Global Aspiration & Biopsy Needles Market By Product Type (Biopsy Needles and Aspiration Needles), By Procedure (Image-guided and Non-image-guided), By Application (Tumour/Cancer, Wounds and Others), By End-user (Hospitals & Surgical Centers, Diagnostic Clinics & Pathology Laboratories, Ambulatory Care Centers and Research & Academic Institutes), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178271

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

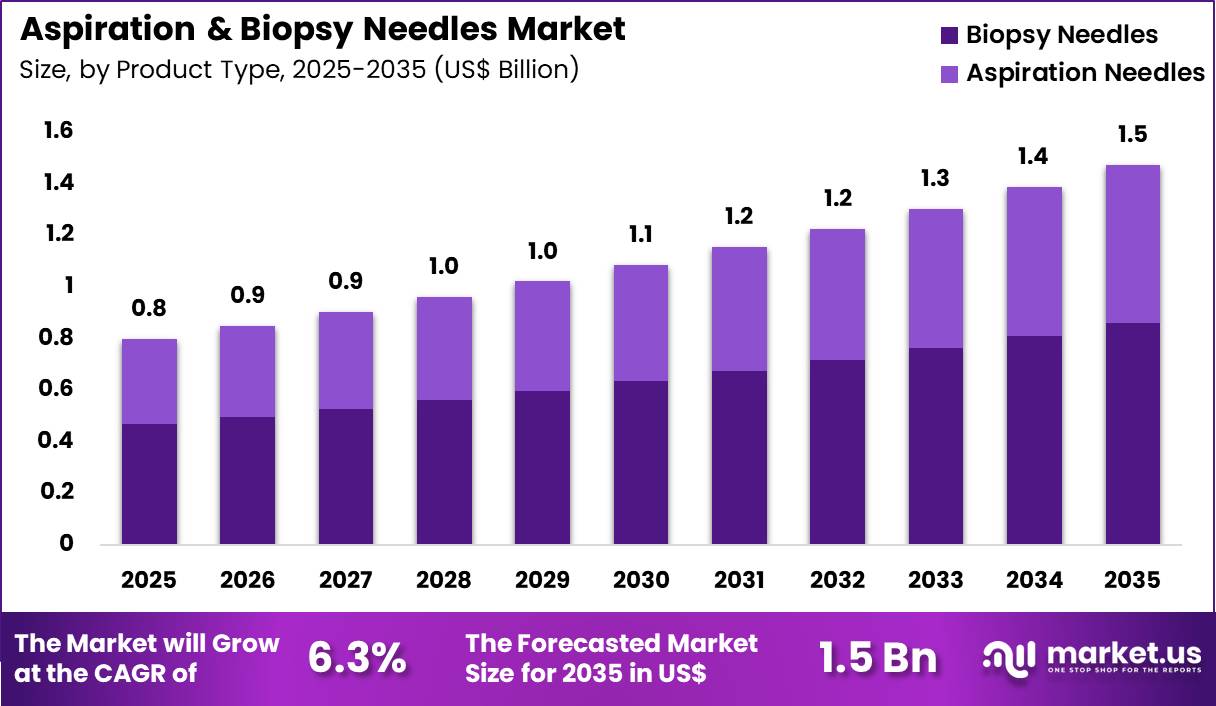

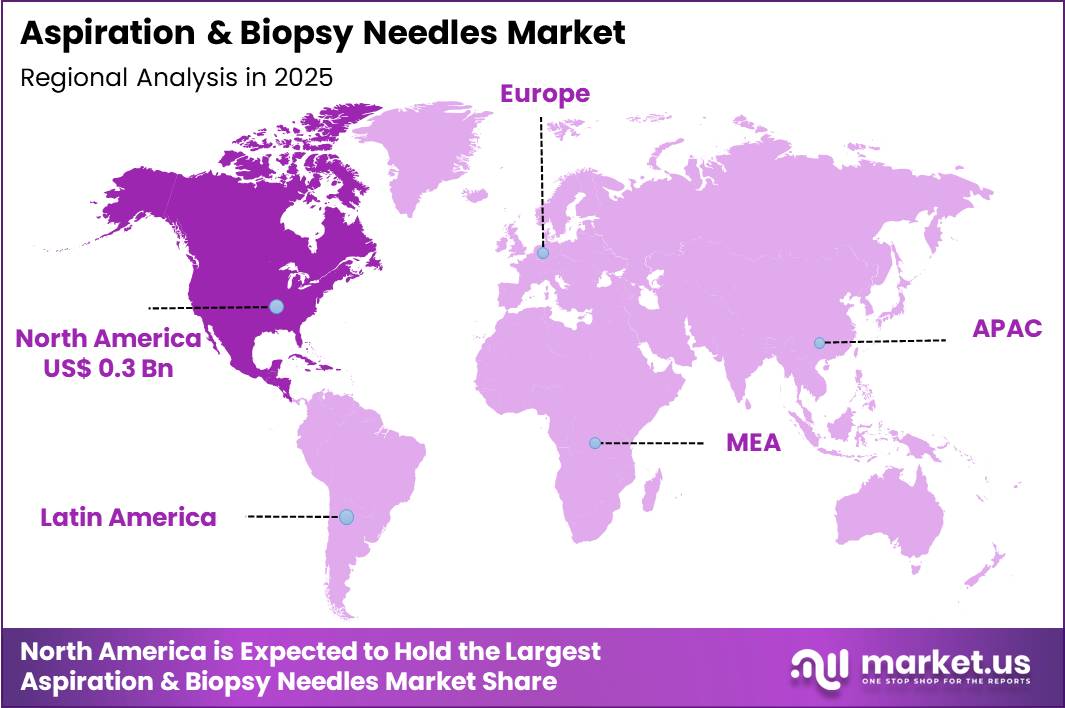

The Global Aspiration & Biopsy Needles Market size is expected to be worth around US$ 1.5 Billion by 2035 from US$ 0.8 Billion in 2025, growing at a CAGR of 6.3% during the forecast period 2026-2035. In 2025, North America led the market, achieving over 38.7% share with a revenue of US$ 0.3 Billion.

Increasing incidence of cancer and chronic diseases drives the aspiration and biopsy needles market as clinicians seek minimally invasive tools that deliver accurate tissue samples with reduced patient trauma and faster recovery times. Interventional radiologists increasingly perform ultrasound-guided fine-needle aspiration on thyroid nodules to differentiate benign from malignant lesions, guiding timely surgical or medical decisions.

These needles enable core biopsy procedures in breast cancer screening, yielding sufficient tissue for histopathological grading and biomarker analysis. Pulmonologists utilize transthoracic needles for peripheral lung lesions identified on CT scans, facilitating rapid diagnosis of primary or metastatic tumors.

