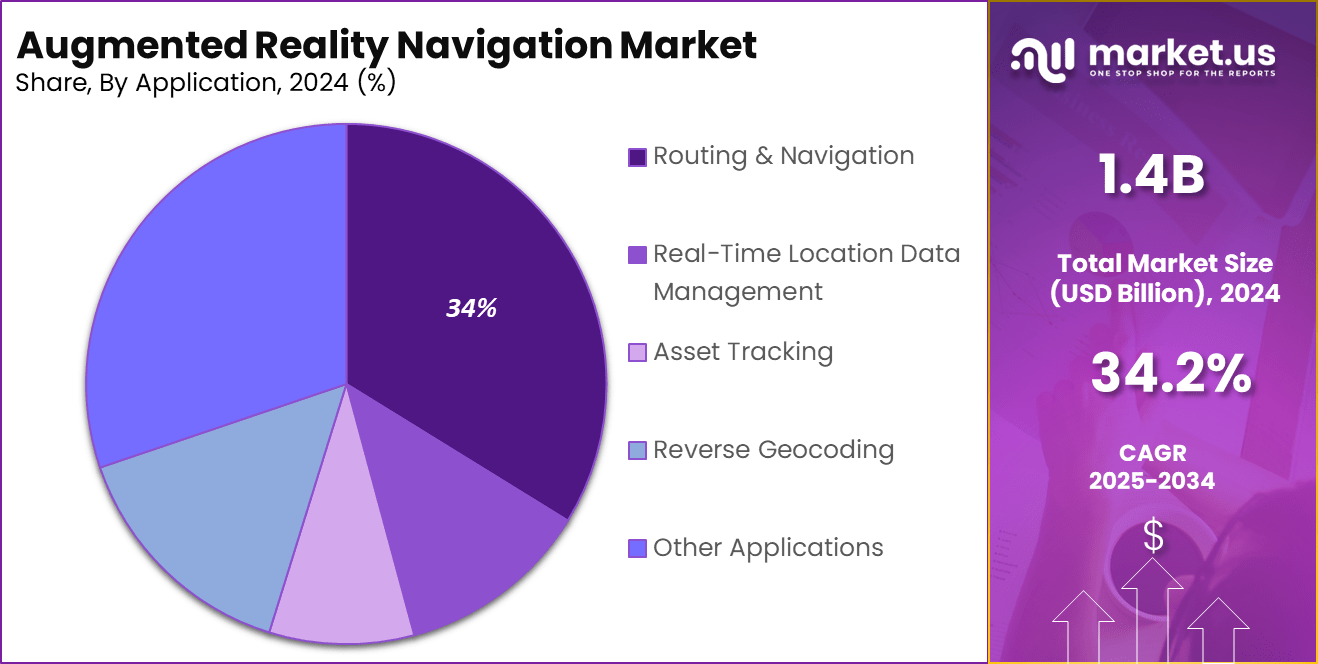

- Routing and navigation applications held a major share at 34%, reflecting strong integration in automotive dashboards and smart mobility systems.

- Gaming and entertainment led the end-use segment with 20%, as AR-based interactive experiences gain popularity in consumer electronics and mobile platforms.

- In 2024, North America dominated the market with a 38% revenue share, generating approximately USD 0.5 Billion.

