Global Auction House Insurance Market Size, Share and Analysis Report By Coverage Type (Property Insurance, Liability Insurance, Fine Art Insurance, Cyber Insurance, Others), By Application (Auction Houses, Art Dealers, Collectors, Museums, Others), By Distribution Channel (Direct Sales, Brokers, Online Platforms, Others), By End-User (Individual, Commercial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176934

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

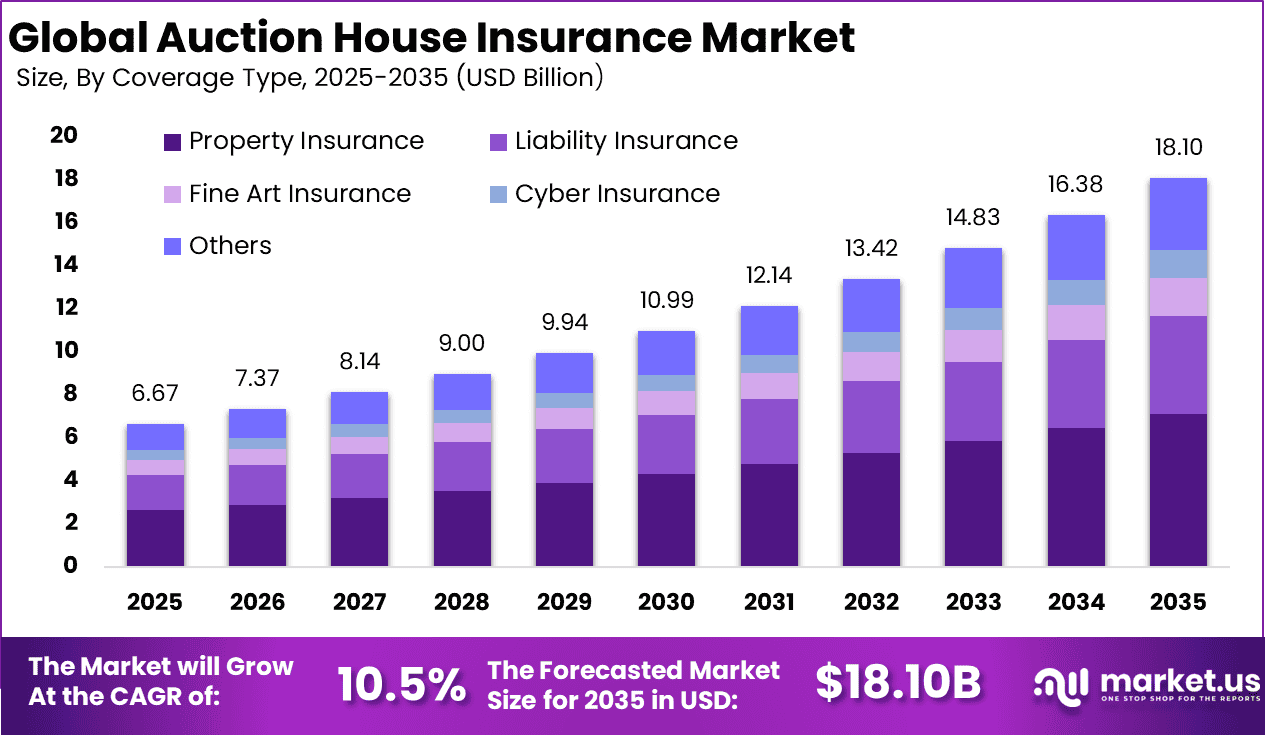

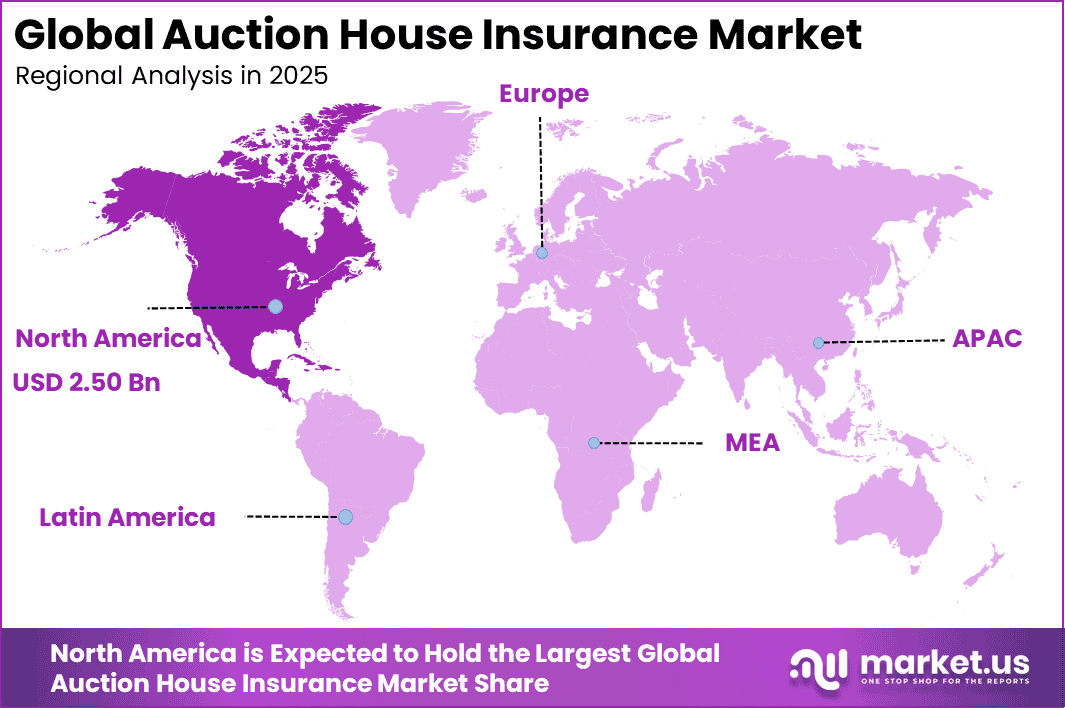

The Global Auction House Insurance Market size is expected to be worth around USD 18.10 billion by 2035, from USD 6.67 billion in 2025, growing at a CAGR of 10.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 37.5% share, holding USD 2.50 billion in revenue.

The Auction House Insurance Market refers to specialized insurance coverage designed to protect auction houses against operational, financial, and asset related risks. These policies typically address exposures linked to high value goods, public attendance, consignor assets, and transactional liabilities. Auction houses operate in environments where artwork, antiques, collectibles, and luxury goods are handled, displayed, and transferred frequently, which increases risk concentration.

Insurance is therefore treated as a core operational safeguard rather than a supplementary expense. Coverage within this market is structured to protect both owned and consigned items, along with liabilities arising from auctions, previews, storage, and transportation. As auction houses expand into online and hybrid auction formats, risk profiles have become more complex.

One of the main driving factors is the increasing value and diversity of items being auctioned. High value artworks, rare collectibles, vintage vehicles, and luxury goods expose auction houses to significant financial loss if damaged, stolen, or disputed. As average lot values rise, the financial impact of a single incident becomes more severe. This drives stronger demand for comprehensive insurance protection.

Demand for auction house insurance is steadily increasing as auction volumes grow across both physical and digital platforms. Online auctions have expanded global participation, increasing transaction frequency and exposure to cyber related and logistical risks. Industry data indicates that more than 65% of auction houses now operate some form of online bidding, which has altered traditional risk models.

For instance, in January 2026, Willis Towers Watson completed its $1.5 billion acquisition of Newfront Insurance Holdings, expanding brokerage capabilities for middle-market clients, including auction houses. This strengthens WTW’s risk advisory for art and specialty assets, supporting seamless coverage during global auctions.

Key Takeaway

- In 2025, property insurance emerged as the leading coverage type in the global auction house insurance market, accounting for 39.4% of total share due to high-value asset protection needs.