Gastroenterologists apply endoscopic ultrasound-guided fine-needle aspiration to pancreatic masses and lymph nodes, improving staging accuracy in gastrointestinal malignancies. Hematologists employ bone marrow aspiration needles to evaluate hematologic disorders, obtaining samples for cytogenetic and flow cytometry studies.

Manufacturers pursue opportunities to develop echogenic and coaxial needle systems that enhance visibility under imaging and allow multiple passes without reinsertion, expanding applications in complex anatomical sites. Developers advance vacuum-assisted biopsy devices that yield larger tissue volumes, facilitating molecular testing for targeted therapies in oncology.

These innovations support robotic-assisted biopsy platforms, reducing operator variability in high-precision procedures. Opportunities emerge in single-use, sterile kits that address infection control in outpatient settings. Companies invest in ergonomic designs and adjustable length options to improve usability across specialties. Recent trends focus on integration with artificial intelligence for real-time guidance and automated sample processing, positioning aspiration and biopsy needles as essential tools in precision diagnostics and personalized medicine.

Key Takeaways

- In 2025, the market generated a revenue of US$ 0.8 Billion, with a CAGR of 6.3%, and is expected to reach US$ 1.5 Billion by the year 2035.

- The product type segment is divided into biopsy needles and aspiration needles, with biopsy needles taking the lead with a market share of 58.4%.

