Global Augmented Reality Board Games Market Size, Share and Analysis Report By Component (Physical Game Components (Board, Pieces, Cards), AR Software/App, Subscription & Content Updates), By Device Type (Smartphone/Tablet-based AR, Dedicated AR Headset/Goggle Games, Hybrid (Screen + Projection), By Game Type (Strategy & Adventure Games, Educational & Learning Games, Party & Social Games, Mystery & Puzzle Games, Others), By Distribution Channel (Retail Stores, Online Marketplaces, Direct Sales, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172468

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Adoption and Usage Statistics

- Increasing Adoption Technologies

- U.S. AR Board Games Market Size

- Component Analysis

- Device Type Analysis

- Game Type Analysis

- Distribution Channel Analysis

- Emerging Trends Analysis

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

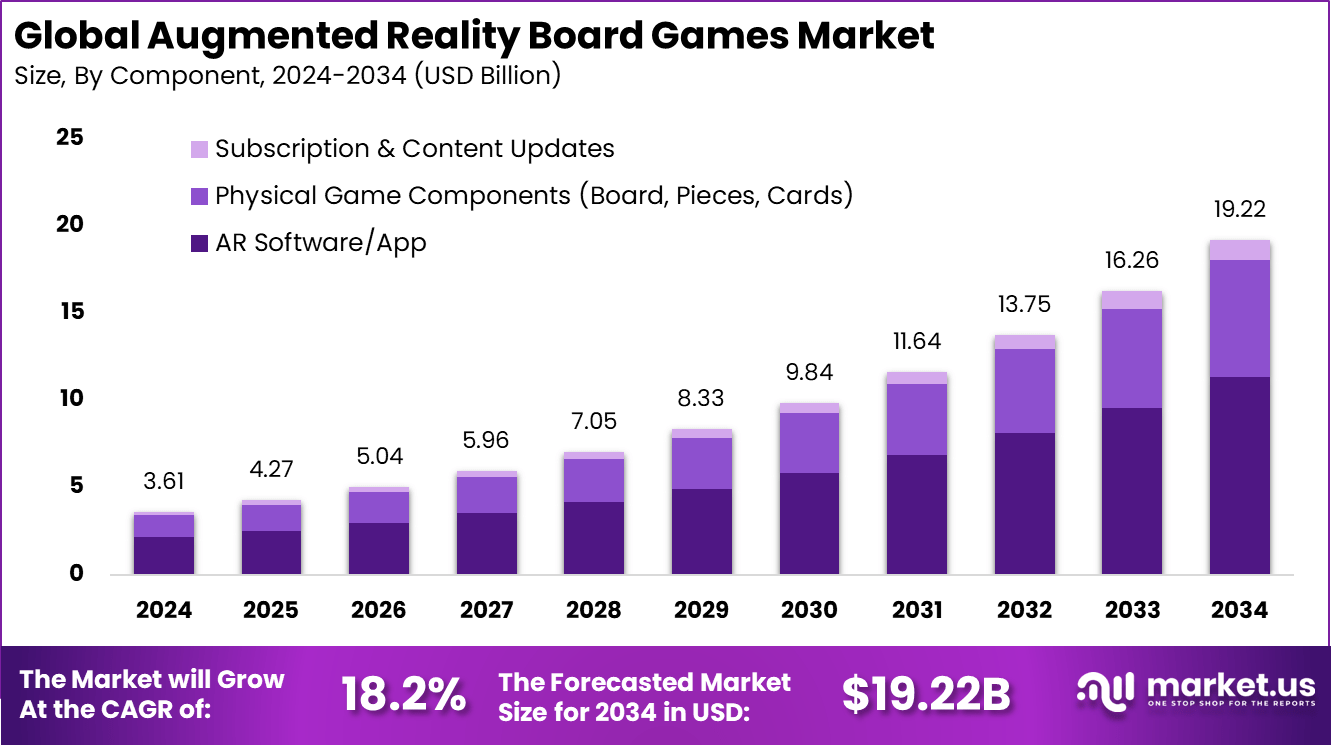

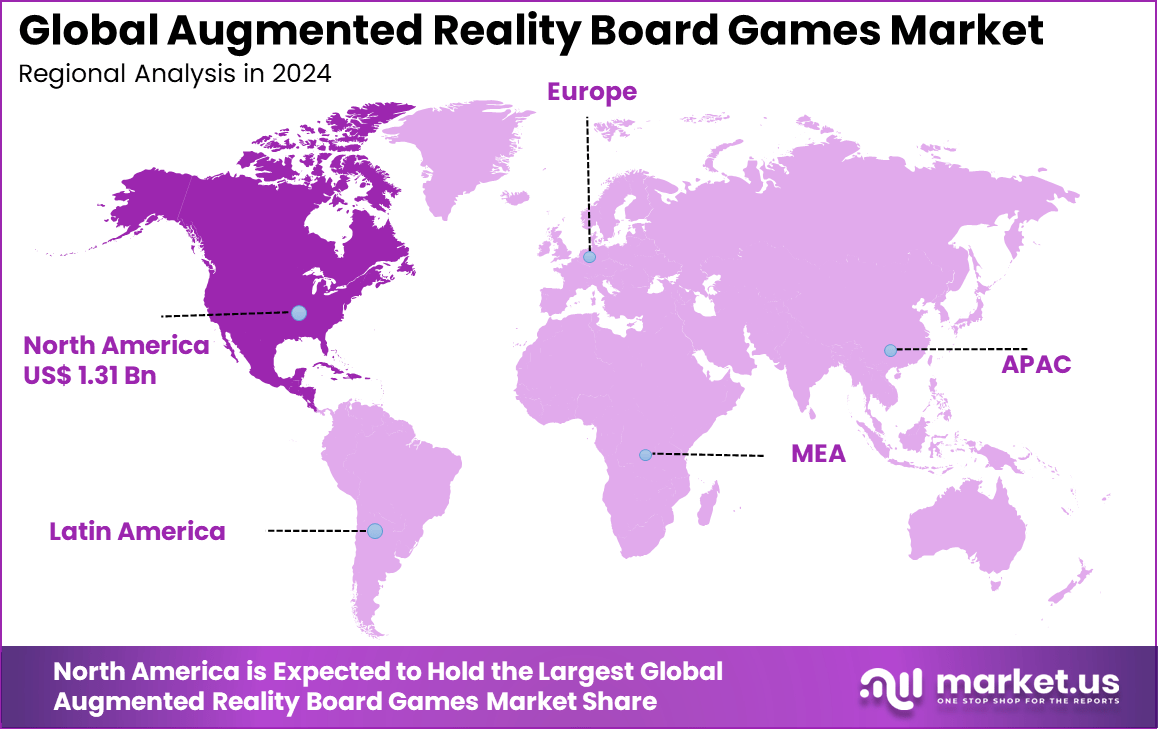

The Global Augmented Reality Board Games Market size is expected to be worth around USD 19.22 billion by 2034, from USD 3.61 billion in 2024, growing at a CAGR of 18.2% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 36.5% share, holding USD 1.31 billion in revenue.

The Augmented Reality Board Games Market refers to board games that combine physical game components with digital overlays using augmented reality technology. These games use smartphones, tablets, or smart glasses to display interactive visuals, animations, and game logic on top of physical boards and pieces. Augmented reality enhances traditional board games by adding dynamic elements while preserving face-to-face social interaction.

The market includes game publishers, AR software platforms, and supporting hardware ecosystems. This market represents a blend of physical and digital entertainment experiences. Augmented reality board games aim to modernize classic gameplay by increasing immersion and replay value. Players interact with both tangible game elements and digital content simultaneously. The market continues to evolve as AR technology becomes more accessible and user-friendly.

