Global At-Home Cancer Testing Market By Cancer Type (Breast, Colon, Prostate, Blood, and Others), By Sample Type (Blood, Cell, Urine, and Stool), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169859

- Number of Pages: 214

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

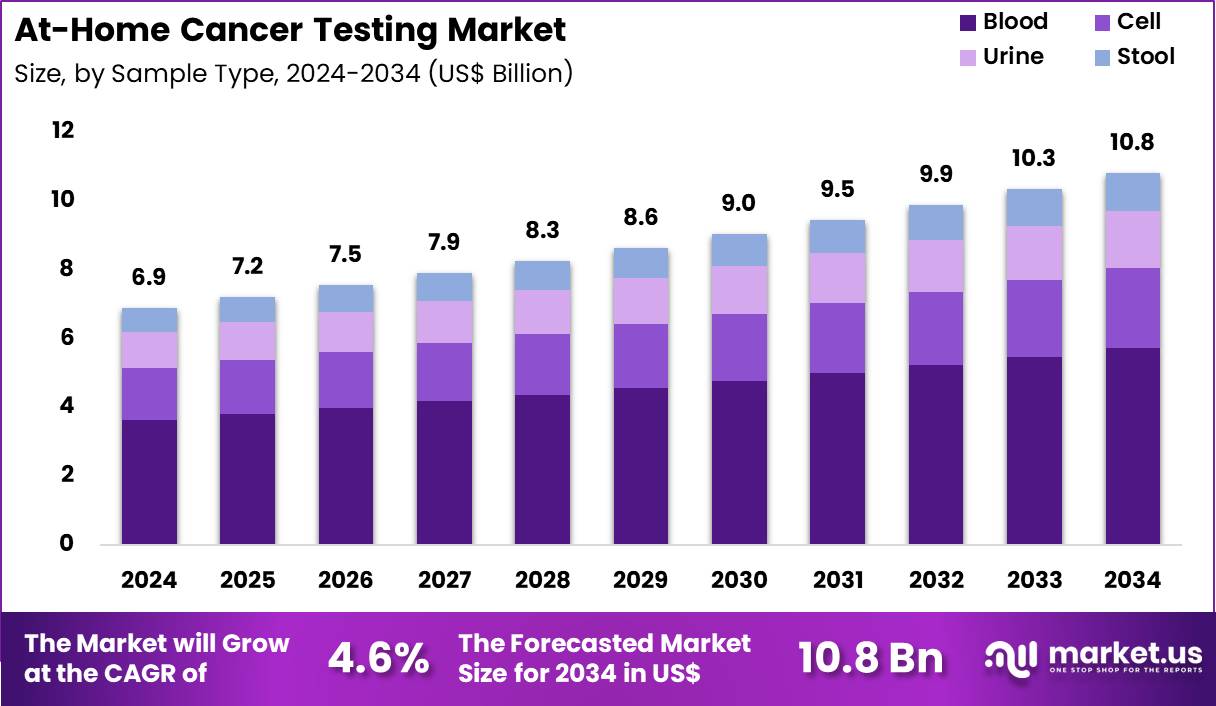

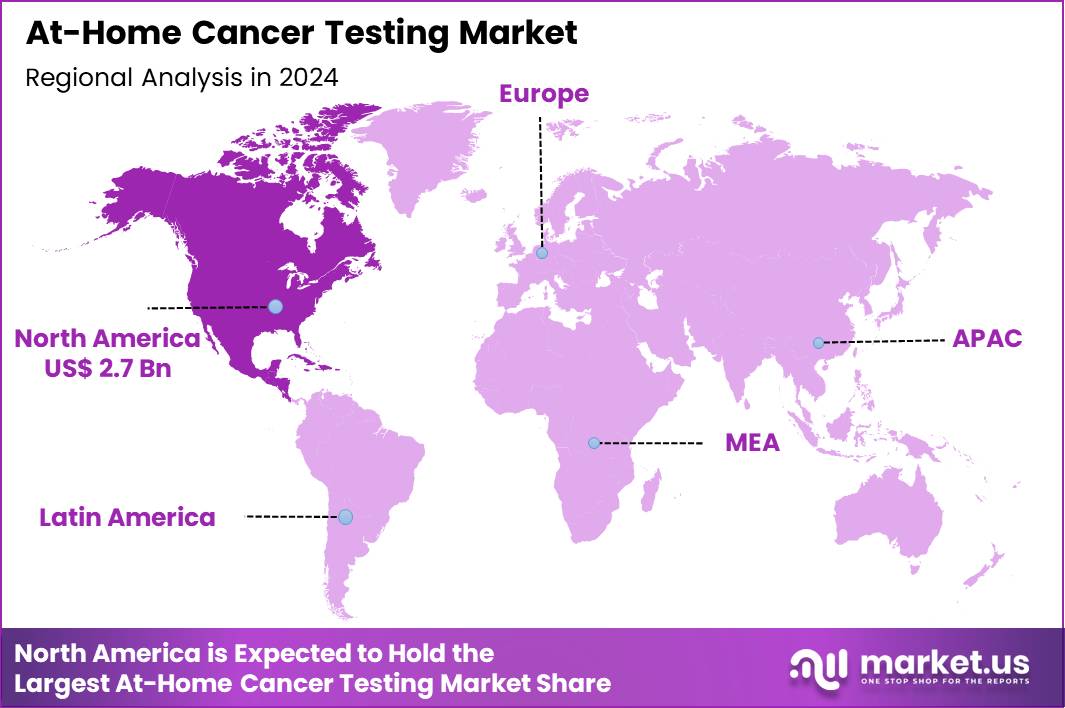

The Global At-Home Cancer Testing Market size is expected to be worth around US$ 10.8 Billion by 2034 from US$ 6.9 Billion in 2024, growing at a CAGR of 4.6% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.8% share with a revenue of US$ 2.7 Billion.

Increasing consumer empowerment in preventive healthcare propels the At-Home Cancer Testing market, as individuals actively seek accessible tools for early detection without relying on clinic appointments. Manufacturers innovate with user-friendly kits that analyze saliva, urine, or blood samples for key biomarkers, enabling discreet self-administration and rapid result delivery via apps.

These tests apply to colorectal cancer screening through stool DNA detection for polyp identification, breast cancer risk assessment via BRCA gene variant analysis, prostate cancer evaluation with PSA level quantification from fingerstick samples, and lung cancer monitoring using exhaled breath condensate for volatile organic compounds. Regulatory expansions create opportunities for transitioning supervised collections to fully unsupervised formats, broadening reach in underserved populations.

On May 24, 2024, the FDA broadened indications for several HPV tests from BD and Roche to include patient-collected vaginal samples in clinical settings, establishing a foundational step toward true at-home cervical cancer screening. This decision reduces procedural barriers and accelerates the integration of self-sampling into standard preventive protocols.