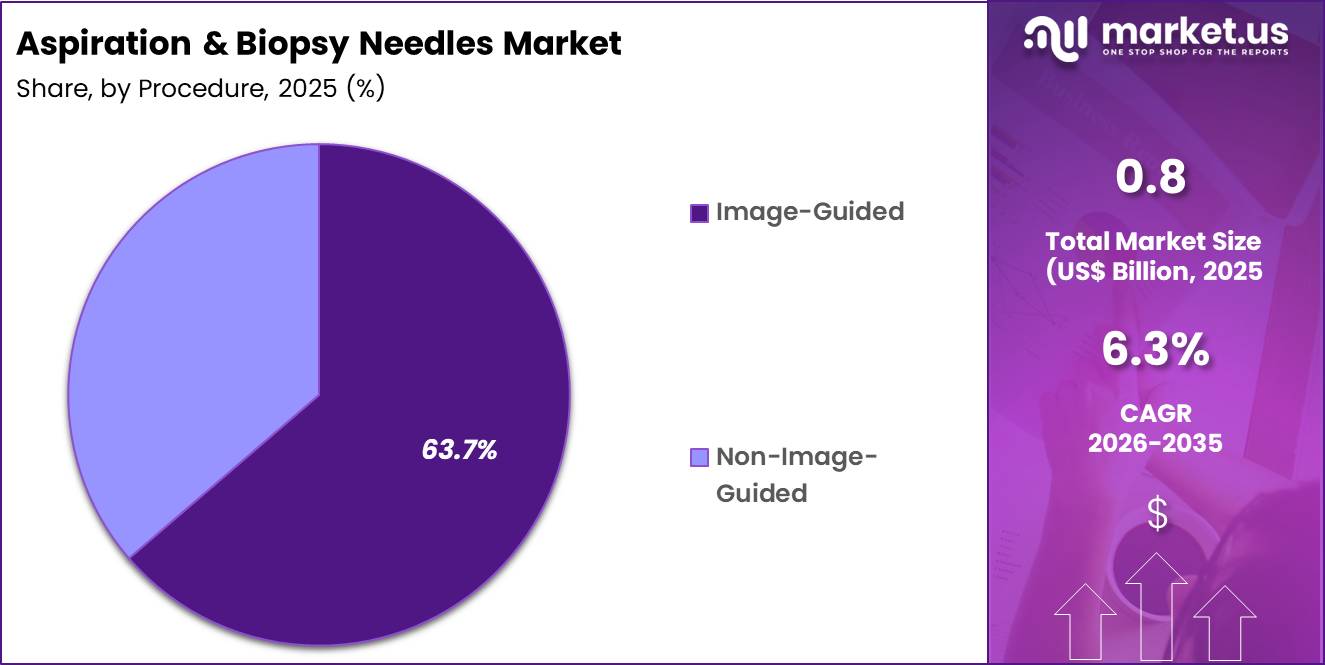

- Considering procedure, the market is divided into image-guided and non-image-guided. Among these, image-guided held a significant share of 63.7%.

- Furthermore, concerning the application segment, the market is segregated into tumour/cancer, wounds and others. The tumour/cancer sector stands out as the dominant player, holding the largest revenue share of 54.9% in the market.

- The end-user segment is segregated into hospitals & surgical centers, diagnostic clinics & pathology laboratories, ambulatory care centers and research & academic institutes, with the hospitals & surgical centers segment leading the market, holding a revenue share of 57.6%.

- North America led the market by securing a market share of 38.7%.

Product Type Analysis

Biopsy needles contributed 58.4% of growth within product type and led the aspiration and biopsy needles market due to their central role in tissue sampling for definitive diagnosis. Oncologists and surgeons rely on core and fine-needle biopsy tools to obtain adequate specimens for histopathological and molecular analysis.

Rising cancer incidence increases the volume of diagnostic procedures, which strengthens demand for high-precision biopsy devices. Advances in needle design improve sample quality and reduce patient discomfort, which reinforces clinical preference.