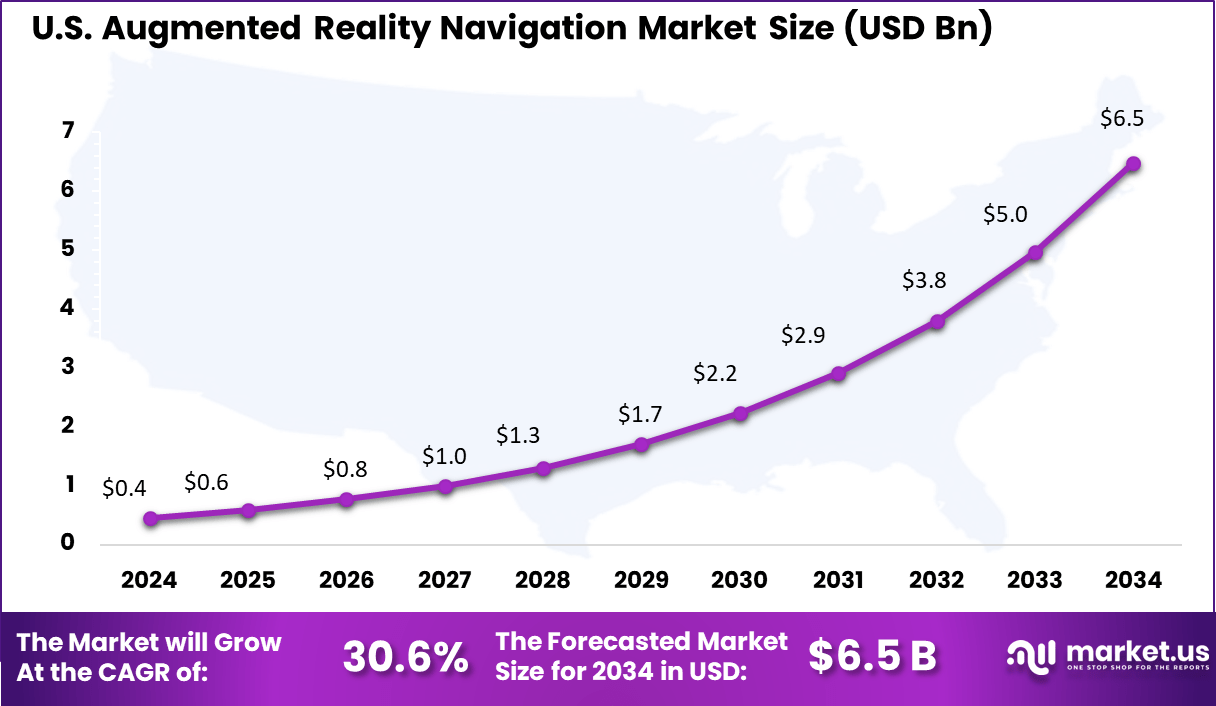

- The United States alone contributed USD 0.49 Billion, reflecting a robust CAGR of 30.6% through 2034.

U.S. Revenue Estimate

The U.S. Augmented Reality Navigation Market was valued at USD 0.4 Billion in 2024 and is anticipated to reach approximately USD 6.5 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 30.6% during the forecast period from 2025 to 2034.

In 2024, the U.S. held a leading position in the Augmented Reality (AR) Navigation Market, supported by its advanced digital infrastructure, strong investment in AR innovation, and widespread consumer adoption of smart technologies. The presence of high-speed 5G connectivity has enabled seamless real-time AR navigation applications, particularly across urban mobility, autonomous vehicles, and smart retail environments.

The leadership of the U.S. can also be attributed to significant government and private sector investments in AR development across automotive, defense, and logistics sectors. The ecosystem is supported by innovation hubs, academic institutions, and startup accelerators which consistently produce AR-focused patents, software development kits, and enterprise solutions.

In 2024, North America held a dominant market position in the global Augmented Reality Navigation market, capturing more than a 38% share. North America is at the forefront of integrating augmented reality (AR) navigation technologies, propelled by significant government initiatives and technological advancements.

The U.S. Department of Transportation (DOT) has committed to modernizing its telecommunications infrastructure, allocating substantial funds to enhance data visualization and immersive technologies within transportation systems. This investment aims to improve navigation systems, streamline operations, and bolster safety measures across various transportation networks.

In the private sector, firms such as GridRaster have received up to USD 15 million over 48 months through the U.S. Air Force’s STRATFI program. Their 3D AI XR solutions combine data from multiple sensors into one AR view, improving awareness and decisions in military use. These efforts highlight North America’s strong focus on advancing AR navigation via targeted funding and partnerships.