Growing integration of multi-cancer early detection platforms accelerates the At-Home Cancer Testing market, as biotechnology firms develop comprehensive assays that screen for multiple tumor signals from a single sample to streamline user experience. Diagnostic developers leverage liquid biopsy technologies that detect circulating tumor DNA and proteins with high specificity, minimizing false positives.

Applications encompass ovarian cancer surveillance through CA-125 and HE4 marker combinations in serum, pancreatic cancer early flagging via KRAS mutations in plasma, skin cancer risk profiling with melanin pathway gene panels from cheek swabs, and bladder cancer detection using urinary cytology enhanced by FISH probes. Telehealth partnerships open avenues for virtual result consultations and follow-up imaging referrals, enhancing clinical utility. Exact Sciences advanced this landscape in 2025 through a strategic partnership with Mayo Clinic, validating real-world performance of its multi-cancer early detection portfolio and reinforcing trust in at-home solutions for broad-spectrum screening.

Rising adoption of AI-driven analytics invigorates the At-Home Cancer Testing market, as companies embed machine learning algorithms to interpret complex biomarker patterns and provide personalized risk scores directly to users. Technology providers refine cloud-connected devices that process raw data for nuanced insights, supporting proactive lifestyle interventions. These advancements facilitate lymphoma monitoring via EBV viral load assays in saliva, thyroid cancer screening with calcitonin level checks from dried blood spots, oral cancer detection through HPV-16/18 genotyping in mouth rinses, and gastric cancer assessment using pepsinogen ratios in at-home gastric fluid tests.