Growth strengthens as personalized medicine expands the need for molecular profiling and repeat biopsies. Improved imaging compatibility enhances targeting accuracy during procedures. Healthcare providers emphasize minimally invasive diagnostic approaches, which favor percutaneous biopsy techniques.

Reimbursement alignment for diagnostic interventions further supports usage. The segment is expected to remain dominant as early and accurate tissue diagnosis continues to guide oncology treatment pathways.

Procedure Analysis

Image-guided procedures generated 63.7% of growth within procedure and emerged as the leading segment due to the demand for enhanced accuracy and safety. Radiologists and interventional specialists use ultrasound, CT, and MRI guidance to target lesions precisely and minimize complications.

Image guidance reduces sampling errors and improves diagnostic confidence, especially in deep-seated or small lesions. Growing availability of advanced imaging infrastructure increases adoption across healthcare facilities.

Growth accelerates as complex cancer cases require precise localization for effective tissue sampling. Training programs emphasize image-guided techniques as standard practice. Technological integration between imaging systems and biopsy tools enhances workflow efficiency.

Patient preference for minimally invasive and accurate procedures further strengthens uptake. The segment is anticipated to maintain leadership as precision-guided diagnostics continue to shape interventional oncology.

Application Analysis

Tumour and cancer applications accounted for 54.9% of growth within application and dominated the aspiration and biopsy needles market due to the critical need for pathological confirmation of malignancy. Early detection programs and cancer screening initiatives increase biopsy referrals. Oncologists depend on tissue diagnosis to determine tumor type, stage, and biomarker profile. Increasing incidence of solid tumors elevates procedure frequency across multiple specialties.

Growth continues as targeted therapies require detailed molecular characterization from biopsy samples. Multidisciplinary cancer care models reinforce repeated diagnostic sampling. Rising awareness of early intervention improves patient participation in screening programs.

Clinical guidelines emphasize tissue confirmation before treatment initiation. The segment is projected to remain dominant as cancer diagnostics continue to rely heavily on accurate and timely biopsy procedures.

End-User Analysis

Hospitals and surgical centers contributed 57.6% of growth within end-user and led the aspiration and biopsy needles market due to their concentration of complex diagnostic and interventional procedures. These facilities manage high volumes of oncology and specialty cases that require coordinated imaging and pathology services. Centralized infrastructure supports safe execution of image-guided biopsies. Multidisciplinary teams increase procedural throughput and device utilization.

Growth strengthens as hospitals expand cancer care units and invest in advanced imaging technologies. Accreditation standards emphasize accurate diagnostic workflows. Teaching hospitals further drive adoption through clinical research and training activities. Referral networks concentrate specialized cases within hospital settings. The segment is expected to remain the primary growth driver as hospitals and surgical centers continue to anchor advanced diagnostic interventions.

Key Market Segments

By Product Type

- Biopsy Needles

- Aspiration Needles

By Procedure

- Image-guided

- Non-image-guided

By Application

- Tumour/Cancer

- Wounds

- Others

By End-user

- Hospitals & Surgical Centers

- Diagnostic Clinics & Pathology Laboratories

- Ambulatory Care Centers

- Research & Academic Institutes

Drivers

Increasing number of image-guided biopsies is driving the market.

The steady rise in image-guided biopsy procedures has substantially increased demand for aspiration and biopsy needles across hospitals and outpatient centers. Greater reliance on minimally invasive diagnostic techniques for cancer staging and treatment planning has expanded the procedural volume.

Healthcare providers are adopting these needles to improve sampling accuracy and reduce patient recovery times. The correlation between rising cancer incidence and the need for tissue confirmation drives consistent procurement of specialized needles. Government health reports document the high volume of such procedures, underscoring their role in modern oncology workflows.

The association between early detection programs and biopsy utilization further accelerates market requirements. National cancer registries highlight the diagnostic importance of needle-based sampling in diverse tumor types.

Key manufacturers are scaling production to meet this procedural surge. This driver supports innovation in needle design for better visibility under imaging guidance. Approximately one million image-guided breast biopsies are performed each year in the United States.

Restraints

High cost of disposable biopsy needles is restraining the market.