Europe Market Trends

In 2024, Europe is experiencing growing adoption of augmented reality navigation as part of its broader push toward smart mobility and digital urban development. The region’s advanced automotive industry plays a critical role, integrating AR to improve driving safety and navigation precision.

Public transport systems and retail environments are also embracing immersive AR wayfinding to support tourists and consumers with dynamic, real-time directions. There is also a rising demand for indoor navigation across hospitals and transport hubs. Countries like Germany and the UK are leading the transformation by embedding AR navigation into autonomous vehicles, smart cities, and retail infrastructure.

Asia Pacific Market Trends

Asia Pacific remains at the forefront of AR navigation innovation, driven by massive urban growth, 5G infrastructure rollouts, and extensive smart city investments. Nations such as China, Japan, and South Korea are applying AR across diverse sectors including transportation, logistics, and consumer retail.

Mobile-based AR navigation is especially popular, offering users real-time overlays for walking routes and indoor locations like airports and malls. The region’s push toward intelligent manufacturing and AI-enhanced AR experiences is enabling continuous improvement. With dense urban populations and a digital-first approach, Asia Pacific continues to be a key driver of global AR navigation technology.

Latin America Market Trends

In 2024, Latin America is showing rapid acceleration in AR navigation usage, supported by growing mobile penetration and smartphone adoption. The strongest uptake is seen in urban commercial zones and entertainment venues where AR aids both indoor and outdoor wayfinding.

While hardware solutions currently dominate the market, there is a noticeable shift toward software-driven navigation tools, especially those that require minimal setup. Smart city pilots and tourism-led innovations are helping municipalities explore AR navigation as an affordable solution to bridge infrastructure gaps and enhance user experiences across major cities in the region.

Middle East & Africa Market Trends

The Middle East & Africa region is increasingly deploying AR navigation within smart city ecosystems and tourism infrastructure. Modern urban centers are prioritizing technology investments to improve digital accessibility, particularly in locations such as malls, airports, and museums. The emphasis is on mobile AR platforms that provide scalable and cost-efficient wayfinding solutions without requiring extensive hardware.

Countries with active smart city agendas are showing early leadership in adopting AR to serve both residents and international visitors. As connectivity continues to improve, AR navigation is gaining traction as a tool to streamline user experiences in dynamic and culturally significant environments.

Component Analysis

In 2024, Hardware segment dominate the global Augmented Reality Navigation market, holding the highest market share of 54%. The hardware segment dominates the global augmented reality (AR) navigation market, holding the largest share due to the growing demand for robust, high-performance devices such as smart glasses, head-mounted displays (HMDs), and AR-compatible mobile devices.

Hardware development is crucial for AR navigation systems, providing the necessary infrastructure to run software applications efficiently. In the United States, the National Aeronautics and Space Administration (NASA) has invested in developing AR hardware for mission-critical applications, including navigation in complex environments such as spacecraft and Mars rovers.

For instance, In 2023, NASA tested AR technology in its Artemis program to enhance astronaut navigation during lunar missions, where headsets displayed real-time navigation data and mission instructions. This innovation is an example of the ongoing efforts to enhance AR hardware for specialized applications. In the automotive sector, firms such as Tesla are using AR-based navigation, supported by improved augmented vision systems, to deliver real-time guidance and hazard alerts.

Additionally, the U.S. Department of Defense is heavily investing in AR hardware development for military navigation systems, focusing on soldier-mounted devices and vehicle-based augmented vision systems, further boosting the demand for AR navigation hardware. With continuous innovations and government-backed investments, the hardware segment will continue to lead the market.

Type Segment Analysis

In 2024, Outdoor Navigation segment dominate the global Augmented Reality Navigation market, holding the highest market share of 58%. Outdoor navigation is the leading type within the augmented reality navigation market, accounting for the highest market share due to its significant adoption in transportation and outdoor activity sectors.