AI enhancements create opportunities for predictive modeling that anticipates progression and integrates with wearable health trackers for holistic monitoring. Color Health expanded its virtual cancer clinic in May 2024 by partnering with SkinIO and Bexa, incorporating distributed at-home solutions for skin and breast cancer detection to boost screening rates and early intervention efficacy.

Key Takeaways

- In 2024, the market generated a revenue of US$ 6.9 billion, with a CAGR of 4.6%, and is expected to reach US$ 10.8 billion by the year 2034.

- The cancer type segment is divided into breast, colon, prostate, blood, others, with breast taking the lead in 2024 with a market share of 38.4%.

- Considering sample type, the market is divided into blood, cell, urine, stool. Among these, blood held a significant share of 52.8%.

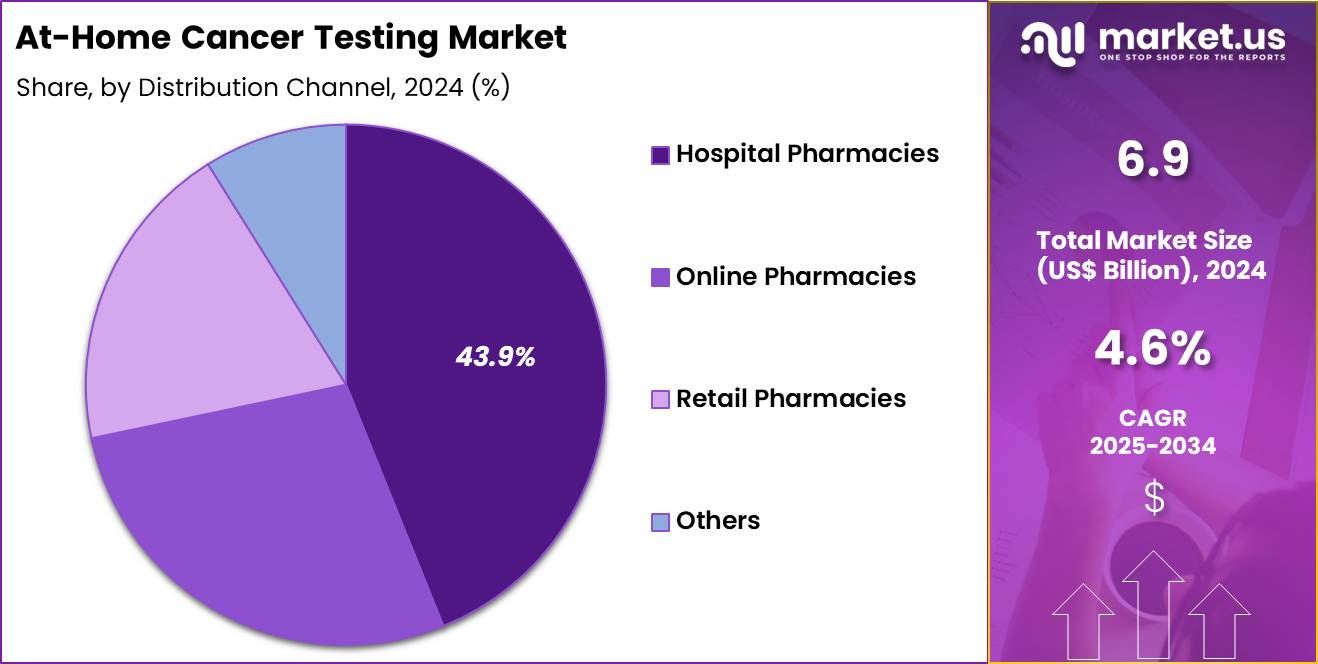

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, online pharmacies, retail pharmacies, others. The hospital pharmacies sector stands out as the dominant player, holding the largest revenue share of 43.9% in the market.

- North America led the market by securing a market share of 38.8% in 2024.

Cancer Type Analysis

Breast cancer testing, holding 38.4%, is expected to dominate as rising global awareness drives more women to adopt at-home screening options for early detection. Advances in blood-based and genetic risk-assessment kits strengthen test reliability and improve user confidence. Public-health campaigns highlight the value of early identification, increasing routine testing among high-risk groups.

At-home breast cancer kits expand access for women in underserved regions who face barriers to clinical screening. Technological improvements enable detection of circulating tumour DNA and protein biomarkers, improving test sensitivity. Increased use of telehealth platforms supports remote guidance and follow-up for home testers.

