At-Home Therapeutic Beauty Devices Market By Product Type (Light-Based Devices, Radiofrequency (RF) Devices, Ultrasonic Devices, Microneedle Tools), By Application (Skin Rejuvenation & Anti-Aging, Acne Treatment, Hair Removal, Pigmentation Correction, and Others), By Sales Channel (E-commerce/Brand Websites, Specialty Stores, Pharmacies, and Multibrand Retail Chains), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157427

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

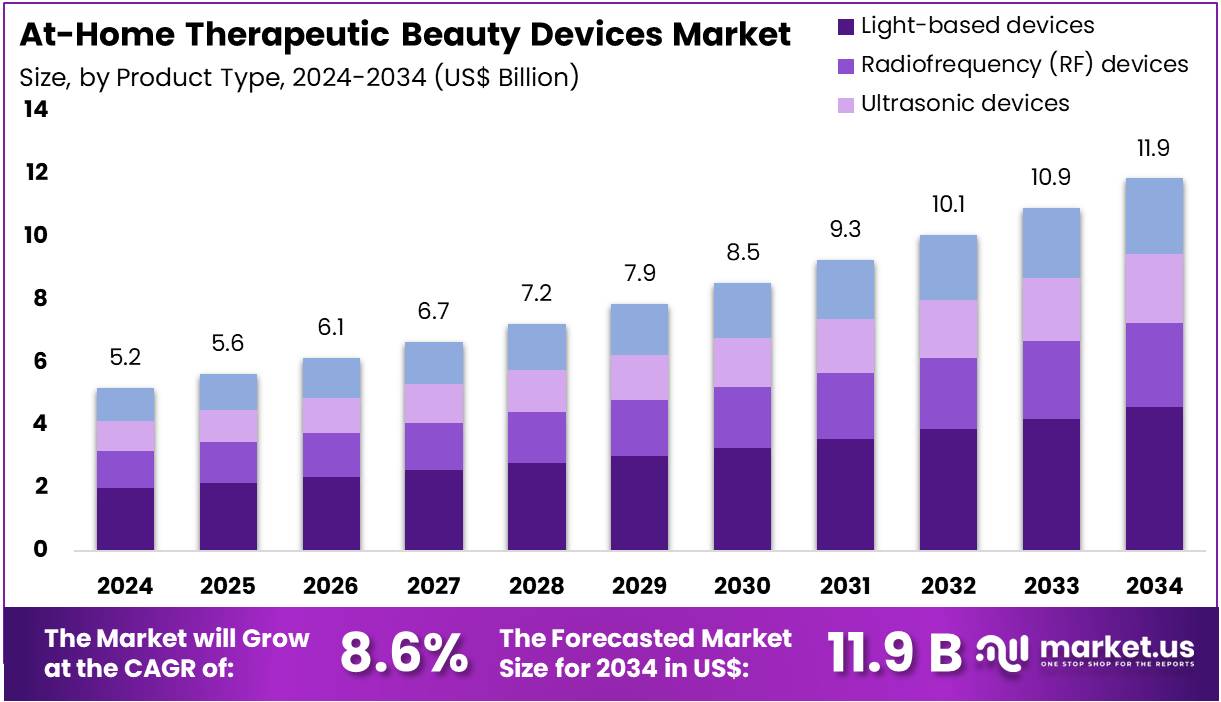

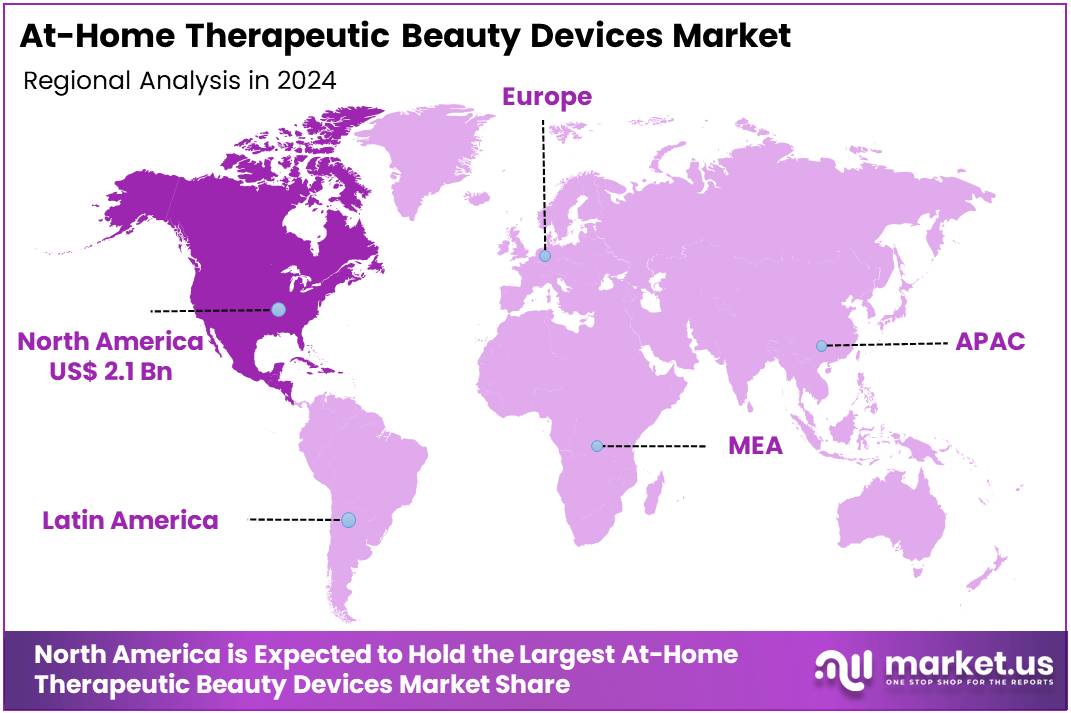

The At-Home Therapeutic Beauty Devices Market size is expected to be worth around US$ 11.9 billion by 2034 from US$ 5.2 billion in 2024, growing at a CAGR of 8.6% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.9% share and holds US$ 2.1 Billion market value for the year.

Rising consumer demand for professional-grade results from the convenience of their own homes is a primary driver of the at-home therapeutic beauty devices market. These devices, which include LED masks, microcurrent facial tools, and radiofrequency wands, offer a less expensive and more convenient alternative to clinical procedures. The American Society of Plastic Surgeons reported in a 2024 press release that there were 28.2 million minimally invasive procedures performed by its members in 2023, a trend that reflects a strong public interest in aesthetic treatments. This high demand for non-surgical cosmetic enhancements has created a robust market for accessible at-home technologies that promise similar benefits without the time commitment or cost of a clinic.