The premium pricing of single-use aspiration and biopsy needles limits their adoption in cost-conscious healthcare environments. Manufacturing requirements for sterility, sharpness, and imaging compatibility elevate production expenses that are passed to providers. Smaller clinics and public hospitals often face budgetary restrictions that favor reusable alternatives where permitted.

Regulatory standards for safety and traceability add to the overall cost structure. In regions with limited reimbursement, these expenses deter routine upgrades to advanced needle technologies. Providers may opt for conventional methods to control operational spending in high-volume settings. This restraint particularly affects penetration in low-resource facilities and developing markets.

Industry attempts to introduce value-oriented lines provide partial relief but have not fully resolved pricing pressures. Despite superior infection control, economic factors slow broader implementation. Consequently, affordability remains a key barrier to universal market growth.

Opportunities

Expansion of outpatient biopsy services is creating growth opportunities.

The shift toward outpatient and ambulatory care settings presents significant potential for aspiration and biopsy needles in community-based diagnostic centers. Governmental initiatives to decentralize cancer diagnostics support the establishment of dedicated biopsy suites outside major hospitals. Increasing patient preference for convenient, same-day procedures amplifies demand for portable and user-friendly needle systems.

Partnerships with ambulatory surgery networks facilitate regulatory compliance and efficient distribution. The large volume of elective biopsies in urban and suburban areas magnifies prospects for specialized needle adoption. Educational programs for interventional radiologists promote standardized techniques in non-hospital environments. This opportunity enables manufacturers to diversify beyond traditional inpatient channels.

Key corporations are developing streamlined kits optimized for outpatient workflows. Overall, outpatient expansion aligns with efforts to improve access and reduce healthcare system burdens. Strategic initiatives in this segment can secure substantial positions in evolving diagnostic landscapes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the aspiration and biopsy needles market through hospital purchasing priorities, diagnostic procedure volumes, and reimbursement clarity. Inflation and higher interest rates raise operating expenses for healthcare providers, which increases price sensitivity for single use needles and related consumables. Geopolitical tensions disrupt supplies of stainless steel, specialty alloys, and sterilization inputs, creating sourcing challenges and delivery delays.

Current US tariffs on imported medical components and finished devices increase manufacturing and procurement costs, which tightens margins and complicates long term supply contracts. These pressures affect smaller distributors and can slow adoption in budget constrained facilities. On the positive side, trade exposure supports domestic production, diversified metal sourcing, and stronger supply chain oversight.

Rising cancer screening rates and demand for minimally invasive diagnostics sustain steady clinical need. With efficient procurement strategies and continued product refinement, the market remains positioned for stable and confident growth.

Latest Trends

Launch of automated core biopsy systems is a recent trend in the market.

In 2024, the introduction of automated spring-loaded core biopsy devices has improved tissue yield and procedural efficiency in image-guided sampling. These systems incorporate single-insertion mechanisms to minimize patient discomfort and procedure time.

Manufacturers have prioritized ergonomic designs and compatibility with ultrasound and CT guidance. Clinical evaluations in 2024 confirmed higher core quality compared to manual alternatives. Mammotome introduced the AutoCore Single Insertion Core Biopsy System in November 2024, marking the company’s first automated spring-loaded device.

This launch targets precision sampling in breast and soft tissue applications. The trend emphasizes reduced operator variability and consistent sample acquisition. Regulatory clearances in 2024 for these platforms have accelerated clinical uptake. Industry collaborations focus on integration with existing imaging consoles. These advancements aim to enhance diagnostic accuracy while streamlining workflows in busy radiology departments.

Regional Analysis

North America is leading the Aspiration & Biopsy Needles Market

North America accounted for a 38.7% share of the Aspiration & Biopsy Needles market in 2024, driven by rising volumes of image guided diagnostic procedures across oncology and pulmonology. Hospitals and outpatient imaging centers expanded minimally invasive tissue sampling to support earlier cancer detection and personalized treatment planning.

Growing adoption of ultrasound, CT, and MRI guided interventions increased the demand for precision engineered needles that enhance sample accuracy. An aging population and higher screening rates for breast, lung, and prostate cancers further strengthened procedural growth.