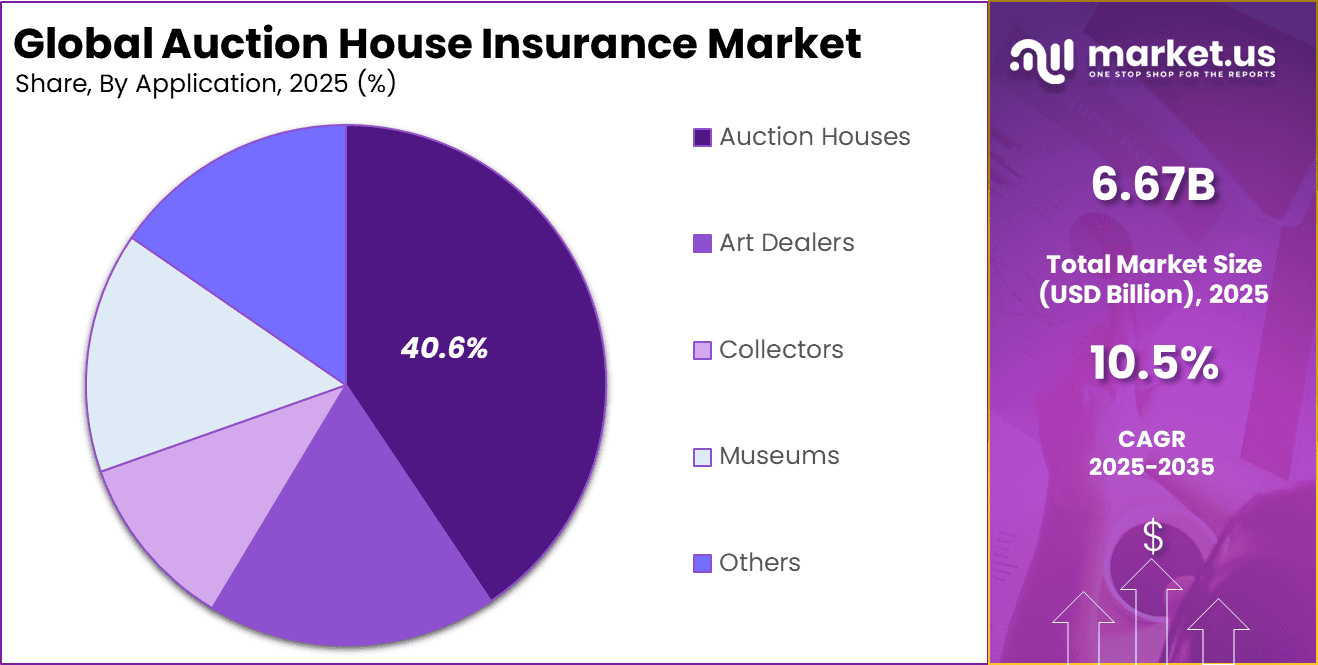

- In 2025, auction houses represented the largest insured entity group, capturing 40.6% of the global market as operators sought comprehensive coverage for artworks, antiques, and collectibles.

- In 2025, direct sales remained the preferred distribution channel, holding a 44.7% share as insurers and auction houses favored direct relationships for customized policy structures.

- In 2025, the commercial segment dominated end-user adoption with a 65.8% share, reflecting the concentration of professional auction operations and institutional clients.