Growing technological advancements and a strong focus on personalization are significant trends shaping the market. Manufacturers are developing devices that leverage AI and smart technology to analyze an individual’s skin condition and provide customized treatment protocols. This has led to a boom in products that offer multi-functional capabilities, such as combining LED therapy with microcurrent or radiofrequency. A 2025 report from the Skin Cancer Foundation noted that the number of melanoma cases in 2024 increased by 7.3% compared to 2023, which is driving a greater consumer interest in at-home devices that provide both therapeutic and preventative benefits. This trend toward devices that are both effective and tailored to the user’s needs is a major force behind market growth.

Increasing investment from major corporations and a focus on clinical validation are creating new opportunities for market expansion. Historically, a lack of clinical evidence has been a challenge for at-home devices, but companies are now investing in studies to prove their efficacy and safety. This strategic shift is building consumer confidence and is crucial for expanding the market’s applications beyond simple anti-aging and into more complex areas like acne treatment and skin rejuvenation. The availability of these advanced, scientifically-backed devices is broadening their appeal to a wider demographic. The rise of e-commerce and direct-to-consumer models is also making these products more accessible, empowering individuals to take control of their skin health in a new and sophisticated way.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.2 billion, with a CAGR of 8.6%, and is expected to reach US$ 11.9 billion by the year 2034.