Physicians favored core and fine needle aspiration techniques to reduce patient recovery time and procedural risk. Ambulatory surgical centers also increased utilization as same day diagnostics became more common.

A strong supporting indicator comes from the American Cancer Society, which projected 1.96 million new cancer cases in the United States for 2023, reinforcing sustained demand for reliable tissue sampling technologies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The Aspiration & Biopsy Needles market in Asia Pacific is expected to expand steadily during the forecast period as cancer awareness and screening programs gain traction across emerging economies. Governments increase investment in diagnostic imaging infrastructure, which enables more image guided procedures in regional hospitals.

Rising urbanization and lifestyle related risk factors contribute to higher cancer incidence and earlier clinical evaluation. Clinicians adopt minimally invasive sampling techniques to improve diagnostic turnaround and patient comfort. Expansion of private oncology centers strengthens access to advanced interventional diagnostics.

Local manufacturing improves availability and affordability of specialized needles. A verifiable signal of growing demand appears in 2023 data from the International Agency for Research on Cancer, which reported that Asia accounts for nearly half of global cancer cases, highlighting the substantial patient base supporting continued regional growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the aspiration and biopsy needles market grow by enhancing product design to improve tissue yield, minimize patient discomfort, and support a wide range of clinical procedures from fine-needle aspiration to core biopsies. They also broaden their reach by integrating advanced materials and ergonomic features that help clinicians maintain precision and control in varied anatomical settings.

Firms strengthen customer relationships through comprehensive training, procedure support services, and bundled kits that align with institutional procurement objectives and streamline workflow adoption. Strategic partnerships with hospitals, diagnostic labs, and medical device distributors help secure preferred supplier agreements and accelerate volume deployment across regions.

Boston Scientific Corporation exemplifies a diversified medical technology company with a robust portfolio of biopsy, access, and intervention tools supported by global sales operations and deep clinical education initiatives that enhance procedural confidence.

The company reinforces its competitive agenda through disciplined investment in innovation, targeted acquisitions that expand complementary capabilities, and a customer-centric commercialization strategy that aligns evolving clinician needs with practical, high-performance solutions.

Top Key Players

- Becton Dickinson

- Boston Scientific

- Cook Medical

- Medtronic

- Olympus Corporation

- Argon Medical Devices

- Merit Medical Systems

- Cardinal Health

- Hologic

- Stryker

Recent Developments

- In fiscal Q1 2026, ended December 31, 2025, Becton, Dickinson and Company reported revenue of US$ 1.330 billion from its BD Interventional segment. The division, which includes biopsy, drainage, and vascular access products, recorded a 5.8% year-over-year increase. The company attributed the growth to consistent procedural demand across US and international healthcare markets, reflecting stable utilization trends within its interventional specialty portfolio.

- In 2025, Boston Scientific Corporation disclosed that its interventional oncology and embolization business generated close to US$ 1 billion in annual revenue. The segment delivered 16% operational growth during the year, supported by continued expansion of its peripheral intervention offerings and rising adoption of minimally invasive diagnostic and therapeutic procedures in oncology settings.

Report Scope

Report Features Description Market Value (2025) US$ 0.8 Billion Forecast Revenue (2035) US$ 1.5 Billion CAGR (2026-2035) 6.3% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Biopsy Needles and Aspiration Needles), By Procedure (Image-guided and Non-image-guided), By Application (Tumour/Cancer, Wounds and Others), By End-user (Hospitals & Surgical Centers, Diagnostic Clinics & Pathology Laboratories, Ambulatory Care Centers and Research & Academic Institutes) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Becton Dickinson, Boston Scientific, Cook Medical, Medtronic, Olympus Corporation, Argon Medical Devices, Merit Medical Systems, Cardinal Health, Hologic, Stryker Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Aspiration & Biopsy Needles MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Aspiration & Biopsy Needles MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Becton Dickinson

- Boston Scientific

- Cook Medical

- Medtronic

- Olympus Corporation

- Argon Medical Devices

- Merit Medical Systems

- Cardinal Health

- Hologic

- Stryker