Demand for AR board games rises as people seek screen-free fun with a tech twist, and 67% favor them for real face-to-face laughs over solo apps. Parents grab sets that teach history or math through popping visuals, making learning stick. Younger adults share clips on social feeds, boosting curiosity in their circles. Quick app links mean easy trials at home, and word spreads at gatherings. Groups want affordable ways to make evenings special, blending nostalgia with modern flair that fits busy lives perfectly.

For instance, in July 2025, BANDAI NAMCO Entertainment rolled out GUNDAM CARD GAME globally in three languages, laying the groundwork for AR-integrated miniature battles in their upcoming GUNDAM ASSEMBLE tabletop game set for 2026. This TCG push captures strong fan response and positions them to blend physical cards with AR visuals.

Key Takeaway

- AR software and applications led the augmented reality board games market with a 58.9% share, reflecting strong demand for immersive gameplay mechanics and frequent content updates.

- Smartphone and tablet-based AR dominated device usage at 92.4%, driven by widespread device availability and ease of access for casual and family gamers.

- Strategy and adventure games accounted for 38.7%, as players favored narrative depth, replay value, and interactive decision-making enabled by AR features.

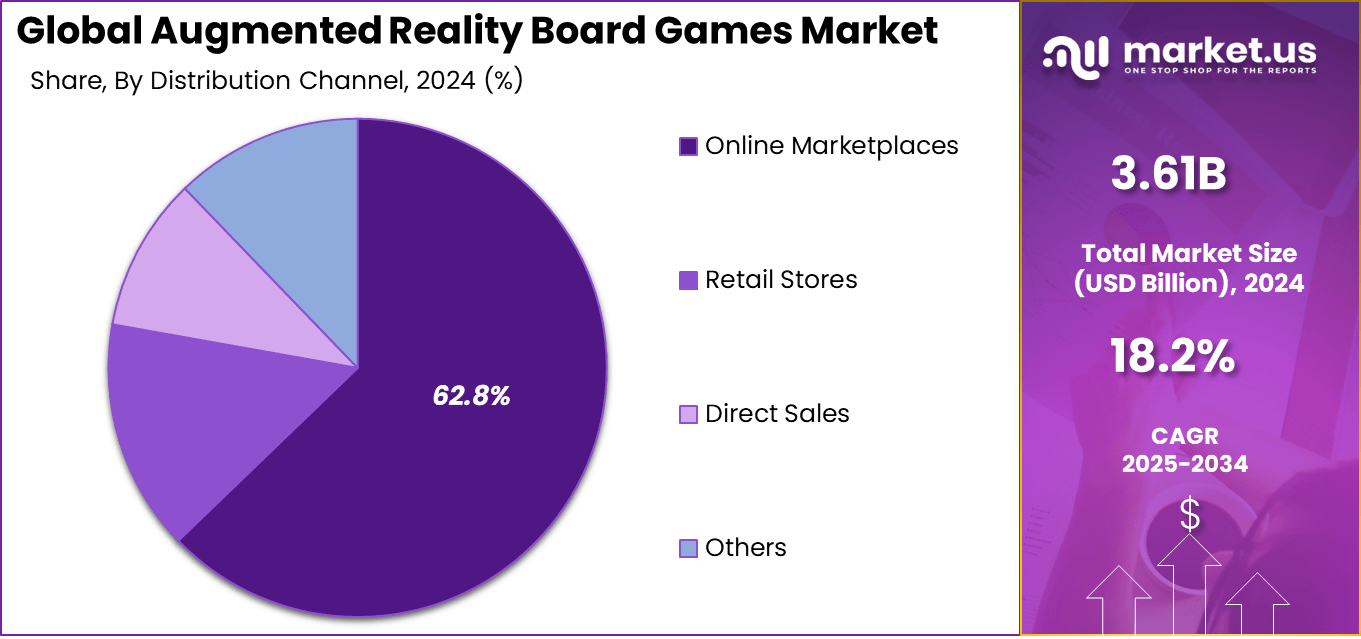

- Online marketplaces captured 62.8% of distribution, supported by digital storefronts, app-based downloads, and global reach.

- North America held a 36.5% share, backed by high gaming adoption, strong AR awareness, and a mature digital entertainment ecosystem.