- The product type segment is divided into light-based devices, radiofrequency (RF) devices, ultrasonic devices, microneedle tools, with light-based devices taking the lead in 2023 with a market share of 38.5%.

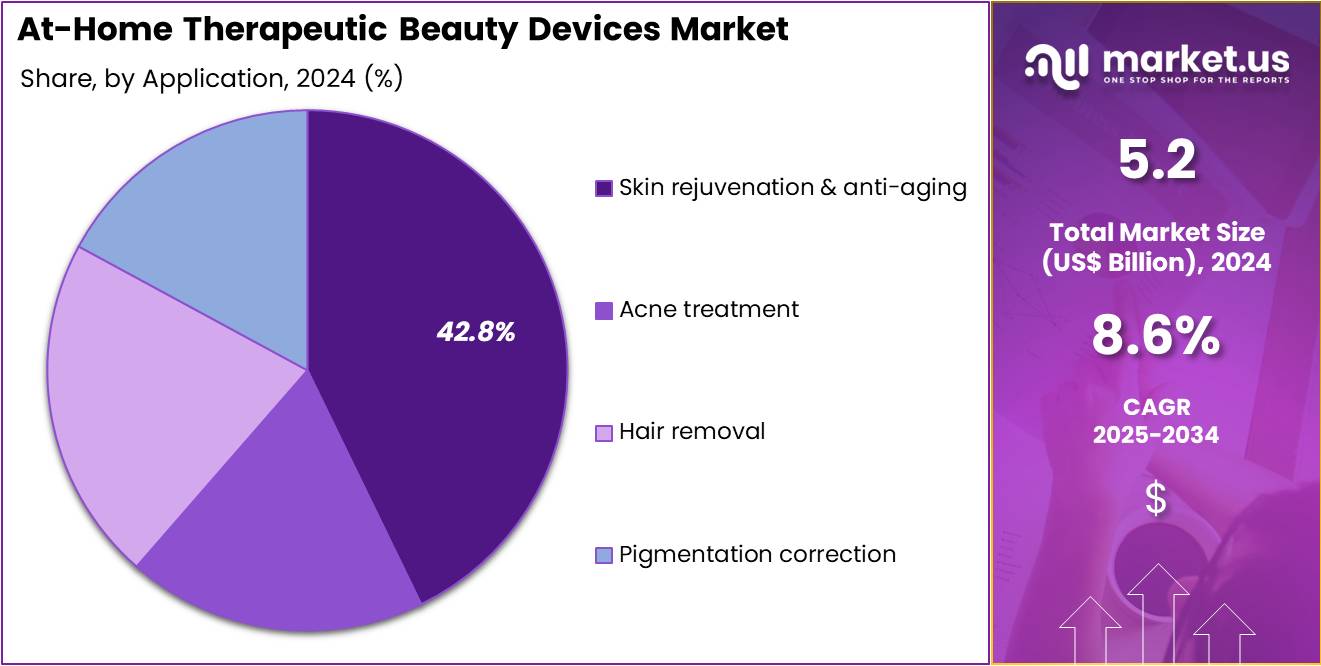

- Considering application, the market is divided into skin rejuvenation & anti-aging, acne treatment, hair removal, pigmentation correction, and others. Among these, skin rejuvenation & anti-aging held a significant share of 42.8%.

- Furthermore, concerning the sales channel segment, the market is segregated into e-commerce/brand websites, specialty stores, pharmacies, and multibrand retail chains. The e-commerce/brand websites sector stands out as the dominant player, holding the largest revenue share of 46.3% in the market.

- North America led the market by securing a market share of 40.9% in 2023.

Product Type Analysis

Light-based devices dominate the at-home therapeutic beauty devices market with a 38.5% share. The segment’s growth is expected to continue as consumers increasingly seek non-invasive, effective, and user-friendly skin treatments. These devices, such as LED and red light therapy tools, are gaining popularity for their ability to treat various skin issues, including wrinkles, fine lines, and skin texture. Technological advancements in these devices are anticipated to enhance their efficacy and safety, making them more attractive to a broad consumer base.