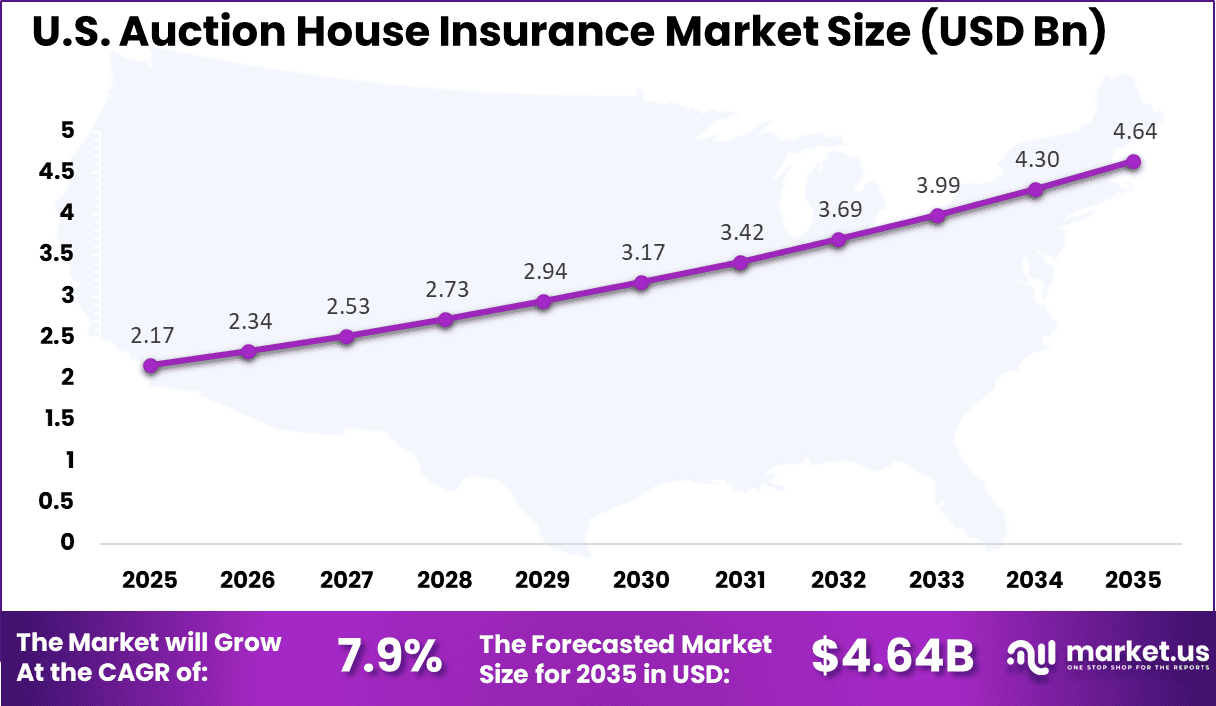

- In 2025, the U.S. auction house insurance market was valued at USD 2.17 billion and recorded a steady 7.9% CAGR, supported by active auction activity and high insurance penetration.

- In 2025, North America led the global auction house insurance market with over 37.5% share, driven by a strong auction ecosystem, high-value transactions, and mature insurance frameworks.

By Coverage Type

Property insurance represents 39.4% of overall adoption in the Auction House Insurance Market. This dominance reflects the high value of physical assets held within auction premises, including artwork, antiques, collectibles, and historical items. Protection against fire, theft, water damage, and accidental loss is treated as a primary risk management requirement.

The importance of property insurance is further reinforced by the temporary custody nature of auction operations. Items are often stored for limited periods prior to sale, which increases exposure to handling and storage risks. As a result, property insurance remains a core component of coverage portfolios for auction houses.

For Instance, in January 2026, AXA XL rolled out updated property insurance features for high-value storage, including better protection for auction venues against fire and theft. This move helps auction houses secure their art collections during peak sales seasons, drawing more clients to their tailored plans. Insurers note quicker claims processing to support busy operations.

By Application

Auction houses account for 40.6% of total application based demand. These entities manage high value inventories and host public events that involve frequent movement of goods. Insurance coverage is essential to safeguard assets during valuation, display, and transaction stages.

Adoption within this segment is driven by reputational and contractual considerations. Clients expect professional risk protection when consigning valuable items. This expectation sustains consistent insurance demand across auction house operations.

For instance, in November 2025, Hiscox highlighted rising auction values in their 2025 report, prompting specialized coverage for auction houses handling contemporary art sales. The report shows growth in mid-tier lots, leading to new policies that cover live events and online bids. Auction operators praise the data-driven risk assessments for fitting real-world needs.

By Distribution Channel

Direct sales represent 44.7% of policy distribution in the Auction House Insurance Market. This channel is preferred due to the specialized nature of auction related risks. Direct engagement allows insurers and clients to define precise coverage limits and policy conditions.

The dominance of direct sales is also supported by long term insurer relationships. Customized underwriting improves clarity and confidence for auction operators. This strengthens the role of direct distribution in policy placement.

For Instance, in November 2025, AXA XL debuted an AI-powered engine in Chubb Studio for direct insurance sales to auction businesses. It personalizes property and liability offers at the point of sale for digital partners. Auction houses gain fast custom policies without brokers, boosting efficiency. The tool drives direct sales growth by simplifying access to specialty coverage.

By End User

Commercial end users represent 65.8% of total market demand. Commercial auction operators handle larger volumes and higher value consignments compared to private sellers. This increases exposure to financial loss and liability risk.

Insurance adoption among commercial users is driven by regulatory compliance and operational scale. Comprehensive coverage supports business continuity and client trust. This maintains strong demand from the commercial end user segment.

For Instance, in October 2025, AIG updated its commercial policies to include broader coverage for auction houses’ valuables like collectibles and stamps during transit and display. Targeted at business users, the enhancements address growing event sizes and cyber risks. Commercial clients value the worldwide liability add-ons that safeguard large-scale operations year-round.