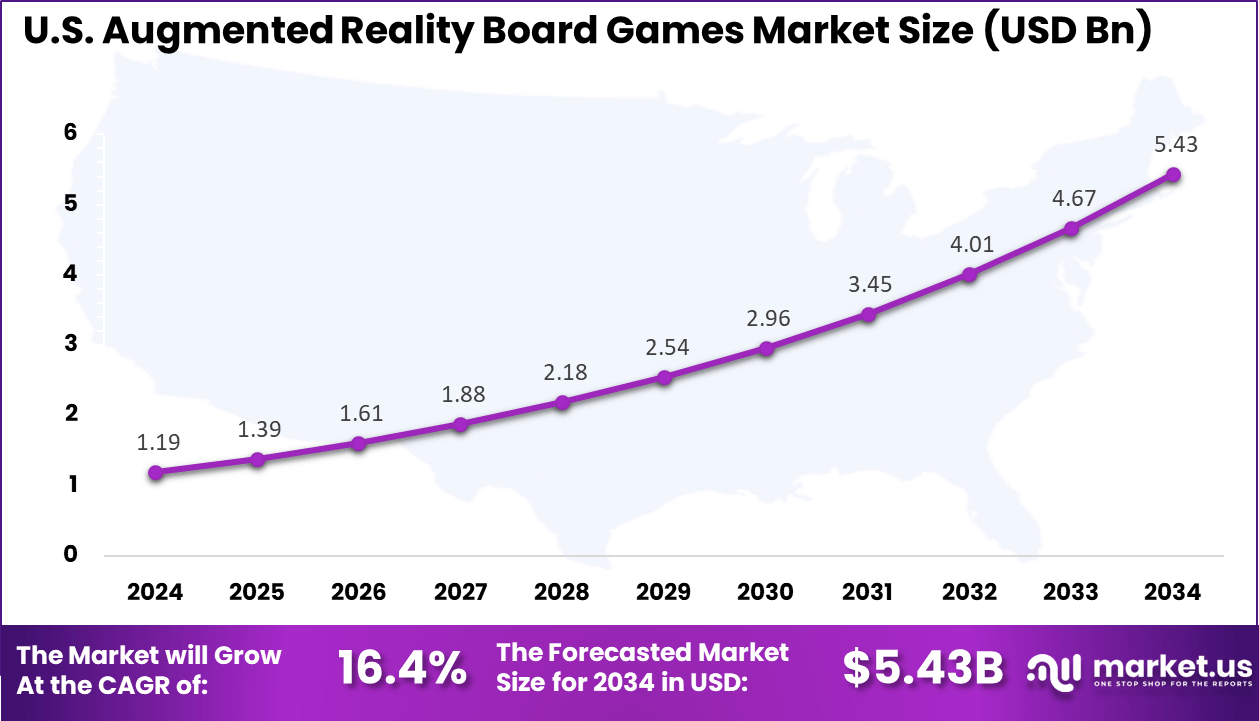

- The U.S. market reached USD 1.19 billion in 2024 and is expanding at a 16.4% CAGR, driven by mobile gaming growth, AR innovation, and rising demand for interactive tabletop experiences.

Key Adoption and Usage Statistics

- User adoption is largely driven by smartphone accessibility and the immersive appeal of augmented reality experiences.

- Mobile AR users are projected to reach around 1.73 billion by the end of 2024, reflecting broad mainstream penetration.

- Player interest is strong, with nearly 50% of mobile gamers preferring titles that include AR features.

- Head-mounted displays remain significant within overall AR gaming hardware, holding a 55% share in 2024 due to deeper immersion and advanced interaction capabilities.

Increasing Adoption Technologies

Augmented reality board games rely on technologies such as computer vision, motion tracking, and real-time rendering. These technologies allow devices to recognize physical boards and game pieces accurately. Mobile AR development frameworks support seamless integration between physical and digital elements. Improvements in camera quality and processing power enhance gameplay accuracy.