Additionally, their convenience and affordability compared to professional treatments are likely to contribute to their increasing demand. With strong online marketing campaigns, social media endorsements, and partnerships with dermatologists, this segment is expected to maintain a leading position in the market. As consumers prioritize skincare and preventive beauty, light-based devices are projected to remain a key growth driver in the at-home beauty space.

Application Analysis

Skin rejuvenation and anti-aging hold the largest application share in the at-home therapeutic beauty devices market, accounting for 42.8%. This segment’s growth is driven by the rising consumer demand for anti-aging solutions and the increasing awareness of skin health. Products designed to address fine lines, wrinkles, and sagging skin are expected to continue gaining traction. Technological advancements in skin rejuvenation devices, including LED, RF, and ultrasonic therapies, are likely to improve treatment outcomes, enhancing consumer satisfaction.

The growing trend of preventive skincare, combined with the affordability and convenience of at-home treatments, is expected to further fuel the segment’s growth. As consumer confidence in these products increases through clinical validation and endorsements, skin rejuvenation devices will likely continue to lead the market. Additionally, the segment benefits from the rising influence of social media and influencers in shaping beauty trends and promoting at-home skincare.

Sales Channel Analysis

E-commerce and brand websites represent the dominant sales channel in the at-home therapeutic beauty devices market, with a 46.3% share. This growth is expected to continue due to the increasing preference for online shopping and the convenience of purchasing directly from brand websites. The direct-to-consumer model is anticipated to drive growth by offering competitive pricing, exclusive products, and convenience. E-commerce platforms enable global reach, making these devices more accessible to consumers in remote areas.

Additionally, the ability to access reviews, ratings, and influencer testimonials online will influence purchasing decisions, further accelerating demand. Retailers and manufacturers are expected to enhance customer engagement through user-friendly websites, seamless checkout processes, and targeted digital marketing campaigns. With increasing confidence in online purchases and the convenience of doorstep delivery, the e-commerce channel is likely to remain the largest contributor to market growth.

Key Market Segments

Product Type

- Light-Based Devices

- Radiofrequency (RF) Devices

- Ultrasonic Devices

- Microneedle Tools

Application

- Skin Rejuvenation & Anti-Aging

- Acne Treatment

- Hair Removal

- Pigmentation Correction

- Others

Sales Channel

- E-commerce/Brand Websites

- Specialty Stores

- Pharmacies

- Multibrand Retail Chains

Drivers

The increasing demand for convenience and at-home alternatives is driving the market

The market for at-home therapeutic beauty devices is experiencing significant growth, primarily fueled by a fundamental shift in consumer behavior toward self-care and convenience. Individuals are actively seeking effective, non-invasive treatments that can be performed in the privacy and comfort of their own homes, avoiding the time commitment and cost associated with professional clinic visits. This desire for accessibility has been a major catalyst, as consumers look to replicate the results of popular in-office procedures with a one-time purchase. The sheer scale of the professional market illustrates this demand.

According to the American Society of Plastic Surgeons (ASPS), the US saw a total of nearly 25.4 million cosmetic minimally-invasive procedures performed in 2023, representing a 7% increase over the previous year. This high volume of professional treatments underscores a massive, addressable market for at-home devices that offer similar benefits, such as skin resurfacing, fat reduction, and hair removal. The at-home segment is poised to capture a growing share of these consumers who are now seeking more flexible and affordable alternatives.

Restraints

The risk of consumer misuse and underreporting of adverse events are restraining the market

A significant restraint on the at-home therapeutic beauty devices market is the potential for consumer misuse and the subsequent risk of adverse events, which can erode brand trust and create public safety concerns. Unlike professional settings where trained specialists operate the devices, at-home use places the onus entirely on the consumer. Incorrect application, improper settings, or using a device on an unsuitable skin type can lead to negative outcomes such as burns, skin irritation, or ineffective results.