Partnerships between diagnostic companies and healthcare organizations expand test availability. Growing prevalence of breast cancer worldwide intensifies screening demand. User-friendly sampling devices make self-testing more accessible. These factors keep breast cancer testing anticipated to remain the leading cancer type.

Sample Type Analysis

Blood, holding 52.8%, is anticipated to dominate due to its high diagnostic value for detecting circulating tumour DNA, tumour-derived proteins, and immune-response markers. Consumers prefer blood-based at-home cancer tests because they offer non-invasive sampling and cover multiple cancer types. Blood samples support early detection, recurrence monitoring, and risk assessment, increasing use among individuals with family history.

Diagnostic manufacturers develop micro-collection devices that simplify home sampling and improve accuracy. Clinical studies confirm strong reliability of blood biomarkers, strengthening adoption. Growth of liquid biopsy technologies boosts demand for blood-based home-testing kits. Telemedicine platforms enable remote result interpretation, expanding usage. Rising public awareness of preventive oncology further accelerates adoption. Convenience and minimal sample handling make blood the preferred home-testing material. These dynamics keep blood projected to remain the dominant sample type.

Distribution Channel Analysis

Hospital pharmacies, holding 43.9%, are expected to dominate distribution due to strong trust among patients and direct linkage to clinical care pathways. Hospitals curate medically validated at-home cancer testing kits, ensuring reliability and regulatory compliance. Patients visiting oncology, radiology, and primary-care departments receive recommendations to purchase home-testing kits through hospital pharmacies. Hospital networks increasingly integrate at-home tests into early-screening programs.

Oncology specialists encourage home sampling for follow-up surveillance, raising pharmacy-based purchases. Hospital pharmacies offer professional counselling for proper sample collection and interpretation, improving compliance. Partnerships between hospitals and diagnostic companies expand kit availability. High patient footfall increases distribution reach. Strong institutional credibility drives higher adoption compared with other channels. These factors keep hospital pharmacies anticipated to remain the most influential distribution channel in the at-home cancer testing market.

Key Market Segments

By Cancer Type

- Breast

- Colon

- Prostate

- Blood

- Others

By Sample Type

- Blood

- Cell

- Urine

- Stool

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

Drivers

The Convenience of Noninvasive At-Home Testing Kits Is Driving the Market

The convenience of noninvasive at-home testing kits has significantly propelled the adoption of cancer screening practices among diverse populations. These kits allow individuals to collect samples such as stool or blood in the privacy of their homes, eliminating the need for immediate clinical visits and reducing logistical burdens. For instance, the multitarget stool DNA test, known as FIT-DNA, which can be performed at home, saw its usage rise from 8.3% in 2021 to 10.0% among adults aged 50–75 in 2023. This increase reflects growing trust in self-administered diagnostics for colorectal cancer detection.

Exact Sciences Corporation, a key player in this space, developed the Cologuard test, which aligns with these trends by offering a user-friendly, mail-in option. The overall colorectal cancer screening rate reached 67.4% for adults aged 45–75 in 2023, partly attributable to such noninvasive methods. Moreover, the fecal immunochemical test (FIT), another at-home option, maintained steady utilization at 9.3% in 2023, underscoring sustained interest in simple, non-invasive tools.

These developments not only enhance compliance but also facilitate early detection, potentially lowering mortality rates associated with delayed diagnoses. As healthcare systems integrate these kits into routine recommendations, their role in broadening screening access continues to expand. Ultimately, this driver positions at-home testing as a cornerstone of proactive cancer prevention strategies.

Restraints

Persistent Access Barriers Are Restraining the Market

Persistent access barriers, including financial constraints and lack of awareness, continue to hinder widespread adoption of at-home cancer testing. Many eligible individuals face challenges such as insurance coverage gaps or transportation issues, which deter participation even in convenient home-based formats. For example, uninsured adults exhibit significantly lower screening rates compared to those with coverage, exacerbating disparities in early detection.

In 2023, only 67.4% of adults aged 45–75 were up to date with colorectal cancer screening, leaving approximately 30% unscreened despite available at-home options. This gap highlights systemic issues like inadequate outreach to low-income or minority communities. Additionally, cervical cancer screening rates declined to 75.4% for women aged 21–65 in 2023, down from 80.0% in 2019, partly due to barriers like fear of invasive procedures or misinformation about self-testing efficacy.