Cloud connectivity also supports adoption by enabling content updates and multiplayer features. Artificial intelligence may be used to control non-player characters or adapt game difficulty. Cross-platform compatibility allows games to run on widely available consumer devices. These technologies reduce barriers to adoption and improve user experience.

One key reason for adopting augmented reality board games is enhanced engagement. AR elements make gameplay more visually appealing and interactive. Players can experience evolving scenarios and animations that respond to physical actions. This creates a richer and more memorable gaming experience.

Another reason is innovation in traditional board gaming. Publishers use AR to refresh classic game concepts without removing physical components. This balance attracts both traditional board game enthusiasts and digital-native players. Adoption is also supported by the educational potential of AR-enhanced games.

U.S. AR Board Games Market Size

The United States reached USD 1.19 Billion with a CAGR of 16.4%, reflecting steady market expansion. Growth is driven by mobile gaming adoption and AR innovation. Players seek new gaming experiences beyond traditional formats. Continued content development supports demand. Market momentum remains positive.

North America accounts for 36.5%, supported by strong gaming culture and technology adoption. Consumers in the region show high interest in interactive entertainment. Advanced mobile infrastructure supports AR gameplay. Developers focus on innovation for this market. The region remains a key contributor.

For instance, in October 2025, Schell Games launched Project Freefall, a multiplayer competitive skydiving tag game for Meta Quest and PC platforms. This early access title showcases advanced mixed reality mechanics, reinforcing U.S. innovation in AR-enhanced gaming. Schell Games continues to lead North American development of immersive, social AR experiences that expand beyond traditional board formats.

Component Analysis

In 2024, AR software and applications account for 58.9%, showing that digital layers are central to augmented reality board games. These applications enable real-time interaction between physical game pieces and virtual elements. Software platforms manage game logic, visuals, and user interaction. Stable performance is critical to maintain gameplay flow. Frequent updates help enhance features and content.

The dominance of AR software is driven by the need for immersive and interactive experiences. Developers focus on improving graphics and responsiveness through software improvements. Applications also support multiplayer functionality and content expansion. Compatibility with common devices increases accessibility. This sustains strong adoption of AR software components.

For Instance, in March 2025, Niantic, Inc. spun off its geospatial AI into Niantic Spatial, focusing on AR platforms that power software for real-world games. This move strengthens app development for board games by improving mapping and interaction layers, making digital overlays more responsive on physical boards. Developers now access advanced tools to create seamless AR experiences without hardware limits.

Device Type Analysis

In 2024, Smartphone and tablet-based AR holds 92.4%, indicating overwhelming reliance on mobile devices. These devices offer built-in cameras, sensors, and displays suitable for AR gameplay. Users prefer mobile platforms due to familiarity and convenience. Mobile access lowers entry barriers for players. This supports widespread adoption.

Growth in this segment is driven by high smartphone penetration. Players can easily download and start games without additional hardware. Tablets provide larger displays for enhanced gameplay. Mobile platforms also support frequent updates. These factors reinforce dominance of mobile-based AR.

For instance, in July 2025, LEGO Group updated its AR apps for smartphones, enhancing Hidden Side sets with better tablet compatibility. Kids scan builds to unlock ghosts and quests directly on devices, turning family tables into interactive zones. This keeps play fluid across common gadgets without extra purchases.

Game Type Analysis

In 2024, Strategy and adventure games account for 38.7%, making them the leading game type. These genres benefit from immersive environments and interactive storytelling. AR elements add depth to planning and exploration mechanics. Players engage longer with complex game scenarios. This improves replay value.

Demand for strategy and adventure games is driven by user interest in skill-based gameplay. AR enhances realism and engagement in these genres. Developers focus on narrative depth and interaction. These games appeal to both casual and dedicated players. This supports steady growth.

For Instance, in November 2023, Niantic, Inc. acquired Sensible Object, developers of AR board games like strategy titles with physical-digital fusion. The deal advances adventure mechanics, letting players command virtual armies on real boards. It highlights how AR elevates deep planning in group play.