A lack of consumer education and the absence of a mandatory, centralized reporting system for non-medical devices exacerbate this issue. While the US Food and Drug Administration (FDA)’s adverse event reporting program exists, it is largely voluntary for consumers and cosmetic products. The Modernization of Cosmetics Regulation Act of 2022 (MoCRA), passed by Congress, is a response to these concerns. The act, which will be fully implemented in the 2024-2025 period, grants the FDA new authority to mandate serious adverse event reporting for cosmetics, highlighting a widespread recognition of the need for greater transparency and regulation to ensure product safety and consumer confidence.

Opportunities

The rising number of FDA-cleared devices is creating growth opportunities

A major opportunity in this market lies in the development and commercialization of new, clinically-proven devices that have received official regulatory clearance. FDA clearance, particularly through the 510(k) process, provides a critical stamp of approval that reassures consumers about a device’s safety and effectiveness. This regulatory validation differentiates a product from the thousands of unverified devices on the market and gives companies a significant competitive advantage.

As consumers become more discerning about their at-home purchases, they increasingly look for products that have been evaluated by a recognized government body. A review of the FDA’s 510(k) database reveals a steady flow of new clearances for at-home devices, including those for laser hair removal, microcurrent facial toning, and light therapy for acne. This continuous stream of cleared products validates the efficacy of these technologies and builds a robust pipeline of new offerings for consumers seeking scientifically-backed solutions.

Impact of Macroeconomic / Geopolitical Factors

The at-home therapeutic beauty devices market is experiencing significant growth, driven by a convergence of macroeconomic and geopolitical factors. The high inflation rates witnessed in recent years have altered consumer spending habits, pushing consumers to seek cost-effective, long-term alternatives to expensive in-salon treatments. This shift has favored at-home devices, which provide a one-time purchase solution for a variety of skincare and hair care needs.

The global supply chain, which is heavily reliant on manufacturing hubs like China and other Asian countries, faces ongoing disruptions due to geopolitical tensions and trade disputes. These tensions, coupled with rising transportation and raw material costs, have increased production expenses and led to price hikes for manufacturers.

The current US trade policy has added a layer of complexity, with a new round of tariffs ranging from 10% to over 50% on imported goods, including certain components for beauty devices from countries like China and the EU. This has compelled manufacturers to either absorb the costs, pass them on to consumers, or consider reshoring manufacturing to the US to avoid the high duties, which can disrupt established supply chains and increase the final cost of the products.

Latest Trends

The integration of artificial intelligence for personalized treatment is a recent trend

A defining trend in 2024 is the accelerated integration of artificial intelligence (AI) and smart technology into at-home beauty devices, enabling a more personalized and effective user experience. This innovation goes beyond simple automation by using sophisticated algorithms to analyze a user’s skin condition through a connected smartphone app or integrated camera. The device then provides a customized treatment plan, guiding the user on the correct settings, duration, and frequency of use. This approach helps to overcome the potential for misuse and increases the probability of achieving a desired outcome.

The US Patent and Trademark Office (USPTO) has shown a clear focus on this area. In February 2024, the USPTO issued new guidance on inventorship for AI-assisted inventions and continues to see a growing number of patent applications for AI-enabled devices across various sectors, including personal care. This signals a major industry shift toward leveraging intelligent technology to make sophisticated beauty treatments more accessible and tailored to the individual.

Regional Analysis

North America is leading the At-Home Therapeutic Beauty Devices Market

The North American at-home therapeutic beauty devices market held a substantial 40.9% share of the global market in 2024. This market leadership is directly attributable to the region’s high consumer spending power, a strong culture of self-care and wellness, and a significant shift toward non-invasive cosmetic procedures. Consumers are increasingly seeking professional-grade results from the comfort and privacy of their homes, a trend that accelerated significantly in recent years. This is particularly true for anti-aging and skin rejuvenation.