Rural residents often encounter delays in mailing samples or interpreting results without immediate provider support. Furthermore, the absence of standardized reimbursement policies for certain kits limits their scalability. These restraints not only perpetuate health inequities but also slow the potential impact of at-home testing on population-level outcomes. Addressing them requires targeted interventions to ensure equitable distribution and education.

Opportunities

Innovations in Self-Sampling Technologies Are Creating Growth Opportunities

Innovations in self-sampling technologies present substantial growth opportunities by enhancing participation in cervical cancer screening among hard-to-reach populations. These advancements enable accurate sample collection without clinician involvement, bridging gaps for those avoiding traditional pelvic exams due to discomfort or stigma. For instance, mailed self-collection kits have demonstrated a potential to increase screening uptake by up to 2.4 times in at-risk groups, with 41% participation rates compared to 17% in standard outreach scenarios.

This boost is critical, as nearly 30% of eligible individuals in the United States remain unscreened for cervical cancer, contributing to about 11,500 annual diagnoses in inadequately screened populations. Key developments include FDA-expanded approvals for HPV self-collection devices, fostering integration into primary care and pharmacy settings. Such technologies also support virtual follow-up, reducing the burden on healthcare infrastructure while maintaining diagnostic precision.

Opportunities extend to partnerships between government programs and developers like Roche Molecular Systems, which produces the cobas HPV test adaptable for self-sampling. Moreover, these innovations align with equity goals by targeting underserved communities, potentially elevating national screening rates toward Healthy People 2030 targets. As scalability improves, self-sampling could transform preventive care delivery across multiple cancer types. Overall, these opportunities signal a pathway to more inclusive and efficient screening ecosystems.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and escalating healthcare budgets drive the at-home cancer testing market, enabling consumers to embrace convenient early-detection tools amid soaring cancer incidences worldwide. Inflation, however, pressures producers by inflating raw material expenses, which compels them to raise kit prices and slows adoption among price-sensitive households in developing economies. Geopolitical strains, including U.S.-China trade barriers, fracture supply chains for critical components sourced from Asia, postponing product rollouts and amplifying freight costs for multinational suppliers.

These tensions, on the other hand, motivate regional governments in Europe and Asia-Pacific to fund domestic biotech initiatives, accelerating innovation and diversifying manufacturing bases for greater self-reliance. The U.S. Section 232 tariffs on medical devices, implemented since April 2025, hike import duties on cancer testing kits to 25 percent or more, straining smaller importers and curbing affordability for American users reliant on overseas tech.

Yet, these measures galvanize U.S. firms to expand local production, creating jobs and shielding the market from volatile global disruptions. In the end, unwavering consumer demand and rapid technological progress propel the at-home cancer testing sector toward robust expansion and improved global access.

Latest Trends

The FDA Approval of At-Home Self-Collection Devices Is Creating Growth Opportunities

The FDA approval of at-home self-collection devices in 2025 marks a pivotal advancement, enabling broader access to cervical cancer screening through user-friendly vaginal swab kits. The Teal Wand, approved on May 15, 2025, allows individuals aged 25–65 to collect samples privately and receive virtual provider consultations for prescriptions and results. This device achieves a positive percent agreement of 95% and negative percent agreement of 90% with clinician-collected samples, demonstrating high reliability for HPV detection.

Its sensitivity reaches 96% for identifying HPV in precancerous cases, equivalent to traditional methods and validated in the SELF-CERV study involving over 600 participants. Such approvals address longstanding barriers, as cervical screening rates stood at 75.8% in 2023, below optimal levels for preventing the over 13,000 annual U.S. cases. By facilitating mail-in submission, these devices reduce clinic visits and enhance compliance in remote or busy demographics.

This trend builds on prior 2024 expansions for in-clinic self-collection, accelerating momentum toward fully home-based options. Developers like those behind the Teal Wand are poised to collaborate with public health initiatives for distribution. The result is a surge in early detection capabilities, particularly for high-risk groups. As adoption grows, this innovation promises to lower incidence rates and healthcare costs associated with advanced disease. In essence, it redefines accessible screening as a standard practice.