Distribution Channel Analysis

In 2024, Online marketplaces represent 62.8%, highlighting their importance in game distribution. Digital platforms allow easy discovery and purchase of AR board games. Users can access updates and additional content seamlessly. Online channels reduce physical distribution costs. This improves market reach.

Growth in online distribution is driven by digital buying habits. Players prefer instant access and downloads. Online platforms also support user reviews and community engagement. Promotions and bundles influence purchase decisions. These factors support continued channel dominance.

For Instance, in July 2025, the AR Board Games app by Pablo AI Team hit Google Play, letting users scan physical boards for online-purchased digital overlays. Marketplaces now bundle apps with sets, making adventure visuals instant downloads. Convenience fuels quick buys for tabletop fans.

Emerging Trends Analysis

Augmented reality board games are increasingly moving toward hybrid gameplay models that blend physical boards with real-time digital interaction. Developers are designing games where animations, characters, and rule changes appear through mobile devices while players continue to interact with physical pieces. This trend reflects a broader shift toward immersive entertainment that preserves social, face-to-face play.

The focus is on enhancing traditional board games rather than replacing them with fully digital formats. Another emerging trend is the use of markerless AR and mobile-based platforms. Modern AR frameworks allow games to function without printed markers or special hardware. This makes gameplay smoother and more accessible to casual users. Multiplayer and cooperative AR board games are also gaining attention, as they support shared storytelling and collaborative problem-solving.

Key Market Segments

By Component

- Physical Game Components (Board, Pieces, Cards)

- AR Software/App

- Subscription & Content Updates

By Device Type

- Smartphone/Tablet-based AR

- Dedicated AR Headset/Goggle Games

- Hybrid (Screen + Projection)

By Game Type

- Strategy & Adventure Games

- Educational & Learning Games

- Party & Social Games

- Mystery & Puzzle Games

- Others

By Distribution Channel

- Retail Stores

- Online Marketplaces

- Direct Sales

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A primary driver for the augmented reality board games market is growing consumer interest in interactive and immersive entertainment experiences. Traditional board games are facing competition from digital gaming, and AR provides a way to modernize physical games without losing their social appeal. Players are increasingly attracted to games that respond dynamically to their actions. This demand is encouraging publishers to experiment with AR-enhanced formats.

Another important driver is the widespread availability of AR-capable smartphones and tablets. Most consumers already own devices that can support augmented reality applications. This reduces the need for additional hardware investments. Easy access to AR technology lowers adoption barriers and expands the potential user base for AR board games.

Restraint Analysis

One key restraint in this market is the complexity of developing high-quality AR experiences. Designing reliable and visually engaging AR content requires specialized technical skills. Smaller game developers may face challenges in funding and expertise. This can limit the number of innovative products entering the market.

User experience limitations also act as a restraint. Some players prefer traditional board games and may resist screen-based interaction during play. Extended screen usage can reduce immersion for certain user groups. Balancing digital enhancement with physical gameplay remains a design challenge.

Opportunity Analysis

A strong opportunity exists in educational and family-oriented AR board games. Augmented reality can enhance learning by visualizing concepts and encouraging active participation. Games focused on problem-solving, science, or language learning can benefit from AR features. This opens doors to adoption in schools and learning centers.

Another opportunity lies in content updates and digital expansion. AR board games allow developers to introduce new levels, characters, or storylines through software updates. This extends the life cycle of physical products. It also enables recurring engagement without producing new physical components.

Challenge Analysis

A major challenge for the market is device fragmentation. AR performance can vary widely depending on camera quality, processing power, and operating systems. Ensuring consistent gameplay across different devices requires extensive testing. This increases development time and costs.

Another challenge is maintaining the balance between digital and physical elements. Overuse of AR features can distract from the core board game experience. Underuse can make the AR element feel unnecessary. Achieving this balance is critical for long-term user satisfaction and repeat play.