The U.S. government has recognized the potential of AR in improving outdoor navigation, particularly for autonomous vehicles and pedestrians. The Department of Transportation (DOT) has allocated substantial funding for projects exploring the integration of AR navigation systems into smart city infrastructure. One notable initiative is the Smart Cities Challenge, where cities like Columbus, Ohio, have received funding to implement AR-based traffic and pedestrian navigation systems.

Furthermore, the U.S. Army Corps of Engineers is conducting research on AR applications for outdoor navigation in construction and infrastructure projects, using augmented reality to improve site navigation and monitoring. The incorporation of AR in outdoor navigation extends to the tourism and entertainment industries as well.

Application Analysis

In 2024, Routing & Navigation segment dominate the global Augmented Reality Navigation market, holding the highest market share of 34%. Routing and navigation applications dominate the augmented reality navigation market due to the increasing need for real-time, accurate, and context-aware navigation across various sectors.

The U.S. government has played a significant role in driving the adoption of AR navigation systems through initiatives like the Federal Highway Administration’s (FHWA) research on AR-enhanced vehicle-to-infrastructure (V2I) communications. These projects aim to create safer and more efficient roadways by integrating AR technology into vehicle systems and traffic infrastructure.

For instnace, in 2023, the FHWA funded pilot projects in several states to test AR systems that provide real-time navigation, including hazard warnings and speed limit information, displayed directly on drivers’ windshields. Furthermore, the U.S. Department of Transportation’s (DOT) research into connected and automated vehicles supports the integration of AR technologies to improve routing, traffic management, and navigation systems for autonomous vehicles.

Additionally, major companies like Apple and Google have also played a critical role in the adoption of AR routing solutions, with their maps now integrating AR features to enhance pedestrian navigation in urban environments. As AR technology continues to evolve, routing and navigation systems are expected to benefit from more accurate, interactive, and real-time navigation features, enhancing user experiences and boosting adoption across multiple sectors.

End-Use Analysis

In 2024, Gaming & Entertainment segment account for the largest share in the global Augmented Reality Navigation market, capturing 20% of the segment. Gaming and entertainment is a dominant end-use segment in the augmented reality navigation market, driven by the rising demand for immersive and interactive experiences.

In the U.S., the entertainment industry has been at the forefront of AR adoption, with numerous companies integrating AR technology into gaming platforms. The U.S. government has supported this adoption through initiatives like the NSF funding for AR research in entertainment technologies. For example, in 2024, the NSF awarded a grant to researchers at the University of California to develop AR systems for interactive gaming that use spatial and environmental data to create more immersive game experiences.

Additionally, the U.S. Department of Energy (DOE) has invested in AR-based technologies to enhance the visual experience in museums, creating interactive exhibits for educational and entertainment purposes. The release of AR games, like Pokémon GO, further boosted this segment, showcasing the potential of AR in creating real-world gaming experiences.

Moreover, major gaming companies such as Microsoft and Sony are heavily investing in AR for gaming consoles. In 2023, Microsoft launched an AR-based update for the Xbox Series X, enabling gamers to interact with the physical environment in new ways. As AR continues to shape the future of gaming and entertainment, the demand for AR navigation solutions in this sector is set to grow significantly.

Growth Factors

Factor Description Rise of Smart Devices More people using smartphones, AR glasses, and tablets boosts AR navigation use. Urbanization and Complex Spaces Bigger cities and complex buildings make clear navigation more necessary. Demand for Immersive Experiences People want navigation that’s hands-free and feels more natural and interactive. 5G and Fast Internet High-speed connections make real-time AR navigation smooth and reliable. Automotive Integration Car makers add AR navigation to dashboards for safer, easier driving. Key Features and Trends