According to the American Academy of Dermatology, acne is the most common skin condition in the US, affecting up to 50 million people annually, creating a large and consistent demand for at-home solutions. Furthermore, the market is propelled by a favorable regulatory environment and a steady stream of new products receiving clearance from the US Food and Drug Administration (FDA), which provides consumers with confidence in the safety and efficacy of these devices.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Asia Pacific at-home therapeutic beauty devices market is anticipated to experience robust growth during the forecast period. This is largely a result of a massive and rising middle-class population, increasing disposable incomes, and a strong cultural emphasis on aesthetics and appearance. The region is home to a significant portion of the global population, and a large consumer base is now willing to invest in advanced personal care products. The market’s expansion is further supported by a growing consumer awareness of skin health and a shift away from traditional, often expensive, in-clinic treatments.

For instance, in China, a 2022 study on a large population found a 54.75% prevalence of myopia in adults, highlighting the widespread need for corrective eye care, which often extends to aesthetic concerns. The increasing availability of products through online channels, combined with a strong influencer culture and targeted marketing campaigns, is likely to make these devices more accessible to a broader consumer base and fuel the market’s significant growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the at-home therapeutic beauty devices market are driving growth through several key strategies. They are heavily investing in integrating advanced technologies like LED light therapy, microcurrents, and radiofrequency into user-friendly devices, miniaturizing professional-grade technology for home use.

Companies are also pursuing aggressive digital marketing and e-commerce expansion, leveraging social media and influencer endorsements to reach a broader audience. Furthermore, they are broadening their product portfolios to offer solutions for a wider range of concerns, from anti-aging to acne treatment, effectively increasing their addressable market. This combination of innovative product development and sophisticated marketing is essential for maintaining a competitive edge.

Solta Medical, a subsidiary of Bausch Health Companies Inc., has established a dominant position in the professional aesthetics market with its portfolio of well-known brands, including Thermage and Fraxel. While its primary business model targets medical professionals, its reputation and technology directly influence the at-home market by setting a standard for efficacy and safety.

The company’s strategy involves continuous innovation in energy-based devices and maintaining a robust intellectual property portfolio. Solta’s focus on clinical validation and its strong brand recognition make it a foundational player in the broader aesthetics industry, influencing consumer trust and demand for similar at-home technologies.

Top Key Players in the At-Home Therapeutic Beauty Devices Market

- YA-MAN

- The Beauty Tech Group

- Solawave

- Panasonic Corporation

- NuFACE

- Nu Skin Enterprises Inc

- L’Oréal

- FOREO

- Cynosure

- Beurer GmbH

Recent Developments

- In March 2025: Panasonic launched the Arc 5 Palm Shaver, a compact grooming tool made from Nagori mineral-based plastic. The shaver delivers an impressive 70,000 cross-cuts per minute and automatically adjusts to the shaving resistance, providing a highly efficient experience. Although priced at US$330 with a relatively modest battery life, WIRED commended the shaver’s ergonomic design and superior precision, positioning it as a high-end option in the men’s grooming market.

- In March 2025: Foreo introduced the Luna 4 Hair, its first device designed specifically for scalp care. Targeted at individuals dealing with thinning and flaking, the device showed noticeable improvements in hair texture within two weeks, with users reporting thicker, shinier hair and reduced scalp irritation. The product received positive feedback, earning an 8/10 rating across various platforms such as The Quality Edit, Glossy, and The Sun.

Report Scope

Report Features Description Market Value (2024) US$ 5.2 billion Forecast Revenue (2034) US$ 11.9 billion CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Light-Based Devices, Radiofrequency (RF) Devices, Ultrasonic Devices, Microneedle Tools), By Application (Skin Rejuvenation & Anti-Aging, Acne Treatment, Hair Removal, Pigmentation Correction, and Others), By Sales Channel (E-commerce/Brand Websites, Specialty Stores, Pharmacies, and Multibrand Retail Chains) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape YA-MAN, The Beauty Tech Group, Solawave, Panasonic Corporation, NuFACE, Nu Skin Enterprises Inc, L’Oréal, FOREO, Cynosure, Beurer GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  At-Home Therapeutic Beauty Devices MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

At-Home Therapeutic Beauty Devices MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- YA-MAN

- The Beauty Tech Group

- Solawave

- Panasonic Corporation

- NuFACE

- Nu Skin Enterprises Inc

- L’Oréal

- FOREO

- Cynosure

- Beurer GmbH