For instance, in December 2024, Microsoft’s HoloLens 2 final update addressed device compatibility but highlighted ongoing glitches in tracking and power. Enterprise users faced uneven performance across hardware. Support transitions expose cross-device sync issues. Groups troubleshoot instead of engaging fully. Standardization lags hinder reliable group play.

Key Players Analysis

Niantic, Inc., Sony Interactive Entertainment, and Microsoft Corporation lead the augmented reality board games market by combining location based AR, advanced graphics, and interactive gameplay mechanics. Their platforms blend physical game elements with digital overlays to enhance player engagement. These companies focus on immersive user experiences, cross device compatibility, and scalable AR engines. Growing interest in mixed reality entertainment continues to strengthen their leadership.

LEGO Group, Hasbro, Inc., Asmodee Group, and Spin Master Corp. strengthen the market by integrating AR features into well known board game franchises. Their offerings combine physical game boards, smart accessories, and companion apps. These providers emphasize family friendly gameplay, repeat engagement, and brand driven storytelling. Rising demand for interactive tabletop experiences supports wider adoption.

BANDAI NAMCO Entertainment, Inc., Tilt Five, Inc., Reality Gaming Group, ARize, Inc., and other players expand the landscape with niche AR board games and hardware enabled experiences. Their solutions focus on tabletop projection, shared AR views, and multiplayer interaction. These companies target hobby gamers and early adopters. Increasing convergence of digital gaming and physical play continues to drive steady growth in the augmented reality board games market.

Top Key Players in the Market

- Niantic, Inc.

- Sony Interactive Entertainment

- Microsoft Corporation

- LEGO Group

- Hasbro, Inc.

- Asmodee Group

- Spin Master Corp.

- Thames & Kosmos

- BANDAI NAMCO Entertainment, Inc.

- Prospero Hall

- Schell Games

- Trigger Global, Inc.

- Tilt Five, Inc.

- Reality Gaming Group

- ARize, Inc.

- Others

Recent Developments

February, 2025: LEGO Holding launches LEGO Digital Play

LEGO Holding introduced LEGO Digital Play as a dedicated entity to explore fresh digital experiences tied to their iconic bricks. This move aims to blend physical building with interactive tech, opening doors for AR overlays in family playtime. Early signals point to prototypes that could enhance board games through smartphone scans and virtual elements.

March, 2025: Niantic sells AR portfolio to Scopely for $3.5 billion

Niantic offloaded its gaming division, including Pokémon GO, to Scopely in a massive $3.5 billion deal, marking a pivot away from direct AR consumer titles. The transaction includes a $350 million cash boost and closes later in the year, freeing Niantic for enterprise AR tools.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Bn Forecast Revenue (2034) USD 19.2 Bn CAGR(2025-2034) 18.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Physical Game Components (Board, Pieces, Cards), AR Software/App, Subscription & Content Updates), By Device Type (Smartphone/Tablet-based AR, Dedicated AR Headset/Goggle Games, Hybrid (Screen + Projection), By Game Type (Strategy & Adventure Games, Educational & Learning Games, Party & Social Games, Mystery & Puzzle Games, Others), By Distribution Channel (Retail Stores, Online Marketplaces, Direct Sales, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Niantic, Inc., Sony Interactive Entertainment, Microsoft Corporation, LEGO Group, Hasbro, Inc., Asmodee Group, Spin Master Corp., Thames & Kosmos, BANDAI NAMCO Entertainment, Inc., Prospero Hall, Schell Games, Trigger Global, Inc., Tilt Five, Inc., Reality Gaming Group, ARize, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Augmented Reality Board Games MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Augmented Reality Board Games MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Niantic, Inc.

- Sony Interactive Entertainment

- Microsoft Corporation

- LEGO Group

- Hasbro, Inc.

- Asmodee Group

- Spin Master Corp.

- Thames & Kosmos

- BANDAI NAMCO Entertainment, Inc.

- Prospero Hall

- Schell Games

- Trigger Global, Inc.

- Tilt Five, Inc.

- Reality Gaming Group

- ARize, Inc.

- Others