Regional Perspective

North America holds a leading position in the Auction House Insurance Market, accounting for 37.5% of total activity. The region benefits from a mature auction ecosystem, strong art and collectibles markets, and established insurance frameworks. Risk transfer through insurance is widely embedded in auction operations. Legal and compliance requirements further support insurance adoption. Auction houses prioritize asset protection and liability management.

For instance, in October 2025, Chubb reinforced U.S. leadership in auction house insurance through its comprehensive fine art coverage, highlighted in industry reports for protecting high-value collections during major auctions. The company’s specialized policies cover museums, galleries, and auction houses with flexible worldwide options and no deductibles for most losses. Chubb’s expertise supports North America’s dominant position amid growing art market sales.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 2.17 Bn and a growth rate of 7.9% CAGR. Growth is supported by sustained activity in fine art, collectibles, and estate auctions. Insurance coverage is increasingly viewed as a standard operational requirement.

Adoption in the U.S. is influenced by high asset values and legal exposure. Commercial auction houses prioritize coverage to protect inventory and maintain client confidence. These dynamics collectively support steady growth in the U.S. market segment.

For instance, in April 2025, Berkshire Hathaway Specialty Insurance promoted key leaders in Ireland while expanding its fine art & specie capabilities across North America, strengthening auction house coverage. This development underscores the company’s commitment to specialty lines, including high-value art risks essential for auction markets, maintaining U.S. dominance in the sector.

Driver Analysis

A primary driver of the auction house insurance market is the high financial value and uniqueness of auctioned items. Damage, loss, or theft of rare assets can result in significant financial and reputational consequences. Insurance provides essential protection against these risks and supports trust between auction houses, consignors, and buyers. This risk transfer function is critical in maintaining market credibility.

Another important driver is the expansion of online and hybrid auction formats. Digital auctions increase transaction volume and geographic reach but also introduce new risks related to logistics, storage, and third party handling. As auction houses manage more complex supply chains and customer interactions, demand for comprehensive insurance coverage continues to increase.

Restraint Analysis

A key restraint in the auction house insurance market is complexity in risk valuation. Auction items often lack standardized pricing due to rarity, provenance, and market volatility. Determining accurate insured values can be challenging and may lead to disputes if losses occur. This valuation uncertainty can slow policy issuance or result in conservative coverage terms.

Another restraint is limited insurance awareness among smaller or regional auction houses. Some operators may underestimate their exposure or rely on basic property insurance that does not fully address consignment or transit risks. This underinsurance limits market penetration and increases vulnerability to financial loss.

Opportunity Analysis

A major opportunity in the auction house insurance market lies in customized and modular policy structures. Coverage tailored to specific asset classes such as fine art, collectibles, or vehicles improves relevance and pricing accuracy. Modular policies allow auction houses to adjust coverage based on auction volume, seasonality, and asset type. This flexibility supports broader adoption.

Another opportunity is the growth of international auctions and private sales. As assets move more frequently across borders, demand for transit and cross jurisdiction coverage increases. Insurance solutions that address customs handling, temporary storage, and international liability exposures can support expanding auction operations.

Challenge Analysis

A significant challenge for the auction house insurance market is managing accumulation risk during major auctions. Large events may concentrate high value assets in a single location for limited periods. This creates elevated exposure to catastrophic loss from fire, natural events, or security incidents. Managing this concentration without excessive premium increases remains challenging.

Another challenge involves aligning coverage with evolving legal obligations. Auction houses face increasing scrutiny related to authenticity, disclosure, and fiduciary duty. Professional liability exposure is growing, and insurers must clearly define coverage boundaries to avoid disputes. Balancing legal protection with clear exclusions requires careful policy design.

Emerging Trends Analysis

An emerging trend in the auction house insurance market is increased demand for coverage linked to online transactions. Cyber related risks such as payment fraud, data breaches, and transaction disputes are becoming more relevant as digital auctions grow. Insurance solutions are gradually expanding to address these exposures alongside traditional physical risks.

Another trend is closer integration between insurance and risk advisory services. Auction houses increasingly seek guidance on storage standards, transport protocols, and security practices. Insurers offering risk assessment support alongside coverage strengthen client relationships and loss prevention outcomes.

Growth Factors Analysis

One of the key growth factors for the auction house insurance market is sustained interest in alternative assets. Collectibles, art, and rare goods are increasingly viewed as investment assets, which raises transaction volumes and asset values. Higher asset concentration directly increases the need for specialized insurance protection.