Regional Analysis

North America is leading the At-Home Cancer Testing Market

North America accounted for 38.8% of the overall market in 2024, and the region experienced strong growth as consumers increasingly adopted remote cancer-screening kits to detect early signs of colorectal, cervical, breast, and genetic cancer risks. Telehealth networks expanded virtual oncology pathways, enabling clinicians to recommend at-home sample-collection kits for follow-up assessment and preventive screening. Pharmacies and diagnostic companies broadened distribution of FDA-approved and CLIA-validated kits, improving access for rural and underserved populations.

Rising healthcare costs encouraged patients to pursue convenient, lower-barrier testing options without visiting clinics. The National Cancer Institute reported 2,001,140 new cancer cases in the United States in 2023 (NCI – U.S. Cancer Statistics, “Estimated New Cases 2023”), and this significant disease burden directly increased demand for early, accessible testing solutions. Genetic-testing providers scaled saliva-based and blood-spot kit availability, while insurers expanded reimbursement for home-based screenings. These combined dynamics strengthened regional market expansion throughout 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience substantial growth during the forecast period as healthcare systems intensify early-cancer-detection initiatives and expand digital health adoption across rapidly urbanizing populations. Consumers increasingly seek home-based screening tools for breast, colorectal, cervical, and hereditary cancers due to rising awareness of early detection benefits. Governments strengthen national cancer-control programs, encouraging individuals to undergo regular screening through accessible diagnostic channels.

Diagnostic laboratories expand home-collection logistics across India, Japan, China, and Southeast Asia, improving patient reach. Telemedicine platforms integrate remote oncologist consultations, increasing adoption of at-home kits for preliminary evaluation. The National Cancer Center Japan reported 378,039 cancer deaths in 2022 (NCC Japan – Cancer Statistics 2022), underscoring the urgent regional need for scalable screening solutions. Private diagnostic chains invest in high-throughput molecular workflows to support increasing test volumes. These advancements collectively position Asia Pacific for robust forward-looking market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key companies in the home-based cancer screening space pursue growth by expanding their test offerings beyond single-site detection to include multi-cancer panels and liquid-biopsy based biomarker assays that appeal to health-conscious consumers seeking early detection from home settings. They integrate digital platforms and mobile apps to provide easy sample-tracking, result reporting and follow-up guidance, which improves user experience and fosters consumer trust.

They expand distribution through online pharmacies, direct-to-consumer models and partnerships with wellness retailers to reach urban and semi-urban segments globally. They scale operations through investments in automated lab workflows, high-sensitivity molecular and genomic assays, and by obtaining regulatory clearances to ensure clinical credibility. They build awareness through preventive-health campaigns and collaborations with telemedicine providers to embed at-home testing within broader preventive care frameworks.

One key player, Guardant Health, specialises in circulating tumor DNA liquid-biopsy tests and leverages its genomic profiling capability, strong laboratory infrastructure and established oncology-test portfolio to deliver at-home and remote cancer screening services at scale, driving market expansion and consumer adoption.

Top Key Players

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- DiaSorin S.p.A.

- Becton Dickinson & Co. (BD)

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics

Recent Developments

- In May 2025, the FDA authorized the Teal Wand, the first cervical cancer screening option that can be used at home. The device, which requires a prescription, enables women between 25 and 65 years old to collect their own vaginal samples, helping remove barriers to routine screening and improving overall participation rates.

- In October 2024, Exact Sciences received FDA approval for Cologuard Plus, the updated version of its at-home stool DNA screening test for colorectal cancer. This new iteration improves performance for identifying both cancer and advanced precancerous growths, building on the widespread use of the original Cologuard test.

Report Scope

Report Features Description Market Value (2024) US$ 6.9 Billion Forecast Revenue (2034) US$ 10.8 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Cancer Type (Breast, Colon, Prostate, Blood, and Others), By Sample Type (Blood, Cell, Urine, and Stool), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Retail Pharmacies, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Inc., bioMérieux SA, DiaSorin S.p.A., Becton Dickinson & Co., Bio‑Rad Laboratories, Inc., Ortho Clinical Diagnostics Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  At-Home Cancer Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

At-Home Cancer Testing MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Roche Diagnostics

- Abbott Laboratories

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- DiaSorin S.p.A.

- Becton Dickinson & Co. (BD)

- Bio‑Rad Laboratories, Inc.

- Ortho Clinical Diagnostics