Feature/Trend Description Real-Time Overlays Live arrows, markers, or info appear right on your view (road, building, etc.). Indoor & Outdoor Navigation Works both inside malls and outside in complex city streets. Voice and Multilingual Support AR directions can be read out loud and shown in different languages. AI-Powered Personalization Guided routes adjust to your needs, habits, or even obstacles instantly. 5G Powered Performance Quick updates and smoother experiences thanks to faster data. Seamless Integration with Smart Tech Runs on phones, AR glasses, and even car windshields. Accessibility Enhancements AR helps people with disabilities or tourists navigate unfamiliar places. Drivers

Growing Demand for Immersive Navigation Experiences

The growing demand for immersive navigation experiences is driving the augmented reality (AR) navigation market globally. In the United Kingdom, the government’s Smart Cities initiative has been investing in AR to enhance urban mobility and pedestrian navigation. In 2022, the UK government allocated £100 million towards improving infrastructure for smart cities, including the integration of AR into transportation systems.

The project focuses on using AR for real-time navigation and traffic management. Similarly, in Japan, the government has supported the development of AR navigation systems for public transportation, ensuring seamless travel experiences in major cities like Tokyo. A notable project is the AR navigation system in the Tokyo Metro, which overlays real-time guidance and train schedules on users’ smartphones, enabling easier navigation through complex subway networks.

Additionally, South Korea has launched a nationwide initiative, with the Ministry of Land, Infrastructure, and Transport (MOLIT) investing in the use of AR in urban mobility applications. These government-backed initiatives, along with advancements in AR hardware and software, are helping to drive the global demand for immersive AR navigation solutions, making transportation and urban mobility more efficient and user-friendly.

Restraint

Challenges in Ensuring Data Privacy and Security

Data privacy and security challenges are significant restraints in the augmented reality (AR) navigation market, particularly as AR systems process vast amounts of personal and location-based data. In the European Union, the GDPR has set stringent standards for data privacy, which impacts AR companies offering navigation solutions.

AR navigation systems that collect user data, such as location, preferences, and behavior, must comply with GDPR’s requirements for data handling, storage, and consent. This adds complexity to the implementation of AR systems, as companies must ensure that data privacy and security protocols are in place to avoid fines and maintain consumer trust.

In Australia, the Office of the Australian Information Commissioner (OAIC) has also raised concerns about data privacy in AR applications, especially those used in public spaces like shopping centers and city streets. The OAIC has been working with businesses to ensure that AR-based navigation systems comply with national privacy laws and offer transparent user agreements.

Opportunities

Integration of AR with Autonomous Vehicle Navigation

The integration of AR with autonomous vehicle navigation presents a substantial opportunity to enhance driving safety and efficiency. In the United States, the U.S. Department of Energy (DOE) has been funding research into integrating AR with autonomous vehicle systems, particularly focusing on the improvement of situational awareness for drivers and passengers.

In 2024, the DOE allocated $15 million to a project that aims to integrate AR technology into autonomous vehicles, enhancing the display of critical navigation information like road conditions, traffic signs, and hazard detection. Similarly, in Germany, Audi and Volkswagen have been collaborating with augmented reality companies to develop HUD that overlay navigation data onto the windshield of autonomous vehicles, providing drivers with real-time updates.

The project, which was unveiled in early 2024, aims to make autonomous driving more intuitive by offering visual navigation cues directly in the driver’s line of sight. These developments highlight the growing opportunities in combining AR with autonomous vehicles, with governments and manufacturers investing in the integration of these technologies to improve transportation systems worldwide.

Challenges

Balancing Real-Time Data Processing and AR Accuracy

Balancing real-time data processing with AR accuracy is a major challenge in the development of AR navigation systems, especially for applications in dynamic environments. In Canada, the National Research Council (NRC) has been involved in research to improve the performance of AR systems, particularly for transportation and infrastructure.

In 2023, the NRC launched a project that focuses on optimizing real-time data processing for AR navigation in autonomous vehicles. This project aims to reduce latency in data transmission, which is crucial for providing accurate, real-time navigation in vehicles. The integration of high-definition maps, LiDAR data, and camera feeds requires processing a large volume of data simultaneously, which can lead to delays in AR navigation systems.