Another growth factor is the professionalization of auction operations. Compliance standards, client expectations, and international participation are rising. Auction houses are adopting formal risk management frameworks that include insurance as a foundational component. This structural shift supports long term market expansion.

Key Market Segments

By Coverage Type

- Property Insurance

- Liability Insurance

- Fine Art Insurance

- Cyber Insurance

- Others

By Application

- Auction Houses

- Art Dealers

- Collectors

- Museums

- Others

By Distribution Channel

- Direct Sales

- Brokers

- Online Platforms

- Others

By End-User

- Individual

- Commercial

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading specialty insurers such as AXA XL, Chubb, and Hiscox hold strong positions in the auction house insurance market. Their coverage typically includes fine art, collectibles, jewelry, transit risk, and public liability. These insurers apply valuation expertise and tailored underwriting for high-value, one-of-a-kind assets. AIG and Allianz Global Corporate & Specialty support large international auction houses with multi-location coverage.

The specialty and Lloyd’s market plays a critical role through Lloyd’s of London, Tokio Marine Kiln, and Atrium Underwriters, offering flexible capacity for complex risks. Beazley Group and Markel Corporation focus on bespoke policies for exhibitions, auctions, and private sales. Sompo International and Berkshire Hathaway Specialty Insurance add capacity for high-limit placements.

Global insurers, reinsurers, and brokers such as Zurich Insurance Group, Liberty Mutual Insurance, and Travelers Insurance provide broader commercial support. Munich Re strengthens market capacity for catastrophic losses. Brokerage firms including Marsh & McLennan Companies, Arthur J. Gallagher & Co., and Willis Towers Watson manage placement and risk advisory.

Top Key Players in the Market

- AXA XL

- Chubb

- Hiscox

- AIG (American International Group)

- Lloyd’s of London

- Zurich Insurance Group

- Allianz Global Corporate & Specialty

- Sompo International

- Tokio Marine Kiln

- Berkshire Hathaway Specialty Insurance

- Liberty Mutual Insurance

- Marsh & McLennan Companies

- Arthur J. Gallagher & Co.

- Willis Towers Watson

- Munich Re

- Atrium Underwriters

- Markel Corporation

- Travelers Insurance

- RSA Insurance Group

- Beazley Group

- Others

Recent Developments

- In October 2025, AXA XL launched its tailorMade® Home all-risks solution, extending coverage to fine art and collectibles alongside property and jewelry for high-net-worth clients. This innovative product sets new standards for private asset protection, leveraging AXA XL’s specialty expertise to meet growing demand in the art auction sector.

- In September 2025, Hiscox launched enhanced cyber insurance modules tailored for auction houses facing rising digital threats from online bidding platforms. The new product covers data breaches and hacking during virtual auctions, addressing 2025’s evolving risks while maintaining competitive rates amid softening markets.

Report Scope

Report Features Description Market Value (2025) USD 6.6 Billion Forecast Revenue (2035) USD 18.1 Billion CAGR(2025-2035) 10.5% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Property Insurance, Liability Insurance, Fine Art Insurance, Cyber Insurance, Others), By Application (Auction Houses, Art Dealers, Collectors, Museums, Others), By Distribution Channel (Direct Sales, Brokers, Online Platforms, Others), By End-User (Individual, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA XL, Chubb, Hiscox, AIG (American International Group), Lloyd’s of London, Zurich Insurance Group, Allianz Global Corporate & Specialty, Sompo International, Tokio Marine Kiln, Berkshire Hathaway Specialty Insurance, Liberty Mutual Insurance, Marsh & McLennan Companies, Arthur J. Gallagher & Co., Willis Towers Watson, Munich Re, Atrium Underwriters, Markel Corporation, Travelers Insurance, RSA Insurance Group, Beazley Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Auction House Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Auction House Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA XL

- Chubb

- Hiscox

- AIG (American International Group)

- Lloyd’s of London

- Zurich Insurance Group

- Allianz Global Corporate & Specialty

- Sompo International

- Tokio Marine Kiln

- Berkshire Hathaway Specialty Insurance

- Liberty Mutual Insurance

- Marsh & McLennan Companies

- Arthur J. Gallagher & Co.

- Willis Towers Watson

- Munich Re

- Atrium Underwriters

- Markel Corporation

- Travelers Insurance

- RSA Insurance Group

- Beazley Group

- Others