Moreover, in Singapore, the government has been testing AR navigation solutions for smart city applications, such as autonomous public transport. However, the challenge remains in ensuring that these systems can process real-time data without compromising the accuracy of the information displayed to users. Despite these efforts, achieving a balance between fast data processing and maintaining high AR accuracy remains a key obstacle to the widespread adoption of AR navigation solutions.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Type

- Indoor Navigation

- Outdoor Navigation

By Application

- Real-Time Location Data Management

- Routing & Navigation

- Asset Tracking

- Reverse Geocoding

- Other Applications

By End-Use

- Aerospace & Defense

- Gaming & Entertainment

- Healthcare

- E-Commerce & Retail

- Military & Defense

- Education

- Industrial & Manufacturing

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global augmented reality (AR) navigation market is experiencing dynamic growth, driven by advancements in AR technology and increasing demand for immersive navigation experiences. Major technology companies are at the forefront of this evolution, integrating AR into their navigation systems to enhance user engagement and functionality.

For instance, Google has been enhancing its AR capabilities through the development of the Android XR platform, which supports AI-integrated experiences on smart glasses and mixed-reality headsets. This platform aims to provide contextual and multimodal interactions using voice, gestures, and real-time camera input, with applications in navigation and other areas.

Similarly, Apple has introduced the Vision Pro, a spatial computer that seamlessly blends digital content with the physical world. While primarily focused on immersive experiences, the Vision Pro’s capabilities extend to navigation, offering users an intuitive interface for exploring and interacting with their surroundings.

In the automotive sector, companies like WayRay are pioneering the integration of AR into vehicle navigation systems. WayRay’s Deep Reality Display technology transforms the entire windshield into a virtual world, displaying navigation information directly onto the glass, thereby enhancing driver awareness and safety.

Top Key Players in the Market

- Google LLC

- Apple, Inc.

- Microsoft Corporation

- WayRay AG

- Neusoft Corporation

- FURUON ELECTRIC CO., LTD.

- ARway Corp.

- Mapbox

- HERE Technologies

- Sygic

- Wiser Marine Technologies

- Viewar GmbH

- Other Key Players

Recent Developments

- On May 30, 2024, Google announced a strategic partnership with augmented reality startup Magic Leap to create immersive experiences that combine physical and digital elements. This collaboration leverages Magic Leap’s expertise in optics and device manufacturing with Google’s technology platforms, aiming to enhance AR navigation capabilities.

- On April 26, 2024, Neusoft Corporation launched its OneCoreGo global smart mobility solution 5.0 at Auto China 2024 in Beijing. This solution showcases Neusoft’s innovative achievements in AI technology and the automotive field, aiming to enhance navigation and mobility services.

- On January 8, 2024, Mapbox introduced new AI-powered features in its latest Navigation SDK. These features equip automakers to offer compelling alternatives to Apple CarPlay and Android Auto, enhancing in-vehicle navigation experiences.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software, Services), By Type (Indoor Navigation, Outdoor Navigation), By Application (Real-Time Location Data Management, Routing & Navigation, Asset Tracking, Reverse Geocoding, Other Applications), By End-Use (Aerospace & Defense, Gaming & Entertainment, Healthcare, E-Commerce & Retail, Military & Defense, Education, Industrial & Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Apple, Inc., Microsoft Corporation, WayRay AG, Neusoft Corporation, FURUON ELECTRIC CO., LTD., ARway Corp., Mapbox, HERE Technologies, Sygic, Wiser Marine Technologies, Viewar GmbH, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Augmented Reality Navigation MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Augmented Reality Navigation MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Apple, Inc.

- Microsoft Corporation

- WayRay AG

- Neusoft Corporation

- FURUON ELECTRIC CO., LTD.

- ARway Corp.

- Mapbox

- HERE Technologies

- Sygic

- Wiser Marine Technologies

- Viewar GmbH

- Other Key Players